Due to the state of the market and the unique characteristics of individual firms, all investments carry a certain amount of risk. Investment risk tends to rise during periods of high uncertainty and fall during periods of low uncertainty. The current state of the Kenyan economy is characterized by heightened inflationary pressures, sustained currency depreciation, and growing anxiety over the public debt of the government. In order to ensure that investment returns are closely matched to risk expectations, this week we turn our attention to investment risk, where we analyse the various ways investment risk can be managed.

We shall cover the topic as follows:

- Introduction

- Types of Investments Risk

- Risk Management

- Investments Products in Kenya Market

- Conclusion

Section 1: Introduction

Investment risk analysis refers to the systematic process of evaluating the potential risks associated with various investment opportunities. It involves assessing the likelihood of different outcomes and potential losses to make well-informed investment decisions. Understanding and analyzing investment risks is crucial for investors seeking to achieve their financial goals while managing uncertainties. Effective risk analysis provides insights into potential pitfalls, enabling investors to make proactive adjustments to their portfolios. The primary objectives of investment risk analysis include;

- Minimizing the possibility of significant financial losses

- Optimizing the risk-return trade-off

- Aligning investment strategies with an individual's risk tolerance, and

- Enhancing the overall decision-making process.

Investing involves a delicate balance between potential returns and associated risks. Successful investors understand that a comprehensive risk analysis is essential for making informed investment decisions. By examining a range of factors that can impact the performance of investments, individuals and institutions can strategize to maximize returns while safeguarding against unnecessary losses. Some of the factors to consider before making an investment include;

- Level of risk – Risk refers to the uncertainty that your investment's actual performance might deviate from your expectations. As such, different asset classes, such as stocks, bonds, real estate, and commodities, carry distinct risk profiles. The equities asset class, for instance, tends to have higher volatility compared to fixed income asset class.

- Expected return - Expected return is a critical metric in investment analysis that quantifies the potential gains an investor could earn from an investment over a specific period. It serves as a guide to estimate the average outcome, accounting for both positive and negative scenarios. By understanding the expected return, investors can make more informed decisions that align with their financial goals and risk tolerance.

- Liquidity - Liquidity refers to the ease with which an investment can be quickly converted into cash without significantly affecting its market price. Liquidity is a crucial consideration for investors, as it impacts your ability to access funds, respond to changing market conditions, and manage unexpected financial needs.

- Investment horizon - Investment horizon refers to the length of time an investor plans to hold an investment before needing to access the funds or achieve a specific financial goal. It is a fundamental consideration that influences the choice of investment vehicles, risk tolerance, and overall investment strategy. Understanding your investment horizon is essential for aligning your investments with your financial objectives

It is important to note that investing in any country involves risks, and the situation can change due to various factors including the expected economic growth both globally and locally, level of inflation, currency prospects, political developments and social stability.

Section 2: Types of Investment Risks

We will focus on the broad categories of investment risks, a) Systematic and, b) Unsystematic risks depending on their stemming sources.

- Systematic Risks - These are market related risk which an investor cannot mitigate through diversification of the portfolio. Systematic risks are mainly caused by factors that are external to an individual or organization and are inter-related to macro-economic indicators such as inflation, Gross Domestic Product (GDP), exchange rate variability and interest rates. The various types of systematic risks include:

-

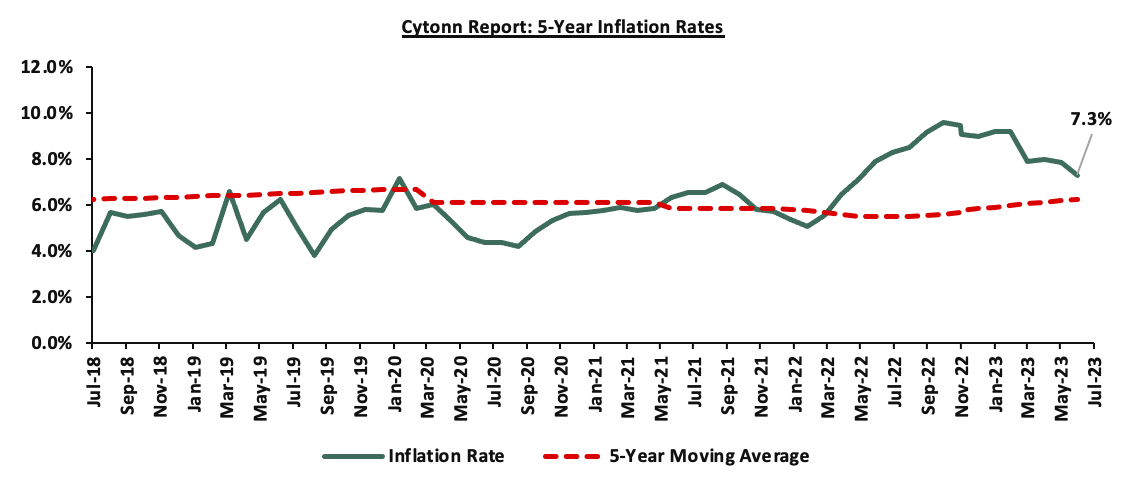

- Inflation/Purchasing Power Risk – Inflation refers to persistent and sustained increase in general price levels, which consequently reduces the purchasing power of money. Inflation risk is, thus, the potential of reduction in the actual worth of an investment and its return owing to inflation. It mostly affects fixed income securities, as their income is fixed on nominal terms: The chart below shows inflation rates in Kenya over the years:

-

- Interest Rate Risk – The risk arises as a result of changing interest rates in the market. Any change in the interest rate as a result of market forces alters the return on investments, mostly fixed income securities as bond prices for instance, are inversely related to the prevailing market interest rates, and,

- Exchange Rate Risk – This is the risk arising from the fluctuation in the value of foreign currency with respect to the local currency. Exchange rate risk affects only the securities of companies or individuals with foreign exchange transactions or exposures, which affects the actual worth of such an investment. The table below shows the performance of the Kenya shillings against major currencies, with the shilling having depreciated against all the selected currencies:

-

Cytonn Report: Performance of the Kenya Shilling Against Select Currencies

Currencies

January 2023 (vs KES)

Current

YTD change

USD

123.4

144.9

(17.4%)

EUR

131.7

156.9

(19.2%)

GBP

148.7

183.1

(23.1%)

JPY

0.95

1.0

(4.3%)

TSHS

0.05

0.06

(9.4%)

USHS

0.033

0.039

(18.2%)

- Unsystematic risks- refer to risks unique to a particular company, individual, or industry and can be reduced to a certain extent by diversification. Unsystematic risks mostly arise from the management, location, or financial obligations of the investor. The various subdivisions of unsystematic risks include;

-

- Liquidity Risk – this is the possibility of not being able to convert an investment into ready cash when a need arises or the difficulty of finding a buyer in the market when one needs to liquidate their investment,

- Financial Risks – refers to the uncertainty in the expected returns as a result of changes in the financial structure of a company. Only risk-free assets give returns equal to their expected returns. An example of this risk is when a firm has no capacity to meet its business obligations and is therefore unable to pay dividends or even interest,

- Political Risk– This refers to risks arising from changes in legislation, trade barriers, or any other political decision that could have a negative impact on the projected rate of return from an investment,

- Business Risk- This is the uncertainty in the returns of an investment due to volatility in a firm’s operating income,

- Legal Risk – Refers to the potential of a loss emanating from insufficient knowledge or misunderstanding of how the law applies to your investment, and,

- Investment Manager Risk – It is the risk linked with the ineffectiveness and inefficiency of an investment manager's ability to manage risks prudently.

Section 3: Risk Management

The process of identifying the risks that an organization faces, measuring the company's risk tolerance, changing and monitoring these risks to an organization's capital and earnings is referred to as risk management. Some of these risks are primarily caused by financial uncertainties, strategic management flaws, natural disasters and accidents, and legal responsibilities. Notably, the technique does not strive to eliminate all hazards, because an investor must incur a risk in order to receive a return above the risk-free rate. As a result, the best strategic risk management method should correlate the risks taken with the tolerance of the firm. As a result, by purchasing insurance, arranging hedging agreements, and implementing organizational changes, a company can raise its exposure to risks it can manage in order to increase returns while minimizing its exposure to hazards it cannot manage. In essence, the optimal risk management model is a collection of hazards that generate the maximum returns for the firm while remaining within its risk tolerance level.

- Strategies in Risk Management

Investors ought to assess and work with the optimal mix of risks for the organization or an individual, which means an investor will take more of some risks while decreasing others and eliminating others altogether. Some of the strategies employed by investors in risk management include:

-

- Diversification- Investors choice to diversify an investment portfolio across assets that are not perfectly correlated the portfolio risk is less than the weighted average of the individual securities in the portfolio. Risks that are eliminated by diversification are called unsystematic risks (firm-specific risks) and they include liquidity risk and financial risk, while systematic risks cannot be diversified away (market risks) and they include interest rate risks, inflation, and exchange rate risk

- Risk transfer- an individual or an organization can choose to shift the risk of losses to another party through strategies like insurance and even reinsurance for insurance companies.

- Risk avoidance- An investor can choose to avoid a certain risk altogether especially for external risks. For example, an investor can choose to avoid investing in a certain country out of political unrest or even to step back from starting a new product line from the associated risk

- Self-insurance- This involves creating back up plans and strategies to address unforeseen risks which means the investor is proactive. One can set up reserve funds to settle the uncertainties as they arise. This happens when an investor has chosen to bear the risks when they arise.

- Metrics in Measuring Investment Risks Exposure

Investors need to measure risk exposure to make informed decisions about their investments and manage potential losses. By assessing risk, investors can evaluate the potential impact of adverse events on their portfolio. Various methods are used to help investors understand the volatility, market correlation, potential loss levels and resilience of their investments in different scenarios, which include:

-

- Standard Deviation- This method quantifies the dispersion of returns around the average historical return by measuring the volatility of asset prices and interest rates. A higher standard deviation indicates greater volatility, meaning the investment option has a higher risk, compared to one with a lower standard deviation. This method is most appropriate in measuring systematic risk (market risk) like risks associated with economic conditions and geopolitical events.

- Beta- This method quantifies the sensitivity of an investment’s returns to overall market movements where the market is used as the beta benchmark, and the market beta is always one. If a security beta is greater than one, then it is more volatile than the market (higher risk), while a lower than one beta indicates lower risk compared to the market. A security with a beta of one has the same volatility profile as the broad market. Notably, this method considers the risk reduction benefits of diversification and is more appropriate for securities held in a well-diversified portfolio.

- Value at Risk (VaR)- This is a statistical measure of the maximum amount of money an investor would expect to lose on an investment portfolio with a given probability under normal market conditions. This measure considers the distribution of historical returns, volatility and correlations between different assets to estimate potential losses which informs investors on their exposure to market fluctuations and make informed decisions about risk tolerance and portfolio allocation, through setting risk limits, and determining capital reserves.

- Duration- The duration measure is used to assess the sensitivity of a fixed-income investment like bonds, to changes in interest rates by providing insights into the potential impact of interest rates changes on bond value. This measure help investors gauge the interest rate risk linked to their bond investment. A longer duration bond points towards greater sensitivity to changes in interest rates and implies higher price volatility, while shorter duration bonds have a lower price volatility to interest rate changes.

- Sharpe Ratio- This measure considers the risk-adjusted return, by subtracting the risk-free rate from the total return then dividing by the standard deviation (historical risk), to provide a single metric that quantifies how well an investment compensates for the amount of risk taken. A higher Sharpe ratio indicates a better risk-adjusted return since it implies the investment generated a higher return compared to its volatility. This measure is appropriate when evaluating different investment options as it allows investors know which options generate higher returns for any given level of risk.

- Advantages of Risk Management

-

- Protection of capital - Effective risk management strategies can prevent significant losses stemming from normal business operations and the business environment like market volatility, thus helping in protection of investor’s capital from losses

- Optimized Resource Allocations and Improved Return on Investment- By identifying potential opportunities and strategic risk management measures, investors are able to achieve better returns in the long-run, as well as better resource allocation which limits unnecessary costs.

- Stability and Continuity- Through identification of potential risks and working on mitigating them, an organization can reduce the chances of major losses by preparing for and addressing potential crises and disruptions

- Enhanced Decision Making- Through identification and analyzing of risks, investors can make informed decisions that take potential losses into account.

However, despite the vast advantages of the risk management process, there are some cons associated with Risk management which include;

- Ambiguity in figuring how much risk to take- It can be difficult to settle on the right amount of risk to take for investors and its important to strike the right balance between taking too much risk and not taking enough risk. Little risk translates to little returns while too much risk exposes the investor to catastrophic losses.

- Costly- A comprehensive risk management model requires financial investment and resource allocation which can be strenuous especially for smaller investors or companies.

Section IV: Investment Products in Kenya Market

There are various investment products available in Kenyan market and their variation mainly depend on return and risk they carry. An investor needs to decide on different channels based on their risk appetite, the returns expected and the liquidity requirement. Investment products available are broadly categorized into two categories:

- Traditional Investments

- Alternative Investments

- Traditional Investments

Traditional investments involve putting capital into well-known assets that are sometimes referred to as public-market investments. The main categories of traditional investment products under this category include:

- Equities- Equities are ownership stake in a company. They are traditional investments that are relatively liquid yet highly volatile making them very risky. They provide returns in the form of dividends and capital growth, making them attractive investment option for long-term investors. To invest in Kenya’s equity market, one need to open a Central Depository and Settlement (CDS) account, which is an electronic account that holds your shares and bonds, and allows for the process of transferring of shares at the Securities Exchange through a licensed stockbroker,

- Fixed Income- These securities which contractually provide an investor with a predetermined return in the form of interest and principal payments. They are also moderately liquid and have low volatility, hence considered less risky. They are suitable for medium to long-term investors. They include fixed deposits, Treasury bills and bonds, and commercial papers,

- Mutual Funds- A Collective Investment Scheme that presents investors with an opportunity to participate in the various asset classes by pooling money together from many investors. The funds are managed by a professional fund manager who invests the pooled funds in a portfolio of securities to achieve objectives of the trust. The funds in the mutual funds earn income in the form of dividends, interest income and capital gains depending on the asset class the funds are invested in. The following are the main types of funds:

-

- Money Market Fund- This fund mainly invests in short-term debt securities with high credit quality such as bank deposits, treasury bills, and commercial paper. The fund is best suited for investors who require a low-risk investment that offers capital stability, liquidity and a high-income yield. The fund is a good safe haven for investors who wish to switch from a higher risk portfolio to a low risk, high-interest portfolio, especially during times of high stock market volatility,

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 25th August 2023

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 25th August 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

GenAfrica Money Market Fund |

13.0% |

|

2 |

Enwealth Money Market Fund |

12.6% |

|

3 |

Cytonn Money Market Fund |

12.5% |

|

4 |

Lofty-Corban Money Market Fund |

12.4% |

|

5 |

Etica Money Market Fund |

12.4% |

|

6 |

Madison Money Market Fund |

12.2% |

|

7 |

Jubilee Money Market Fund |

12.1% |

|

8 |

Kuza Money Market fund |

12.0% |

|

9 |

Co-op Money Market Fund |

11.6% |

|

10 |

Apollo Money Market Fund |

11.6% |

|

11 |

GenCap Hela Imara Money Market Fund |

11.4% |

|

12 |

Old Mutual Money Market Fund |

11.4% |

|

13 |

Sanlam Money Market Fund |

11.4% |

|

14 |

ICEA Lion Money Market Fund |

11.3% |

|

15 |

Absa Shilling Money Market Fund |

11.3% |

|

16 |

AA Kenya Shillings Fund |

11.2% |

|

17 |

Nabo Africa Money Market Fund |

11.0% |

|

18 |

Dry Associates Money Market Fund |

10.9% |

|

19 |

KCB Money Market Fund |

10.8% |

|

20 |

NCBA Money Market Fund |

10.8% |

|

21 |

CIC Money Market Fund |

10.5% |

|

22 |

Orient Kasha Money Market Fund |

10.2% |

|

23 |

British-American Money Market Fund |

9.5% |

|

24 |

Mali Money Market Fund |

9.3% |

|

25 |

Equity Money Market Fund |

9.0% |

- Fixed Income Fund – This fund invests in interest-bearing securities, which include treasury bills, treasury bonds, preference shares, corporate bonds, loan stock, approved securities, notes and liquid assets consistent with the portfolio’s investment objective. The fund is suitable for investors who are seeking a regular income from their investment, including those who intend to secure a safe haven for their investments in times of stock market instability,

- Equity Fund- This type of fund aims to offer superior returns over the medium to longer-term by maximizing capital gains through investing in listed securities. This fund is suited for investors seeking medium to long-term capital growth in their portfolios and want to gain exposure to equity investments. The fund has a medium to high-risk profile. Due to the volatile nature of the stock markets, risk is usually reduced through holding a diversified portfolio of shares across different sectors,

- Balanced Fund – This fund invests in a diversified spread of equities and fixed income securities with the objective to offer investors a reasonable level of current income and long-term capital growth. The fund is suited to investors who seek to invest in a balanced portfolio offering exposure to all sectors of the market. It is also suitable for pension schemes, treasury portfolios of institutional clients, co-operatives and high net worth individuals amongst others. The fund is a medium risk fund and has a medium risk profile, and,

- High Yield Fund – This type of fund invests in securities that generally pay above average interests and dividends, with the fund’s objective being delivery of high returns to investors. The fund has a high-risk profile and is suited for long-term investors who are looking for growth of their portfolio’s over-time.

- Alternative Investments

Alternative investments are those that fall outside the conventional investment types such as publicly-traded stocks, bonds, and cash. The most common alternative investments today are:

- Real Estate - This involves investment in property and land. Real Estate is considered an alternative investment that is illiquid, relatively stable and uncorrelated to traditional investments. They are suitable for long-term investment plans, which makes them a risky investment. Real Estate can yield high returns, and is useful for diversification and as a hedge against inflation since its value increases over time. Real Estate offers returns in the form of rental yield and price appreciation, and,

- Private Equity - It generally involves buying shares in companies that are not listed on a public exchange or buying shares of public companies with the intent to make them private. Private equity can involve many strategies that may help provide money to companies at different stages of their development. The most widely used strategies are venture capital, buyouts and distressed investing.

In determining the appropriate investment option, one should consider:

- Liquidity needs and time horizon for investment- The liquidity varies from one asset to another. An individual must evaluate the target for the investment chosen and the length of time they for which they require illiquid assets,

- The rate of return- A rational investor seeks out a venture that would provide maximum return for a given level of risk,

- The cost of the investment- One should harbour the same sentiments in purchasing an investment as they do in buying groceries. The price of the investment is a key element. Over time, the returns received should exceed the cost of the investment, and,

- The regulatory and legal constraints placed on the venture- Awareness of the tax treatments that the selected investment options are subject to assists one in evaluating their longstanding returns.

Section V: Conclusion and Outlook

Investment risk analysis is an integral part of the investment process, as it helps investors navigate the complex landscape of opportunities and risks associated with them, thus enhancing the potential for successful outcomes while managing the exposure to risk. This analysis revolves around the fundamental concept of Risk-Reward Trade off where higher return potential often comes in a high-risk package. However, investors should always strike the right balance of risk that aligns with their risk tolerance and financial goals to ensure optimal return on investment and optimal resource allocation.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.