On 15 June 2023, the National Treasury presented Kenya’s FY’2023/2024 National Budget, to the National Assembly highlighting that the total budget estimates for FY’2023/24 increased by 8.7% to Kshs 3.7 tn from the Kshs 3.4 tn in FY’2022/2023 while the total revenue inclusive of grants increased by 15.7% to Kshs 3.0 tn from the Kshs 2.6 tn in FY’2022/2023. The increase is mainly due to 17.3% increase in ordinary revenue to Kshs 2.6 tn for FY’2023/2024, from the Kshs 2.2 tn in FY’2022/23.

The FY’2023/2024 budget focuses mainly on providing solutions to the heightened concerns on the high cost of living, the measures put in to accelerate economic recovery as well as undertaking a growth-friendly fiscal consolidation to preserve the country’s debt sustainability. Notably, the government projects to narrow the fiscal deficit to 4.4% of GDP in FY’2023/24, from the estimate of 5.8% of GDP in FY’2022/23. As such, this week, we shall discuss the recently released budget and the tabled Finance Bill 2023 with a key focus on Kenya’s fiscal components. We shall do this in four sections, namely:

- FY’2022/2023 Budget Outturn as at May 2023,

- Comparison between FY'2022/2023 and FY'2023/2024 Budget estimates,

- Analysis and House-view on Key Aspects of the 2023 Budget,

- Key tax changes in the Finance Bill 2023 and their impact, and,

- Conclusion

Section I: FY’2022/2023 Budget Outturn as at May 2023

The National Treasury gazetted the revenue and net expenditures for the eleven months of FY’2022/2023, ending 31 May 2023. Below is a summary of the performance:

|

(Amounts in Kshs bn unless stated otherwise) |

||||||

|

Cytonn Report: FY'2022/2023 Budget Outturn - As at 31 May 2023 |

||||||

|

Item |

12-months Original Estimates

(A) |

Revised Estimates

(B) |

Actual Receipts/Release

(C) |

Percentage Achieved of the Revised Estimates

(D) = C/B |

Prorated

(E) = B *(11/12) |

% achieved of the Prorated

(F)= C / E |

|

Opening Balance |

0.6 |

|||||

|

Tax Revenue |

2,071.9 |

2,108.3 |

1,740.4 |

82.5% |

1,932.6 |

90.1% |

|

Non-Tax Revenue |

69.7 |

83.7 |

71.1 |

85.0% |

76.7 |

92.8% |

|

Total Revenue |

2,141.6 |

2,192.0 |

1,812.2 |

82.7% |

2,009.3 |

90.2% |

|

External Loans & Grants |

349.3 |

520.6 |

311.8 |

59.9% |

477.2 |

65.3% |

|

Domestic Borrowings |

1,040.5 |

886.5 |

464.7 |

52.4% |

812.6 |

57.2% |

|

Other Domestic Financing |

13.2 |

13.2 |

15.5 |

117.4% |

12.1 |

128.0% |

|

Total Financing |

1,403.0 |

1,420.3 |

792.0 |

55.8% |

1,302.0 |

60.8% |

|

Recurrent Exchequer issues |

1,178.4 |

1,266.0 |

975.1 |

77.0% |

1,160.5 |

84.0% |

|

CFS Exchequer Issues |

1,571.8 |

1,552.9 |

1,130.1 |

72.8% |

1,423.5 |

79.4% |

|

Development Expenditure & Net Lending |

424.4 |

393.8 |

191.1 |

48.5% |

361.0 |

52.9% |

|

County Governments + Contingencies |

370.0 |

399.6 |

305.3 |

76.4% |

366.3 |

83.3% |

|

Total Expenditure |

3,544.6 |

3,612.3 |

2,601.6 |

72.0% |

3,010.3 |

86.4% |

|

Fiscal Deficit excluding Grants |

1,403.0 |

1,420.3 |

789.5 |

55.6% |

1,302.0 |

60.6% |

|

Fiscal Deficit as a percentage of GDP |

|

|

5.9% |

|

|

|

|

Total Borrowing |

1,389.8 |

1,407.1 |

776.4 |

55.2% |

1,289.9 |

60.2% |

The key take-outs from the report include:

- Total revenue collected as at the end of May 2023 amounted to Kshs 1,812.2 bn, equivalent to 82.7% of the revised estimates of Kshs 2,192.0 bn for FY’2022/2023 and is 90.2% of the prorated estimates of Kshs 2,009.3 bn. We note that the government has not been able to meet its prorated revenue targets eleven months into the FY’2022/2023, partly attributable to the tough macroeconomic environment in the country as a result of elevated inflationary pressures with May 2023 inflation rate coming in at 8.0%, above the CBK target range of 2.5%-7.5%. Cumulatively, tax revenues amounted to Kshs 1,740.4 bn, equivalent to 82.5% of the revised estimates of Kshs 2,108.3 bn and 90.1% of the prorated estimates of Kshs 1,932.6 bn.

- Total financing amounted to Kshs 792.0 bn, equivalent to 55.8% of the revised estimates of Kshs 1,420.3 bn and is equivalent to 60.8% of the prorated estimates of Kshs 1,302.0 bn. Additionally, domestic borrowing amounted to Kshs 464.7 bn, equivalent to 52.4% of the revised estimates of Kshs 886.5 bn and is 57.2% of the prorated estimates of Kshs 812.6 bn,

- The total expenditure amounted to Kshs 2,601.6 bn, equivalent to 72.0% of the revised estimates of Kshs 3,612.3 bn, and is 86.4% of the prorated expenditure estimates of Kshs 3,010.3 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 975.1 bn, equivalent to 77.0% of the revised estimates of Kshs 1,266.0 bn and 84.0% of the prorated estimates of Kshs 1,160.5 bn, and development expenditure amounted to Kshs 191.1 bn, equivalent to 48.5% of the revised estimates of Kshs 393.8 bn and is 52.9% of the prorated estimates of Kshs 361.0 bn. Further, Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 1,130.1 bn, equivalent to 72.8% of the revised estimates of Kshs 1,552.9 bn, and 79.4% of the prorated amount of Kshs 1,423.5 bn.

- Total Borrowings as at the end of May 2023 amounted to Kshs 776.4 bn, equivalent to 55.2% of the revised estimates of Kshs 1,407.1 bn for FY’2022/2023, and are 64.4% of the prorated estimates of Kshs 1,134.2 bn. The cumulative domestic borrowing target of Kshs 886.5 bn comprises of adjusted Net domestic borrowings of Kshs 425.1 bn and Internal Debt Redemptions (rollovers) of Kshs 461.4 bn,

- The cumulative public debt servicing cost amounted to Kshs 1,019.8 bn which is 74.9% of the revised estimates of Kshs 1,361.0 bn, and is 89.9% of the prorated estimates of Kshs 1,134.2 bn. Notably, the Kshs 1,019.8 bn debt servicing cost is equivalent to 56.3% of the actual revenues collected as at the end of May 2023, which is 26.3% points above IMF’s recommended threshold of 30.0%. As such, the current budget deficit is 5.9% of GDP, 0.1% points above the government's projected budget deficit of 5.8% of GDP in FY'2022/2023, further emphasizing on how much public debt servicing weighs on the country’s expenditure.

The government has been unable to meet its revenue targets for the eleven months of the FY’2022/2023, mainly on the back of the tough economic situation exacerbated by the elevated inflationary pressures that have remained above the CBK target range of 2.5%-7.5%, with the year on year inflation rate in May 2023 coming in at 8.0%, up from 7.9% recorded in April 2023. But it is good to n ote that the absorption rate has also remained below the pro rated amounts. As such, the government is yet to fully benefit from the strategies put in place to improve revenue collection such as expanding the revenue base and sealing tax leakages, and suspension of all tax relief payments. However, we believe that the current measures such as the expected implementation of the Finance Bill 2023 that will lead to the upward readjustment of the Excise Duty Tax, Income Tax as well as the Value Added Tax will play a big role in expanding the tax base and consequently enhance revenue collection.

Section II: Comparison between FY’2022/2023 and FY’2023/2024 Budgets estimates

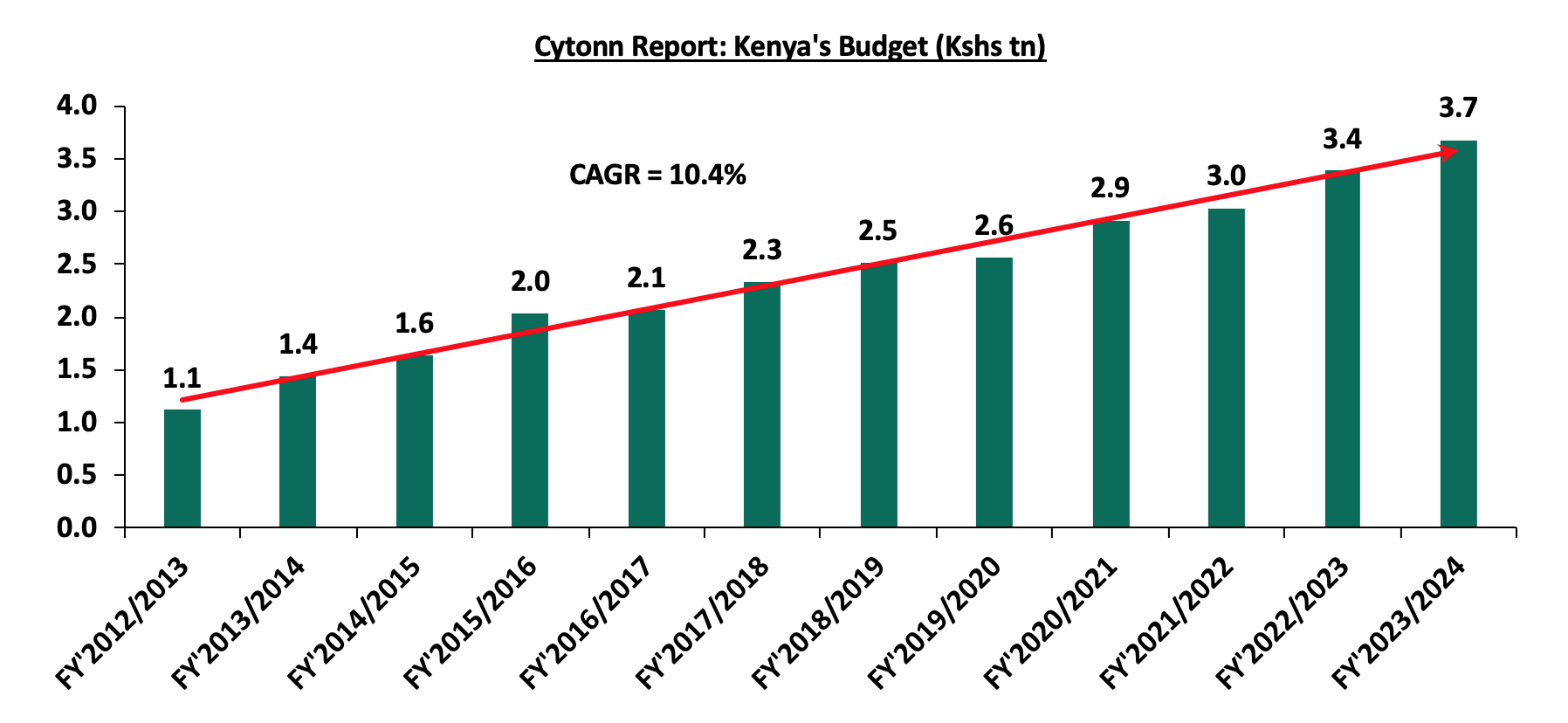

The Kenyan Government budget has been growing over the years on the back of increasing recurrent and development expenditures. The chart below shows the evolution of the government budget over an eleven-year period:

Source: National Treasury of Kenya

For the FY’2023/2024, the budget is projected to increase by 8.7% to Kshs 3.7 tn, from Kshs 3.4 tn in FY’2022/2023. The expenditure will be funded by revenue collections of Kshs 3.0 tn and borrowings amounting to Kshs 718.0 bn.

The table below summarizes the key buckets and the projected changes:

|

(Amounts in Kshs billions unless stated otherwise) |

|||

|

Cytonn Report: Comparison between FY’2022/2023 and FY’2023/2024 Budgets Estimates |

|||

|

Item |

FY'2022/23 Supplementary Budget I |

FY'2023/24 Estimates |

Change y/y (%) |

|

Ordinary Revenue |

2,192.0 |

2,571.2 |

17.3% |

|

Total Appropriation-in-Aid |

336.8 |

348.7 |

3.5% |

|

Total grants |

31.4 |

42.2 |

34.2% |

|

Total Revenue & Grants |

2,560.3 |

2,962.0 |

15.7% |

|

Recurrent expenditure |

1,498.7 |

1,564.9 |

4.4% |

|

Recurrent Consolidated Funds Services (CFS) |

867.8 |

986.2 |

13.6% |

|

Development expenditure |

618.2 |

743.5 |

20.3% |

|

County Transfer & Contingencies |

399.6 |

385.4 |

(3.5%) |

|

Total expenditure |

3,384.3 |

3,680.0 |

8.7% |

|

Fiscal deficit inclusive of grants |

(824.0) |

(718.0) |

(4.2%) |

|

Projected Deficit as % of GDP |

(5.8%) |

(4.4%) |

(1.4%) points |

|

Net foreign borrowing |

395.8 |

131.5 |

(66.8%) |

|

Net domestic borrowing |

428.3 |

586.5 |

37.0% |

|

Total borrowing |

824.0 |

718.0 |

(12.9%) |

|

Source: Financial Statement For the FY 2023/2024-Budget , The Mwananchi Guide for the FY’2023/24 National Treasury of Kenya |

|||

Some of the key take-outs include;

- The government projects total revenue inclusive of grants for FY’2022/23 to increase by 15.7% to Kshs 3.0 tn (equivalent to 18.2% of GDP), from the Kshs 2.6 tn in FY’2022/2023 (equivalent to 17.5% of GDP). The increase is mainly due to a 17.3% increase in ordinary revenue to Kshs 2.6 tn (equivalent to 15.8% of GDP) for FY’2023/2024, from the Kshs 2.2 tn in FY’2022/23 (equivalent to 15.3% of GDP),

- Total expenditure is set to increase by 8.7% to Kshs 3.7 tn (equivalent to 22.6% of GDP), from Kshs 3.4 tn (equivalent to 23.9% of GDP) in the FY’2022/23 Budget estimates,

- Recurrent expenditure is set to increase by 4.4% to Kshs 1.6 tn in FY’2023/2024, from Kshs 1.5 tn in the FY’2022/2023 budget estimates, while Consolidated Funds Services (CFS) expenditure is expected to increase by 13.6% to Kshs 986.2 bn, from Kshs 867.8 bn in the FY’2022/2023 budget estimates. Also, Development expenditure is set to increase by 20.3% to Kshs 743.5 bn, from Kshs 618.2 bn in the FY’2022/2023 budget estimates,

- Public debt is expected to continue growing in FY’2023/24, as the approximate Kshs 718.0 bn fiscal deficit will be financed through domestic debt totaling Kshs 586.5 bn and foreign debts totaling Kshs 131.5 bn. However, the total borrowing is expected to reduce by 12.9% to Kshs 718.0 bn in the FY’2023/24, from Kshs 824.0 bn as per the FY’2022/2023 supplementary budget, in a bid to reduce Kenya’s public debt burden which was estimated at 64.7% of GDP as of March 2023, surpassing the 50.0% recommended threshold by 14.7% points, and,

- The budget deficit is projected to decline by 1.4% points to 4.4% of GDP, from the 5.8% of GDP in the FY’2022/2023 budget, mainly as growth in revenues outpace growth in expenditure.

Section III: Analysis and House-view on Key Aspects of the FY’2022/2023 Budget

- Revenue

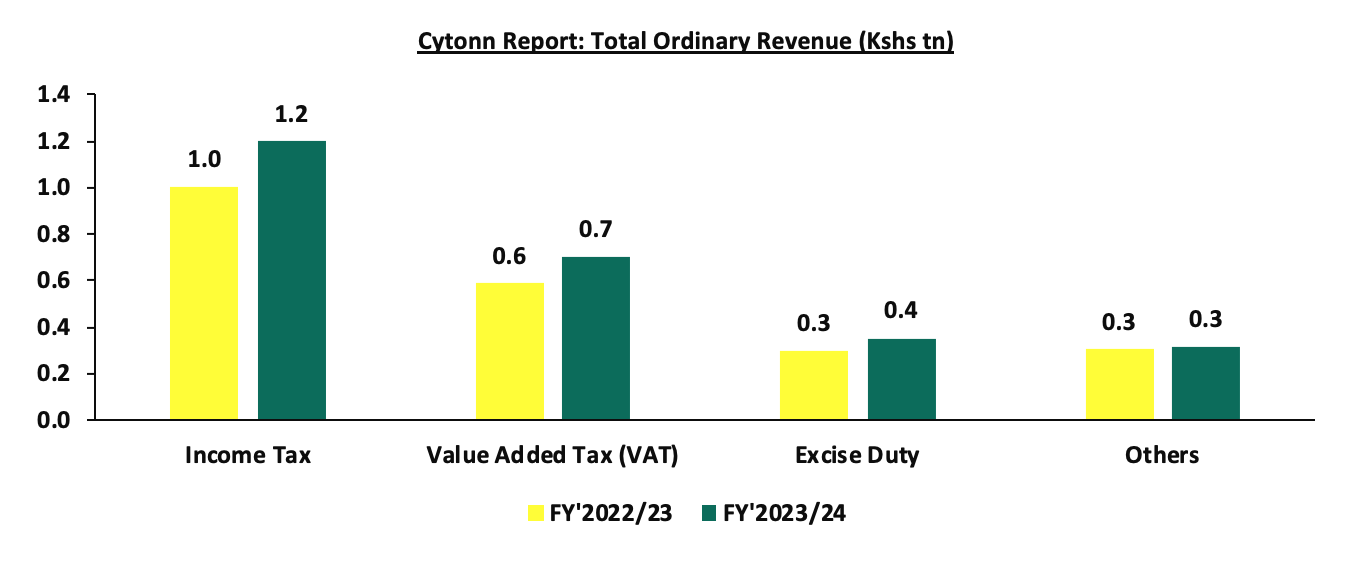

Revenue is projected to increase by 15.7% to Kshs 3.0 tn in FY’2023/24, from Kshs 2.6 tn in the FY’2022/23 supplementary budget. The increased revenue projections in the FY’2023/24 are mainly attributable to the projected 17.3% growth in ordinary revenue to Kshs 2.6 tn in FY’2023/24, from Kshs 2.2 tn in the FY’2022/23 budget. The main sources of revenue will be:

- Income Tax, which remains the highest contributor to government revenue, contributing 40.5% of the total revenue projections of Kshs 3.0 tn, is expected to increase by 19.3% to Kshs 1.2 tn in FY’2023/24, from Kshs 1.0 tn in FY’2022/2023,

- Value Added Tax (VAT) contributing 23.7% of the projected revenue collections is projected to increase by 19.7% to Kshs 703.3 bn in FY’2023/24 budget, from Kshs 587.7 bn in the FY’2022/23 budget, and,

- Excise Duty contributing 11.9% to the projected revenues for the FY’2023/24 is expected to increase by 18.7% to Kshs 352.7 bn, from Kshs 297.2 bn in FY’2023/24 budget estimates.

The chart below compares ordinary revenue projections for FY’2023/24 and FY’2022/23:

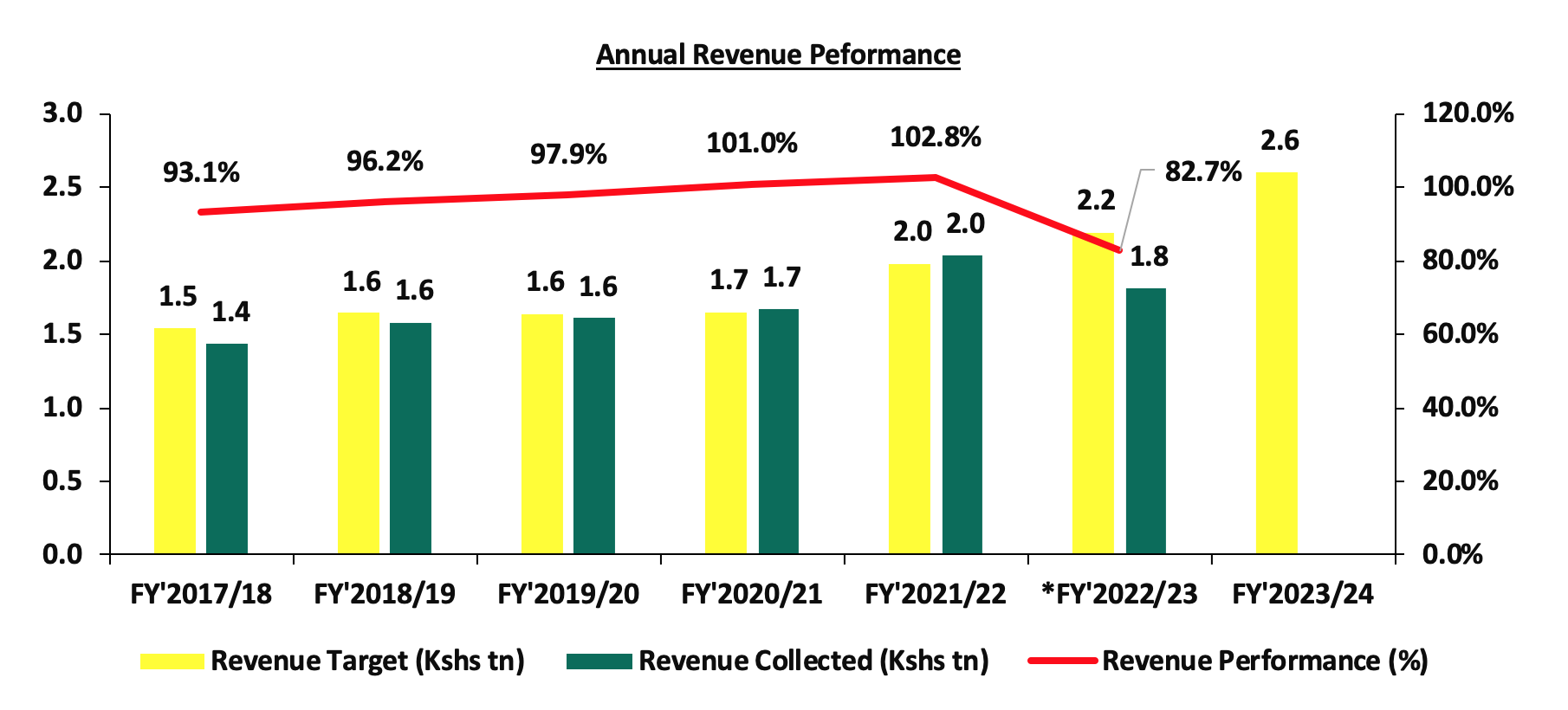

The government relies on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target. Historically, the government has struggled to meet its target revenue collections resulting to an ever-present fiscal deficit. As such, there are still concerns about the government's ability to meet its revenue collection targets in FY’2023/2024, on the back of the current operating environment. The business environment has deteriorated with the average PMI for the first 5 months in 2023 coming at 48.9 below the 50-mark threshold, mainly occasioned by high inflationary pressures and the rising interest rates. The chart below shows the ordinary revenue performance in the previous fiscal years:

Source: National Treasury of Kenya and Kenya Revenue Authority

*Total Revenue collection as of 31 May 2022

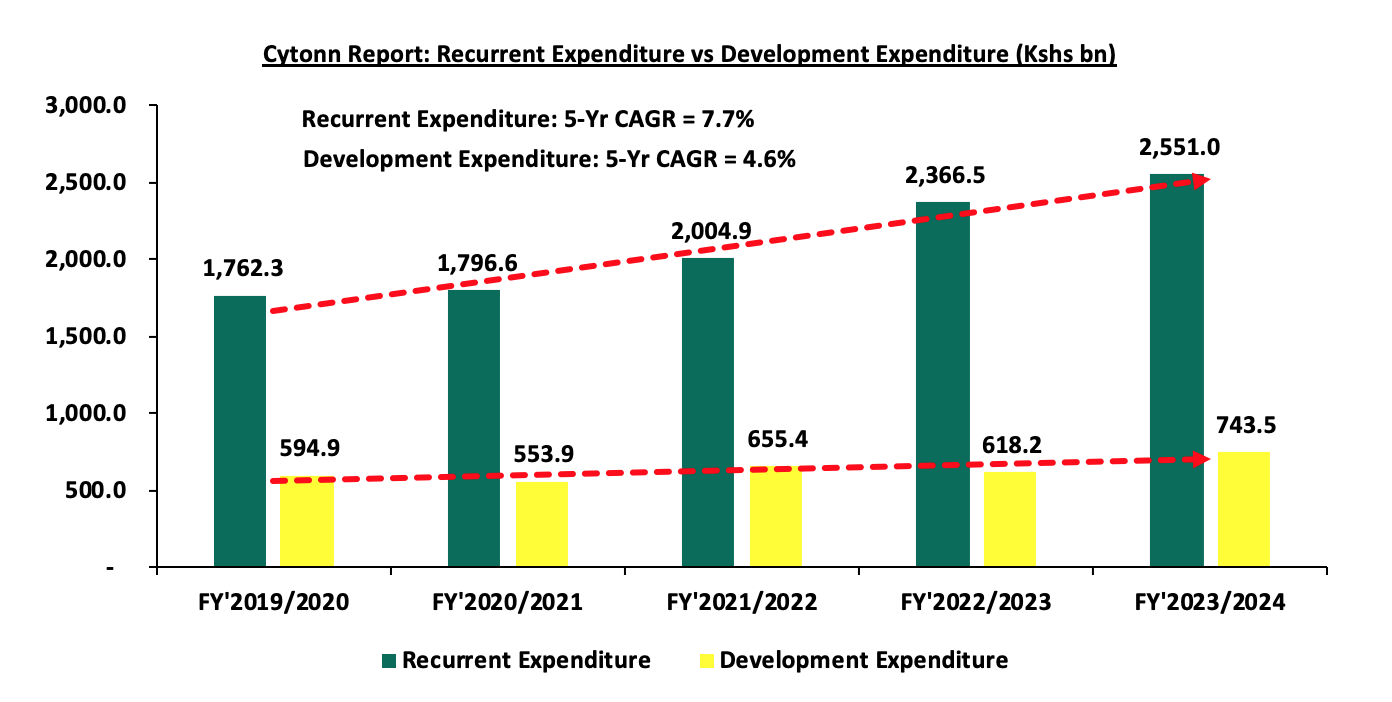

- Expenditure

Expenditure is expected to increase by 8.7% to Kshs 3.7 tn, from Kshs 3.4 tn in the FY’2022/23 budget with recurrent expenditure taking up 69.3% of the total expenditure for FY’2023/2024, in comparison to the 69.9% in FY’2022/2023. The chart below shows the comparison between the recurrent expenditure allocations and development expenditure allocations over the past five fiscal years:

*Recurrent Expenditure includes the Consolidated Fund Services (CFS) Expenditure

Some of the key take-outs include;

- Recurrent expenditure takes the largest proportion of government expenditure over the last five fiscal years growing at a 5-year CAGR of 7.7% to Kshs 2,551.0 bn in FY’2023/24, from Kshs 1,762.3 bn in FY’2019/2020. For the FY’2023/2024, the recurrent expenditure increased by 7.8% to Kshs 2,551.0 bn, from Kshs 2,366.5 bn in FY’2022/2023 mainly due to a 13.6% increase in Consolidated Fund Services (CFS) expenditure to Kshs 986.2 bn from Kshs 867.8 bn in FY’2022/2023. The increase can be mainly attributed to the increased debt servicing cost which represented 88.5% of the CFS FY’2022/2023 budgetary allocation. We expect the debt servicing cost to continue increasing as the Kenyan shilling depreciates against the dollar, given that 67.3% of the country’s external debt is denominated in US Dollars as of March 2023, and,

- Development expenditure on the other hand continues to lag behind contributing only 20.2% of the FY’2023/24 expenditure estimates. Allocation to infrastructure remains the highest taking 63.0% of the development expenditure. In the FY’2023/2024, infrastructure expenditure is set to increase by 12.4% to Kshs 468.2 bn, from Kshs 416.4 bn in FY’2022/2023 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, energy, and water sectors in order to open many areas to economic activities and spur growth in other sectors of the economy. The table below shows the sectors with the highest expenditure allocation over the last five fiscal years:

|

(Amounts in Kshs billions unless stated otherwise) |

|||||||

|

Cytonn Report: Kenya Budget Highest Expenditure Allocations |

|||||||

|

Item |

FY'2019/2020 |

FY'2020/2021 |

FY'2021/2022 |

FY'2022/2023 |

FY'2023/2024 |

Change |

CAGR |

|

Interest Payments, pensions & Net Lending |

553.3 |

586.5 |

718.3 |

867.8 |

986.2 |

13.6% |

12.3% |

|

Education |

494.8 |

505.1 |

503.9 |

544.4 |

628.6 |

15.5% |

4.9% |

|

Infrastructure |

435.1 |

363.3 |

383.3 |

416.4 |

468.2 |

12.4% |

1.5% |

|

County shareable Revenue |

310.0 |

316.5 |

370.0 |

399.6 |

385.4 |

(3.5%) |

4.5% |

|

Public Admin & Int. Relations |

298.9 |

289.3 |

299.7 |

342.2 |

327.0 |

(4.4%) |

1.8% |

|

Total |

2,092.1 |

2,060.7 |

2,275.2 |

2,570.4 |

2,795.4 |

8.8% |

6.0% |

Source: The Mwananchi Guide for the FY’2023/24 National Treasury of Kenya

Notably, the allocation to interest payment, pension and net lending increased by 13.6% to Kshs 986.2 bn in FY’2023/24 from Kshs 867.8 bn in FY’2023/24, partly attributable to high cost of servicing debt.

- Borrowing

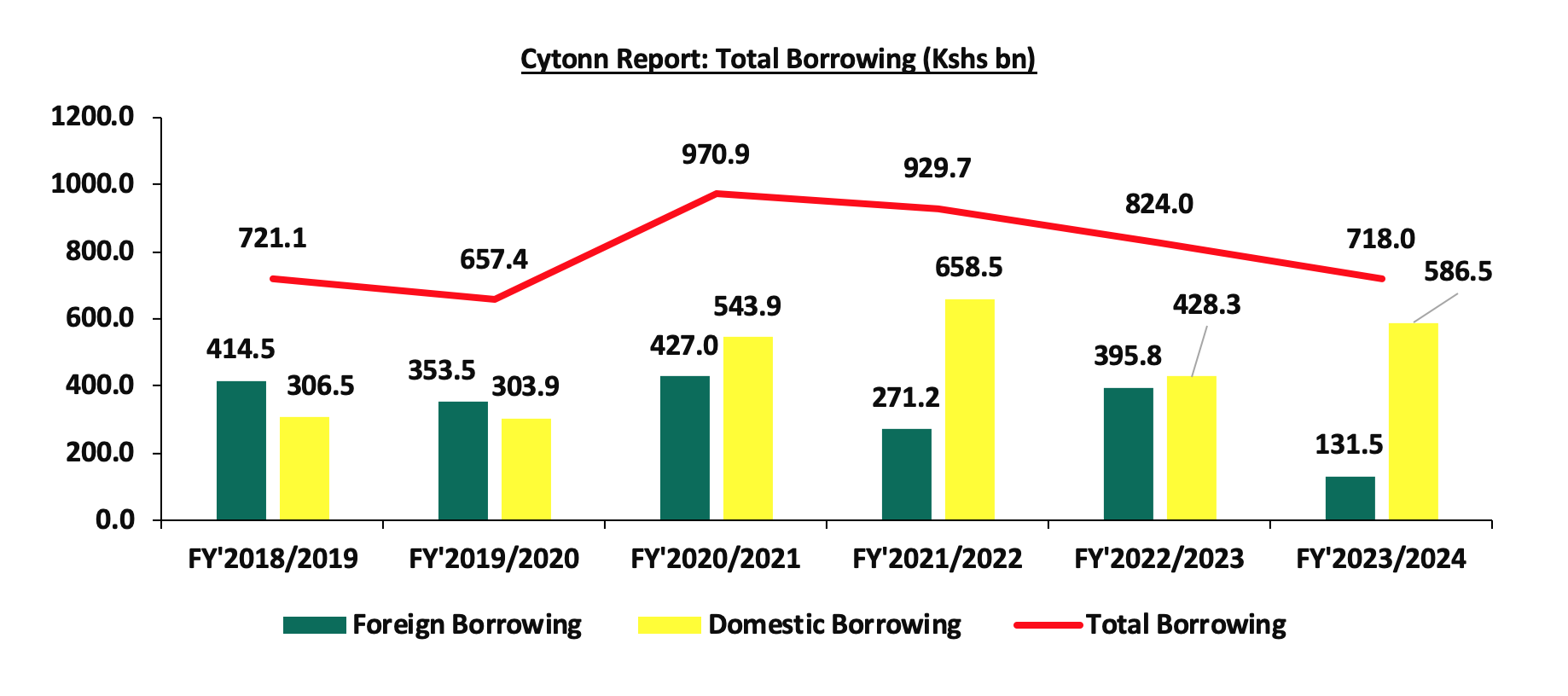

The total borrowing for the FY’2023/24 is set to reduce by 12.9% to Kshs 718.0 bn, from Kshs 824.0 bn, in FY’2022/23 budget estimates. The public debt mix is projected to comprise of 18.3% foreign debt and 81.7% domestic debt, from 48.0% foreign financing and 52.0% domestic financing as per the FY’2022/23 budget. The debt servicing costs are set to rise by 19.4% to Kshs 1.6 tn in FY’2023/24, from Kshs 1.4 n in the FY’2022/23 budget. The rise in debt servicing expenses can be partly attributable to the depreciation of the Kenyan shilling given that a larger proportion of external debt is denominated in US dollars. The chart below shows the evolution of public borrowing to fill the fiscal deficit gap over the last five years:

The key take-outs from the chart include:

- The proportion of foreign financing has been declining over time standing at 18.3% in FY’2023/24 from 57.5% in FY’2018/2019. The decline is expected to reduce Kenya’s exposure to external shocks, as the less we owe in foreign currency, the less exposed we are to any shocks in the foreign markets. However, the increased domestic borrowing by the government may lead to slow growth in the private sector lending as banks prefer lending to the government as opposed to the private sector which is considered riskier, and,

- The total borrowing has been declining in the last four years, reflecting the government’s fiscal consolidation efforts aimed at reducing the fiscal deficit and dependence on debt through rationalization of tax expenditures and ensuring the sustainability and value for money from the available resources.

We therefore note the persistent fiscal deficit is mainly on the back of low revenue collection and high expenditure. As such, the government needs to minimize spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. This would allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue.

Section IV: Key Tax changes in the Finance Bill and their impact

The Cabinet Secretary for the National Treasury tabled the Finance Bill 2023 in Parliament for discussion and consideration. The proposed tax measures in the Finance Bill 2023 are expected to add about Kshs 379.2 bn to the exchequer for the fiscal year 2023/24. The bill was passed by Parliament following the third reading and now awaits the president's assent, after which the provisions will take effect. Among the proposals are:

Under the Income Tax Act;

- Introduction of withholding tax (WHT) on Payments made in respect of digital content monetization. The Finance Bill 2023 had proposed introduction of 15.0% WHT on collections made by digital content creators, however the finance committee made an amendment to the clause by capping the WHT at 3.0%. The government move to introduce the WHT on digital content is attributable to the growing popularity of digital content creation in Kenya due to increase access to internet, digital marketing and the growing youthful population, as such it will enable the government to widen its tax base,

- The Finance Bill 2023, introduced a new contribution to the National Housing Development Fund (NHDF). Initially, the bill had proposed a 3.0% deduction from employees’ basic monthly salary with the employer matching the contribution. However, the finance committee recommended a downward revision of the rate to 1.5% deduction from employees’ basic monthly salary, with the employer matching the contribution. Additionally, the committee proposed the removal of the maximum limit of individual contributions, and the contributors will not access their contributions at the end of the 7 years as earlier proposed,

- Introduction of a new tax at a rate of 15.0% for repatriated profit for non-residents who do not distribute dividends in Kenya, equivalent to the rate charged on dividend paid to non-residents,

- The Finance Bill 2023 proposes to change the bands for Turnover Tax (ToT) to a range of Kshs 500,000.0 to Kshs 25.0 mn from the current Kshs 1.0 mn to Kshs 50.0 mn. Additionally, the bill proposes to increase the turnover tax to 3.0%, from the current 1.0%. The move by the government to increase the turnover tax is mainly to increase its revenue,

- The bill also proposes reduction of the rate of Residential Rental Income tax to 7.5% from the current 10.0% in a bid to promote compliance of property owners and boost the government’s revenue collection,

- The Finance bill 2023 proposes to introduce a 5.0% WHT on payments made to residents’ persons or permanent establishments in respect to sales promotions, marketing and services. The move is to enhance compliance in the industry by tracking the revenues earned by the respective service providers and enhance compliance, and,

- The Finance Bill 2023, proposes to introduce two new tax band; i) 32.5% for monthly incomes between Kshs 500,000.0 and 800,000.0, and, ii) 35.0% for monthly incomes above Kshs 800,000.0. A move aimed at increasing the tax revenue to support the fiscal budget. However, with majority of Kenyans earning less than Kshs 100,000.0 per month, its impact on the tax revenue will be very negligible.

Under the Excise Duty Act;

- The Finance Bill 2023 proposes to repeal annual inflation adjustment, which currently the commissioner general has the power to adjust the specific rate of excise duty once per year to consider inflation. The proposal is a welcomed move since it will provide much-needed certainty for business planning,

- The finance bill 2023 proposes the introduction of excise duty on imported sugar at the rate of Kshs 5.0 per kg excluding the sugar imported or purchased locally for use in the manufacture of pharmaceutical products,

- The Finance bill 2023, proposes an introduction of 0% excise duty on fees charged on the advertisement on alcoholic beverages, betting, gaming, and lottery and prize competition, a move aimed at discouraging consumption of the services deemed inimical to citizens,

- The Finance bill 2023 proposes the introduction of excise duty on imported fish at Kshs 100,000.0 per metric ton or 10.0% of the value, a move aimed at protecting the local fishing industry,

- The bill proposes to introduce a fine of Kshs 5.0 mn or a jail term not exceeding 3 years upon conviction to offenses relating to excise stamps. A proposal aimed at curbing illicit trade in excisable goods and encourage compliance that may support revenue collection by the government, and,

- The bill proposes to decrease excise duty on telephone, internet, and fees charged on money transfer services agencies and other financial services to 15.0% from the current 20.0%. This proposal is aimed at increasing the affordability of mobile devices and promote accessibility to these services.

Under the Value Added Tax Act;

- The Finance Bill 2023 proposes to subject petroleum products excluding liquid petroleum gas (LPG) to a VAT at a standard rate of 16.0%, up from the 8.0% introduced in 2018, this was after a transition clause that provided for an exemption of VAT for such products for a period of 2 years expired. The proposed move is expected to increase the cost of production, given that fuel is a major input in most businesses. As such the cost of living is expected to rise given that producers will pass the cost to consumers through hike in consumer prices. On the other hand, the bill proposed the zero rate on LPG products to lower their cost, and,

- The bill also proposes the removal of VAT for Aircraft, parts and engines as part of the government's bid to support the aviation sector and improve the profitability of the airlines.

Given the tight fiscal space, the Finance Bill 2023 aims to shore tax revenue which is expected to support the 3.7 tn budget for FY’2023/2024. The government intends to mobilize ordinary revenue of Kshs 2.6 tn, 17.3% increase from the 2.2 tn in FY’2022/23. As such, the government will have a fiscal deficit inclusive of grants of Kshs 718.0 bn. However, we expect the increase and introduction of additional taxes in addition to the changes in National Health Insurance Fund (NHIF) contributions and the new contribution requirement in the National Social Security Fund (NSSF) to severely impact households’ disposable income.

Section IV: Conclusion

The Kenyan economy has continued to remain resilient despite recording a slowdown in growth to 4.8% in 2022 compared to a growth of 7.6% recorded in 2021. The slowdown was partly attributable to the uneven weather patterns experienced in 2022, which impacted agricultural production, given agriculture is the main contributor to the GDP. However, the economy is expected to rebound in 2023 and expand by 5.5%, mainly supported by private sector growth, continued strong growth of the financial services sector, and recoveries in the agricultural sector. Furthermore, in the FY’2023/2024 budget, the government has allocated Kshs 4.5 bn for the fertilizer subsidy program aimed at lowering the cost of farm input and enhance food supply in the country.

The government has reduced its appetite for foreign debt, projecting to borrow Kshs 131.5 bn in foreign debt in the FY’2023/24, a 66.8% decrease from 395.8 billion in the FY’2022/23. The move is expected to lower the cost of debt servicing, given that foreign debt has been ballooning as a result of the Kenya shilling's sustained depreciation against major currencies. However, the government's shift to borrow more domestically, by projecting to increase its domestic borrowing by 37.0% to Kshs 586.5 bn in FY’2023/24, from Kshs 428.3 bn in FY’2022/23, is expected to have an impact on credit to the private sector. This is mainly because bank’s view lending to the government as more secure than lending to the private sector in order to minimize losses given the elevated credit risk.

Overall, we are of the view that the main driver of the growing public debt is the fiscal deficit occasioned by lower revenues as compared to expenditures. As a result, implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by minimizing spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. Fiscal consolidation would also allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue. However, the overall risk to the economy remains high, owing to the high debt servicing costs in the next fiscal year given the maturing USD 2.0 bn Eurobond due in June 2024.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.