Following the release of the H1’2023 results by Kenyan insurance firms, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed insurance companies and the key factors that drove the performance of the sector. In this report, we assess the main trends in the sector and areas that will be crucial for growth and stability going forward, seeking to give a view on which insurance firms are the most attractive and stable for investment. As a result, we shall address the following:

- Insurance Penetration in Kenya,

- Key Themes that Shaped the Insurance Sector in H1’2023

- Industry Highlights and Challenges,

- Performance of The Listed Insurance Sector in H1’2023, and,

- Conclusion & Outlook of the Insurance Sector.

Section I: Insurance Penetration in Kenya

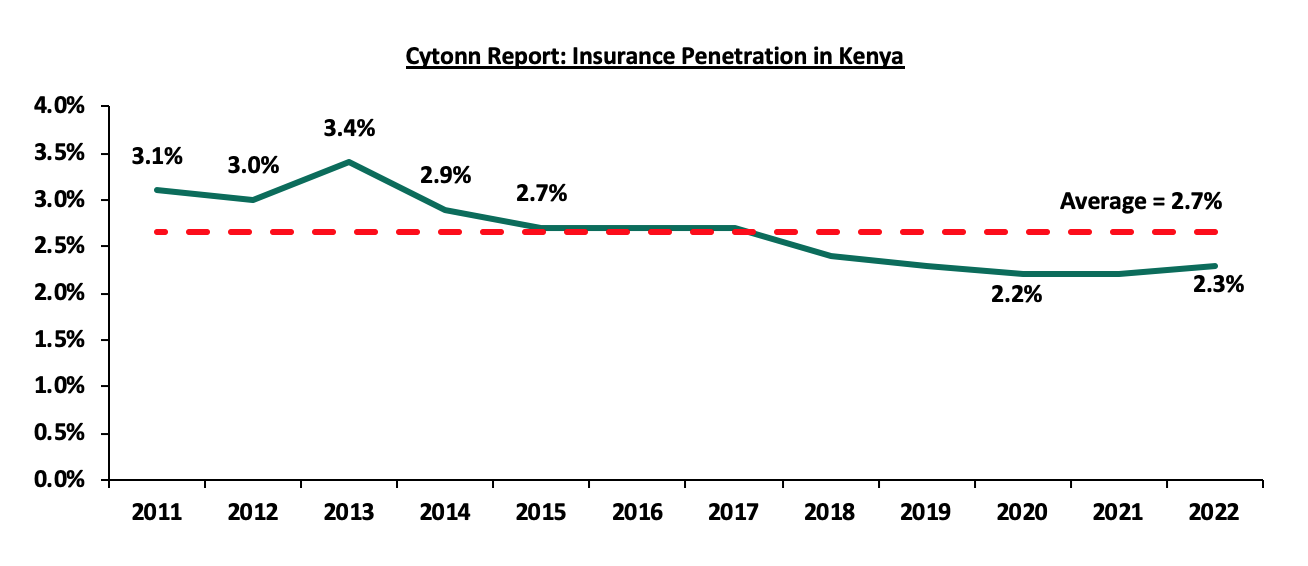

The rate of Insurance penetration in Kenya has remained historically low compared to other major economies, with the insurance penetration coming in at 2.3% as at FY’2022, according to the Kenya National Bureau of Statistics (KNBS) 2023 Economic Survey. The low penetration rate, which is below the global average of 7.0%, according to Swiss RE Institute, is attributable to the fact that insurance uptake is still seen as a luxury and mostly taken when it is necessary or is a regulatory requirement. In addition, a large portion of the Kenya’s work force is in the informal sector, making up approximately 83.0% of the total working population, where there are no strict regulations for taking up insurance plans. Notably, Insurance penetration remained unchanged at 2.3% in 2022, similar to what was recorded in 2021 and 2020, despite the economic recovery that saw an improved business environment. The chart below shows Kenya’s insurance penetration for the last 12 years:

Source: CBK Financial Stability Reports

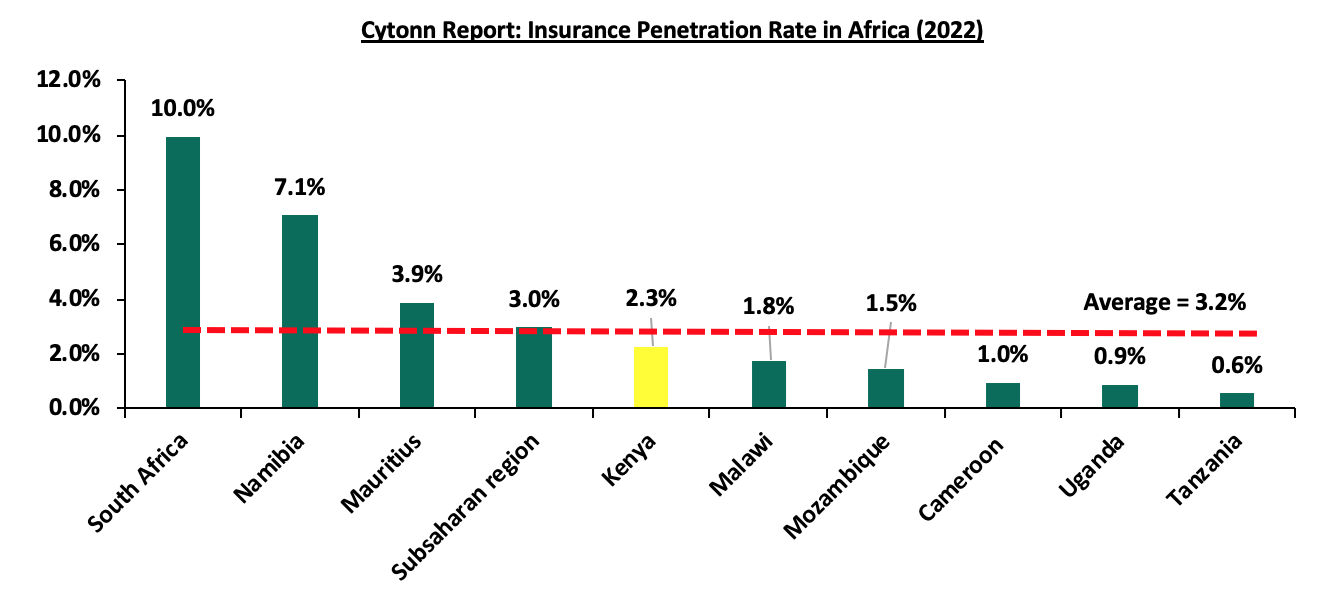

The chart below shows the insurance penetration in other economies across Africa:

Source: Swiss Re, GCR Research, KNBS

Over the period, insurance penetration in Africa has remained low compared to other developed economies, averaging 3.2% in 2022, mainly attributable to lower disposable income in the continent and slow growth of alternative distribution channels such as mobile phones to ensure a wider reach of insurance products to the masses. In addition, insurance products are often not tailored to specific needs of the local population, which can discourage uptake among the population. South Africa remains the leader in insurance penetration in the continent, with a penetration rate of 10.0% in 2022, owing to a mature and highly competitive market, coupled with strong institutions and a sound regulatory environment.

Section II: Key Themes that Shaped the Insurance Sector in H1’2023

In H1’2023, the country witnessed a tough economic environment occasioned by elevated inflationary pressures with the average inflation at 8.5% in H1’2023 compared to 6.3% over a similar period in 2022. The economic growth also slowed by 0.6% points to 5.4% in 2023, from 6.0% recorded in 2022 according to the Kenya National Bureau of Statistics (KNBS). Despite the economic Challenges facing the country, the insurance sector showed resilience registering a 14.8% growth in gross premiums to Kshs 101.5 bn in Q1’2023, from Kshs 88.4 bn in Q1’2022, outpacing the 11.3% growth in insurance claims to Kshs 42.9 bn in Q1’2023, from Kshs 38.5 bn in Q1’2022, according to the Q1’2023 Insurance Regulatory Authority Insurance Industry Report.

The general insurance business contributed 61.6% of the industry’s gross premium income compared to 38.4% contribution by long-term insurance business in Q1’2023. In Q1’2023, gross premiums from the general insurance registered a growth of 15.9% to Kshs 62.5 bn, up from Kshs 53.9 bn recorded over a similar period in 2022. Similarly, gross premiums from the long-term business increased by 12.9% to Kshs 39.0 bn, from Kshs 34.5 bn in Q1’2022. In addition, motor insurance and medical insurance classes of insurance accounted for 61.7% of the gross premium income under the general insurance business, albeit lower than 63.5% recorded in Q1’2022. On the other hand, the largest contributors of gross premiums for long-term insurance business were deposit administration and life assurance classes accounting for 52.3% of gross premiums under this class in Q1’2023, albeit lower than 59.5% recorded in Q1’2022.

Since most of the insurance companies invest in the stock market they were also affected by the 16.1% decline in the NASI in H1’2023, but this was better than the 25.2% decline recorded in H1’2022. However, the index remained in a decline position resulting in the deterioration of the insurance sector’s bottom line as a result of fair value losses in the equities investments. The sector’s allocation to quoted equities continues to reduce, with the proportion of quoted equities to total industry assets declining to 2.4% in H1’2023, from 4.0% in H1’2022.

To help with the penetration and increased efficiency the industry has adopted a number of key measures some among them being:

- Adoption of Alternative Channels: Convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks,

- Adoption of technology: Advancement in technology and innovation making it possible to make premium payments through mobile phones,

- Product innovation: Infusion of artificial intelligence into insurance client user interface and introduction of parametric insurance products such as flood insurance and livestock insurance covers has contributed to increased uptake of insurance covers, leading to growth in gross premiums which increased by 14.8% to Kshs 101.5 bn in Q1’2023, from Kshs 88.4 bn in Q1’2022, and,

- Diversification of Investments: The sector’s investments income increased significantly by 51.8% to Kshs 17.4 bn in Q1’2023, from Kshs 11.4 bn in Q1’2022, mainly attributable to the 59.9% growth in investment income from the long-term insurance business to Kshs 14.4 bn, from Kshs 9.0 bn in Q1’2022. Notably, the investment income from the general business increased by 21.9% to Kshs 3.0 bn, from Kshs 2.4 bn in Q1’2022.

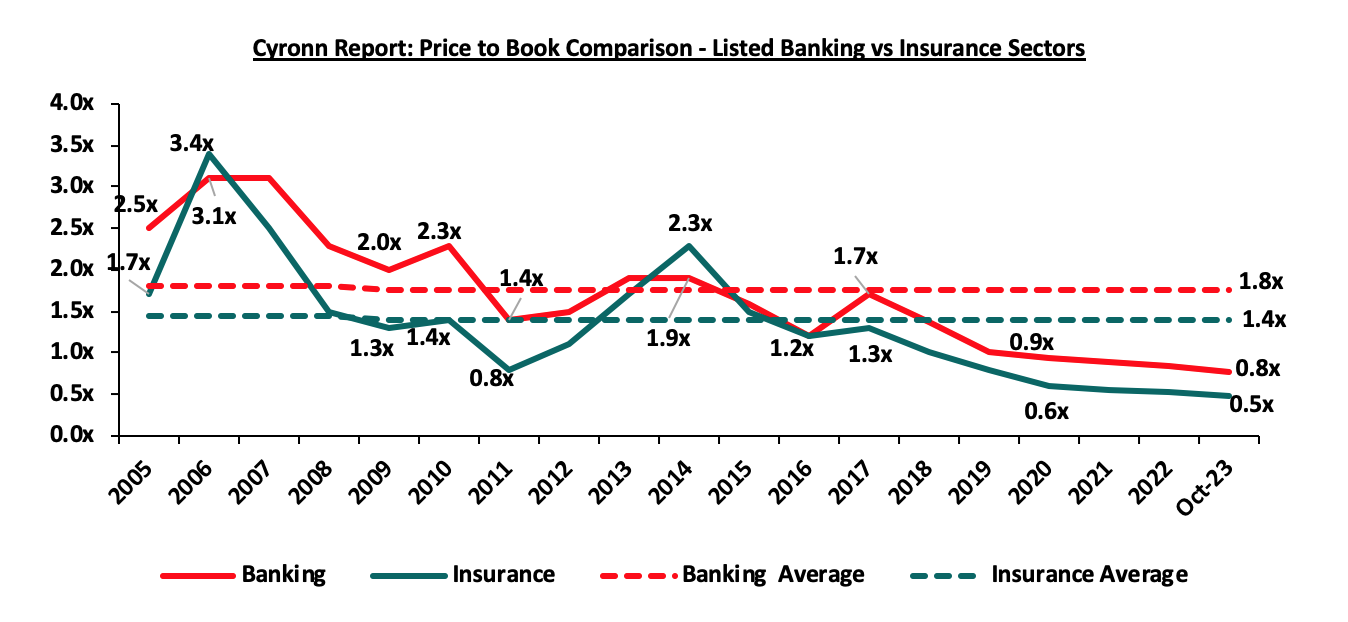

On valuations, listed insurance companies are trading at a price to book (P/Bv) of 0.5x, lower than listed banks at 0.8x, but both are lower than their 17-year historical averages of 1.4x and 1.8x, for the insurance and banking sectors respectively. These two sectors are attractive for long-term investors supported by the strong economic fundamentals. The chart below shows the price to book comparison for Listed Banking and Insurance Sectors:

- Regulation

In the pursuit of fostering a globally competitive financial services sector, the regulatory authority has been diligently implementing regulations to address both long-standing and emerging challenges within the industry. The situation became quite challenging, not only due to the impact of the COVID-19 pandemic but also due to the prevailing economic pressures. This presented a complex balancing act for insurance underwriters, as they needed to maintain prudence in their operations while simultaneously adhering to the established regulations. Regulations used for the insurance sector in Kenya include the Insurance Act Cap 487 and its accompanying schedule and regulations, Retirement Benefits Act Cap 197 and The Companies Act. In H1’2023, regulation remained a key aspect affecting the insurance sector and the key themes in the regulatory environment include;

- IFRS 17 - IFRS 17, the international accounting standard for insurance contracts, aims to establish a framework for how insurance companies should recognize, measure, present, and disclose information about their insurance contracts. The primary goal is to ensure that insurance companies provide accurate and transparent information that effectively represents the nature of these contracts. Given the disruptions caused by the COVID-19 pandemic, the International Accounting Standards Board (IASB), responsible for establishing worldwide financial reporting standards, made the decision to delay the implementation of IFRS 17. However, it's important to note that all the Kenya’s listed insurance companies have already incorporated the provisions of IFRS 17 in their recently released H1’2023 financial results. In doing so, they have also restated their financial statements for FY’2022 to align with this new standard. By replacing, IFRS 4, this new standard is anticipated to bring about significant improvements in the way insurance companies report their financial results. It is designed to provide a deeper and more insightful view of the current and future profitability of insurance contracts. One of its key features is the separation of financial and insurance results in the income statement. This separation will enable a more thorough analysis of the core performance of insurance entities and enhance the comparability of different insurance companies,

- IFRS 9 - IAS 39, Financial Instruments Recognition and Measurement was replaced with IFRS 9, Financial Instruments to address the classification and measurement of financial instruments, impairment, and hedge accounting. The guidelines introduce new classification and measurement especially for financial assets, necessitating insurers to make judgements to determine whether financial investments are measured at amortized cost or fair value, and whether gains and losses are included in the profit or loss or other comprehensive income. The new impairment model under IFRS 9 is based on expected credit losses and subsequently, all financial assets will carry a loss allowance, meaning that insurers will have to provision higher for impairment losses. Many insurance companies have opted to use the temporary exemption from implementation of IFRS 9, by continuing to apply IAS 39, but the temporary exemption expired January 2023. IFRS 9 will enable insurance companies to develop appropriate models for their customer debtors and develop plans that will help them lower their credit risk in the future, and,

- Risk Based Supervision - Risk-Based Supervision, as enforced by the Insurance Regulatory Authority (IRA), involves the implementation of guidelines that compel insurance companies to maintain a capital adequacy ratio of at least 200.0% of the minimum required capital. These regulations further stipulate that insurers should regularly monitor their capital adequacy and solvency margins on a quarterly basis. The primary objective behind this regulatory approach is to ensure that insurance companies remain financially stable, enabling them to operate as a going concern while also delivering satisfactory returns to their shareholders. We expect more mergers within the industry as smaller companies struggle to meet the minimum capital adequacy ratios. We also expect insurance companies to adopt prudential practices in managing and taking on risk and reduction of premium undercutting in the industry as insurers will now have to price risk appropriately.

- Capital Raising, Share Purchase and Consolidation

The move to a risk-based capital adequacy framework presented opportunities for capital raising initiatives mostly by the small players in the sector to shore up their capital and meet compliance measures. With the new capital adequacy assessment framework, capital is likely to be critical to ensuring stability and solvency of the sector to ensure the businesses are a going concern. In October 2022, Allianz announced that it had completed the transaction to acquire a majority stake in Jubilee Holdings Limited’s general insurance business in East Africa. The two companies announced the agreement on September 29, 2020, where Allianz had agreed to acquire the majority shareholding in the short-term general (property and casualty) insurance business operations of Jubilee Holdings. In Kenya, the former Allianz Insurance Company of Kenya and Jubilee General Insurance Company of Kenya merged to operate under the name Jubilee Allianz General Insurance Company of Kenya, with the aim to leverage on the two entities footprints in Africa and create a leading Pan-African financial services group. Consequently, US-based finance and insurance corporation American Insurance Group (AIG) announced its move to dispose of at least Kshs 2.0 bn (USD 13.5 mn) of its majority shareholding in AIG Kenya Insurance to NCBA Group.

- Technology and Innovation

One of the major drivers in the insurance sector is technology and innovation. While the insurance sector was traditionally slow to embrace digital advancements, the outbreak of the COVID-19 pandemic in 2020 compelled the industry to swiftly adopt digital channels for the distribution of insurance products. Consequently, a significant number of insurance companies have leveraged these digital avenues to stimulate growth and enhance insurance accessibility across the nation. Given that the manual handling and assessment of insurance claims is a laborious and imperfect process, the integration of Artificial Intelligence (AI) plays a crucial role in the investigation of claim legitimacy and the detection of fraudulent claims. For instance, Jubilee Holdings introduced a digital virtual assistant that enables clients to access real-time services, including end-to-end insurance product purchases and assistance, all without the need for human intervention.

Section III: Industry Highlights and Challenges

The insurance sector has seen consistent expansion in the past ten years. As a result, we expect that it will continue to achieve gradual growth due to an improving awareness as well as the increased technological advancements which have continued to shape the sector. As such, we expect a continued increase in insurance premiums, which, in turn, will bolster the industry's capacity to maintain profitability.

In H1’2023, the Insurance Regulatory Authority (IRA), in line with their mandate of regulating and promoting development of the insurance sector approved 12 new or repackaged insurance products filed by various insurance companies. In the new products, 2 or 16.7% of the 12 products were bundled products, 3 or 25.0% of the 12 products were medical plans, 1 or 8.3% of the 12 products was micro insurance, 1 or 8.3% of the 12 products was non-linked insurance, 2 or 16.7% of the 12 products were life products, while miscellaneous accounted for 3 or 25.0% of the total new/repackaged products.

Industry Challenges:

- High market competition: One of the major challenges in the insurance sector is the intense competition within the market. Despite the relatively low level of insurance adoption in the country, there are 57 insurance companies all offering similar products. Some insurers have resorted to questionable tactics in their quest for market supremacy, including the practice of premium undercutting. This strategy involves offering clients unrealistically low premiums in an effort to gain a competitive edge and safeguard their market share. Such practices have significantly contributed to underwriting losses in the industry. Although there were initial plans in March 2021 to engage a consultant to review pricing strategies in the industry, these efforts faced resistance from the regulatory authorities. However, discussions regarding pricing remain ongoing, and they take place against the backdrop of a fragile insurance market, where higher premium prices could potentially exacerbate the issue of low insurance adoption,

- Insurance fraud: Insurance Fraud is an intentional deceit performed by an applicant or policyholder for financial advantage. In recent years, there has been an upsurge in fraudulent claims, particularly in medical and motor insurance, with estimates indicating that one in every five medical claims are fraudulent. This is mainly through exaggerating medical costs and hospitals by making patients to undergo unnecessary tests. In FY’2022, 150 fraud instances were reported, with fraudulent motor accident injury claims accounting for 22.0% of the total. Fraudsters also collude with hospitals to make false claims fake surgeries and treatments, while health-care providers overcharge insured patients. The sector has been adopting the use of block chain and artificial intelligence to curb fraud within the sector. Key to note, most companies are also setting up their own assessment centres across the country so as to better determine the actual compensation,

- High loss ratios: Core insurance business performance has been dwindling, mainly attributable to the high loss ratios, which have deteriorated further, following the increase in claims outpacing the increase in premiums. As of Q1’2023, loss ratios under the general insurance business increased by 4.3% points to 72.0%, from 67.7% recorded in Q1’2022, mainly attributable to 16.8% increase in claims to Kshs 21.5 bn, from Kshs 18.4 bn in Q1’2022, that outpaced the 13.2% increase in net premiums to Kshs 42.5 bn, from Kshs 37.6 bn in Q1’2022. However, the loss ratios under the long-term insurance business eased, with the ratio declining to 62.8% as of Q1’2023, from 64.3% in Q1’2022, largely attributable to the 8.7% increase in net premiums to Kshs 34.0 bn, from Kshs 31.3 bn in Q1’2022, which outpaced the 6.3% growth in net claims to Kshs 21.4 bn, from Kshs 20.1 bn in Q1’2022. This situation has been a major concern for the industry as it affects its overall profitability and sustainability. Finding ways to address these high loss ratios is crucial to ensure the long-term health and success of the insurance sector,

- Dwindling trust from insurance consumers: One pressing issue in the insurance industry is the erosion of trust among policyholders and beneficiaries. During the H1’2023, the Insurance Regulatory Authority (IRA) registered 522 complaints in Q1’2023. General insurance business accounted for 79.1% of the complaints whereas 20.9% were made against long-term insurers. The grievances included instances where insurance companies failed to fulfill claim settlements and engaged in persistent negotiations regarding insurance terms, and,

- Regulatory compliance: Regulation on capital requirements has made it difficult for smaller insurance companies to continue operating without increasing their capital or merging in order to raise their capital base. Additionally, some of global regulatory requirements such as implementation of IFRS 17 are costly due to the need to revamping and realigning accounting and actuarial systems.

Section IV: Performance of the Listed Insurance Sector in H1’2023

The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance:

|

Cytonn Report: Listed Insurance Companies H1’2023 Earnings and Growth Metrics |

||||||||

|

Insurance Company |

Core EPS Growth |

Insurance Revenue Growth |

Loss ratio |

Expense Ratio |

Combined Ratio |

ROACE |

ROaA |

ROaE |

|

Britam Holdings |

334.5% |

33.8% |

66.1% |

71.4% |

137.5% |

9.7% |

1.0% |

2.0% |

|

CIC Group |

168.2% |

19.9% |

70.6% |

50.4% |

121.1% |

23.2% |

1.4% |

7.7% |

|

Jubilee Holdings |

(47.8%) |

11.4% |

114.5% |

38.5% |

153.0% |

16.5% |

1.1% |

4.3% |

|

Liberty Holdings |

(760.0%) |

(151.2%) |

61.9% |

71.2% |

133.1% |

7.5% |

0.5% |

2.4% |

|

Sanlam Kenya |

(1794.0%) |

(8.8%) |

89.2% |

40.8% |

130.0% |

60.5% |

(0.5%) |

(18.1%) |

|

H1'2023 Weighted Average |

19.8% |

9.7% |

86.6% |

54.2% |

140.8% |

15.9% |

1.0% |

3.1% |

|

H1'2022 Weighted Average |

16.0% |

1.7% |

83.4% |

43.4% |

126.8% |

10.5% |

2.2% |

2.2% |

|

*Market cap weighted as at 27/10/2023 |

||||||||

|

**Market cap weighted as at 09/06/2022 |

||||||||

The key take-outs from the above table include;

- Core EPS growth recorded a weighted growth of 19.8% in H1’2023, compared to a weighted growth of 16.0% in H1’2022. The sustained growth in earnings was attributable to the improved profitability owing to the increased insurance revenue despite the tough operating environment occasioned by the elevated inflationary pressures as well as the depreciation of the Kenyan currency against the dollar,

- The insurance revenue grew at a faster pace of 9.7% in H1’2023, compared to a growth of 1.7% in H1’2022,

- The loss ratio across the sector increased slightly to 86.6% in H1’2023 from 83.4% in H1’2022,

- The expense ratio increased to 54.2% in H1’2023, from 43.4% in H1’2022, owing to an increase in operating expenses, a sign of reduced efficiency,

- The insurance core business still remains unprofitable, with a combined ratio of 140.8% as at H1’2023, compared to 126.8% in H1’2022, and,

- On average, the insurance sector delivered a Return on Average Equity (ROaE) of 3.1%, an increase from a weighted Return on Average Equity of 2.2% in H1’2022.

Based on the Cytonn H1’2023 Insurance Report, we ranked insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40.0% and the latter a weight of 60.0%.

For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review:

|

Cytonn Report: Listed Insurance Companies H1’2023 Franchise Value Score |

|||||||

|

Insurance Company |

Loss Ratio |

Expense Ratio |

Combined Ratio |

Return on Average Capital Employed |

Tangible Common Ratio |

Franchise Value Score |

Ranking |

|

CIC Group |

70.6% |

50.4% |

121.1% |

23.2% |

17.3% |

17 |

1 |

|

Sanlam |

89.2% |

40.8% |

130.0% |

60.5% |

1.4% |

19 |

2 |

|

Jubilee |

114.5% |

38.5% |

153.0% |

16.5% |

26.0% |

22 |

3 |

|

Britam |

66.1% |

71.4% |

137.5% |

9.7% |

12.9% |

23 |

4 |

|

Liberty |

61.9% |

71.2% |

133.1% |

7.5% |

100.0% |

24 |

5 |

|

*H1’2023 Weighted Average |

86.6% |

54.2% |

140.8% |

15.9% |

24.0% |

|

|

The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation. The overall H1’2023 ranking is as shown in the table below:

|

Cytonn Report: Listed Insurance Companies H1’2022 Comprehensive Ranking |

|||||

|

Bank |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

H1'2023 Ranking |

H1'2022 Ranking |

|

CIC Group |

1 |

3 |

2.2 |

1 |

5 |

|

Jubilee Holdings |

3 |

2 |

2.4 |

2 |

1 |

|

Liberty Holdings |

5 |

1 |

2.6 |

3 |

2 |

|

Sanlam Kenya |

2 |

4 |

3.2 |

4 |

4 |

|

Britam |

4 |

5 |

4.6 |

5 |

3 |

Major Changes from the H1’2023 Ranking are;

- CIC Group improved to position 1 in H1’2023 from position 5 in H1’2022 driven by an improvement in both franchise and intrinsic scores, attributable to the improvement in the expense ratio to 50.4%, from 51.1%, taking the combined ratio to 121.1%, an improvement from the 122.8% recorded in H1’2022,

- Jubilee Holdings declined to position 2 in H1’2023, from position 1 in H1’2022 mainly due to the declines in both the franchise and intrinsic scores in H1’2022, driven by the deterioration in the loss ratio to 114.5%, from 99.4% in H1’2022., taking the combined ratio to 153.0%, from the 133.0% in H1’2022,

- Britam Holdings declined to position 5 in H1’2023, from position 3 in H1’2022 mainly due to declines in both the franchise and intrinsic scores in H1’2023, driven by the deterioration in the expense ratio to 71.4%, from 48.6% in H1’2022, taking the combined ratio to 137.5%, from the 122.1% in H1’2022, and,

- Liberty declined to position 3 in H1’2023 from position 2 in H1’2022 mainly due to deterioration in both the franchise score and intrinsic value score.

Section V: Conclusion & Outlook of the Insurance Sector

In H1’2023, the insurance sector continued to suffer from low penetration rates which has been worsened by deteriorated business environment emanating from rising interest rates, increased inflationary pressures as well as the persisted currency depreciation. As a result, the level of disposable income among households has decreased. However, the sector continues to undergo transition where traditional models have been disrupted, mainly on the digital transformation, innovation and regulation front, which have positively impacted the outlook. We also expect the insurance sector to maintain the culture of innovation achieved during the pandemic period while maintaining the customer-centricity as the main focus of the sector’s operating model. As a result, we believe that in order to maintain profitability, the insurance industry will need to engage in careful balancing acts. Some of these things the industry can take to grow significantly and raise penetration in the nation include:

- Enhance Operational Efficiency: Insurance companies should focus on streamlining their operations to reduce high expense ratios that have been hampering premium growth. In H1’2023, the weighted average expense ratio remained elevated at 54.2%, from 43.4% in H1’2022, owing to an increase in operating expenses, a sign of reduced efficiency. Efficiency can be achieved by optimizing operating models and leveraging digitalization to expedite processes and cut costs,

- Partnerships and alternative distribution channels: We anticipate that Underwriters will continue forming alliances and expanding their reach through various distribution channels. This may involve collaborating with other financial service providers, such as asset managers who have diversified into offering insurance-linked products. In addition to existing Bancassurance partnerships with banks, insurers can leverage the bank's product distribution network to promote their own insurance offerings. Furthermore, the integration of mobile money payment solutions is projected to remain a growing trend. This is due to the convenience it offers, along with the widespread use of mobile phones in the country,

- Optimization of A Portfolio: To maintain the sector's recovery and achieve profitability, insurance companies should optimize their portfolio by re-evaluating their goods and services. The sale of business divisions deemed to be unproductive can help insurers focus on their core and profitable products while eliminating non-core offers. For instance, in September 2023, AIG Insurance Kenya announced plans to enter into a Kshs 2.0 bn deal with NCBA Group which would see the bank acquire 100% of the issued share capital from the insurer. As insurers focus more on profitable goods, portfolio optimization will eventually include reducing holdings in unprofitable subsidiaries and affiliates and impact underwriters' products,

- Regulations: We also anticipate increased regulation in the sector from the regulatory body and other international players to ensure its solvency and sustainability. Notably, all the listed Insurers have adjusted their insurance contract recognition methods to IFRS 9 and IFRS 17 having restated their financial statements in line with these new reforms. The push by the regulator to have the desired capital adequacy levels will likely see more consolidations as insurers try to meet the capital requirements, especially for small firms. Additionally, there are increased efforts by regulators, governments and policymakers to ensure that Environmental, Social and Governance (ESG) regulations become a necessity in the insurance sector. As such, insurers will have no option but to incorporate ESG and as such, services and products offered by insurers should ensure environmental sustainability, ethics and regulatory compliance and data privacy, and ensuring social responsibility,

- Technology and innovation: The sector will continue experiencing enhanced technological tools and innovations such as Artificial Intelligence and real time data in hyper personalization of insurance marketing so as to use customer information to tailor content, products and services in line with customer preferences. With such tools, insurers will effectively respond to changes in buying behaviours and tailoring products and services to the needs of the customers to ensure their loyalty hence high retention. Firms will also adopt increased inclusion of advancements like smart contracts through block chain that would help eliminate processing costs, reduce insurance fraud and fictitious claims and improve customer satisfaction through efficient claims processing,

- Investment diversification: Insurance companies should prioritize diversifying their investments through channels like pension schemes, unit trusts, fund management, and investment advisory services to enhance their profitability and mitigate potential losses. This strategic shift is crucial, given the rising combined ratios that have led to insurers experiencing losses in their core operations, where underwriting expenses and claims have been increasing relative the realised premium increases. For instance, As of Q1’2023, loss ratios under the general insurance business increased by 4.3% points to 72.0%, from 67.7% recorded in Q1’2022, mainly attributable to 16.8% increase in claims to Kshs 21.5 bn, from Kshs 18.4 bn in Q1’2022, that outpaced the 13.2% increase in net premiums to Kshs 42.5 bn, from Kshs 37.6 bn in Q1’2022, and,

- Insurance awareness campaigns: Insufficient knowledge on insurance products and their importance continues to persist, massively contributing to the low insurance penetration. Insurance is still largely assumed as regulatory compliance, rather than a necessity. The regulators, insurers, and other stakeholders should enhance insurance awareness campaigns to increase understanding of insurance products. According to a survey commissioned by the Association of Kenya Insurers (AKI), the second largest contributor to low insurance uptake at 27.0% is a lack of knowledge of the various insurance products and their benefits. As such, there is a lot of headroom for insurers to educate, repackage, and tailor their products to different potential clients.

To read the H1’2023 Insurance Report, please download it here

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.