The National Health Insurance Fund (NHIF) was established in 1966 through an act of parliament. Its core mandate is to provide affordable medical insurance coverage to all Kenyans, thereby enabling Kenyans to access quality and affordable medical services from medical institutions. The fund is governed by the NHIF Act (1998), which over the years has been subjected to a number of amendments to address the changing health care needs of the health sector in the country. Some of the notable changes in recent years include:

- Introduction of the Comprehensive Medical Insurance Scheme for Civil Servants (CMSCS) in January 2012. The CMSCS is part of NHIF and provides medical insurance to civil servants and their eligible beneficiaries. The scheme enables civil servants to enjoy inpatient treatments without any limits in government, missions, and some private hospitals,

- Introduction of the Health Insurance Subsidy Program (HISP) in September 2014. The program is financed by the government of Kenya, and the funds are channeled to NHIF for the benefit of identified households that are classified as poor and vulnerable,

- Upward revision of NHIF rates in April 2015, the rates increased from a contribution range of between Kshs 30.0 and Kshs 320.0, to a contribution range of between Kshs 150.0 to Kshs 1,700.0 depending on the employee’s salary. The benefits package was expanded to include not only inpatient cover but also other benefits such as outpatient cover and maternity benefits, among others,

- Launch of Universal Health Coverage program. The program is aimed at enabling all Kenyan Citizens to access free basic health care services in all public health facilities. The pilot phase was launched in December 2018 and was implemented Isiolo, Machakos, Nyeri and Kisumu counties, and

- Launch of biometric registration in October 2020 for all NHIF member. The move was intended to improve efficiency and enhance convenience for members seeking services and also reduce medical fraud.

On 1 May 2023, President William Ruto announced that there would be changes to the National Health Insurance Fund (NHIF) contributions deducted from the employees’ gross salary. The move is aimed at increasing the total contributions received by revising the contribution rate to 2.75% of the gross salary as opposed to the current charging of a fixed rate of between Kshs 150.0 – Kshs 1,700.0 depending on the gross salary bracket. Additionally, the increase in contributions is expected to enable the NHIF to address some of the witnessed cash crunch, which has resulted in some hospitals declining the use of NHIF cards to cover medical bills due to the delayed disbursements of funds by the NHIF to hospitals. According to the Ministry of Health Sector working group report 2021-2022, NHIF paid a total claim of Kshs 71.3 bn against the Kshs 78.8 bn it received from member contributions. This represents a 90.5% claim ratio, which was the highest claim ratio in the last 5 years, leaving only 9.5% of the total contributions received to cater for the fund’s other expenses, thereby exacerbating the Fund’s solvency risk and the possibility of its inability to meet future financial obligations. This further points towards the need for NHIF to revise upward the NHIF contributions if the fund is to be sustainable and profitable in the long term. As such, we saw it fit to review the National Health Insurance Fund (NHIF) to shed light on the current state of the fund in terms of the milestones achieved and the challenges faced while looking at the impact of the upward adjustment of the NHIF deductions. We shall also make a comparison with similar initiatives in other countries and give our recommendations towards achieving a sustainable Fund. We shall undertake this by looking into the following;

- The National Health Insurance Fund (NHIF),

- Challenges facing the National Health Insurance Fund (NHIF),

- The National Health Insurance Fund’s Membership and Contributions,

- National Health Insurance Fund Acts,

- Case Study and Recommendations, and,

- Conclusion.

Section I: The National Health Insurance Fund (NHIF)

The National Health Insurance Fund, formerly known as the National Hospital Insurance Fund, was established in 1966 through an Act of Parliament. The fund was initially intended for employed individuals in the formal sector, however, in 1972, the act was amended to incorporate those in the informal sector. In 1998, the original act was replaced with the National Insurance Fund Act, No.9 of 1998, which transformed the fund into a state owned corporation run by a board of Management. The fund’s core mandate is to provide affordable medical insurance cover to all Kenyans as well as facilitate access to quality and affordable medical services from medical institutions. This is achieved through:

- Registering and receiving contributions,

- Processing payments to accredited health care providers,

- Carrying out regular internal accreditation of health facilities,

- Contracting health care providers as agents to facilitate the health insurance scheme,

- Protecting the interests of the contributors to the Fund, and,

- Advising on the national policy to be followed with regard to National Health Insurance.

The Fund is governed by a Board of Management, as defined in the National Insurance Fund Act, No.9 of 1998, with their role being management, control, and administration of the Fund’s assets to ensure the Fund achieves its goals and objectives. The members of the Board of management consist of:

- The Chairperson, who is appointed by the President,

- The Principal Secretary, Ministry of Health,

- The Principal Secretary, National treasury and planning,

- One person nominated by the Kenya Medical Association,

- One person nominated by the Federation of Kenya Employees,

- One person nominated by the Central Organization of the Trade unions,

- Two persons, not being Governors, nominated by the Council of Governors,

- Two persons, not being Officers, nominated by the Cabinet Secretary, Ministry of Health, and,

- The Chief Executive Officer (CEO), who is appointed by the Board of Management through a competitive process and serves for term of 3 years and is eligible for appointed for a further and final 3-year term

The day to day management and implementation of policy matters are done by the Chief Executive Officer (CEO). The Fund’s Board of Management is mandated with the following functions and objectives:

- To receive all the contributions and other payments due to the Fund,

- To make payments out of the Fund to the accredited health facilities,

- To set criteria for the accreditation of hospitals and to declare such hospitals,

- To regulate the contributions payable to the Fund, benefits, and other payments to be made out of the Fund,

- To promote the interests of the contributors to the Fund, and,

- To advise on the national policy to be followed with regards to National Health Insurance and implement all government policies.

Section II: Challenges facing the National Health Insurance Fund (NHIF)

Despite the progress made by NHIF over the 57 years it has been in operation, the fund has encountered a number of challenges that have hampered its ability to achieve its objectives. These challenges have raised uncertainties about the sustainability of the fund and had a damaging effect on the Funds image. Some of the notable challenges include;

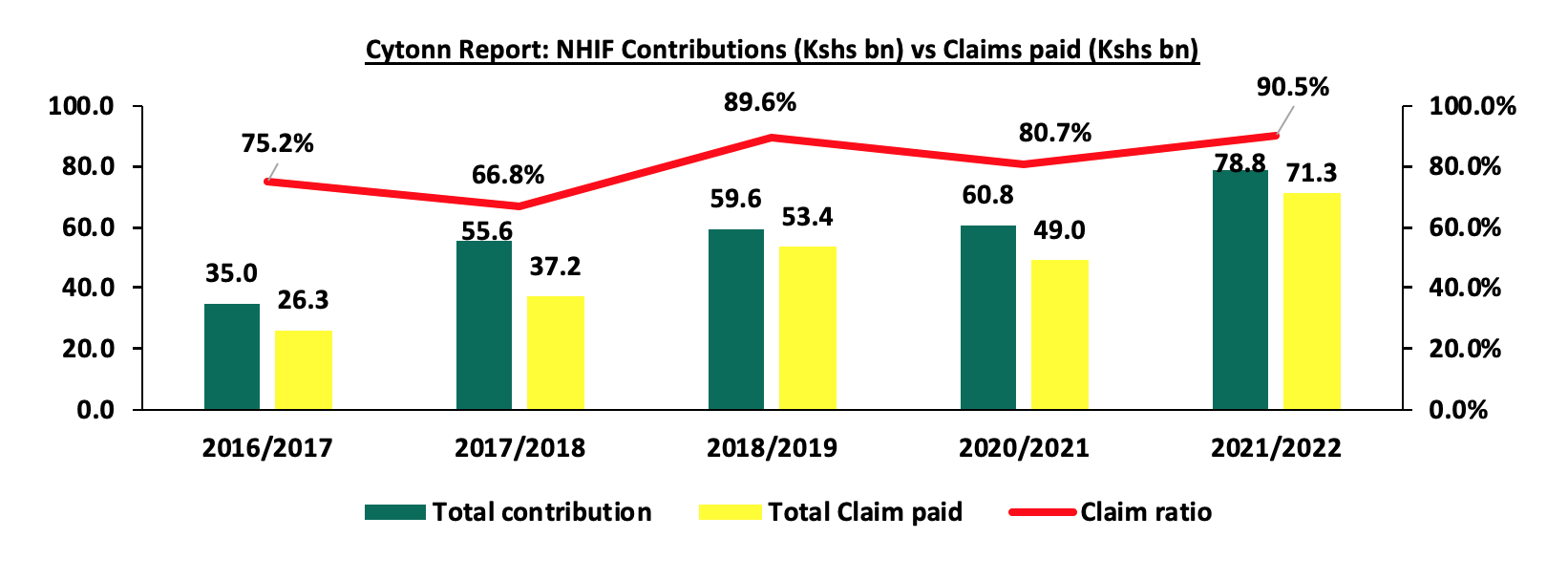

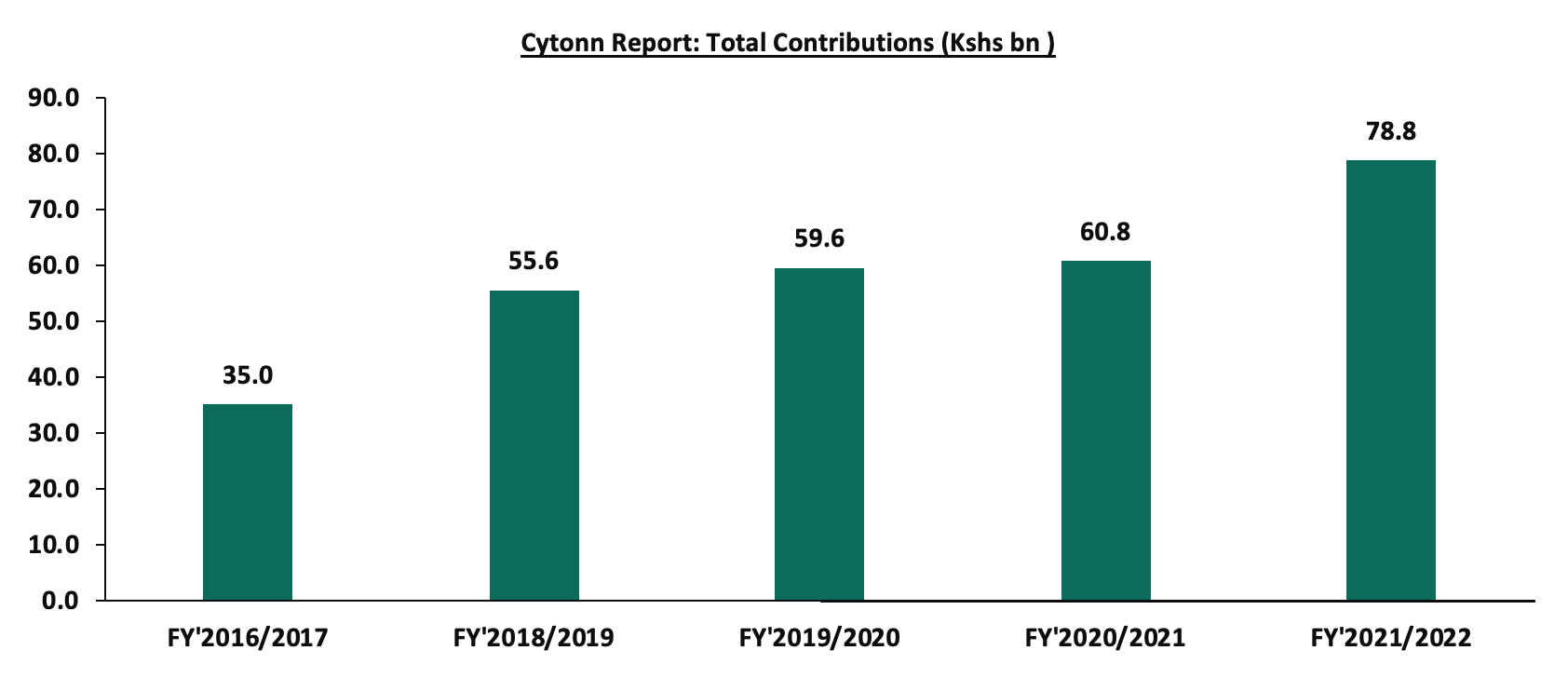

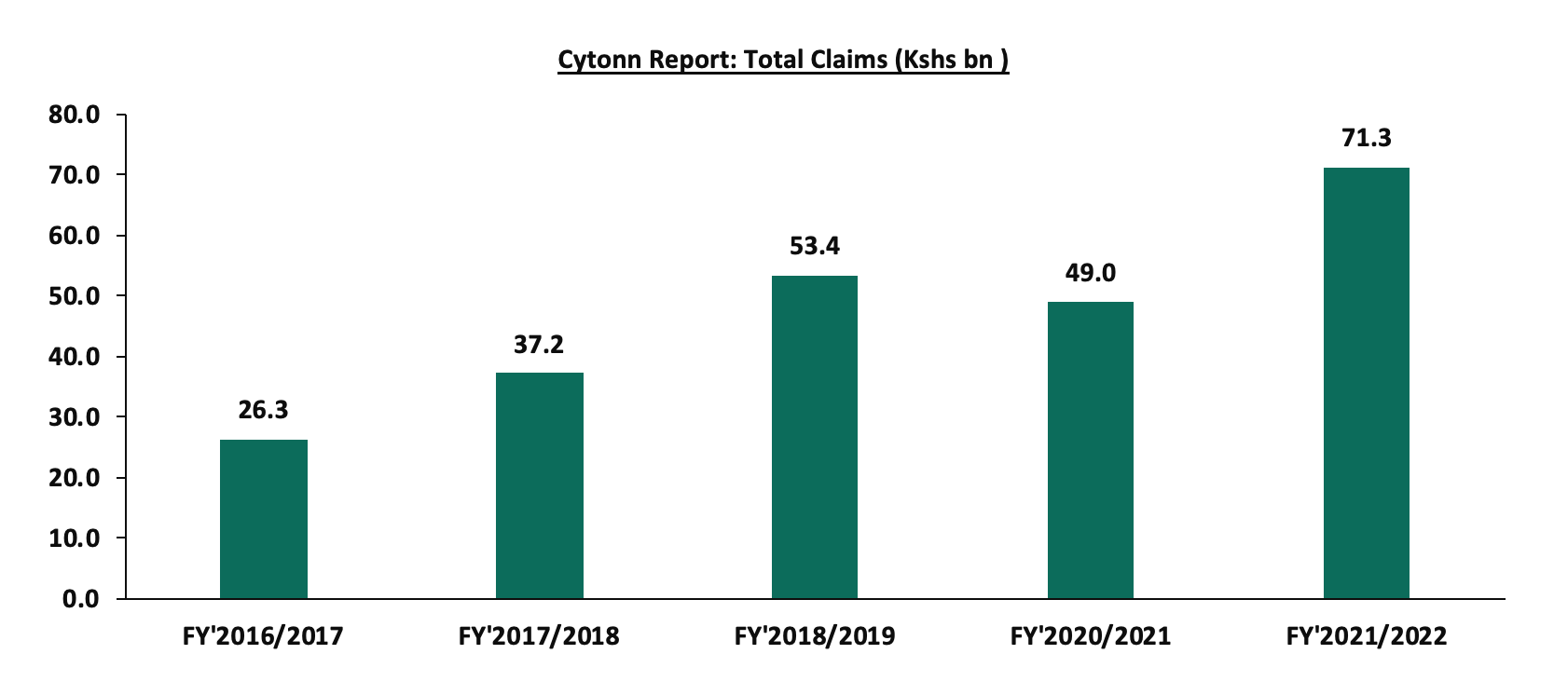

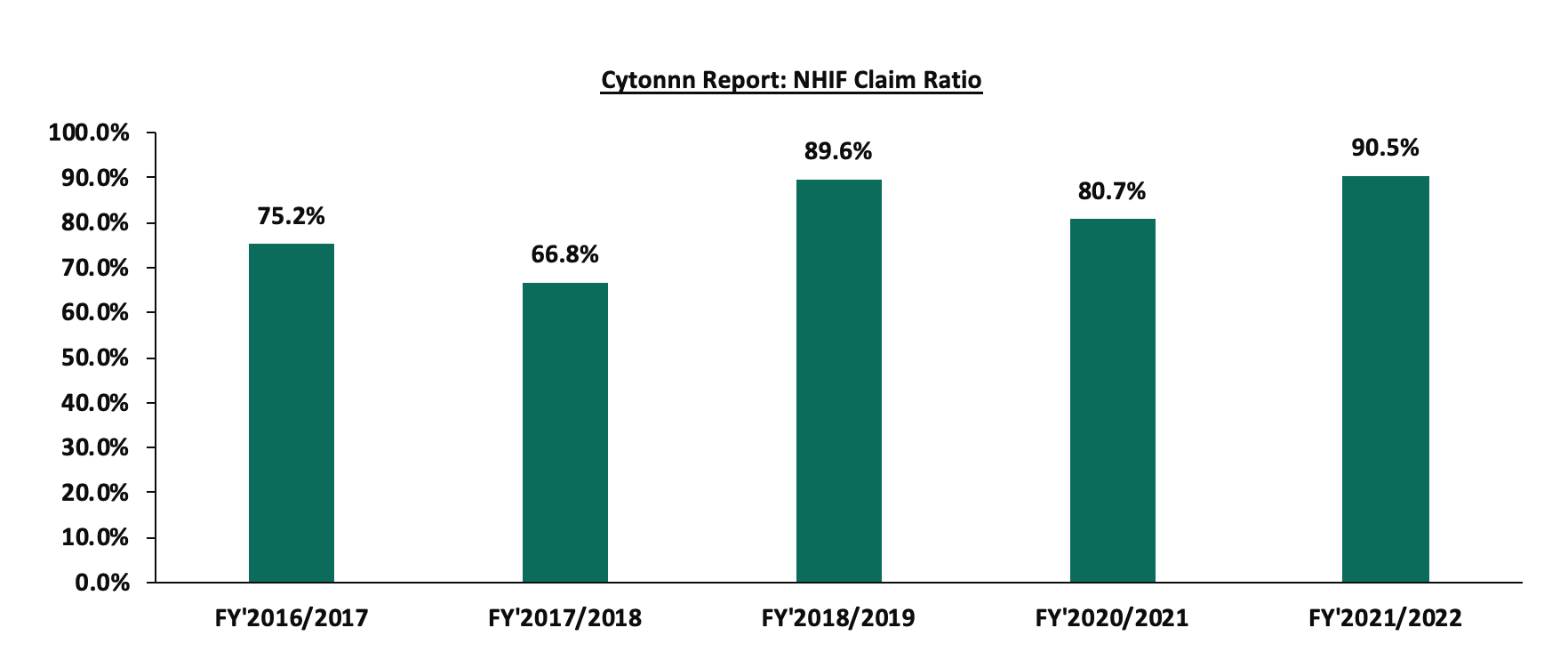

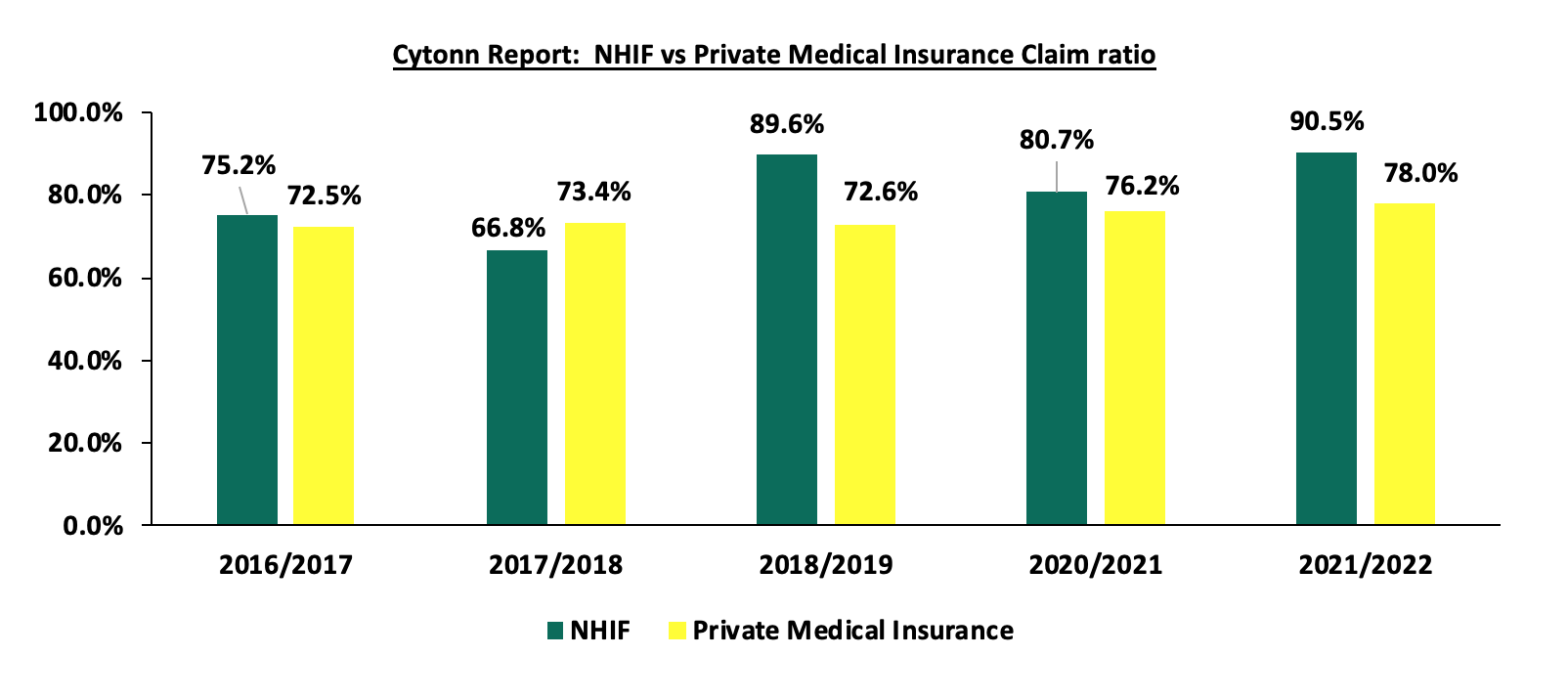

- High payout ratio - Despite the fact that NHIF premium contributions have been increasing over the years, with total contributions to the Fund growing at a 5-year CAGR of 17.6% to Kshs 78.8 bn in FY’2021/2022 from Kshs 35.0 bn in FY’2016/2017, the growth in total payout from the fund has outpaced the growth in total contribution received, having grown by a 5-year CAGR of 22.1% to Kshs 71.3 bn in FY’2021/2022, from Kshs 26.3 bn in FY’2016/2017. This has led the claim ratio for FY’2021/2022 to increase by 15.3% points to 90.5% from the 75.2% claim ratio recorded in FY’2016/2017. As such, the high pay-out ratio reduces the fund’s net operating surplus, increasing the Fund’s solvency risk and the possibility of its inability to meet future financial obligations. Below is the graph of growth of the claim ratio for the last 5 years:

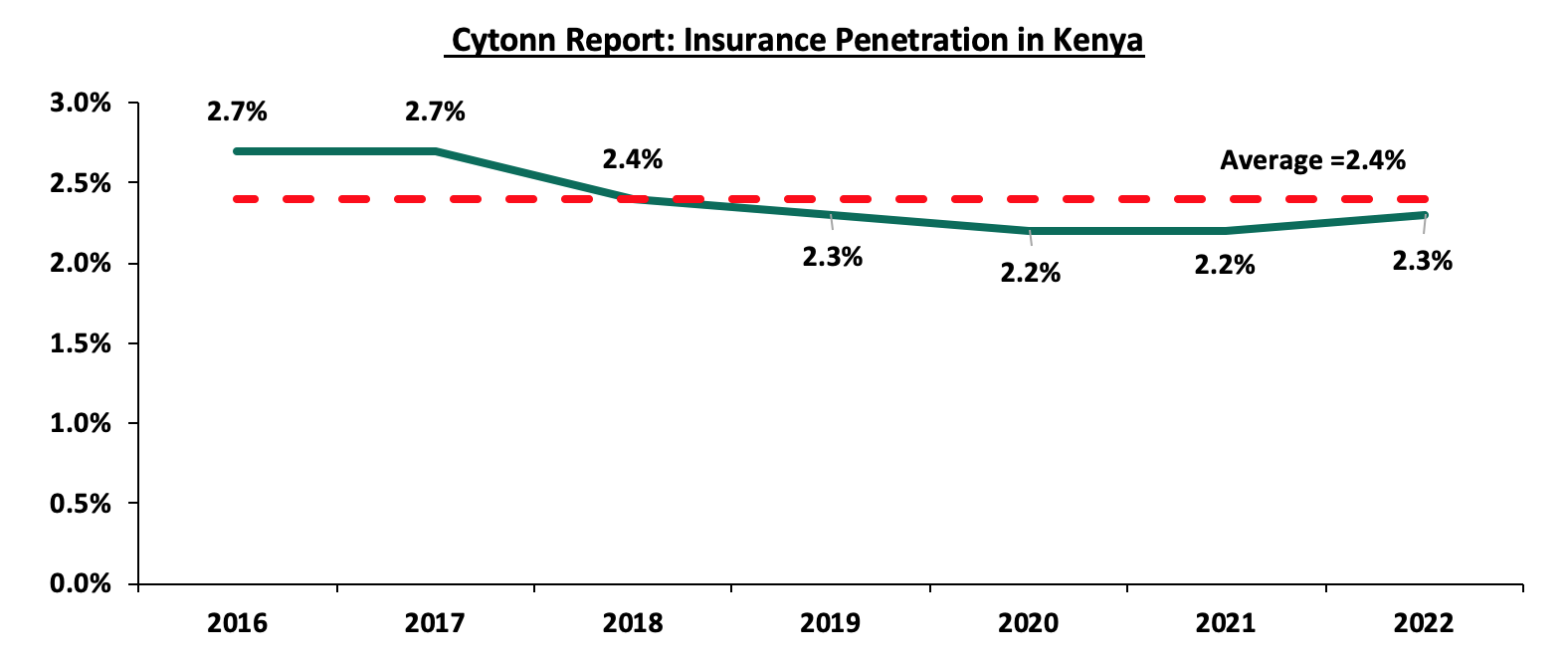

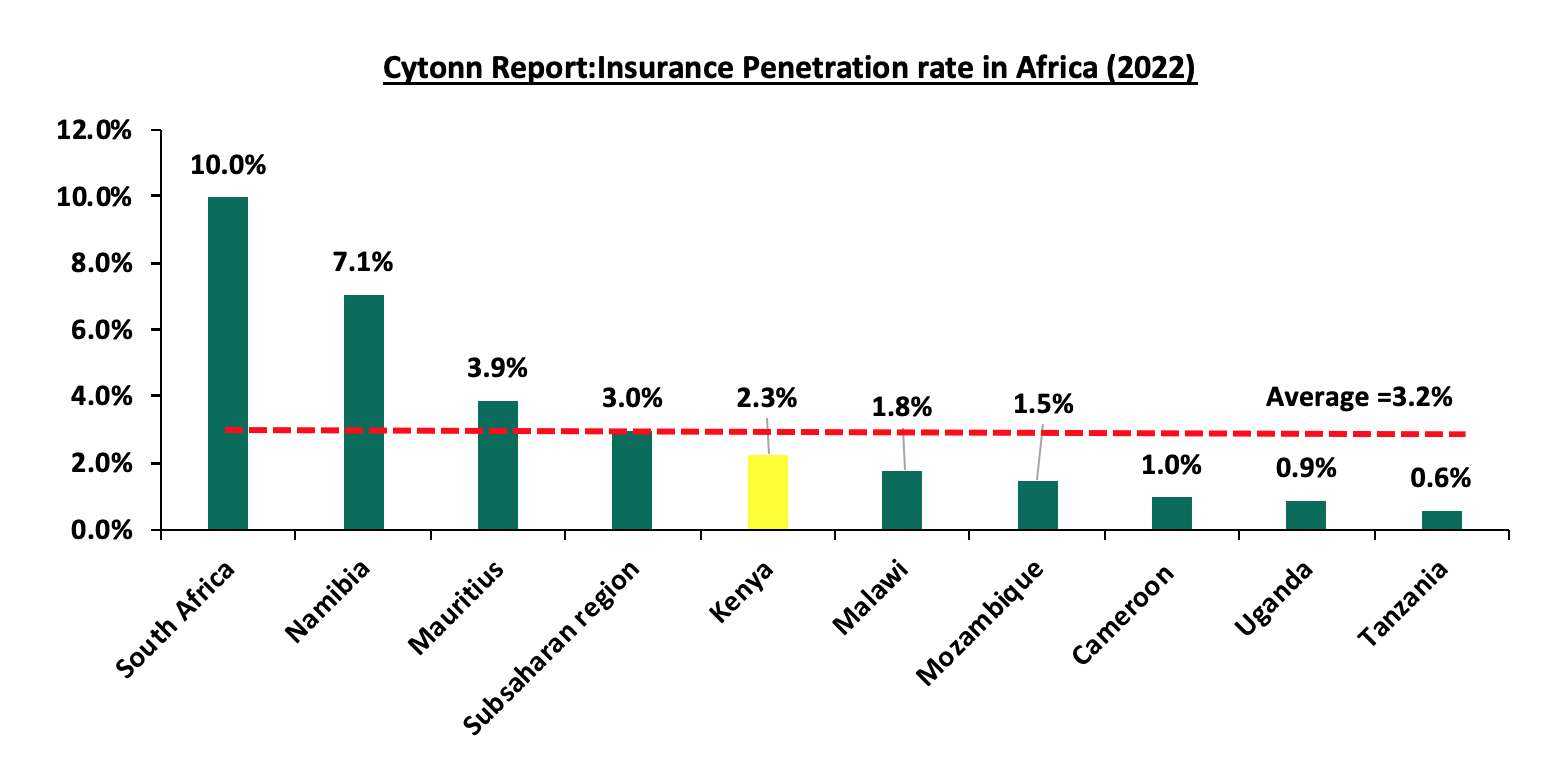

- Low Insurance Penetration – Insurance uptake in Kenya continues to remain low compared to other key economies, with insurance penetration at 2.3% as of FY’2022, according to the Q4’2022 Insurance Regulatory Authority (IRA) and the Kenya National Bureau of Statistics (KNBS) 2023 Economic Survey. The low penetration rate, which is below the global average of 7.0%, according to the Swiss RE institute, is attributable to the fact that insurance uptake is still seen as a luxury and is mostly taken when it is necessary or a regulatory requirement. Notably, Insurance penetration remained unchanged at 2.3% in 2022, similar to what was recorded in 2021 and 2020. The chart below shows Kenya’s insurance penetration for the last 12 years:

Source: CBK Financial Stability Reports

Source: Swiss Re, GCR Research, KNBS

- Failure to achieve revenue targets – For the last 3 years, the fund has been operating below its targeted revenue collection, which constitutes the total contribution received plus the investment income earned. In FY’2021/2022, the funds collected a total revenue of Kshs 80.4 bn, which was below the revenue target of Kshs 90.6 bn representing a revenue target attainment of 88.8%. This was below the previous year’s revenue target attainment of 96.1% from a total revenue of Kshs 62.0 bn against a revenue target of Kshs 64.5 bn,

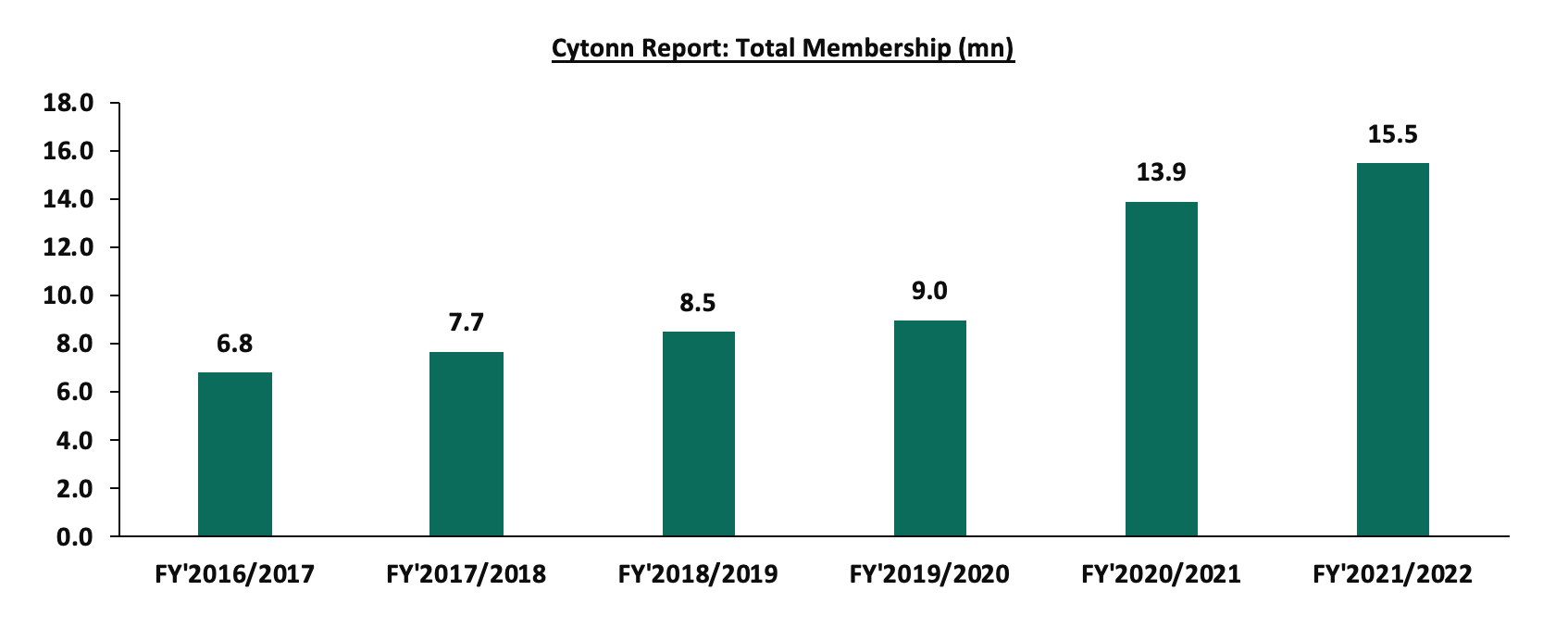

- High attrition rate – The fund has continued to experience a decline in active membership who make monthly contributions due to low retention rates as a result of attrition of informal sector registered members, partly attributable to low disposable income. According to the Ministry of Health Sector report 2021/2022, the Fund’s active membership stood at 43.2% of the 15.5 mn registered members in FY’2021/2022, compared to an active membership of 89.7% out of the 6.8 mn members in FY’2016/2017,

- Fraudulent Claims – There have been numerous instances of fraudulent claims, including collaboration between some beneficiaries and health service providers. Additionally, there have been reports of some health service providers participating in altering or falsifying information to increase their payouts from the Fund. Such occurrences have led to an increase in claims, consequently reducing the net operating surplus of the Fund. Notably, the total claims paid out of the fund increased at a 5-year CAGR of 22.1% to Kshs 71.3 bn in FY’2021/2022, from Kshs 26.3 bn in FY’2016/2017,

- Rise in cost of medical services – The cost of medical drugs and procedures has also been on the rise in the wake of the Kenya shilling’s depreciation against the US dollar, forcing healthcare providers to pass on the increased cost to insurers and patients who pay out of pockets,

- Overdependence on total Contributions as the source of funding - According to the Ministry of Health Sector report 2021/2022, the fund’s other income totaled Kshs 1.6 bn out of the total revenue of Kshs 80.4 bn in FY’2021/2022, representing 2.0% of the total revenue collected

- Delayed Remittances – The Fund has experienced delayed remittances of the NHIF contributions by some employers and self-employed individuals. Consequently, this has continued to hinder the Fund’s ability to meet its collection targets. In June 2023, the Cabinet Secretary for the Ministry of Health, Susan Nakhumicha, noted that the government owed NHIF a total of Kshs 20.0bn, and,

- Mismanagement and misappropriation of funds – There have been cases of corruption and mismanagement of funds at the NHIF. As such, this has hampered the Fund’s ability to meet its objectives, with the Fund also witnessing dwindling trust from the contributors.

Section III: The National Health Insurance Fund’s Membership and Contributions

Membership in the NHIF is mandatory for all workers in formal employment, with the contributions ranging between Kshs 150.0 to Kshs 1,700.0 depending on the employee’s gross salary bracket. According to the Ministry of Health Sector working group report 2021-2022, NHIF membership stood at 15.5 mn members with an active membership of 6.7 mn as at 30 June 2022. The chart below shows the evolution of membership since FY’2016/2017:

Source: Ministry of health Sector working group report

The total contributions made to the Fund have grown at a 5-year CAGR of 17.7% to Kshs 78.8 bn in FY’2021/2022, up from Kshs 35.0 bn collected in FY’2016/2017. This is mainly attributable to the upward revision of workers’ monthly contribution rates to a scale of between Kshs 500.0 and Kshs 1, 700.0 from Kshs 320.0 in 2015, due to the expansion of benefit package to include outpatient cover, special initiatives such as Health Insurance Subsidy Programme (HISP), Universal Health Care and Linda Mama Programme. The graph below shows the growth of the total contributions to the Fund:

Source: Ministry of health Sector working group report

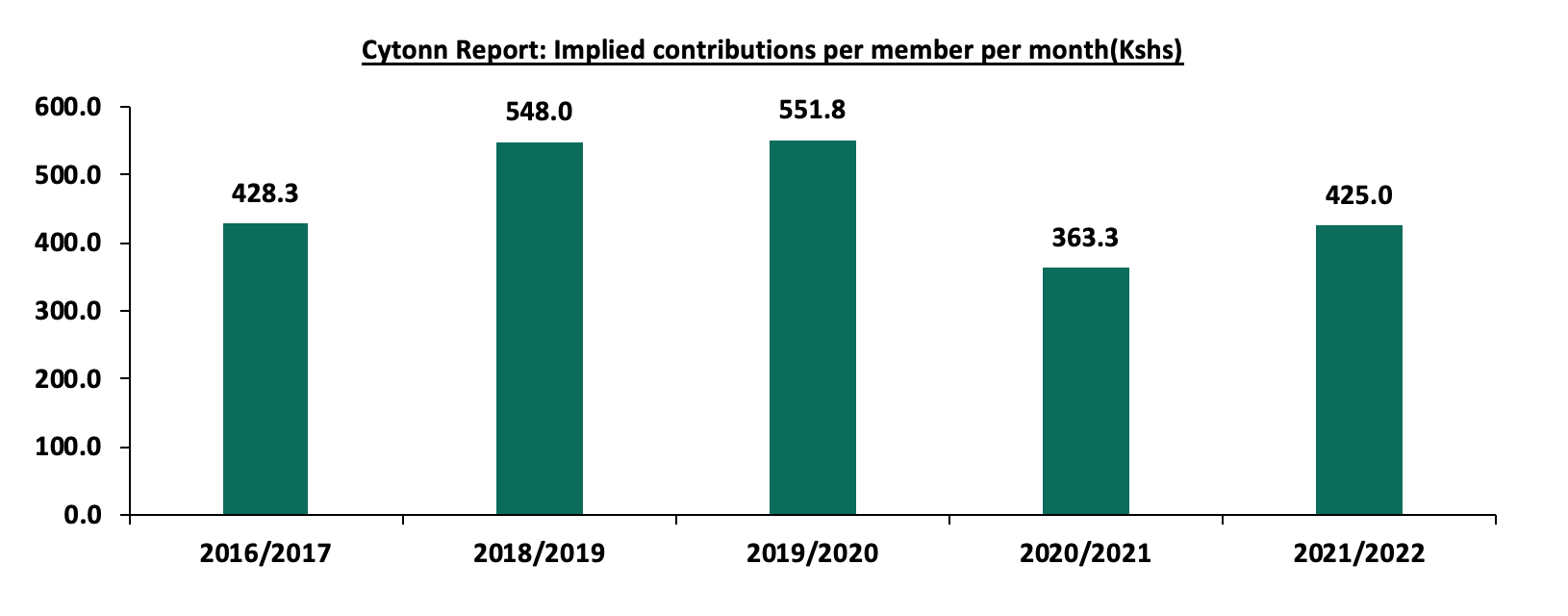

However, in FY’2021/2022 the fund did not meet its collection target of Kshs 90.6 bn, achieving only 88.8% of its target, compared to the 96.1% target achievement recorded in FY’2020/2021. This was attributable to a tough macroeconomic environment as a result of the negative effects of the COVID-19 pandemic, which caused companies to downsize, reduce salaries, and even shut down. Similarly, the informal sector also experienced financial challenges brought on by the negative effects of the COVID-19 pandemic which impaired their ability to make voluntary contributions to the fund. Below is graph showing the implied monthly contributions per member:

Source: Ministry of health Sector working group report

The total claims paid out of the fund have also increased at a 5-year CAGR of 22.1% to Kshs 71.3 bn in FY’2021/2022, from Kshs 26.3 bn in FY’2016/2017, mainly attributable to increased uptake of outpatient cover and special cover packages. The graph below shows the growth of the total claims paid out of the Fund:

Source: Ministry of health Sector working group report

Despite the significant growth in the total membership contributions, the growth of the total claims paid continues to weigh down on the net contributions retained in the fund. Notably, in FY’2021/2022, the claim ratio was at its peak, coming in at 90.5%, representing 9.8% points increase from the 80.7% ratio recorded in FY’2020/2021. The increase was mainly a result of the high uptake of outpatient cover and special cover packages, partly due to prevalence of chronic diseases. Below is the graph showing the movement of the benefits to contribution ratios over the years:

Source: Ministry of health Sector working group report

NHIF claim ratio of 90.5% as at 30th June 2023 is significantly high when compared to the Private Medical insurance claim ratio of 78.0%, according the Insurance Regulatory Authority (IRA) Q2’2022 Insurance industry report. This high claim ratio of NHIF indicates there is a possibility of the Fund being overcharged by health service providers or the contributions charged by NHIF are not sufficient enough to run the fund. NHIF needs to come up with austeric measures to lower the claim ratio to match the Private Medical Insurance claim ratio of 78.0%. With a total contribution of Kshs 78.8 bn and Claim ratio of 78.0%, the fund will have paid out a total claim of Kshs 61.5 bn and consequently the fund will have a surplus of Kshs 17.3 bn as opposed to the current surplus of Kshs 7.5 bn. Below is the graph comparing the claim ratio for NHIF with the Private medical insurance claim ratio:

Source: Ministry of health Sector working group report, IRA

Section IV: National Health Insurance Fund Acts

NHIF Act 1998 is the principal statute that governs the NHIF, with the Act having been amended severally to accommodate the changing health care needs of the Kenyan population as well as lessen the restrictions in the health sector. The main focus of the continued amendment has been to operationalize key areas under the NHIF Act 1998 in order to attain the Universal Health Coverage (UHC) through the removal of financial barriers. Key reforms that have since been implemented to enhance the capacity of the NHIF to effectively deliver its mandate include;

- Upward revision of workers’ monthly contribution rates to a scale of between Kshs 500.0 and Kshs 1, 700.0, from Kshs 320.0 in 2015,

- Expansion of the NHIF benefit package to also accommodate the outpatient care services from the previous restriction of just offering inpatient services only,

- Amendment of the NHIF Act to outline appropriate legal framework for UHC implementation, such as digitization of the processes in order to scale up UHC as well as the introduction of additional benefits,

- Expansion of the empaneled healthcare providers network to ensure members have easy access to affordable and quality health services, and,

- Implementation of biometric registration and identification of NHIF beneficiaries to enhance convenience for members seeking services and also reduce medical fraud.

- The National Health Insurance Fund Act, Regulations, 2022

The NHIF Act 1998 was subjected to several amendments and passed in parliament in December 2021 and assented into law in January 2022 and was referred to the National Health Insurance Fund Act, Regulations, 2022. The regulations sought to:

- Prescribe the mode of identification of beneficiaries for purposes of fulfilling goals of the fund,

- Ensure that every person of 18 years and above and is a Kenyan resident is registered member of the Fund,

- Define the different types of contributions to be made to the Fund, and,

- Provide for benefit entitlements to members and their beneficiaries and the payment of claims to healthcare providers.

Key provisions in the NHIF Amendments 2022 included;

- The draft had proposed to maintain the current contributions of between Kshs 150 and Kshs 1600 for individual in salaried employment earning up to Kshs 99,999,

- For salaried individuals earning gross income of Kshs 100,000.0 and above, they were to be subjected to a monthly contribution rate of 1.7%, in contrast to the current flat rate of Kshs 1,700.0 per month,

- For the individual identified under the indigents and vulnerable group, the government committed to pay Kshs 500.0 per month on their behalf, and,

- Other contributors not employed or listed as an indigent or vulnerable person were to pay a monthly contribution rate of Kshs 500.0.

- The National Health Insurance Fund Regulations, 2023

Following the recent release of the proposed amendments to the current Act, the NHIF invited public participation and feedback on the Draft National Health Insurance Fund (NHIF) Amendment Act Regulation, 2023. The draft is meant to replace the NHIF Act 1998 (amended in 2022) subject to approval by the Parliament.

The Key provisions that have been proposed include;

- There will be a standard contribution rate of 2.75% of the gross monthly income for a person in salaried employment. This will be in contrast with the current Act in which individuals in formal employment are contributing between Kshs 150.0 to Kshs 1700.0 based on gross salary bracket,

- For the self-employed person, they will be subjected to a special contribution at a rate of 2.75% of the declared or assessed gross monthly income. The minimum contribution for a self-employed member will not fall below Kshs 300.0,

- The national government commit to pay Kshs 13,300.0 annually on behalf of indigent and vulnerable persons,

- Other contributors not employed or listed as an indigent or vulnerable person shall pay a monthly contribution of Kshs 1,000.0, as opposed to the Kshs 500.0 proposed in the draft regulations 2022, and,

- The proposed regulation reduces the period for access to benefit after registration to 60 days as opposed to the current 90 days.

Comparison between the Current and Proposed NHIF rates

The proposed regulations will see a drop in contributions for individuals earning less than Kshs 30,000.0 per month, while an increase for persons earning Kshs 30,000.0 and above per month. The table below shows the comparison of current and proposed rates for members for the select income bracket;

|

Cytonn Report: Current and Proposed NHIF Rates |

||

|

Employee Gross monthly Income per month (Kshs) |

Current Rate (Kshs) |

Proposed Rate (2.75% of the Gross Salary) (Kshs) |

|

15, 000.0 - 19,999.0 |

600.0 |

412.5 - 550.0 |

|

25,000.0 – 29,999.0 |

850.0 |

687.5 – 825.0 |

|

35,000.0 - 39, 999.0 |

950.0 |

962.5 – 1,100.0 |

|

45,000.0 - 49,999.0 |

1,100.0 |

1,237.5 - 1,375.0 |

|

60,000.0 - 69,999.0 |

1,300.0 |

1,650.0 - 1,925.0 |

|

80,000 .0 - 89,999.0 |

1,600.0 |

2,200.0 - 2,475.0 |

|

100,000.0 - 200,000.0 |

1,700.0 |

2,750.0 - 5,500.0 |

|

300,000.0 - 500,000.0 |

1,700.0 |

8,250.0 - 13,750.0 |

Source: Cytonn Research

Key take outs from the above table;

- Individuals earning less than Kshs 30,000.0 per month will have their contributions dropping by between 2.9% and 40.0% per month,

- Individuals earning over Kshs 100,000.0 will see an increase to over Kshs 2,700.0 per month contributions from the current flat rate of Kshs 1,700.0, and,

- For persons earning Kshs 500,000.0 per month, their contribution will rise 7 times to Kshs 13,750.0. from the current flat rate of Kshs 1,700.0 per month.

Some of the impacts of the proposed regulations and rates on contributors include;

- Increase affordability by low income earners: Under the proposed regulations the required monthly contributions from low income earners will drop. As such, this is expected to increase affordability to many people with low income in both formal and informal employment, and,

- Increased burden for high income earners: The proposed regulation will see the contributions from high income earners significantly increase. This is likely to add burden and reduce disposal income among the earners under those brackets,

- Increased cost to the government: The government’s committing to increase its monthly contribution for the indigent and vulnerable persons, will strain on its expenditure given the government has been recording a budget deficit occasioned by low revenue collection and high expenses.

Section V: Case Studies and Recommendations

National Health Insurance Funds are government sponsored insurance covers aimed at ensuring its citizens get affordable medical covers irrespective of their social-economic status. This enables the citizens to access health care services without having to dig into their pockets to cater for the medical expenses. In most cases they are mandatory and a portion of the employee’s salary is deducted and remitted to these funds. National Health Insurance Funds have been created in several countries, and often vary in terms of structure and systems of operations. In this tropical we shall focus on the United Kingdom National Health Service and Japan National Health Insurance System. Additionally, we shall discuss key take outs from the Case Studies;

|

Cytonn Report: Summary of National Health insurance Funds in Various Countries |

|

|

Institution |

Key-Take-outs/Features |

|

Japan National Health Insurance System (NHIS) |

|

|

United Kingdom National Health Service (NHS) |

|

Source: Cytonn Research

In order to ensure the effectiveness of the NHIF, the government, in collaboration with the NHIF's board of management and health service providers, can borrow a number of key takeaways from Japan's NHIS and the UK NHS and work together to address some of the challenges faced by the funds. As such, we recommend the undertaking of the following actionable steps:

- Improve the Infrastructure of Public Hospitals: To achieve a Universal Health Care (UHC) system, the government should invest in facilities in public hospitals to ensure they offer quality services, given that the majority of individuals in rural areas access health services from public hospitals due to difficulty accessing private hospitals. According to the UK Department of Health and Social Care report Annual report and Account 2021-2022, NHS spent £32.1 bn (Kshs 4.9 tn) to finance the commissioning of new hospitals, renovate existing health care facilities, and purchase health care equipment’s among others. UK investment in improving health facilities infrastructure has enabled one of the best health care systems in the world, as it is among the top 5 best health systems in the world, according to the Common Wealth Secretariat

- Investigate the high Claims Ratio: The claims ratio for NHIF is at 90.5% whereas the Insurance Regulatory Authority, IRA, says that medical claims ratio should be at 78%, the high claims ratio for NHIF may point to fraud or overbilling by hospitals

- Creation of Strong partnerships with both the public and private health service providers: With the recent bad blood between NHIF and the local health service providers on the back of delayed remittance of the amounts owed, NHIF should aim to rebuild a cordial relationship with them in order for Kenyan Citizens to access health care services in any health facility. In most instances, Kenyans are forced to pay for health services out of their pockets as some hospitals decline the use of NHIF cards to settle for expenses. In Japan, the good relationship between NHIS and the health service providers has enabled Japan’s residents to have the freedom to access health care services anywhere at any time,

- The Government should have an active role in setting up the Fees charged by the service providers: Given that there are reports showing that some health service providers are altering or falsifying information to increase their payouts from the Fund, the government should play an active role in setting the baseline fees for the services offered in health institutions to prevent Kenyans and the fund from being overcharged. In Japan, the government is responsible for preparing the fee schedule entailing all the fees for all the services offered by health institutions and ensuring strict adherence to the schedule, and,

- Government should consider including a subsidy program for NHIF: The elevated prices of food and fuel have reduced Kenyan residents’ disposable income, and therefore Kenyans have to dig into their pockets in the event that they have surpassed their limits. Insurance penetration in Kenya continues to remain low compared to other key economies, with insurance penetration at 2.3%, which is below the global average of 7.0%,according to the Swiss RE institute, and is attributable to the fact that insurance uptake is still seen as a luxury and is mostly taken when it is necessary or a regulatory requirement. As such, the government should come up with a subsidy program aimed at cushioning Kenyans from rising medical costs. Case in point; Japan has a subsidy program called the "High Cost Medical Expense Benefit System" aimed at shielding the residents from the burden of medical expenses in the event they exceed their monthly limits. The system sets the maximum threshold an individual can pay out of pocket depending on their age and income.

Section VI: Conclusion

The major concern facing the National Health Insurance Fund is its sustainability and profitability in the long term given the high claim ratio, which reduces the Fund’s net operating surplus. Additionally, the heightened concern has been exacerbated by the delayed remittance from the government, which has hampered the Fund’s ability to settle its obligations with the country’s health service providers. As such, the proposed increase in the NHIF rate to 2.75% is a commendable step in addressing the cash crunch witnessed in the fund. With the high claim ratio, it further reinforces the need for an upward revision of the rate, given that the growth in total claims is outpacing the growth in total contributions received. However, given the high cost of living in Kenya, exacerbated by elevated inflationary pressures, the increase in rates will be an additional cost to Kenyans, reducing their disposable income. We are of the view that to achieve Universal Health coverage, the government should increase its investment in developing the health care infrastructure in order to ensure the equitable provision of health services.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.