For several years, the Kenyan Real Estate industry has been marred by controversies of land and housing companies, as well as unscrupulous developers and Real Estate agents who have swindled buyers through failed promises, and undelivered projects. Despite the Real Estate sector being a major contributor to the country’s Gross Domestic Product (GDP), and surpassing perennial major contributors to GDP such as transport to become the second largest contributor to the economy, there is still the lack of proper regulation and oversight over developers activities and other stakeholders in the sector. This poses significant challenges that could claw back the gains.

In our topicals namely, Real Estate Developers Regulatory Framework and Off-Plan Real Estate, we highlighted the urgent need for Kenya to establish a regulatory framework that is anchored in law, addressing the unique needs of Real Estate developers, financiers and other stakeholders in the sector including buyers. Additionally, we highlighted the lack of a competent regulatory framework in the off-plan investment sector, as the existing provisions do not fully encompass the specific regulatory needs and protections required for off-plan investments. These gaps in regulation have allowed some developers to exploit the system, leading to various challenges and risks for buyers.

In light of the above concerns, it became imperative to institute legislation that effectively addresses these challenges, thereby ensuring robust consumer protection and the mitigation of a diverse array of risks and uncertainties such as developer non-compliance, fund mismanagement, and unethical practices within the Real Estate and construction sectors. In response to these critical industry issues, the tabling of Real Estate Regulation Bill of 2023 before Senate in August emerged as the culmination of collective efforts of lawmakers to restore order, transparency, and sanity in the sector. Sponsored by Trans-Nzoia Senator Allan Chesang, the Bill aims to establish regulatory measures for Real Estate developers, agents, and projects.

Acknowledging the importance of regulating the sector and recognizing that the Bill is a significant step towards introducing a structured and accountable regulatory framework within Kenya's Real Estate domain, we assert that the Bill suffers from substantial shortcomings, particularly concerning its compatibility with existing Real Estate and construction industry regulations. Therefore, it is of utmost importance that these discrepancies are harmonized with current laws and regulations, necessitating a thorough redrafting of the Bill and further deliberation before its formal enactment. In support of this, key industry stakeholders, including the Estate Agents Registration Board (EARB), the governing body for Real Estate agents in Kenya, and the Institution of Surveyors of Kenya (ISK), have strongly opposed the Bill noting that the proposal to regulate Real Estate professionals alongside developers and land buying companies, who are primarily business entities, is unreasonable and impractical. In our topical this week, we review the Real Estate Regulation Bill 2023 by covering the following;

- Overview of Kenya’s Real Estate Sector,

- Real Estate Regulation Bill 2023 Framework,

- Concerns Raised by Existing Regulatory Authorities and Our View, and,

- Recommendations and Conclusion.

Section I: Overview of Kenya’s Real Estate Sector

The Kenyan Real Estate sector has been a major contributor to the country’s Gross Domestic Product (GDP) in recent years, expanding at a 5-year Compounded Annual Growth Rate (CAGR) of 5.7% to Kshs 521.1 bn in Q2’2023, from Kshs 394.6 bn in Q3’2018. The positive performance can be attributed to several factors such as; i) rapid population and urbanization rates facilitating demand for Real Estate developments, ii) government and the private sector focus to facilitate the provision of affordable housing, iii) collaborative initiatives by public and private stakeholders to enhance the country’ infrastructure, resulting in the creation of new opportunities for property development in previously untapped areas, iv) increased expansions by international hotel chains in the hospitality sector, v) provision of long-term accessible low-interest home loans to potential buyers by the Kenya Mortgage Refinance Company (KMRC), and, v) rapid expansion drive by both local and international retailers boosting the retail sector.

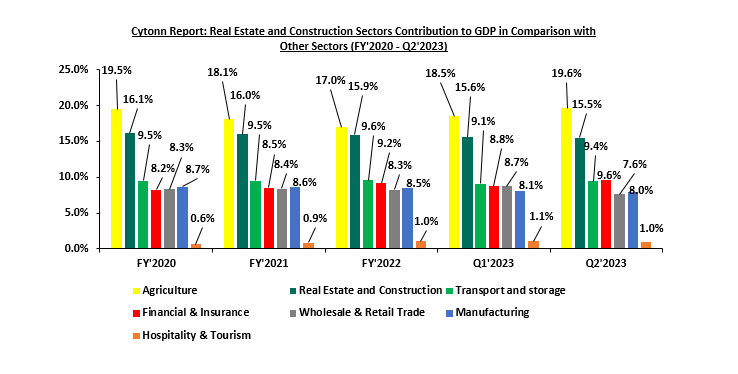

Additionally, the Real Estate and construction sectors collaboratively contributed 15.5% to the total GDP in Q2’2023, only behind the Agricultural sector that contributed 19.6%. This impressive performance of the sectors in Q2’2023, which surpassed perennial major contributors to GDP such as financial services and insurance at 9.6%, transport at 9.4%, manufacturing at 8.0% and trade contributed at 7.6%, underscores the growing importance of these two sectors to the Kenyan economy and signifies a positive outlook. The graph below shows the trend of Real Estate and Construction sectors contribution to GDP between FY’2020 and Q2’2023;

Source: Kenya National Bureau of Statistics (KNBS)

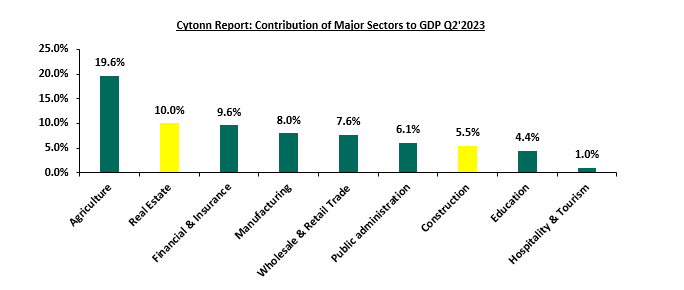

The graph below shows the top sectoral contributors to GDP during Q2’2023, with Real Estate being the second-largest contributor;

Source: Kenya National Bureau of Statistics (KNBS)

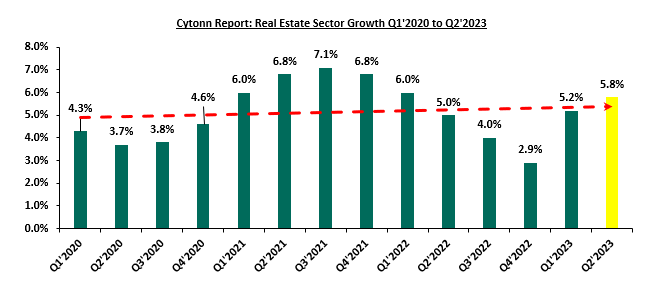

However, the Real Estate sector’s growth rate over the years has been fluctuating, registering downward growth trends in FY’2020 on the back of the entry and prevalence of COVID-19 pandemic in the country. Nevertheless, in 2021, the sector experienced a significant rebound in activities following the gradual reopening of the economy majorly occasioned by the lifting of travel restrictions, lockdowns and bans initially instituted to mitigate spread of the virus. The sector’s growth rates experienced a shocks in 2022, declining from 5.0% in Q2’2022 to 2.9% in Q4’2022. This was attributed to the anticipation of the August 2022 elections which saw investors adopt a ‘wait-and-see’ attitude. Notably, the sector rebounded in Q1’2023, growing at a rate of 5.2% on the back of enhanced investor confidence owing to the peaceful conclusion of August polls. Other factors that continued to weigh down on the optimal performance of the sector include an oversupply of 5.8 mn SQFT of commercial office space in the Nairobi Metropolitan Area (NMA), 3.3 mn SQFT in the Nairobi Metropolitan Area (NMA) retail market, 2.1 mn SQFT oversupply in the overall Kenyan retail market as at 2023, and, a subdued REIT market due to limited investor awareness of the investment instrument among other factors. The graph below shows the Real Estate Sector Growth Rate between Q1’2020 and Q2’2023;

Source: Kenya National Bureau of Statistics (KNBS)

Challenges Faced by Various Stakeholders in the Real Estate Sector

The following presents a summary of challenges faced by developers and other key stakeholders during Real Estate development in Kenya. These challenges underscore the need for a regulatory body that will help supervise development activities in a manner that enhances the efficiency of the Real Estate sector in Kenya. These include;

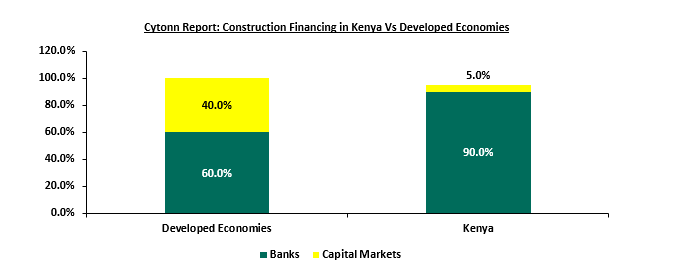

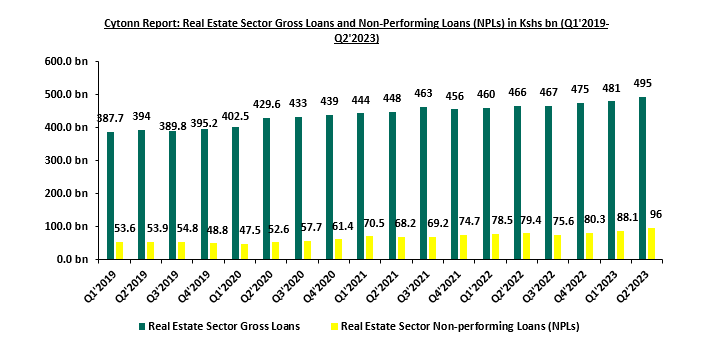

- Challenges in Obtaining Funding for Construction: Due to sub-par performance of the Kenyan capital markets, commercial banks have remained the primary source of funding for Real Estate developers, providing nearly 95.0% of funding for construction activities as opposed to 40.0% in developed countries. This implies that other capital markets contribute only 5.0% of Real Estate development funding, compared to 60.0% in developed economies. The performance of the real estate portfolio has also been wanting with the gross Non-Performing Loans (NPLs) in the sector increasing as at the Q2’2023, the NPL saw an increase of 9.0% to Kshs 96.0 bn in from Kshs 88.1 bn in Q1’2023. This signals continued elevated credit risk, making it difficult for developers to access financing as banks demand more collateral and implement tighter lending requirements such as higher interest rates on the loans. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: Capital Markets Authority (CMA), World Bank

The graph below shows the Gross Loans advanced to the Real Estate sector against Non-Performing Loans in the sector from Q1’2019 to Q2’2023;

- Increasing Total Development Costs: The rising costs of construction in Kenya fueled by elevated inflationary pressures on commodities, supply chain disruptions of the key construction materials from overseas markets, shortage of raw materials used in local production by manufacturing companies continue to increase the total development costs incurred by developers. According to Integrum, the average cost of construction is estimated at Kshs 41,600 to Kshs 100,800 per SQM in 2023 depending on various factors such as location of project and type of development, 22.7% up from a range of between Kshs 34,650 to Kshs 77,500 per SQM in 2022. Worth noting is, construction costs do not include professional fees, development management costs, land acquisition and enhancement costs, marketing costs, financing costs and other incidental and acquisition costs that add up to the total cost of development,

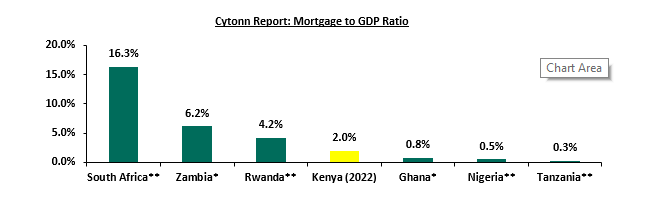

- Inefficiencies in the Mortgage / Off-Take Market: Limited development of the Kenyan mortgage market makes it difficult for developers and investors to sell properties, as homebuyer’s ability to purchase property is weighed down by the inability to access affordable long-term home financing. As such, Kenya’s mortgage-to-GDP ratio remains depressed at 2.0%, compared to other African countries such as South Africa at 16.3%. The Kenya Mortgage Refinancing Company (KMRC), the sole Mortgage Liquidity Facility (MLF) in the country which officially began its lending in 2021, is yet to stamp its dominance in the mortgage market and increase its attractiveness to more stakeholders in the sector. KMRC has only refinanced mortgage loans valued at Kshs 7.6 bn as at June 2023, which was a 484.6% increase from home loans disbursed in 2021 valued at Kshs 1.3 bn, when it began its lending operations. However, notwithstanding, the value of home loans refinanced by the KMRC as at June 2023 remains low at 2.9% of the value of mortgage loans outstanding which stood at Kshs 261.8 bn as at 2022. The graph below shows the mortgage to GDP ratio of Kenya compared to other countries as at 2022;

Figure as of: *(2020) ** (2021)

Source: Centre for Affordable Housing Finance Africa (CAHF)

- Scarcity of Serviced Land: The scarcity in supply of land serviced with sufficient roads, water, and electric supply, sewer lines, and utilities prompts private developers, and buyers (purchasers) to dig deeper into their pockets to provide such basic infrastructure and amenities, necessary to support new developments for their projects. This in turn increases overrun hidden costs incurred during development,

- Lengthy Approval Processes: The lengthy approvals processes in obtaining construction permits and requisite approvals in Kenya makes navigating Real Estate development in the country difficult and exhausting. According to the World Bank, it takes approximately 160 days to obtain necessary construction permits and approvals from pre-construction phase to post-construction. This creates delays in project delivery for both developers and individuals as well as increases costs for development. Notably, the report estimates the total costs required to obtain construction approvals and permits at Kshs 239,563,

- Sub-Standard Buildings: According to Status of The Built Environment Report 2022 Report, 69.8% of the inspected projects by National Construction Authority (NCA) were found to be non-compliant with building codes and regulations. This non-compliance resulted from various factors such as lack of adherence to building codes, poor construction practices, and the use of substandard materials and unqualified contractors. Non-compliance leads to costly delays in project completion, hefty fines, and even collapse of buildings. An audit report by the Nairobi Building Inspectorate (NBI) indicated that out of 14,895 buildings audited across the country, 10,791 were unsafe for occupancy and needed reinforcement or demolition, and 723 of the buildings were deemed dangerous. Only 1,217 were in fair condition and 2,194 were in safe condition. National Construction Authority (NCA’s) 2019 audit report in Kenya, reports there have been over 87 reported cases of collapsed buildings since 2015, with an estimated 200 people dead and 1,000 people injured. As a result, these buildings are continuously endangering lives of purchasers/tenants and could potentially lead to further loss of lives and property,

- Inadequate Consumer Protection in Off-Plan Sale Arrangements: There is a lack of comprehensive legislation specifically addressing off-plan investments, which leaves buyers vulnerable to potentially fraudulent activities or unethical practices by developers as they take advantage of the information asymmetry that exist among most buyers in the housing market. The absence of clear guidelines on issues such as buyer rights has created an imbalance in the relationship between developers and buyers. Furthermore, the lack of oversight and monitoring allows some developers to operate without proper scrutiny, potentially leading to partnering with quack contractors in construction to deliver sub-standard buildings, project delays, or even abandonment of projects,

- Limited Remedies for Breach of Contract: The existing legal framework has not adequately addressed remedies for breaches of contract or non-compliance by developers. Apart from alternative resolution mechanisms that might have been agreed stakeholders in the off-plan development, parties in the transactions are left with very limited options to seek redress in case of project delays, poor construction quality, or other contractual violations,

- Absence of Escrow Accounts: There is absence of mandatory requirements for developers to establish escrow accounts or mechanisms to safeguard buyers' funds or compensate them upon not delivering the projects as stipulated in contracts, posing a significant risk. Without such accounts, developers easily misuse buyers' deposits and fail to deliver the promised properties, leaving buyers with financial losses and unfinished projects, and,

- Increasing Number of Unlicensed Real Estate Agents: The rise of unlicensed Real Estate agents commonly known as ‘brokers’ poses a multifaceted challenge including legal, ethical, and reputational concerns. It is crucial for the sector to address this issue to ensure the protection of consumers, maintain professional standards, and foster trust in the industry.

Section II: Real Estate Regulatory Bill 2023 Framework in Kenya

This section discusses key aspects, including the establishment and operation of the Real Estate Board, the role and functioning of the Registrar and register, the process for registering and licensing Real Estate agents in Kenya, the procedures for registering Real Estate projects, the specific duties assigned to Real Estate developers, and the rights and obligations of Real Estate buyers designed to enhance consumer protection mechanisms. Additionally, we shall address potential offences and the corresponding penalties for those who violate the proposed regulations, along with the repeal of the existing Estate Agents Act, Cap 533.

- Formation and Operationalization of Real Estate Board

The Bill proposes the establishment of a national Real Estate Board under Part II, Section 4 of the proposed Act. The Board will have the powers of; i) suing and can also be sued, ii) acquiring, holding and disposing of movable and immovable property, iii) entering into any contract or other transaction, and doing all such other acts and things which a body corporate may lawfully do, and, iv) exercising the powers and performing the functions conferred to it under the Act.

Composition of the Real Estate Board

The management of the Board shall vest in a Board of Directors consisting of;

- a Chairperson appointed by the Cabinet Secretary of Land, Physical Planning, Housing, and Urbanisation,

- the Principal Secretary for matters land and physical planning or a designated representative,

- the Principal Secretary responsible for housing and urbanization or a designated representative;

- the Principal Secretary for the National Treasury or a designated representative;

- one man and one woman nominated by the Council of County Governors;

- one person nominated by the association representing the largest Real Estate land buyers association in Kenya,

- one person nominated by the association representing the largest Real Estate developers association in Kenya;

- one person nominated by the association representing the largest Real Estate agents in Kenya; and

- a Registrar appointed in accordance with section who shall be an ex officio member of the Board.

The Act will also allow the Cabinet Secretary to appoint a relevant and qualified Chairperson and the members of the Board of Directors, with the notice of the appointments being communicated through the Kenya Gazette. The appointees will hold office for a period of three years and be eligible for reappointment for one further term.

Some of the functions conferred to the Board under the Act include;

- Advise the National and county governments on the regulation and development of the Real Estate sector,

- Register Real Estate agents and Real Estate projects,

- License Real Estate agents,

- Maintain a public database with information on Real Estate agents and Real Estate projects registered under the Act with such details as may be prescribed,

- Maintain a public database with information on Real Estate agents and Real Estate projects whose registration have been revoked, and,

- Establish fixed rates, fees and charges to be levied by real estate agents and developers.

Additionally, the Board will be assigned roles in coming up with recommendations to the relevant government agencies to facilitate the growth and promotion of an efficient and competitive Real Estate sector. Such recommendations will be on; i) guidance to protection of the interests of purchasers, Real Estate agents and developers, ii) creation of a single window system for processing time bound project approvals and clearances to ensure timely completion of projects, iii) creation of an independent, transparent, and robust mechanism for addressing complaints, iv) measures to encourage investment in the Real Estate sector by the private sector, v) measures to encourage construction of affordable buildings and in line with environmentally sustainable and green building standards, and, vi) measures to facilitate amicable conciliation of disputes between the developers and Real Estate buyers through dispute settlement forums set up by the buyers, Real Estate agent or developer associations.

- Formation and Operationalization of the Registrar and Register

The Act will allow the formation of a Registrar of Real Estate Agents and Projects who will be appointed by the Board of Directors and will hold the office for five years and eligible for re-appointment.

The functions of the Registrar under the Act include;

- Maintaining a register of Real Estate agents and Real Estate projects in accordance with the Act and in the way prescribed by the Board of Directors,

- Receiving applications for registration Real Estate agents and Real Estate projects and, with the approval of the Board of Directors,

- Having the powers to recommend the Board of Directors on suspensions or revocations of registration of a Real Estate agent or Real Estate project, and,

- Any other functions that might be assigned by the Board of Directors from time to time.

Additionally, the Registrar will be required to record details such as the date of entry, address, qualifications, and other particulars of each registered person and update on any changes in these details. The registered persons will be issued a Certificate of Registration that will be in force for one year upon which a renewal of the certificate will be made on payment. The Registrar will also have the authority to remove any name from the register as ordered by the Board of Directors. Furthermore, the Registrar will be required to publish in the Gazette the name, address, and qualifications of every person registered under the Act, where the publication will serve as evidence of registration.

One great achievement that has been highlighted by the Act is that the Registrar will be responsible for establishing and maintaining an online digital Real Estate portal. This portal will facilitate the registration of Real Estate agents and projects, providing a platform for; i) interaction between various stakeholders, ii) access to finance, information, innovation, and the global market for Real Estate agents and developers, iii) providing information on clearances, approvals, and registration requirements for Real Estate agents and projects, iv) receiving complaints and comments from the public and other industry stakeholders, and, v) serving as a gateway to all Real Estate services offered by the National and County governments, and, vi) for discharging any other duties as required by the Board.

- Registration and Licensing of Real Estate Agents in Kenya

The Bill outlines the process for registering as a Real Estate agent and obtaining a practicing license in Kenya. The process will begin with an application for a practicing license by a Kenyan individual which shall be submitted to the Board of Directors within 28 days of receipt. The Board will thereafter issue a practicing license if the applicant is registered in accordance with the Act, has complied with any relevant continuing educational and professional development standards for that year, and has met all other requirements prescribed by the Board. Such requirements include; a Kenyan citizenship, and a degree certificate in Real Estate or equivalent from a university recognized in Kenya. The practicing license will be valid from the day it is issued to the 31st day of December of that same year. If issued during the first month of any practicing year, it should be valid from the first day of that month. The Board of Directors will have powers to suspend or cancel a practicing license on several grounds issued under the Act. However, the affected licensees will be accorded opportunities to be heard before suspension or cancelation of their practicing licenses.

- Registration of Real Estate Projects in Kenya

Upon making the Bill into law, the Board will be required to operationalize a web-based online system for submitting applications for project registration within a year of its establishment. The process of registration of Real Estate project will start with the developer applying to the Board. The application must include details such as the developer’s name, address, registration particulars, and past projects. This is in addition to an authenticated copy of approvals and commencement certificates from the relevant Board for the project, sanctioned plans, layout plans, and specifications of the proposed project. The application should also contain details about development works to be executed in the proposed project, proposed facilities, and location details of the project with clear demarcation of land dedicated for the project along with its boundaries. Finally, the application should include proforma of the allotment letter, agreement for sale, and the conveyance deed proposed to be signed with the purchasers; and the number, type and the carpet area of apartments or plots, as the case may be, in the project.

Notably, a developer will not be able to advertise, market, book, sell, offer for sale or invite persons to purchase any plot, apartment or building in any Real Estate project that is not registered in accordance with the Act. If a Real Estate project is to be developed in phases, each phase must be considered a separate Real Estate project and therefore, the developer must obtain registration for each phase separately.

Additionally, a statutory declaration by the developer or an authorized person by the developer will also be needed on regards to the specific Real Estate project or phase of a Real Estate project. The statutory declaration should indicate that;

- The developer has a legal title to the land for the proposed development, with valid documents authenticating such title,

- The land is free from all encumbrances, or details of any encumbrances on the land are provided,

- The developer commits to complete the project or phase within a specified time period,

- For off-plan projects, 70.0% of the amounts realized for the Real Estate project from purchasers will be deposited in a separate account to cover construction and land costs,

- The developer will withdraw amounts from the separate account to cover project costs in proportion to the percentage of project completion,

- Withdrawals from the separate account will be certified by an engineer, an architect, and a chartered accountant in practice to ensure they are in proportion to the percentage of project completion,

- The developer will get their accounts audited within six months after the end of every financial year by a chartered accountant in practice, and,

- The developer will take all pending approvals on time.

Grant or Rejection of the Registration

Upon receipt of an application, the Board will have 14 days to either grant or reject registration. The registration will be valid for the period declared by the developer for project completion. In cases of force majeure, which include natural calamities like war, flood, drought, fire, cyclone, earthquake, et cetera, that affect the regular development and completion of the Real Estate project, the Board will be able to extend the registration for not more than one year.

Revocation of Registration of a Developer Executing a Real Estate Project

The Board will be able to revoke the registration of a developer if the developer defaults on any requirements under the Act, violates any terms or conditions of approval given by the competent authority, is involved in any unfair practice or irregularities, or indulges in fraudulent practices. The Board must give the developer at least 30-days’ notice before revoking the registration. With such, developers will have no opportunity or excuse to deliberately under-develop or totally stall projects.

Upon revocation, the Board will have the powers to; i) debar the developer from accessing its website in relation to that project, their name listed as defaulters, and other government entities are informed about the revocation, ii) consult the appropriate level of government to take action including carrying out the remaining development works by a government entity or by the association of purchasers, and, iii) direct the bank holding the project bank account to freeze the account, or subsequently issue directions to de-freeze the account if necessary for project progress. However, it has to be noted that the association of purchasers will have the first right of refusal for carrying out the remaining development works on the project by the deregistered developer.

- Specified Duties of Real Estate Developers in Kenya

The Bill has gone ahead to clearly specify detailed responsibilities to be followed by every developer in Kenya from across the construction life of a project. These duties include;

- Accountability : The developer will be accountable for all obligations, responsibilities, and functions outlined in the Act, either to purchasers as per the sales agreement or to the association formed by purchasers. This responsibility persists until the apartments, plots, or buildings are conveyed to purchasers or the common areas are transferred to the association of purchasers or the relevant authority,

- Defect Management: The developer will be responsible for addressing structural defects or any other defects, even after the conveyance deed of the apartments, plots, or buildings has been executed,

- Certificate Procurement: The developer must obtain the necessary completion certificate or occupancy certificate from the relevant authority and make it available to purchasers individually or to the association of purchasers, as required by the Act,

- Lease Certificate Compliance: If the Real Estate project is developed on leasehold land, the developer is responsible for obtaining a lease certificate specifying the lease period and certifying that all dues and charges related to the leasehold land have been paid. This certificate must be provided to purchasers,

- Essential Services: The developer must provide and maintain essential services, charging reasonable fees, until the project is completely and permanently handed over to the purchasers. Additionally, the developer must directly pay all service charges to the relevant service providers until the physical possession of the Real Estate project is transferred to the purchasers or the association of purchasers, as applicable. These charges will be collected from the purchasers for the payment of service charges,

- Association Formation: The developer should facilitate the formation of an association of purchasers, ensuring that purchasers have a collective entity to represent their interests after the sale of the project,

- Conveyance Deed: The developer is obligated to execute a registered conveyance deed for apartments, plots, or buildings in favor of purchasers. Additionally, the developer must transfer an undivided proportionate title in the common areas to the association of purchasers or the relevant authority, as required by the Act, and,

- Mortgage Restrictions: After executing an agreement for sale for any apartment, plot, or building, the developer is prohibited from mortgaging or creating a charge on such property. In as much as such actions are taken, developers should not affect the rights and interests of the purchasers who have taken or agreed to take possession of these properties.

Other notable regulations that have been stipulated by the Act to control the activities of the developers and protect the interests of the purchasers include;

- Obligations on the Truthfulness of Project Advertisements: Developers must compensate individuals who sustain losses due to incorrect or false statements in notices, advertisements, or through other forms of marketing. Those affected by such statements can withdraw from the project and receive a full refund along with prescribed interest,

- No Deposit without a Sale Agreement: Developers cannot accept more than 10.0% of the property cost as an advance payment or application fee without entering into a written agreement for sale. The agreement must specify development particulars, payment schedules, the date on which the possession of the apartment, plot or building is to be handed over, the rates of interest payable by the developer to the purchaser and the purchaser to the developer in case of default from either parties, or other prescribed details,

- Obligations in Case of Project Transfer to a Third Party: Developers cannot transfer majority rights and liabilities to a third party without written consent from two-thirds of purchasers and approval from the Board. Upon approval, the third party must fulfill pending obligations, including those in agreements with purchasers,

- Approval of Plans: Developers must build and finish their proposed projects following the plans, layouts, and specifications approved by the relevant authorities. They cannot make any changes to these approved plans, layouts, specifications, or the features and amenities mentioned in them for apartments, plots, or buildings without getting consent from the buyers first. For any other alterations or additions to the approved plans, layouts, and specifications of buildings or common areas within the project, developers need written consent from at least two-thirds of the buyers who have agreed to purchase apartments in that building,

- Defects Liability: If a buyer notifies the developer of any structural defects or issues with work quality, services, or other obligations within 5 years from the possession date, it is the developer's responsibility to fix these problems within 30 days at no extra cost on the clients. If the developer fails to address these defects, affected clients have the right to receive suitable compensation as per the provisions of the Act,

- Insurance of Real Estate Projects: Developers must obtain required insurances, including title insurance and construction insurance, as mandated by the Board. Developers will be responsible for paying insurance premiums before transferring insurance to the association of purchasers upon completion of handing over the project and agreement,

- Transfer of Title: Developers must transfer property title and undivided proportionate titles in common areas to purchasers or associations within a specified period per approved plans. This Transfer must occur within 3 months of obtaining an occupancy certificate. Additionally, necessary documents and plans, including common areas, must be handed over to the association within 30 days after obtaining a completion certificate, and,

- Compensation for Delay or Failure to Complete: Developers must return the amount received from purchasers along with interest if they fail to complete or provide possession within specified timeframes or due to revocation of registration of developer by the Board in accordance to the Act. The interest rates for delay will be prescribed by the Board. The kind of compensation is required for losses due to defective land title or other limitations set by any existing laws.

- Specified Rights and Duties of Real Estate Buyers

The Act has also specified the rights and duties bestowed on a property buyer of a Real Estate property from a developer that enhance consumer protection. Such duties include;

- Information Access: Property buyers must have the right to obtain information about approved plans, layout plans, and specifications approved by competent authorities. This includes other details provided in the Act, its rules, and regulations, or any conditions agreed with the developer through the sales agreement. Additionally, property buyers can know the project's completion schedule, including provisions for water, sanitation, electricity, and other amenities and services,

- Claim Possession: Property buyers have the right to claim possession of their apartments, plots, or buildings, while the association of purchasers can claim possession of common areas, as per the developer's declaration under the Act,

- Access to Documents and Plans: After taking physical possession of their properties, property buyers have the right to receive necessary documents and plans, including those related to common areas, from the developer,

- Payment Obligations: Buyers must make payments within the time as specified in the sales agreement, including registration charges, municipal taxes, water and electricity charges, maintenance charges, ground rent, and other applicable fees,

- Interest for Delayed Payments: Property buyers are liable to pay interest at the prescribed rate for any delay in making payments as agreed upon by the developers towards the above services. However, the interest charges liable to the property buyers can be reduced through mutual agreement between the developer and the purchaser.

- Participation in Association Formation: Every property buyer will be mandated to participate in forming an association of purchasers, and,

- Timely Possession: Purchasers should take physical possession of their properties within 2 months of the issuance of the occupancy certificate and must participate in the registration of the conveyance deed for their apartments, plots, or buildings, in accordance to the act

- Offences and Penalties Accorded to Law Breakers

The Real Estate Regulations Bill 2023 encompasses a range of offenses and corresponding penalties aimed at safeguarding compliance with its provisions and upholding the ethical conduct within the Real Estate industry. Moreover, they serve as a deterrent against any illicit activities or practices within the Real Estate sector, thus safeguarding the interests of both industry stakeholders and the general public. Among the key violations delineated in the Bill are the following:

- Non-registration of Real Estate Projects: Developers found guilty of embarking on Real Estate projects without adhering to the mandatory registration requirements specified by the Act guilty may face penalties that include imprisonment for a duration not exceeding 3 years, a fine amounting to no less than Kshs 5.0 mn, or a combination of both punitive measures,

- Providing false information: Real Estate developers or estate agents found guilty of providing deceptive or inaccurate information to the regulatory Board may be subjected to a fine equivalent to 5.0% of the estimated cost of the implicated Real Estate project, as evaluated and determined by the Board,

- Failure to Comply with Board Orders: where specified parties mentioned in the Act are found guilty of violation of the directives and orders issued by the Board under the Act will be subjected to a daily penalty rate, with cumulative consequences that can extend up to a maximum of Kshs 20.0 mn or 10.0% of the estimated cost of the Real Estate project, as ascertained by the Board,

- Failure to Comply with Court Orders: Any person who fails to adhere to or contravene court orders issued under the provisions of the Act is deemed an offense may result in imprisonment for a period of up to 3 years, a monetary fine not exceeding Kshs 10.0 mn, or a combination of both penalties, and,

- General Offense Penalty: This section addresses committed. Developers convicted of offenses under the Act for which no specific penalties are prescribed elsewhere in the legislation may be liable to a fine of no more than Kshs 1.0 mn.

- Repeal of Estate Agents Act, Cap 533

This section of the Real Estate Regulation Bill, 2023, addresses the transition from the existing Estate Agents Act, Cap. 533, to the new regulatory framework established by the Bill. It outlines several key provisions to ensure a smooth transition and continuity of operations. The Act begins by declaring the repeal of the Estate Agents Act, effectively ending its legal validity and relevance under the new regulatory framework, and immediately ceasing the operations and existence of the Estate Agents Registration Board (EARB) upon the appointment of the new regulatory Board. The new Board of Directors shall be appointed within 3 months of the commencement of the Real Estate Regulation Act. This new Board will assume the responsibilities and authority outlined in the Bill.

However, to ensure continuity in the retention of staff, the Bill notifies that existing staff and employees of the EARB who were not under notice of dismissal prior to the commencement of the new Act will be deemed to be employees of the newly established Board. Any actions, regulations, directives, instructions, administrative measures, contracts, or obligations that were initiated, issued, taken, entered into, or incurred by the EARB before the commencement of the Act will continue to remain in force. This is because these regulations and measures will be considered as if they were made, issued, taken, entered into, or incurred under the new Act. Moreover, all assets and liabilities of the EARB which will be existing before the commencement of the Act will be transferred and managed by the newly established Board under the Real Estate Regulation Act. All ongoing legal matters involving EARB will not be disrupted by the change in regulatory authority as the Real Estate Regulation Board will take over as the responsible party.

Section III: Concerns Raised by Existing Regulatory Authorities and Our View

This section engages in a comparative analysis, contrasting the provisions of the proposed Bill with the roles and functions of existing Real Estate regulatory authorities in Kenya, such as and the Estate Agency Registration Board (EARB) and the Institute of Surveyors of Kenya. The comparative examination aims to identify areas of alignment, potential overlaps, and discrepancies in the responsibilities and functions of these regulatory bodies within the Real Estate sector's regulatory framework. The objective is to ensure clarity and coherence in the regulatory landscape of Kenya's Real Estate industry.

The proposed Real Estate Regulation Bill 2023 has sparked varying reactions from various existing Real Estate regulatory authorities. While some clauses have received positive recognition, most have been met with dismissal. The Bill 2023 has essentially targeted only three major players in the sector including; Real Estate agents, Real Estate developers and property buyers. Other stakeholders in the Real Estate industry have their own regulatory mechanisms such as;

- Valuers under the Valuers Act, Cap 532 which establishes Valuers Registration Board (VBR),

- Physical planners regulated under the Physical Planning Act Cap 286,

- Land use planners regulated under the Environmental Management and Co-ordination Act (EMCA) Cap 387,

- Contractors under the National Construction Authority (NCA) Act, Cap 486 which established the National Construction Authority (NCA),

- Engineers under the Engineer’s Act No. 43 of 2011 which established the Engineers Board of Kenya (EBK), and,

- Architects and Quantity Surveyors Act, Cap 525 Act establishes the Board of Registration of Architects and Quantity Surveyors (BORAQS).

It is worth noting that concerns have been raised about the effectiveness of the existing Estate Agents Regulatory board in addressing the persistent rise in fraudulent Real Estate transactions in the country, often involving numerous unscrupulous estate agents. Additionally, there is currently no independent and well-structured board or authority responsible for regulating Real Estate developers in Kenya, nor is there an entity dedicated to registering Real Estate development projects or advocating for the rights and interests of property buyers in the country especially those based in diaspora.

- Estate Agency Registration Board (EARB)

The Estate Agents Registration Board (EARB) proudly stands as the sole regulatory authority for estate agency practices in Kenya, operating under the legal framework of the Estate Agents Act, 1984, Cap 533. This legislation grants EARB its mandate, which includes the registration of estate agents and the crucial duty of ensuring that practicing estate agents meet stringent standards of competence and conduct. The overarching goal is to promote sanity, transparency and accountability in the Real Estate agency and safeguard the interests of the stakeholder in the industry and the public in general. Consequently, only estate agents who are duly registered with EARB, hold valid licenses, and possess current practicing annual certificates are permitted to engage in estate agency activities.

On September 27, 2023, the Estate Agents Registration Board (EARB) issued an official statement in response to the proposed Real Estate Regulation Bill, 2023. The EARB expressed its reservations regarding the Bill, emphasizing that they were not consulted or involved in its preparation. Their key contention revolves around the existing regulatory framework that already governs real estate agents through the Estate Agents Act, Cap 533. They argue that the Bill should primarily focus on regulating property developers and land trading companies, as real estate agents are adequately regulated under the current legal provisions.

However, it is worth noting that the Real Estate agency sector has faced challenges associated with unscrupulous agents and brokers, with these individuals registering real estate agency companies in total disregard of the laws. These individuals continue to conduct their business operations without proper licenses, despite the oversight of the EARB. In some instances, directors of such unlicensed companies engage in fraudulent activities and when found guilty, charged and fined, they re-enter the industry by rebranding their companies and essentially carry on with their deceitful Real Estate dealings. Regrettably, the legal and regulatory actions taken against these individuals often yield minimal results in deterring them from defrauding the public and circumventing government systems. Recognizing these challenges, the EARB has acknowledged the need for legal and institutional reforms to enhance its efficacy in regulating estate agency practices in Kenya. However, the limited progress observed in addressing these issues has led to the formulation of the proposed Bill.

The concerns raised by the EARB regarding their lack of involvement in the formulation of the Bill should not be a major issue. In Kenya's legislative process, public participation comes into play after a Bill has been introduced in the House and is subsequently referred to the relevant committee during the First Reading stage. The committee places advertisements in the media requesting for public views on the Bill. The relevant committee facilitates public participation on the Bill through appropriate mechanisms which include: Inviting submission of memoranda, holding public hearings, consulting relevant stakeholders, and consulting experts on technical subjects. The committee's role is to take all these inputs into account while examining the Bill and preparing its report to the House. This means that there is still an opportunity for the Estate Agents Regulatory Board to have their concerns and views heard by the committee that will be formed during this process. So, despite not being part of the initial formulation, there is a mechanism in place for their input to be considered in shaping the final Bill.

- Institution of Surveyors of Kenya (ISK)

On 21st September, 2023 Institution of Surveyors of Kenya (ISK) also issued their statement on the proposed Bill. ISK is a professional organization that unites various disciplines in the Real Estate sector. The body believed that regulated the whole sector with one Act and under one board is a hard task for the government and hence every stakeholder in the sector should be handled and regulated separately to make the regulation effectively and efficiently. The body underscored the presence of the EARB under the Estate Agents Act, tasked with regulating the Real Estate agency sector and hence with a few additional in the Act and allocation of more resources to the EARB by Ministry of Lands to empower its operations countrywide, there is no need additional regulatory framework for estate agents.

Furthermore, ISK raises concerns about the composition of the proposed board. They point out that the board consists of principal secretaries and individuals nominated from associations that are not governed by government laws, leaving out qualified individuals from existing regulatory boards highlighted above in running the Board. With this setup, ISK contends that professional individuals in the sector might end up being regulated by unprofessional individuals, rendering the board inefficient in fulfilling its mandates.

A significant concern expressed in the statement is the proposal to regulate professionals in the sector through a non-professional board under the new Bill. ISK finds this proposal alarming and insists that professionals and Real Estate developers, who are primarily business-oriented, should be subject to separate regulatory mechanisms.

In our view, we believe that initiating a roadmap for regulating a sector that has long faced challenges is a positive step. The Real Estate sector has received limited attention despite being the second-largest contributor to the country's economy for over a decade. Addressing these longstanding issues should enhance sustainability, accountability, and transparency in the sector, thereby restoring the trust and confidence that many Kenyans have in investing in the Real Estate market. However, we raise crucial issues in the Bill such as:

- Issues of Real Estate Agency Licensing: The Bill under Part IV, Section 29(5) stipulates that a practicing license for Real Estate agents in Kenya will be valid from the day it is issued to 31st day of December of that same year. Therefore, if the license is issued on the 1st of December or the 30th of December of a certain year, it would only be valid for that month for the period between the issuance date and end of December. In our view, this clause creates ambiguity as its could lead to several implications such as; i) the agent would only be able to practice for a very limited time before needing to renew their license, ii) the agent would need to incur the another cost and effort of renewing their license soon after obtaining it, and, iii) the short validity might impact any long-term contracts or deals the agent wishes to handle within that year. Therefore, Real Estate agents might prefer to apply for their practicing license earlier in the year to maximize its validity period. However, this would depend on individual circumstances and business needs,

- Extended Defects Liability Period: The Bill under Part VI, Section 41(4) stipulates that a defect liability on the developer will last for 5 years, contrary to 6 months as stipulated in existing laws. With such, tenants or purchase will enjoy extended protection on their investments, reduced costs on repairs and maintenance, and higher expectations regarding the quality and durability of the construction for a maintained period of time and developers have to follow strict quality standards in construction so as avoid any unnecessary defects hence improved construction practices and quality control. Tenants might take advantage of this extended liability period, leading to financial risks for developers, and developers may adjust property prices to cover potential future liabilities, potentially increasing property prices,

- Regulation of Large Projects in Phases: The Bill under Part V, Section 32(1) stipulates that large projects constructed in phases will have the phases registered and approved separately by the Board even after the county government and NCA have approved the project as a whole. Upon implementation of the Bill to an Act, the clause might lead to; i) prolonged timelines leading to further delays in project initiation, ii) increased administrative, legal, compliance and financial burden impacting the overall project expenses, iii) developers may shy away from multi-phased projects due to complexity and cost, favoring smaller, single-phased developments thus reducing activities and investment in the Real Estate sector,

- Ambiguity of the Title: While the title of the Bill implies regulation of the entire Real Estate sector, its contents predominantly target three stakeholders: developers, Real Estate agents, and buyers. This leaves out various other stakeholders in the industry, such as valuers, surveyors, architects, engineers, and many more. This inconsistency between the title and the content may lead to inefficiencies in addressing the sector's persistent issues. Recommendations include revising the title to reflect the specific targets for regulation or breaking down the Bill into several other Bills to address each stakeholder separately, and,

- Deletion of Role of Quantity Surveyor as Project Cost Accountant: The Bill, in Part V, Section 33(2)(l)(vi) stipulates that the portion of money withdraw from an escrow account formed between the developer and the purchasers will be certified by just certified by an engineer, an architect and a chartered accountant in practice, leaving out quantity surveyors. According to Board of Registration of Architects and Quantity Surveyors (BORAQs), a body that registers and regulates Architects and Quantity Surveyors in Kenya under the Architects and Quantity Surveyors Act Cap 525, the main roles of a quantity surveyor in a Real Estate project are; cost advice to clients before and after architectural drawings for budget preparation, ii) cost planning techniques to analyze a project systematically against performance and aesthetic requirements, iii) preparing Bills of Quantities (BQs), which serve as standard contract documents in the construction industry, iv) advising on the appropriate tendering procedures through selecting suitable contractors and subcontractors, v) they help in cost control by providing financial statements at regular intervals to keep clients and designers informed of the project's financial status, and, vi) assessing the value of authorized variations at every stage of construction which serve as the basis for recommending payments to contractors and ensure that the work aligns with the contract terms. Consequently, exclusion from certifying expenditures may result in inefficiencies and affect the accurate recommendation of funds from the escrow account for developer use.

Therefore, addressing these concerns and issues is crucial to ensure that the proposed Real Estate Regulation Bill aligns with the diverse needs and complexities of the Real Estate sector in Kenya.

Section IV: Recommendations and Conclusion

To address the concerns inherent in the proposed Real Estate Regulation Bill 2023 and make it more workable, we given the following recommendations to the Kenyan government;

- Harness Collaboration of Existing Authorities: Engage in a more extensive consultation process with existing regulatory bodies such as the Estate Agents Registration Board (EARB) and the Institution of Surveyors of Kenya (ISK) to understand their concerns and incorporate their suggestions into the Bill. This collaboration can help create a more comprehensive and effective regulatory framework,

- Separate Regulatory Mechanisms for Different Stakeholders: Recognize the unique needs and challenges of different stakeholders in the Real Estate industry and consider separate regulatory mechanisms where necessary. For example, architects, engineers, and quantity surveyors have distinct roles and responsibilities, and their regulation could be more effectively addressed through their respective professional bodies,

- Clearly Establish the Scope of the Bill: Revise the title of the Bill to accurately reflect its scope. If the Bill predominantly targets specific stakeholders like developers, real estate agents, and buyers, the title should reflect this focus to avoid confusion,

- Define Reasonable Periods: Reconsider the proposed defect liability period for developers. While extending it to five years can protect buyers, it may lead to increased property prices and financial risks for developers. A balanced approach, such as setting the period at two to three years, could be more effective. In addition, consider extending the license validity to a reasonable period e.g., 12 months since registration, to reduce administrative burdens on real estate agents and ensure that they can efficiently conduct their business without frequent renewals,

- Empower Existing Regulatory Bodies: Provide additional resources and authority to existing regulatory bodies such as the Estate Agents Registration Board (EARB) to improve their effectiveness in regulating their respective sectors of the Real Estate industry, and,

- Professional Education and Training: Promote ongoing education and training for real estate agents, developers, and other professionals in the industry to enhance their competence and professionalism. This will emphasize transparency and accountability measures in the Bill to reduce fraudulent activities and unethical practices in the Real Estate sector.

In conclusion, the Real Estate sector in Kenya presents attractive prospects for both local and international investors and developers. As such, a proposed law to regulate the entire Real Estate and construction sectors is a welcome move, geared to protect consumers and mitigate the diverse array of risks and uncertainties such as developer non-compliance, fund mismanagement, and unethical practices. However, the proposed Real Estate Regulation Bill 2023 has generated varied reactions from existing regulatory authorities within the industry. While the Bill primarily targets Real Estate agents, developers, and property buyers, it has raised concerns among these regulatory bodies about its scope, potential implications, and the need for collaboration. By considering the concerns of existing regulatory authorities, and incorporating various recommendations we have offered, the government through the Real Estate Regulation Bill 2023 can pave the way for a more transparent, efficient, and accountable Real Estate sector in Kenya.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.