Introduction

It has been three years since the Kenya Kwanza government assumed office, and one of its key pillars under the Bottom-Up Economic Transformation Agenda (BETA) is providing affordable housing to Kenyans. This housing program builds on initiatives from the previous administration under the Jubilee government's Big Four Agenda, launched in 2017 with the ambitious goal of delivering 1,000,000 housing units by 2022.

The continued emphasis on housing by both the current and previous regimes underscores its importance, as outlined in Article 43(1)(b) of the Kenyan Constitution, which states that "every individual has the right to accessible and adequate housing, as well as to reasonable standards of sanitation." The Jubilee government aimed at addressing housing needs both in the supply and the demand side. Some of the key initiatives that took off from the Jubilee government include; i) establishment of the Kenya Mortgage Refinance Company (KMRC), a non-deposit-taking financial institution mandated to provide long-term loans to Primary Mortgage Lenders, ii) removal of stamp duty for first-time homebuyers purchasing homes under the Affordable Housing Program (AHP), iii) development of 13,529 affordable units, iv) implementation of the Tenant Purchase Scheme (TPS) under the National Housing Corporation, and, iv) elimination of VAT tax for affordable housing programs among others.

During its tenure, the Kenya Kwanza government has focused on strengthening the housing program, addressing both the demand and supply sides. The government aims to deliver 250,000 housing units annually. Consequently, the government wants to achieve this ambitious target through; i) structuring affordable long-term housing finance scheme, including a National Housing Fund and Cooperative Social Housing Schemes, that will guarantee the offtake of houses from developers, ii) growing the number of mortgages from 30,000 to 1,000,000 by enabling low-cost mortgages of Kshs 10,000 and below, and, iii) giving developers incentives to build more affordable housing.

In line with these goals, the government has implemented several notable initiatives. These include the launch of numerous Affordable Housing Programs across the country, the establishment of the Housing Levy through the Affordable Housing Act of 2024, and improved access to KMRC loans. Together, these efforts are aimed at comprehensively addressing the country's housing needs.

Housing remains a significant challenge in the country, and the government must progressively work towards implementing a holistic housing program to address diverse housing needs. With the Affordable Housing Program now in its second year under the Kenya Kwanza government, it is prudent to review its progress and provide necessary recommendations where applicable.

This week, we focus on the Affordable Housing Program in the country, covering the following areas;

- Review of areas of focus under the Affordable Housing Program,

- Key developments under the program,

- Challenges faced by the Affordable Housing Program, and

- Recommendations, and,

- Conclusion

Section I: Review of areas of focus under the Affordable Housing Program in Kenya

This section will examine the key areas of focus of the Affordable Housing Program

- Increasing the supply of affordable housing in the country

One of the key focus areas of the Kenya Kwanza government under its housing agenda is to increase homeownership in the country. Currently, there is a significant housing deficit, with an annual demand of 250,000 housing units far exceeding the current supply of 50,000 units. Moreover, only 2% of these houses cater to low-income earners.

Under the Fourth Medium-Term Plan, the government aims to construct 200,000 housing units annually. Of these, 60,000 units will be financed through government support, while 140,000 units will be funded via the National Housing Development Fund. To address this housing gap, the Kenya Kwanza government has launched various housing projects nationwide.

Under the Affordable Housing Program, housing units are provided in three categories: social housing units, affordable housing units, and market-rate housing units. The Affordable Housing Act defines these categories as follows:

- Social housing unit: A house targeted at individuals earning a monthly income below Kshs 20,000.0

- Affordable housing unit: A house targeted at individuals earning a monthly income between Kshs 20,000.0 and Kshs 149,000.0

- Affordable middle-class housing unit: Housing for middle- to high-income earners, targeted at individuals earning over Kshs 149,000.0 per month.

This categorization ensures that the program addresses the housing needs of various income groups, promoting inclusive homeownership opportunities.

The government plans to allocate housing units in its projects using a ratio of 50:30:20 for affordable housing units, Affordable middle-class housing units, and social housing units, respectively. In its Mid-term scorecard review, the government announced that the program would be implemented across all constituencies, aiming to construct 200 units per constituency. Additionally, the government reported a total of 112,405 housing units as either completed or ongoing, with 730,062 units under the Affordable Housing Program.

- Increasing access to mortgages

Under the Affordable Housing Program, the government is also focusing on stimulating demand by increasing access to mortgages through key institutions such as the Kenya Mortgage Refinance Company (KMRC) and the National Housing Corporation (NHC). The program aims to grow the number of mortgages from 30,000 to 1,000,000 by offering low-cost mortgages of Kshs 10,000 and below.

The Kenya Mortgage Refinance Company (KMRC) plays a crucial role in disbursing mortgages to Primary Mortgage Lenders (PMLs), who then advance home loans to Kenyans. KMRC, a treasury-backed financial institution, does not accept deposits. It was established in 2018 under the Companies Act, 2015, and received its operating license from the Central Bank of Kenya (CBK) in September 2020.

KMRC provides concessional, fixed, long-term financing to PMLs, including banks and SACCOs, enabling them to extend affordable mortgages to Kenyans, particularly moderate- to low-income earners. As of December 2024, KMRC had refinancedKshs 13.9 bn to 12 PMLs, helping 3,855 Kenyans access affordable mortgages at concessional fixed rates ranging from 7.0% to 9.9%, compared to the industry average of 14.3%.

The National Housing Corporation (NHC) is also mandated to increase access to financing for homebuyers through various loan products. These include rural and peri-urban loans, which offer a maximum repayment period of up to 10 years. The loans are capped at a maximum of Kshs 5 mn for a single-family unit and Kshs 10 mn for multi-family dwellings. Currently, the loans carry an interest rate of 13.0% per annum on a reducing balance basis.

- Creation of job opportunities

Unemployment is one of the biggest challenges faced in Kenya. As the government focuses on increasing housing supply and expanding access to mortgages, job creation remains a key priority under the Affordable Housing Program (AHP). The program aims to create jobs both directly and indirectly.

In its Mid-term scorecard, the program revealed that during its lifecycle, at least 1,000,000 jobs are expected to be created. Additionally, the government has facilitated the creation of 206,000 direct and indirect jobs since 2022 achieving only 20.6% of the target.

The government is also keen on supporting the local Jua Kali industry. The Mid-term scorecard highlighted that Kshs 4.4 bn has been allocated specifically for Jua Kali artisans and Medium and Small Enterprises (MSMEs) integrated into the program. The initiative provides employment to young Kenyans as masons, carpenters, plumbers, electricians, painters, steel fixers, and others.

Under the Bottom-Up Economic Transformation Agenda (BETA), the program will leverage the Jua Kali sector to produce mass fittings such as windows and doors, further boosting local manufacturing and job creation.

- Advancing incentives to developers

With the aim of providing incentives to private developers for the construction of affordable housing, the government has introduced various incentives for developers, including;

- Value Added Tax Exemption on goods imported or developed locally for the direct and exclusive use in the construction of affordable units - To benefit from this exemption, the affordable housing project must be approved by the Cabinet Secretary (CS) responsible for matters relating to housing,

- Reduced corporate tax rate for affordable housing developers - The third schedule of the Income Tax Act offers a reduced corporation tax rate of 15% for companies that construct a minimum of 100 residential units within a financial year. This reduced rate is applicable only with the approval of the Cabinet Secretary responsible for housing,

- Reduced rate of Import Declaration Fee on goods imported into the country under the affordable housing scheme,

- Reduced rate of Railway Development Levy on goods imported into the country under the affordable housing scheme - Section 8 (2A) (b) of the Miscellaneous Fees and Levies Act 2016 stipulates a reduced railway development levy of 1.5% on the customs value of goods imported under an affordable housing scheme, subject to approval by the CS Finance based on the recommendation of the CS responsible for housing matters, and,

- Affordable housing scheme no longer exempt from thin capitalization provisions - This acknowledged that housing projects are costly to execute, requiring developers to rely significantly on borrowing from non-resident entities to finance the initiatives.

Section II: Key Developments under the Program

In this section we shall look at the key developments under the program;

- Affordable Housing Act 2024

On 19th September 2024, the President signed the Affordable Housing Act, 2024, into law. To fund housing projects in the country, the Kenya Kwanza government pushed for the enactment of this law, which allows the collection of a housing levy from salaried Kenyans and directs the funds toward the construction of houses. The main objectives of the Act are: i) to impose a levy to facilitate the provision of affordable housing and institutional housing, ii) to give effect to Article 43(1)(b) of the Constitution regarding the right to accessible and adequate housing and reasonable standards of sanitation, and iii) to provide a legal framework for the implementation of affordable housing programs and institutional housing projects.

Since its enactment, the Act mandates a 1.5% deduction from an employee’s gross monthly salary, with a matching 1.5% contribution from employers on behalf of each employee. These contributions are remitted monthly, enabling the Kenya Kwanza government to collect the necessary funds for housing construction under the program. In the first year of enforcement, the levy has generated Kshs 88.7 bn.

However, concerns have emerged over the effectiveness of fund utilization, as the Controller of Budget revealed that only 52.8% of the Ksh 88.7 bn collected from the levy has been used for affordable housing projects, amidst delays in project completion. Additionally, earlier this year, the government disclosed that some of the funds collected had been directed towards government securities.

In general, the establishment of a housing levy has been a significant boost to Kenya Kwanza’s agenda of providing housing to Kenyans, provided the funds are effectively utilized for their intended purposes. Currently, the government needs to review its strategy, particularly in the implementation of the fund, to ensure that all collected funds are used efficiently.

- Enhancement of loan products by Kenya Mortgage Refinance Company (KMRC)

KMRC continues to be a key player under the Affordable Housing Program through the disbursement of loans to Primary Mortgage Lenders (PMLs) in Kenya. As of December 2024, KMRC had provided Kshs 13.9 bn (USD 107.6 mn) in refinancing to 12 Primary Mortgage Lenders (PMLs), allowing 3,855 Kenyans to secure affordable mortgages with concessional fixed interest rates ranging from 7.0% to 9.9%, significantly lower than the industry average of 14.3%.

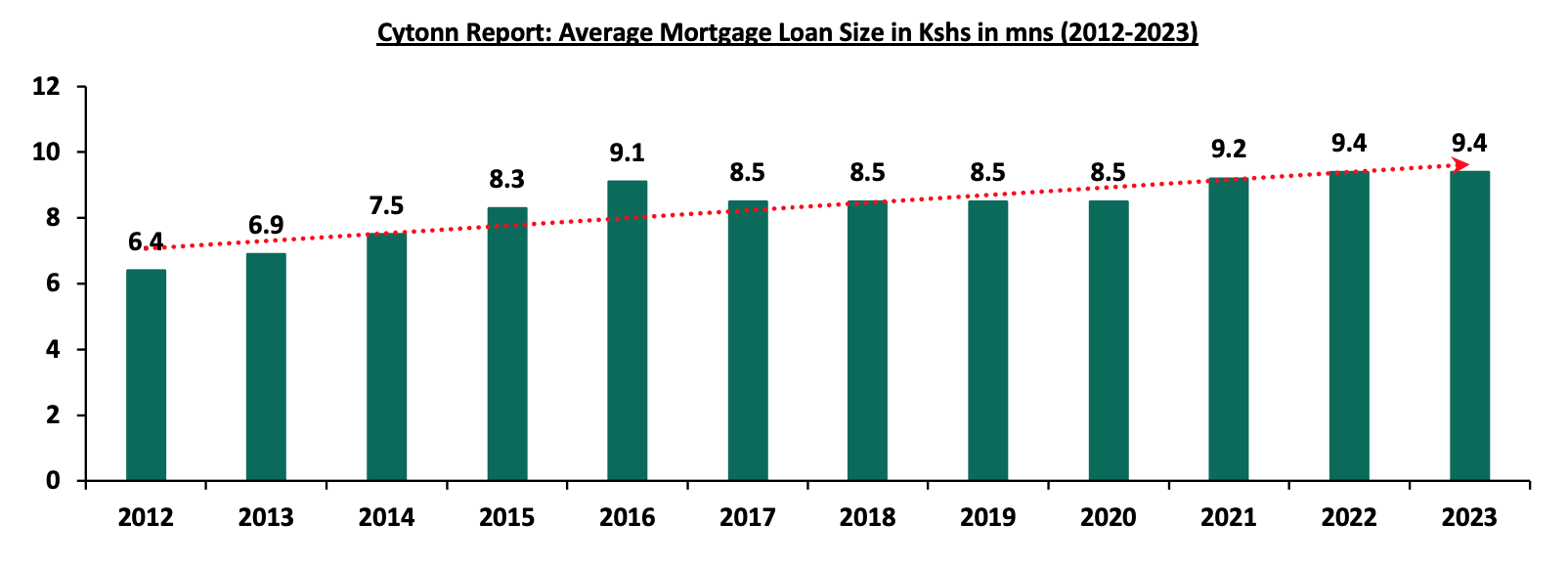

Additionally, in February 2024, KMRC raised its maximum loan size nationwide to Ksh 10.5 mn, up from Ksh 8.0 mn in the Nairobi Metropolitan Area and Ksh 6.0 mn in other parts of the country. This was a positive move to improve the mortgage market, especially considering that the new lending cap in the Nairobi Metropolitan Area now exceeds the average loan size in the country. According to Annual Banking Supervisory Report 2023, the average mortgage size in the country was Ksh 9.4 mn in 2023. Below is a chart showing the average mortgage loan size between 2012 to 2023;

Source: Central Bank of Kenya (CBK)

KMRC has been instrumental in strengthening and improving Kenya's mortgage market infrastructure. By introducing standardized procedures and practices, along with facilitating capacity-building programs for mortgage lenders, KMRC has enhanced the market’s stability, efficiency, and overall quality. These efforts have significantly simplified access to financing for borrowers, enabling more individuals to achieve their homeownership goals.

- Launch of various Affordable Housing Programs across the country.

This year, the government, led by President William Ruto, launched several Affordable Housing Projects across the country. The program reported a 1,061.0% increase in completed affordable housing units, with 122,116 new units either completed, launched, or under construction in 40 counties. The government also revealed that it aims to construct at least 200 units per constituency. Here are some of the Affordable Housing Projects which have been launched by the president during the year;

|

# |

Name of the Affordable Housing Project |

|

1 |

Pioneer Affordable Housing Project |

|

2 |

Kidiwa Affordable Housing Project |

|

3 |

Kapsuswa Affordable Housing |

|

4 |

Nanyuki Affordable Housing Project |

|

5 |

Timau Affordable Housing project |

|

6 |

Makenji Affordable Housing Project |

|

7 |

Talai Affordable Housing Project |

|

8 |

Nyaribari Masaba Affordable Housing Project |

|

9 |

Siaya Affordable Housing Project. |

|

10 |

Alego Usonga Affordable Housing Project |

|

11 |

Embu Affordable Housing project |

|

11 |

Lumumba Affordable Housing Project |

|

12 |

Makasembo Affordable Housing Project |

|

13 |

Kakamega Affordable Housing Project |

|

14 |

Jogoo Road Affrodable Housing Project |

|

15 |

Stoni-Athi Affordable Housing Project |

|

16 |

Mokowe Affordable Housing |

Source: Online Research and Cytonn Report

These projects are at various stages of completion; however, concerns have been raised regarding the pace at which they are being completed. Notably, over 60.0% of the funds collected through the Housing Levy remain underutilized after one year of enforcement of the levy, while projects are not progressing at the same rate as the funds are being collected. This clearly highlights a gap in the efficiency of fund utilization.

Key milestones within the year

- President William Ruto and former Prime Minister Raila Odinga commissioned Phase One of the LAPFUND Makasembo Affordable Housing Project in Kisumu, a significant step in Kenya’s Affordable Housing Programme. This phase, built on an 11.6-acre site, delivered 910 housing units: 180 one-bedroom, 100 two-bedroom, and 290 three-bedroom low-cost units, plus 600 two-bedroom and 700 three-bedroom middle-cost units, with 1,754 parking spaces. Valued at Kshs 3.5 bn, the project is a collaboration between the Kisumu County Government and the Local Authorities Pension Fund (LAPFUND), initiated in 2021. The event also marked the groundbreaking for Phase Three, expanding the project’s total of 1,870 units to meet Kisumu’s rising housing demand. The estate includes modern amenities such as preschools, a daycare, boreholes, solar-powered streetlights, high-speed lifts, landscaped gardens, and playgrounds, fostering a comprehensive living environment. For more information, please see our Cytonn Monthly-May 2025

- President William Ruto officiated the handover of 1,080 housing units at the Mukuru Affordable Housing Project in Nairobi’s Embakasi South, marking a pivotal moment in Kenya’s housing sector. Spanning 56 acres, this ambitious initiative, the largest of its kind in the country, aims to deliver 13,248 units by March 2026. The project, valued at over Kshs 7.0 bn and funded through the Housing Levy Fund, offers bedsitters at Kshs 3,900, one-bedroom units at Kshs 4,000, and two-bedroom units at Kshs 5,000 monthly under a rent-to-own scheme. This milestone follows the reclamation of the land, previously grabbed illegally, by the Ethics and Anti-Corruption Commission in 2020. For more information, please see our Cytonn Weekly #21/2025,

- The Kenyan government announced its plan to pursue an ambitious plan to secure Kshs 9.2 bn from private investors to construct 2,820 affordable homes in Stoni Athi, Machakos County, as part of its Affordable Housing Programme. The National Housing Corporation (NHC) is driving this effort through a Public-Private Partnership (PPP) model, where private developers fund construction on NHC-owned land, while the government contributes infrastructure, including roads and electricity. For more information, please see our Cytonn Monthly-February 2025

- President William Ruto laid the foundation stone for the Mokowe Affordable Housing Project in Lamu County, marking a significant step in Kenya’s quest to address its housing deficit valued at 1.2 bn . This ambitious initiative, located in Mokowe within Lamu West Constituency, comprises 468 residential units and 75 commercial shops, reflecting a broader vision to enhance living standards and stimulate economic growth in the coastal region. For more information, please see our Cytonn Monthly-February 2025

- The Jogoo Road Phase I Affordable Housing Project, a 500 units residential development, was launched by President William Ruto. The project is a flagship initiative under Kenya’s Affordable Housing Program (AHP) aimed at addressing the housing deficit in urban areas. Located in Makadara Constituency, Nairobi County, the project targets low and middle-income families by offering affordable housing units in a region where demand for quality, cost-effective homes is high. This project is expected to provide a viable alternative by integrating modern housing with improved infrastructure, while also addressing past issues of displacement. The total project cost is estimated at approximately Kshs 1.0 bn. For more information, please see our Cytonn weekly #11.2025

- New Mortgage Products

The government is working to offer a variety of loan products to Kenyans across different income levels and regions. Recently, it announced the introduction of a Kshs 10.0 bn low-cost mortgage scheme, funded by the Housing Levy, aimed at facilitating rural home construction. The scheme offers single-digit interest loans repayable over ten years, with individual applicants eligible for up to Kshs 5.0 mn and multiple-family dwellings up to Kshs 10.0 mn.

Commercial banks typically overlook rural housing markets due to low property valuations and limited penetration in these areas. This initiative is part of a broader affordable housing strategy, which includes the creation of the County Rural and Urban Affordable Housing Committee. The committee is tasked with developing frameworks and investment programs tailored to meet the housing needs of each county.

There was an introduction of a State-backed initiative to provide affordable mortgages of up to Kshs 6.0 mn to non-salaried workers, aiming to enhance homeownership among the informal sector, which comprises approximately 83.0% of the nation's 18.0 mn labor force. The Kenya Mortgage Guarantee Trust (KMGT) will cover up to 40.0% of defaulted mortgages, encouraging banks and savings and credit cooperative societies (Saccos) to extend credit to individuals with irregular incomes.

This initiative addresses the challenge that many workers lack the consistent monthly pay required by traditional mortgage models. Even among the 3 mn formally employed workers, 88.0% earn less than Kshs 100,000 monthly, raising concerns about their ability to afford mortgage repayments. By reducing perceived risk for lenders, KMGT aims to make homeownership more accessible.

Additionally in March 2025, Kenya secured Kshs 559.6 mn from the World Bank Group to initiate a credit guarantee scheme aimed at providing affordable mortgages to non-salaried workers, commonly referred to as "hustlers." This initiative, managed by the Kenya Mortgage Guarantee Trust (KMGT), seeks to mitigate lender risk by covering up to 40% of potential mortgage defaults, encouraging financial institutions to extend home loans to informal sector workers who typically lack consistent income streams.

The KMGT operates in collaboration with the Kenya Mortgage Refinance Company (KMRC), which has been instrumental in providing affordable mortgage financing by disbursing Kshs 11.9 bn to financial institutions since its inception. Despite these efforts, Kenya's mortgage market remains underdeveloped, with only 30,015 home loans totaling Kshs 281.5 bn as of December 2023, and an average loan size of Kshs 9.4 mn—figures that highlight the challenges low- and middle-income earners face in accessing home financing.

Section III: Challenges and gaps in the program

Here are some of the challenges and gaps in the program;

- Inefficient utilization of the Housing Levy

Recently, there have been concerns regarding how the funds collected from the levy are being utilized. During last year, it was revealed that some of the funds had been invested in government securities, such as Treasury Bills and Treasury Bonds. The Permanent Secretary in the State Department of Housing and Urban Development noted that the Board is not an implementing body and, therefore, cannot utilize the funds. At the same time, the Permanent Secretary emphasized the need for a five-year plan from the implementing agency. For efficient implementation, the government must develop a well-thought-out plan to ensure that funds are not left idle and are used effectively.

This year, there have been discussions surrounding the affordable housing initiative sparking concerns about the project’s transparency, financial viability, and long-term sustainability. Critics argue that the ambitious program, which aims to address Kenya’s housing deficit by constructing low-cost units across the country, may suffer from inadequate oversight mechanisms and unclear funding structures. One major red flag involves the proposed financing model, which relies on a mandatory levy collected from workers and employers.

Additionally, Kenya’s Affordable Housing Levy, introduced to fund low-cost housing and address the country’s housing deficit, is at the center of controversy following revelations that the government plans to redirect these funds to construct schools, markets, police posts, and hospitals. This shift, outlined in proposed regulations, has sparked concerns about transparency and the potential misuse of funds intended for affordable housing, raising questions about the government’s commitment to its original promise to Kenyan workers. This move has been criticized heavily by various organizations such as Central Organization of Trade Unions (COTU) and the general public. The government aims to raise Kshs 500 bn over the next decade to construct 363,860 homes, including units for civil servants and security personnel, alongside social infrastructure. Of this, Kshs 142.4 bn is earmarked for non-housing projects like schools and health centers, which critics argue deviates from the levy’s core purpose.

- Consistency and clarity of numbers reported

There have been instances where the public has questioned the accuracy of the numbers reported regarding the program. For example, the number of job opportunities created under the project needs to be clearly defined, with a breakdown of jobs by project and specialization for better clarity rather than just giving an abstract figure. Additionally, the reported figures should remain consistent at all times.

- Infrastructure and Bureaucratic Barriers

Poor infrastructure increases construction costs, passed on to buyers. Multiple agencies involved in approvals create delays, with licensing processes described as “lengthy and costly”.

Developers in Ngara, for instance, face high costs for utilities, inflating unit prices. Bureaucracy deters private investment, slowing the shift from 83.0% government-led to more private-driven projects.

- Delay in launching the affordable housing units

The state postponed the launch of 4,888 housing units, initially scheduled for March 2025, has been postponed to a later date in 2025 due to delays in the installation of essential fittings, notably lifts. Housing Principal Secretary acknowledged the setback, stating that while final touches are being applied and the allocation process is ongoing.

This postponement underscores the broader challenges facing the AHP. The program aims to deliver 200,000 housing units annually to mitigate Kenya's substantial housing shortfall. However, as of February 2025, only 124,000 units were reported to be at various stages of construction, highlighting a significant lag behind targets. Additionally, the program has experienced low public engagement; since the introduction of a housing levy in July 2023, which deducts 1.5% from workers' salaries matched by employers, much of the collected funds have been invested in Treasury papers due to challenges in fund absorption within the program.

- Lack of transparency and Corruption

Kenya’s affordable housing project initiative has faced a fresh challenge where it was found that a financially unstable construction company, despite struggling with debt and tax issues, was controversially awarded a Kshs 2.2 bn contract in January 2025 to construct affordable housing units in Loitoktok, Kajiado County. At the time of the tender award, the company had not paid a court-ordered debt of Kshs 1.9 mn and was also involved in a tax dispute with the Kenya Revenue Authority over Kshs 4.2 mn in unpaid taxes. These financial struggles were confirmed through separate court proceedings, including one that led to the brief jailing of one of the company’s directors for defaulting on payments.

Additionally, Kenya’s Affordable Housing Programme (AHP) board announced a plan to have the AHP to undergo an independent economic impact audit following underperformance in meeting its objectives. Launched to address the country’s 2.0 mn-unit housing deficit and create one million jobs annually, the programme has struggled significantly. As of the 2023/24 financial year, only 40,000 housing units were delivered—16.0% of the annual target of 250,000—while job creation stood at just 120,000. Moreover, project delays and budget shortfalls have hindered progress, with the government’s 2024/25 housing budget of Kshs 92.5 bn still falling short of what’s needed.

- Poor maintenance projects’ property

After the handover of projects to owners, there have been instances where the quality of the buildings has significantly deteriorated. Issues such as peeling paint and poor sanitation within the projects have been reported, tarnishing the reputation of the program

Section IV: Recommendations

To maintain the quality of building projects, the government should strengthen builder accountability by including warranties that require developers to address structural or quality-related issues within a specific period after handover. Additionally, the government can establish a maintenance fund, where a small percentage of the purchase price or rent is allocated to cover repairs and upkeep post-handover.

To improve the uptake of houses under the project, the government should launch targeted marketing and awareness campaigns to educate the public on the availability, pricing, and benefits of the housing units. These campaigns should emphasize how the program aligns with their housing needs and highlight all the advantages of purchasing houses through the program. Additionally, the government should invest in essential infrastructure, such as roads, schools, healthcare facilities, and public transport near housing projects, to enhance their appeal to potential buyers.

A comprehensive pipeline of housing projects should be developed, outlining projects for both the short-term (1–2 years) and long-term (3–5 years). The pipeline should include detailed project plans, timelines, budgets, and expected outcomes, with each project in the pipeline having clear milestones and objectives. This structured approach will help prevent delays and allow for continuous project execution, ensuring that funds are regularly absorbed.

A well-developed plan is necessary in order to improve absorption of the housing fund; plan must include a robust monitoring and evaluation framework to track the progress of each project in the pipeline. Regular assessments will allow the government to identify challenges early on, make necessary adjustments, and ensure that the funds are being spent effectively. Feedback updates should be established to revise project plans based on real-time data and outcomes.

Section V: Conclusion

The Kenya Kwanza government has made significant progress towards providing affordable housing in the country, particularly over the past two years. This progress has been catalyzed by the introduction of the Housing Levy under the Affordable Housing Act of 2024, which has provided a substantial boost to the government’s ambitious goal of delivering 200,000 housing units annually. This move aligns with the government’s broader agenda to address the growing housing deficit and make homeownership more accessible to Kenyans.

However, despite these positive strides, there remains considerable room for improvement, especially in the efficient implementation and management of the program. The private sector plays a pivotal role in the provision of housing in the country, and as such, attracting more private developers into the program is crucial. The government’s incentives for developers are an essential aspect of this effort, but they need to be continuously evaluated and enhanced to make the program more appealing to private investors because it will assist in covering the overall housing deficit.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.