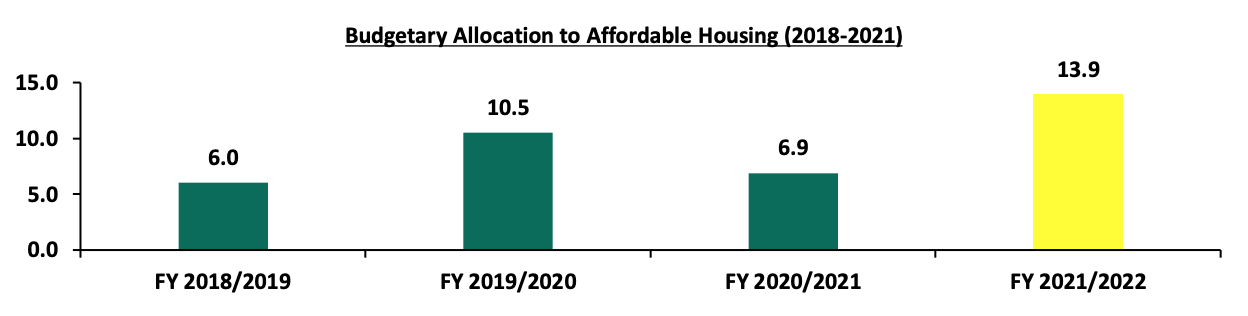

In 2017, the President, H.E Uhuru Kenyatta launched the Affordable Housing programme as one of the key pillars of the ‘Big Four Agenda’. The government had planned to deliver 500,000 by 2022 and with the president’s five-year term almost coming to a close, the government is already far out of reach since only about 1,000 units have been delivered through the Pangani and Park Road Ngara projects. Even before the onset of the COVID-19 pandemic, the government had no sustainable plan on how to fund the initiative despite increasing its budgetary allocation by 75.0% to Kshs 10.5 bn in FY’2019/20, from Kshs 6.0 bn in FY’2018/19.

We have previously tackled two topicals related to affordable housing:

- Affordable Housing in Kenya - in April 2018 we talked about whether the delivery of affordable housing can be a reality and concluded that the initial plan was very useful but some elements needed to be addressed to increase the likelihood of success, and,

- Accelerating Funding to Affordable Housing - in May 2020, we discussed ways of accelerating funding for affordable housing and concluded that there was need to mobilize alternative sources of funding, particularly the opening up of capital markets access to developers, to provide a low-cost capital raising mechanism.

This week, we look into the status of affordable housing in the Nairobi Metropolitan Area (NMA) and benchmark with more established case studies with the aim of giving recommendations on what can be done to enhance achievement of the initiative by covering:

- Introduction to Affordable Housing,

- Demand and Supply of housing in Kenya,

- Affordable Housing Programme in Kenya,

- Background, Status and Progress of the Affordable Housing Programme (AHP),

- Achievements of the Affordable Housing Programme (AHP), and,

- Challenges facing the Affordable Housing Programme (AHP).

- Lessons Kenya Can Learn from Other Countries,

- Recommendations, and conclusion.

Section I: Introduction to Affordable Housing

According to the Economic Times, affordable housing refers to housing units that are affordable by that section of society with the median household income or below. Based on this definition and with the statistics from Kenya National Bureau of Statistics (KNBS) on income distribution in the formal sector indicating that 74.4% of employees earn the median gross income of Kshs 50,000 or below per month, affordable housing in Kenya would therefore be units employees in median gross income bracket can afford; assuming a maximum of 30.0% of their gross income is spent on housing costs, these are individuals who can afford to pay rent of Kshs 15,000 per month and below. According to the government’s Blue Print, affordable houses range between at Kshs. 1.0 mn to Kshs. 3.0 mn per unit on average, and would therefore fit into the budget of two individuals earning at least Kshs. 50,000 each per month which is the Kenyan median income.

Assuming a 20-year mortgage at a 13.5% interest rate, and using the rule of the thumb of a maximum of 40.0% of their income being used to pay monthly instalments, then the median income household can afford a maximum of Kshs 3.4 mn for a house. As a result, in our view, at prevailing market conditions, an affordable house would be of Kshs 3.4 mn and below.

From our Cytonn Annual Markets Review-2021, the average price per SQM in the Nairobi Metropolitan Area residential market stood at Kshs 119,494. That would translate to a house price of Kshs 4.8 mn for the size of a 40.0-SQM 2 bedroom in affordable housing which is more than two times the price of such a unit under the government’s affordable housing initiative.

The table below gives a summary of what constitutes the average sizes and prices of affordable housing units in the Nairobi Metropolitan Area according to the government data;

|

Summary of Affordable Housing Units in the Nairobi Metropolitan Area |

|||

|

Typology |

Unit size (SQM) |

Unit Price (Kshs mn) |

Price per SQM(Kshs) |

|

1 |

30 |

1.0 |

33,333 |

|

2 |

40 |

2.0 |

50,000 |

|

3 |

60 |

3.0 |

50,000 |

|

Averages |

|

|

44,444 |

Source: Boma Yangu

The Affordable housing initiative comprises of three types of housing that target formal income earners as follows;

- Social Housing - Designated for individuals earning up to Kshs 14,999 monthly, accounting for 2.6% of the formal income earners (KNBS),

- Low-Cost Housing - Designated for individuals earning between Kshs 15,000 and Kshs 49,999 monthly, accounting for 71.8% of the formal income earners, and,

- Mortgage-Gap Housing - Designated for individuals earning between Kshs 50,000 and Kshs 100,000 monthly, accounting for 22.6% of the formal income earners.

With the above categorization indicating the initiative is targeting 97.0% of the formal income earners, it is quite worrying that only 3.0% of the formal income earners can comfortably afford to own homes hence it is necessary to address this problem to enhance home ownership in the country.

Section II: Demand and Supply of Housing in Kenya

According to the Center for Affordable Housing, Kenya has an accumulated housing deficit of 2.0 mn housing units, growing by 200,000 units annually. This is mainly due to the difference between the demand of 250,000 housing units and an estimated supply of 50,000 units every year. Notably, the Ministry of Housing indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. In summary, while 74.4% of Kenya’s working population requires affordable housing, only 17.0% of the housing supply goes into serving this low to lower-middle income segment. This supply issue has remained a challenge attributed to factors such as high construction costs, inadequate supply of development land, and, inadequate infrastructure.

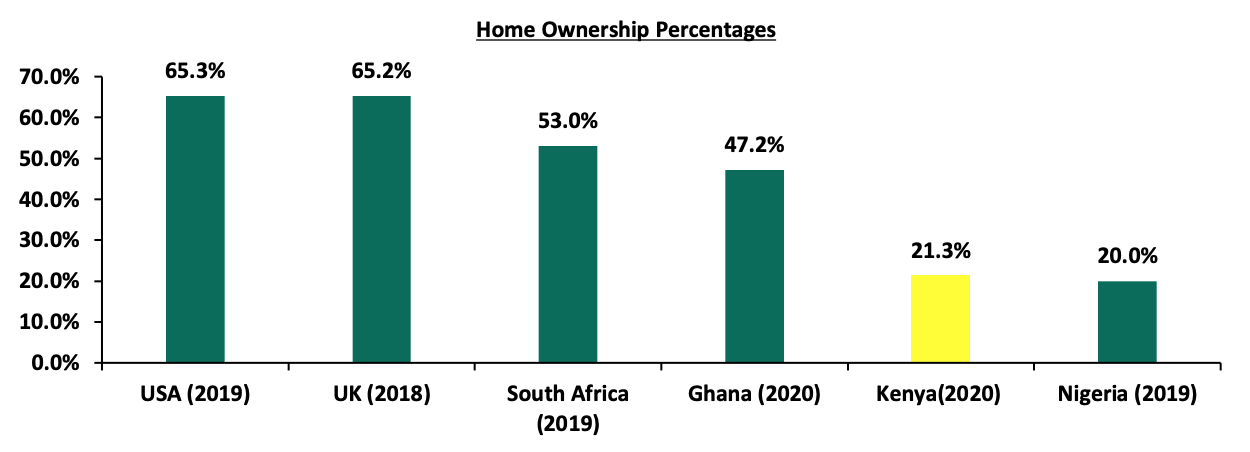

On the other hand, the growth in annual demand of housing has been fueled by the high urbanization and population growth rates at 4.0% and 2.3%, respectively, compared to global averages of 1.8% and 1.0%, respectively, as at 2020. Home ownership in Kenya also remains low compared to other African countries, at 21.3% in urban areas as at 2020, compared to other African countries such as South Africa and Ghana with a 53.0% and 47.2% urban home ownership rates, respectively. This signals the urgent need to emphasize the need for investment in affordable housing to bridge the housing deficit and increase home ownership in the country especially for the low income earners.

The graph below shows home ownership percentages for different countries compared to Kenya;

Centre for Affordable Housing Africa, Federal Reserve Bank

Section III: Affordable Housing Initiative in Kenya

- Background, Status and Progress of the Affordable Housing Initiative

The concept of affordable housing was not entirely new as of 2017. Kenya’s Vision 2030 first medium-term goal (2009-2012), had a target of increasing housing production from 35,000 units annually to 200,000 units annually for all income levels. However, the Kenyan Government delivered approximately 3,000 units only during that period, compared to a target of 800,000 houses, according to the World Bank Economic Update of 2017. With the fact that less than 1.0% of the target had been achieved, the Affordable Housing Program initiative became a pillar under the Big 4 Agenda in 2017, aimed at delivering the promise, of constructing 500,000 units by 2022. Under the agenda, the government also planned to; i) enhance affordability of homes by addressing the interest rate to be between 3.0%-7.0% and tenure of 25 years, ii) reduce cost of construction per SQM by 30.0%, iii) close the annual low-income housing gap by 60.0%, iv) create 350,000 jobs in the construction sector, and, v) Increase construction sector contribution to GDP. Additionally, the government established one platform and two entities to facilitate the affordable housing as listed below;

- Boma Yangu Online Platform – The platform facilitates the registration for housing allocations and has so far attracted about 325,000 applications as at January 2022. The platform supports three kinds of contributions namely; statutory contributions capped at Kshs 2,500 per month per employee, voluntary monthly contributions and joint contributions. Key to note, contributions to the Housing Fund can be accessed as soon as 15 years after a member’s first contribution or the attainment of retirement age.

- National Housing Corporation (NHC) – The corporation facilitates the implementation of the Government’s Housing Policies and Programs with a focus on promoting low-cost houses, stimulating the building industry and encouraging housing research. The NHC is also the government's main agency through which public funds for low cost housing are channeled to local authorities, and,

- Kenya Mortgage Refinance Company (KMRC) – The company plays a major role in the implementation of the government’s housing policies and programs by delivering affordable home ownership loans. KMRC provides the loans to Primary Mortgage Lenders (PMLs) to re-finance client mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) to individual borrowers whose monthly household income is not more than Kshs 150,000. The loans are issued at a fixed rate of 5.0% for onward lending at single digit rates.

Currently, the affordable housing initiative continues to take shape in the NMA and other counties. The table below indicates some of the notable ongoing affordable housing projects in the NMA;

|

Summary of Notable Ongoing Affordable Housing Projects in the Nairobi Metropolitan Area |

|||||

|

Name |

Developer |

Location |

Number of Units |

Pricing (Kshs) |

Status |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

1,562 |

1 bed: 1.0 mn 2 bed: 2.0 mn 3 bed: 3.0 mn

|

Ongoing |

|

River Estate Affordable Housing Program |

National Government and Edderman Property Limited |

Ngara |

2,720 |

||

|

Mavoko Affordable Housing Program |

NHC through Epco Builders Limited |

Machakos |

5,360 |

1.0 – 3.0 mn (Affordable Housing) and 2.0 mn – 8.0 mn (Middle Income) |

Initial Stages |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru, Enterprise Road |

15,000 |

- |

Ongoing |

Source: Online Research

Ongoing projects in other counties include Changamwe and Buxton Estates in Mombasa, Kakamega Affordable Housing Project in Kakamega and Nakuru Affordable Housing Program in Nakuru. For the Nairobi Metropolitan Area, other projects on the pipeline are Shauri Moyo, Makongeni and Starehe houses. The private sector has also played a major role in the roll out of affordable housing units to fast track their delivery and providing affordable housing financing to their clients below markets rates, with flexible repayment plans, and longer repayment periods. Some of the projects by the private sector include;

|

Private Affordable Housing Projects in the Nairobi Metropolitan Area |

||||

|

Project Name |

Developer |

Location |

Number of Units |

Status |

|

Kentek Ventures |

Kentek Venture Limited |

Ruiru |

53,716 |

Ongoing |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

30,000 |

Ongoing |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

8,888 |

Ongoing |

|

Tsavo Apartments |

Tsavo Real Estate |

Embakasi, Riruta,Thindigua, Roysambu and Rongai |

3,200 |

Ongoing |

|

Unity West |

Unity Homes |

Tatu City |

3,000 |

Ongoing |

|

Greatwall Gardens |

Edermann Property |

Mlolomgo |

2,200 |

Ongoing |

|

RiverView |

Karibu Homes |

Athi River |

561 |

Ongoing |

Source: Online Research

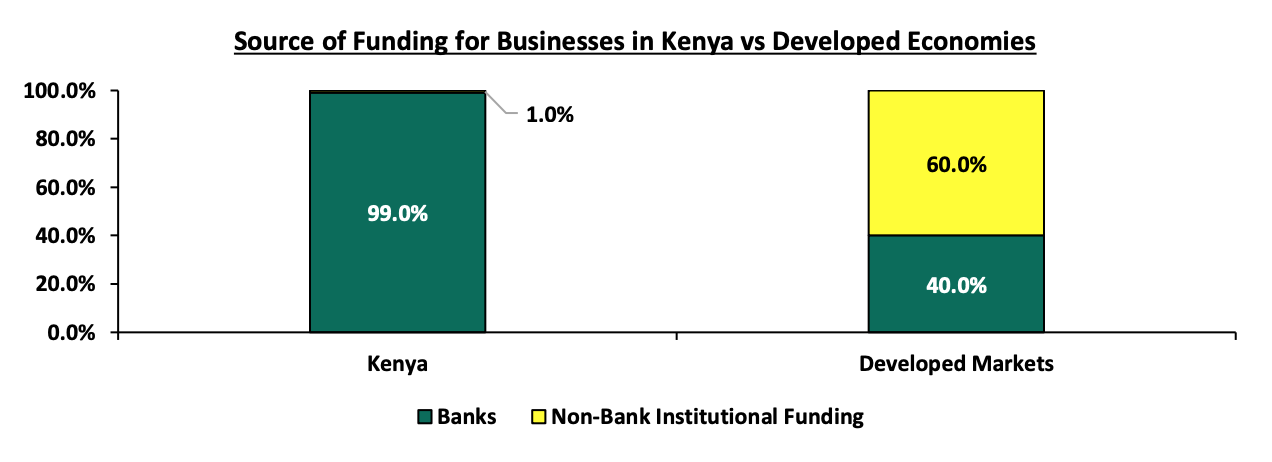

Despite the private sector’s efforts in complementing the government’s efforts in achieving affordable housing, we note that the roll out of Affordable Housing projects has remained a challenge due to the overreliance on traditional sources of funding projects such as bank debt as opposed to alternative sources of funding such as structured real estate project notes and Real Estate Investment Trusts (REITs). According to the Capital Markets Authority, Kenya’s businesses rely on banks for 95.0% of the funding with only 5.0% of the funds coming from the Capital Markets. Additionally, the bureaucracy and the slow approval processes in the construction industry has contributed to the delays in some of the projects breaking ground, especially during the lockdown period when operations were temporarily halted to adhere to COVID-19 measures.

- Achievements of the Affordable Housing Initiative

Despite the fact that the Affordable Housing Programme is set to fall short of its target, the initiative has made some achievements. Key among them being:

- Increased Budgetary Allocations and Diverse Sources of Funding: Since the Big Four Agenda was introduced in 2017, a total of Kshs 37.3 bn has so far been allocated collectively to fund the Affordable Housing Programme. This amount has been facilitating construction of new units, upgrading of existing units and has been offered to KMRC to support affordable mortgages. The only exception was in FY’2020/2021 where budgetary allocation was reduced as funds were diverted to help the government in containing the spread of the COVID-19 pandemic. Additionally, in December 2021, the Capital Markets Authority (CMA) approved the issuance of a Kshs 3.9 bn Medium Term Note (MTN) Program for Urban Housing Renewal Development Limited which will finance the construction of the ongoing Pangani Affordable Housing Project. The graph below indicates the budgetary allocation towards affordable housing from FY’2018/19 to FY’2021/2022;

Source: National Treasury

- Incentives to Home Owners and Developers - The government has made progress in improving the housing situation over the past three years by formulating incentive policies and fiscal reforms. These incentives are meant to motivate home buyers and developers into accelerating the development and progress of affordable housing;

For home owners, the government offers;

- Affordable housing relief of 15.0% of gross emoluments up to Kshs 108,000 per annum or Kshs 9,000 per month for Kenyans buying houses under the Affordable Housing Scheme,

- Tax exemption for interest on mortgage repayments up to Kshs 25,000 per month or Kshs 300,000 per annum provided that the taxpayer occupies the property,

- The National Housing Development Fund (NHDF) - The Fund aims to bridge the gap for affordable housing in Kenya by enabling end-buyer uptake through provision of affordable financing solutions such as the Tenant Purchase Scheme (TPS), and,

- A waiver on stamp duty for first- time home buyers under the affordable housing initiative, and,

- Pension scheme members the opportunity to utilize up to 40.0% of their accumulated pension benefits towards the direct purchase of a residential house in addition to the previous provisions allowing the utilization of up to 60.0% of pension benefits to secure a mortgage facility.

For Developers the government offers;

- Reduction in corporate tax by 50.0% from 30.0% to 15.0% for developers of over 100 affordable housing units annually,

- Exemption from Value Added Tax for supplies imported or purchased for direct and exclusive use in the construction of affordable houses by licensed Special Economic Zones (SEZ), subject to a minimum of 5,000 units. Good case example is Tatu City, a mixed-use development of over 5,000 acres located in Ruiru, Kiambu County and the first operational SEZ in Kenya, and,

- The waiving of building approval fees for all affordable housing projects in Nairobi.

These incentives among others, have led to increased developments related to affordable housing and also boosted the development and uptake of affordable homes in the country.

- Launch and operationalization of the Kenya Mortgage Refinance Company (KMRC) - The Kenya Mortgage Refinance Company is a treasury backed lender which was established in August 2018 and licensed for operations in September 2020. The firm aims to provide long term funds to Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and SACCOs in order to increase the availability and affordability of home loans to Kenyans. The lending to PMLs in FY’2020/21 refinanced a portfolio of 1,427 mortgages valued at Kshs 2.1 bn. In FY’2021/22, KMRC tripled the lending allocation to Kshs 7.0 bn representing a 153.5% increase. The lending is done at 5.0% to PMLs for onward lending to affordable housing clients at single digit interest rates. KMRC re-finances mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) to individual borrowers whose monthly household income is not more than Kshs 150,000,

- Launch of Numerous Affordable Housing Projects: From the onset of the Big 4 Agenda, the government has launched a couple of projects focused on affordable housing. Key to note, Pangani and Park Road Estates have managed to deliver about 1,000 units with some already handed over for sale to potential buyers. In the Pangani Housing Project, 1,000 units are set to be handed over in May 2022. The housing project targets 1,562 units out of which 952 are in the affordable housing category. The private sector has also contributed to this initiative by initiating a couple of projects that cater to the low and middle income group, and,

- Establishment of the National Housing Development Fund (NHDF): The Fund aims to bridge the gap for affordable housing in Kenya by; i) enabling end-buyer uptake through provision of affordable financing solutions such as the anticipated nationwide Tenant Purchase Scheme (TPS), ii) allowing mortgage and cash buyers to save towards the purchase of an affordable home through the Home Ownership Savings Plan and, iii) extending mortgage loans to members at an interest rate of up to 7.0% p.a.

- Impediments towards the Achievement of National Housing Agenda in Kenya

The timely delivery of the Affordable Housing program has been impeded by several bottlenecks, with the Government only delivering less than 5,000 housing units which is a far cry from an ambitious target of 500,000 units at the end of 2022. Some of these bottlenecks include;

- Inadequate Funding: Inadequate funding has been a setback for both the government and the private sector players as discussed below;

-

- Government: Housing developments are capital intensive, particularly the mass production of affordable housing projects for which the government is the largest financier. Budgetary allocation to affordable housing has been low which has limited the supply of housing units. In the FY’2021/22 budget, the National treasury allocated Kshs 13.9 bn affordable housing which is only 7.6% of the total amount allocated to Infrastructure, Housing, Urban Development and Public Works Sector at Kshs 182.5 bn. On mortgage financing as a means, the government is also not clear on the sustenance of the Kenya Mortgage Refinance Company (KMRC) funding model in order to maintain lending at 5.0% to Primary mortgage lenders for onward lending at single digit rates.

- Private Sector and Developers: In Kenya, the main source of funding for real estate developers is banks which provide 99.0% of funding as compared to just 40.0% in developed countries. The capital markets structure in the country, which could be a source of alternative funds, is non-supportive and under-developed, hindering raising of funds for affordable housing developments for the private sector players. Funding to developers has also been affected by the uncertainty occasioned by the COVID-19 pandemic, with most investors opting for capital preservation.

The graph below shows sources of funding businesses in Kenya compared to developed countries;

- Unaffordable Mortgages: According to the Central Bank of Kenya’s Bank Supervision Annual Report 2020, the residential mortgage market recorded a 3.7% decline in the number of mortgage loans accounts, to 26,971 in December 2020, from 27,993 in December 2019. Mortgage access and penetration in the country still remains low mainly due to; i) low-income levels that cannot service the high mortgage initial deposits and subsequent installment payments, ii) high interest rates for mortgages ranging between 7.0-13.0%, iii) exclusion of employees in the informal sector due to inability to service mortgages, iv) lack of capital markets funding towards real estate purchases for end buyers, and, iv) lack of a secondary mortgage market that would improve ability and capacity of banks and other lenders to finance more mortgages. Notably, with the average mortgage loan size of Kshs 8.6 mn and interest rates at 10.9% and a maximum tenor of 20 years, one is required to make monthly repayments of approximately Kshs 88,000 per month, which is unaffordable assuming a median gross salary of Kshs 50,000,

- Inadequate Supply of Development Land: There is an inadequate supply of serviced land ready for development in most locations around the country. When available, this land is expensive especially in urban areas like Nairobi Metropolitan Area where land prices have grown at a 10-year CAGR of 8.3% according to Cytonn Research. Most of the land owners are also not willing to sell off land as they await long term price appreciation while others generally feel the need to maintain their ancestral land,

- High Construction Costs: Exorbitant land prices has led to increased development costs as land costs account for 25.0% - 40.0% of development costs in urban areas. The average cost of construction per square meter (SQM) stood at Kshs 44,754 in 2021. With the average plinth area of a 2-bedroom apartment under affordable housing at 40.0 SQM, the average cost of a complete unit stands at Kshs 1.7 mn which is unaffordable for most Kenyans when the seller has to realize a return after selling the unit, especially in the COVID-19 times when spending power remains weak,

- General Government Bureaucracy: According to the Centre for Affordable Housing Finance Africa, it takes 44 days to register a property in Kenya with the average cost to register the property standing at 5.9% of the property price. This when compared to some African countries like Ghana, where it takes 33 days, and the average cost is also less at 4.1%, illustrating the generally slow processes in Kenya. There also exist several agencies involved in the approval of licensing of housing development proposals ranging from respective county government approval to the National Construction Authority and the National Environmental Management Authority resulting to a lengthy, costly and complicated process before actual construction. This is not appealing to developers and potential investors thus slowing down provision of affordable housing,

- Ineffective Policy Actions: The Ministry of Housing and Urban Development established the Integrated Project Delivery Unit to act as a single point for regulatory approval for developments, infrastructure provision and developer incentives which is still awaiting operationalization to date. Incentives offered to developers such as reduction of income tax for developers developing more than 100 affordable units annually from 30.0% to 15.0% are neither clear nor accessible and fail to serve the desired purpose,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Affordable Housing Development: The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the intended objective as a result of:

- Regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security,

- Lack of clarity on returns and revenue-sharing,

- The extended time-frame of PPPs at 30 years, and,

- Bureaucracy and slow approval processes.

- Unsustainable Funding Model for the Kenya Mortgage Refinance Company (KMRC): The Kenya Mortgage Refinance Company is responsible for funding affordable mortgages in the country. In an aim to consolidate more funds for onward lending at 5.0%, however, the funding model for KMRC is not sustainable and it’s not clear on how the firm will borrow and maintain lending at such single digit rates. KMRC is likely to attract fewer investors as it seeks to both borrow and maintain lending at the low rates, and as a result, face competition from government instruments which are offering higher rates to investors. Some of the government bonds such as the 20-year bond are attracting a return of 13.5% and would seem more attractive to investors. It is therefore not clear how the firm will borrow and maintain lending at a 5.0% rate with the latest postponement of the green bond issue attributed to challenges surrounding rates, quantum and bond guarantee negotiations.

Section IV: Lessons Kenya Can Learn from Other Countries

In our previous topicals on Affordable Housing in Kenya and Accelerating Funding to Affordable Housing covered in April 2018 and May 2020, respectively, we highlighted Singapore and South Africa among the countries that have made strides in affordable housing. We now take a look at the lessons on initiatives that we can learn from these aforementioned countries, in addition to those from Canada and Japan.

|

Country |

Key Take-Outs |

|

Singapore |

|

|

Canada |

|

|

South Africa |

|

|

Japan |

|

Section V: Recommendations

From the above lessons, the following can be implemented to accelerate the affordable housing initiative in the Nairobi Metropolitan Area;

- Remove Obstacles in the Capital Markets: The private sector’s participation in the development of affordable housing in Kenya has been crippled by the unavailability of financing and the high dominance on banks as a source of funding. Learning from developed countries such as Singapore and the United Kingdom, capital markets play a key role in the mobilization of commercial financing. There is therefore need to deepen our capital markets and stimulate its growth and we believe that this can be achieved by;

- Allowing for sector funds: The current capital markets regulations require that funds must diversify. Consequently, one has to seek special dispensation in the form of sector funds such as a financial services fund, a technology fund or a real estate UTF fund. Regulations allowing unit holders to invest in sector funds would expand the scope of unit holders interested in investing in affordable housing,

- Reduce the minimum investments to reasonable amounts: Currently, the minimum investment for sector specific funds is Kshs 1.0 mn, while that for Development-Real Estate Investments Trusts (D-REIT) is currently at Kshs 5.0 mn. The high minimum initial and top up investments amounts are unreasonably high given that the national median income for employed individuals is estimated at around Kshs 50,000. This therefore locks out a lot of potential investors,

- Eliminate conflicts of interest in the governance of capital markets: The capital markets regulations should enable a governance structure that is more responsive to market participants and market growth, and,

- Improve fund transparency to provide investors with more information: Each Unit Trust Fund should be required to publish their portfolio holdings on a quarterly basis and make the information available to the public so as to enhance transparency for investors. Providing investors with more information will help both investors and prospects make better informed decisions and subsequently improve confidence and funding for such housing backed investment schemes.

- Focus on Enabling Environment Rather than Construction: The government should focus more on providing an enabling environment for developers and investors, as well as stimulating economic growth to ensure that even citizens can afford housing on their own. In the informal settlement areas, the government should look to prioritize repairs and upgrades, rather than the construction of new houses which is costlier and takes more time. In Canada, their National Housing Strategy is focused on repairing and upgrading units rather than doing new constructions. This strategy has so far borne fruit given the successful Community Programs Partnerships that have so far overseen repair of over 126,000 units by 2021,

- Focus on Urban Planning in the NMA: The government of Kenya can also adopt the technique of high-rise buildings with compact plinth areas in the Nairobi Metropolitan Area (NMA) to cater for the growing population. With a population of approximately 5.6 mn, Singapore is classified as one of the most densely populated cities in the world at 7,909 people per SQKM. Due to land scarcity, urban planners sought to maximize land use through construction of high rise and high-density buildings. The government then implemented a mandatory code in 2008 with requirements to ensure environmental sustainability of buildings leading to a higher quality of life for its residents, and

- Reduce Bureaucracy and Regulatory Hindrances in the Working of PPPs: The government needs to address regulatory gaps in PPP deals. Despite the Public Private Partnerships (PPP) Bill 2021 being signed into law, more can be done in addressing regulatory hindrances such as, lack of a revenue sharing mechanism and lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate easier access to private sector funds through the use of the land as security. In South Africa PPPs become SPVs, making lending funds to them easier such as Fleurhof Project, a USD 350.0 mn (Kshs 35.4 bn) residential development in Johannesburg, near Soweto. The project targeting low-income households started in 2009 was done through a partnership between International Housing Solutions (IHS), a private equity firm, and Calgro M3, the developer, and around 5,000 residents currently live at the Fleurhof Project.

In conclusion, the government has made some progress towards affordable housing by delivering units in the Nairobi Metropolitan Area and initializing several other projects in other counties. We believe that for affordable housing to properly take off and meet the existing demand in the NMA, the government has to implement comprehensive solutions with a main focus on increasing financing for affordable housing development. If the financing gap can be bridged, the government will be a step closer to achievement of the Big Four Agenda.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.