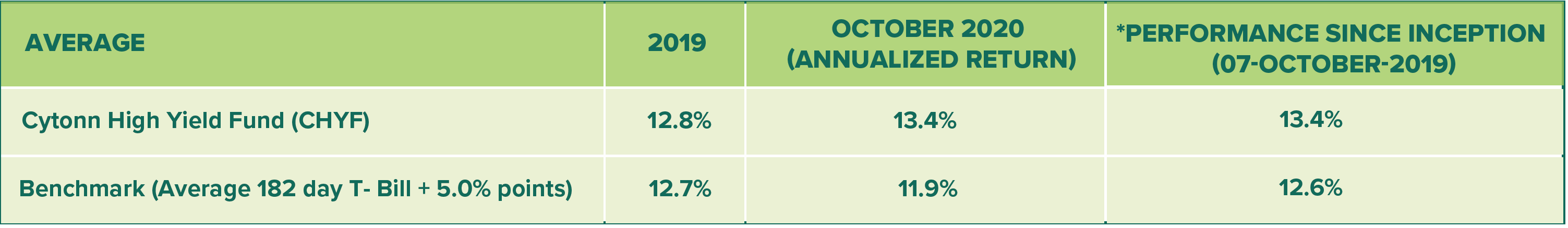

1. FUND PERFOMANCE

*Historical Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns

2. FUND MANAGER’S REPORT AND OUTLOOK

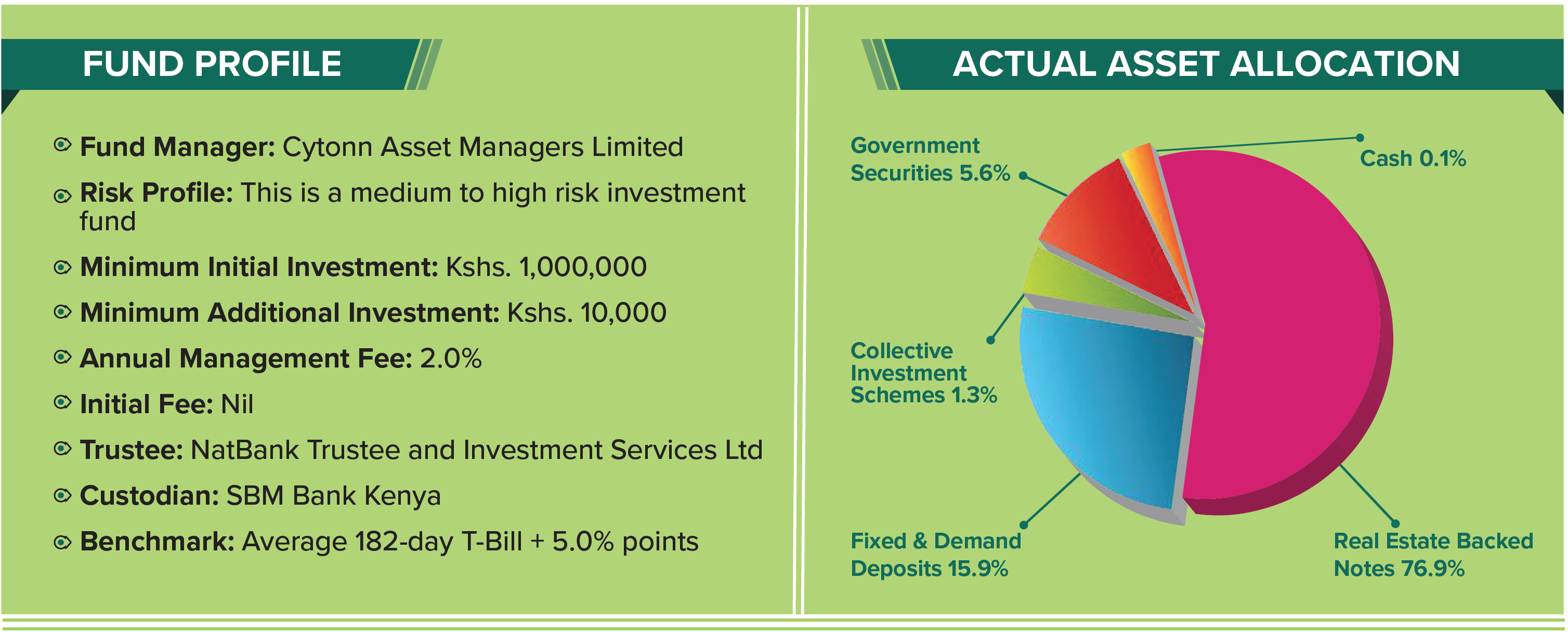

Fund Objective

The Cytonn High Yield Fund is a specialized Collective Investment Scheme with exposure skewed towards investment in real estate assets.The Fund aims at capital preservation while earning high returns and maintaining sucient liquidity. The Fund aims to achieve above average returns that not only beat inflation but are also better than the yields oered by both government securities and fixed deposit.

Portfolio Strategy

The fund will largely be invested in fixed income and real estate related securities. Being a specialized Fund, the Fund can invest up to 80.0% in real estate funds, but to ensure sucient diversification no single investment should be more than 25.0% of the portfolio unless in special cases.

Economic report and outlook

According to Kenya National Bureau of Statistics (KNBS), the Kenyan economy recorded a 5.7% contraction in Q2’2020 down from a growth of 5.3% recorded in a similar period of review in 2019. This was the first contraction since the Q3’2001 when the country recorded a 2.5% contraction. The overall performance was cushioned by growths in Agriculture, Forestry and Fishing activities which grew by 6.4%; Financial and Insurance activities, 1.7%; Construction, 3.9%; Real Estate Activities, 2.2% and Mining and Quarrying activities, 10.0%. Accommodation & tourism and the Education sectors were the hardest hit, declining by 83.3% and 56.2% respectively. During the month, there was a continued downward readjustment on the yield curve, which saw the FTSE NSE Kenya Government Bond Index gain by 0.5%, taking the YTD performance to a 2.8% gain. The downward readjustment is mainly attributable to increased demand, due to the bias by banks towards government securities as opposed to lending due to increased credit risk. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with the October y/y inflation coming in at 4.8%, a rise from 4.2% recorded in September, while m/m inflation came in at 0.95%. The rise was driven by a 1.0% rise in the food and non-alcoholic drinks’ Index, a 0.9% increase in the housing, water, electricity, gas and other fuels’ index and a 0.6% rise in the transport index. During the month, the Kenyan shilling remained under pressure against the US dollar, losing by 0.3%, to close the month at Kshs 108.8 from Kshs 108.5 in September, mainly attributable to increased end-month importer dollar demand amidst lackluster dollar inflows.

Portfolio Performance

The Cytonn High Yield Fund successfully delivered above-market returns in October, averaging 13.4% against the benchmark return of 11.9% p.a.

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.