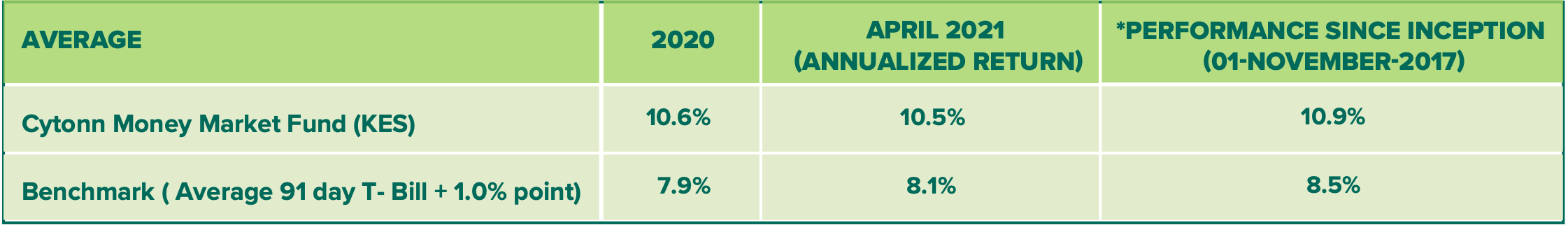

FUND PERFORMANCE

* Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns since inception.

FUND MANAGERS REPORT AND OUTLOOK

Fund Objective

The Cytonn Money Market Fund is a low-risk fund that seeks to obtain a high level of current income while protecting investor’s capital and liquidity.

Portfolio Strategy

The Cytonn Money Market Fund successfully delivered above-market returns in April 2021, averaging 10.5% p.a. The Fund outperformed the industry average and its benchmark of 91-day T-Bill+1% points at 8.1%.

Portfolio Performance

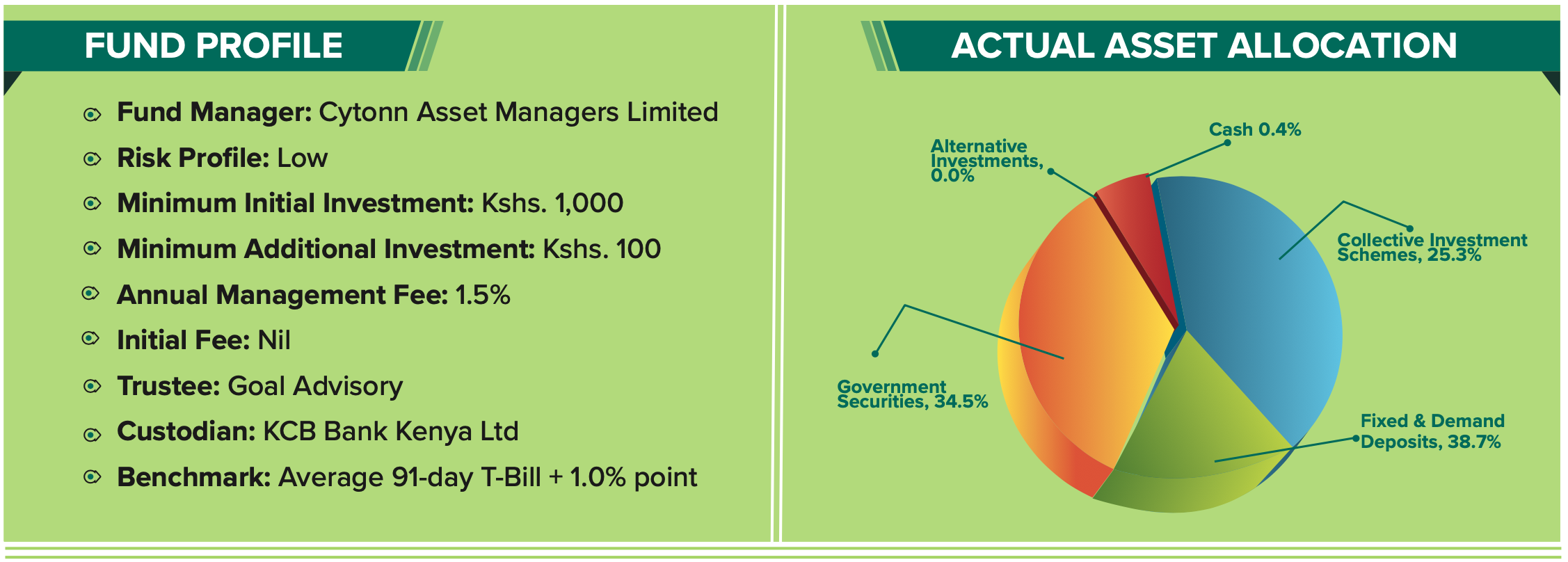

The portfolio objective will be to outperform the income yield available on money market call accounts and fixed deposit accounts by investing in interest-bearing securities and other short-term money market instruments. These securities are usually available to the wholesale or institutional clients. The Fund will also be managed conservatively with active management of duration, credit and liquidity risks.

Economic Report and Outlook

According to Kenya National Bureau of Statistics (KNBS), the Kenyan economy recorded a 1.1% contraction in Q3’2020 down from a growth of 5.8% recorded in a similar period in 2019. This was the second consecutive contraction, after the 5.7% recorded in Q2’2020, pointing to an economic recession. The overall performance was cushioned by growths in Agriculture, Forestry and Fishing activities which grew by 6.3%; Financial and Insurance activities, 5.3%; Construction, 16.2%; Real Estate Activities, 5.3% and Mining and Quarrying activities, 18.2%. Accommodation & tourism and the Education sectors were the hardest hit, declining by 57.9% and 41.9% respectively. During the month, there was a marginal upward readjustment on the yield curve, which saw the FTSE NSE Kenya Government Bond Index decline marginally by 0.3%, taking the YTD performance to a 1.3% decline. The upward readjustment is mainly attributable to investors attaching a higher risk premium on the country following the recent spikes in COVID-19 infections coupled with the lower credit rating from S&P Global. Yields on shorter dated papers were on the rise with the 364-day and 182-day papers gaining marginally by 0.2% and 0.1% points to 9.5% and 8.0%, respectively, while the 91-day paper remained unchanged at 7.1%. During the month, the Kenya Shilling appreciated by 1.8% against the US Dollar to close the month at Kshs 107.8, from Kshs 109.5 recorded at the end of March, mostly attributable to the lackluster demand for the dollar.

Going forward, Cytonn Asset Managers Limited (CAML) expects the Cytonn Money Market Fund (CMMF) to continue to deliver above-average returns leveraging on optimal asset allocation in line with the Fund’s Investment Policy Statement.

As of 29th April 2021, cash, bank deposits and government securities constituted 74.7% of the portfolio

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.