FUND PERFORMANCE

* Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns since inception.

FUND MANAGER’S REPORT AND OUTLOOK

Fund Objective

The Cytonn Money Market Fund is a low-risk fund that seeks to obtain a high level of current income while protecting investor’s capital and liquidity.

Portfolio Strategy

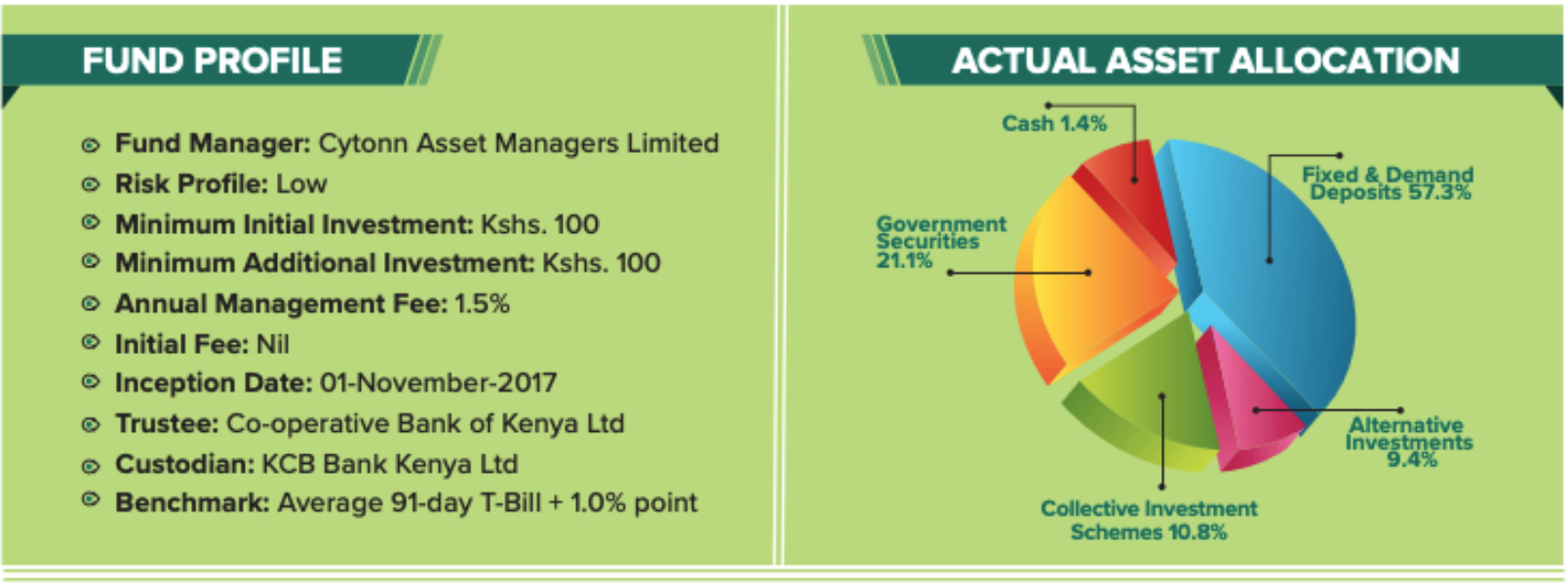

The portfolio objective will be to outperform the income yield available on money market call accounts and fixed deposit accounts by investing in interest-bearing securities and other short-term money market instruments. These securities are usually available to the wholesale or institutional clients. The Fund will also be managed conservatively with active management of duration, credit and liquidity risks.

Portfolio Performance

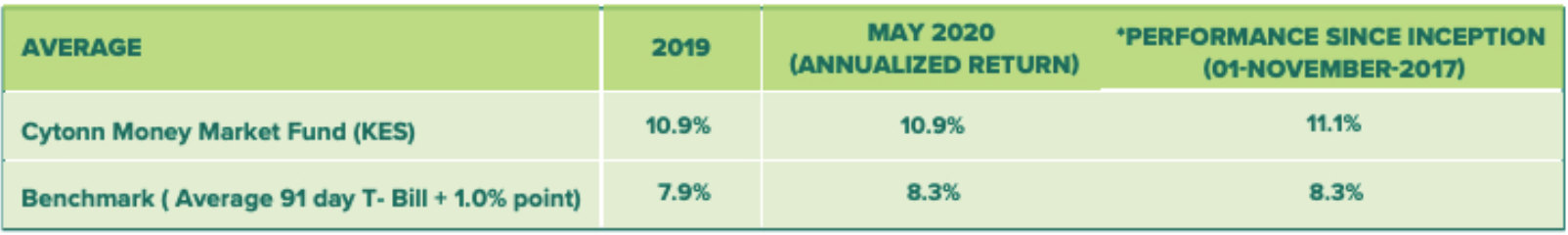

The Cytonn Money Market Fund successfully delivered above-market returns in May 2020, averaging 10.9% p.a. The Fund outperformed the industry average and its benchmark of 91-day T-Bill+1% points at 8.3%.

Economic report and outlook

Economic growth remains subdued due to the ongoing COVID-19 pandemic, which has disrupted various sectors. The Central Bank revised the growth projection downward to 2.3% from 5.2% as at the start of the year. There has been pressure on interest rates with the yield curve shifting upwards from the December levels, this is despite a cumulative 1.5% points’ downward revision of the Central Bank Rate (CBR) since the beginning of the year to the current rate at 7.0%, to cushion the economy from the negative e ects emanating from COVID-19 pandemic. On the short end of the yield curve, the Central Bank of Kenya has managed to maintain the yields relatively stable with the 91 day T-Bill rising marginally to 7.3% from 7.2% recorded in April. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with the May inflation coming in at 5.5% driven by increases in food and Kerosene prices. We expect inflation to remain stable despite supply side disruption due to COVID-19 as low demand for commodities compensates for the cost-push inflation, coupled with the low oil prices in the international markets. We have seen a lot of pressure on the currency due to the demand for the dollar as a safe haven but we do not foresee further declines as the Central Bank remains active in the market to cushion the shilling.

Going forward, Cytonn Asset Managers Limited (CAML) expects the Cytonn Money Market Fund (CMMF) to continue to deliver above-average returns leveraging on optimal asset allocation in line with the Fund’s Investment Policy Statement.

As of 29th May 2020, cash, bank deposits and government securities constituted 78.4% of the portfolio

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.