In March 2021, Kenya saw its sovereign rating downgraded by all the major rating agencies; Standard & Poor’s , Fitch Rating and Moody’s. The lowering of the credit rating was mainly on the back of Kenya’s high fiscal deficit coupled with the economic shocks occasioned by the challenges brought about from the impact of the COVID-19 pandemic. With the downgrading and the constant increase in the fiscal deficit we have seen some pressure on the local bonds yield curve which has resulted to 1.4% decline in the FTSE NSE Bond Index. Despite the challenges that have been facing the economy the shilling has held stable this year having appreciated by 0.5% YTD following a 7.7% depreciation in 2020. The main support that the shilling has been having is the lower demand from imports and the decline in dividend payments, we have seen increased inflows to the bond market, increased diaspora remittances, inflows from the IMF in support of the economy and the higher forex reserves held by the Central bank. This week we shall be focusing in detail the factors that are expected to drive the performance of the Kenya shilling and the interest rates and thereafter give our outlook for 2021;

In our Currency and Interest Rates Outlook which was covered in May 2020, our outlook on the currency was a 5.5% depreciation by the end of 2020, driven by the reduced exports earning due to the lockdown measures put in place by Kenya’s trade partners coupled with the high fiscal deficit seen during the period. On the interest rates, we expected a slight upward readjustment on the yield curve due to the increased pressure on the government to plunge in the budget deficit coupled with the increased demand by investors for higher yields due to the perceived risk in the country.

With the shilling having appreciated by 0.5% on a YTD basis and the upward readjustment seen on the yield curve since the year began, we saw the need to revisit the topic on currency and interest rates outlook, in order to shed some light on how the shilling and the interest rates are expected to behave in 2021.

In this note, we shall be focusing in detail the factors that are expected to drive the performance of the Kenya shilling and the interest rates and thereafter give our outlook for 2021 based on these factors. We shall cover the following:

- Historical Performance of the Kenyan Shilling,

- Evolution of the Interest Rate Environment,

- Factors Expected to Drive Currency Performance,

- Underlying Factors Expected to Drive The Interest Rate Environment, and,

- Conclusion and Our View Going Forward

Section I: Historical Performance of the Kenyan Shilling

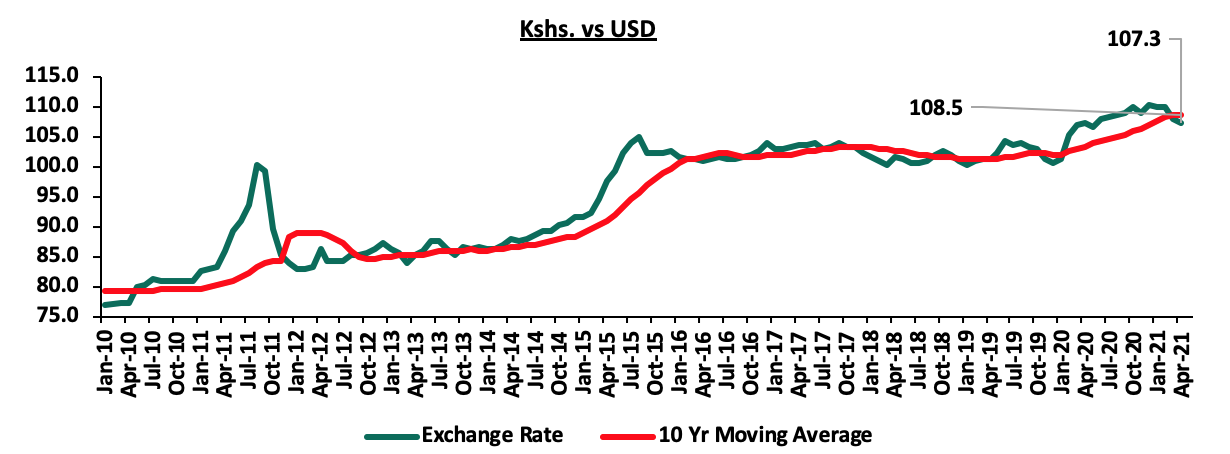

Over the past 8 years, the Kenya Shilling has been relatively stable against the US Dollar as can be seen from the chart below.

Source: Central Bank of Kenya

Below are some of the factors that has been supporting the shilling

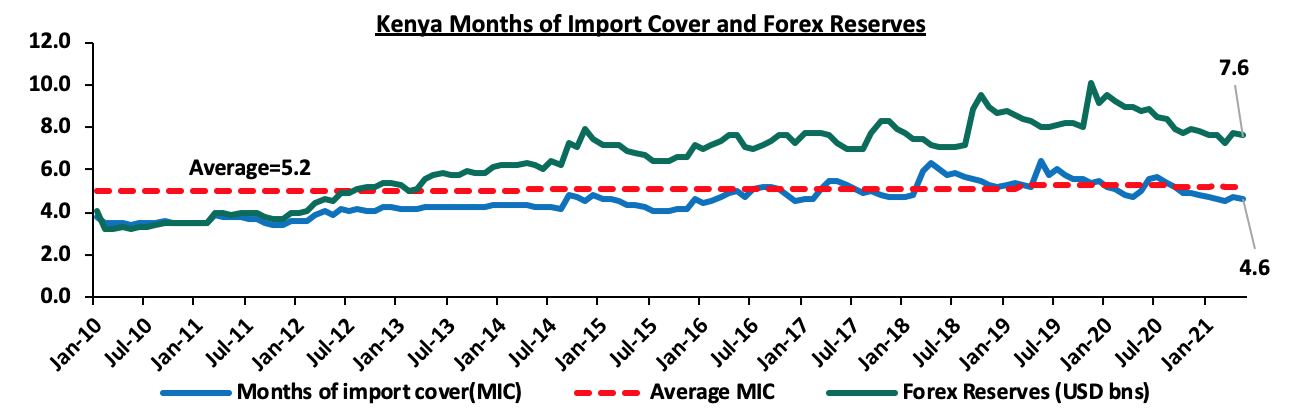

- The high reserves held by the Central bank which was above the statutory target of 4.0-months import cover, having averaged USD 8.1 bn equivalent to 5.2 months average import cover.

The chart below shows the trend of the evolution of the forex reserves:

Source: Central Bank of Kenya

Since the onset of the pandemic, forex reserves have been dwindling with the lowest reserves being recorded on the week ended 26th March 2021 of USD 7.3 bn (4.5 months of import cover). The decline is largely attributable to reduced tourism and foreign travel inflows due to Covid-19 constraints, as well as increased debt service obligations due to the shilling depreciating by 7.7% in 2020.

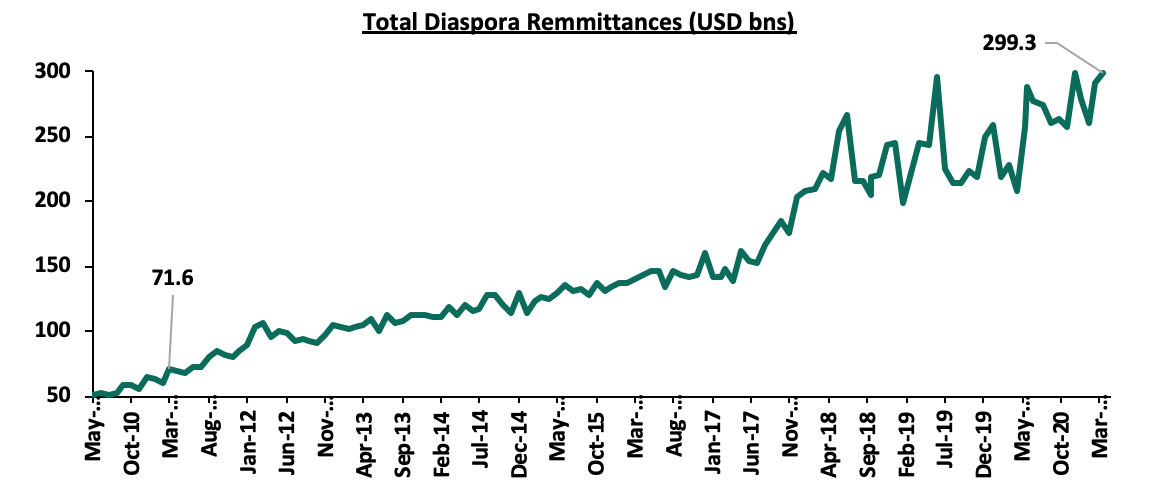

- Strong diaspora remittances, which have grown by a 10-year CAGR of 15.6% to USD 299.3 mn, in April 2021 from USD 71.6 mn recorded in April 2011 attributable to the increasing Kenyan population in the diaspora and advancing technology that makes transfer of money easier. The chart below shows the trend of the evolution of the Diaspora Remittances:

Source: Central Bank of Kenya

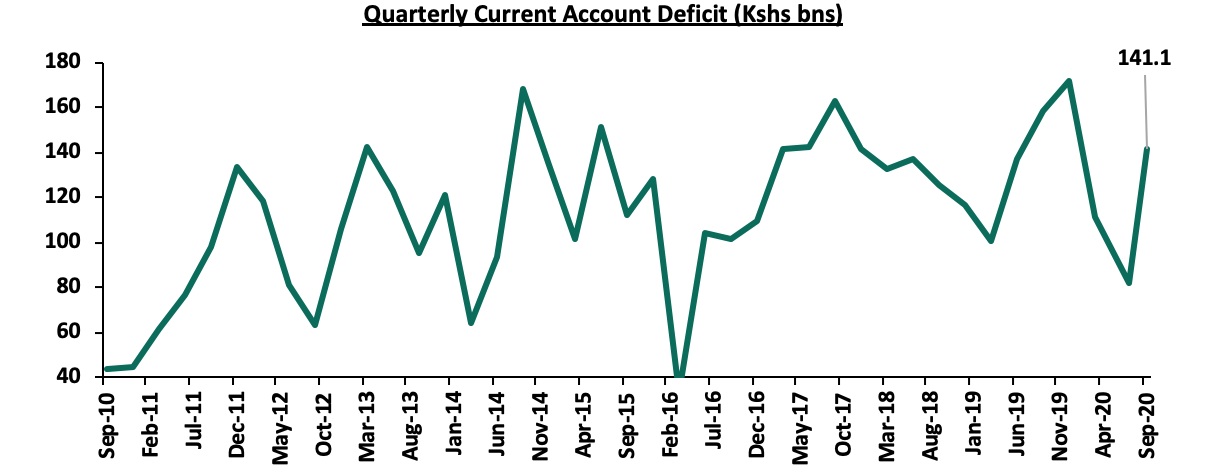

- The narrowing of the current account due to the increased value of the country’s principal exports with a key focus on the value of tea exports which have grown by a 10-year CAGR of 3.8% to an estimate of Kshs 11.4 bn in January 2021, from Kshs 7.8 bn recorded in January 2011, Below is a chart showing the trend of the current account on a quarterly basis:

Source: Reuters

- The increased flow of business especially from the tourism sector pre-COVID period evidenced by the 3.9% growth in tourist arrivals to 2.1 mn in 2019 from 2.0 mn tourists in 2018 after recording a 37.3% increase from 1.5 mn in 2017. However, tourist arrivals declined by 85.5% to 1.1 mn in 2020 as COVID-19 took a toll on the economy, and,

- Improved investment into the country as measured by the FDI flows into the country which had grown significantly by 115.0% to USD 1.3 bn in 2019 from USD 0.6 bn in 2015.

Last year due to the pandemic the shilling depreciated significantly up to 7.7% in 2020 as compared to the 0.5% appreciation in 2019. The shilling recorded an all-time low of Kshs 111.6 against the dollar on December 17th 2020, which was mainly attributable to the reduced dollar inflows as foreigners exited the market and companies closed for the holiday season leading to a reduction in exports of other commodities.

We have however seen a recovery and stability of the shilling this year with the total shilling having appreciated by 0.5% on a YTD basis to close at Kshs 108.2 on 21st May 2021.

The current appreciation of the shilling is mainly attributable to:

- The Forex reserves, currently at USD 7.5 bn (equivalent to 4.6-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- The improving current account position which narrowed to 4.8% of GDP in the 12 months to December 2020 compared to 5.8% of GDP during a similar period in 2019, and,

- Improving diaspora remittances evidenced by a 43.8% y/y increase to USD 299.3 mn in April 2021, from USD 208.2 mn recorded over the same period in 2020, has cushioned the shilling against further depreciation.

Section II: Evolution of the Interest Rate environment in Kenya

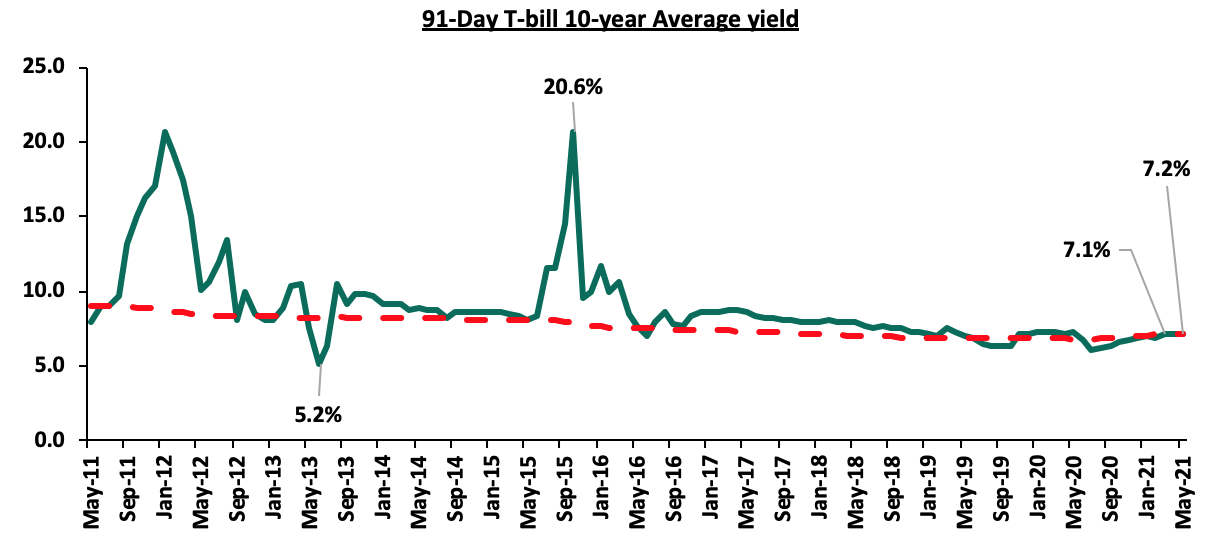

Kenya’s interest rate environment has witnessed high volatility more so in the periods between 2011 and 2015. During this period, the yields on government papers increased, with the 91-day paper’s yield coming in at 21.7% in October 2015, a 3-year high from the last recorded high yields of 20.6% recorded in January 2012. Key to note, yields on government papers largely follow what is happening in the economy and in times of expected high borrowing, lending rates tend to shoot up.

Since 2016, the yield on government papers have remained relatively stable despite the continuous high budget deficit which has averaged about 8.0% over the last 10 years and is currently projected to come in at 8.7% of the GDP as per the FY’2020/21 supplementary Budget I. In order to see how the entire yield curve has performed over the last 10 years the chart below summarizes the key shifts. It is clear that yields have been stable and this can be attributed to

- The continuous improvement in the fiscal deficit

- The improved revenue collections. This has registered a 10 year CAGR of

- The diversification of funding sources by the government

- The discipline in rejecting expensive bids by the CBK

Source: Central Bank of Kenya

Given the adverse effects emanating from the COVID-19 pandemic and the lowering of Kenya’s Credit rating by various rating agencies, we expect the government to borrow aggressively in the local market as it seeks to plug in the fiscal deficit and consequently create uncertainty in the interest rate environment. For the first nine months of FY’2021/2021, the government has continued to fall short of its revenue collection, collecting cumulatively only Kshs 1.9 tn (63.6% of its revised annual target of Kshs 2.9 tn) as at March 2021. The shortfall in the revenue collection stems from the tax incentives that were seen in 2020 as the government tried to cushion its citizens from the pandemic. However, the reversal of these tax incentives has seen an improvement in tax collections with KRA reporting that it had surpassed its revenue target collection for the month of April 2021 by collecting Kshs 176.7 bn, against a target of Kshs 170.2 bn.

We believe that in order for the government to ease pressure on the interest rate, they should:

- Continue implementing measures to reduce debt service to revenue ratio which was estimated at 41.4% at the end of 2020, 11.4% points higher than the recommended threshold of 30.0% but 15.4% points lower than FY’ 2019’s debt service ratio of 56.8%, attributable to reduced debt service obligations during the year,

- Contain the government expenditure. With the new devolved system of governance, there needs to be a check on the government spending, both at the county and Central government level. The current aggression in borrowing by the government is aimed at financing its operations at both levels and it would be important to limit expenditure to the core activity of the government as well as reduce wasteful spending, and,

- Shift financing strategies to prioritize concessional financing, and to use commercial borrowing in limited amounts.

Section III: Factors expected to drive currency performance

In this section, we will analyze the key factors expected to drive the performance of the Kenyan Shilling:

- Balance of payments

According to the Q3’2020 Balance of Payments report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s current account deficit narrowed by 10.6% (equivalent to 11.5% of GDP) in Q3’2020, to Kshs 141.1 bn, from Kshs 157.9 bn (equivalent to 12.7% of GDP) recorded in a similar period of review in 2019. This was attributed to an 11.1% increase in the value of exports to Kshs 163.7 bn in Q3’2020, from Kshs 147.3 bn in Q3’2019, while imports reduced by 6.6% to Kshs 392.7 bn in Q3’2020. Towards the end of 2020, the export sector witnessed slight improvement evidenced by the increase in merchandise exports mainly on account of increased earnings from horticulture as well as tea and coffee. As the Corona virus restriction measures continue to ease, we expect the demand in Kenya’s export markets to normalize as accelerated vaccination continues in many countries. This will support movement of both commodities and people globally. However, the business environment will still have a sluggish growth as key sectors like tourism continue to suffer losses occasioned by the third wave of the virus that has seen bans on several international travels. Also, the high fuel prices currently witnessed in the country are likely to increase the import bill. The high import bill will weigh on the improving current account balance and as such, we expect the shilling to stabilize against other currencies.

- Government debt

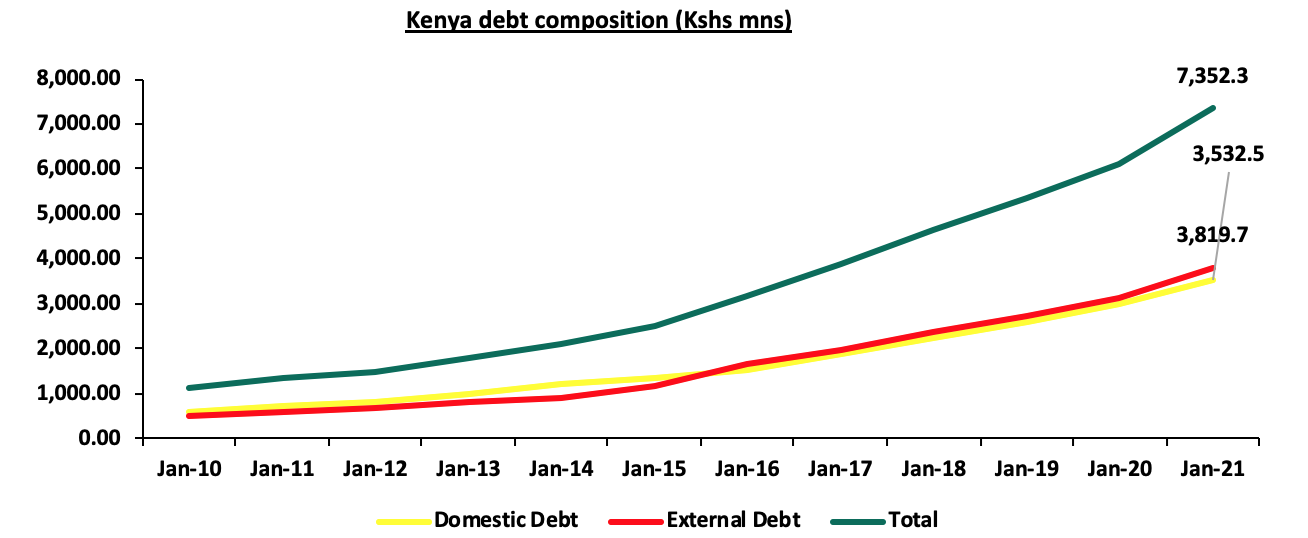

We expect the shilling to experience pressure due to the repayment of the government debt. The projected amounts that is expected to be used for foreign debt servicing stands at Kshs 427.0 bn. Currently, Kenya’s debt stands at Kshs 7.4 tn of which Kshs 3.8 tn is external debt as highlighted in the chart below:

- Forex Reserves

Since the onset of the pandemic, Kenya’s Forex Reserves have been dwindling with May 2021 recording a 9.4% decline to USD 7.5 bn (4.6- months import cover), from USD 8.3 bn (5.2-months imports cover) in May 2020. The dwindling forex reserves seen during the period can be attributed to low inflows from key sectors like tourism amid government obligations of debt servicing. However, the USD 314.0 mn disbursement from the International Monetary Fund (IMF) to the government earlier in April, has supported the reserves as evidenced by the 4.4% increase to USD 7.7 bn (4.8-months imports cover) in April 2021 from USD 7.3 bn (4.5-months imports cover) in March 2021. Going forward, we expect the reserves to be supported by increasing diaspora remittance inflows, continued investor capital inflows with hope for an economic recovery and increasing exports as the key trading partners continue to contain the virus and re-open their economies. However, the elevated debt levels witnessed in the country are likely to put forex reserves under pressure as most of it will be used to repay the debts. As a consequence, the Kenyan shilling will be exposed to foreign exchange volatility causing it to weaken.

- Monetary Policy

In 2021 the Central Bank Rate (CBR) was revised down to 7% from 8.25% in January 2020. As a result, domestic investment activities have declined as Kenya’s financial and capital assets have become less appealing to investors on account of their lower real rate of return. Consequently, the shilling saw significant depreciation up to 7.7% in 2020, as the demand for the dollar continued increasing. However, on a YTD basis the shilling has appreciated by 0.5% to close the week ended 21st May 2021 at Kshs 108.2. The interest rates have been stable and any further declines in the rates would lead to more depreciation of the shilling. It is therefore important that the monetary policy committee is cautious on the next moves. On the other hand, the Inflation rates have remained within the government’s target of 2.5% - 7.5% despite the high fuel prices and as such, we do not expect the CBK to increase the rates as the Central Bank is mainly focused on reviving the economy.

Outlook:

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

|

Positive |

|

Government Debt |

|

Negative |

|

Forex Reserves |

|

Neutral |

|

Monetary Policy |

|

Neutral |

From the above currency drivers, 1 is Positive (balance of payment), 1 is negative (Government Debt), while 2 are neutral (Forex Reserves and Monetary Policy) indicating a neutral outlook for the currency.

Section IV: Underlying factors expected to drive the Interest Rate environment

- Fiscal Policies

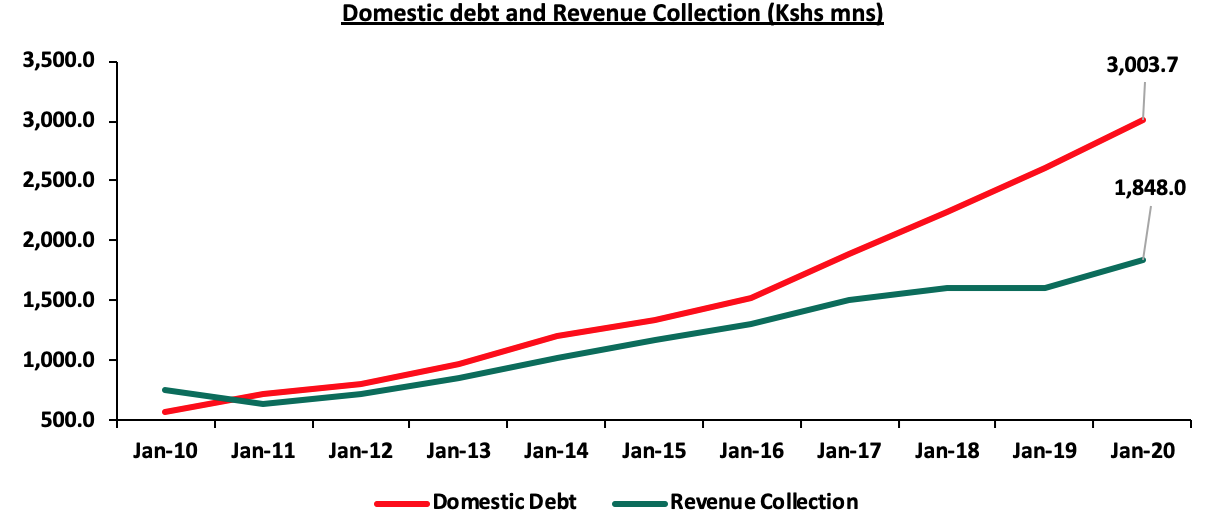

The country has been running a fiscal deficit which is expected to continue growing in the short term as the overall budget grows but the revenue collections struggle to keep pace. The government has introduced more measure to increase revenue collections and we have already seen those bear fruits. The Finance Act 2020 that introduced the minimum tax and digital services tax, will play an instrumental role in enhancing revenue collection through tax amendments meant to broaden the tax base. Due to the continued increase in the deficit we expect the government to borrow heavily in the market. The projected total borrowings in the next fiscal year stands at 952.9 mn which is a projected deficit of 7.7% of the GDP. Below is a chart showing the revenue collections and domestic borrowings over the last 10 years:

Liquidity

The MPC lowered the Cash Reserve to Ratio (CRR) to 4.25% from 5.25% in their March 2020 sitting and increased the maximum tenor of Repurchase Agreements (Repos) to 90 days from 28 days so as to enable banks to access long-term liquidity secured in their holdings in government papers. The CBK also availed Kshs 35.2 bn to commercial banks, in a bid to support borrowers affected by the Coronavirus pandemic. As a result, liquidity in the money market has remained favorable though volatile as evidenced by the interbank rates averaging between 6.2% and 1.8% since the pandemic started. In an ideal situation, ample liquidity in the money market, the lowering of commercial banks’ lending, and deposit rates would lead to increased money supply in the economy and an increase in consumers’ purchasing power.

We believe that the lower CRR has played a big role in maintaining favorable liquidity in the money market and as the effects of the Coronavirus continue to be felt in the economy, banks are still finding it difficult to lend to businesses and individuals as the levels of uncertainty and credit risk increases. Consequently, more money is expected to flow into government securities, which will provide some relief on government yields due to decreased credit competition from the private sector. However, liquidity in the money market might tighten as the Central Bank looks to settle the T-bill maturities worth Kshs 165.0 bn for the FY’2020/21. Moreover, increased balance sheet activity ahead of half year reporting could sustain some pricing pressure especially on deposits. On the other hand, increased government payments ahead of the fiscal year end could help offset the relative squeeze.

- Monetary Policy

Since April 2020, the MPC has retained the CBR at 7.00% in a bid to promote stability in the financial markets and mitigate the economic and financial disruptions brought about by the virus. Over the same period up until 2021, Inflation rates have remained stable and within the 2.5%-7.5% target range despite the recent increases in fuel prices.

Outlook:

|

Driver |

Outlook |

Effect on Interest Rates |

|

Fiscal Policies |

|

Negative |

|

Monetary Policy |

|

Neutral |

|

Liquidity |

|

Neutral |

From the above basis, 1 of the drivers is negative (fiscal policies), and 2 are neutral (Monetary policies and liquidity). We therefore believe that the interest rate environment remains uncertain and will likely adjust upwards.

Section V: Conclusion and our view going forward

Based on the factors discussed above and factoring in the continued efforts to contain the Corona Virus outbreak;

- We expect the Kenyan shilling to remain stable within a range of Kshs 107.5 and Kshs 110.1 against the USD in 2021 based on the purchasing power parity (PPP) and interest rate parity (IRP) approach respectively, with a bias of a 0.6% appreciation on account of:

- Gradual improvement in the export sector as Kenya’s trading partners continue to reopen their economies which will support the narrowing of the current account deficit, and,

- Stable forex reserves on the back of increasing diaspora remittance inflows, continued investor capital inflows and debt relief from other institutions. However, these will be weighed down by the elevated government borrowings, reduced domestic investment on the back of low real returns and the high import bills brought about by high fuel prices.

- We expect an upward readjustment on the yield curve with our sentiments being on the back of:

- Increased pressure on the government to meet its budget deficit by borrowing more domestically. The government is likely to accept expensive bids and in turn destabilize the interest rate environment, and,

- Muted lending to businesses and individuals on the back of elevated risk levels as the effects of the Coronavirus continue to be felt in the economy and ahead of the 2022 August election, despite lowering of the credit reserve ratio.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.