Education plays a central role in households' consumption budget, with education being the second priority after food, at 30.2%, compared to food which had a priority of 31.8%, according to the Kenya National Bureau of Statistics Finaccess Household Survey report. Previously, we have covered the following topics on Education investment plans:

- Education Investment Plans in Kenya in Cytonn Weekly #07/2020 - We focused on analyzing the various education investment plans in the market and the factors to be considered when selecting a suitable investment plan, and,

- Financial Planning for Education in Cytonn Weekly #10/2021 - We focused on how to plan your finances in preparation for future Education cost that one might incurred

In order to continue sensitizing the market on the importance of Education Investment Plans, we found it timely to reiterate the topic and this week we will cover the following sections:

- Introduction

- Understanding the concept of Savings and Investments,

- Importance of Education Investment Plans,

- Key Considerations when choosing an Education Investment plan,

- Education investment plans in Kenya,

- Limitations of Uptake of Education Investment Plans,

- Alternatives to Education Investment Plans, and,

- Conclusions

Section I: Introduction

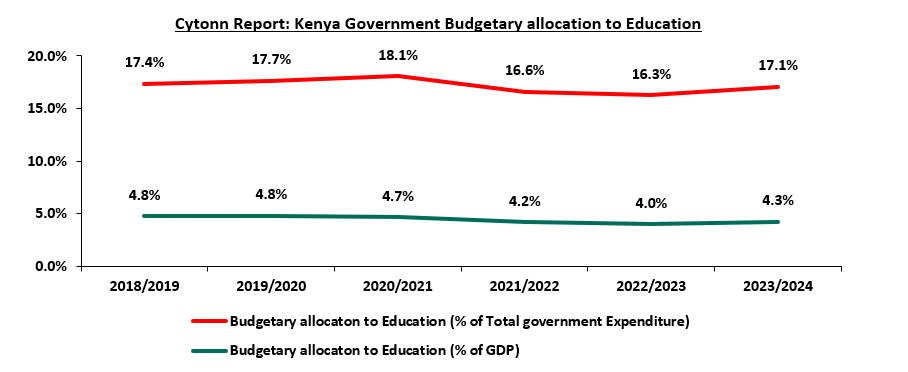

Education is a key aspect of any economy, with the Kenyan government making significant allocations towards education expenditure in every fiscal year. In FY’2023/2024, the education sector received the second largest share of the government expenditure, with the government increasing its allocation to the sector by 15.5% to Kshs 628.6 bn from Kshs 544.4 bn in FY'2022/2023. The allocation represented 4.3% of the GDP, up from 4.0% of GDP in FY’2022/2023. Below is a chart showing a percentage of education expenditure against total government expenditure and against GDP:

Source: The National Treasury

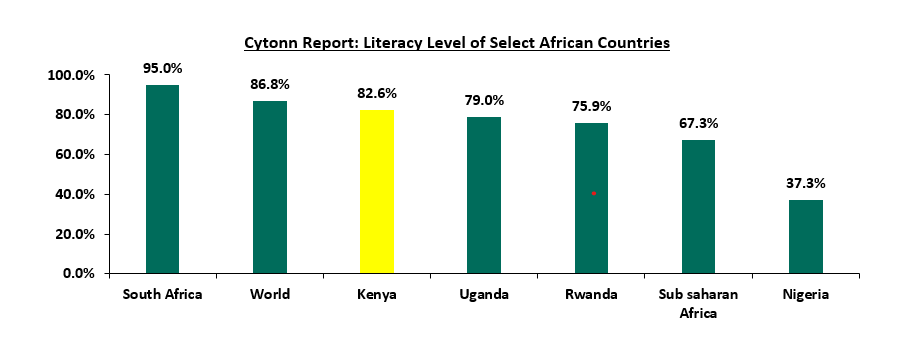

According to World bank Kenya has a literacy level of 82.6%, which is 15.3% points higher than the Sub-Saharan average literacy level of 67.3%. The graph below shows the literacy level of select African countries to the Sub-Saharan and global averages.

Source: World Bank

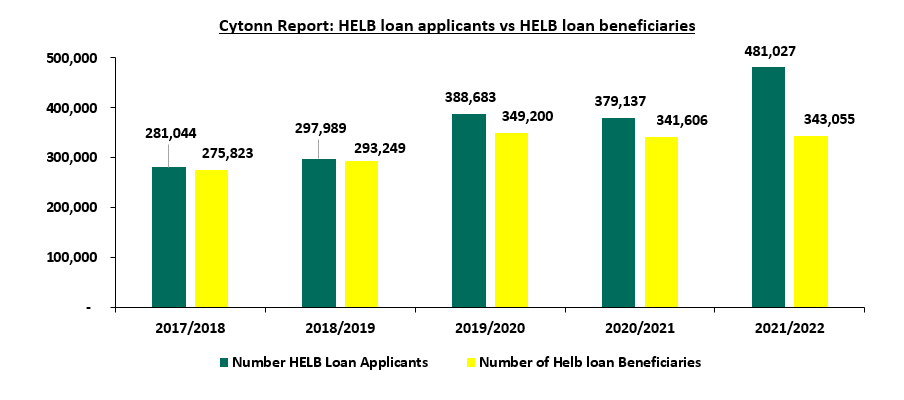

Despite government interventions in funding the education sector, education costs are still a burden to guardians, leading to a growth in the number of applicants for the loans issued by the Higher Education Loan Board (HELB). According to the Kenya National Bureau of Statistics (KNBS) Economic Survey 2023, the total number of HELB loan applicants increased by 27.9% to 481,027 applicants in FY’2021/22 from 376,137 applicants in FY’2020/21. However, despite the increase in applicants, the number of loan beneficiaries only rose by a paltry 0.4% to 343,055 from 341,606 in FY’2020/21. As a result, the number of unsuccessful applicants increased by 299.7% to 137,900 in FY’2021/22 from 34,500 in FY’2020/21. The graph below shows the growth of HELB loan applicants and beneficiaries in the last 5 years.

Source: KNBS Economy Survey report

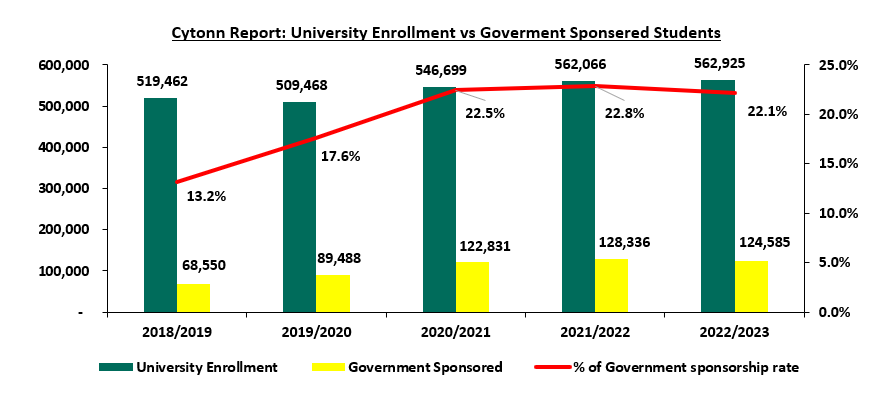

Additionally, there were 481,027 applicants for bursaries from the HELB in FY’2021/2022, out of which only 37,982 applicants were awarded bursaries, a 2.7% decline from the 39,055 in FY’2020/21. As a result, the rate of students transitioning from secondary schools to universities remains marginal, with the number of university enrolments growing at a 5-year CAGR of 1.6% to 562,925 students in FY’2022/23 from 519,462 students in FY’2017/18. Additionally, the low rate of government sponsorship has contributed to the low transition, with the number of government-sponsored students enrolled in the universities decreasing by 2.9% to 124,585 students in FY’2023/24 from 124,585 in FY’2022/2023. This translates to a 22.1% sponsorship rate in FY’2022/2023 compared to 22.8% in FY’2021/2022. The graph below shows the number of university enrollments and government-sponsored students in the last 5 years:

Source: KNBS Economic Survey

This highlights the importance of guardians looking for alternate ways to support education expenses. Financial services firms have seized the chance to solve these challenges by developing products (Education Investment Plans) to assist parents in saving and investing for their children's education. Education Investment Plans are medium to long-term savings and investment plans promoted by a financial institution, such as an insurance company or an asset manager. In terms of structure, Education Investment Plans are clearly distinguished by the fact that they frequently have an investment lock-in period during which the guardian is expected to make periodic contributions. These funds then gain interest and help the contributor attain their financial goals. The beneficiary of the funds could be a dependent or one may save for their own education.

Section II: Understanding the concept of Savings and Investment

Savings and investments are essential components of any financial strategy. Saving entails consuming less of a given amount of resources in the present in order to consume more in the future by setting aside a portion of your income in some form of an asset. This may involve opening a savings account with a financial institution such as a bank or a Sacco and making regular contributions to the account until you attain the desired amount. Investments, on the other hand, involve the purchase of an asset with the hope of generating some income in the future or the asset appreciating, hence being able to sell it at a profit. Saving is often confused with investing, but they are not the same. Saving focuses on capital preservation, whereas investing focuses on capital appreciation as well as wealth generation. The decision to invest or save depends on various factors, such as:

- Time horizon – Savings are convenient to access when needed and are typically appropriate for short-term objectives. It involves creating an emergency fund to cover unforeseen costs such as medical expenses and car repairs Compared to savings, investments have less liquidity as one has to wait longer to access the funds. Usually preferred for medium to long-term goals such as saving for retirement and Education planning,

- Risk tolerance – Savings are low-risk as the funds are not invested anywhere, minimizing the possibility of a decrease in the total amount. They are usually suitable for risk-averse individuals. However, investments involve risks, and there is no guarantee of the safety of the invested amounts due to day-to-day market changes,

- Returns – Investments have a higher potential for higher returns as compared to savings accounts, as money is used to purchase an asset to generate a return, while savings remain as they are and therefore do not generate any income

The decision to save or invest should correlate with one’s financial situation so as to meet the intended financial goals. Ultimately, combining both saving and investing enables one to reap the benefits of capital preservation while at the same time creating wealth. This is especially beneficial for Education investment plans so as to enable the guardian to meet the intended future education expense.

Section III: Importance of Education Investment plan

To achieve Education financial goals, Educations Investments Plans are one of the avenues that can be used. Education investment plans have a number of benefits such as:

- Financial Freedom – An education investment plan ensures that the guardian has the needed funds to cater for the future education needs when the needs arrives and still be able to meet the other budgeted expenses as planned, without having to dip into other funds to settle the education expenses. Additionally, with education investment plans, you are able to spread the expected education cost over a period of time, thereby reducing significant pressure on your pocket when the need arises

- Avoid debts – An education investment plan enables one to avoid future loans that their children or dependents will have to pay as they start working such as Higher Education Loans Board (HELB) loans. Upon reaching university, the student will not find himself or herself in a situation where they have to take loans for their studies, as the education investment plan would cater of that. This avails more cash to the students when they start working as the monthly HELB loan repayment amount may be saved or even invested

- Serves as a Contingency Measure – With the tough economic times affecting business or job security not assured, a parent can rest assured that they will be able to provide for their dependent’s education should their source of income be affected, and

- Peace of Mind – Having an Education investment plan relieves situations such as overlapping of expenses and financial stress in the event of unexpected expenses, thereby bringing about peace of mind.

- Tax Benefit - Education Investment plans are entitled to a tax relief of 15.0% of the premium, subject to a maximum tax relief of Kshs 5,000.0 per month or Kshs 60,000.0 per year, provided that the time horizon of the plan is more than 10 years.

Section IV: Key considerations when choosing an Education Investment Plan

A guardian or parent has to choose an education plan that can provide safety, preservation, and growth, as well as fit into their overall investment objectives. The following are key factors to consider:

- The financial profile of the Investor - This refers to the different and unique characteristics each investor has. Before making any financial decisions, one should consider their age because it has an impact on their risk tolerance as well as the time horizon they are ready to commit to an investment. A young couple with a young child can choose to invest in a longer education plan, while an older couple with more mature children does not have the need for saving for such a long time. A longer tenor also affords the younger couple the opportunity to have a more aggressive portfolio as they have more time to recover from any losses. It is also key for guardians to profile themselves based on the financial goals they hope to achieve with the investment plan. If they want to invest for a short period they should consider other investment vehicles, whereas if they would like a longer-term investment then education investment plans are the best option for them,

- Inflation - The value of money now is higher than a similar amount in the future due to the effect of inflation. To ensure that you preserve the strength of your education savings, it is important that you save in a plan that offers above-inflation interest rates. Inflation refers to the continuous rise in the prices of commodities and services. This means that if you were saving for university fees, say Kshs 1.0 mn, then the fees in 10 years would be higher for the same service. It is recommended to have a financial goal higher than the current market conditions. Guardians should also save their money with an issuer that offers interest rates significantly higher than inflation rates to cushion inflationary effects,

- Affordability – One should buy into a plan that they can comfortably afford so as to make sure they meet the premium payment schedule as agreed. Some plans usually penalize you for delayed or late submission of premiums, and the penalties will eat into your final payout. Sometimes the inability to meet premiums might see you abandon the plan half-way, leading to the guardian not achieving the intended goal of the education investment plan,

- Additional Benefits with the plan - Most education plans have additional benefits such as life insurance, which is sometimes subject to payment of an additional premium. Life insurance serves to provide financial protection to the beneficiary in the unfortunate event that the guardian passes on. The guardian may also choose to have the education plan and the life insurance separately insured with different firms,

- Lock in period – Educations plans usually have a minimum lock-in period, which is the minimum time period for which the contributions cannot be withdrawn by the guardian after joining the education plan. At times, withdrawing before the lock-in period is over comes with some consequences, such as losing the interest earned during the period and the contributions being subjected to a redemption fee, resulting in the guardian receiving less than the aggregate amount. In case the guardian's investment time horizon is shorter than the lock-in period, the guardian should look for an education plan that is suitable for his or her needs,

- Mode of Payout – The mode of payout from Education investment plans differs from one issuer to another. There are education plans that give out the total amount contributed plus interest as a lump sum, while other plans make a number of partial payments during the tenure of the plan,

- The Issuer of the Plan - When seeking an Education plan provider, it is important for one to do their due diligence on the plan provider. Education plans are often long-term investments that are hard to get out of; therefore, one should think about whether to buy an insurance-based product or an investment manager-based product. An important practice is to consult individuals who have already bought such plans and get to hear their experiences, as well as seek the advice of qualified financial advisors who are familiar with the product.

Section v: Education Investments Plans in Kenya

Education Investment Plans have a relatively longer lock-in period, which helps promote investor discipline. Ideally, an investment plan that caters to a long-term goal should have low liquidity. In Kenya, most market players have set the minimum tenor at 5 years. This serves the logic that most parents and guardians save for secondary and university education, and they often start saving early on. The plans require a minimum monthly investment amount ranging from Kshs 1,000.0 to Kshs 6,000.0. However, the payments are flexible in that one may pay monthly, quarterly, semiannually, or annually. Other key features of Education plans include:

- Riders – This entails additional benefits that Education investment plans offer. They are compulsory or optional, depending on the issuer. In most cases, Education investment plans have life cover as an added benefit to protect the beneficiaries from unforeseen events such as death, permanent disability, or critical illness. Other riders include job loss cover and accidents cover,

- Minimum sum assured – This is the minimum amount to be paid to the beneficiary in the unfortunate event of the death or permanent disability of the guardian, in case it occurs before the maturity of the Education investment plan

- Surrender value – This is the total amount that can be withdrawn when the guardian withdraws from the Education investment plan before maturity. It is usually the total amount contributed less the redemption fees and penalties

- Paid-up option – This refers to the option of having the education plan run to maturity without having to make any additional premium during the tenor of the plan. However, for the guardian to enjoy this benefit, they must have contributed a minimum amount set by the issuer as stipulated in the policy document, thereby protecting the beneficiary from losing out on some of the benefits of the plan

- Tax relief – Education plans are entitled to a tax relief of 15.0% of the premium, subject to a maximum tax relief of Kshs 5,000.0 per month or Kshs 60,000.0 per year. However, for the guardian to enjoy this benefits, the contributions to the Education investment plan have to be done through salary deduction.

- Bonuses – These are periodic payments made by the issuer to the policyholder during the tenor of the plan and constitute a portion of the sum assured and the accrued interest.

- Grace period – This is the time period that the education plan can run in case of delayed remittance of contributions by the policy holder, without having the policy holder penalized

Below is a list of some of the existing education plans in Kenya

|

Cytonn Report: Select Education Plans in Kenya |

|||

|

Education Plan |

Investment Period |

Minimum Investment amount |

Other Features |

|

CIC Academia Policy |

5 -14 Years (premium payment term) 9-18 years (policy term) |

Kshs 2,500 |

On the unfortunate death of the policy holder, the beneficiary receives 50.0% of the sum assured together with all accrued bonuses. The remaining 50.0% is paid up upon maturity. |

|

The policy can be surrendered after 3 years |

|||

|

The benefits are paid out after the completion of the premium payment and maturity of the policy, in 4 installments of 15.0% of the sum assured spread out in a time period of 4 years. Upon maturity 45% of sum assured is paid |

|||

|

Britam Boresha Elimiu |

6-18 years |

Kshs 1,500 |

Guarantees a total cash payout of 200% of the sum assured |

|

The payouts are made in the last 2 years before the policy matures |

|||

|

Waiver of future premiums in the event of guardians death |

|||

|

Liberty Scholar plan |

10-20 years |

Kshs 1,600 |

Cash payments in the last 5 years before the policy matures spread out in 4 installments of 14.0% of the sum assured and upon maturity 50.0% of the sum assured Is paid |

|

Policy bonuses at each policy anniversary |

|||

|

Death benefits are 100.0% of the sum assured plus accumulated bonuses |

|||

|

Waiver of future premiums in the event of guardians death |

|||

|

Life cover and accident benefits |

|||

|

Madison Bima ya Karo |

10-21 years |

Kshs 3,100 |

Cash payments are made during the last 5 years before the policy matures |

|

Life cover constitute of death benefit (50.0% of sum assured), Critical Illness ( 25.0% of the sum assured) and last expense ( Adult - 100,000, Children - 50,000) |

|||

|

Standard Chartered Education plus |

10 years |

Depends on the Age of the Policy holder(5,000 - 6,000) |

Premium amount is based on age |

|

Minimum Sum assured is Kshs 2 mn |

|||

|

Maturity benefits paid out from year 6 to Year 9. |

|||

|

Life cover constitute of death benefit (Kshs 2 mn), Critical Illness ( Kshs 1 mn) |

|||

|

APA elimu |

5-20 years |

Depends on the Age of the Policy holder with Mininum sum assured of Kshs 3 mn |

The policy can be surrendered after 3 years |

|

Waiver of future premiums in the event of guardians death |

|||

|

Life cover constitute of death benefit (100.0% of sum assured) and Critical Illness ( 30.0% of the sum assured) |

|||

|

ICEA Lion Usomi Bora |

8-18 years |

Kshs 2,100 |

Waiver of future premiums in the event of guardians death |

|

Life cover constitute of death benefit (100.0% of sum assured) and Critical Illness ( 100.0% of the sum assured) |

|||

|

The policy can be surrendered after 3 years |

|||

|

The benefits are paid out after the completion of the premium payment and maturity of the policy, in 4 installments of 25.0% of the sum assured spread out in a time period of 4 years. |

|||

|

Cytonn Education Investment Plan (CEIP) |

3-20 years |

Kshs 1,000 |

Minimum investment and top up of Kshs 1,000 |

|

Contributions can be done monthly, quarterly, half yearly and yearly depending on guardians decision |

|||

From the above table, the below are the key take-outs:

- Insurance companies all provide life insurance together with their education policies. The sum assured in this case refers to the amount that is paid out to a client’s next of kin should they die. This amount varies with the monthly contribution amount and the tenor of investment. These insurance companies incorporate life insurance premiums into the monthly payments in order to avoid clients making two separate payments,

- Insurance Companies however, offer less returns than education products by investment managers. This is mainly because education policies in insurance companies are taken as more of a savings plan rather than an investment plan,

- The minimum investment amounts vary from Kshs 1,500 to Kshs 5,000

Section VI: Limitations of Education Investment Plans Uptake

Education Investment plans continue to face a number of challenges which has continue to hamper the growth of these products. Some of these challenges include:

- Low returns – Most Education investment plans in Kenya offer low returns, with some giving out zero returns for the time period the plan was active. This makes other investments options in the market to look more attractive given that they are offering not just high returns but returns that are above the inflation rate thereby preserving the value of the amounts saved,

- Bad Publicity – There have been a number of cases of people receiving less than they had contributed to the Education investment plans and this has created the perception of Education plans being an unsafe way to save, especially given the fact that they are long-term investments. For example, some Education plans have penalties for early withdrawals which reduces the total payouts, and,

- Complexity of Education Plans – Education Investment plans have a complex structure which make it difficult for people to understand. For example, calculating premium and the total cash payout is a complex process since a lot of factors are considered such as the age of the parent. The lack of understanding of the plans, coupled with the negative publicity have made people to view them as scams and therefore shy away for them.

Section VII: Alternative to Education Investment plans

In addition to the Education Investment Plans discussed above, there are various investments avenues whereby individuals can take advantage of when financially planning for education. They include:

- Collective Investment Schemes (CIS) – These are schemes that pool money from multiple investors and are managed by professional fund managers. The Fund managers invest the pooled funds with a view to paying a return in accordance with the investment objectives that have been established for the scheme. An example of CIS:

- Money market funds: These are CIS that invest in short-term debt securities with high credit quality such as bank deposits, treasury bills, and commercial paper. They are best suited for investors who require a low-risk investment that offers capital stability, liquidity, and a high income yield.

- Savings Account - These are deposit accounts offered by banking and non-banking institutions. They are preferably used for short term time horizon as their interest rate are low.

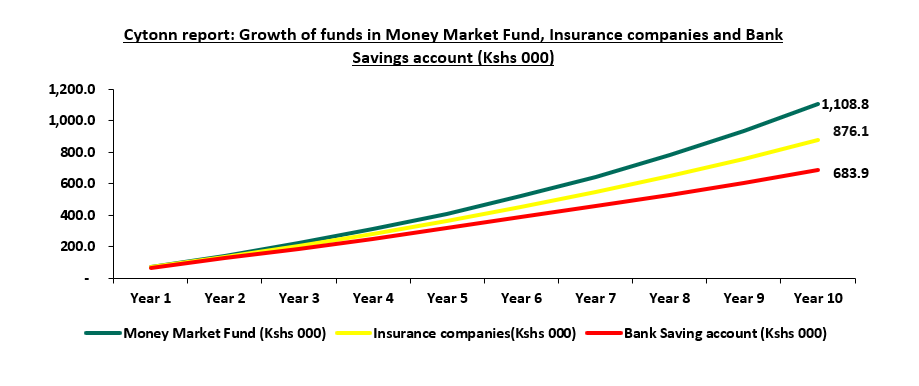

To illustrate the different returns one would get under various alternatives, we assumed a person who starts with a Kshs 10,000.0 initial investment and makes monthly top-ups of Kshs 5,000 saves in a money market fund, an insurance firm, and a bank savings account. Below are the amounts at maturity they would get:

|

Cytonn Report: Analysis of Education Investment Plans |

|||

|

|

Money Market Fund |

Insurance companies |

Bank Savings |

|

Initial Amount (Kshs) |

10,000 |

10,000 |

10,000 |

|

Monthly Top-ups (Kshs) |

5,000 |

5,000 |

5,000 |

|

Tenor (Years) |

10 |

10 |

10 |

|

Average Rate of Return |

12.0% |

7.9% |

3.6% |

|

Amount after Maturity (Kshs) |

1,108,831 |

876,056 |

683,852 |

|

Source: Money Market Fund Interest rates – Effective annual rate of the Top 5 Money market Funds i.e Cytonn, Etica, Enwealth, Madison and GenAfrica Money Market Funds as published on 21st July 2023 |

|||

|

Insurance Companies – Average Rates of CIC, Britam , Liberty and ICEA lion |

|||

|

Bank Savings Rate – Central Bank of Kenya |

|||

Evidently, the returns from saving in a money market fund are the highest. At the end of 10 years, saving in a money market fund will give returns of Kshs 1,108,831 compared to Kshs 876,056 and Kshs 683,852 when saving in an insurance education policy and in a bank savings account, respectively.

Section VIII: Conclusion

Education Investment Plans play a crucial role in enabling parents to plan for their children’s future. However, in order to increase the uptake of education plans, issuers should:

- Increase the returns – Issuers, especially insurance companies, have focused a lot on the insurance component and failed to work on the investment components, which has led people to receive little or zero return from their long-term investments. Due to the high rates of inflation, issuers must actively strike a balance between the insurance and investment components in order to safeguard the value of the sum assured.

- Simplification of the product – Parents and guardians should be able to at least have a rough estimate of the total premium and payout that will be done by the company. That way, the cases of insurance companies not meeting their obligations are addressed at the root of the problem

It is essential that before making any investment decision consult a financial advisor is in order to better understand what you are getting into, before signing any binding agreement. Different Savings plans have their understand advantages and disadvantages and therefore it is important to choose a product that matches your needs and goals. A guardian may decide to invest in both money market funds and an Education plan so as to ensure that their contributions are earning returns and to protect their beneficiaries from unforeseen future occurrences such as death, permanent disability, critical illness, and even retrenchment. This will ensure that the child’s future is well protected irrespective of any situation that may occur in the future

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.