Over the past decade, Kenya has transformed into a technology epicenter largely propelled by financial technology (Fintech). This wave has been supported by various success stories such as M-PESA which disrupted the mobile money transfer space globally. This week, we will look at the fintech industry in general, how it has been affected by the spread of the coronavirus and finally, its importance to the general public.

Having done related topicals previously i.e. Technology & Investments and Fintech Impact on Kenya’s Financial Services Industry, we decided to look at the topic in the four sections:

- Introduction: Fintech Industry in Kenya

- Factors that have shaped the Fintech Industry in Kenya

- Fintech’s growth during the COVID-19 pandemic

- Challenges/ Risks brought about by fintech

- Conclusion

Section 1: Introduction: Fintech Industry in Kenya

The agility of Kenya’s mobile banking system has created opportunities for digital entrepreneurs. The penetration of mobile telephony and receptiveness of the nation to technological innovations has placed Kenya among the top financial innovators. Kenya is ranked 2nd in Africa after South Africa and closely followed by Nigeria (Santosdiaz, 2020).

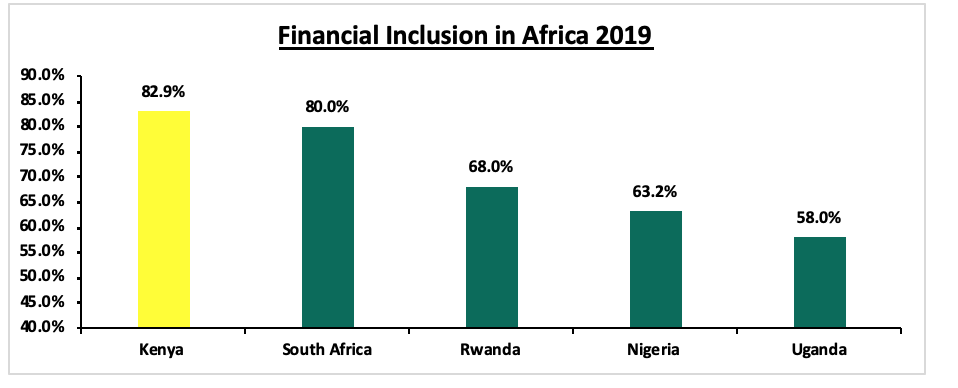

The reception of mobile money technology has increased financial inclusion, providing financial services to the ‘unbanked’. In a survey that was done by the Central Bank of Kenya (CBK), Kenya National Bureau of Statistics (KNBS) and FSD Kenya indicated that 82.9% of Kenyans over the age of 18 years have access to at least one financial product. Kenya leads in financial inclusion in Africa closely followed by South Africa, Rwanda, Nigeria and Uganda (2019 FinAccess Household Survey, 2019).

Several factors have contributed to this impressive outcome among them rapid uptake of mobile money, adoption of transformative financial technologies and innovations, and government initiatives and policies.

M-PESA, a mobile phone money transfer platform, has contributed to meaningful financial inclusion besides acting as an impetus for the creation of other fintechs. Through M-PESA, users are capable of depositing, withdrawing, transferring money and paying for goods and services using their phones. Several fintech businesses, which have thrived in Kenya as a result of M-PESA, include mobile lending, mobile banking, fundraising applications, mobile payment, insure-tech, peer-to-peer lending applications, business-to-business lending, digital payment, online trade, international money transfer, online foreign exchange, online procurement, online betting and other block chain applications.

Section 2: Factors that have shaped the Fintech Industry during the Pandemic

The financial services industry in the country is seeing its traditional model disrupted by technology and regulations; from March when the pandemic hit, many individuals and businesses have been forced to resort to technological avenues to curb the spread of the virus as they enforce social distancing. Also, the virus has created opportunities for digital financial services to accelerate, and enhance financial inclusion. Some of the factors shaping the financial services landscape include:

- Accelerating Economic Relief

Many payment companies are well-positioned to aid governments across the globe through rapid disbursement of government relief funds. Locally, companies such as M-PESA and some banks are already taking advantage of their technological expertise in fintech to support these government initiatives. For example, Safaricom PLC through Kazi Mtaani is able to disburse government relief to unemployed youths through their mobile money platform.

- COVID-19 has Accelerated going Contactless

COVID-19 has created an acute demand for contactless financial solutions. Clients are more aware of the risk of paper money as it changes hands many times over and pin pad systems are touched by hundreds of people. Furthermore, the World Health Organization has insisted on the use of contactless payments. Consequently, due to their innovative nature, fintech companies, according to the IMF, are likely to generate new and transformative solutions. Firms such as PayPal waived their charges on funds transfers from business accounts to bank accounts while some digital lenders considered hardship plans from their borrowers to allow them to make interest payments only.

Section 3: Fintech’s Growth during the Coronavirus Pandemic

Traditional financial institutions that lack vigorous digital and mobile solutions in place are struggling to service their clients in the current environment. Digital solutions have proven essential allowing clients to access their funds especially now that clients are practicing social distance and quarantine measures. We expect growing demand from traditional financial institutions seeking to partner with fintech firms to boost or build their systems. From the Banks that have recently released their H1’2020 financials, the contribution of fintech to the effective running of the institutions especially during the COVID-19 times is evident. For instance, some banking institutions such as KCB rely on digital transactions as a substitute of traditional banking. Evidently, the bank’s transactions performed over digital media rose to 98.0% from 95.0% during the second quarter of the year. For Equity Bank, during the second quarter of the year, digital transactions accounted for 94.0% of the group’s total transactions. The bank has been able to grow its digital platforms significantly with the volumes transacted over their payments application increasing by 79.3% to Kshs 5.2 bn in H1’2020, from Kshs 2.9 bn in H1’2019. For Cytonn Money Market Fund, the number of transactions performed digitally on a daily basis rose by 293.9% between 1st January 2020 and 30th June 2020.

The Government’s Role in Fintech’s Growth

The Kenyan government through its regulatory bodies and parastatals has been at the forefront to promote Fintech in the country before and during the COVID-19 pandemic. We have seen this through different efforts and initiatives that have been deployed to increase financial inclusion. The government of Kenya through the Ministry of Information, Communications, and Technology has established a task force to look into how the country can leverage on blockchain and IoT technology. The government also partnered with Mastercard to develop a digital payment platform for government services on top of the existing providers such as M-PESA, Airtel Money etc.

Following the COVID-19 pandemic, the government through the CBK also instituted several measures to encourage the use of digital payments. The withdrawal limit for mobile money transactions was pushed from Kshs 70,000 to Kshs 150,000. CBK also directed that transaction costs for a bank to mobile transfer and mobile money transfers of Kshs 1,000 and below be removed. These measures seek to promote social distancing and Peer-To-Peer (P2P) transactions during the health crisis.

From a regulatory standpoint, CBK has tabled a bill, seeking to curb the steep digital lending rates that have plunged many borrowers into a debt trap as well as predatory lending. The principal objective of this Bill is to amend the Central Bank of Kenya Act to regulate the conduct of providers of digital financial products and services.

The banking sector and the telecoms sector have been leading in Fintech adoption, as evidenced by various banking digital apps and Safaricom’s M-PESA; however the investment and insurance sectors are lagging behind fintech adoption. Closer home, through our subsidiary, Cytonn Fintech, we have managed to successfully launch the Cytonn Wallet which is powered by Cytonn Money Market Fund (CMMF). The digital wallet has enabled clients to invest, withdraw, and send money instantly to a bank or mobile money account, and still earn an attractive rate of return through our money market fund. The provision of this all-inclusive financial ecosystem increases the efficiency in processing both payments and investments.

Section 4: Challenges/ Risks brought about by fintech

Some of the key concerns that exist when it comes to fintech revolve around the risks of unsupervised complexity on the industry, data leaks and the infringement of consumer rights. This ultimately poses a challenge to the overall stability of the financial industry. The two main risks or concerns in the industry include:

- Its Interdisciplinary nature. This simply means that fintech is a combination of products with both traits of finance and technology. Many products appear simple but in essence they can be quite comprehensive since the model becomes a hybrid of both technology and finance. This becomes a challenge for even the consumers to understand thus making it easy for some to be taken advantage of,

- Lack of Regulation. Considering the fact that Fintech is a relatively new industry and its fast-paced nature, it is important to consider regulation in the space. The industry has grown at an extremely fast pace to the extent that some disputes related to the industry cannot be resolved due to the lack of existing policies and guidelines for operating in the space. So far, big fintech companies have been in difficult situations with the authorities because of data security and the risk it poses to the consumers of the various fintech products, and,

- Conservative Nature of Financial Services. By nature, the Financial Services is very conservative. It took a lot of engagement with CBK and a supportive government regime for M-PESA to grow to what it is today. The insurance and investment management industry remains largely manual and lag behind Fintech innovations.

Section 5: Conclusion

In conclusion, the COVID 19 pandemic shows that the trend towards greater digitalization of financial services is here to stay. To build inclusive societies and address rising inequalities during and after the ongoing crisis, global and national leaders must close the digital divide across and within countries to reap the benefits of digital financial services. This means finding the right balance between enabling financial innovation and addressing several risks: insufficient client protection, lack of financial and digital literacy, unequal access to digital infrastructure, and data biases that need action at the national level; as well as addressing money laundering and cyber risks through international agreements and information sharing, including on antitrust laws to ensure adequate competition. It’s time for financial institutions to make full use of our core capabilities to win the competition during digital transformation and accelerate inclusive finance development.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.