In pursuit of a stable and sustainable economic future, the Kenyan government prioritizes balancing its economic policies, especially regarding the Balance of Payments. Achieving this balance is essential to ensuring stable trade relations, managing capital inflows and outflows, addressing inflationary pressures, and maintaining a favourable exchange rate system. These efforts are geared towards fostering economic growth, creating employment opportunities, and implementing strategic commercial policies, all of which play pivotal roles in Kenya's pursuit of a robust and sustainable economic trajectory. In light of this, we saw it fit to focus on Kenya’s balance of payments to analyse the current state and what can be done to improve it.

We have previously tacked the subject of balance of payments in our topical titled Kenya’s Balance of Payments - released in September 2023, we explored the country's balance of payments, which reflects its economic transactions with other nations. We examined the key components, including the current account and the capital account, and assessed Kenya's performance. Additionally, we analyzed the factors influencing the balance of payments and provided policy recommendations for addressing the situation.

This week, we will review Kenya’s current balance of payment by covering the following:

- Overview of the Balance of Payments,

- The Current State of Kenya’s Balance of Payments,

- Evolution of Kenya’s Balance of Payments,

- Performance Measurements of Kenya’s Balance of Payments,

- Factors Affecting Kenya’s Balance of Payments, and,

- Policy Recommendations and Conclusion.

Section I: Overview of the Balance of Payments

The balance of payments (BOP) is the method by which countries measure all of the international monetary transactions within a certain period. It is a crucial financial record that captures the economic interactions between Kenya and the rest of the world during a specified timeframe. It provides a systematic account of how the country engages with the global economy, encompassing a wide range of economic activities including trade of goods and services, financial investments, and various transfer payments like foreign aid and grants from other nations. The Balance of Payments (BOP) holds significant importance as a key economic metric, offering a concise representation of the movement of resources between a nation and its trade partners. This financial record categorizes transactions into three primary accounts: the Current Account, the Capital Account, and the Financial Account;

- Current Account

The Current Account is one of the primary components of the BoP and tracks transactions related to the day-to-day economic activities of a country with other countries. The component captures transactions of exports and imports of goods and services, income receipts, and payments. It includes four main sub-accounts;

- Balance of Trade (Trade Balance) - This sub-account records the value of Kenya's exports of goods (like tea, coffee, and flowers) and imports of goods (machinery, petroleum, etc.). If Kenya’s exports are more than its imports, it has a trade surplus in this category, otherwise, it has a trade deficit,

- Services Trade - The services trade accounts for the export and import of services such as tourism, transportation, and financial services. Kenya's income from foreign tourists and revenue from providing services to other nations contribute to the services subsection of the current account,

- Income - In this sub-account, Kenya records income flows from its foreign investments (like profits and dividends from foreign-owned assets in Kenya) and income paid to foreign investors holding assets in Kenya, and,

- Current Transfers - This sub-account captures unilateral transfers of funds, including foreign aid, remittances from Kenyan expatriates working abroad, and other gifts or grants from foreign sources.

- Capital Account

The Capital Account in the BoP records capital transfers and transactions involving non-produced, non-financial assets. It may include items like the transfer of ownership of patents, copyrights, and trademarks;

- Capital transfers – They represent transactions involving the transfer of ownership of non-financial assets between a country and other countries which do not result in any corresponding goods, services, or financial claims, and,

- Acquisition/disposal of non-produced, non-financial assets – These are transactions involving the transfer of ownership rights to assets that are neither produced nor considered financial assets, that is, intangible assets such as brand names and trademarks, and rights to use land resources for various economic activities.

- Financial Account

The Financial Account is a crucial component that records financial transactions between Kenya and other countries. It includes;

- Foreign Direct Investment (FDI) - This sub-account tracks the flow of investments where foreign entities directly invest in Kenyan businesses or assets. For example, foreign companies setting up operations in Kenya,

- Portfolio Investment - Portfolio investment includes transactions involving financial assets like stocks and bonds. It reflects foreign investors' purchases of Kenyan securities and Kenyan investors' purchases of foreign securities,

- Reserves Assets - The official reserves sub-account accounts for changes in Kenya's foreign exchange reserves held by the central bank. This can result from currency interventions or other actions affecting reserves, and,

- Other reserves - This covers various financial transactions such as loans, currency, deposits, and trade credits between Kenya and foreign countries.

Other components under financial account include Financial Derivatives and Other Changes in Financial Assets and Liabilities.

Section II: The Current State of Kenya’s Balance of Payments

In this section, we will analyse the individual components of Kenya’s balance of payments.

- Current Account Balance

Kenya’s current account deficit narrowed by 34.5% to Kshs 104.1 bn in Q2’2024 from the Kshs 159.0 bn deficit recorded in Q2’2023. The narrowing of the deficit was driven by;

- The narrowing of the merchandise trade account deficit (the value of import goods exceeds the value of export goods, resulting in a negative net foreign investment) by 3.7% to Kshs 341.2 bn in Q2’2024, from Kshs 354.3 bn recorded in Q2’2023, driven by the 10.9% growth in merchandise exports to Kshs 276.2 bn, from Kshs 249.1 bn in Q2’2023 which outpaced the 2.3% increase in merchandise imports to Kshs 617.5 bn from Kshs 603.4 bn recorded in a similar period in 2023,

- A 0.6% improvement in the secondary income balance surplus (the transactions recorded in the secondary income account pertain to those current transfers between residents and non-residents that directly affect the level of gross national disposable income and thus influence the economy’s ability to consume goods and services) to a surplus of Kshs 239.2 bn from a surplus of Kshs 237.7 bn in Q2’2023, and,

- The narrowing of the primary income deficit (the earnings that residents of a country receive from their investments abroad and the compensation they receive for providing labour to foreign entities) by 34.6% to Kshs 45.6 bn in Q2’2024, from Kshs 69.8 bn recorded in Q2’2023, attributable to a reduction in interest payable on external debt.

The table below shows the breakdown of the various current account components, comparing Q2’2022, Q2’2023 and Q2’2024:

|

Cytonn Report: Q2’2024 Current Account Balance |

||||

|

Item |

Q2’2022 |

Q2’2023 |

Q2’2024 |

Q2’2023-Q2’2024 % Change |

|

Merchandise Trade Balance |

(365.6) |

(354.3) |

(341.2) |

3.7% |

|

Service Trade Balance |

59.3 |

27.4 |

43.6 |

59.1% |

|

Primary Income Balance |

(51.6) |

(69.9) |

(45.6) |

34.6% |

|

Secondary Income (Transfers) Balance |

63.2 |

237.7 |

239.2 |

0.6% |

|

Current Account Balance |

(294.6) |

(159.0) |

(104.1) |

34.5% |

Source: Kenya National Bureau of Statistics (KNBS), All values in Kshs bn

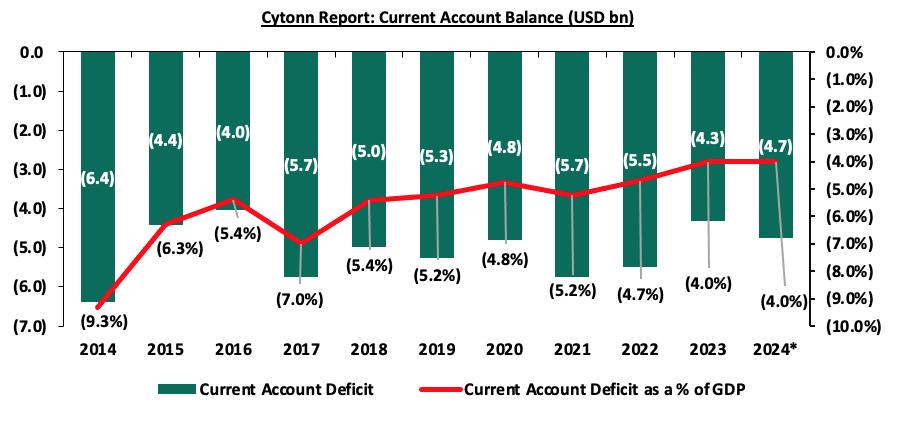

We observe that, over the last ten years, Kenya’s current account balance has been running deficits, implying that the country relies more on the outside world for its goods and services. The current account deficit as a percentage of GDP was at 4.0% in 2023. The current account deficit is projected to remain stable at 4.0% of GDP in 2024 due to the improvement of exports, especially of agricultural commodities, resilient remittances, and a recovery in imports supported by a stable exchange rate. The chart below shows the current account deficit over the last 10 years;

Source: IMF Data *projected for 2024

- Financial Account and Capital Account

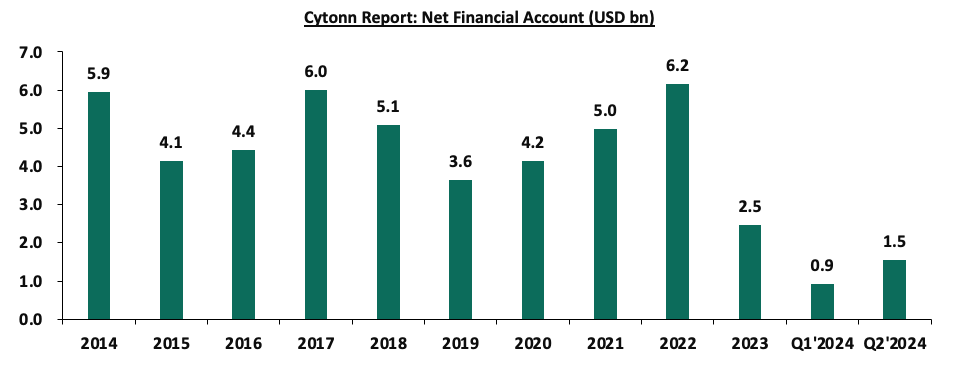

The financial account balance represents the difference between domestic buyers' purchases of foreign assets and foreign buyers' acquisitions of domestic assets. A surplus contributes positively to the balance of payments, while a deficit subtracts from it. This balance reflects the claims or obligations related to financial assets involving non-residents, where an increase in domestic ownership of foreign assets is an outflow and decreases the financial account of the country, while an increase in foreign ownership of domestic assets is an inflow and increases the financial account. The financial account balance recorded a surplus of Kshs 198.3 bn in Q2’2024, a decrease of 40.0% from the surplus of Kshs 330.7 bn recorded in Q2’2023. A key point to note is that a deficit in the financial account indicates that there are more investment funds flowing out of the country than inflows, while a surplus in the financial account means that more investment funds are flowing into the country than out, indicating that foreign investors are purchasing more domestic assets than domestic investors are acquiring foreign assets, leading to a net inflow of capital. The chart below shows the trend in the financial account over the last ten years;

Source: World Bank Data, KNBS Data

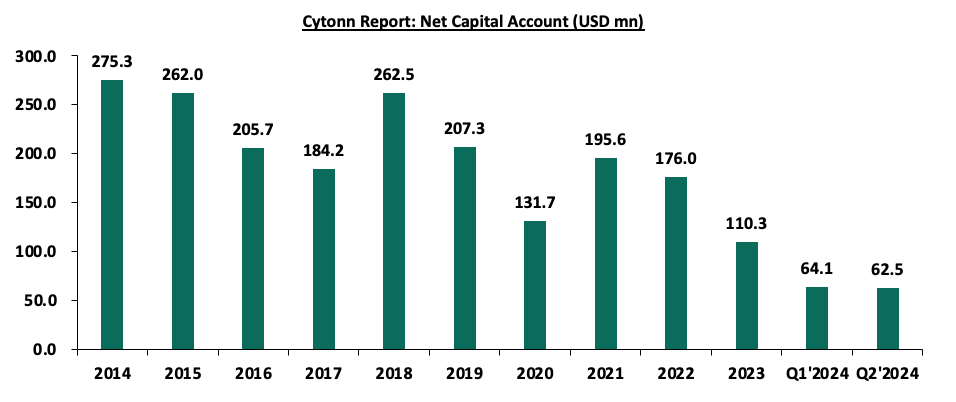

On the other hand, the capital account balance increased by 64.4% to a surplus of Kshs 8.0 bn in Q2’2024 up from a surplus of Kshs 4.9 bn in Q2’2023. Notably, the capital account has shown mixed performance over the past 10 years, with a negative 10-year compound annual growth rate (CAGR) of 8.7%, declining to USD 110.3 mn in 2023 from USD 275.3 mn in 2014. This decline is partly due to capital flight, as many foreign direct investors have become hesitant to invest in the country. Below is a chart highlighting the movement of the capital account over the last 10 years;

Source: World Bank Data, KNBS Data

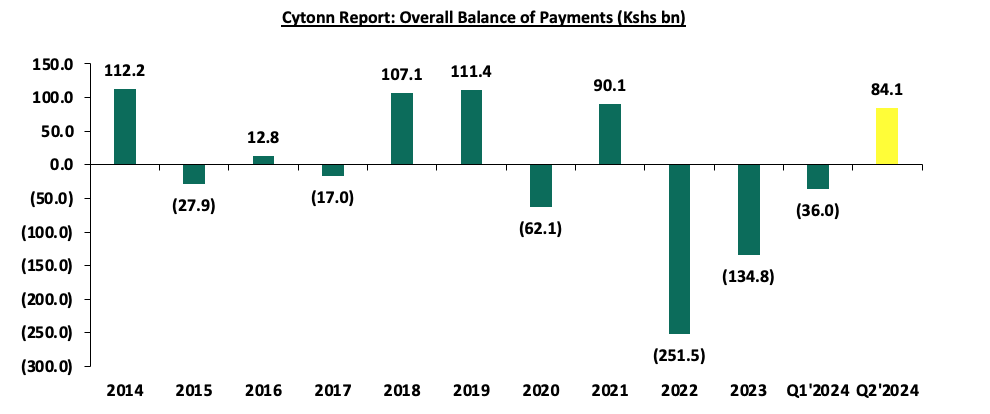

Section III: Evolution of Balance of Payments

Kenya’s overall balance of payments has been fluctuating over the years, with the balance of payments standing at a surplus of Kshs 84.1 bn in Q2’2024, a deterioration from a surplus of Kshs 152.9 bn in Q2’2023, but a significant improvement from a surplus of Kshs 10.9 bn in Q2’2022. The shift from Q2’2022 is primarily attributable to a reduction in the running current account deficit, an increase in the capital account surplus, and the reduced cost of debt servicing, which have collectively offset the persistent trade imbalance caused by Kenya’s high import dependency. Below is a graph highlighting the trend in Kenya’s balance of payments over the last ten years;

Source: Kenya National Bureau of Statistics (KNBS)

Key take-outs from the chart include;

- In 2022, the balance of payment ended the year at a deficit of Kshs 251.5 bn primarily due to increased capital outflows following the heightened uncertainty in the business environment following the political tensions arising from the country’s general election,

- In 2023 the balance of payment ended the year at a deficit of Kshs 138.4 bn, narrowing from a deficit of Kshs 251.5 bn in 2022, mainly driven by a 13.0% improvement in the current account balance to a deficit of Kshs 603.7 bn in FY’2023, from a deficit of Kshs 694.2 bn in FY’2022, and the 4.6% increase in capital account balance to Kshs 17.3 bn from Kshs 16.5 bn recorded in a similar period in 2022. The performance was however weighed down by a 21.2% decrease in the financial account balance to a surplus of Kshs 384.7 bn from a surplus of Kshs 488.4 bn in FY’2022,

- Kenya’s balance of payment (BoP) position improved by 71.8% in Q1’2024, as the deficit narrowed to Kshs 36.0 bn, from a deficit of Kshs 127.8 bn in Q1’2023, and a significant improvement from the deficit of Kshs 134.8 bn recorded in FY’2023. The y/y positive performance in BoP was mainly driven by a 246.1% improvement in the financial account balance to a surplus of Kshs 121.6 bn in Q1’2024, from a deficit of Kshs 83.2 bn in Q1’2023, and a 22.2% increase in capital account balance to Kshs 8.5 bn from Kshs 6.9 bn recorded in a similar period in 2023. The performance was however weighed down by an 18.8% deterioration in the current account balance to a deficit of Kshs 131.2 bn from a deficit of Kshs 110.5 bn in Q1’2023, and,

- The balance of payment deteriorated by 45.0% in Q2’2024, with a surplus of Kshs 84.1 bn, from a surplus of Kshs 152.9 bn in Q2’2023, and a significant improvement from the Kshs 36.0 bn deficit recorded in Q1’2024. The y/y negative performance in BoP was mainly driven by a 40.0% decline in the financial account balance to a surplus of Kshs 198.3 bn in Q2’2024, from a surplus of Kshs 330.7 bn in Q2’2023. This follows the depletion of reserve assets by Kshs 33.2 bn, and the government did not receive credit and loans from the International Monetary Fund (IMF) during the quarter. The performance was however supported by a 34.5% improvement in the current account balance to a deficit of Kshs 104.1 bn from a deficit of Kshs 159.0 bn in Q2’2023.

Looking ahead, we anticipate that the balance of payments will remain in surplus in the short term, as the continued strengthening of the shilling against major currencies helps reduce the country's import costs, narrowing the current account deficit. Additionally, various trade agreements, such as those between Kenya and the EU, and among the EAC, SADC, and COMESA, will help increase both the volume and diversity of exports. These agreements will also create more opportunities for Kenya to access new markets and sell its goods. The outlook for Kenya's current account is optimistic, as continued growth in key export sectors and sustained diaspora remittances are expected to further improve the current account balance. Efforts to diversify exports and enhance value addition in agricultural products, along with prudent fiscal and monetary policies, will be crucial in sustaining this positive trajectory. We expect that the current administration’s focus on fiscal consolidation will improve the balance of payments performance by minimizing the costs of servicing external debts. Additionally, favourable weather conditions and government intervention through subsidy programs are set to boost agricultural production in the country, thereby increasing the export of agricultural products, and supporting the current account.

Section IV: Performance Measurements of Balance of Payments

Balance of payments is influenced by a number of factors which include;

- Exports and Imports

Exports are goods and services that a country sells to other countries. Exports affect the balance of payment by increasing the value of goods and services sold to other countries and reducing the trade deficit. Exports also form a major source of foreign currency, which contributes to the stability of the domestic currency against other currencies. Imports on the other hand are goods and services that a country buys from other countries. Imports affect the balance of payment by offsetting the value of goods and services sold to other countries and thereby increasing the trade deficit. An increase in the value of imports also reduces the foreign currency reserves and the current account balance.

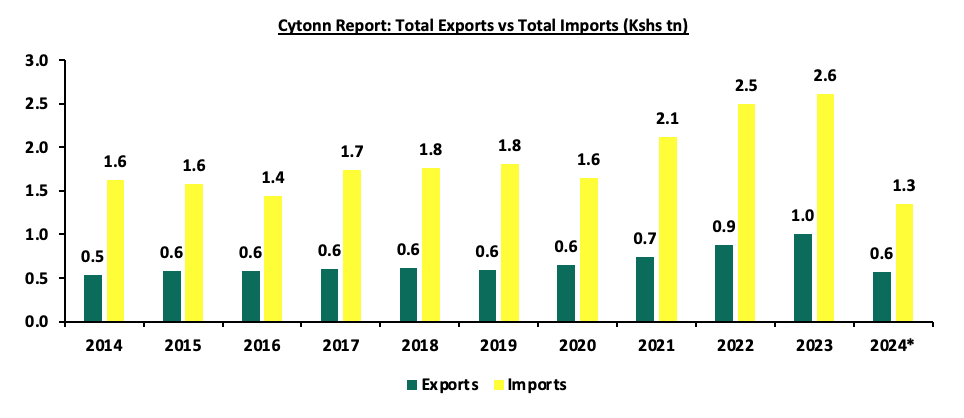

Over the last ten years, Kenya’s annual value of imports has averaged Kshs 1.9 tn, higher than the average annual value of exports of Kshs 0.7 tn, hence resulting in running trade deficits over the period. However, over the same period, exports registered a compounded annual growth rate of 6.5% to Kshs 1.0 tn in 2023 from Kshs 0.5 tn in 2014, which outpaced that of imports at 4.9% to Kshs 2.6 tn in 2023 from Kshs 1.6 tn in 2014, attributable to the government’s efforts to diversify the country’s export base and boost export-oriented sectors like agriculture as well as increased access to regional and international markets. The chart below shows the total imports and exports over the last ten years;

Source: KNBS, *Provisional figures (as of Q2’2024)

- Foreign Direct Investments

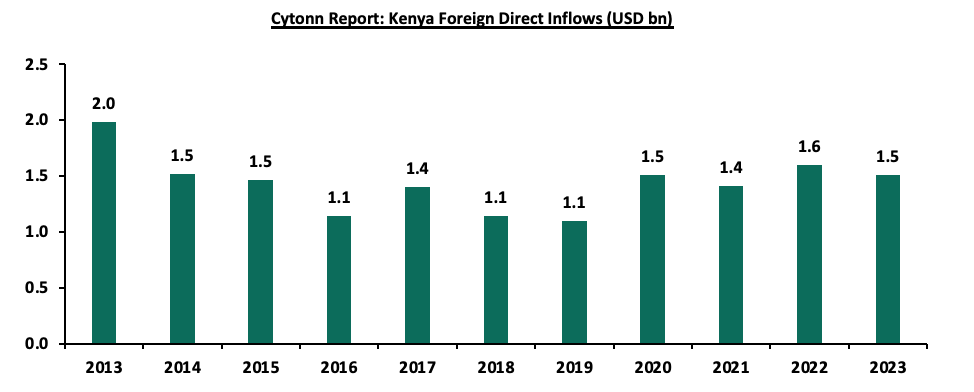

A Foreign direct investment (FDI) is an investment by a business or an individual in one country in an enterprise in another country with the intention of establishing a lasting interest. FDI inflows decreased by 5.8% to USD 1.5 bn in 2023, from USD 1.6 bn in 2022 attributed to the tough economic environment and the high interest rates in global giant economies which made them more attractive for foreign investments.

FDI can improve the current account of the BOP by increasing the exports of goods and services from the host country to the foreign market. This is especially true if the FDI is in export-oriented sectors or if the foreign investor uses local inputs and suppliers. A good example is FDI in Kenya’s horticulture sector which has boosted its exports of flowers, fruits, and vegetables to Europe and other regions. FDI can also worsen the current account of the BOP by increasing the imports of goods and services from the foreign market to the host country if the FDI is in import-dependent sectors. The chart below shows Kenya’s FDI inflows over the last ten years;

Source: UNCTAD World Investments Report

- Debt

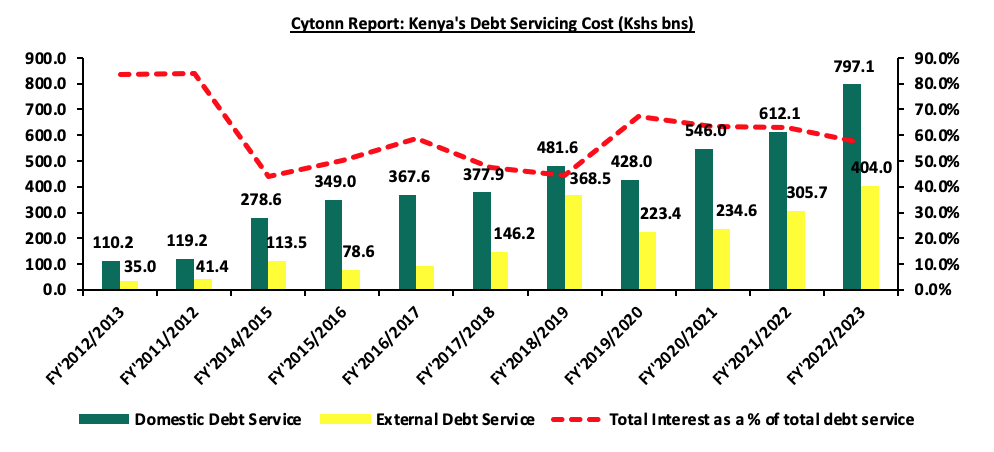

Kenya’s debt stock has been on the rise over the years mainly due to a widening fiscal deficit coupled with increased debt servicing costs. Key to note, the country’s debt stood at Kshs 10.8 tn as of October 2024, equivalent to 66.7% of GDP and 16.7% points above the IMF recommended threshold of 50.0% for developing nations. The increased debt burden has consequently led to a decline in the gross reserves as it necessitates a drawdown in the reserves, leading to the deterioration of the balance of payments. The graph below shows the debt servicing costs over the last ten fiscal years:

Source: National Treasury

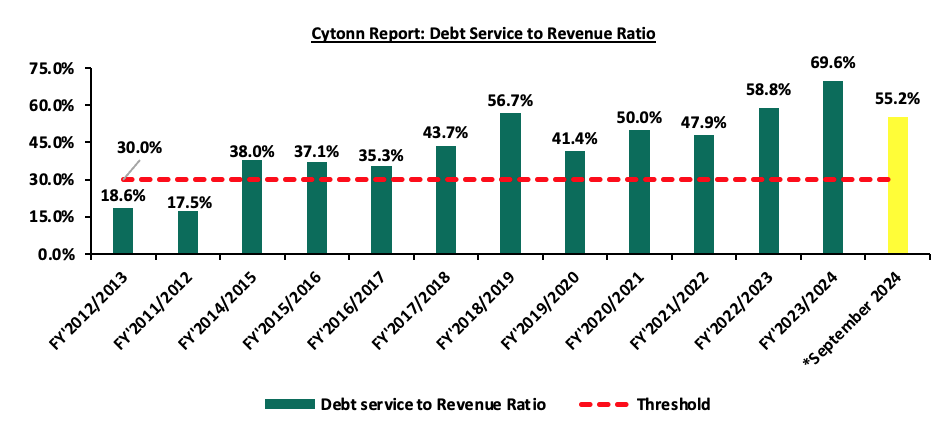

The country’s debt service to revenue ratio increased by 10.8% points to 69.6% in the FY’2023/2024 up from 58.8% observed in FY’2022/2023, and remained a significant 39.6% points above the IMF’s recommended threshold of 30.0%. Notably, the country’s debt service to revenue ratio stood at 55.2% as at the end of September 2024. The sustained level of debt service to revenue ratio above the recommended threshold is a worrying sign but has been steadily improving following the successful buyback of Kenya’s Eurobond back in February which reduced credit risks for the country and the ongoing IMF program. The situation is, however, still at risk from global supply disruptions accelerated by the ongoing geo-political tensions in the Russian-Ukrainian and Israel-Palestine conflicts. Below is a chart showing the debt service to revenue ratio for the last ten fiscal years;

Source: National Treasury, *Provisional figures

Balance of payments deficit indicates that the country is spending more than it is receiving. As such, it is forced to borrow more money to pay for goods and services from the rest of the world. In the long term, a country becomes a net consumer and not a net producer of global economic output which leads to more debt requirements. Additionally, a persistent deficit may necessitate the selling of some of the resources to pay its creditors.

Section V: Factors Affecting Balance of Payments

The balance of payment reflects the economic interaction of a nation with the rest of the world over a specific period. Several factors not limited to economic, political, government policies, global economic conditions as well as currency, determine the state of balance of payment of a nation. These factors include:

- Balance of Trade - When a country’s value of exports of goods and services is more compared to its imports, then it has a trade surplus. This in turn is a good indicator of the balance of payments as it means the inflows outrun the outflows. Further, more import value of goods and services of a country compared to the export value is called a trade deficit and is viewed as an indicator of a poor balance of payment as the nation is spending more on imports than its earnings, which negatively affects the balance of payment,

- Interest Rates - Fluctuations in a country’s interest rates can influence capital flows, as higher interest rates often attract foreign capital, improving the financial account of the balance of payments. Conversely, low interest rates can encourage capital outflows as investors seek higher returns abroad, potentially leading to a deterioration in the balance of payments,

- Foreign Direct Investment (FDI) - FDI refers to foreign investments in terms of business interests and assets into a foreign country. This in turn increases the inflow of foreign exchange, the development of new technology, increased employment opportunities as well as increased tax revenues. In turn, an increase in FDI is favourable to the balance of payment while a decrease has a negative effect on the country’s BoP,

- Exchange rates - When market forces or deliberate government policies depreciate the currency of a nation, the prices of exports in foreign markets are cheaper compared to the imports. In turn, the export inflows increase due to an increase in demand, resulting from cheaper prices, while the imports decrease as the inflated import prices reduce consumption appetite,

- Economic growth rate - When the differential rate of GDP growth across countries increases, the country’s attractiveness of its assets increases, which in turn leads to increased capital flows. This can be in the form of portfolio investments, loans, and other capital flows. Consequently, this will lead to an improved balance of payment account, by improving the financial account,

- Inflation - When a country’s inflation rate increases compared to its trade partners, the home prices of goods and services increase, which reduces the demand for the country’s exports. Additionally, high inflation increases the cost of imports as they are cheaper compared to domestic products being exported to other countries. In turn, this can lead to a deficit in the BoP,

- Government policies - The government can enact policies that are geared to encourage exports or to reduce the value of imports, which is meant to improve the trade surplus. Some of the policies can be imposing tariffs, quotas on imports, or a total import ban on a product, to reduce the value of imports. Such policies can affect the financial account of the BoP. Tighter controls may prevent foreign investment and restrict outflows, potentially causing capital flight and negatively impacting the balance of payments,

- Global economic conditions - Shifts in the global economies like commodity price fluctuations, and recessions, affect the state of the balance of payment. This is a result of impacted trade, capital flows, foreign remittances, and reduced financial transactions. All these can affect the health of the BoP leading to a trade deficit,

- Excessive government borrowing - High levels of foreign debt can increase a country’s risk of financial crises, which can make investors pessimistic about the government’s ability to service debt. As a result, it can lead to the withdrawal of investments, and capital flight as well as negatively impact the financial account of the BoP, and,

- Remittances - Money sent back home by citizens working abroad can significantly impact the current account of a country’s BoP. The flow of remittances contributes positively by increasing foreign currency reserves, which can improve the balance of payments. A decline in remittances may have the opposite effect.

Section V: Policy Recommendations and Conclusion

To establish a balance of payment surplus, every government must implement policies that benefit the BOP's health by increasing exports while decreasing imports. As a result, we propose the following specific recommendations for the government to reduce the BoP deficit and enhance the overall status of the BoP account:

- Encourage export diversification - the government should shift from complete over-reliance on traditional exports like tea, horticulture, and coffee, through diversification in promoting value-added processing and manufacturing to increase export revenue,

- Reducing Imports - The government should carefully cut down on imports and only import what is needed while encouraging domestic production of some of the imports. This can be achieved through the introduction of import restrictions like quotas and tariffs. Notably, this should be carefully done to strike a balance between domestic industry protection as well protecting existing trade relationships with other nations,

- Export promotion - The government can employ different strategies to encourage more export volumes and produce. This can be done through actively engaging in trade pacts that favour Kenyan exports in new markets. Additionally, the government can provide export incentives and subsidies to increase Kenyan products’ price competition in foreign markets,

- Encouraging Foreign Direct Investment (FDI)- The government should be strategic in creating an attractive investment environment for foreign investments through improving regulatory transparency as well as reducing hurdles in the process. The Kenyan government can target key investment sectors of global interest like the Renewable energy sector and Sustainable Energy Development Goals (SEDG), and make it favourable for foreign investors,

- Increase agricultural produce- the government should support small-scale farmers with improved agricultural technology and quality inputs, as well as improved access to credit. This will help increase agricultural productivity, thus increasing exports, while reducing the dependence on some of the unnecessary agricultural imports like sugar and wheat, and,

- Maintaining a sustainable debt level- The government should also strike a balance between foreign borrowing which helps increase the foreign reserves, while maintaining a good credit score with its creditors. This ensures that the country remains attractive for investors’ capital and financial flows.

The country’s balance of payments continues to be weighed down by the persistent current account deficit. This has been brought about by the high costs of debt servicing as well as the high import dependency and slower export growth. The government has a significant role to play in managing the debt levels, reducing the fiscal deficit, and restoring economic stability to improve the balance of payments position. Looking ahead, Kenya’s balance of payments looks optimistic, driven by growth in key export sectors, fiscal consolidation, and sustained diaspora remittances which are expected to improve the current account balance. We note that the current administration’s focus on fiscal consolidation will improve the balance of payments performance by reducing the costs of servicing external debts through the change of the public debt mix in the FY/2024/25 budget to consist of 46.3% external financing and 53.7% domestic financing. Moreover, the fertilizer subsidy program is expected to lower the costs of farm inputs, enhance agricultural production in the country, and increase exports of agricultural products. Furthermore, the ongoing strengthening of the Kenyan Shilling against most trading currencies is expected to lower the import bill hence narrowing the current account deficit. We also expect that multilateral trade partnership deals such as the one between Kenya and the EU and the one among the EAC, SADC, and COMESA, will boost the amount and variety of exports that are needed and offer more opportunities to sell them. However, the government needs to reduce the country’s overreliance on debt and imports. One of the best ways to achieve this is to promote domestic production and attract foreign direct investments, especially in export-oriented sectors, to boost the country’s export values.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.