On 29th April 2021, the National Treasury presented its Budget Estimates for the next fiscal year, FY’2021/22. It is important to note that this is the biggest budget the country has had, a 5.6% increase to Kshs 3.1 tn in FY2021/22, from last year’s Kshs 2.9 tn. Considering the effects of the pandemic, the government has taken a cautious approach in terms of revenue projections. Furthermore, the allocation of resources has been aligned to priority programs under the Big Four Agenda, the Third Medium Term Plan (2018-2022) of the Vision 2030 blueprint, and various initiatives under the Post Covid-19 Economic Recovery Strategy. This is to ensure spending is directed towards the most critical needs considering the available resources.

As such, we will be reviewing the estimates and discuss the following:

- A comparison of the FY’2020/21 budget and the projected FY’2021/22 budget as per the 2021 Budget Estimates,

- Analysis and House-view on Key Aspects of the 2021 Budget Estimates, and,

- Conclusion,

Section I: A comparison of the FY’2020/21 budget and the projected FY’2021/22 budget as per the 2021 Budget Estimates

Below is a summary of the major changes as per the 2021 Budget Estimates:

|

Comparison of 2020/21 and 2021/22 Fiscal Year Budgets as per The 2021 Budget Estimates |

||||

|

FY'2020/21 Supplementary Budget I (a) |

FY'2021/22 Budget Policy Statement |

FY'2021/22 Budget Estimates (b) |

% Y/Y Change (a, b) |

|

|

Total revenue |

1,848.0 |

2,033.9 |

2,038.6 |

10.3% |

|

External grants |

73.0 |

46.1 |

62.0 |

(15.1%) |

|

Total revenue & external grants |

1,921.0 |

2,080.0 |

2,100.6 |

9.3% |

|

Recurrent expenditure |

1,835.1 |

1,986.0 |

2,019.2 |

10.0% |

|

Development expenditure & Net Lending |

653.0 |

609.1 |

619.5 |

(5.1%) |

|

County governments + contingencies |

403.9 |

414.9 |

414.8 |

2.7% |

|

Total expenditure |

2,892.0 |

3,010.0 |

3,053.5 |

5.6% |

|

Fiscal deficit excluding grants |

(970.9) |

(930.0) |

(952.9) |

(1.9%) |

|

Deficit as % of GDP |

8.7% |

7.5% |

7.7% |

(11.6%) |

|

Net foreign borrowing |

427.0 |

267.2 |

290.1 |

(32.1%) |

|

Net domestic borrowing |

543.9 |

662.8 |

662.8 |

21.9% |

|

Total borrowing |

970.9 |

930.0 |

952.9 |

(1.9%) |

|

GDP Estimate |

11,168.5 |

12,393.1 |

12,393.1 |

11.0% |

Source: National Treasury, Amounts in Kshs bns

Some of the key take-outs include;

- The 2021 Budget estimates point to a 5.6% increase of the budget, to Kshs 3.1 tn from Kshs 2.9 tn in the FY’ 2020/21 supplementary budget,

- Recurrent expenditure is set to increase by 10.0% to Kshs 2.0 tn, from Kshs 1.8 tn as per the supplementary budget, while development expenditure is projected to decline by 5.1% to Kshs 619.5 bn from Kshs 653.0 bn as per the FY’2020/21 supplementary budget. Under recurrent expenditures, ministerial recurrent expenditures increased by 4.8% to Kshs 1,321.7 bn, from Kshs 1,261.0 bn, while interest payment and pension increased by 21.5% to Kshs 697.5 bn from Kshs 574.1 bn in the FY2020/21 supplementary budget,

- The budget deficit is projected to decline to Kshs 952.9 bn (7.7% of GDP) from the projected Kshs 970.9 bn (8.7% of GDP) in the FY’2020/21 supplementary budget; in line with the International Monetary Fund’s (IMF’s) recommendation, in a bid to reduce Kenya’s public debt requirements,

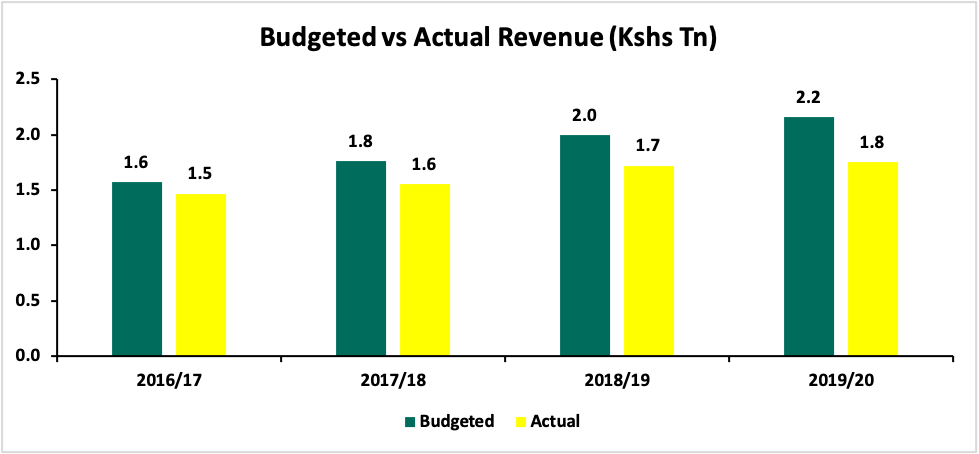

- Revenue is projected to increase by 10.3% to Kshs 2.0 tn, from Kshs 1.9 tn in the FY’2020/21 supplementary budget, with measures already in place to work towards increasing the amount of revenue collected in the next fiscal year,

- Total borrowing is expected to decline by 1.9% to Kshs 952.9 bn from Kshs 970.9 bn as per the FY’2020/21 supplementary budget , in a bid to reduce Kenya’s public debt burden which is estimated at 69.6% of GDP as at December 2020, 19.6% points above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%, and,

- Debt financing of the 2021/22 budget is estimated to consist of 30.4% foreign debt and 69.6% domestic debt, from 28.7% foreign and 71.3% domestic as per the FY’2020/21 supplementary budget. Consequently, we might see an increase in domestic interest rates as the government tries to encourage capital flow,

Section II: Analysis and House-view on Key Aspects of the 2021 Budget Estimates

Below we give our analysis and view on various aspects of the 2021 Budget Estimates:

- Revenue collection Fiscal Policy Framework:

The estimates target a revenue collection of Kshs 2.0 tn which is 16.4% of the GDP, where ordinary revenues are projected to come in at Kshs 1.8 tn or 14.3% of GDP. The on-going reforms in tax policy and revenue administration will support revenue performance. Revenue collection will be enhanced by tax amendments meant to broaden the tax base in the Finance Act 2020 that introduced the minimum tax and digital services tax. Over the medium term, the fiscal policy will be targeted at helping raise revenues from 16.4% of GDP in FY’2020/21, to 18.1% of GDP in FY2024/25.

According to the Kenya Revenue Authority, collections for the month of April 2021 increased by 22.6% to Kshs 176.7 bn compared to Kshs 144.1 bn in April 2020. This performance can be attributed to the low base effect where collections in 2020 were significantly lower as a result of movement restrictions during the period.

The government’s goal is to reduce the fiscal deficit and stabilize growth in public debt while ensuring debt sustainability. They intend to achieve this through a combination of revenue enhancement initiatives and expenditure rationalization. We are of the view that the higher targeted revenue collection will be driven by the prospects of an economic recovery. This budget estimates has indicated that the government is set to cut back on borrowing and instead opt for higher taxation, KRA has positioned itself to collect more by introducing a raft of tax amendments that are aimed at widening the tax base and other than raising taxes the government should also look at sealing tax leakages within KRA.

- Expenditure Projections:

As per the FY’202/22 budget estimates, total expenditure is set to increase by 5.6% to Kshs 3.1 bn from Kshs 2.9 bn in the supplementary budget FY’2020/21. Recurrent expenditure is set to increase as the development expenditure is expected to decline; with recurrent increasing by 10.0% to Kshs 2.0 tn, from Kshs 1.8 tn as per the supplementary budget, while development expenditure is projected to decline by 5.1% to Kshs 619.0 bn from Kshs 653.0 as per the revised FY’2020/21 budget. The increase in the recurrent expenditure has mainly been driven by the increased interest payments in the past given the high borrowing in the country which has seen interest payments increase by 21.0% to Kshs 560.3 bn, from Kshs 463.1 bn in FY2020/21, according to the national treasury. One of the key concerns lies in the proportion of recurrent expenditure compared to development spending which as per the estimates is expected to come in at 66.1% against 33.9%, respectively.

The quality of fiscal consolidation remains a concern as a majority of the cuts to government expenditure fell on development spending, which could potentially compromise the growth potential of the economy. To reduce government expenditure, and in turn what needs to be plugged in through borrowing, we suggest the following:

- Encouragement of Public-Private Partnerships (PPPs) which will involve the private sector in development, increase efficiency while reducing pressure on the government. The recently launched Kenya Pension Funds Investment (KEPFIC), that allows pension funds to invest up to 10.0% of their Assets Under Management (AUM) on infrastructure and alternative investments is a step in the right direction since it will not only reduce the infrastructural burden of debt but also deepen and enhance the capital market,

- Reduction of the public wage bill - through rationalization of the public office roles we currently have by getting rid of redundancies in the representation of counties and constituencies, and, etc. and relooking at the salaries, allowances and benefits earned,

- Better efforts to fight corruption, as funds lost to corruption are estimated at roughly a third of the national budget (Estimates from the Ethics and Anti-Corruption Commission), and Kenya being engaged in the fight against corruption since the 1960’s, without successfully being able to get rid of recurrent scandals involving huge sums of public funds, and,

- Development budget absorption needs to improve as most fiscal years end in an under-absorbed development budget and an over-spent recurrent budget. Development projects need to be prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process; while also being prudent in recurrent spending.

- Deficit Financing:

From the tabled estimates, the fiscal deficit is projected at 7.7% of GDP whose funding will be through a net external borrowing of Kshs 291.3 bn coupled with a net domestic borrowing of Kshs 661.9 bn. The total new public debt requirement for the FY’2021/22 is set to decline by 11.6% to Kshs 952.9 bn from Kshs 970.9 bn, in FY’2020/21, as per the revised budget. The public debt requirement mix is projected to comprise 30.4% foreign debt and 69.6% domestic debt, compared to the 28.7% foreign debt and 71.3% domestic debt as per the supplementary budget FY’2020/2021. For the Medium term, official sources for loans on concessional terms will be maximized while non-concessional, commercial external borrowing and sovereign bond issuance will be limited to projects with high financial and economic returns in-line with the government’s development agenda. Additionally, the government intends to provide support for infrastructure to improve debt management operations for both the primary and secondary markets to enhance investor access, promote confidence among participants and further deepen the capital markets,

The higher domestic debt composition could have the following two results:

- A decline in Kenya’s exposure to external shocks, as the more we owe in foreign currency, the more exposed we are to any shocks in the foreign markets. Given the recent loss in value of the shilling against the dollar, where the local currency depreciated 7.7% against the dollar in 2020, a lower reliance on foreign debt will help control the amount owed in both interest and principle payments, and,

- Increase the crowding out of the private sector because the higher the government’s local debt appetite, the more the banks are inclined not to lend to the private sector as the rates on government securities remain attractive. Notably, appetite for domestic debt has been on arise, concurrently, interruptions from the Covid-19 pandemic saw banks shy away from lending due to elevated credit risk on the borrowers and thus opting to lend to the government.

Considering the projected revenues and expenditures, for the Medium-term, official sources for loans on concessional terms will be maximized while non-concessional, commercial external borrowing, and sovereign bond issuance will be limited to projects with high financial and economic returns in line with the government’s development agenda. Additionally, the government intends to provide support for infrastructure to improve debt management operations for both the primary and secondary markets to enhance investor access, promote confidence among participants and further deepen the capital markets.

Section III: Conclusion

Similar to governments across the world, the FY'2021/2022 budget estimates point to an expansionary budget in a bid to steer the country out of the pandemic-driven economic downturn. The budget is however hinged on meeting the revenue collection targets, expected to be boosted by the relaxation of the tax cushions that had been implemented during the peak of the pandemic last year. This premise however ought to be a factor of economic recovery which is still uncertain given the uncertainty surrounding the persistence of the pandemic. The fiscal deficit is estimated to reduce to 7.7% of GDP mainly as a result of an expected decline in recurrent expenditure and an improvement in revenues. The latter will be highly dependent on how well the government will be able to implement some of the measures put in place. Debt sustainability continues to be a key concern, with the country’s public debt–to-GDP ratio having increased considerably over the past five years to 69.6% as at December 2020, from 44.3% as at the end of 2013 with half of the debt being external. In our view, there are still concerns on how the government will be able to meet its revenue collection targets given that the country is still experiencing effects from the third wave of the pandemic. Some measures have been put in place, however, changes that touch on tax revenues in the current environment where there is heightened uncertainty may have unintended budgetary consequences.