Global Economic Growth

Global growth is projected to have contracted by 4.4%, according to IMF, World Economic Outlook (October 2020) led by the significant contraction of 5.5% and 3.3% for the developed and developing economies respectively. The decline was largely due to the impact of COVID-19 more specifically:

- Worsening economic conditions as a result of COVID-19 infections leading to large disruptions in business activity than expected,

- Decline in consumption of goods and services as people had to rely on their savings due to loss of jobs and inactive business environment as well as effects from adhering to social distancing and movement restrictions set in place to reduce the Virus spread,

- Depressed mobility as both domestic and international travel, and,

- A contraction in global trade due to the measures put in place to control COVID-19 such as restricted movement.

According to the World Trade Organization (WTO) in a press release (Press/862 Press Release) world merchandise trade volume is projected to have contracted by 9.2% in 2020 a less severe drop compared to earlier projection of 12.9% in April 2020.

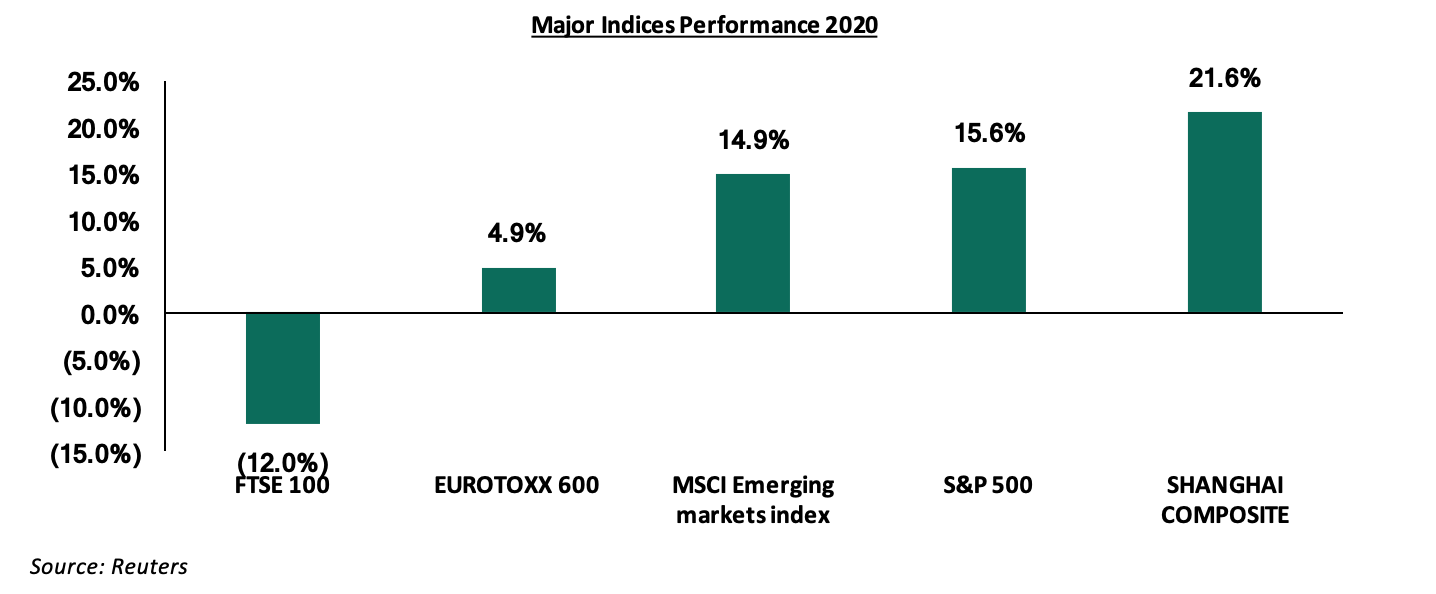

Global Equities Market Performance

Global equity markets registered mixed performance during the year, with FTSE 100 being the only loser among the major world indices. Despite the tenacity of the COVID-19 pandemic, equities markets have been driven higher by the expected economic recovery and eased monetary policies coupled with the rally in tech stocks during the third and fourth quarters of the year. Positive results from late-stage COVID-19 vaccine trials also led to the spontaneous recovery of the markets. Below is a chart highlighting the performance of select stock indices;

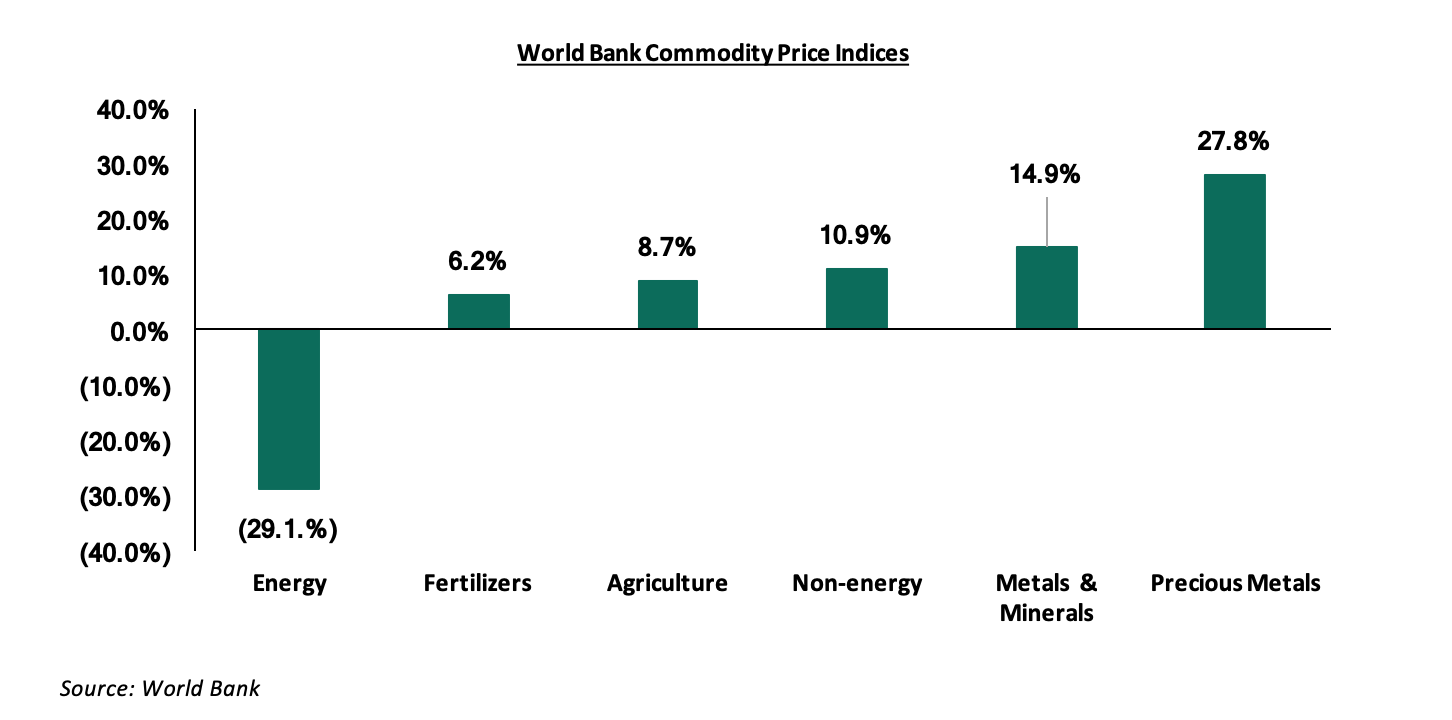

Global Commodities Market Performance

Global commodity prices registered mixed performance in 2020, with energy prices getting the greatest impact from COVID-19 having declined by 29.1% largely driven by slowing global demand. Fertilizers, agriculture, non-energy commodities, metals & minerals, registered gains of 6.2%, 8.7%, 10.9% and 14.9%, respectively while precious metals were the largest gainers gaining by 27.8%, according to the World Bank Commodity Prices Index. The gains by precious metals can be attributed to the heightened preference by investors who sought them as the key store of value. Below is a summary performance of various commodities;