Global Economic Growth:

According to the World Bank the global economy is projected to grow at 2.7% in 2025, matching the 2.7% recorded in 2024. This forecast marks a slight upward revision from earlier projections, reflecting economic recovery, particularly for emerging markets. The World Bank’s growth projection is 0.6% points lower than the IMF’s 2025 forecast of 3.3%. However, recent developments indicate that some central banks, such as those in the United States and England, have begun to cut interest rates in response to easing inflation, which could stimulate economic activity going forward. Notably, advanced economies are expected to record a 1.9% growth in 2025, up from the 1.7% expansion recorded in 2024. However, emerging markets and developing economies are projected to expand by 4.2% in 2025, remaining unchanged from an estimated growth of 4.2% in 2024.

The stabilization in global economic growth in 2024 as compared to 2023 is majorly attributable to;

- The recovery in global trade supported by a pickup in goods trade. Services-trade growth is expected to provide less tailwinds this year, given that tourism has nearly recovered to pre-pandemic levels. However, the trade outlook remains lackluster compared to recent decades, partly reflecting a proliferation of trade-restrictive measures and elevated trade policy uncertainty, and,

- A decrease in inflation rates making progress toward central bank targets in advanced economies and Emerging Markets and Developing Economies (EMDEs), but at a slower pace than previously expected. Core inflation has remained stubbornly high in many economies, supported by rapid growth of services prices. As such, by the end of 2026, global inflation is expected to settle at an average rate of 3.5%, broadly consistent with central bank’s targets.

The global economy is showing signs of improvement, with inflationary pressures easing and several central banks moving from rate hikes to rate cuts. This shift is expected to support economic recovery, although growth remains uneven across regions.

Global Commodities Market Performance:

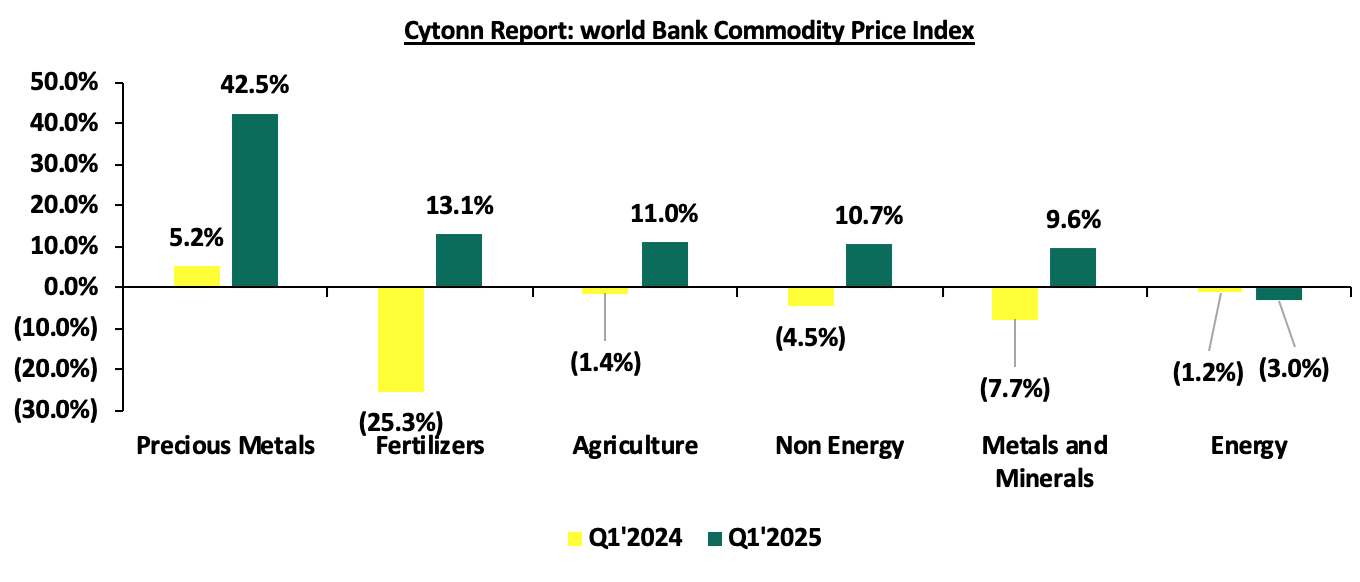

Global commodity prices registered mixed performance in Q1’2025, with prices of energy declining by 3.0%, higher than the 1.2% decrease recorded in Q1’2024, mainly as a result of the declining energy production and exports among oil-importing economies coupled with reduced geopolitical tensions on the Middle east that caused disruption on the supply leading. On the other hand, prices of Precious Metals, Fertilizers, Agriculture, and Non-Energy increased by 42.5%, 13.1%, 11.0%, and 9.6% respectively, on the back of increased global demand coupled with easing supply chain constraints. Below is a summary performance of various commodities;

Source: World Bank

Q1’2025 data as of February 2025

Global Equities Market Performance:

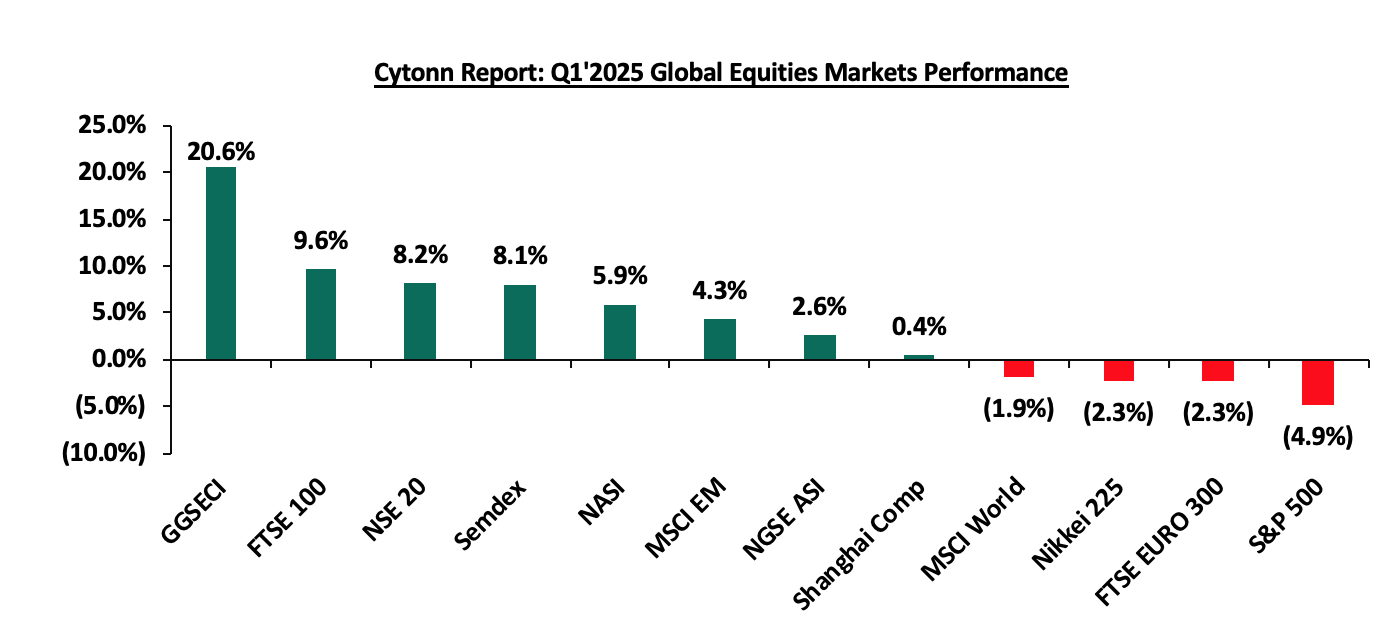

The global stock market recorded mixed performance in Q1’2025, with most indices in the developed countries recording gains during the period, largely attributable to increased investor sentiments as a result of continued economic recovery following the full reopening of the economies coupled with investor preference for the stock markets in the developed countries. Notably, GGSECI was the best performer during the period, recording a gain at 53.5% in Q1’2025 largely driven by gains in the large-cap stocks such as Access Bank, MTN Ghana and Standard Chartered Bank gaining by 74.4%,27.6% and 13.0%, following improved earnings during the period, additionally supported by easing inflation. S&P 500 was the largest decliner, recording losses of 4.9% with the performance being skewed by tariffs imposed by US President Donald Trump which hit the top global corporations coupled with the increase in bond yields even though the interest rates were cut. Below is a summary of the performance of key indices as at the end of Q1’2025:

*Dollarized performance