According to the Central Bank of Kenya (CBK), the private sector credit growth declined in 2021 coming in at an average of 7.8%, in comparison to the 8.0% recorded in 2020 partly due to the cautious lending strategy adopted by banks during the COVID-19 operating environment. High cost of credit remains one of the main challenges that hinders credit growth with the big banks charging a higher cost of credit in comparison to smaller banks reflecting their strong pricing power based on a wide distribution network, multiple services and well established brands. On the other hand, small banks have to compete for customers by offering relatively cheaper credit in order to grow their loan book. According to the Kenya Bankers Association cost of credit calculator, ABSA Bank topped the list of most expensive banks charging a total of Kshs 14.3% for a 1.0 mn loan over a period of 1 year as of March 2021. On the other hand, Bank of Baroda ranked as the cheapest bank charging Kshs 6.1% for the same loan purely as interest charges with no additional charges. In this topical, we shall analyze Kenya’s cost of credit amid the pandemic environment and cover the following;

- Introduction to credit in Kenya,

- Accessibility to Credit,

- Effects of interest rate on credit,

- Analysis of the true cost of credit, and,

- Conclusion

Section 1: Introduction to Credit in Kenya

- Introduction

Credit is a contractual agreement between a lender and a borrower where the lender agrees to advance a certain sum of money to the borrower and the borrower, in return, agrees to repay the money at a future date with an interest on the principal amount. Cost of credit on the other hand, refers to all costs related to the issuance of credit, including interest and any fees tied to acquiring credit, usually expressed by the Annual Percentage Rate (APR), a metric that factors in additional costs and fees on the annual interest rate. Credit growth is defined as an increase in loans for the private sector, individuals, and government agencies. When credit becomes more available, consumers can borrow and spend more, while businesses can borrow and invest.

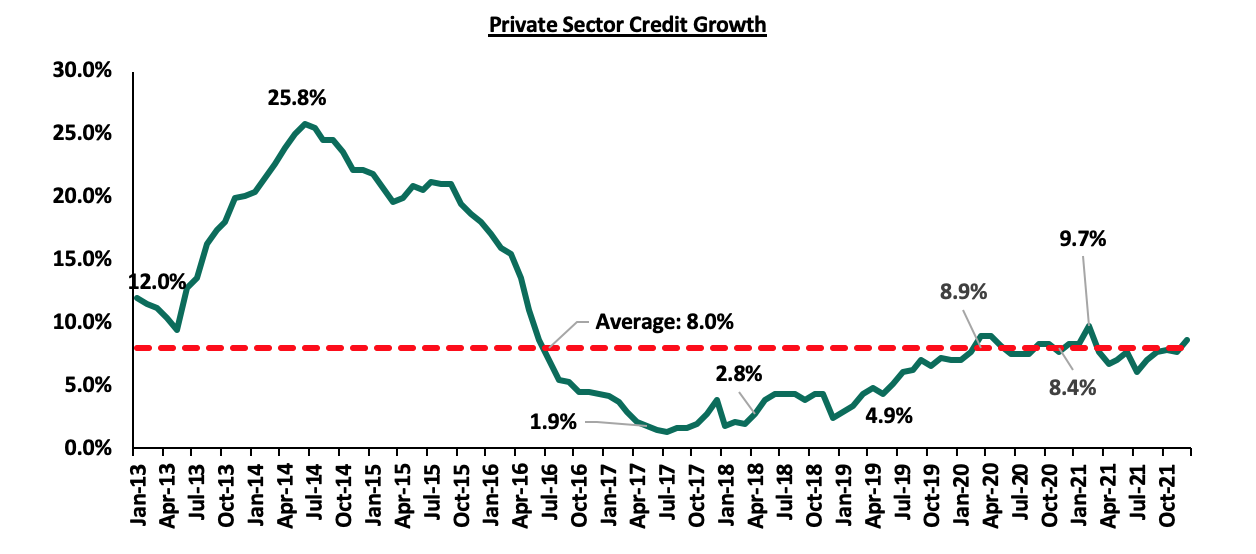

The Kenyan credit market has seen significant growth over the last five years with net domestic credit extended by commercial banks increasing by a 5-year CAGR of 11.0% to Kshs 3.4 tn in Q3’2021, from Kshs 3.1 tn in Q3’2017, mainly supported by increased net lending to the government and the private sector. Despite this growth, it is important to note that Kenya’s private sector credit growth has faced some challenges that have continued to hamper its growth. During the interest rates cap, the private sector credit growth was at its lowest, growing by 3.7%, lower than the 16.0% average growth recorded a year before. In 2020, following the emergence of the COVID 19 pandemic, credit growth remained subdued as most banks shied away from lending to customers on the back of the elevated credit risk. Notably, the average loan growth came in at 11.7%, slower than the 12.8% recorded in FY’2019 and slower than the 26.3% growth in government securities, an indication of banks’ preference of investing in Government securities as opposed to lending due to the elevated credit risk occasioned by the pandemic.

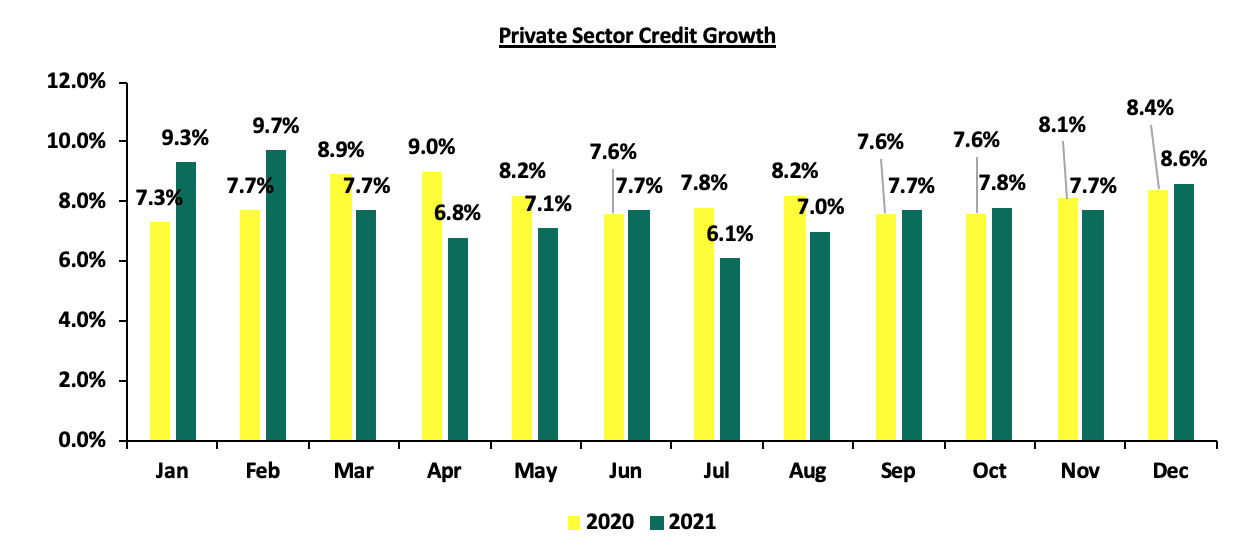

The graph below compares the private sector credit growth in 2020 and 2021:

- Initiatives put in place to promote credit growth

Given the changing economic environment, the Central Bank of Kenya (CBK), in collaboration with other stakeholders, has pursued a variety of initiatives ranging from licensing of new products, regulatory reforms, technological innovations and public education to promote credit growth in Kenya. Some of the initiatives include;

- Retaining the Central Bank Rate (CBR) at 7.00% and lowering the Cash Reserve Ratio to 4.25% - The accommodative monetary policies adopted by the Monetary Policy Committee (MPC) since March 2020, have continued to support the country’s economic growth. The lowering of the CRR to25% from 5.25% injected approximately Kshs 35.2 bn in additional liquidity to commercial banks for onward lending to distressed borrowers and to also supporting lending to the tourism, trade and transport and communication, Real Estate, manufacturing and agriculture sectors. As at the end of 2021, Private sector credit growth had increased to 8.6%, from 8.4% recorded in December 2020,

- Regulatory reforms by the Central Bank of Kenya (CBK) – In 2017, the Banking Act was amended to include heavy penalties wherein commercial banks became subject to incur a penalty of up to a maximum of Kshs 20.0 mn, from the previous Kshs 5.0 mn, for failure to disclose the true cost of credit to consumers. As a result, consumers are now better able to understand the terms of the debt they are taking on, the potential consequences of defaulting, and are able to compare different loan products and make informed credit decisions. Additionally, the Kenya Bankers Association (KBA) in collaboration with the Central Bank of Kenya (CBK) introduced a credit cost calculation website in which commercial banks and micro-finance institutions are required to publish their true cost of credit. This has promoted full disclosure of bank charges and fees to facilitate informed banking decisions by the public,

- Alternative sources for government funding– The Kenyan Government has pursued alternative funding sources such as the Sovereign Bonds and has adopted reforms to improve government spending as evidenced by the Kshs 1.0 bn Kenya Eurobond issued on 17th June, 2021. The government also intends to issue two more Eurobonds by June 2022 to help fund the FY'2021/2022 budget. As such, banking institutions have to increase their lending to the private sector given that the government reduces its borrowing from banks and consequently reduces competition with private sector borrowing, and,

- Introduction of Annual Percentage Rate (APR) for loans – The Kenya Bankers Association rolled out the APR in 2014 which converts all direct costs associated with the loan into a single figure. Consequently, borrowers can use the APR to compare different loan products on a like-for-like basis, based on the total cost of the facility, and make more informed credit decisions.

- Hindrances to Private Sector Credit growth

Despite the initiatives put in place by the government and other stakeholders to promote private sector credit growth, the sector is still not performing as expected mainly due to;

- High cost of credit – In addition to the interest, there are other costs associated to credit that range from bank fees and charges to third party costs, such as legal fees, insurance and government levies. The high costs and associated overheads have to be borne by fewer borrowers hence this poses constraint to private sector credit growth,

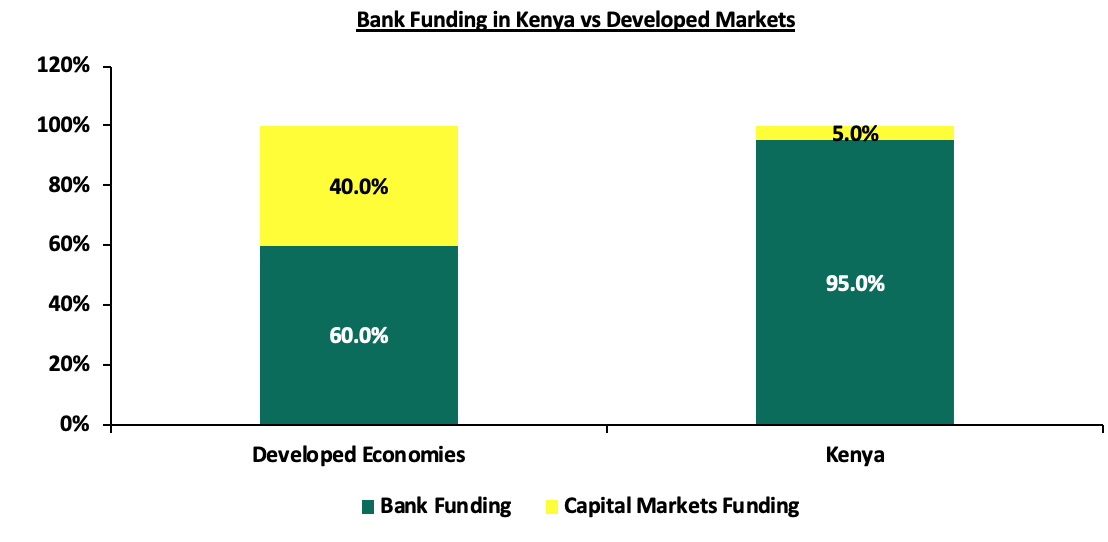

- Lack of alternative sources of funding – According to World Bank data, in more developed markets, both regulated and unregulated capital markets contribute about 60.0% of all business funding and the remaining 40% of capital coming from banks. However, in Kenya businesses funding largely rely on bank funding and according to the Capital Markets Authority Soundness Report Q4’2020, the regulator, CMA, highlighted that funding from the capital markets in Kenya stood at 5.0%, with the banking sector taking up 95.0% of the funding for businesses. This shows that our capital markets remain subdued compared to other economies, and access to funding remains a concern. The upshot is that there is banking dominance in Kenya, which then makes capital hard to access, and when accessed it is expensively priced. The chart below compares bank funding in Kenya and developed markets;

- Low financial literacy which impede informed financial decisions – Borrowers require sufficient financial knowledge to be able to access credit. This enables them to look for the lowest interest rates when comparing loan terms, and hence incur lesser cost of borrowing money. Additionally, financial literacy can assist debtors in determining the best ways to get out of debt, better use of credit and ways of getting out of credit

Section 2: Accessibility to Credit

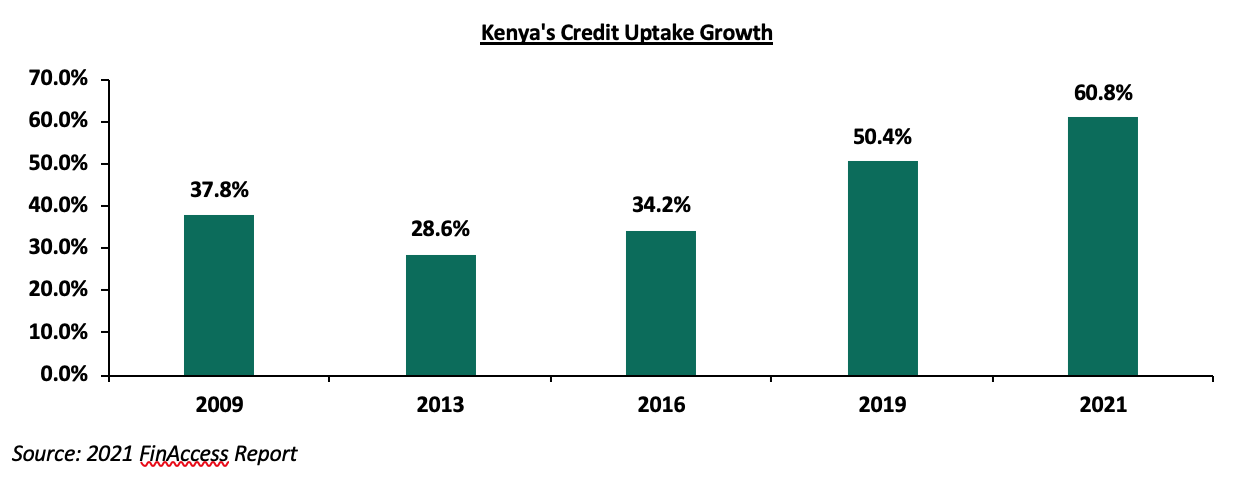

The most common options for credit in Kenya include mobile money, banks, informal groups, insurance, digital apps and microfinance institutions. According to the 2021 FinAccess Report, as of 2021, mobile money was the most used financial platform accounting for 81.4% of users, followed by banking institutions at 44.1%, then informal groups at 28.7%. The usage of digital loan apps declined to 2.1% in 2021, from 8.3% in 2019 mainly due to increased competition from bank-based product innovations, unfair debt collection practices by the Digital Loan Apps, non-listing of borrowers to the Credit Reference Bureaus (CRBs), and anticipated regulation of the Apps by the CBK. Notably, bad or no credit history and negative listing on CRBs remain the biggest hindrance to credit accessibility. The graph below shows the evolution of credit uptake over the last five years;

In December 2021, President Uhuru Kenyatta signed into law the Central Bank of Kenya (CBK) Amendment Act, 2021 which confers the CBK powers to regulate the digital lending services sector and aims to amend the Central Bank of Kenya Act Chapter 491 to provide and allow for the licensing of digital credit service providers, who are currently not regulated. As stated in our Cytonn weekly #49/2021, the act also defines relevant terms for the business of digital credit lending where a digital credit provider is a person licensed by the CBK to carry on digital credit business while a digital credit business is one of providing credit facilities or loan services through a digital channel. Further, the act aims to provide for a fair and non-discriminatory marketplace for access to credit.

With digital lending apps being one of the most easily accessed credit platforms, we expect this move by CBK to increase credit accessibility through;

- Enforcing reporting requirements for digital credit providers – Borrowers will be able to make informed decisions based on the reports given by the digital apps. Additionally, there will be transparency in the pricing of credit given that the digital lending apps will be required to report to their respective borrowers and the CBK information such as; the breakdown of the cost of doing business, type of the loan and risk profile of the customer just like other regulated lending platforms,

- Penalizing any violation or offences – The digital apps, will be subject to penalties under the Central Bank Act regulations that are specific to lending institutions. This will also enhance transparency and consumer protection against unscrupulous digital lenders who have taken advantage of the unregulated space to infringe on various consumer rights and privacy, and,

- Enhancing Credit information sharing – This will play a big role in enabling borrowers to build credit history which they can use to negotiate for better credit terms. Borrowers can also use their positive credit history as an alternative to traditional physical collateral.

Effects of Interests rate on Credit growth

Interest rates constitute an important component when determining the cost of borrowing. When interest rates rise, the cost of credit rises in tandem since financial institutions charge more for credit implying that borrowers will have to use more of their earnings to pay interest on loans. Additionally, borrowers tend to borrow less during periods of high interest rates, which hampers the growth of credit. On the other hand, when interest rates are low, the cost of credit declines and borrowers tend to take out more loans, to fund their businesses and projects, thus promoting the growth of credit in the private sector. Additionally, locking in a lower interest rate implies lower cost of credit in the long run. Borrowers are also able to refinance some of their outstanding loans during a period of sustained low-interest rates hence support in debt stabilization.

In a bid to protect consumers from high cost of credit and not earning any interest on their savings accounts, the Central Bank of Kenya (CBK) introduced the Banking (Amendment) Act 2015 in August 2016, capping lending rates at 4.0% points above the Central Bank Rate (CBR) and deposit rates at 70.0% of the CBR rate. However, despite the positive intention of the amendment, the impact on private sector credit growth was negative as credit growth deteriorated even further as evidenced by;

- The average growth in private sector credit during the 3 years of interest rate capping came in at 3.7%, in comparison to 19.0% 3 years before the capping,

- The average cost of loans by banks went up, as banks charged excessive fees and additional costs on their loans. In return, this discouraged potential borrowers and further subdued growth in the sector, and,

- The total amount of commercial banks loan growth declined, with listed banks recording a loan growth of 6.3% in FY’2016, and 6.1% in FY’2017 compared to 17.0% in FY’2015, before the rate cap was introduced in August 2016. The loan growth further declined to 4.3% in FY’2018 as banks shied away from lending to the private sector.

In order to spur credit growth in the private sector, the government repealed the Banking (Amendment) Act 2015 in November 2019, given that the regulatory framework had proved to be a hindrance to credit growth, evidenced by the continued decline of private sector credit growth. Consequently, there has been significant growth in private sector credit evidenced by;

- The improvement in private sector credit with the average growth rate 3 years after the repeal coming in at 7.8% in comparison to the 3.7% recorded in the 3 years of interest rate capping, and,

- A 12.8% growth in loans extended by listed banks to the private sector in FY’2019 with the growth being accelerated towards the tail end of FY’2019 following the repeal of interest rate cap. For FY’2020, average loan growth came in at 11.7%, higher than the average growth during the interest rate cap but lower than FY’2019 growth rate. The slowdown was largely due to the elevated credit risk occasioned by the pandemic.

The graph below shows the private sector credit growth before (2013 – July 2016), during (August 2016 – October 2019) and (November 2019 – December 2021) after the interest rate cap;

Section 4: Analysis of the True Cost of Credit in Kenya

In an effort to promote transparency and control of the total cost of credit, the CBK and the Kenya Bankers Association (KBA) made public a website called the ‘CostofCredit’ in which banks, both commercial and micro-finance institutions, are required to publish their Annual Percentage Rate (APR), loan repayment schedule and any additional details on their loans. There are various costs associated with a loan in addition to the interest rate component and depending on the type of loan a borrower takes up. These costs include;

- Government Levies: This refers to the excise duty at 20.0% of the Application/ Processing/ Initiation/ Arrangement/ Commitment Fees charged,

- Legal Fees – This refers to the amount charged by the appointed external lawyers in Accordance to the Advocates (Remuneration) (Amendment) Order, 2014. The fees exclude VAT and disbursements, which will be determined after the Lawyers' work is completed,

- Stamp Duty – This is a government levy levied on the sale of property that usually ranges from 1.0% - 4.0% of the property's value,

- Valuation Fees - This is the amount charged by the appointed valuers according to the Land Valuers Licensing (Remuneration) Notice 2013 (as varied or amended). It is usually exclusive of VAT and disbursements as these are cleared after the valuation work is complete, and,

- Insurance - Insurance is charged by the Insurer on the basis of the Option selected by the borrower for the period of the Facility. Insurance includes Mortgage Protection, Credit Life Insurance, Fire Insurance, Property Insurance and Car Insurance, where applicable.

Below is an analysis of the true cost of credit whereby we have ranked the top 15 cheapest and most expensive banks, based on the APR as of 3rd February 2021. We have assumed that an individual has taken up a Kshs 1.0 mn 3-years personal secured loan or a Kshs 1.0 mn 3-years personal unsecured loan under the up-to 5 years category. For mortgage, we assume an individual takes up a Kshs 3.0 mn 10-year mortgage loan for a mortgage worth Kshs 8.6 mn and pays a 10.0% deposit.

|

Personal Loan - Secured |

||||

|

No. |

Bank |

Annual Interest Rate |

Other Charges |

Annual Percentage Rate |

|

1 |

Middle East Bank |

17.0% |

5.9% |

22.9% |

|

2 |

Guaranty Bank |

13.0% |

6.7% |

19.7% |

|

3 |

Kingdom Bank |

16.0% |

2.6% |

18.6% |

|

4 |

Family Bank |

13.0% |

4.3% |

17.3% |

|

5 |

Eco Bank |

13.6% |

3.3% |

17.0% |

|

6 |

Co-operative Bank |

15.6% |

0.9% |

16.5% |

|

6 |

SBM Bank |

13.9% |

2.6% |

16.5% |

|

8 |

KCB Bank |

13.0% |

3.3% |

16.3% |

|

9 |

Bank of Africa |

13.5% |

2.8% |

16.3% |

|

10 |

Development Bank |

13.0% |

3.1% |

16.1% |

|

11 |

Equity Bank |

13.0% |

3.1% |

16.1% |

|

12 |

Stanbic Bank |

13.7% |

2.2% |

15.8% |

|

13 |

Prime Bank |

13.0% |

2.7% |

15.7% |

|

13 |

Paramount Bank |

13.0% |

2.7% |

15.7% |

|

14 |

Diamond Trust Bank |

13.0% |

2.7% |

15.7% |

|

15 |

Mayfair Bank |

13.0% |

2.6% |

15.6% |

|

Top 5 Most expensive Banks |

14.5% |

4.6% |

19.1% |

|

|

Top 5 Cheapest Banks |

12.3% |

0.4% |

12.6% |

|

|

Top 15 Average |

13.8% |

3.2% |

17.0% |

|

Source: www.costofcredit.co.ke

The key take outs from the table include;

- For personal loans, the average APR for the top 5 expensive banks is 19.1% with the average annual rate coming in at 14.5% in comparison to the 12.6% average APR and 12.3% average annual rate for the cheapest banks. The average additional charges for the most expensive banks came in at 4.6%, 4.2% points higher than the 0.4% average additional charges for the cheapest banks. Notably, most of the cheapest banks such as Bank of Baroda do not have additional charges reflecting the banks efforts to steer the growth of their loan books,

- Middle East Bank has the highest APR coming in at 22.9% with the highest annual rate at 17.0% and additional charges of 5.9%,

- The average APR for the top 15 banks stands at 17.0% with the annual average rate standing at 13.8%. Additionally, the average additional charges came in at 3.2%, 1.4% points lower than the average additional charges for the most expensive banks.

|

Personal Loan – Unsecured |

||||

|

No. |

Bank |

Annual Interest Rate |

Other Charges |

Annual Percentage Rate |

|

1 |

Family Bank |

13.0% |

18.8% |

31.8% |

|

2 |

Kingdom Bank |

13.0% |

17.8% |

30.8% |

|

3 |

Middle East Bank |

17.0% |

5.9% |

22.9% |

|

4 |

Guaranty Trust Bank |

13.0% |

6.7% |

19.7% |

|

5 |

Sidian Bank* |

13.0% |

5.8% |

18.8% |

|

6 |

I&M Bank |

18.0% |

0.0% |

18.0% |

|

7 |

Standard Chartered Bank |

14.0% |

3.7% |

17.7% |

|

8 |

ABSA Bank |

13.0% |

4.3% |

17.3% |

|

8 |

Bank of Africa |

14.5% |

2.8% |

17.3% |

|

10 |

Eco Bank |

13.6% |

3.3% |

17.0% |

|

11 |

Prime Bank |

13.0% |

3.7% |

16.7% |

|

12 |

Equity Bank |

13.0% |

3.6% |

16.6% |

|

13 |

Co-operative Bank |

13.0% |

3.5% |

16.5% |

|

13 |

SBM Bank |

13.9% |

2.6% |

16.5% |

|

15 |

KCB Bank |

13.0% |

3.3% |

16.3% |

|

Top 5 Most expensive Banks |

13.8% |

11.0% |

24.8% |

|

|

Top 5 Cheapest Banks |

13.0% |

0.6% |

13.6% |

|

|

Top 15 Average |

13.9% |

5.7% |

19.6% |

|

|

*Period up to 1 year |

||||

Source: www.costofcredit.co.ke

The key take outs from the tables include;

- For personal unsecured loans, the average APR for the top 5 expensive banks is 24.8% with the average annual rate coming in at 13.8% in comparison to the 13.6% average APR and 13.0% average annual rate for the cheapest banks,

- The average additional charges for the most expensive banks stands at 11.0%, 10.4% points higher than the 0.6% average additional charges for the cheapest banks and 6.4% higher than the average additional charges for the most expensive banks offering secured loans. This can be attributed to the additional cost that borrowers incur to compensate the lenders of the perceived credit risk associated with unsecured loans, and,

- Family Bank has the highest APR standing at 31.8% with the highest additional charges at 18.8%.

|

Mortgage |

||||

|

No. |

Bank |

Annual Rate |

Other Charges |

Annual Percentage Rate |

|

1 |

KCB Bank |

13.0% |

28.7% |

41.7% |

|

2 |

Middle East Bank |

17.0% |

16.0% |

33.0% |

|

3 |

Co-operative Bank |

15.6% |

9.2% |

24.8% |

|

4 |

Prime Bank |

13.0% |

7.3% |

20.3% |

|

5 |

Diamond Trust Bank |

13.0% |

7.3% |

20.3% |

|

6 |

National Bank of Kenya |

13.0% |

7.0% |

20.0% |

|

6 |

Paramount Bank |

13.0% |

7.0% |

20.0% |

|

8 |

Guardian Bank |

13.0% |

6.9% |

19.9% |

|

9 |

Victoria Bank |

13.0% |

6.9% |

19.9% |

|

10 |

Equity Bank |

13.0% |

6.8% |

19.8% |

|

11 |

SBM Bank |

13.9% |

5.4% |

19.3% |

|

12 |

ABSA Bank |

12.8% |

6.3% |

19.1% |

|

13 |

Standard Chartered |

12.5% |

6.5% |

19.0% |

|

14 |

Eco Bank |

13.6% |

5.4% |

19.0% |

|

15 |

Family Bank |

13.0% |

5.8% |

18.8% |

|

Top 5 Most expensive Banks |

14.3% |

13.7% |

28.0% |

|

|

Top 5 Cheapest Banks |

12.7% |

4.2% |

16.9% |

|

|

Top 15 Banks Average |

13.5% |

8.8% |

22.3% |

|

Source: www.costofcredit.co.ke

The key take outs from the tables include;

- The average APR for the top 15 banks under the mortgage category stands at 22.3%, 2.7% points higher than the average APR for personal unsecured loans and 5.3% higher than the average APR for personal secured loans,

- For mortgage, the average APR for the top 5 expensive banks is 28.0% with the average annual rate standing at 14.3%, in comparison to the 16.9% average APR and an average annual rate of 12.7% for the cheapest banks,

- The average additional charges for the most expensive banks stands at 13.7%, 2.7% points higher than the 11.0% average additional charges for personal unsecured loans for the most expensive banks, and,

- KCB Bank has the highest APR standing at 41.7% with the highest additional charges at 28.7%.

Section 5: Conclusion

On average, the annual interest rate for Kenyan banks is within a range of 13.0% - 13.5% for the various categories of loans offered. This is approximately 4.0% points higher than South Africa’s average annual rate which stands at 7.5% and 10.2% higher than USA’s 3.3%. However, Kenya’s average annual interest rate is 7.5% lower than Ghana’s average lending rate of 21.0%.

We note that the high cost of credit has been one of the major challenges hindering the growth of the private sector. Additionally, digital lending apps have continued to charge high costs and consequently resulting in borrowers being affiliated with high interest rates leading to a rise in defaults. For instance, the branch app, one of the top player in the digital lending market offers an APR of 22.0% – 229.0%, depending on a consumer’s loan option. On the other hand, M-Shwari, Kenya's first mobile-based savings and loans product, launched in 2012 by Safaricom and NCBA, charges a 7.5% facilitation fee on all credit, regardless of duration, bringing the annualised loan rate to 90.0%. Given these high additional fees charged by lenders, especially for mortgage, the total cost of credit remains relatively high and undermines credit growth as borrowers tend to borrow less.

We believe that more needs to be done in order to spur the private sector credit growth. Below are some of the initiatives that the government can adopt;

- The establishment of a strong consumer protection agency and framework that implements and enforces consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. This will promote robust disclosures on credit costs, free and accessible consumer education, and enforcement of disclosures on borrowings and interest rates, as well as the handling of consumer complaints and concerns. This can be borrowed from the US government which following the financial crisis of 2008, established the Consumer Financial Protection Bureau, a body responsible for consumer protection in the financial sector. Recently, the bureau launched an initiative to reduce the exploitative fees after bank revenue from overdraft and non-sufficient funds (NSF) fees surpassed USD 15.0 bn, in 2019. The website provides a platform for consumers to share their experience and complaints on matters concerning fees for things they believe are covered by the baseline price of a product or service, unexpected fees for a product or service, fees that seem too high for the purported service or fees where it is unclear why they were charged,

- Increase competition to reduce over-reliance on banks - In Kenya, banks account for 95.0% of all funding, while only 5.0% comes from non-bank institutional funding, indicating that the economy is overly reliant on bank lending. The government can balance funding sources by diversifying non-bank funding, allowing borrowers to access more flexible and cost-effective funding options, and,

- Consumer education – The government should come up with ways of educating the public and providing guidelines on financial decisions. This will enable borrowers to acquire knowledge on issues like how to access credit, the use of collateral, and establishing a strong credit history. However, this will also require the adoption of risk based lending by banks where cost of credit varies based on a borrower’s credit history. The move will also increase financial literacy which will help borrowers analyse credit in terms of the costs associated and terms given by the lending institutions. This can be achieved by means such as introducing a website that breaks down the key fundamentals and guidelines on the basic information that consumers need to be able to make informed financial decisions.

In our view, the initiatives already put in place by the government coupled with the above, will go a long way in promoting credit growth in the private sector. As of 2021, the average growth rate for the private sector came in at 7.7% and is expected to remain strong on the back of existing policy measures, including the MSMEs Credit Guarantee Scheme, and continued economic recovery. Given the reduced Gross Non-Performing Loans Ratio for listed banks in Q3’2021 to 12.0%, from 12.4% in Q3’2020, we expect to see banks gradually increase lending to the private sector on the back of an improved business environment. However, risks lie on the downside due to the possibility of elevated credit risk brought about by the emergence of new COVID-19 variants and compounded by the upcoming elections.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.