Following the release of the FY’2020 results by Kenyan insurance firms, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed insurance companies and the key factors that drove the performance of the sector. In this report, we assess the main trends in the sector, and areas that will be crucial for growth and stability going forward, seeking to give a view on which insurance firms are the most attractive and stable for investment. As a result, we shall address the following:

- Insurance Penetration in Kenya

- Key Themes that Shaped the Insurance Sector in FY’2020,

- Industry Highlights and Challenges,

- Performance of The Listed Insurance Sector in FY’2020, and,

- Conclusion & Outlook of the Insurance Sector.

Section I: Introduction

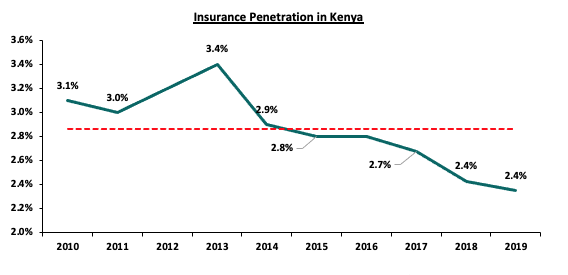

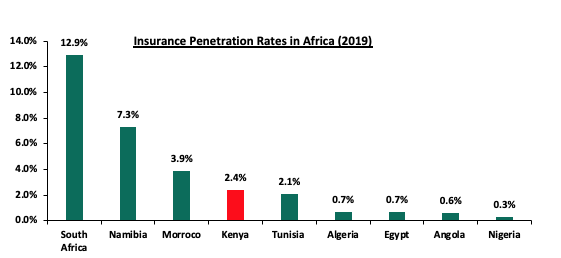

Insurance uptake in Kenya remains low compared to other key economies with the insurance penetration in at 2.4% according to 2020 Financial Stability Report by Central Bank of Kenya (CBK). The low penetration level, which is below the global average of 7.2%, is attributable to the fact that insurance uptake is still seen as a luxury and mostly taken when it is necessary or a regulatory requirement.

The chart below shows the insurance penetration in other economies across Africa:

Section II: Key Themes that Shaped the Insurance Sector in FY’2020

FY’2020 was marked by the global social and economic shocks from the COVID-19 pandemic. Amid this operating environment, the insurance sector was impacted through i) increased insurance claims at 52.7% in Q4’2020 against 48.8% in Q4’2019, ii) reduction in premiums, and, iii) the poor performance in the stock market as evidenced by the NASI index declining by 8.6% in 2020. The Kenyan economy contracted in both Q2’2020 and Q3’2020 by 5.7% and 1.1%, respectively, with the financial services sector and insurance sector registering a reduced growth by to 5.3% in Q3’2020, from 7.6% growth in Q3’2019.

Key highlights from the industry performance:

- Convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks,

- Advancement in technology and innovation making it possible to make premium payments through mobile phones,

- A growing middle class, whose previously increasing disposable income was driving demand for insurance products and services, was affected by the Pandemic due to job losses and reduced sources of income, and,

- Lower investments income, mostly from the poor performance by some of the companies in the equities segment of the Capital Markets,

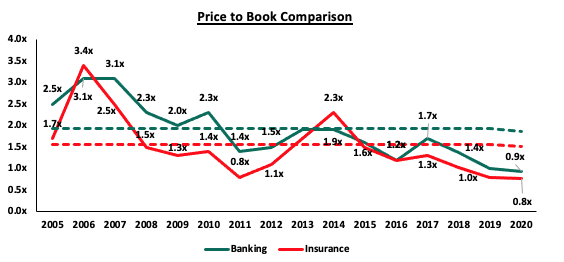

On valuations, listed insurance companies are trading at a price to book (P/Bv) of 0.8x, lower than listed banks at 0.9x, their 15-year historical averages of 1.5x. This two sectors are attractive for long-term investors supported by the strong economic fundamentals.

In the last five years, the life insurance market in Kenya has experienced growth in both the level of direct premiums as well as in the equity held by the industry constituents shaped by the following themes;

The key themes that have driven the insurance sector include:

- Technology and Innovation

Although the industry has been slow in adopting digital trends, the onset of the COVID-19 pandemic in FY’2020 saw the adoption of digital distribution of insurance products as a matter of necessity. Consequently, many insurance companies increasingly took advantage of the available digital channels to drive growth and increase insurance penetration in the country. The current number of mobile data subscribers, according to Communications Authority of Kenya (CAK), stands at 40.9 mn and is expected to grow to 60.0 mn subscribers in 5 years. The high mobile penetration implies that Mobile phones offer a new way of distributing insurance products to the younger generation of consumers and those consumers that have not been served through traditional distribution methods. Given that the process of handling and inspecting claims manually is cumbersome and imperfect, the use of Artificial Intelligence (AI) assists in investigating the legitimacy of claims and identifying those that are fraudulent. An example is Liberty Holdings which has been using AI to rollout e-policy documents, self-services for retail customers and collect customer feedback.

- Regulation

To ensure that the sector benefits from a globally competitive financial services sector, the regulator has been working through regulation implementations to address some of the perennial, as well as emerging problems in the sector. The COVID-19 environment proved challenging especially on the regulatory front, as it was a balance between remaining prudent as an underwriter and adhering to the set regulations given the negative effect the pandemic. Regulations used for the insurance sector in Kenya include the Insurance Act cap 487 and its accompanying schedule and regulations. In FY’2020, regulation remained a key aspect affecting the insurance sector and the key themes in the regulatory environment include;

- IFRS 9 - IAS 39, Financial Instruments Recognition and Measurement was replaced with IFRS 9, Financial Instruments to address the classification and measurement of financial instruments, impairment, and hedge accounting. The guidelines recommends an entity to measure the loss allowance at an amount equal to lifetime expected credit losses for receivables. Many insurance companies are now using a simplified loss rate approach in determining the provisions for premium receivables, with some opting to delay implementation of IFRS 9 to January 2022. IFRS 9 will enable insurance companies to develop appropriate models for their customer debtors and develop plans that will help them lower their credit risk in the future,

- IFRS 17- The standard establishes the principle for recognition, measurement, presentation and disclosure of insurance contracts with the objective of ensuring insurance companies provide relevant information that faithfully represents the contracts. However, as a way to protect the insurance industry from the negative effects of the pandemic the International Accounting Standards Board (IASB), the international body responsible for setting up financial reporting standards deferred its implementation to be effective from January 2023 or earlier. The standard, having replaced IFRS 4, is expected to give better information on profitability by providing more insights about current and future profitability of insurance contracts. Separation of financial and insurance results in the income statement will allow for better analysis of core performance for the entities and allow for better comparability of insurance companies,

- Risk Based Supervision - IRA has been implementing risk-based supervision through guidelines that require insurers to maintain a capital adequacy ratio of at least 200.0% of the minimum capital by 2020. The regulation requires insurers to monitor the capital adequacy and solvency margins on a quarterly basis, with the main objective being to safeguard the insurer’s ability to continue as a going concern and provide shareholders with adequate returns. We expect more mergers within the industry as smaller companies struggle to meet the minimum capital adequacy ratios. We also expect insurance companies to adopt prudential practices in managing risk and reduction of premium undercutting in the industry as insurers will now have to price risk appropriately, and,

- Capital Raising and share purchase

The move to a risk based capital adequacy framework will likely lead to capital raising initiatives mostly by the small players in the sector to shore up their capital. With the new capital adequacy assessment framework, capital is likely to be critical to ensuring stability and solvency of the sector to ensure the businesses are a going concern. In September 2020, Jubilee Holdings announced a strategic transaction with Allianz, a German multinational Underwriter and asset manager for the sale of 66.0% stake in the general business excluding medical for a total consideration of Kshs 10.8 bn. We expect that this amount will be ploughed back in to the company as part of the capital boost to grow other business lines. For more information, please see our analysis on the same on Cytonn Q3’2020 Markets Review

Section III: Industry Highlights and Challenges

Following the stable growth achieved by the insurance sector over the last decade, we expect the sector to transition into a more stable sector on the back of an improving economy and heightened regulations, which will enhance the capacity of the sector to sustain profitability. The following activities were undertaken by the Insurance Regulatory Authority (IRA), in line with their mandate of regulating and promoting development of the insurance sector;

- Industry Circulars

In FY’2020, IRA issued 11.0 circulars ranging from COVID-19 Insurance Business Impact Template in Q2, Reporting of fire and engineering risks with sums insured above KES 1 billion and group life business. For example, in Q4’2020 the authority issued a circular numbered IC & RE 07/2020 to insurance companies, reinsurance companies and reinsurance brokers on dealings with reinsurers and reinsurance brokers that are not registered under the Insurance Act.

- Recently Developed or Repackaged Insurance Products

In FY’2020, 31.0 new or repackaged insurance products were filed by various insurance companies and approved by IRA. The onset of COVID-19 accelerated the repackaging of insurance products where 11 or 35.5% of the 31 products were medical plans, while life products accounted for 15 or 48.4% of the total repackaged products.

Industry Challenges:

- Fraud: Insurance fraud is an intentional deception committed by an applicant or policy holder for financial gain. Recent years have seen an increase in fraudulent claims especially in medical and motor insurance, with estimates indicating that one in every five medical claims are fraudulent mainly through inflated medical bills and hospitals making patients take unnecessary tests. In the whole of 2020, 143.0 fraud cases were reported, with 16.8% being motor accident injury claims and 16.1% being theft by agents. The sector has been adopting the use of block chain and artificial intelligence to curb fraud within the sector, as well as most companies setting up their own assessment centres across the country so as to better determine the actual compensation,

- Premium Undercutting: Premium undercutting is the practice where an insurance company secretly offers clients unrealistically low premiums in order to gain competitive advantage and to protect their market share. This is a major driver of underwriting losses suffered by the industry. The regulator has recently announced that they are engaging a consultant to relook at the industry premium pricing, after a previous attempt was stopped through a court order. Some industry players have argued price fixing will kill innovation and that the industry players should be left free to set their own prices, and,

- Regional regulators: Subsidiaries of Kenyan insurance companies are facing challenges in the areas of operation. For instance, in Tanzania, insurance brokers are required to be at least two-thirds (67.0%) owned and controlled by citizens of Tanzania. In Kenya, regulation on capital has made it difficult for smaller insurance companies to continue operating without increasing their capital or merging in order to raise their capital base.

Section IV: Performance of the Listed Insurance Sector in FY’2020

The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Listed Insurance Companies FY'2020 Earnings and Growth Metrics |

||||||||

|

Insurance |

Core EPS Growth |

Net Premium growth |

Claims growth |

Loss Ratio |

Expense Ratio |

Combined Ratio |

ROaE |

ROaA |

|

Jubilee Insurance |

1.7% |

3.3% |

3.4% |

101.3% |

56.3% |

157.6% |

12.3% |

3.0% |

|

Liberty |

(2.0%) |

(2.9%) |

(0.4%) |

55.2% |

45.9% |

101.1% |

8.1% |

1.7% |

|

CIC |

(192.3%) |

(3.2%) |

(0.9%) |

71.4% |

50.1% |

121.5% |

(3.9%) |

(0.8%) |

|

Britam |

(357.2%) |

0.5% |

20.8% |

85.7% |

78.5% |

164.2% |

(39.2%) |

(6.9%) |

|

Sanlam |

(168.4%) |

21.3% |

18.5% |

83.7% |

54.2% |

137.9% |

(4.8%) |

0.3% |

|

*FY'2020 Weighted Average |

(157.9%) |

1.6% |

9.5% |

88.1% |

62.9% |

151.1% |

(9.4%) |

(1.3%) |

|

**FY'2019 Weighted Average |

6.4% |

10.2% |

16.3% |

79.4% |

56.8% |

136.2% |

11.9% |

3.3% |

|

*Market cap weighted as at 25/05/2021 |

|

|||||||

|

**Market cap weighted as at 17/07/2020 |

|

|||||||

The key take-outs from the above table include;

- Core EPS growth recorded a weighted decline of 157.9%, compared to a weighted growth of 6.4% in FY’2019. The decline in earnings was attributable to reduced premiums during the period following negative effects to the sector from the COVID-19 pandemic, coupled with losses recorded in the equities markets and low yields from government papers,

- The premiums grew at slower pace 1.6% in FY’2020, compared to a growth of 10.2% in FY’2019, while claims also grew at a slower rate of 9.5% in FY’2020, from the 16.3% recorded in FY’2019 on a weighted average basis,

- The loss ratio across the sector increased to 88.1% in FY’2020, from 79.4% in FY’2019, owing to increased claims from perennial challenges facing the industry such as fictitious claims and increased benefit payments from the life business owing to job layoffs,

- The expense ratio increased to 62.9% in FY’2020, from 56.8% in FY’2019, owing to an increase in operating expenses,

- The insurance core business still remains unprofitable, with a combined ratio of 151.1% as at FY’2020, compared to 136.2% in FY’2019, and,

- On average, the insurance sector has delivered a Return on Average Equity of (1.3%), a decline from 3.3% in FY’2019.

Based on the Cytonn FY’2020 Insurance Report, we ranked insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40.0% and the latter a weight of 60.0%.

For the franchise value ranking, we included the earnings and growth metrics as well as the operating metrics shown in the table below in order to carry out a comprehensive review:

|

Bank |

Loss Ratio |

Expense Ratio |

Combined Ratio |

Return on Average Capital Employed |

Tangible Common Ratio |

|

Jubilee Holdings |

101.3% |

56.3% |

157.6% |

12.3% |

24.2% |

|

Sanlam Kenya |

83.7% |

54.2% |

137.9% |

(4.8%) |

5.1% |

|

Liberty Holdings |

55.2% |

45.9% |

101.1% |

8.1% |

19.2% |

|

Britam Holdings |

85.7% |

78.5% |

164.2% |

(39.2%) |

11.2% |

|

CIC Group |

71.4% |

50.1% |

121.5% |

4.1% |

19.2% |

|

Weighted Average FY'2020 |

98.7% |

56.5% |

155.2% |

10.1% |

22.9% |

The Intrinsic Valuation is computed through a combination of valuation techniques, with a weighting of 40.0% on Discounted Cash-flow Methods, 35.0% on Residual Income and 25.0% on Relative Valuation. The overall FY’2020 ranking is as shown in the table below:

|

Insurance Company |

Franchise Value Score |

Intrinsic Value Score |

Weighted Score |

FY'2020 Ranking |

FY'2019 Ranking |

|

Liberty Holdings |

15 |

2 |

7.2 |

1 |

3 |

|

Jubilee Holdings |

19 |

1 |

8.2 |

2 |

1 |

|

Sanlam Kenya |

22 |

3 |

10.6 |

3 |

4 |

|

CIC Group |

20 |

5 |

11.0 |

4 |

5 |

|

Britam Holdings |

29 |

4 |

14.0 |

5 |

2 |

Major Changes from the FY’2020 Ranking are;

- Liberty Holdings improved to position 1 in FY’2020 from position 3 in FY’2019 mainly due to improvements in the franchise score following resilient earnings in FY’2020,

- Sanlam Insurance improved to position 3 in FY’2020 from position 4 in FY’2019 mainly due to improvements in both the franchise and intrinsic value scores,

- CIC Group improved to position 4 in FY’2020 from position 5 in FY’2019, mainly due to an improvement in franchise scores, as the expense and returns on equity remained unchanged,

- Jubilee Holdings whose rank declined to position 2 in FY’2020 from position 1 in FY’2019, on the back of a weak franchise score, driven by the deterioration in its Loss and expense ratios, and,

- Britam Holdings whose rank declined to position 5 in FY’2020 from position 2 in FY’2019, on the back of a weak franchise score, driven by the deterioration in its expense ratio to 78.5% in FY’2020 from 62.2% in FY’2019

Section V: Conclusion & Outlook of the Insurance Sector

The sector was suffering from declining penetration even before the pandemic and this was worsened by the interruptions caused by the pandemic. However, the sector continues to undergo transition where traditional models have been disrupted, mainly on the digital transformation and regulation front. We expect a moderate growth in premiums as underwriters come up with products suited to the pandemic period mostly in the medical and life businesses. On the other hand, the recovery and opening up of logistical barriers currently at play will see an increased uptake of motor vehicle and marine insurance. We are of the view that insurance companies have a lot they can do in order to register considerable growth and improve the level of penetration in the country to the 2019 continental average of 7.2%, some of this include:

- We expect continued partnerships with other financial services players including Fund managers who have ventured into offering insurance linked products as well as the current bancassurance relationship with Banks. Insurance companies will still want to leverage on the penetration of bank products to also push insurance products. Integration of mobile money payments to allow for policy payments is also expected to continue because of convenience which it provides and also mobile phone penetration in the country is high therefore insurance companies will want to leverage this to improve penetration,

- Technology and innovation capabilities are set to continue being the key anchors of growth for Sub-Saharan Africa in the coming years. The COVID-19 pandemic has challenged the underwriters to be more innovative in product pricing and premium calculations which will be underpinned by continued technological deployment. We also expect to see the distribution of more insurance products move online as the world embraces social distancing and the traditional face-to-face selling method will be used less, and,

- We also expect that there will be increased regulation in the sector as insurers adjust their insurance contract recognition methods in preparation to the coming into effect of IFRS17 in January of 2023 or earlier. The push by the regulator to have the desired capital adequacy levels will see increased consolidations as most capital buffers were eroded due to the pandemic.

- We also expect most underwriters to consider growing their investment income through diversifying their investments by moving to some non-traditional asset classes. For example the FY’2020 saw Jubilee Holdings invest Kshs 4.2 bn in Bujagali power plant in Uganda, thus increasing the ownership stake to 18.2% from 8.8%. The need for diversification has been necessitated by the slow growth in premiums against an increase in underwriting expenses.

For the FY’2020 Insurance Report, please download it here

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.