Economic Growth:

During the first half of the year the economy contracted by 0.4% due to the 5.7% contraction in Q2’2020 down from a growth of 5.3% recorded in a similar period in 2019. The contraction was largely driven by the 83.3% decline in the accommodation and food sector following the closure of most facilities and also the reduction in tourist arrivals into the country. Some of the other sectors like agriculture helped cushion the economy from further decline. This is the first contraction since the third quarter of 2001 when the country recorded a 2.5% contraction.

Considering the recent easing of some of the restrictions and reopening of some of the sectors we expect the economy to slightly rebound and this is already reflected by the improvement in PMI where we’ve seen readings as high as 59.1 in October 2020, pointing to an improvement in the Kenya private sector outlook. The IMF October Report: A long and difficult ascent also expects the Kenyan Economy to grow by 1.0% an improvement from the June projections of a (1.0%) growth but the economy should recover to grow at 4.7% in 2021. Notably, H1’2020 average GDP growth now stands at 1.0%. For more information, see our Q2’2020 GDP Note.

The Kenya Shilling:

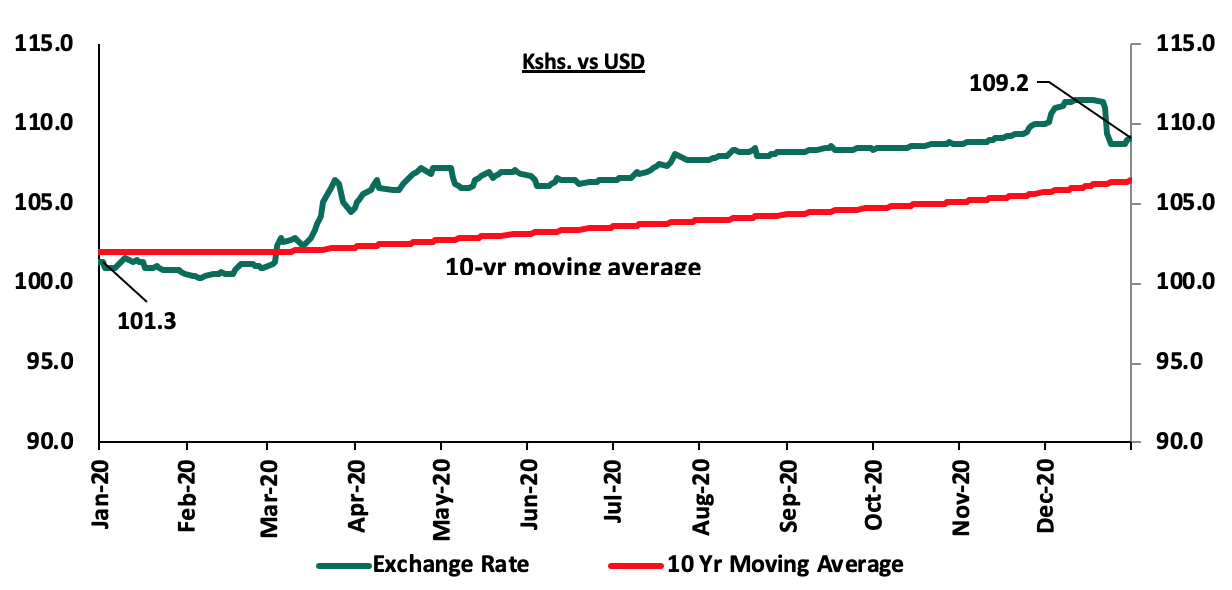

The Kenya Shilling depreciated by 7.7% against the US Dollar to close at Kshs 109.2 in 2020, compared to Kshs 101.3 at the end of 2019.

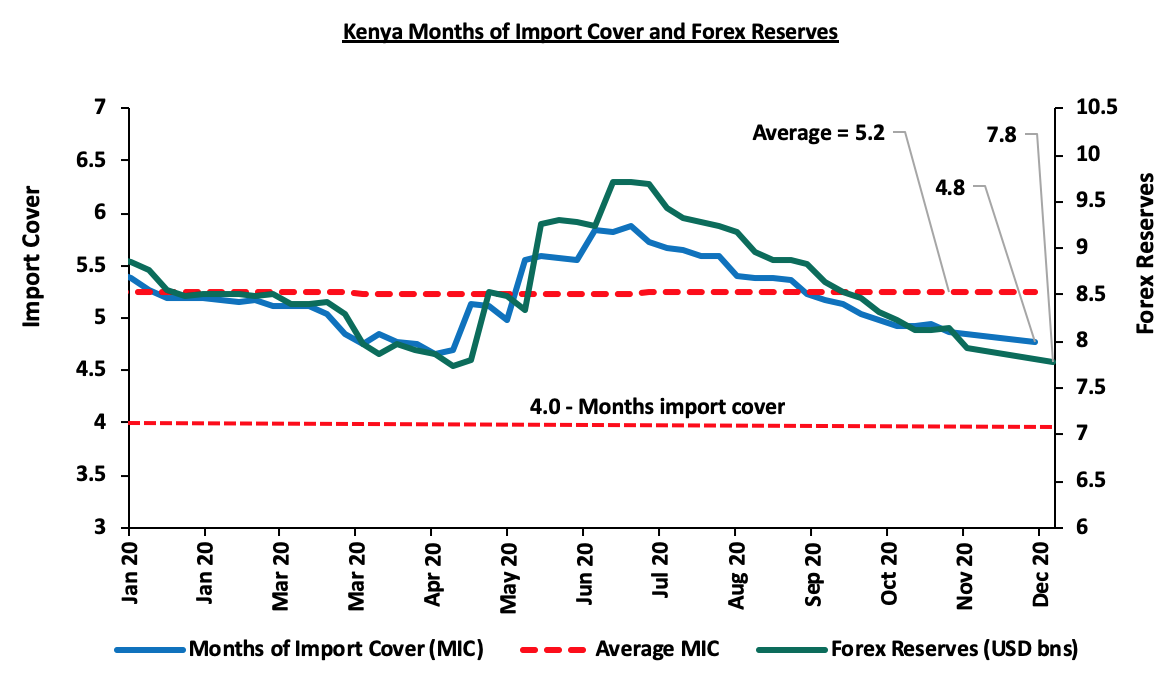

The shilling was under pressure from increased dollar demand as people prefer holding onto hard currency during such times and also a decline in dollar inflows from both exports of goods and services like tourism. The Central Bank, however, was active in the market to help support the currency. Consequently, the county’s foreign exchange reserves have been on the decline but despite this, we are still well above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. This can be seen in the below diagram;

Some of the measures instituted during the year to cushion the shilling include:

- The Government agreed to a USD 2.3 bn credit drawdown facility with the IMF, Kenya targeting an initial disbursement of about USD 725.0 mn in this fiscal year. The facility will be a welcome relief to the currency as it will aid in boosting the forex reserves and help improve market sentiments. This was after the IMF completed its virtual mission to Kenya identifying that the country has suffered unprecedented shock from the pandemic and held discussions with the authorities on a program to support the next phase of their COVID-19 response,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- Monetary policy support from CBK by maintaining the policy rate at the current 7.0%, a further reduction would lead to a further depreciation of the shilling.

Inflation:

The inflation rate remained relatively low in 2020 with the average monthly inflation rate coming in at 5.2%. The December numbers were 5.6% up from November 5.5% and lower than the December 2019 number of 5.8% The low inflation can be attributed to the low fuel prices experienced during the first half of the year, coupled with the favorable weather conditions experienced at the tail end of the year which has ensured that food commodity prices remained low through most of the year.

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5% with the key risks being drought in the first quarter of the year, high fuel costs due to increased crude prices globally as economies recover and further depreciation of the currency.

Monetary Policy:

During the year the Monetary Policy Committee met 8 times. They lowered the Central Bank Rate (CBR) twice, in the meetings held on 27th January 2020 and 23rd March 2020, from 8.25% at the beginning of the year to 7.00%. In their last meeting held on 26th November 2020, MPC retained the CBR at 7.0% for the fifth consecutive time, indicating that the previous cuts were having the intended effect on the economy. The committee concluded that the current accommodative monetary policies together with the fiscal measures are still being transmitted and continue to support the economy.

Additionally, the Cash Reserve Ratio was reduced to 4.25%, from 5.25% in their March 2020 meeting, to inject liquidity to banks for onward lending to businesses and households that have been adversely affected by the Coronavirus pandemic.

2020 Key Highlights:

- In May, Moody’s Credit Agency released its rating outlook where it changed Kenya’s sovereign credit outlook to “negative”, from a previous outlook of “stable”, but affirmed the earlier on B2 credit rating. The agency highlighted that the negative outlook was a result of rising financial risks brought about by the country’s large borrowing requirements especially during this time where the fiscal outlook is deteriorating due to lower revenue collections. According to Moody’s, the large borrowing needs, the negative fiscal outlook, will and continues to expose Kenya to exchange and interest rate shocks thus threatening any fiscal consolidation measures that had been set by the government. For more information, see our Cytonn Weekly #08/2020,

- During the second quarter of the year, the government was able to receive funds from international organizations to help the country fight against the negative effects of the pandemic. The table below shows the funds the government has received so far towards supporting the economy during the Coronavirus pandemic period;

|

Entity |

Amount Received in Kshs bn |

|

Central Bank of Kenya |

7.4 |

|

International Monetary Fund |

78.7 |

|

International Development Association (IDA) |

80 |

|

World Bank |

80 |

|

International Bank for Reconstruction and Development |

26.6 |

|

Total |

272.7 |

For more information, see our Cytonn Weekly #19/2020 and Cytonn Weekly #20/2020,

- The Kenyan President signed the Finance Bill 2020 and below are some of the key highlights affecting investments decisions more directly:

-

- Under the Income Tax Act, the key highlights included:

-

-

- Extending the upper limit of the Residential Income Tax to Kshs 15.0 mn from Kshs 10.0 mn to allow landlords with rental income of between Kshs 288 and Kshs 15.0 mn to access the more concessional tax rate of 10% of gross income, and reduce administrative costs of ascertaining profit for such landlords,

- Introduction of a minimum tax, to be introduced at a rate of 1.0% of the gross turnover. This new tax will apply to all persons whether they’re making profits or incurring losses.

- Introduction of Digital Service Tax, to be introduced at a rate of 1.5% of the gross transaction value, to be charged on individuals who generate income from the provision of services through the digital market place., and,

- Some allowable items such as (i) any entrance fee or annual subscription paid during that year of income to a trade association, (ii) capital expenditure on expenses relating to authorization and issue of shares, debentures or similar securities offered for purchase, listing on any securities exchange and acquiring a rating for purposes of listing, (iii) income from a registered home ownership savings plan, and, (iv) Income from employment paid in the form of bonuses, overtime, and retirement benefits to employees whose taxable employment income before bonus and overtime allowances does not exceed the lowest tax band will now not be tax allowable.

-

- The National Treasury released the 2020/2021 fiscal year budget. The total FY’2020/21 budget is estimated at Kshs 3.2 tn, a 2.6% increase from the Kshs 3.1 tn revised FY’2019/20 budget, mainly due to an 18.1% increase in the Consolidated Fund Services (CFS) to Kshs 1.0 bn from Kshs 0.9 bn in the FY’2019/20 revised estimates. The increase in Consolidated Fund Services expenditures is mainly as a result of an increase in public debt servicing expenses which will form 88.0% of the total CFS expenditure. For more information our FY 2020/21 Pre-Budget Discussion Note, and,

- The Parliamentary Budgetary Office highlighted in their Budget watch 2020/21 and the Medium Term, that the current budget would most likely not steer the country out of the current crisis. Some of the highlights from the report included;

- Revenue Prospects during the Pandemic: The ordinary revenue collected as of June 2020 was Kshs 1.6 tn, Kshs 300.0 bn (16.0%) below the set target of Kshs 1.9 tn according to the Budget estimates. The National Treasury projects ordinary revenue to decline from Kshs 1,643.4 bn in 2019/20 (revised estimates II) to Kshs 1,621.4 bn in 2020/21. A decline in income tax collection is expected to be among the major drivers of the expected decline in revenue due to income loss by workers across most sectors. According to the treasury, the ministry is targeting a fiscal deficit of 7.3% for FY2021/2022, down from the current financial year’s deficit of 8.4%,

- Debt Management FY’2020/21: The country’s debt servicing will be a significant source of liquidity pressures in FY’2020/21. Public debt service expenses are projected to increase by Kshs 157.7bn (about 20.0%) to Kshs 925.9 bn in FY’2020/21, and,

For more information, see our Cytonn Weekly #37/2020.

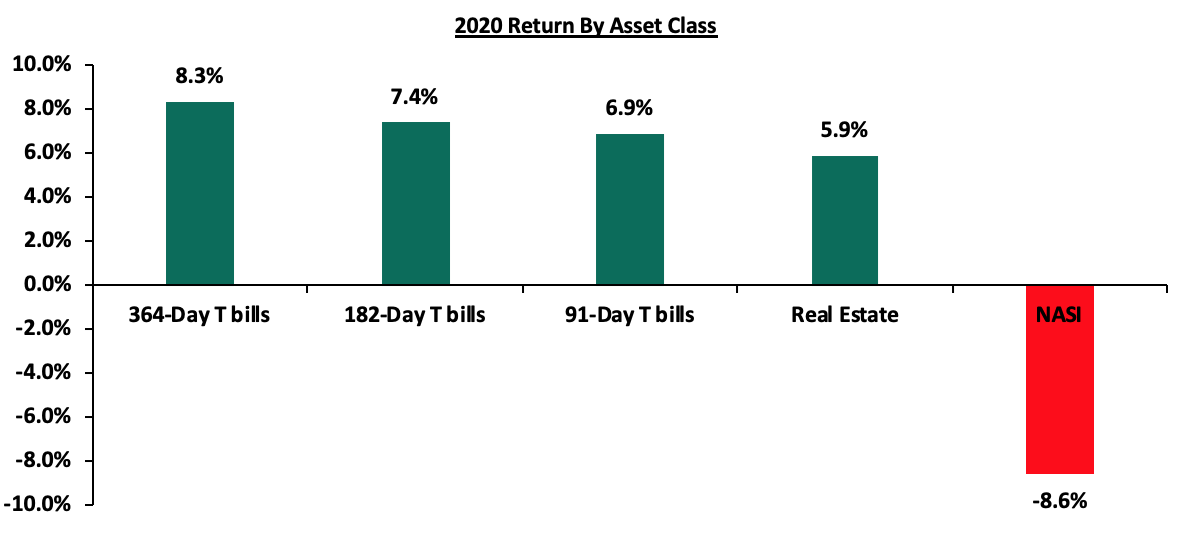

The graph below shows the summary of returns by asset class in 2020 (T- Bonds, T-Bills and Equities). The lowest-performing asset in 2020 was NASI with returns of (8.6%), while the rest had positive returns; the 364-day Government paper closed at a yield of 8.3%, the 182-day and 91-day Government papers recorded yields of 7.4% and 6.9%, respectively, while Real estate recorded returns of 5.9%.

The table below shows the macro-economic indicators that we track, indicating our expectations for each variable at the beginning of 2020 versus the experience

|

Macroeconomic Indicators 2020 Review |

||||

|

Macro-Economic Indicators |

2020 Expectations at Beginning of Year |

Outlook - Beginning of Year |

2020 Experience |

Effect |

|

Government Borrowing |

We expected the government to come under pressure to borrow as it was well behind both domestic and foreign borrowing targets for FY 2019/20, and with the expectations of KRA not achieving the revenue targets and the government having a net external financing target of Kshs 347.0 bn to finance the budget deficit |

Negative |

The government is 11.1% ahead of its prorated borrowing target of Kshs 243.1 bn having borrowed Kshs 270.1 bn. In our view, due to the current subdued economic performance brought about by the effects of the COVID-19 pandemic, the government will record a shortfall in revenue collection with the target having been set at Kshs 1.9 tn for FY’2020/2021 thus leading to a larger budget deficit than the projected 7.5% of GDP, ultimately creating uncertainty in the interest rate environment as additional borrowing from the domestic market may be required to plug the deficit. |

Negative |

|

Exchange Rate |

We project that currency will range between Kshs 101.0 and Kshs 104.0 against the USD in 2019, with continued support from the CBK in the short term through its sufficient reserves currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover |

Neutral |

The Kenya Shilling depreciated by 7.7% against the US Dollar to close at Kshs 109.2 in 2020, compared to Kshs 101.3 at the end of 2019. We expect the currency to remain under pressure as the dollar demand for trade and government debt service outweighs the dollar inflows as some of the sectors like tourism are affected. |

Negative |

|

Interest Rates |

Despite the expectations of a bias towards expansionary monetary policy in 2020, we expect slight pressure on interest rates following the repeal of the interest rate cap which in effect is expected to result in increased competition for bank funds from both the private and public sectors as the Government tries to raise funds to plug in the budget deficit |

Neutral |

Yields on government securities are at risk of increasing due to the expected increase in government debt requirements. This is so despite the accommodative stance adopted by the Monetary Policy Committee. |

Neutral |

|

Inflation |

Inflation was expected to average 5.2%, within the government target range of 2.5%- 7.5%, compared to 7.0% last year |

Positive |

Having averaged 5.2% in 2020, we project inflation to remain within the central Banks target. |

Positive |

|

GDP |

GDP growth was projected to come in at between 5.7%, slightly higher than our 5.6%, 2019 expectations, but similar to the 5-year historical average of 5.7% |

Neutral |

After having contracted in the first half of 2020, the economy is projected to start recovering with the GDP growth for 2021 projected at *% |

Negative |

|

Investor Sentiment |

We expect 2020 to register improved foreign, mainly supported by long term investors who enter the market looking to take advantage of the current low/cheap valuations in select sections of the market |

Positive |

With economic recovery and companies having positive valuations we are projecting an improvement in investor sentiment |

Positive |

|

Security |

We expect security to be maintained in 2020, especially given that the political climate in the country has eased |

Positive |

The political climate in the country eased during the year with major discussions revolving around the containment of the pandemic. |

Positive |

Since the beginning of the year, the notable changes we have seen out of the seven metrics that we track, fall under exchange rate and GDP, where both changed from neutral to negative as highlighted in the summary above. In conclusion, macroeconomic fundamentals showed mixed performances during the year but we expect a recovery in 2021 supported by the improving business conditions in the country. This will, however, be highly dependent on how well the government can handle the pandemic which remains a major concern.