The Kenyan Economy is projected to grow at an average of 5.4% according to various organizations as shown below.

|

No. |

Organization |

Q1’2021 Projections |

Q1’2020 Projections |

|

1. |

International Monetary Fund |

4.7% |

6.0% |

|

2. |

Cytonn Investments Management PLC |

4.0% |

4.3% |

|

3. |

Central Bank of Kenya |

6.4% |

3.4% |

|

4. |

National Treasury |

7.0% |

6.0% |

|

5. |

UNCTAD |

5.7%* |

5.5% |

|

6. |

Africa Development Bank (AfDB) |

5.0% |

6.0% |

|

7. |

World Bank |

4.7% |

6.0% |

|

Average |

5.4% |

5.3% |

|

|

* Forecasted in Q4’2020 |

|||

Source: Cytonn Research

The growth is largely supported by the opening up of the country for business which is projected to help sectors like tourism, hospitality and trade etc. which were worst hit by the pandemic, to recover. There was a general optimism in the first quarter with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first two months averaging at 52.3, which is higher than the 49.4 recorded during a similar period in 2020 pointing to a solid improvement in the private sector. Also, from the Kenya Revenue Authorities collections it was clear that the economy was doing much better with the collections for the month of March, increasing by 11.2% to Kshs 144.6 bn from the Kshs 127.7 bn collected in February 2021.

The country however saw two of the key rating agencies revise the countries credit outlook with the Standard & Poor’s, lowering its long-term foreign and local currency sovereign credit ratings on Kenya to 'B' from 'B+’ while Fitch Rating affirmed Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'B+' with a Negative Outlook. The revisions were on the back of lower economic performance due to the pandemic and the high debt levels increasing the country’s vulnerability

Despite the positivity at the beginning of the year, the macroeconomic environment in Kenya has come under pressure towards the end of Q1’2021, as a result of;

- Expectations of lackluster economic growth, following fears of a third wave of COVID-19 and the announcement of new restrictions measures by the government,

- Volatility in the foreign exchange market and the decline in the forex reserves to USD 7.3 bn equivalent to 4.5 months of import cover, and,

- Declining business conditions as evidenced by the Stanbic Bank Monthly Purchasing Manager’s Index (PMI), which declined to 50.9 in February, from 53.2 the previous month.

Inflation:

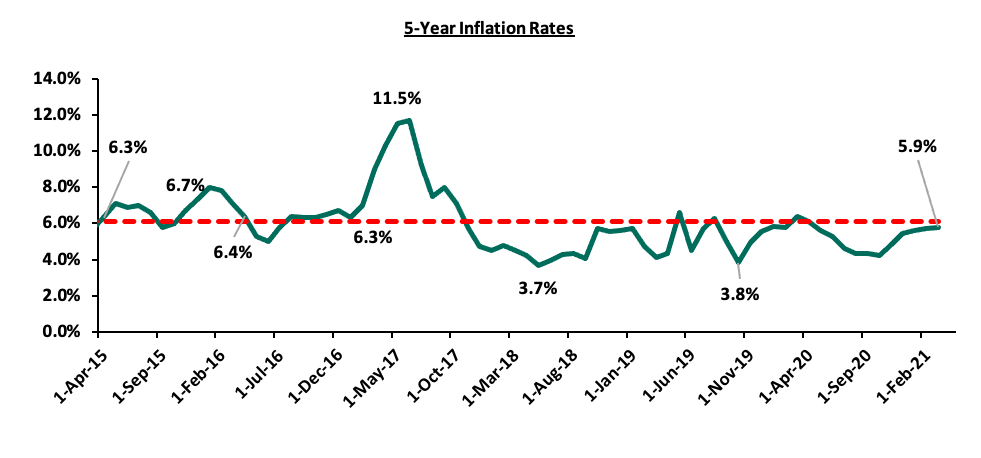

The average inflation rate declined to 5.8% in Q1’2021 compared to 6.1% in a similar period in 2020. Inflation for the month of March came in at 5.9% with the m/m inflation from the 5.8% recorded in February. The rising inflation rate can be attributed to the rising fuel prices since the start of the year. Going forward, we expect inflation to be higher than 5.2%, which was the average in 2020, but remain within the government target range of 2.5% - 7.5%, mainly due to the rising global fuel prices and the new taxes introduced at the start of the year that will be transmitted to the final consumers.

Below chart is the inflation chart for the last five years:

The Kenya Shilling:

The Kenya Shilling depreciated against the US Dollar by 0.3% in Q1’2021, to close at Kshs 109.5, from Kshs 109.2 at the end of Q4’2020, attributable to the importer dollar demands outweighing inflows from sectors such as agriculture and remittances. During the week, the Kenya Shilling appreciated against the US Dollar by 0.4% to close at 109.5, from 109.8 the previous week. We expect the shilling to continue depreciating in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus outbreak, which has seen investors continue to prefer holding their investments in dollars, other hard currencies and commodities, and,

- Continued strengthening of the US Dollar against major currencies as evidenced by the 3.7% gain in the ICE U.S. Dollar Index as compared to a 6.7% decline in 2020. The ICE U.S. Dollar Index is a benchmark index that measures the international value of the US Dollar where investors can monitor the value of the US Dollar relative to a basket of six other world currencies.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 7.3 bn (equivalent to 4.5-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. The Forex reserves have been declining and this may mean that the government of Kenya will struggle to support the local currency when it depreciates if the trend continues,

- The improving current account position which narrowed to 4.6% of GDP in the 12 months to February 2021 compared to 5.8% of GDP during a similar period in 2020, and,

- Improving diaspora remittances evidenced by an 18.9% y/y increase to USD 260.3 mn in February 2021, from USD 219.0 mn recorded over the same period in 2020, has cushioned the shilling against further depreciation.

Monetary Policy:

The Monetary Policy Committee (MPC) met twice in Q1’2021, maintaining the Central Bank Rate (CBR) at 7.0% in both meetings. In the two sittings held in Q1’2020, the MPC concluded that the current accommodative monetary policies together with the package of policy measures implemented over the last year have protected the economy from substantial decline and supported the most vulnerable citizens, and as such decided to retain the Central Bank Rate (CBR) at 7.0% for the eighth time since April 2020 when the rate was lowered to 7.00% from 7.25%.

Q1’2021 Highlights:

- Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, where the Kenyan economy recorded a 1.1% contraction in Q3’2020 down from a growth of 5.8% recorded in a similar period in 2019. This was the second consecutive contraction, following the 5.7% contraction recorded in Q2’2020. Consequently, the average GDP growth rate for the 3 quarters in 2020 is a contraction of 0.6%, a decline from 5.5% recorded during a similar period in 2019,

- KNBS also released the Quarterly Balance of Payments report for Q3’2020 highlighting that the balance of payments deteriorated in Q3’2020, coming in at a deficit of Kshs 178.0 bn from a surplus of Kshs 13.2 bn in Q3’2019. This translates to a balance of payment deficit equivalent to 14.5% of GDP in Q3’2020, from a deficit equivalent to 1.1% of GDP recorded in Q3’2019. The decline was mainly due to the 73.5% decline in the Financial Account balance to Kshs 32.1 bn in Q3’20202 from Kshs 120.9 bn recorded in Q3’2019. For more information, see our Cytonn monthly January 2021,

- The National Treasury released the Supplementary Budget Estimates I for the 2020/21 fiscal year on the back of a challenging first half of the fiscal year 2020/21, with the challenges including the adverse effects of the COVID-19 pandemic on the economy. The proposed budget was tabled to the National Assembly for debate and approval at a later date. The Treasury proposes an increase in the gross total supplementary budget by Kshs 120.8 bn to Kshs 3,036.5 bn from Kshs 2,915.7 bn previously. The proposed budget increment is attributable to COVID-19 related expenditure and efforts by the government to spur economic activity. For more information, see our Cytonn Weekly #06/2021,

- The Kenyan authorities and the International Monetary Fund (IMF) mission team reached an agreement on economic and structural policies that would reinforce a 38-month program under the Extended Fund Facility (EFF) and Extended Credit Facility (ECF). Notably, the credit facility is approximately USD 2.4 bn (Kshs 262.9 bn) and is meant to help Kenya respond to the unprecedented shock of the COVID-19 pandemic as well as reduce Kenya’s debt levels. The agreement is subject to approval from the IMF’s Management and Executive Board consideration, which is expected to happen in the coming weeks. For more information, see our Cytonn Weekly #07/2021,

- Standard & Poor’s, a US-based credit rating agency, lowered its long-term foreign and local currency sovereign credit ratings on Kenya to 'B' from 'B+’, on the back of the effects of the ongoing pandemic which resulted in GDP contraction of 5.7% and 1.1% in Q2’ and Q3’2020, respectively, and increasing debt levels, which in turn increase the country’s vulnerability to debt defaults. For more information, see our Cytonn Weekly #10/2021, and,

- Fitch Rating affirmed Kenya's Long-Term Foreign-Currency Issuer Default Rating (IDR) at 'B+' with a Negative Outlook. The agency pointed out that the rating reflected a track record of strong growth, relative macroeconomic stability and a favorable government debt structure which was balanced by negatives such as rising public debt levels and high net external indebtedness. On the other hand, the Negative Outlook on the ratings reflected the underlying weaknesses of the public finances and the uncertain pace of planned fiscal consolidation. Below is a summary of the credit rating on Kenya so far:

-

Rating Agency

Previous Rating

Current Rating

Current Outlook

Date Released

S&P Global

B+

B

Stable

5th March 2021

Moody’s

B1

B2

Negative

19th June 2020

Fitch Ratings

B+

B+

Negative

26th March 2021

-

The agency however warned that they would downgrade the rating based on; i) the country’s failure to stabilize the debt to GDP ratio which is currently at 69.6%, ii) political instability around the upcoming elections, iii) the continued impact of COVID-19 which could lead to delays in the economic recovery, and, iv) a sustained fall in exports, remittances, and other external receipts or the emergence of strains on external financing.