According to the 2021 Economic Survey Report by the Kenya National Bureau of Statistics (KNBS), the Kenyan economy contracted by 0.3% in 2020, from the restated 5.0% growth recorded in 2019 due to the lockdowns following the emergence of the COVID-19 pandemic. The contraction was spread across all sectors of the economy but the sectors that were hard hit included the accommodation and food serving activities, education, and professional and administrative services. Notably, the tourism and hospitality sector recorded reduced activities following the containment measures leading to a 47.7% decline in food and accommodation services in 2020.

In 2021, the Kenyan economy is projected to grow at an average of 5.3% as the economy opens up but the largest challenge remains how fast the vaccination rollout shall be done and how fast business shall take to recover. The table below shows the projections by various organizations:

|

No. |

Organization |

2021 Projections |

|

1. |

International Monetary Fund |

7.6% |

|

2. |

National Treasury |

6.2% |

|

3. |

World Bank |

4.5% |

|

4. |

S&P Global |

4.4% |

|

5. |

Cytonn Investments Management PLC |

4.0% |

|

Average |

5.3% |

|

Source: Cytonn Research

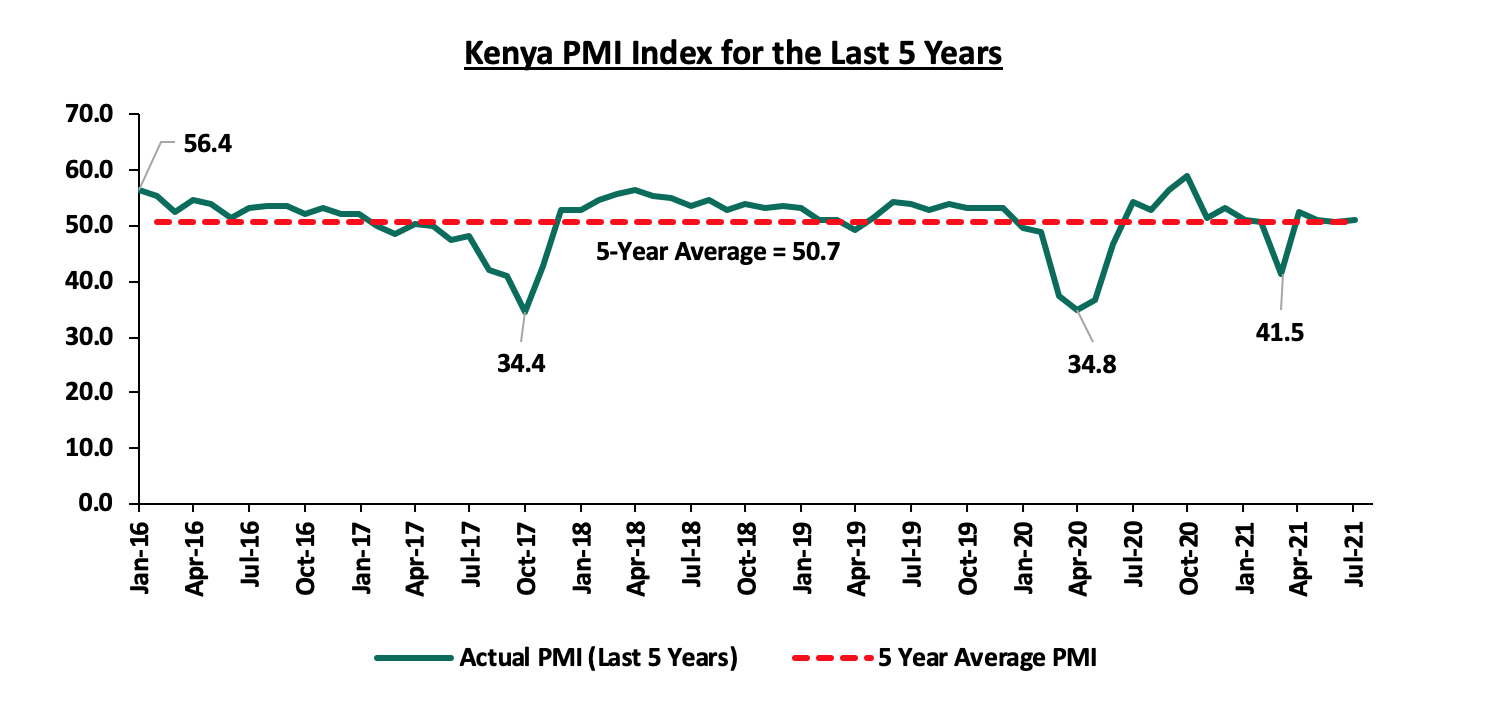

Business conditions in the Kenyan private sector recorded solid improvement in the third quarter, with the average Stanbic Bank Monthly Purchasing Managers’ Index (PMI) for the first eight months averaging 50.2, higher than the 45.2 recorded during a similar period in 2020, and the 50.0 recorded at the end of Q2’2021. For the month of August 2021, the index increased to 51.1 from the 50.6 recorded in July 2021 partially driven by an acceleration in new order growth and a rise in sales in four of the five monitored sectors. Below is the PMI chart for the last five years:

Inflation:

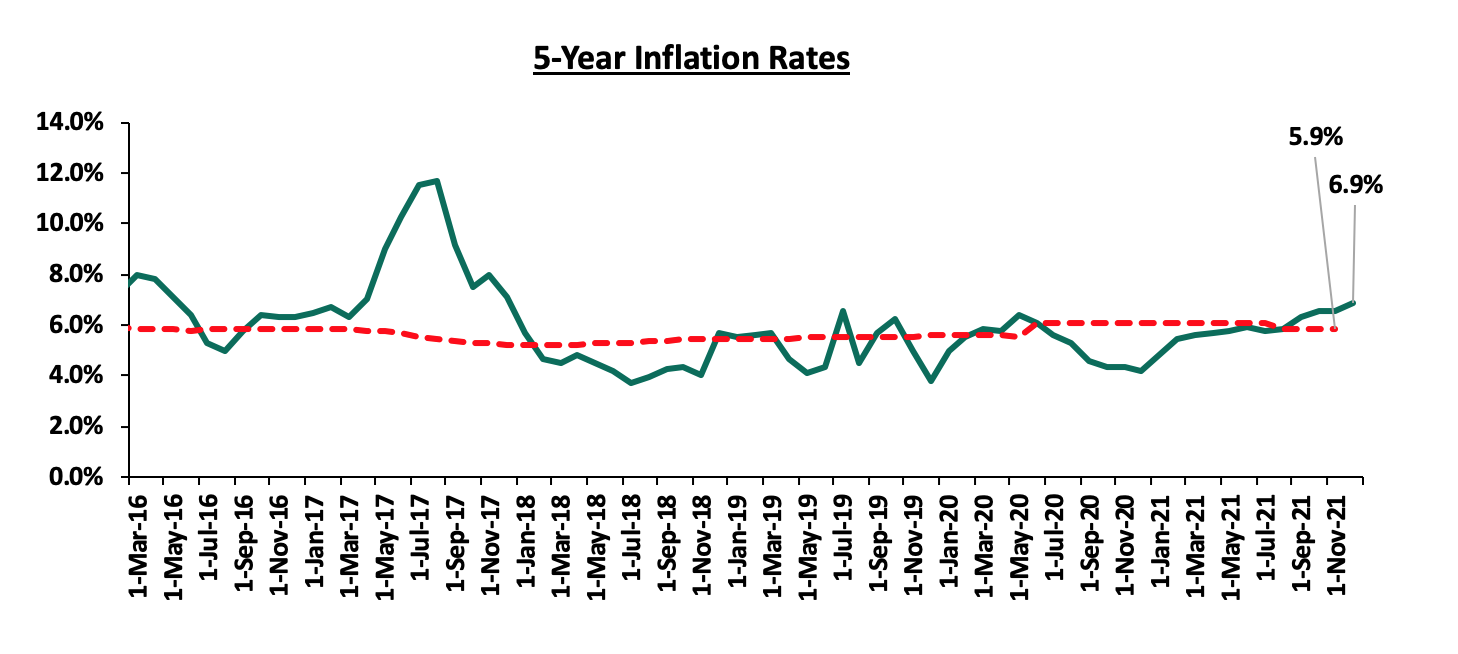

The overall inflation has been on the rise with the inflation ending the quarter at 6.9% in September. The increase in the inflation rate is attributable to the rising food and fuel prices since the start of the year. Below is the inflation chart for the last five years:

September Inflation

The y/y inflation for the month of September increased to 6.9%, from the 6.6% recorded in August, in line with our expectations. This is the highest reading since the pandemic begun. The increase was mainly attributable to the increase in the y/y food and non-alcoholic beverages, transport, Housing, water, electricity, gas and other Fuels inflation prices which increased by 10.6%, 9.2 and 6.1% respectively. Food and non-alcoholic beverages index has had the greatest increase year on year attributable to supply constraints following the erratic weather while the transport index increased the most on a m/m basis attributable to the increase in fuel prices witnessed in September.

The table below shows a summary of both the year on year and month on month commodity groups’ performance;

|

Major Inflation Changes – September 2021 |

|||

|

Broad Commodity Group |

Price change m/m (September-21/August-21) |

Price change y/y (September-21/September-20) |

Reason |

|

Food & Non-Alcoholic Beverages |

0.1% |

10.6% |

The m/m increase was mainly contributed by increase in prices of carrots, oranges and cabbages among other food items. The increase was however mitigated by a decline in prices of tomatoes, sifted maize flour and spinach |

|

Housing, Water, Electricity, Gas and other Fuel |

0.9% |

6.1% |

The m/m increase was as a result of increase in the price electricity and cooking gas despite the slight decline in the price of single room house rent

|

|

Transport Cost |

1.2% |

9.2% |

The m/m increase was as a result of the increase in prices of super petrol and diesel in the month of September after the fuel subsidy that was introduced in April was lifted |

|

Overall Inflation |

0.3% |

6.9% |

The m/m increase was due to a 1.2% increase in the transport index as compared to the 0.3% decline in the month of August |

Source: KNBS

Going forward, we expect the inflation pressures to remain elevated but within the government’s set range of 2.5% - 7.5%. The key drivers remain the high fuel and food prices as well as the impact of the increase in tariffs and taxes following the recent communication by KRA on inflation adjustment on Specific Rates of Excise Duty effective from 1st October 2021. The rising inflation remains a concern as the IMF has already cautioned the government against exceeding the set target rate as this will increase the risk of an inability to access further credit facilities from the international lender. We anticipate continued pressure on the government to keep the inflation under control before the next IMF evaluation test date which is in December 2021.

The Kenya Shilling:

The Kenya Shilling depreciated against the US Dollar by 2.4% in Q3’2021, to close at Kshs 110.5, from Kshs 107.9 in Q2’2021, marking a 9-months low. The depreciation is partly attributable to increased import activities by local traders as well as increased dollar demand across various sectors including energy amidst weak inflows. During the week, the Kenya Shilling depreciated marginally against the US Dollar by 0.1% to close at 110.5, from 110.4 the previous week. We expect the shilling to remain under pressure as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.4 bn (equivalent to 5.8-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July, 2021 coupled with the USD 407.0 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June, 2021, and

- Improving diaspora remittances evidenced by a 14.2% y/y increase to USD 312.9 mn in August 2021, from USD 274.1 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Monetary Policy:

During the quarter, the Monetary Policy Committee (MPC) met twice and in both sittings, maintained the Central Bank Rate (CBR) at 7.0% after concluding that the accommodative stance implemented in April 2020 was having the intended effects on the economy.

However, during the 28th September 2021 sitting, the committee raised concerns on the rising inflation noting that there was need to monitor the inflation and respond to any second round effects in a bid to maintain price stability. Below are some of the key highlights from the meeting:

- Overall inflation stood at 6.6% in August 2021 compared to 6.5% in July, 2021 mainly attributable to increase in food and fuel prices which rose by 10.7% and 9.2%, respectively. Despite the increase, inflation remains within the Government’s target range of 2.5%-7.5% but pressure abides in the short term following the rise in fuel and food prices coupled with the recently implemented tax measures,

- Private sector credit growth has been recovering, having grown by 7.0% in the twelve months to August 2021, an increase from the 6.1% recorded in July 2021. The key sectors supporting this growth include Consumer Durables (20.1%), Transport and Communication (11.8%) and Manufacturing (9.3%), and,

- The current account deficit to GDP is estimated at 5.5% in the 12-months to August 2021, a 0.8% points increase, from 4.7% recorded over a similar period in 2020. Exports of goods remained strong, growing by 11.5% in the eight months to August 2021, compared to a similar period in 2020. Receipts from exports of horticulture and manufactured goods increased by 25.0% and 39.1%, respectively, in the period January to August compared to a similar period in 2020. However, receipts from tea exports declined by 5.8 %, partly attributable to the impact of accelerated purchases in 2020.

The MPC concluded that the current accommodative monetary policy stance remains appropriate and therefore decided to retain the Central Bank Rate (CBR) at 7.00%, in line with our expectations. The Committee will meet again in November 2021, but remains ready to re-convene earlier if necessary.

Q3’2021 Highlights;

- The World Bank Board of Executive Directors approved a USD 130.0 mn (Kshs 14.0 bn) additional loan financing for the Kenya COVID-19 Health Emergency Response Project to facilitate affordable and equitable access to COVID-19 vaccines for Kenyans. The funding will enable Kenya to procure more vaccines through the African Vaccine Acquisition Task Team (Avatt) and the COVID-19 Vaccines Global Access (Covax) facilities in addition to supporting the deployment of the vaccines by boosting the country’s cold-storage capacity. For more information, see our Cytonn Weekly #26/2021,

- The Kenya Revenue Authority (KRA) released the FY’2020/2021 revenue performance, highlighting that the total revenue collected was Kshs 1.67 tn, against the revised target of Kshs 1.65 tn, representing a performance rate of 101.0%. This is despite the challenges posed by the COVID-19 pandemic on business conditions and people’s income. For more information, see our Cytonn Weekly #27/2021,

- The National Treasury gazetted the revenue and net expenditures for the first two months of FY’2021/2022, highlighting that total revenue collected as at the end of August 2021 amounted to Kshs 272.4 bn, equivalent to 15.3% of the original estimates of Kshs 1,775.6 bn and is 84.1% ahead of the prorated estimates of Kshs 148.0 bn. The performance is mainly attributable to enhanced compliance enforcement efforts, introduction of new taxes such as digital services tax and reopening of the economy as more people continue to get vaccinated leading to improved domestic consumption and external demand. On the other hand, the total expenditure amounted to Kshs 407.5 bn, equivalent to 12.8% of the original estimates of Kshs 3,193.0 bn, and is 76.6% of the prorated expenditure estimates of Kshs 532.2 bn. For more information, see our Cytonn Weekly #37/2021, and,

- The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum wholesale and retail petroleum prices effective 15th September 2021 to 14th October 2021, highlighting that the prices of Super Petrol, Diesel and Kerosene had increased to Kshs 134.7, Kshs 115.6 and Kshs 110.8 respectively, attributable to the lifting of the fuel subsidy introduced in April, 2021. For more information, see our Cytonn Weekly #37/2021.

Going forward, we expect Kenya’s economy to record a gradual recovery in 2021, growing at a rate of 4.0%, from the 0.3% contraction recorded in 2020. However, we foresee the emergence of new COVID-19 variants, slow vaccine distribution, rising inflation coupled with the high debt appetite to slow down the recovery.