According to the Kenya National Bureau of Statistics (KNBS) Q1’2022 Quarterly GDP Report the Kenyan economy recorded a 6.8% expansion in Q1’2022, up from the 2.7% growth recorded in Q1’2021. The performance was bolstered by rebounds in most economic activities, which had contracted significantly in the Q1’2021 as a result of COVID-19 control measures. The Kenyan Economy is projected to grow at an average of 5.1% in 2022 according to various organizations as shown below:

|

No. |

Organization |

2022 Projections |

|

|

International Monetary Fund |

5.7% |

|

|

National Treasury |

6.0% |

|

|

World Bank |

5.5% |

|

|

S&P Global |

4.4% |

|

|

Cytonn Investments Management PLC |

4.0% |

|

Average |

5.1% |

|

Source: Cytonn Research

The growth will largely be supported by the gradual recovery of the economic environment as well as continued vaccine inoculation. However, risks lie on the downside on the economic outlook mainly due to;

- The persistent geopolitical pressures occasioned by the Russian-Ukrainian war which has seen increased inflationary pressures,

- Persistent supply chain constraints which have led to the rise of commodity prices,

- The resurgence of COVID-19 infections in the country and the country’s trading partners, and,

- Uncertainties surrounding the upcoming August 2022 elections which could lead to economic disruptions.

Key to note, Kenya’s general business environment has continued to deteriorate with the average Purchasing Manager’s Index for the first five months of 2022 standing at 49.7 mainly on the back of increased commodity prices which have seen reduced consumer spending.

Inflation:

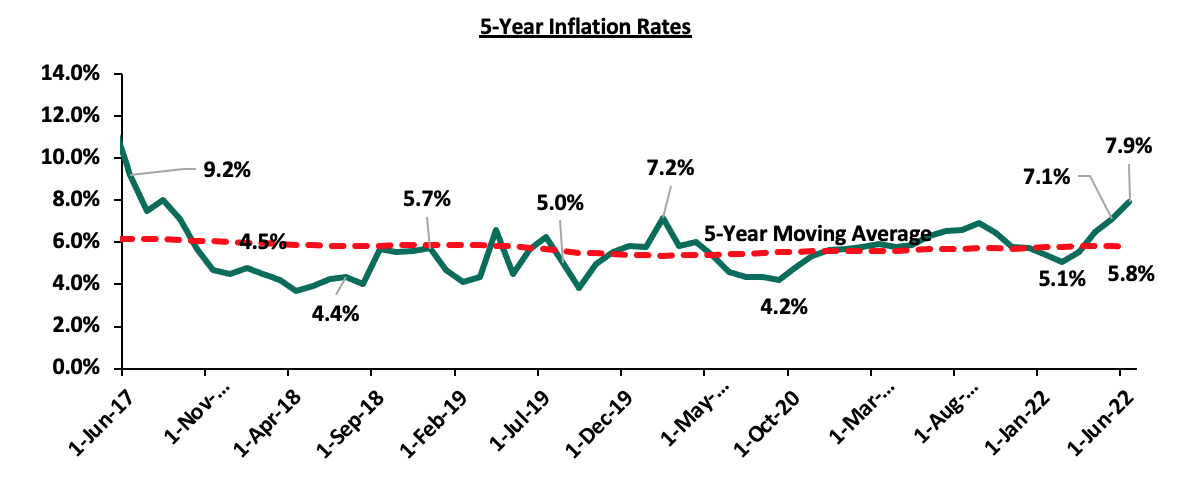

The average inflation rate increased to 6.3% in H1’2022, compared to 5.9% in H1’2021, attributable to 13.8% and 7.1% year on year increases in food and oil prices, respectively, in H1’2022. Notably, the price of super petrol, diesel and kerosene have increased by 22.7%, 26.6% and 23.6% to Kshs 159.2 per litre, Kshs 140.0 per litre and Kshs 127.9, from Kshs 129.7 per litre, Kshs 110.6 per litre and Kshs 103.5 per litre, year to date. Inflation for the month of June 2022 came in at 7.9%, the highest since August 2017, and an increase from the 7.1% recorded in May, attributable to a 1.2%, 1.5% and 0.9% increase in the food and non-alcoholic beverages index, household and equipment as well as the transport index. The June 2022 y/y inflation rate is the highest since August 2017. Below is the inflation chart for the last five years:

For the first time in five years, Kenya’s inflation has surpassed the government’s target range of 2.5% - 7.5%, despite efforts by the Monetary Policy Committee (MPC) to contain the rise by raising the Central Bank Rate (CBR) to 7.5%. The increase is largely attributable to the increase in food and fuel prices amid supply chain constraints coupled with a depreciating currency. This comes at a time, when the government expected a USD 244.0 mn (Kshs 28.8 bn) approval from the International Monetary Fund (IMF) under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) arrangement whose one of the requirements is that inflation remains within the government range. Going forward, we expect inflationary pressures to remain elevated on the back of rising fuel prices and consequently an increase in the rise of basic commodities given that fuel is a major input in most sectors. Additionally, the National Treasury has indicated that the fuel subsidy under the Petroleum Development Fund is inefficient and is likely to adjust the fuel prices upwards with a view of eliminating the fuel subsidy in the FY’2022/2023. The move is expected to increase inflationary pressures even further as fuel is a major input to the inflation basket and consequently put more pressure on the government to raise the CBR. However, we believe that the fiscal stance is likely to have minimal impact on inflation given that the rise is primarily due to external shocks and is largely pegged on how soon supply chains stabilize.

The Kenyan Shilling:

The Kenyan Shilling depreciated against the US Dollar by 4.1% in H1’2022, to close at Kshs 117.8, from Kshs 113.1 at the end of Q4’2021, partly attributable to increased dollar demand in the energy, oil and manufacturing sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. During the week, the Kenya Shilling depreciated against the US Dollar by 0.2% to close at 117.9, from 117.7 the previous week. We expect the shilling to remain under pressure in 2022 as a result of:

- Continued rise in global crude oil prices on the back of persistent supply chain bottlenecks further exacerbated by the Russian-Ukrainian geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the resurgence of COVID-19 infections in the country,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever-present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.1% of GDP in the 12 months to April 2022 compared to the 4.8% for a similar period in 2021. The wider deficit reflects a higher import bill, particularly for oil, which more than offset increased receipts from agricultural and services exports, and remittances, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 19.8% to Kshs 8.5 tn in April 2022, from Kshs 1.4 tn in April 2011 thus putting pressure on forex reserves to service some of the public debt. It is worth noting that the average GDP growth over the same period has been 3.9%, an indicator that the increase in debt is not translating into GDP growth.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 8.0 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 750.0 mn World Bank loan facility received in March 2022 and are expected to be boosted further by the expected USD 244.0 mn from the International Monetary Fund (IMF), and,

- Improving diaspora remittances evidenced by a 7.6% y/y increase to USD 339.7 mn as of May 2022, from USD 315.8 mn recorded over the same period in 2021 which has continued to cushion the shilling against further depreciation. In the May 2022 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 59.9% in the period, followed by Europe at 17.8% while the rest of the world accounted for 22.3% of the total.

Monetary Policy:

The Monetary Policy Committee (MPC) met thrice in H1’2022 and for the first time since April 2020, increased the Central Bank Rate by 50.0 bps to 7.5% from 7.0%, in the third sitting in May 2022. The MPC noted that there was a scope for tightening of the monetary policy given the high rate of inflation which was expected to continue increasing on the back of rising global fuel and commodity prices. The Committee will meet again in July 2022, but remains ready to re-convene earlier if necessary.

Fiscal Policy:

The total Kenyan budget for the FY’2022/2023 is projected to increase by 10.3% to Kshs 3.3 tn from the Kshs 3.0 tn in FY’2021/2022 while the total revenue is set to increase by 20.0% to Kshs 2.4 tn from the Kshs 2.0 tn in FY’2021/2022. The increase is mainly due to a 25.4% increase in ordinary revenue to Kshs 2.1 tn for FY’2022/2023, from the Kshs 1.8 tn in FY’2021/22 with the increase largely depended on the continued economic recovery. However, risks abound the projection mainly on the back of uncertainties surrounding the resurgence of COVID-19 infections as well as the August 2022 elections that could disrupt the economic environment. For more information, see our note on Kenya’s FY’2022/2023 Budget Review.

For the FY’2021/2022, we expect the government to meet its revenue collection target having collected Kshs 1,718.7 bn, equivalent to 95.0% of the revised estimates of Kshs 1,808.3 bn for FY’2021/2022 and 103.7% of the prorated estimates of Kshs 1,657.6 bn in the first eleven months of FY’2021/2022. Notably, the total expenditure amounted to Kshs 2,636.6 bn, equivalent to 80.4% of the revised estimates of Kshs 3,279.8 bn, and 87.7% of the prorated expenditure estimates of Kshs 3,006.5 bn, an indication of modest spending by the government. The total borrowings as at the end of May 2022 amounted to Kshs 955.7 bn, equivalent to 66.3% of the revised estimates of Kshs 1,441.1 bn and 72.3% of the prorated estimates of Kshs 1,321.0 bn.

Going forward, we expect the government to implement additional initiatives to help maintain the current trend of meeting revenue collection targets.

Weekly Highlights:

- Q1’2022 GDP Growth

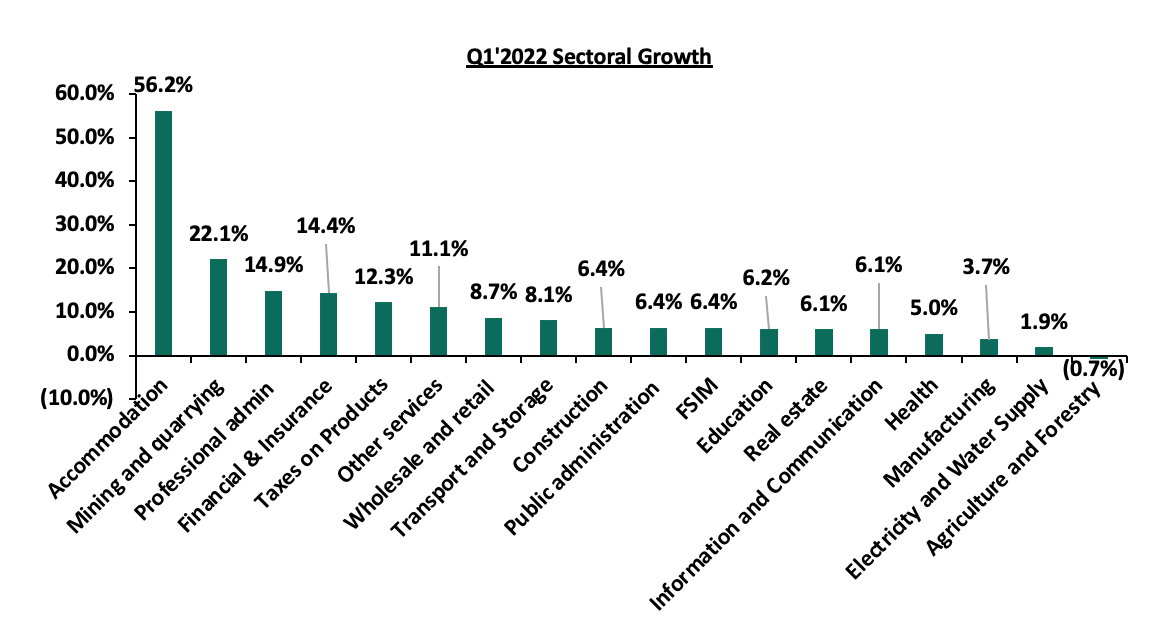

The Kenya National Bureau of Statistics (KNBS) released the Quarterly Gross Domestic Product Report, highlighting that the Kenyan economy recorded a 6.8% growth in Q1’2022, up from the 2.7% growth recorded n Q1’2022, pointing towards continued economic recovery. The performance was largely supported by rebounds in most economic activities, with significant growth being recorded in sectors like transportation and storage (8.1%), accommodation and Food Serving activities (56.2%) as well as Professional, administrative and Support Services (14.9%) among others. The key take-outs from the report include;

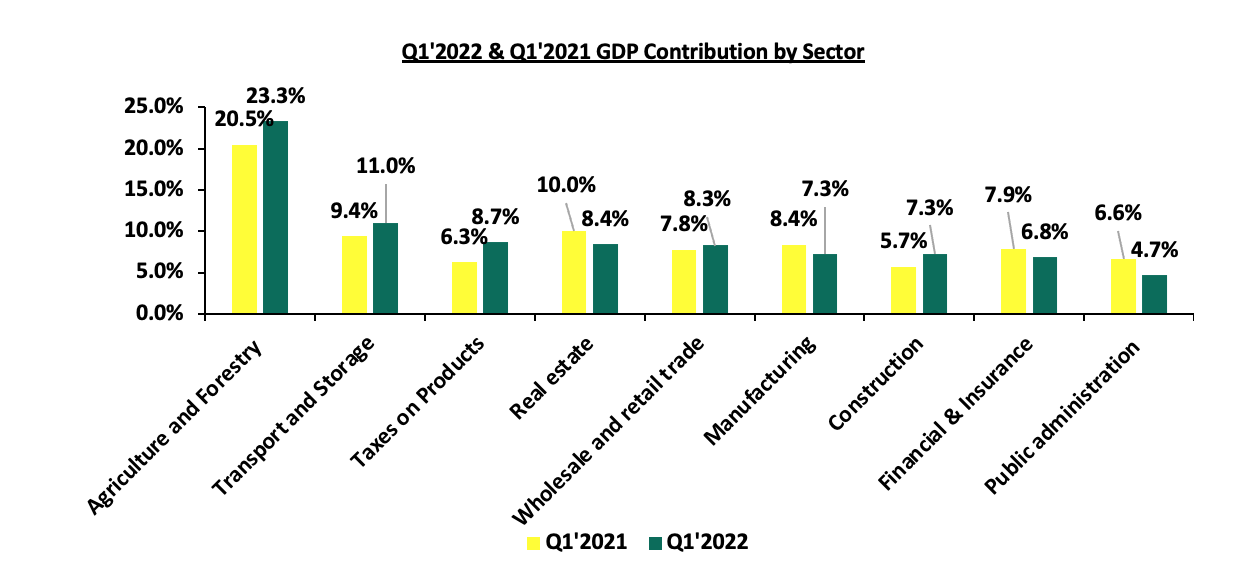

- Sectoral Contribution to Growth - The biggest gainer in terms of sectoral contribution to GDP was agriculture, increasing by 2.8% points to 23.3% from 20.5% Q1’2021, while public administration was the biggest loser, declining by 1.9% points to 4.7% in Q1’2022, from 6.6% in Q1’2021. The accommodation and food services sector recorded the highest growth rate in Q1’2022 growing by 56.2% compared to the 33.3% contraction recorded in Q1’2021 mainly attributable to the relaxation of most COVID – 19 travel and other restrictions which saw activity in the sector increase. The chart below shows the top contributors to GDP by sector in Q1’2022:

Source: KNBS Q1’2022 and Q1’2021 GDP Report

- Continued subdued Growth in the Agricultural Sector – Agriculture, Forestry and Fishing activities recorded a decline of 0.7% in Q1’2022 compared to a 0.4% growth in Q1’2021. The contraction during the quarters was primarily attributed to lower rainfall in Q4’2021, as well as the delayed onset of rains during the quarter under review, resulting to lower agricultural production. The sector's poor performance was reflected by declines recorded in horticultural exports and tea production. However, increased production of cane, milk, and coffee cushioned the sector from a deeper slump,

- Gradual growth in the manufacturing sector - The manufacturing sector reported a growth of 3.7% in Q1’2022 compared to a 2.1% growth in a similar period of review in 2021, mainly supported by a 6.4% growth in the food sector. However, the sectoral contribution declined by 1.1% points to 6.8%, from 7.9% in Q1’2021, and,

- Rebound in the Accommodation and Food services sector- The sector recorded 56.2% growth in Q1’2022 compared to a 33.3% contraction recorded in Q1’2021, attributable to the relaxation of COVID-19 containment restrictions on the back of a positive vaccine rollout. Additionally, the sectoral contribution increased to 1.0% from 0.5% recorded in Q1’2021. The chart below shows the different sectoral GDP growth rates for Q1’2022:

Source: KNBS Q1’2022 GDP Report

According to the National Treasury, the Kenyan economy is expected to grow by 6.0% in 2022 supported by recovery in the agriculture and service sectors. However, we note that the agricultural sector remains subdued largely due to erratic weather conditions and constrained supply of products such as fertilizers. Going forward, we expect Kenya’s GDP to continue growing in tandem with the global economy supported by recovery in sectors like accommodation and food services sector, manufacturing and retail. On the downside, concerns remain elevated on the resurgence of COVID-19 infections and the upcoming August elections.

- Kenya Q1’2022 Balance of Payments

The Kenya National Bureau of Statistics released the Quarterly Balance of Payments report for Q1’2022 report highlighting that Kenya’s balance of payments deteriorated in Q1’2022, coming in at a deficit of Kshs 120.6 bn, from a deficit of Kshs 25.3 bn in Q1’2021. The performance was mainly attributable to the 186.0% decline in the financial account balance. The deterioration was however mitigated by a 39.7% contraction of the current account deficit to Kshs 95.0 bn, from Kshs 157.5 bn in Q1’2021. The table below shows the breakdown of the various balance of payments components, comparing Q1’2022 and Q1’2021:

|

Q1’2022 Balance of Payments |

|||

|

Item |

Q1'2021 |

Q1'2022 |

% Change |

|

Current Account Balance |

(157.5) |

(95.0) |

(39.7%) |

|

Capital Account Balance |

2.2 |

7.4 |

228.8% |

|

Financial Account Balance |

107.3 |

92.2 |

(186.0%) |

|

Net Errors and Omissions |

17.0 |

(125.2) |

(838.5%) |

|

Balance of Payments |

(25.3) |

(120.6) |

376.9% |

All values in Kshs bns

Key take-outs from the table include;

- The current account deficit (value of goods and services imported exceeds the value of those exported) contracted by 39.7% to Kshs 95.0 bn, from Kshs 157.5 bn in Q1’2021, mainly attributable to 19.2% increase in the secondary income balance to Kshs 184.1 bn, from Kshs 154.5 bn recorded in Q1’2020,

- The financial account balance (the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by the foreign buyers) declined by 186.0% to a surplus of Kshs 92.2 bn, from a surplus of Kshs 107.3 bn in Q1’2021. On the other hand, the stock of gross official reserves increased by 14.3% to stand at Kshs 969.3 bn, from 847.8 bn in Q1’2021, and,

- Consequently, the Balance of Payments (BoP) position deteriorated to a deficit of Kshs 120.6 bn from a deficit of Kshs 25.3 bn in Q1’2021, mainly due to the 186.0% decline in the financial account balance.

During the period of review, the Kenya shilling remained under pressure, depreciating by 5.0% y/y to close the quarter at Kshs 115.0, from Kshs 109.5 at the end of Q1’2021. However, the shilling was supported by the sufficient forex reserves held by the Central Bank of Kenya which increased by 6.8% in the same period to close the quarter at USD 7.8 bn, from USD 7.3 bn recorded at the end of Q1’2021. We expect modest recovery in most sectors of the economy in 2022 including the tourism sector which will consequently support the country’s forex reserves. However, the recovery is largely determined by the stability of the global economy as well as the vaccine rollout in the country.

- Finance Act 2022

The Cabinet Secretary for the National Treasury tabled the Finance Bill 2022 on 13th April 2022 to the parliament for discussion and was assented into law by the President of Kenya on 22nd June 2022. As highlighted in our Cytonn Weekly #15/2022, the proposed tax measures in the Finance Bill 2022, were expected to add Kshs 50.4 bn to the exchequer for the fiscal year 2022/23. After discussion and consideration by the parliament, some of the proposals were approved, some rejected and some amended. Below, we highlight the key tax changes in the assented Finance Act as a follow up to our previous highlight;

Under the Income Tax Act;

- The Finance Bill 2022 proposal to increase digital service tax (DST) to 3.0% from the current 1.5% was rejected by the parliament. However, the proposal to exempt non-resident entities with a permanent establishment in Kenya from DST was approved.We expect the products and services offered by digital platforms to continue supporting small business growth at an affordable price. We also expect to see more firms enter the market as this is a welcoming move,

- The Finance bill proposal to increase the Capital Gains Tax (CGT) on transfer or sale of property by an individual or company to 15.0% from the current 5.0% was approved. The bill however, provides an exemption for firms that are certified by the Nairobi International Financial Center Authority, highlighting that the applicable rate on the transfer of an investment shall be the prevailing rate at the time the investment was made if (i) the firm invests Kshs 5.0 bn in Kenya, and, (ii) the transfer of such investment is made after five years. Additionally, the proposal to tax gains from financial derivatives for foreigners under the CGT rate of 15.0% was also approved. However, gains arising from financial derivatives that are traded at the Nairobi Securities Exchange will be exempted.

We expect an increase in the price of property as the move is expected to result in increased dealing and transaction costs. In the financial derivatives market, we expect an even slower uptake with the introduction of the policy,

Under the Excise Duty Act;

- The Finance Bill proposal to empower the Kenya Revenue Authority’s Commissioner General to exempt specific excisable products from the annual inflation adjustments depending on the economic circumstances in the relevant year was approved. However, the Commissioner General has to seek approval from the cabinet secretary.

We expect that this provision will allow the Commissioner General to exempt critical products like fuel from inflationary adjustment particularly for periods when fuel prices are high, in order to prevent further increase in the cost of living, - The Finance Bill 2022 proposal to increase excise duty on various goods such as non-alcoholic beverages, cosmetic and beauty products, powdered beer and spirits, among others was approved. We expect the contribution of excise duty tax to total tax revenue to increase from the current 13.8% as estimated for the Fiscal Year 2022/2023 in the Budget Statement and consequently aid in narrowing the gap between revenues and expenditure, and,

- The Finance Bill proposal to add various goods such as hatching eggs imported by licensed hatcheries, neutral spirits imported by registered pharmaceutical manufacturers and locally manufactured passenger motor vehicles to the list of tax-exempt items was approved by the parliament.

We expect the policy to aid in boosting the manufacturing and health sectors which are part of the big four agenda. On the downside, we expect the policy to have a negative effect on the total excise duty collected.

Under the Value Added Tax Act;

- The Finance Bill 2022 proposal to remove maize flour, cassava flour, wheat and meslin flour from the list of tax-exempt goods under the Second Schedule to the Value Added Tax (VAT) Act 2013 was rejected.

With items like maize flour being a staple meal in Kenyan households, we expect reduced pressure on the cost of living as well as the inflation basket given that food is a headline contributor to Kenya’s inflation.

Overall, we expect the adoption of the Finance Act 2022 will result in an upward adjustment to the Excise Duty Tax, Income Tax, and Value Added Tax, thereby increasing revenue collection. However, we are of the view that the Kenya Revenue Authority should consider more ways to broaden the tax base in order to ensure that the increased taxes do not burden taxpayers and that we reduce our reliance on debt.