Housing Pillar of the Government of Kenya’s Big 4 Agenda. It was incorporated in April 2018 as a non- deposit taking financial institution under the supervision of the Central Bank of Kenya with the single purpose of providing long-term funds to primary mortgage lenders (Banks, Micro Finance Banks and SACCOs) in order to increase the availability and affordability of mortgage loans to Kenyans. The company was licensed by the Central Bank of Kenya (CBK) in August 2018 and began operations in September 2020. We have previously covered four topicals on KMRC namely;

- Kenya Mortgage Refinance Company, in April 2018 where we introduced KMRC as a mortgage liquidity facility and demystified the conditions necessary for the KMRC to thrive,

- Kenya Mortgage Refinance Company Update in April 2019, where we reintroduced what mortgage refinance companies are, why they are needed, how they operate, what benefits they give,

- Kenya Mortgage Refinance Company Recap in November 2020, where we drew lessons from Saudi Real Estate Refinance Company, and,

- Kenya Mortgage Refinance Company Update in August 2021, where we benchmarked with the Jordan Mortgage Refinance Company.

This week we update progress of KMRC by highlighting their latest initiatives to achieve their objectives and offer recommendations on how to boost finance for refinancing mortgages, based on similar initiatives from other countries. We shall therefore cover the following topics;

- Overview of the Housing Sector in Kenya,

- Home Financing in Kenya,

- Kenya Mortgage Refinance Company (KMRC) Progress,

- Case Studies and Lessons Learnt,

- Recommendations, and,

- Conclusion

Section I: Overview of the Housing Sector in Kenya

According to the Centre for Affordable Housing, Kenya has a housing supply of approximately 50,000 units annually with only 2.0% percent of this incoming supply targeted for the low income earners. With a housing deficit of 2.0 mn units which continues to grow annually by 200,000 and the low supply rate, the government’s plan of delivering 500,000 units by the end of 2022 is far out of reach. On the other hand, home ownership in Kenya has remained low at 21.3% in urban areas as at 2020, implying that 78.7% of the urban population are renters. The low home ownership rate is attributed to;

- Exclusion of self-employed citizens due to lack of the credit information and not meeting criteria threshold for mortgage products,

- The tough economic times reducing savings and disposable income,

- High property costs,

- The high initial deposits required to access mortgages, and,

- Tight underwriting standards for bank lending due to the increasing number of Non-Performing Loans (NPLS) in the Real Estate sector, which increased by 1.4% to Kshs 69.2 bn in Q3’2021 from Kshs 68.2 bn recorded in Q2’2021 according to The Central Bank of Kenya.

Availability of affordable housing finance continues to be the key challenge towards home ownership in Kenya. This is why the government established the Kenya Mortgage Refinance Company whose main objectives include;

- Provision of secure long-term funding at attractive rates to member institutions to enable them scale up their mortgage lending operations,

- Contributing to the growth of Kenyan capital markets through the issuance of KMRC bonds as a source of sustainable long-term fund,

- Standardization of mortgage practices in Kenya through enhancing capacity building to primary mortgage lenders,

- Facilitating the entry of new mortgage lenders in the market in order to broaden the scope of mortgage issuance and as a result increase competition among the primary lenders,

- Support lowering the cost of funds to primary mortgage lenders, which lead to a lowering of onward mortgage rates, thereby improving affordability and extending the range of potential borrowers, and,

- Facilitating member institutions to extend the mortgage maturity in line with the objective of long-term finance.

Section II: Housing Finance in Kenya

Mortgages have continued to lag behind as a home financing alternative, as evidenced in the Central Bank of Kenya- Bank Supervision Annual Report 2020, which indicated that the residential mortgage market recorded a 3.7% decline in the number of mortgage loans accounts, to 26,971 in December 2020 from 27,993 in December 2019. The overall value of mortgage loans outstanding therefore registered a 2.1% decline from Kshs 237.7 bn in December 2019 to Kshs 232.7 bn in December 2020. The performance decline of the mortgage market was mainly attributed to fewer mortgage loans advanced by banks due to the effects of COVID-19, and, a depressed economy that caused an increase in mortgage defaults as well as a reduction in savings and disposable income. For analysis on home ownership percentages in different countries, the number of mortgage accounts and mortgage to GDP ratios, please see the Real Estate section above.

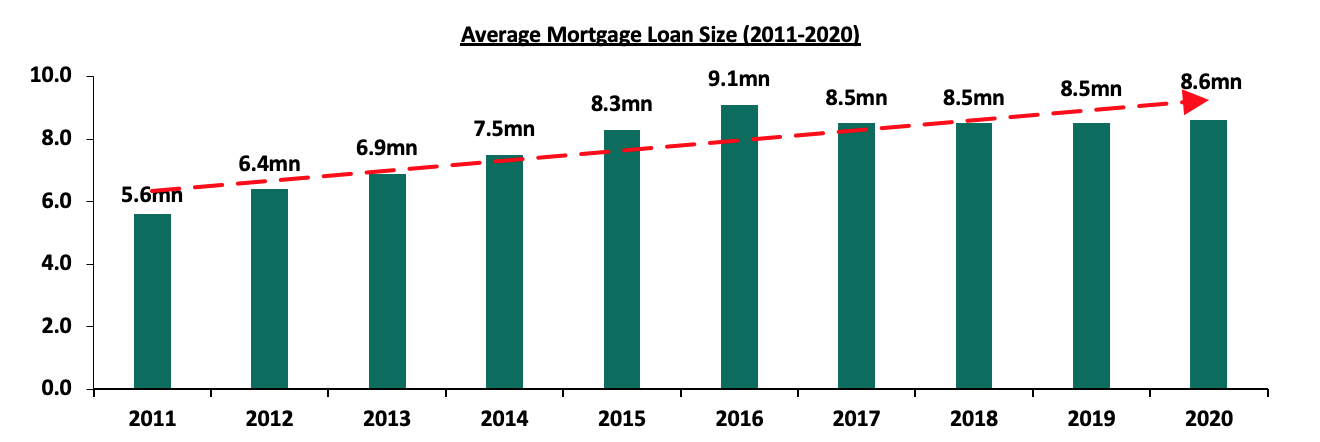

Despite the number of mortgage accounts decreasing, the average mortgage loan size increased from Kshs 8.5 mn in 2019 to Kshs 8.6 mn in 2020, with the government making efforts to avail relatively affordable mortgage facilities through the Kenya Mortgage and Refinance Company (KMRC) as banks tighten credit standards to the mortgage market in the midst of high loan default rates. The average mortgage loan size increased by a 10-year CAGR of 4.4% as at 2020, while the average loan accounts increased by a 10-year CAGR of 5.3% which is a positive trend. The increase in loan accounts over the ten years is attributable to the combined efforts by the government and the private sector players to avail affordable mortgages with flexible terms in order to accommodate more clients especially in the low and middle income bands thereby boosting home ownership rates. The graph below shows the average mortgage loan size from 2011 to 2020;

Source: Central Bank of Kenya (CBK)

The KMRC has made strides in boosting mortgage liquidity for Primary Mortgage Lenders (PMLs) in order to boost mortgage uptake in the country and we now highlight the performance of the facility focusing on new developments by the firm and initiatives it is undertaking to achieve its objectives.

Section III: Kenya Mortgage Refinance Company Progress

- Overview and Developments by KMRC

The Kenya Mortgage Refinance Company is a treasury-backed lender, which operates as a non-deposit taking financial institution regulated and supervised by the Central Bank of Kenya. The facility lends to PMLs at an annual interest rate of 5.0%, thus enabling them to write home loans at single digit rates, lower than the market average rate of 13.9%. KMRC has so far raised funds in form of loans, bonds and equity. It has a loan facility worth Kshs 37.3 bn as shown below:

|

# |

Institution |

Amount (Kshs bn) |

|

1 |

World bank |

25.0 |

|

2 |

African Development Bank (AfDB) |

10.0 |

|

3 |

Equity Capital |

2.3 |

|

Total |

37.3 |

Source: KMRC

In terms of products, KMRC offers two key loan products which include;

- Affordable housing loans: These are loans extended to Primary Mortgage Lenders (PMLs) to re-finance mortgage loans capped at Kshs 4.0 mn in Nairobi Metropolitan Area (Nairobi, Kiambu, Machakos & Kajiado) and Kshs 3.0 mn in other parts of the country to individual borrowers whose monthly household income is not more than Kshs 150,000. The loans are issued at a fixed rate of 5.0%, and,

- Marketing housing loans: These are loans extended to Primary Mortgage Lenders to re-finance mortgage loans above the Affordable Housing loans threshold of Kshs 4.0 mn, and income greater than 150,000.

In January 2022 KMRC got approval from the Capital Markets Authority (CMA) to roll out a Kshs 10.5 bn medium-term bond programme. The firm aimed to raise Kshs 1.4 bn during the first tranche of issuance in February 2022. The first tranche issued recorded an oversubscription of 478.6%, attributable to the attractive returns offered by the bond of 12.5%, receiving bids worth Kshs 8.1 bn. KMRC only accepted bids worth Kshs 1.4 bn since the bond did not have a green shoe option. In light of the above, International Finance Corporation (IFC), an international financier, announced plans to buy Kshs 4.2 bn worth bonds from the Medium Term Note Program (MTN). If successful, since the purchase is expected to be on the second tranche, this will make IFC an anchor investor to the mortgage lender’s MTN, with a 40.0% stake of the bond. IFC owns 11.8% of the KMRC shares as at 30th September 2020, having invested Kshs 213.7 mn in the KMRC during formation. Breakdown of KMRC shareholding is as shown below;

|

KMRC Shareholding |

||||

|

Institution |

Amount Contributed (Kshs) |

Total Allotment (Kshs) |

Number of Shares |

% |

|

KCB Bank Kenya ltd |

600,000,000 |

361,675,025 |

3,616,750 |

20.0% |

|

CS National Treasury |

800,000,000 |

458,000,000 |

4,580,000 |

25.3% |

|

IFC |

213,700,000 |

213,700,000 |

2,137,000 |

11.8% |

|

Shelter Afrique |

200,000,000 |

200,000,000 |

2,000,000 |

11.1% |

|

Co-operative Bank |

200,000,000 |

200,000,000 |

2,000,000 |

11.1% |

|

NCBA Bank |

50,000,000 |

50,000,000 |

500,000 |

2.8% |

|

HFC Limited |

50,000,000 |

50,000,000 |

500,000 |

2.8% |

|

Barclays Bank |

50,000,000 |

50,000,000 |

500,000 |

2.8% |

|

DTB Bank |

50,000,000 |

50,000,000 |

500,000 |

2.8% |

|

Harambee Sacco |

25,000,000 |

25,000,000 |

250,000 |

1.4% |

|

Stanbic Bank |

20,000,000 |

20,000,000 |

200,000 |

1.1% |

|

Stima Sacco |

20,000,000 |

20,000,000 |

200,000 |

1.1% |

|

Credit Bank |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Unaitas Saccox |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

imarika Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Kenya Police Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Imarisha Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Mwalimu National Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Bingwa Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Ukulima Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Tower Sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Safaricom sacco |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

KWFT |

10,000,000 |

10,000,000 |

100,000 |

0.6% |

|

Total |

2,388,700,000 |

1,808,375,125 |

18,083,751 |

100.0% |

Source: Kenya Mortgage Refinance Company (KMRC)

The table below shows the particulars of the MTN;

|

Description of Note |

|

|

Issuer |

Kenya Mortgage Refinance Company (KMRC) |

|

Trustee |

Ropat Trust Company Ltd |

|

Aggregate Nominal Amount |

Kshs 10.5 bn |

|

Issue Date |

4th March 2022 |

|

Listing Date |

14th March 2022 |

|

Tranche 1 |

Kshs 1.4 bn |

|

Interest Rates |

12.5% p.a., payable semi-annually in arrears |

|

Placing Agent |

NCBA Investment Bank Ltd. |

|

Receiving Bank |

KCB Bank Kenya Ltd. |

|

Specified Denomination |

Kshs 100,000 with integral multiples of Kshs 100,000 thereof |

|

Tenor |

7 years amortizing, with a Weighted Average Life of 4.5 years |

|

Interest on Late Payments |

Initial Interest Rate plus a margin of 2.0% p.a. to trade creditors |

|

Credit Rating |

GCR-AA+AA- (Highest certainty of timely payment of obligations) |

|

Default |

In case of default, issuer commences negotiations with any one or more of its creditors with a view to the general readjustment or rescheduling of its indebtedness. N/B; Trade creditors not mentioned |

Source: World Bank

- KMRC Achievements

The following are key achievements by KMRC;

-

- Increased Capital to Primary Mortgage Lenders for Refinancing: In December 2020, KMRC made its debut lending of Kshs 2.8 bn to primary mortgage lenders out of the total Kshs 4.5 bn that was available for refinancing. In the FY’2021/22 that began in July 2021, KMRC tripled the lending allocation to Kshs 7.0 bn representing a 153.5% increase,

- Increased Mortgage Uptake in the Country: The lending to primary mortgage lenders at December 2020 refinanced a portfolio of 1,427 mortgages, at single digit interest rates to make them affordable to more clients and increase mortgage uptake,

- Solving the Balance Sheet Mismatch for PMLs to Encourage Long Tenor Mortgages: KMRC is offering the institutions long term financing at a fixed rate of 5.0% which will enable them offer long tenor mortgages with minimal liquidity or interest rate risk concerns to reduce over dependence on deposits while offering loans,

- Spurred Competition in the Mortgage Market for the Benefit of Borrowers: KMRC lending at 5.0% to primary mortgage lenders for onward lending at single digit rates has spurred competition among lending institutions particularly those offering higher interest rates. This has prompted some lending institutions to revise their terms in order to remain competitive. In turn, mortgage borrowers are able to benefit from fair interest rates, and,

- Successful Bond Issuance for Mortgage Funding: The firm got an approval from Capital markets Authority (CMA) to roll out a Kshs 10.5 bond programme. In the first tranche of the issuance, the firm aimed to raise Kshs 1.4 bn and recorded an over subscription of 478.6%. The funds raised through bond issue are incorporated in capital for refinancing to primary mortgage lenders.

- Challenges facing KMRC

Despite the above achievements, KMRC has faced numerous challenges which include;

- High Property Prices: Given the high property prices in the Nairobi Metropolitan area, clients may run out of options for houses. During FY’2021, prices for detached units averaged at Kshs 12.2 mn while that of apartments averaged at Kshs 9.3 mn which are both higher than the KMRC affordable housing loan limits of Kshs 4.0 mn in the NMA region and Kshs 3.0 mn elsewhere. The table below shows the performance of both apartments and detached units in the Nairobi Metropolitan Area (NMA) in FY’2021 assuming an average size of 90-SQM unit;

|

Average Property Prices |

||||||

|

Segment |

Average Unit Size (SQM) |

Average Price per SQM FY'2021 |

Price FY'2021 |

Average Rental Yield FY'2021 |

Average Price Appreciation FY'2021 |

Total Returns |

|

Detached Units |

||||||

|

High End |

90 |

193,715 |

17.4mn |

3.9% |

1.0% |

4.9% |

|

Upper Mid-End |

90 |

142,460 |

12.8mn |

4.2% |

1.8% |

6.0% |

|

Satellite Towns |

90 |

72,067 |

6.5mn |

4.7% |

1.1% |

5.8% |

|

Detached Units Average |

90 |

136,081 |

12.2mn |

4.3% |

1.3% |

5.6% |

|

Apartments |

||||||

|

Upper Mid-End |

90 |

121,504 |

10.9mn |

5.4% |

0.3% |

5.7% |

|

Lower Mid-End |

90 |

110,194 |

9.9mn |

5.2% |

1.9% |

7.1% |

|

Satellite Towns |

90 |

77,023 |

6.9mn |

5.3% |

2.0% |

7.3% |

|

Apartments Average |

90 |

102,907 |

9.3mn |

5.3% |

1.4% |

6.7% |

Source: Cytonn Research 2021

- High Default Rates Leading to a High Number of Non-Performing Loans (NPLs): According to Quarterly Economic Review July-September 2021 by the Central Bank of Kenya (CBK), The Gross Non Performing Loans in the Real Estate sector increased by 1.4% to Kshs 69.2 bn in Q3’2021, from Kshs 68.2 bn recorded in H1’2021. On a YoY basis, the performance represented a 16.6% increase from Kshs 57.7 bn realized in Q3’2020, attributed to increased Real Estate loan default rates. The high number of non-performing loans is expected to reduce loan advances as lenders will cushion themselves from credit risk that would expose them to possible collapse,

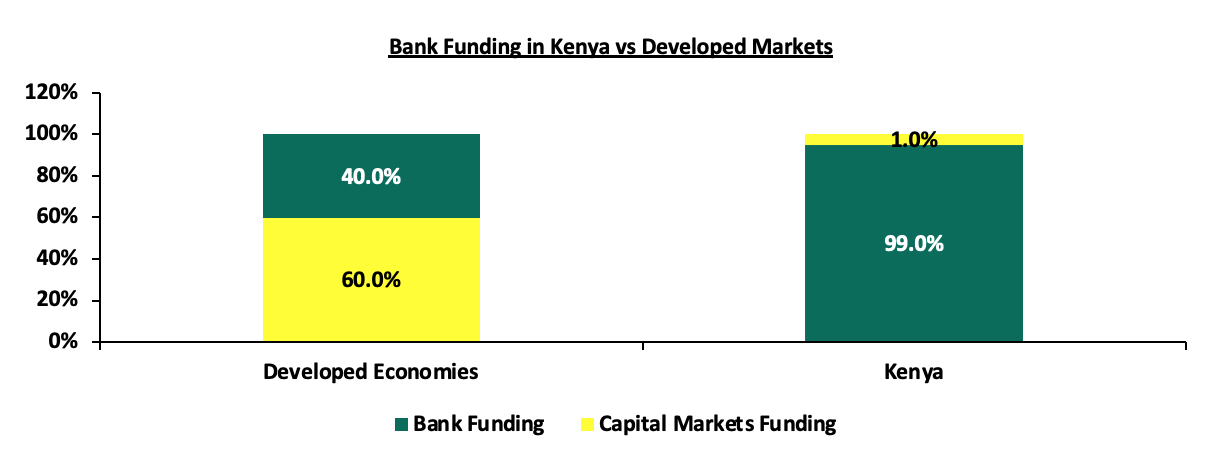

- Constrained and Unsustainable Funding Model: The current funding model of KMRC is unclear, some of the government instruments such as the 20-year bond are attracting a return of 13.9% and would seem more attractive to investors. It is therefore not clear how the firm will borrow and maintain lending at a 5.0% rate, and,

- Inability to Meet Criteria Threshold for Mortgage Products: The primary lending institutions have a set of eligibility criteria to meet before they can receive funding from KMRC mostly set under the World Bank and African Development Bank (AfDB) standards as discussed. Most of these requirements have not been met thus limiting the number of primary mortgage lenders for the loans.

Section IV: Case Studies and Lessons Learnt

In our previous topical on Kenya Mortgage Refinance Company Update, and, Kenya Mortgage Refinance Company Recap covered in August 2021 and November 2020, respectively, we provided case studies of the Jordan Mortgage Refinance Company and the Saudi Real Estate Refinancing company, respectively. In this topical, we now look at the lessons and key takeout’s that we can derive from the aforementioned mortgage refinancing companies alongside the Tanzania Mortgage Refinancing Company (TMRC).

|

Institution |

Key takeout’s/ Achievements |

|

Jordan Mortgage Refinancing Company |

|

|

Saudi Real Estate Refinance Company |

|

|

Tanzania Mortgage Refinance Company |

|

Section V: Recommendations

From the above lessons, the following can be implemented to accelerate funding for KMRC;

- Develop a Clear Financing Model: The first tranche of KMRC Medium Term Note (MTN) program recorded an oversubscription of 478.6%, attributable to the attractive returns offered by the bond of 12.5%. This was possible with the firm having raised funds from the World Bank and African Development Bank. However, with the firm tapping into the capital markets, the subsequent bonds offered may face competition from government instruments which are offering higher rates. Some of the government bonds such as the 20-year bond are attracting a return of 13.9% and would seem more attractive to investors. To ensure that it can comfortably lend at single digit rates, KMRC should come up with a comprehensive funding mechanism to prevent a negative spread between the lending rate and the borrowing rate. KMRC could either:

-

- Refinance at cost which would mean no spread for the facility, as well as competition from treasury bonds which is approximately 13.5%-13.9%, possibly leading to undersubscription,

- Refinance lenders’ mortgage portfolios using finance from the World Bank and other shareholders’ equity as they build up on entry to capital market,

- Increase Capital and Investor Confidence through Listing in the Stock Exchange: KMRC should in its long term plans look to list on the Nairobi Stock Exchange (NSE) in order to increase funding and grow investor confidence. JMRC was listed in the Amman Stock Exchange in 2011. After the listing, the net revenue has increased at an 8-year CAGR of 16.2% from USD 13.3 mn (Kshs 1.5 bn) in 2012 to an estimated USD 44.4 mn (Kshs 4.9 bn) as at FY’2020. Listing not only helps improve capital by raising funds from the general public, it also helps build confidence from investors since financials are publicly available and listed companies are viewed to have stronger regulation and scrutiny,

- Increased Transparency: Many market participants have questions about the sustainably of the funding model and sustainability of the 5% lending rate, it would be constructive for KMRC board and management to come out and address this market concern, and,

- Source Funding from International Debt Markets: To accelerate funding, KMRC should in its long tern plans consider issuing bonds in the international market to raise a larger pool of resources to refinance mortgages. Saudi Real Estate Company is currently looking into tapping the international markets for a debut USD 500.0 mn dollar-denominated bond in 2022, to fund the growth of its Real Estate loan book.

Section VI: Conclusion

In conclusion, the efforts by KMRC to avail mortgages to clients at favorable rates is expected to improve mortgage uptake in Kenya thereby driving the home ownership rates. However, there is lack of clarity on the funding model of the company in order to maintain their lending rate of 5.0% given that even the government itself accesses 20-year Treasury bonds at an interest rate of 13.9%. We are of the view that in order to deepen our capital markets and stimulate its growth, these obstacles can be addressed by; i) bridging regulatory framework to allow unit holders to invest in sector funds dedicated to affordable housing, ii) reduce high minimum investments in REITs to reasonable amounts given that the national median income for employed individuals is estimated at around Kshs 50,000., and, iii) eliminate conflicts of interest in the governance of capitals markets to a structure that is more responsive to market participants and market growth. These would help increase house ownership levels, reduce the ever-widening housing supply gap and help diversify sources of capital.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.