In July 2020, a committee appointed by the Principal Secretary, State Department for Housing and Urban Development, recommended the establishment of the Real Estate Developers Regulatory Board, “REDRB” by October 2020 through an executive order subject to the Cabinet’s approval. In this week’s topical, we focus on the Board by covering;

- A Brief Overview of the Kenya Real Estate Sector;

- Functions of the Real Estate Developers Regulatory Board;

- Expected Benefits and Challenges of the Regulatory Board;

- Case Studies;

- United Arabs Emirates (UAE)-Dubai Real Estate Regulatory Agency (RERA)

- Jamaica Real Estate Board

- Lessons for Kenya from the case of UAE and Jamaica;

- Conclusion.

- A Brief Overview of the Kenya Real Estate Sector

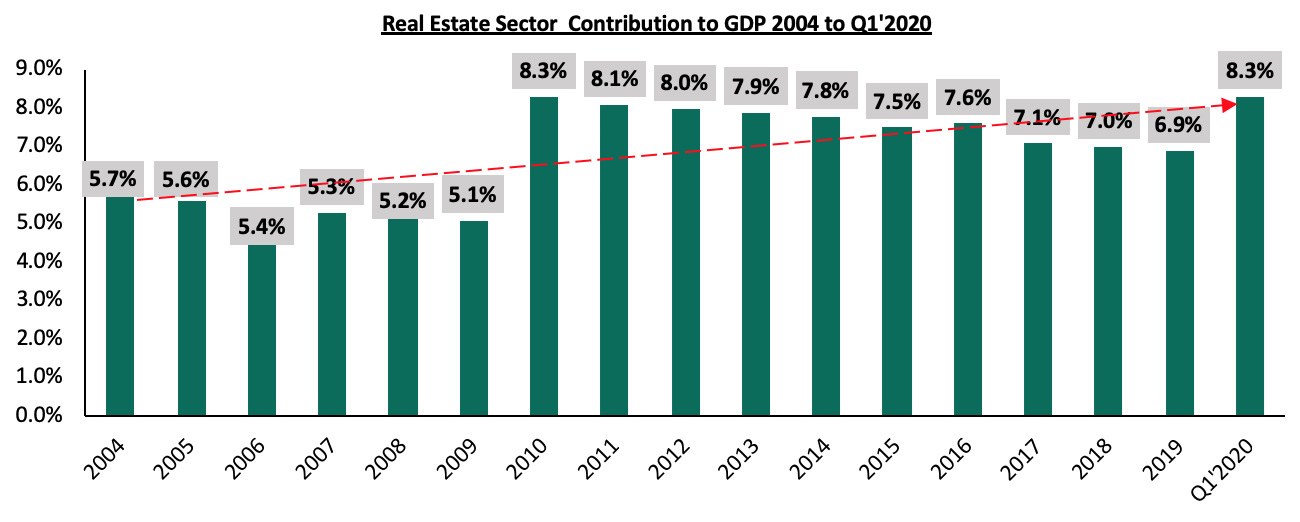

The Kenya real estate sector has experienced significant growth over the past years starting from 2004 through to 2016, with a marginal decline in 2017 due to political instability during the electioneering period as seen from the growth in its contribution to GDP. The graph below shows the real estate sector contribution to GDP 2004 to Q1’2020;

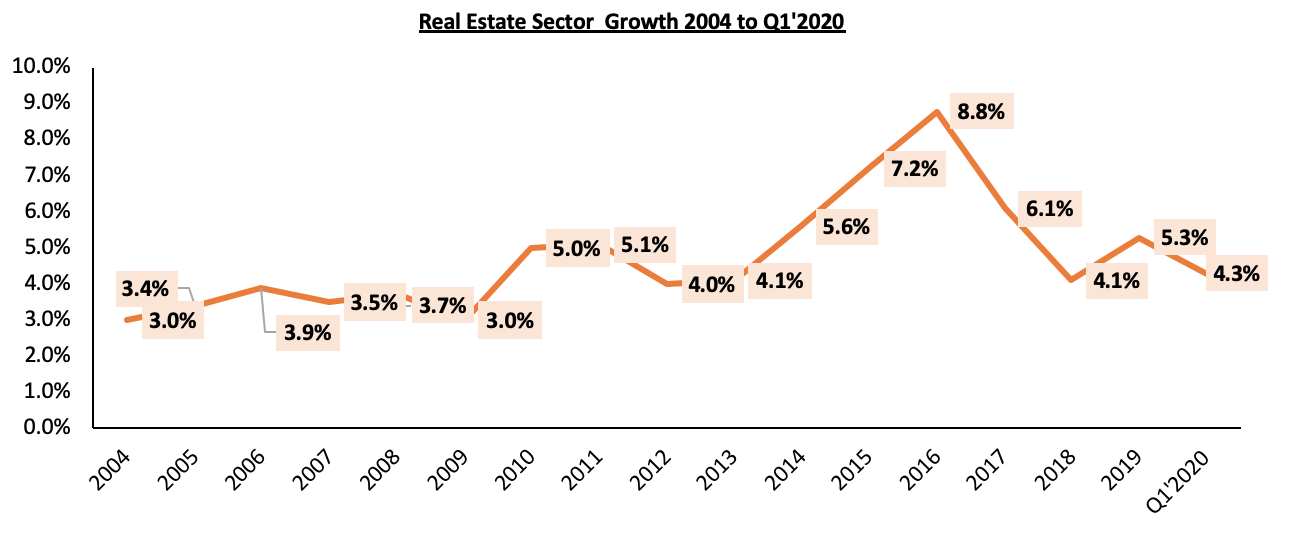

Below is a representation of the growth of the sector over the years;

Source: Kenya National Bureau of Statistics

The growth can be attributed to:

- The existing housing deficit which has remained at around 2 million as per the World Bank,

- Increased urbanization with the country having an urbanization rate of 4.3% compared to the global average of 2.0%,

- Supporting demographic with many people being in their productive years fueling demand of properties,

- Nascent real estate sector, and,

- The economic growth and the ease of doing business with Kenya being ranked #56 out of 190 by World Bank as at 2020 in the ease of doing business ranking.

The above opportunities have contributed to growth in the sector as real estate developers come in to seize them. In a bid to walk the journey, home ownership especially in urban areas where prices of properties have been increasing people have taken different paths to home ownership among them: purchase of land and construction of own houses, Sacco and Chama investments to pull together resources for land buying and home construction, taking mortgages and purchase through off plan offers.

Off plan purchasing has been on rise due to limited resources from both developers and home owners. There are many positive reasons why potential homeowners should consider investing in off plan investments as covered in our topical Off Plan Investment in Real Estate - What a Buyer Needs to Know. Despite the positive impact made by the private sector especially in resolving the existing housing deficit and on overall driving the economy, one of the main challenges facing the sector has been presence of a number of fraudulent developers who fail to deliver projects or delay the delivery as per agreed upon timelines, and without giving any remedy to investors. On the other hand, some buyers fail to honor their contractual obligations of paying up their monthly deposits as agreed with the developer, thus interrupting the project’s cash flows and cycles leading to delay or non-completion of projects. The above have resulted in legal tussles, loss of investor’s funds and lack of confidence in the sector.

There is currently no legal framework that governs the relation between the developers and buyers with regards to off plan developments despite the model gaining popularity over the years. However, there exists the proposed Housing Bill of 2019 which provides for regulation of developers. Despite being the most ideal way to regulate the developers, the bill is yet to be enacted due to the lengthy procedures to be followed before it becomes a law. However, a board can be established through an executive order to regulate the sector’s players as a short term measure.

In July 2020, a committee appointed by the Principal Secretary, State Department for Housing and Urban Development, recommended the establishment of the REDRB, by October 2020 through an executive order subject to the Cabinet’s approval. The establishment of the board is aimed at promoting a transparent, efficient and competitive real estate sector, protecting the interest of the sector players and restoring investor confidence through safeguarding buyers’ deposits as well as providing a speedy dispute resolution mechanism between developers and home buyers. According to the committee, the proposed regulatory board is a short term measure to curb the upsurge of cases of disputes currently occurring between developers and home buyers, through regulating the developers who undertake real developments for sale to the public, and this incorporates those that undertake off plan development. In the long term, the regulatory board should be anchored in the Housing Bill once it is enacted given that the provision for regulating developers is provided within the bill. The provisions in the proposed Housing Bill upon enactment will provide the Board with a legal framework that is expected to resolve the problem of rampant and protracted disputes between developers and home buyers especially in the case of off plan developments in the real estate sector.

- Functions of the Real Estate Developers Regulatory Board

The Key functions of the Real Estate Regulatory Board will include;

- Registering, licensing and regulating real estate developers- This is aimed at improving professionalism within the real estate sector and restoring investor confidence,

- De-registering rogue developers- Cases of developers who fail to deliver projects within agreed upon timelines, or fail to deliver at all leading to losses to buyers’ investments, have been on the rise with buyers seeking for court remedies and relying on sale agreements. The Board thus aims to protect the interest of the property buyers in the wake of increased off-plan developments, by de-registering fraudulent developers. Additionally, the Board will develop a regulatory mechanism to prevent loss of investments by unit buyers, introduce a dispute resolution mechanism and also provide guidelines on the collection of buyers’ deposits and subsequent payments for off-plan pre-sales,

- Registering housing projects intended for sale to the public by developers- This is intended to limit the sale of properties that are unlicensed or those considered unsafe for occupation and ensure that all the procedures required in building and advertising properties have been followed by the developers,

- Publishing and maintaining a website of records- The website will provide the public with information on all registered developers and housing projects. This will enhance transparency and thus protect property buyers from fraudulent transactions,

- Creating a transparent and robust dispute resolution mechanism between developers and buyers- This is intended to curb the upsurge of disputes especially related to delays or non-delivery of projects, which have been resulting in long legal tussles and court battles, and,

- Collecting and analyzing data on real estate development in the housing sector- The Board will maintain a database with details on housing projects in Kenya. This will be useful in tracking the activities and growth of the sector over the years.

- Expected Benefits and Challenges of the Regulatory Board

The establishment of the Board is expected to positively impact on the real estate sector. Some of the expected benefits include;

- Development of a clear regulatory framework for real estate development- The Board will provide guidelines that will govern both developers and unit buyers to ensure that each of the parties’ interest are protected. The framework will outline a robust disputes’ resolutions mechanism, thus reduce legal tussles, loss of investor’s investments and lack of confidence in the sector,

- Protection of deposits and interests of unit buyers- The Board will provide guidelines on collection of buyers’ deposits and subsequent payments for off-plan pre-sales, thus ensure that property buyer’s capital is not mismanaged,

- Protection of interests of real estate developers - The Board will put in place a mechanism to ensure that buyers honour their contractual obligations of paying up their monthly deposits as agreed with the developer to avoid interrupting project cash flows that could cripple development activities,

- Fostering transparency in the sector- This will be achieved through provision of a database of all real estate developers including the registered and de-registered rogue developers. Currently there exists no mechanism for investors to determine the reliability and authenticity of developers,

- Encouraging professionalism in the real estate sector by eradication of unscrupulous developers- We expect this to force developers to be more strategic when taking up projects to ensure ability to deliver as per the laid down agreements. This will go a long way in avoiding loss of investments and legal disputes among parties, and,

- Increase in delivery of property and especially housing units- The establishment of the Board is expected to restore investor confidence, thus increased activities especially on the residential front which is most prone to disputes resulting from project delays and non-delivery by some developers.

We expect the Board to face challenges in the strive towards regulating the real estate sector. Some of the key challenges include;

- Bureaucracy and delay in the registration process- Government agency delay in approval and registration may hinder the timely delivery of projects due to backlog in project approvals as the Board strives to ensure top-notch compliance by all developers,

- Corruption in the regulation process as some developers strive to cut down on the registration and approval process before undertaking development projects,

- Non-compliance by some developers who may be unwilling to adapt to the set guidelines and rules set to be introduced by the Board, and,

- Lack of adequate public sensitization on the existence of the Board and its functions which is likely to make it difficult for the Board to protect the public interest through a complicated legal structure.

- Case Studies

Having looked at the formation, functions, benefits, and challenges likely to face the Kenya Real Estate Developers Regulatory Board, we now look into case studies of countries where similar boards exist and thus derive lessons Kenya can learn for the success of the same.

- United Arabs Emirates (UAE)-Dubai Real Estate Regulatory Agency (RERA)

The Real Estate Regulatory Agency (RERA) is a UAE government agency established with the intent of regulating the real estate sector in Dubai. The agency was formed in July 2007 and is anchored under the Dubai Land Department. The agency was established through an executive order by his Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the United Arab Emirates and Ruler of Dubai.

The main functions of RERA include;

- Licensing all real estate activities- The agency licenses the activities by the agencies, agents and developers by providing the necessary certifications to ensure smooth transitions of properties from the developers to the buyers,

- Managing real estate developers' trust account- The trust account exists particularly to protect buyers by setting a requirement for developers selling off-plan units to deposit all amounts paid by purchasers into an escrow account with an escrow agent accredited by the Dubai Lands Department. The amounts deposited in the escrow account are exclusively allocated for the purposes of construction of the particular real estate project and any other directly related activities. Failure to comply may lead to penalties and even revoking of license to operate,

- Regulating and registering rental agreements- RERA lays out the responsibilities of both the landlords and the tenants and once a contract has been made between a tenant and a landlord for occupancy, RERA enforces these agreements to ensure full compliance,

- Regulating and supervising the owner’s associations- The agency regulates the activities by landlords or property owners to ensure that they provide transparent pricing policies and plans for the buyers. It does this by stipulating relevant rules and regulations to home owners to create a balance between protecting their interests and that of the buyers,

- Regulating real estate advertisements in the mass media-RERA works through establishing laws on how property developers advertise through the media. In the laws, adverts for developers especially the sales on specific projects must display the details of the company’s RERA’s registration number, the escrow accounts used in receiving payments and details of the agent overseeing the sale of the properties,

- Regulating and licensing real estate exhibitions- RERA gives licenses to all the real estate exhibitions organized by developers within Dubai. It also controls the activities when doing exhibitions such as ensuring relevant rules to displaying products are followed and that all the necessary procedures such as registration by the exhibiters have been done prior to the events,

- Publishing studies for the sector- RERA formulates, processes, documents and places standard procedures associated with property. The agency also provides statistical data on the property market for consumption by both the government and the public, and,

- RERA also informs people on regulatory acts when buying and renting the real estate in Dubai- RERA designs its laws and regulation to provide an easy legislative system to control Dubai real estate market. It is also eligible for recommending new property laws to the government.

One of the main challenges facing RERA is;

- Non-compliance- Some developers dodge being regulated thus affecting the Board’s operations as it limits its ability to streamline the real estate sector. Some developers also fail to follow the rules and regulations that have been stipulated thus affecting the interest of the buyers. The developers’ failure to adhere to all the rules and regulations have negatively impacted the agency’s schedule of activities which in the long run affects the delivery of projects procedures taken before projects can be licensed.

Achievements of RERA include;

- RERA has helped real estate professionals’ transition to the new regulatory standards by working closely with the government & industry stakeholders to oversee the development of a National Real Estate Policy, improve consumer protection and streamline real estate services within Dubai,

- RERA successfully created a system that has established the rights of landlords, sellers, buyers, tenants as well as property management companies operated in Dubai. The rights acts as the foundation of the legal system and they are in place to protect the interest of the key players in the real estate market,

- RERA has successfully created a system where developers can register to become legally certified to either rent or sell their properties. Once successfully registered, a developer is issued with a certified identity card,

- The Agency has designed its laws and regulation to provide an easy legislative system to control Dubai real estate market, for example the Interim registration law -Law 13 of 2008 which stipulates that all sales and clearances of off-plan units need to be registered on the provisional real estate register that is sustained by the Dubai Land Department and the trust account law - Law 8 of 2007, which protects buyers by setting a requirement for developers selling off-plan units to be registered with RERA, and ,

- The Dubai real estate sector has been expanding evidenced by a 5.6% points increase in the sector’s contribution to GDP which stood at t 13.6% in 2019 compared to 8.0% in 2007, according to the Dubai Land Department. The growth can be partially attributed to the existence of the Agency which has streamlined the sector.

- Jamaica Real Estate Board

The Jamaica Estate Board was operationalized on 1st September 1988 following an Act of Parliament and consists of a 12-member Board of Directors appointed by the Minister of Economic Growth and Job Creation. The introduction of the legislation to regulate the real estate profession had been the subject of much public debate and ministerial attention for over two decades and was necessary in order to protect members of the public who use the services of real estate dealers to purchase property or who contract with private land and housing developers for the acquisition of units in housing schemes.

Functions of the Jamaica Real Estate Board;

- To consider and determine applications for;

- Registration as real estate dealers and real estate salesmen, and,

- Licensing and the renewal of licenses of real estate dealers and real estate salesmen.

- To monitor the activities of developers or real estate salesmen,

- To take lawful measures necessary or desirable to assist it in protecting the mutual interests of persons entering into land transactions,

- To ensure adherence to the strict regulations for monies held in a trust account where buyers pay their monies, and,

- To exercise the powers to authorize withdrawals from the trust fund account for the purposes of protecting the purchaser’s monies.

Achievements of the Real Estate Board of Jamaica;

- Facilitation of the establishment of a clear regulatory framework that includes a dispute resolution mechanism between developers and buyers. They clearly stipulate how off-plan buying should be undertaken, i.e.;

- The developer under the prepayment contract should be registered,

- The developer must deposit authenticated copies of the project approvals to the Board together with all plans, drawings, and specifications,

- A signed copy of every prepayment contract be forwarded by the developer to the Board within fourteen days from the signing of the contract by the parties involved,

- The developer must pay the money received from a prepayment contract into a trust account to be maintained by him with an authorized financial institution and the money shall be held on trust until completion or recession of the contract,

- The developer is allowed to withdraw the money from the trust upon completion of the development scheme or if the developer terminates the contract it by reason of default of the purchaser and the authorized financial institution, must write a notice of such withdrawal to the Board,

- The Board has ensured that a high standard of professional conduct is maintained by persons in the industry, as well as by those seeking to join by providing licensing courses before registering developers, subjecting developers to prosecution if they default their agreements with buyers and ensuring that the monies deposited by buyers are protected when held I trust until the projects are complete. These actions have therefore contributed to reduced rogue developers, and,

- Provision of a database search of registered developers to the public thus ensuring investor or property buyer confidence.

Challenges facing the Real Estate Board of Jamaica;

- Inadequately trained real estate practitioners therefore the need to offer pre-licensing courses to avoid registering unskilled personnel,

- Inexperienced and unsystematic real estate developers who seek registration. Some of the requirements are police and bankruptcy clearance, Certified copies of Certificate of Incorporation and Articles of Incorporation (for companies only), evidence of ownership of land being developed, evidence of approval of the development scheme and evidence of scheme financing whether personal or through an authorized financial institution or both, and,

- The inadequacy of the public’s knowledge and education on the roles and responsibilities of real estate developers and the Real Estate Board which reduces the transactional volumes as investors lack knowledge on how their interests are protected.

- Lessons for Kenya from the case of UAE and Jamaica

In places like Dubai in UAE, the real estate sector accounts for approximately 13.6 % of the GDP according to the Dubai Land Department as of 2019, this is compared to an average of around 7.0% for most countries. We attribute this partially to the existence of the regulatory board which has streamlined the sector making it more attractive to investors.

Some of the lessons that the Kenya Real Estate Regulatory Board can learn from the case of Dubai and Jamaica include;

- There is a need to create public awareness- Just like for the case of RERA, the Kenya’s Real Estate Developers Regulatory Board should work towards educating the public on the existence of the board, its functions and the relevant regulatory frameworks in the real estate sector. This will enable them understand their rights, obligations and procedures to follow in the case of arising disputes during transactions in the property market,

- Establishment of rules and regulations for managing real estate developers trust accounts- In both Dubai and UAE, the monies paid by property buyers are deposited in a trust account overseen by the regulatory board. In the case of Jamaica, the funds cannot be withdrawn by the developer until contract completion. However it provides for a window where a developer may apply for utilization of 90% of monies held in trust account subject to a valuation of works by a registered professionals e.g. architect. Similarly, the Kenya Board could manage the real estate developers trust accounts and have the powers to authorize withdrawals from the trust fund account for the purposes of protecting the buyers’ investments,

- The Board must purpose to work with the government and industry stakeholders in the transition to new regulatory standards- The Real Estate Developers Regulatory Board should establish an effective transition to new regulatory standards in the real estate sector by working with the government and key industry stakeholder to oversee activities such as protecting the interest of the buyers, ensuring delivery of projects, regulating advertisements and publishing real estate related data as done by RERA. In addition, we recommend that the Board be eligible for recommending new property laws to the government, and,

- Establishment of clear and strict guidelines in the regulation of developers, with heavy penalties for the non-compliant parties- Non-compliance to the rules and regulations is one of the challenges that has been impacting the functionality of the regulatory boards and agencies, as in the case of the Real Estate Regulatory Board of Dubai. To mitigate against this, the Kenya Real estate Developers Regulatory Board should establish strict guidelines to be adhered to, with heavy penalties for the non-compliant parties.

- Conclusion

Real Estate developers have successfully been regulated in other jurisdictions through the establishment of either an authority or a Board. Therefore, the establishment of the Kenya Real Estate Developers Regulatory Board is a step in the right direction especially in the wake of a booming property market, amid increasing cases of fraudulent market players. Once formulated and operational, we expect the Board to promote the growth of an impartial, transparent, efficient, and competitive real estate sector that will be essential in restoring investor confidence and enhancing the growth of the economy in general. In our view, the success of the Board in achieving its objectives is subject to operating independently, being corruption-free, having a clear regulatory framework which includes a dispute resolution mechanism, and being anchored under the Housing Bill in the long run as per the recommendations of the committee.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.