Every government that takes office is concerned with policies pertaining to trade, capital flows, inflation management, the exchange rate system, economic growth, employment opportunities, and commercial policies aimed at ensuring a country's economic growth. Kenya, like any other country, aims at achieving both internal balance by promoting price stability and external balance by maintaining a balance of payment equilibrium. Key to note, Kenya’s balance of payment stood at a deficit of Kshs 120.6 bn as of Q1’2022, a 376.9% increase from a deficit of Kshs 25.3 bn in Q1’2021 mainly due to a decline in the gross official reserves which have gone into debt service. The deterioration in the balance of payment is one of the key challenges that the new administration will face hence the need to develop policies to manage it. As such, we saw it fit to focus on Kenya’s balance of payment to analyze the current state and what can be done to improve the status. We shall do this by looking into the following;

- Introduction,

- The Current State of Kenya’s Balance of Payments,

- Balance of Payments Outlook and Recommendations, and,

- Conclusion

Section I: Introduction

Balance of payments, BOP, summarizes the economic transactions made by residents of a country, such as Kenya, against the rest of the world over a specific period of time. Put simply, it’s the net amount of the money that leaves Kenya versus the money that comes into Kenya. The transactions include exports and imports of goods, financial assets and services, as well as other transfer payments which may be in form of foreign aid and grants from other governments. BOP is an essential economic indicator as it provides a summary of how resources flow between a country and its trading partners. Balance of payments divides transactions into three broad accounts; Current Account, Capital account and Financial Account;

- Current Account

The component captures transactions of exports and imports of goods and services, income receipts and payments, as well as net current transfers. Categorically, the current account has three components, as explained below;

- Trade balance – Refers to the value of goods and services that Kenyan residents export less those that they import,

- Primary income balance – Refers to the income that Kenyan residents earn from the rest of the world from working and also financial investments, less what they pay, and,

- Secondary income balance – Refers to the income that Kenyan residents earn from the rest of the world through the government, less what they pay. It also consists of current transfers between residents and non-residents that directly affect the level of gross national disposable income and thus influence the economy’s ability to consume goods and services.

- Capital Account

The capital account records two main types of transactions; capital transfers and acquisition of non-produced, non-financial assets;

- Capital transfers – Refers to transactions where a party has transferred ownership of something to another party without receiving anything in return such as forgiveness of debt and conditional grants for capital projects, and

- Acquisition/disposal of non-produced, non-financial assets – Involves transactions of intangible assets such as brand names and trademarks and rights to use land resources for various economic activities.

- Financial Account

The financial account component records transactions between parties that involve a change of ownership of assets or liabilities and is structured according to different classes of investments such as direct investments, portfolio investment, financial derivative, among others.

Section II: The Current State of Kenya’s Balance of Payments

Here, we shall analyze the individual components of Kenya’s balance of payments, its evolution as well as its overall performance.

- Components of Balance of Payments

- Current Account Balance

Kenya’s current account deficit narrowed by 39.7% in Q1’2022 to Kshs 95.0 bn, from Kshs 157.5 bn recorded in Q1’2021 despite an 18.5% expansion in the merchandise trade deficit to Kshs 333.4 bn in Q1’2022, from Kshs 281.4 bn in Q1’2021. The narrowing of the this was driven by;

- A 19.2% increase in the secondary income balance to Kshs 184.1 bn, from Kshs 154.5 bn in Q1’2021, and,

- A 783.0% increase in Service Trade Balance in Q1’2022 to a surplus of Kshs 98.9 bn, from a surplus Kshs 11.2 bn in Q1’2021 mainly driven by the increase in travel and transport services receipts following resumption of international travel after all of the restriction measures were lifted.

The table below shows the breakdown of the various current account components, comparing Q1’2021 and Q1’2022:

|

Cytonn Report: Q1’2022 Current Account Balance |

|||

|

Item |

Q1’2021 |

Q1’2022 |

% Change |

|

Merchandise Trade Balance |

(281.4) |

(333.4) |

18.5% |

|

Service Trade Balance |

11.2 |

98.9 |

783.0% |

|

Primary Income Balance |

(41.7) |

(44.6) |

6.9% |

|

Secondary Income (Transfers) Balance |

154.5 |

184.1 |

19.2% |

|

Current Account Balance |

(157.5) |

(95.0) |

(39.7%) |

Source: Kenya National Bureau of Statistics (KNBS), All values in Kshs bns

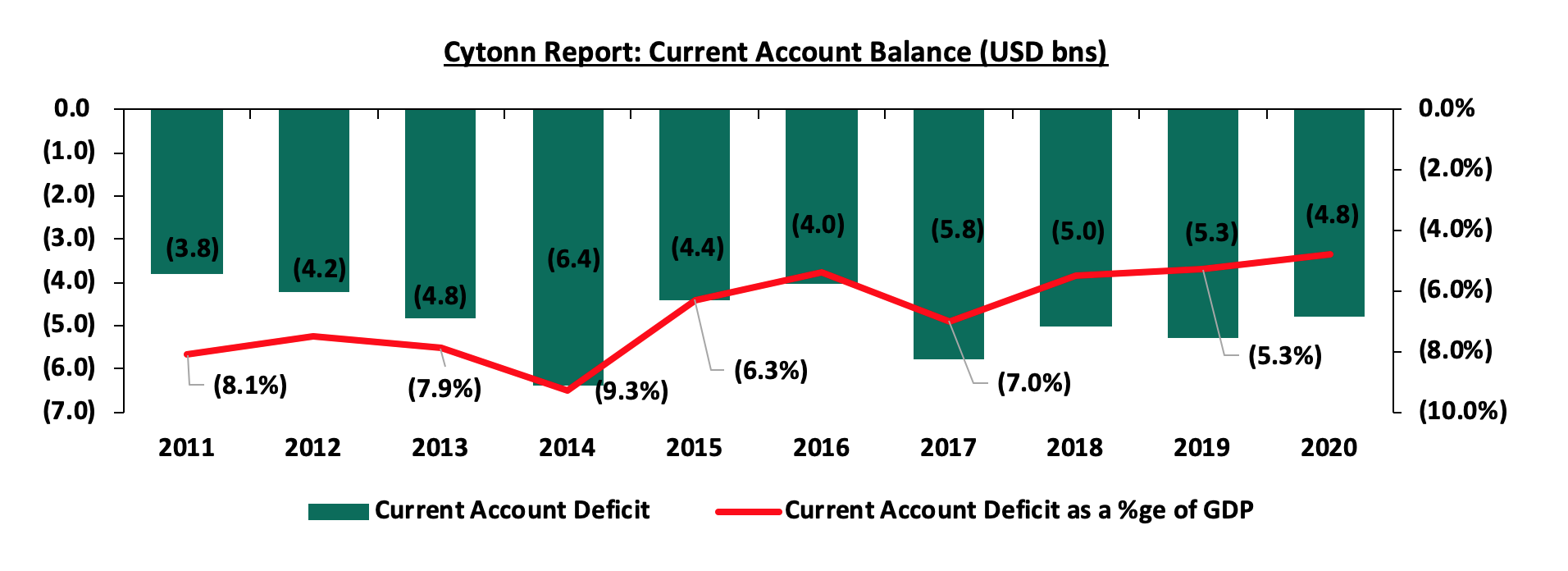

We note that, over the last ten years, the current account balance has been running deficits an indication that Kenya relies more on the outside world for its goods and services. The current account as a percentage of GDP was estimated at 5.2% in the 12 months to August 2022. For 2022, the current account deficit is projected at 5.9% of GDP mainly supported by a rebound in horticulture and tea exports as well as increased inflows of remittances. The chart below shows the current account deficit over the last 10 years;

Source: World Bank Data

- Financial Account and Capital Account

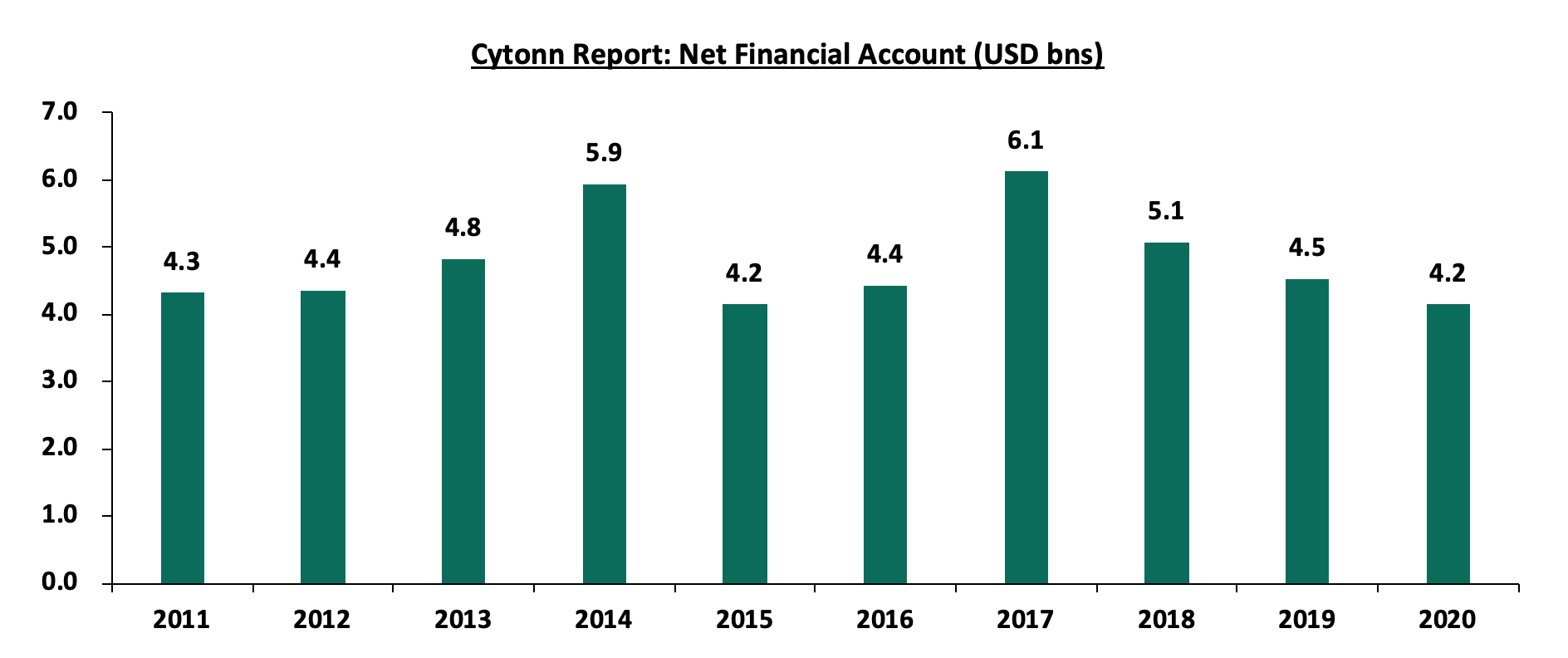

The financial account balance is the difference between the foreign assets purchased by domestic buyers and the domestic assets purchased by the foreign buyers and they end up affecting the capital account of the country. It looks more on the financing and investments part of the country form outsiders. In Q1’2022, the financial account declined by 14.0% to a surplus of Kshs 92.2 bn, from a surplus of Kshs 107.3 bn in Q1’2021. Key to note, a surplus of the financial account indicates that there are more investments funds flowing into the country than flowing out. The chart below shows the trend in the financial account over the last ten years;

Source: World Bank Data

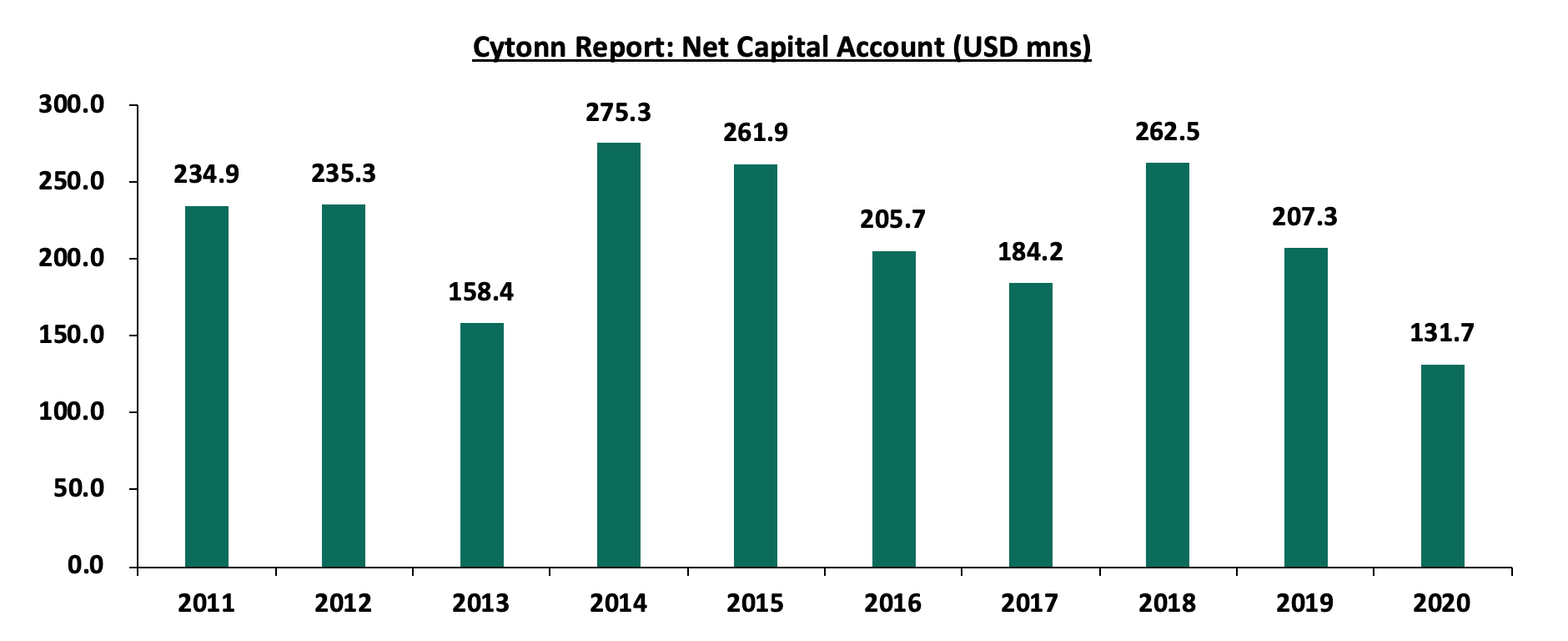

On the other hand, the capital account balance recorded a 7.6% decline to Kshs 7.4 bn from Kshs 8.0 bn in Q1’2021. Key to note, the account has been declining at a 10-year CAGR of 5.8% to USD 131.7 mn in 2020 from USD 240.2 mn in 2010. The declining capital account is partly attributable to capital flight in the country with many direct foreign investors not reinvesting in the country. Below is a chart highlighting the movement of the capital account over the last 10 years;

Source: World Bank Data

- Evolution of Balance of Payments

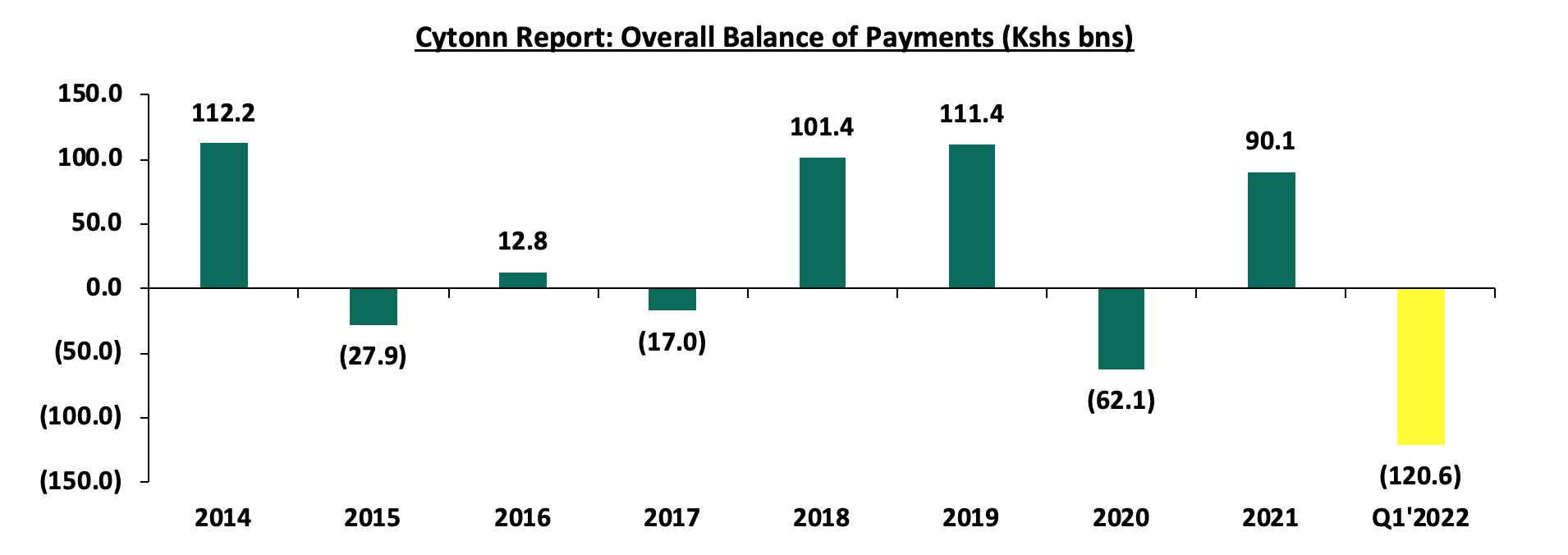

Kenya’s overall balance of payments has been fluctuating over time, standing at a deficit of Kshs 120.6 bn in Q1’2022, attributable to the running current account deficit and the high debt servicing. The performance has been mainly supported by the financial account, which has accumulated a surplus over the years. The current account deterioration can be attributable to faster growth in the merchandise import bill compared to merchandise exports due to the increased fuel costs and the lower exports. It is important to note that the deterioration in trade terms contributes to an excess of import bills over export earnings as Kenya has remained a net importer of food, fuel and other raw materials. Below is a graph highlighting the trend in the Kenya’s balance of payments over the last eight years;

Source: Kenya National Bureau of Statistics (KNBS)

Key take-outs from the chart include;

- In 2021, the balance of payment ended the year at a surplus of Kshs 90.1 bn primarily due to increased capital flows from the rest of the world as the global economy recovered from the pandemic, and,

- Q1’2021 recorded a deficit of Kshs 120.6 bn, a 376.9% increase from a Kshs 25.3 bn deficit in Q1’2021 mainly due to increased drawdowns in the official reserves to service external debt. This was further exacerbated by the depreciation of the Kenyan shilling against the US dollar given that with 57.0% of external debt having been denominated in US dollars as at the end of Q1’2022.

Going forward, we expect the balance of payments to deteriorate further as the local currency continues to depreciate and prices of commodities continue to increase and our exports remains lower. The services earnings will however create a caution due to recovery in the tourism sector.

- Performance Measurements of Balance of Payments

Balance of payments is influenced by a number of factors which include;

- Exports and Imports

Exports are goods and services that are produced domestically, but then sold to consumers residing in other countries. Exports lead to an inflow of funds to the country since the transactions involve selling domestic goods and services to foreigners. Imports on the other hand are goods and services purchased from the rest of the world by residents of a country rather than domestically produced items.

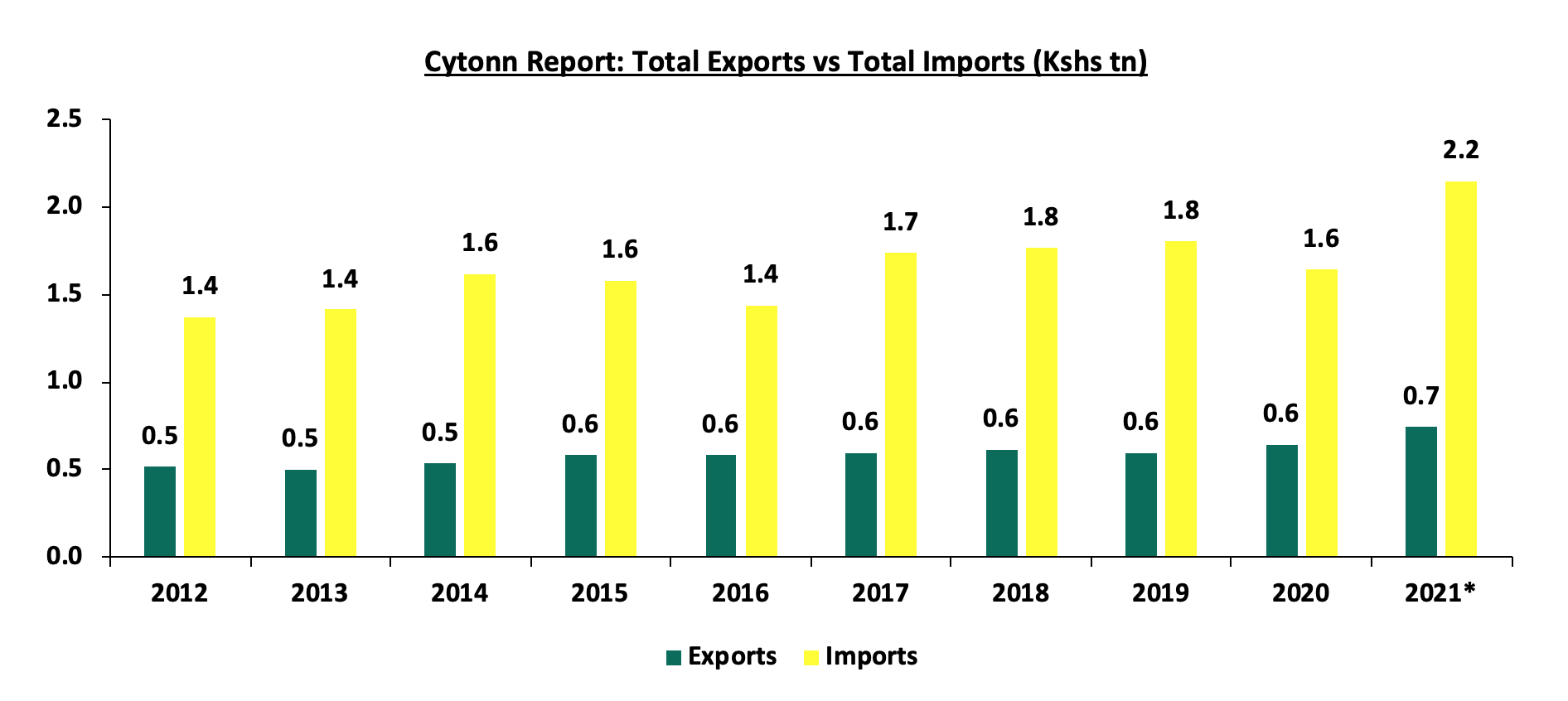

Over the last ten years, imports have been generally more than the exports and they continue to grow at a faster pace than the exports. This continues to be one of the key challenges. The chart below shows the total imports and exports over the last ten years;

Source: KNBS, *Provisional figures

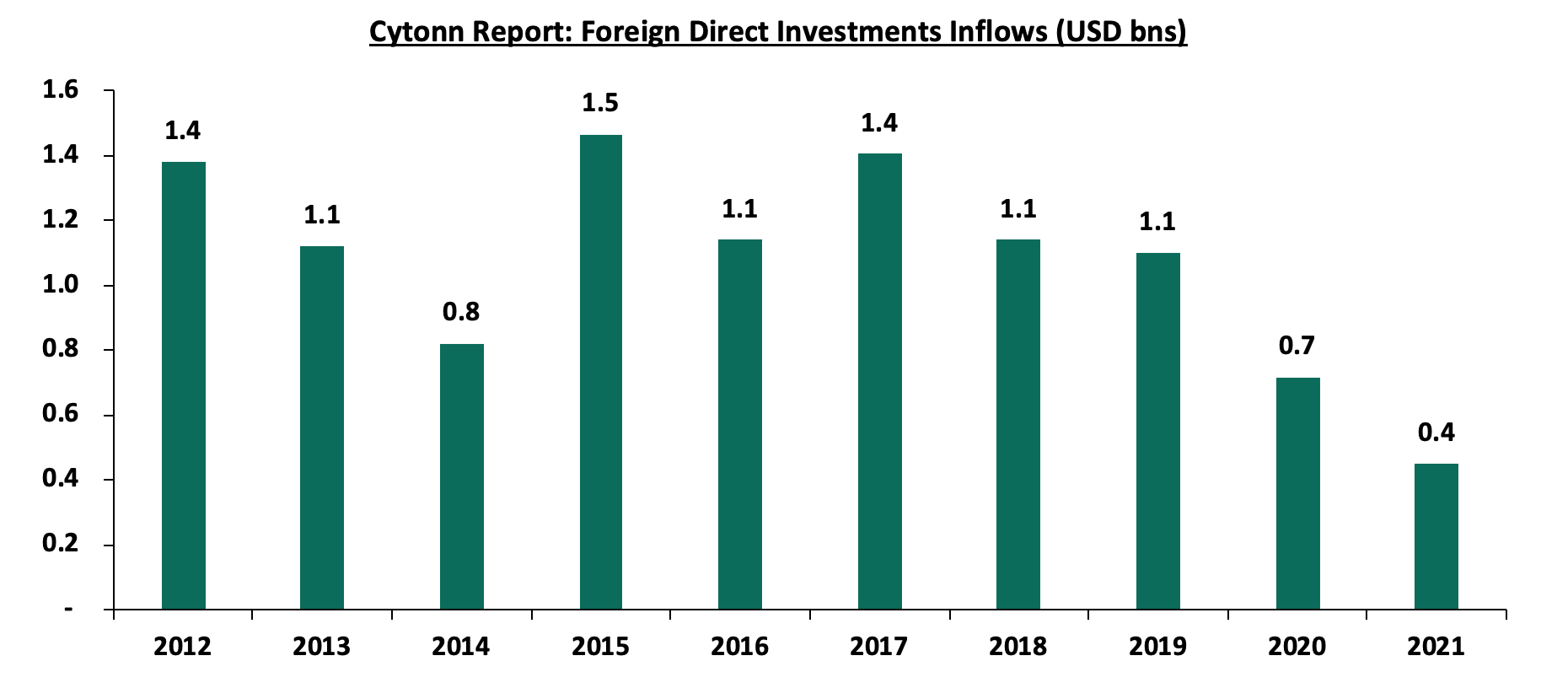

- Foreign Direct Investments

A Foreign direct investment (FDI) is an investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest. Key to note, Kenya has seen a gradual slowdown in FDI despite the improving ease of doing business. The inflows declined by 35.2% to USD 0.5 bn (Kshs 50.7 bn) in 2021, from USD 0.7 bn (Kshs 78.3 bn) in 2020 mainly due to the uncertainties that surrounded the electioneering period coupled with the tough economic environment occasioned by the pandemic. FDIs help with economic growth as it supports businesses and the government. The chart below shows the FDI inflows over the last ten years;

Source: UNCTAD World Investments Report

- Debt

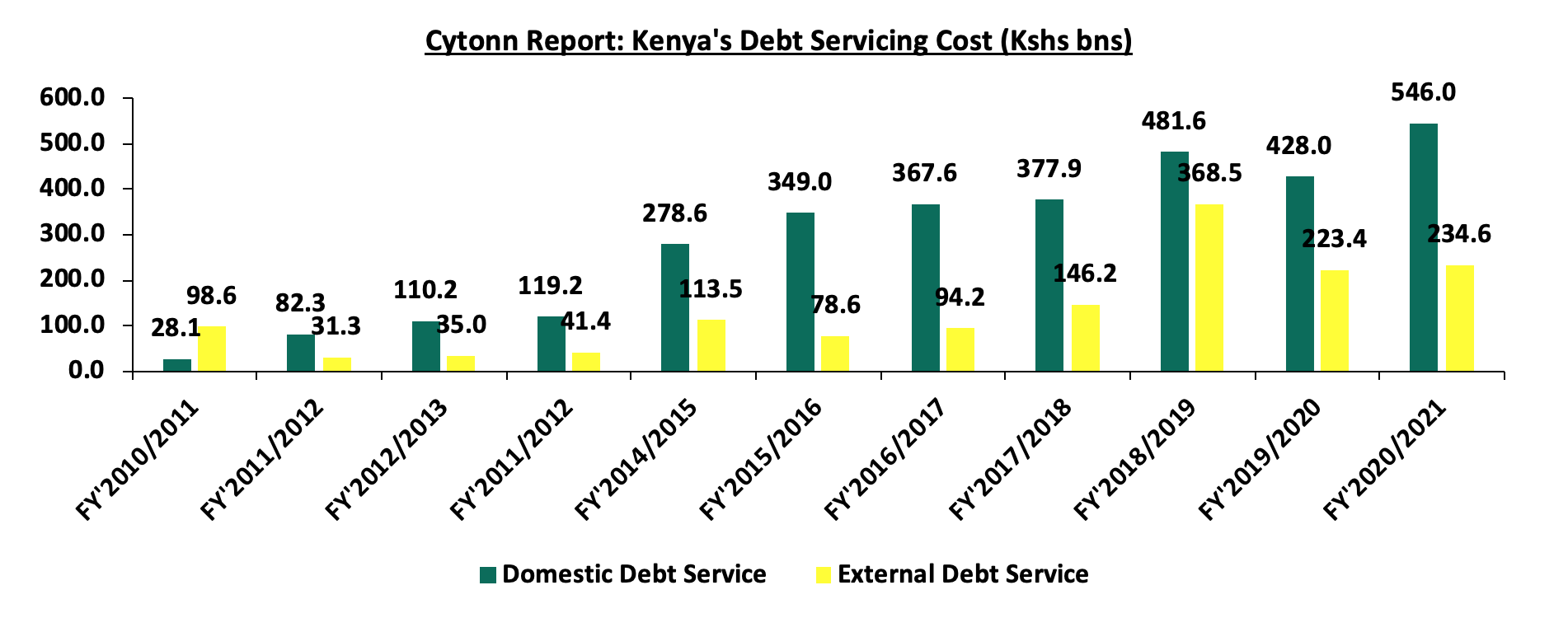

Kenya’s debt stock has continued to increase over the years mainly due to a widening fiscal deficit coupled with increased debt servicing costs. Key to note, the country’s debt stood at Kshs 8.6 tn as of July 2022, equivalent to 68.1% of GDP and 18.1% points above the IMF recommended threshold of 50.0% for developing nations. The increased debt burden has consequently led to a decline in the gross reserves as it necessitates a draw down in the reserves, leading to the deterioration of the balance of payments. The graph below shows the debt servicing costs over the last ten fiscal years:

Source: National Treasury

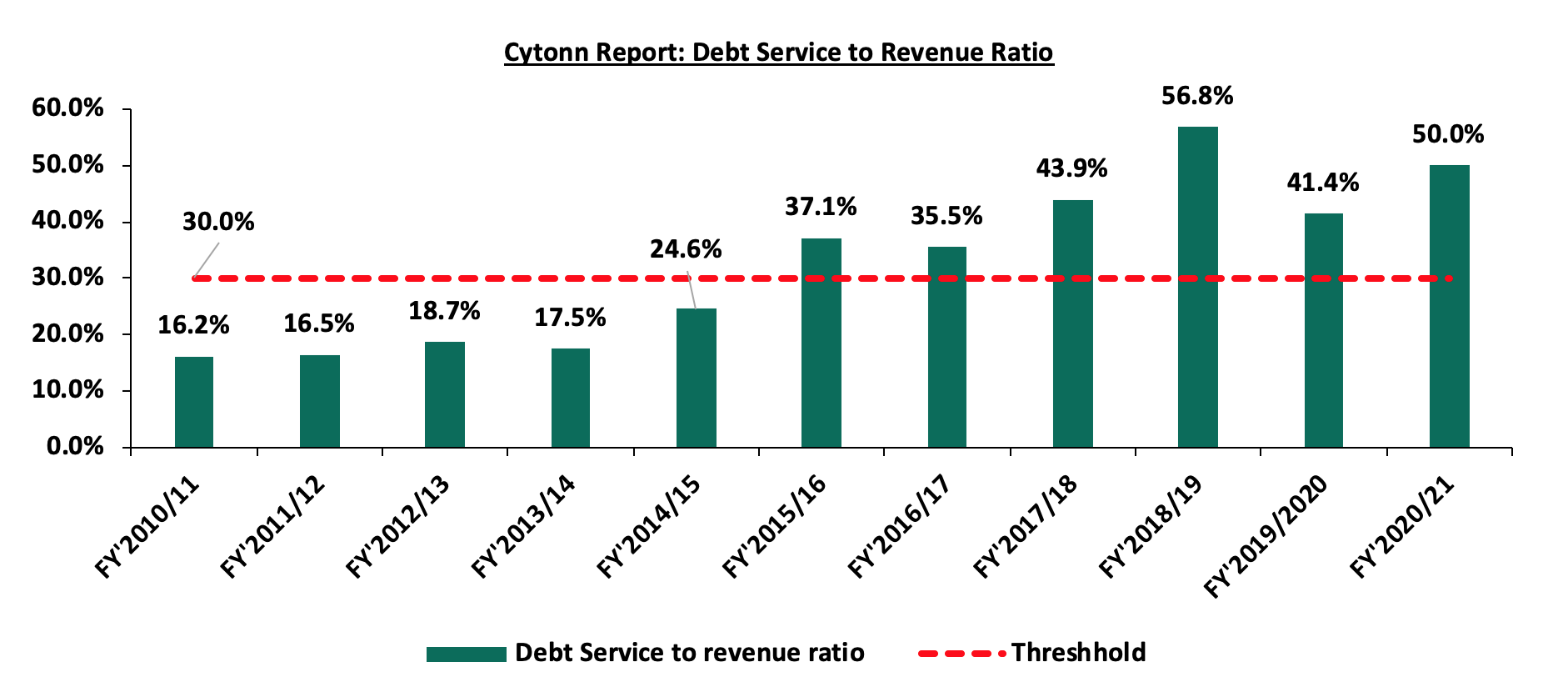

Consequently, the debt service to revenue ratio has continued to increase and was estimated at 50.0% for the FY’2020/2021, 20.0% points higher than IMF’s recommended threshold of 30.0%. The sustained level of debt service to revenue ratio above the recommended threshold is a worrying sign, elevating the refinancing risk following shocks arising from the pandemic and global supply disruptions accelerated by the ongoing Russian-Ukrainian conflict. Below is a chart showing the debt service to revenue ratio for the last ten fiscal years;

Source: National Treasury

Balance of payments deficit indicates that the country is spending more than it is receiving. As such, it is forced to borrow more money to pay for the goods and services from the rest of the world. In the long-term, a country becomes a net consumer and not a net producer of the global economic output which leads to more debt requirements. Additionally, a persistent deficit may necessitate selling of some of the resources to pay its creditors.

Section III: Balance of Payments Outlook and Recommendations

The aim of any government is to ensure self-sufficiency and one of the ways to get here is to strive for a more sustainable balance of payments, which will be driven by sustainable trade and an appealing investment environment. A persistently negative balance of payments exposes the country to a variety of risks including;

- Risk of Capital Flight – A negative balance of payments leads to the reduction of investor confidence by foreign investors. As such, there is a risk of most investors withdrawing their investments which consequently leads to a reduction in forex reserves as well as revenues collected,

- Foreign Ownership of Assets – A current account deficit leads to a deficit on the financial and capital accounts. The deficit in the financial account means foreigners have an increasing claim on the country’s assets which they can desire to be returned at any point in time. When a country’s best assets are purchased by foreigners, the country’s long-term income deteriorates as it leads to future outflows of interest and dividends to foreign investors,

- Risk of Currency Depreciation – When a country is running a large current account deficit, it is at a risk of the country’s currency depreciating due to insufficient capital flows. Additionally, currency depreciation can lead to imported inflation for consumers and firms who rely on imports,

- Debt Unsustainability – If the current account deficit is being financed through borrowing, the debt burden increases and consequently the cost of borrowing. Such high debt burden leads to little finances to spend on investments and various developments, and,

- Depletion of foreign reserves – Increased debt burden translates to increased debt servicing costs which leads to a decline in the foreign reserves if used to fund the repayments. There is risk of running out of official foreign reserves of a country in the long term.

In our view, the government should look into the following broad policies to improve the balance of payments;

- Expenditure-switching policies –Refers to policies aimed at enticing people to switch their spending from imported goods to domestic products such as import tariffs,

- Expenditure reducing policies – Such policies are aimed at reducing domestic expenditure hence reducing the level of imports and may include deflationary monetary and fiscal policies,

- Supply side policies – These are government economic policies aimed at making industries and markets run more smoothly and efficiently, thereby contributing to economic growth. The policies are aimed at improving the competitiveness of domestic firms which may involve increasing quantity and quality of factors of production as well as manufacturing thereby optimizing the export capacity, and,

- Improving macroeconomic stability – Refers to policies that would make a country attractive to inward investments thus raising local production consequently improving capacity for export to bridge the current account deficit.

In light of the above, the government of Kenya should look into key factors such as improving exports, compressing the imports and attracting more direct investments so as to minimize borrowing. Below are our specific recommendations;

- Reduce Imports – To improve Kenya’s current account deficit, the government ought to take steps to reduce imports, primarily through self-sufficiency, which means only importing which it must. For example, a focus on agriculture will reduce the amount we spend on importing food items such as wheat, sugar, maize and other agricultural commodities that we can grow locally,

- Increase Exports – To further improve Kenya’s current account deficit, we expect the government to adopt policies that encourage more exports. In order to enhance productivity of the export sector, the government can promote value addition especially in agro-processing to increase the value of exports. We can also cautiously adopt strategies such as lowering of tariffs, exports subsidies and duty exemption for some of these industries,

- Improving Foreign Direct Investments - According to Foreign Investment Survey 2020 Report, FDI accounted for the largest share of the stock of foreign liabilities at 52.9 per cent in 2018 and 2019. The stock of FDI rose to Kshs 940.9 mn from KSh 870.8 million in 2018 on account of increases in both equity and retained earnings. The government can encourage FDI by improving infrastructure, offering financial incentives and easing some of the regulatory measures that discourage foreign investments. This will consequently lead to an increase in revenues as well as foreign exchange reserves,

- Debt Management - As stated above, Kenya’s external public and public guaranteed debt has been increasing over the years as a result of the need to fund Kenya’s budget deficit. This has consequently led to a decline in the foreign exchange reserves which are used in repaying the debt. To manage the debt levels, the government can i) embark on fiscal consolidation, ii) promote the operations of capital markets so that we have increased local savings, iii) improve the current account deficit, iv) diversify funding of projects to include the private sector, and iv) ensure enhanced parliamentary oversight. Additionally, the government should spur economic growth and address financial weaknesses of essential parastatals, while aggressively privatizing those that can easily be done by private sector such as sugar companies and the national oil corporation. Such actions will reduce the debt burden in the country which will reduce the forex reserves used in financing debt thus improving the balance of payments,

- Effective Tax Policies – In our view, the Kenyan government should focus on ensuring that all tax reforms and policies especially those from economic populists are aligned with economic goals and do not impede productivity. Furthermore, as the country seeks fiscal consolidation, it is worth noting that lowering tax rates across the board may be counterproductive unless accompanied by a reduction in expenditure,

- Acceleration of Local Entrepreneurship – Entrepreneurship is core to producing new and innovative goods and services, which will promote local sufficiency and reducing imported dependency,

- Improve the Ease of Doing Business – To attract more FDI and improve local competitiveness, the government needs to focus intently on ease of doing business so that entrepreneurs are focused on running businesses not chasing approvals, bribing bureaucrats and long waits, and,

- Remove obstacles to local capital formation and savings – Entrepreneurs need capital to finance their businesses, and this capital will come from both banks and capital markets. According to world bank data, in well-functioning markets, banks provide only 40.0% of businesses funding, with the balance of 60.0% of capital coming from capital markets. However, in Kenya, banks provide 99.0% of business funding with only 1.0% coming from our capital markets. This is mainly due to the many obstacles in our capital markets that discourages savings. As such, the government ought to focus on removing obstacles to capital formation.

Section IV: Conclusion

Kenya has been experiencing a current account deficit over the last ten years which has continuously led to a weak balance of payment. Given the current state of the economy characterized by a subdued business environment, elevated inflationary pressures and a high debt burden, we expect that urgent policy measures will be implemented to manage the debt levels, reduce the fiscal deficit, restore economic stability, and mitigate the negative impacts on the Kenyan citizens. We however note that the new government has a significant role to play in stabilizing the economy against a backdrop of unprecedented challenges that continue to weigh on the key macro-economic indicators. As such, we maintain our view that the new administration has limited choices but to focus on ways to boost economic growth, in a bid to reduce the over reliance on debt and imports which stand out as the most critical issues for the country. One of the best ways to accomplish this would be to foster an effective capital markets that enables the business community to raise long-term funds for capital purchases, thereby propelling their growth and the country's economic growth.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.