On 12 June 2025, the National Treasury presented Kenya’s FY’2025/2026 National Budget to the National Assembly highlighting that the total budget estimates for FY’2024/25 increased by 7.1% to Kshs 4.3 tn from the Kshs 4.0 tn in FY’2024/2025 while the total revenue inclusive of grants increased by 8.0% to Kshs 3.4 tn from the Kshs 3.1 tn in FY’2024/2025. The increase is mainly due to an 6.7% increase in ordinary revenue to Kshs 2.8 tn for FY’2025/2026, from the Kshs 2.6 tn in FY’2024/25.

The FY’2024/2025 budget focuses mainly on providing solutions to the heightened concerns on the high cost of living, the measures put in place to stimulate sustainable economic recovery as well as undertaking a growth-friendly fiscal consolidation to preserve the country’s debt sustainability. Notably, the government projects to narrow the fiscal deficit to 4.8% of GDP in FY’2025/26, from the estimate of 5.1% of GDP in FY’2024/25. As such, this week, we shall discuss the recently released budget and the Finance Bill 2025 with a key focus on Kenya’s fiscal components. We shall do this in four sections, namely:

- FY’2024/2025 Budget Outturn as at May 2025,

- Comparison between FY'2024/2025 and FY'2025/2026 Budget estimates,

- Analysis and House-view on Key Aspects of the 2025 Budget,

- Finance Bill 2025, and,

- Conclusion and Our View.

Section I: FY’2024/2025 Budget Outturn as at May 2025

The National Treasury gazetted the revenue and net expenditures for the eleventh month of FY’2024/2025, ending 30th May 2025. Below is a summary of the performance:

|

FY'2024/2025 Budget Outturn - As at 30th May 2025 |

|||||||

|

Amounts in Kshs Billions unless stated otherwise |

|||||||

|

Item |

12-months Original Estimates |

Revised Estimates I |

Revised Estimates II |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates II |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

|

|

1.2 |

|

|

|

|

Tax Revenue |

2,745.2 |

2,475.1 |

2,400.7 |

2,011.4 |

83.8% |

2,200.7 |

91.4% |

|

Non-Tax Revenue |

172.0 |

156.4 |

180.2 |

145.2 |

80.6% |

165.2 |

87.9% |

|

Total Revenue |

2,917.2 |

2,631.4 |

2,580.9 |

2,157.8 |

83.6% |

2,365.8 |

91.2% |

|

External Loans & Grants |

571.2 |

593.5 |

718.4 |

426.1 |

59.3% |

658.5 |

64.7% |

|

Domestic Borrowings |

828.4 |

978.3 |

1,167.0 |

932.9 |

79.9% |

1,069.8 |

87.2% |

|

Other Domestic Financing |

4.7 |

4.7 |

8.5 |

4.4 |

52.1% |

7.8 |

56.9% |

|

Total Financing |

1,404.3 |

1,576.5 |

1,894.0 |

1,363.4 |

72.0% |

1,736.1 |

78.5% |

|

Recurrent Exchequer issues |

1,348.4 |

1,307.9 |

1,412.7 |

1,263.1 |

89.4% |

1,294.9 |

97.5% |

|

CFS Exchequer Issues |

2,114.1 |

2,137.8 |

2,289.0 |

1,637.0 |

71.5% |

2,098.3 |

78.0% |

|

Development Expenditure & Net Lending |

458.9 |

351.3 |

354.9 |

264.8 |

74.6% |

325.4 |

81.4% |

|

County Governments + Contingencies |

400.1 |

410.8 |

418.3 |

354.3 |

84.7% |

383.4 |

92.4% |

|

Total Expenditure |

4,321.5 |

4,207.9 |

4,474.9 |

3,519.2 |

78.6% |

4,102.0 |

85.8% |

|

Fiscal Deficit excluding Grants |

1,404.3 |

1,576.5 |

1,894.0 |

1,361.4 |

71.9% |

1,736.1 |

78.4% |

|

Total Borrowing |

1,399.6 |

1,571.8 |

1,885.4 |

1,359.0 |

72.1% |

1,728.3 |

78.6% |

|

Public Debt |

1,910.5 |

1,910.5 |

2,042.1 |

1,448.1 |

70.9% |

1,871.9 |

77.4% |

Source: National Treasury

The Key take-outs from the release include;

- Total revenue collected as at the end of May 2025 amounted to Kshs 2,157.8 bn, equivalent to 83.6% of the revised estimates II of Kshs 2,580.9 bn for FY’2024/2025 and is 91.2% of the prorated estimates of Kshs 2,365.8bn. Cumulatively, tax revenues amounted to Kshs 2,011.4 bn, equivalent to 83.8% of the revised estimates II of Kshs 2,400.7 bn and 91.4% of the prorated estimates of Kshs 2,200.7 bn,

- Total financing amounted to Kshs 1,363.4 bn, equivalent to 72.0% of the revised estimates II of Kshs 1,894.0 bn and is equivalent to 78.5% of the prorated estimates of Kshs 1,736.1 bn. Additionally, domestic borrowing amounted to Kshs 932.9 bn, equivalent to 79.9% of the revised estimates II of Kshs 1,167.0 bn and is 87.2% of the prorated estimates of Kshs 1,069.8 bn,

- The total expenditure amounted to Kshs 3,519.2 bn, equivalent to 78.6% of the revised estimates II of Kshs 4,474.9 bn, and is 85.8% of the prorated target expenditure estimates of Kshs 4,102.0 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 1,263.1 bn, equivalent to 89.4% of the revised estimates II of Kshs 1,412.7 and are equivalent to 97.5% of the prorated estimates of Kshs 1,294.9 bn,

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 1,637.0 bn, equivalent to 71.5% of the revised estimates II of Kshs 2,289.0 bn, and are 78.0% of the prorated amount of Kshs 2,098.3 bn. The cumulative public debt servicing cost amounted to Kshs 1,448.1 bn which is 70.9% of the revised estimates II of Kshs 2,042.1 bn, and is 77.4% of the prorated estimates of Kshs 1,871.9 bn. Additionally, the Kshs 1,448.1 bn debt servicing cost is equivalent to 67.1% of the actual cumulative revenues collected as at the end of May 2025, and,

- Total Borrowings as at the end of May 2025 amounted to Kshs 1,359.0 bn, equivalent to 72.1% of the revised estimates II of Kshs 1,885.4 bn for FY’2024/2025 and are 78.6% of the prorated estimates of Kshs 1,728.3 bn. The cumulative domestic borrowing of Kshs 1,167.0 bn comprises of Net Domestic Borrowing Kshs 597.2 bn and Internal Debt Redemptions (Rollovers) Kshs 569.9 bn.

The government missed its prorated revenue targets for the eleventh consecutive month in FY’2024/2025, however registering a significant performance improvement, achieving 91.2% of the prorated revenue targets in May 2025. The shortfall is largely due to the challenging business environment experienced in previous months with the Purchasing Managers’ Index (PMI), averaging 49.2, below the 50.0 neutral mark, in the first half of the FY’2024/2025, exacerbated by high taxes and an elevated cost of living. However, the cost of credit has seemingly declined, providing some relief to businesses and households. The improved business environment is reflected in the Purchasing Managers’ Index (PMI), which has averaged at 50.9 in the second half of FY’2024/25 so far. The PMI however dipped to 49.6 in May 2025 from 52.0 in April 2025, signaling a contraction in private‑sector output after seven months of expansion. While efforts to enhance revenue collection, such as broadening the tax base, curbing tax evasion, and suspending tax relief payments, are yet to yield full benefits, future revenue performance will depend on how quickly private sector activity gains momentum. This is expected to be supported by a stable Shilling, lower borrowing costs, and continued efforts to enhance economic growth. The reduction in the Central Bank Rate (CBR) by 25 basis points to 9.75% from 10.00%, following the Monetary Policy Committee’s (MPC) meeting on June 10th, 2025, is expected to further ease credit conditions and support private sector expansion.

Section II: Comparison between FY’2024/2025 and FY’2025/2026 Budgets estimates

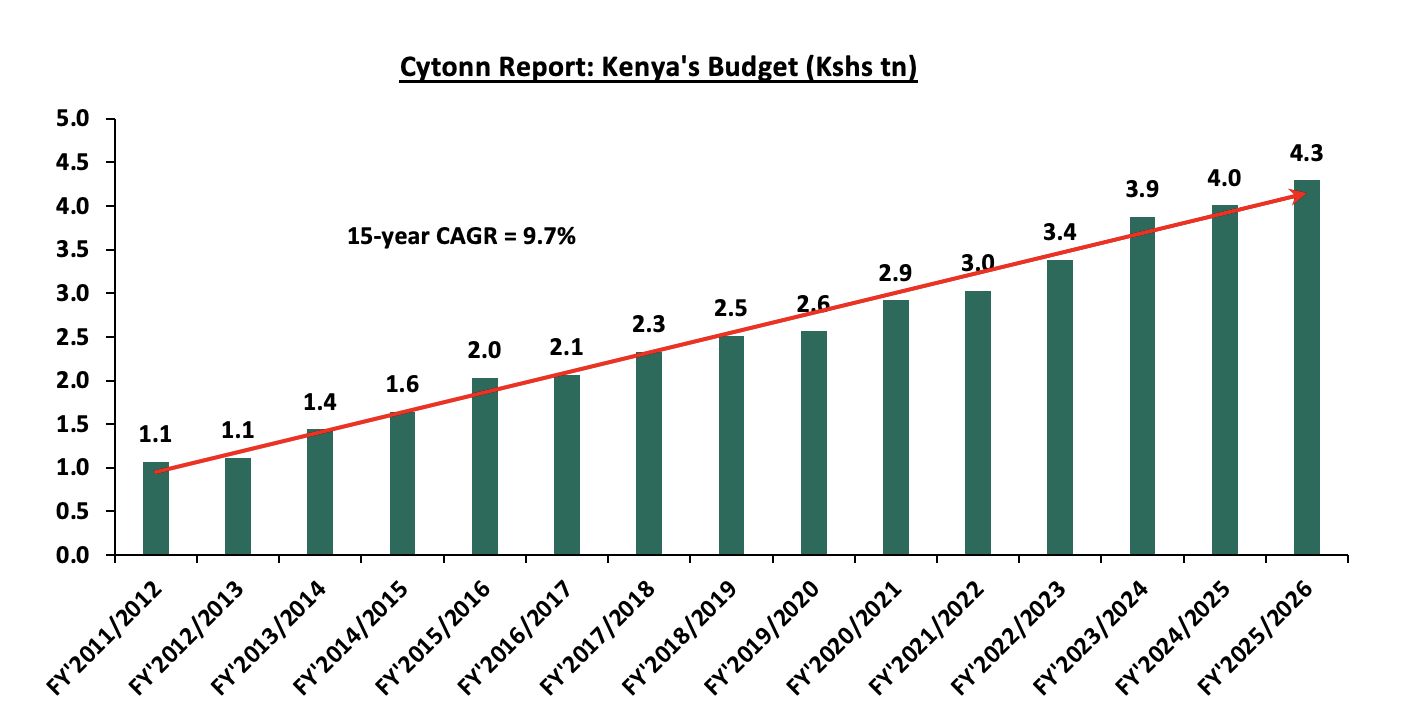

The Kenyan Government budget has been growing over the years on the back of increasing recurrent and development expenditures. The chart below shows the evolution of the government budget over a fifteen-year period:

Source: National Treasury of Kenya

For the FY’2025/2026, the budget is projected to increase by 7.1% to Kshs 4.3 tn, from Kshs 4.0 tn in FY’2024/2025. The expenditure will be funded by revenue collections of Kshs 3.4 tn and borrowings amounting to Kshs 923.2 bn.

The table below summarizes the key buckets and the projected changes:

|

Cytonn Report: Comparison between FY’2024/2025 and FY’2025/2026 Budgets Estimates |

|||

|

Item |

FY'2024/25 Supplementary Budget II |

FY'2025/26 Estimates |

Change y/y (%) |

|

Amounts in Kshs billions unless stated otherwise |

|||

|

Ordinary Revenue |

2,580.9 |

2,754.7 |

6.7% |

|

Ministerial Appropriation-in-Aid |

486.8 |

567.0 |

16.5% |

|

Total grants |

52.6 |

46.9 |

(10.8%) |

|

Total Revenue & Grants |

3,120.3 |

3,368.6 |

8.0% |

|

Recurrent expenditure |

1,705.7 |

1,805.0 |

5.8% |

|

Recurrent Consolidated Funds Services (CFS) |

1,242.7 |

1,337.3 |

7.6% |

|

Development expenditure |

624.7 |

693.2 |

13.0% |

|

County Transfer & Contingencies |

445.6 |

474.9 |

6.6% |

|

Total expenditure |

4,007.5 |

4,291.9 |

7.1% |

|

Fiscal deficit inclusive of grants |

(887.2) |

(923.3) |

4.1% |

|

Projected Deficit as % of GDP |

(5.1%) |

(4.8%) |

(0.3%) pts |

|

Net foreign borrowing |

281.5 |

287.7 |

2.2% |

|

Net domestic borrowing |

605.7 |

635.5 |

4.9% |

|

Total borrowing |

887.2 |

923.2 |

4.1% |

Source: National Treasury of Kenya, www.parliament.go.ke

Some of the key take-outs include;

- The government projects total revenue inclusive of grants for FY’2025/26 to increase by 8.0% to Kshs 3.4 tn (equivalent to 17.5% of GDP), from the Kshs 3.1 tn in FY’2024/2025 (equivalent to 17.9% of GDP). The increase is mainly due to a 6.7% increase in ordinary revenue to Kshs 2.8 tn (equivalent to 14.3% of GDP) for FY’2024/2025, from the Kshs 2.6 tn in FY’2023/24 (equivalent to 14.8% of GDP),

- Total expenditure is set to increase by 7.1% to Kshs 4.3 tn (equivalent to 22.3% of GDP), from Kshs 4.0 tn (equivalent to 23.0% of GDP) in the FY’2024/25 Budget estimates,

- Recurrent expenditure is set to increase by 5.8% to Kshs 1.8 tn (equivalent to 9.4% of GDP), in FY’2025/2026, from Kshs 1.7 tn in the FY’2024/2025 budget estimates. Consolidated Funds Services expenditure is set to increase by 7.6% to Kshs 1.3 tn in FY’2025/2026, from Kshs 1.2 tn in the FY’2024/2025 budget estimates.

- Development expenditure is set to increase by 11.0% to Kshs 693.2 bn, from Kshs 624.7 bn in the FY’2024/2025 budget estimates,

- Public debt is expected to continue growing in FY’2024/25, as the approximate Kshs 923.2 bn fiscal deficit will be financed through domestic debt totaling Kshs 635.5 bn and foreign debts totaling Kshs 287.7 bn. Similarly, the total borrowing is expected to increase by 4.1% to Kshs 923.2 bn in the FY’2025/26, from Kshs 887.2 bn as per the FY’2024/2025 supplementary budget II. Notably, Kenya’s public debt burden which stood at 66.6% of GDP as of September 2024, surpassing the 50.0% recommended threshold by 16.6% points, continues to exert pressure on fiscal sustainability and increase the risk of debt distress in the country, and,

- The budget deficit is projected to decline by 0.3% points to 4.8% of GDP, from the 5.1% of GDP in the FY’2024/2025 budget, mainly as growth in revenues outpace growth in expenditure.

Section III: Analysis and House-view on Key Aspects of the FY’2025/2026 Budget

- Revenue

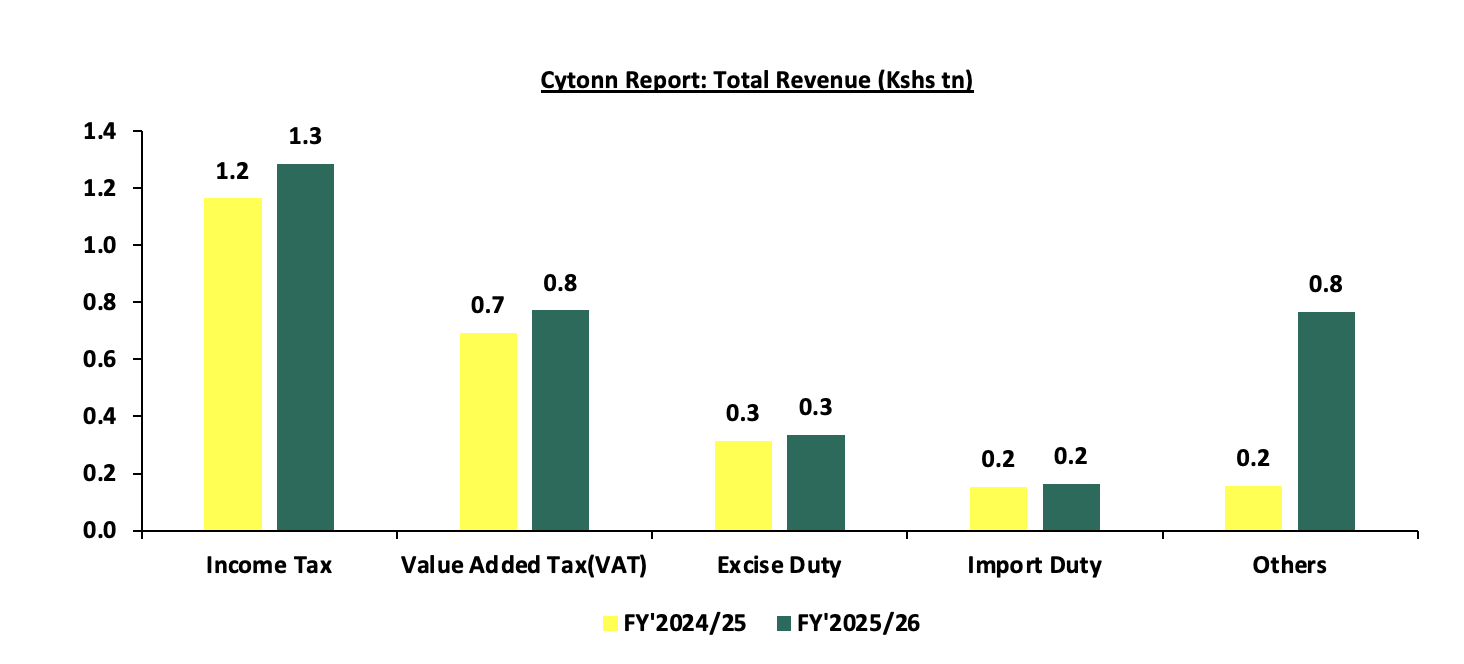

Revenue is projected to increase by 8.0% to Kshs 3.4 tn in FY’2024/25, from Kshs 3.1 tn in the FY’2024/25 supplementary budget II. The increased revenue projections in the FY’2025/26 are mainly attributable to the projected 6.7% growth in ordinary revenue to Kshs 2.8 tn in FY’2025/26, from Kshs 2.6 tn in the FY’2024/25 budget. The main sources of revenue will be:

- Income Tax, which remains the highest contributor to government revenue, contributing 38.7% of the total revenue projections of Kshs 3.3 tn, is expected to increase by 10.3% to Kshs 1.3 tn in FY’2025/26, from Kshs 1.2 tn in FY’2024/2025,

- Value Added Tax (VAT) contributing 23.2% of the projected total revenue is projected to increase by 11.1% to Kshs 771.7 bn in FY’2025/26 budget, from Kshs 694.3 bn in the FY’2024/25 budget,

- Excise Duty contributing 10.1% to the projected revenues for the FY’2025/26 is expected to increase by 6.5% to Kshs 335.5 bn, from Kshs 315.0 bn in FY’2024/25 budget estimates, and,

- Import Duty contributing 4.9% to the projected revenues for the FY’2025/26 is expected to increase by 6.5% to Kshs 162.9 bn, from Kshs 157.1 bn in FY’2024/25 budget estimates.

The chart below compares ordinary revenue projections for FY’2025/26 and FY’2024/25:

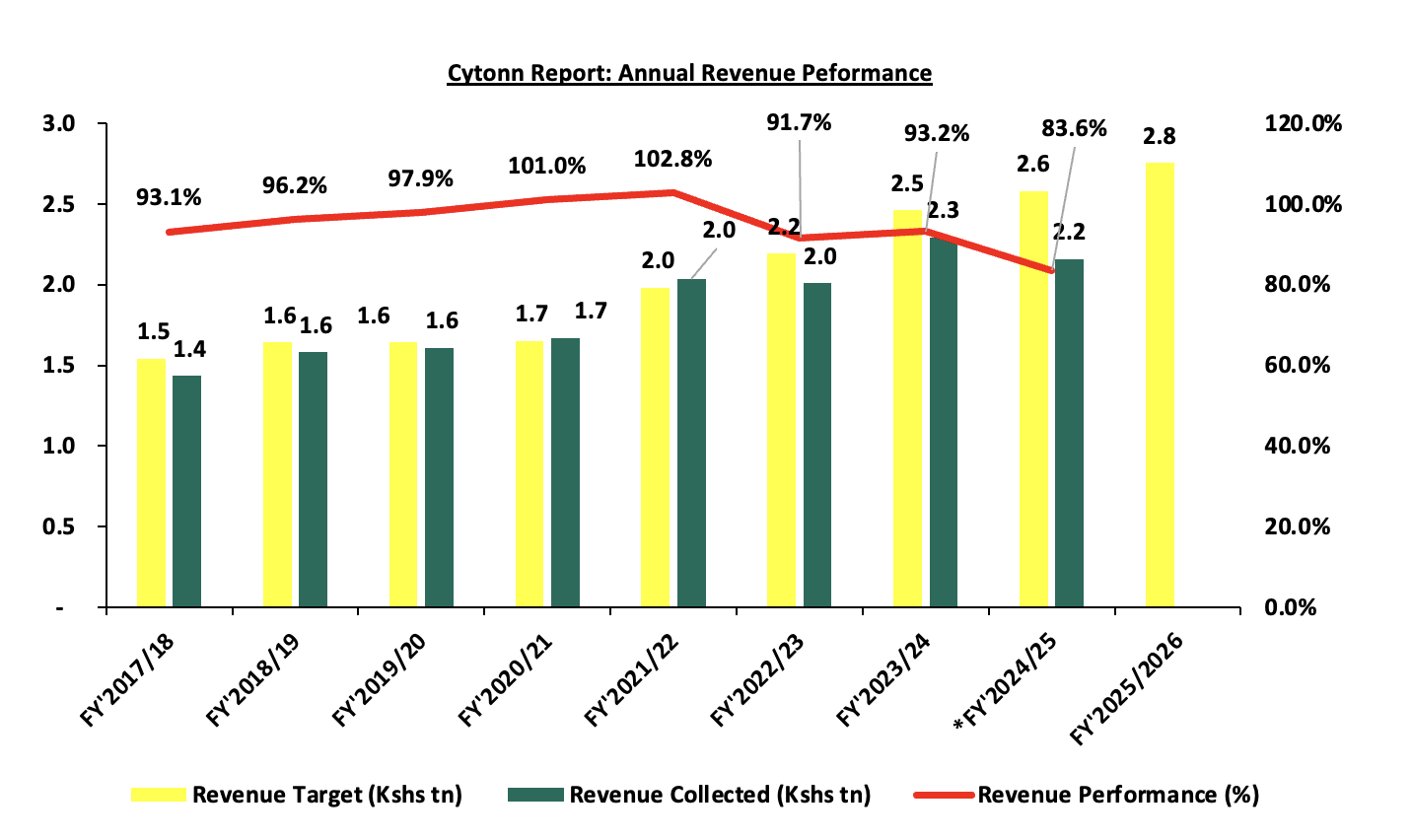

The government relies on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target, which has seemingly resulted in improved revenue collection as evidenced by 93.2% of the revenue targets in FY’2023/24, and having attained 91.2% of the prorated revenue numbers for FY’2024/25 as of end May 2025. To enhance domestic revenue mobilization and support key government programs in FY’2025/2026, the Kenyan government is implementing a blend of tax policy and administrative measures focused on expanding the tax base, improving compliance, and leveraging technology. Priority sectors such as the digital economy, agribusiness, and SMEs are being targeted through tax education and outreach, while the Kenya Revenue Authority (KRA) has introduced digital tools like auto-populated VAT and simplified PAYE returns, the Electronic Rental Income Tax System, and integration of fuel dispensers with the Tax Invoice Management System to streamline compliance and increase transparency. These innovations aim to promote a fair and inclusive tax culture while reducing administrative burdens. However, despite the efforts in place, historically, the government has struggled to meet its target revenue collections resulting to an ever-present fiscal deficit. As such, there are still concerns about the government's ability to meet its revenue collection targets in FY’2025/2026 mainly on the back of the current operating environment, where the cost of living remains elevated despite an ease in inflationary pressures. The chart below shows the ordinary revenue performance in the previous fiscal years:

Source: National Treasury of Kenya and Kenya Revenue Authority

*Total Revenue collection as of 31 May 2025

- Expenditure

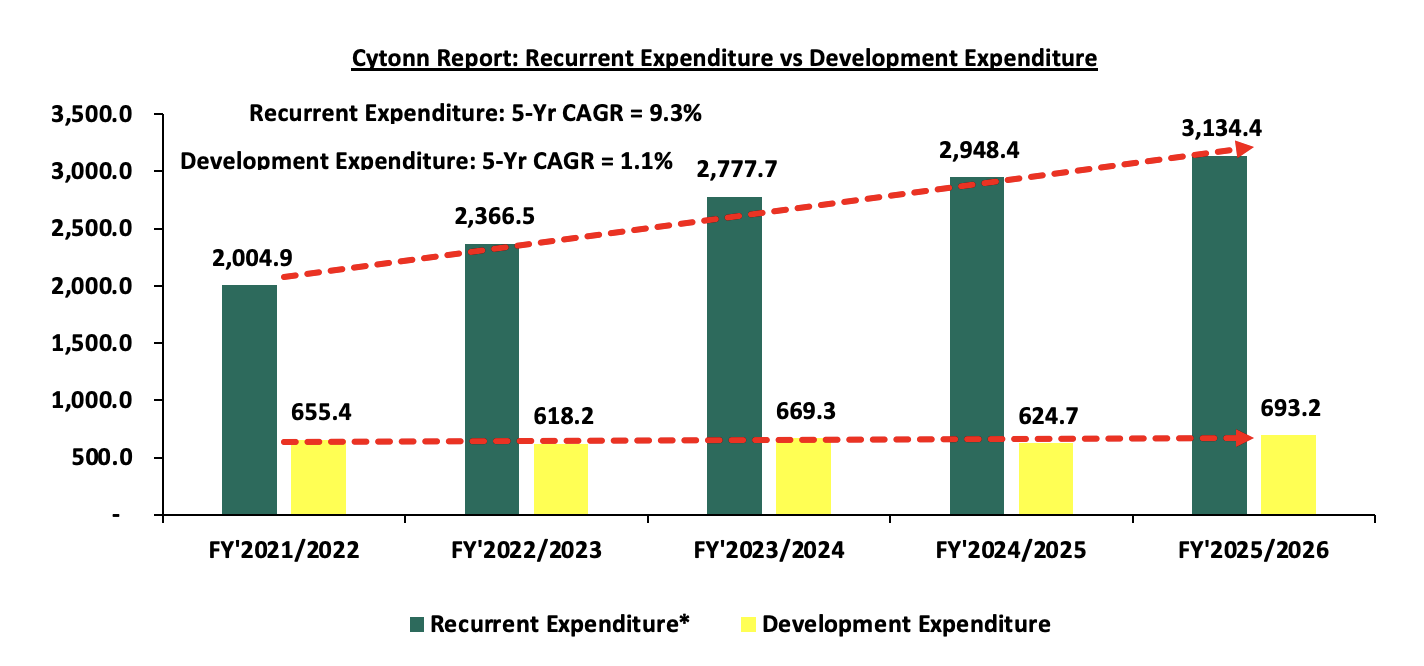

Expenditure is expected to increase by 7.1% to Kshs 4.3 tn, from Kshs 4.0 tn in the FY’2024/25 budget with recurrent expenditure taking up 73.0% of the total expenditure for FY’2025/2026, in comparison to the 73.6% in FY’2024/2025. The chart below shows the comparison between the recurrent expenditure allocations and development expenditure allocations over the past five fiscal years:

Source: National Treasury of Kenya

*Recurrent Expenditure includes the Consolidated Fund Services (CFS) Expenditure

Some of the key take-outs include;

- Recurrent expenditure takes the largest proportion of government expenditure over the last five fiscal years growing at a 5-year CAGR of 9.3% to Kshs 3,134.4 bn in FY’2025/26, from Kshs 2,004.9 bn in FY’2021/2022. For the FY’2024/2025, the recurrent expenditure is estimated to increase by 6.3% to Kshs 3,134.4 bn, from Kshs 2,948.4 bn in FY’2024/2025 mainly due to a 7.6% increase in Consolidated Fund Services (CFS) expenditure to Kshs 1,337.3 bn from Kshs 1,242.7 bn in FY’2024/2025. The increase can be mainly attributed to the increased debt servicing cost which represented 88.5% of the CFS expenditure in FY’2024/2025 as of 30th May 2025. We expect the debt servicing cost to continue increasing as the government is expected to borrow more to close the revenue gap, and,

- Development expenditure on the other hand continues to lag behind contributing only 16.2% of the FY’2025/26 expenditure estimates. Allocation to infrastructure remains the highest taking 77.3% of the development expenditure. In the FY’2025/2026, infrastructure expenditure is set to increase by 12.2% to Kshs 535.6 bn, from Kshs 477.2 bn estimate in FY’2024/2025 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, sea, and airport sectors in order to open many areas to economic activities and spur growth in cross border trade and regional integration. The table below shows the sectors with the highest expenditure allocation over the last five fiscal years:

|

Amounts in Kshs billions unless stated otherwise |

|||||||

|

Cytonn Report: Kenya Budget Highest Expenditure Allocations |

|||||||

|

Item |

FY'2021/2022 |

FY'2022/2023 |

FY'2023/2024 |

FY'2024/2025 |

FY'2025/2026 |

Change |

CAGR |

|

Interest Payments, Pensions & Net Lending |

718.3 |

867.8 |

1057.7 |

1242.7 |

1337.0 |

7.6% |

13.2% |

|

Education |

503.9 |

544.4 |

628.6 |

656.6 |

702.7 |

7.0% |

6.9% |

|

Infrastructure |

383.3 |

416.4 |

468.2 |

477.2 |

535.6 |

12.2% |

6.9% |

|

County Shareable Revenue |

370.0 |

399.6 |

423.9 |

445.6 |

474.9 |

6.6% |

5.1% |

|

Public Admin & Int. Relations |

299.7 |

342.2 |

327.0 |

322.4 |

335.4 |

4.0% |

2.3% |

|

Total |

2275.2 |

2570.4 |

2905.4 |

3069.7 |

3271.8 |

6.6% |

7.5% |

Source: The Mwananchi Guide for the FY’2025/26, National Treasury of Kenya

Notably, the allocation to interest payment, pension and net lending increased by 7.6% to Kshs 1,337.0 bn in FY’2025/26 from Kshs 1,242.7 bn in FY’2024/25, partly attributable to high cost of servicing debt.

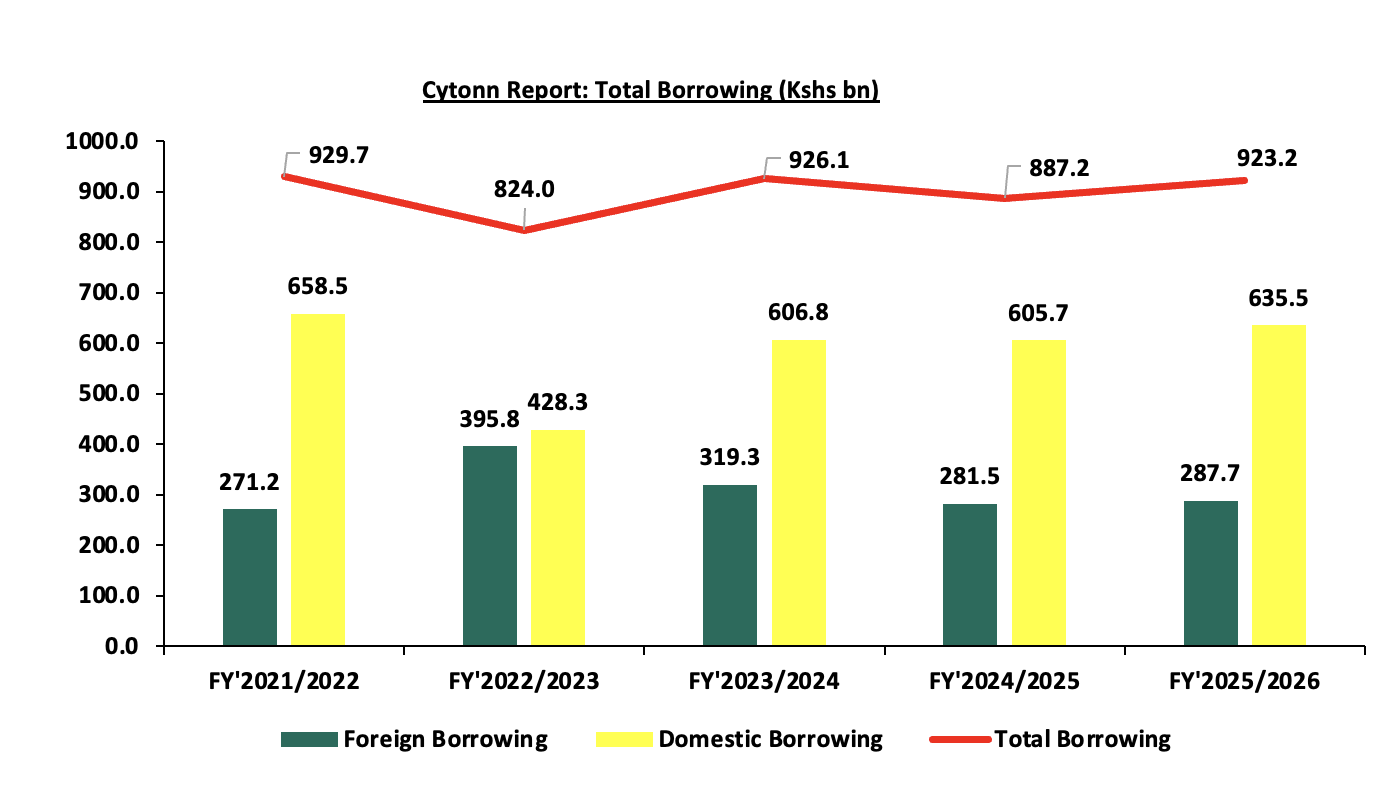

- Borrowing

The total borrowing for the FY’2024/25 is set to increase by 4.1% to Kshs 923,2 bn, from Kshs 887.2 bn, in FY’2024/25 budget estimates II. The public debt mix is projected to comprise of 31.2% foreign debt and 68.8% domestic debt, from 31.7% foreign financing and 68.3% domestic financing as per the FY’2024/25 Supplementary Budget II. The rise in debt servicing expenses can be partly attributed to the government’s high affinity for debt to finance the wide budget deficits, partly fueled by the ballooning recurrent expenditure and debt costs. As the government works towards maintaining sustainable debt levels, it will be crucial to implement debt management reforms, prioritize concessional borrowing, and develop the domestic debt market to lower borrowing costs further. Additionally, the government will explore innovative financing options such as debt swaps, diaspora bonds, and sustainability-linked instruments to diversify funding sources, and support fiscal consolidation. The chart below shows the evolution of public borrowing to fill the fiscal deficit gap over the last five years:

The key take-outs from the chart include:

- The proportion of domestic financing is estimated to rise slightly to 68.8% in FY’2025/26 from 68.3% in FY’2024/25. While this may heighten the risk of crowding out the private sector given banks' preference for lending to the government due to lower perceived risk, it is worth noting that interest rates have been on a downward trajectory since last year, with the 91-day T-bill averaging at 8.2% for June 2025, compared to an average rate of 16.0% in June 2024, which could ease some pressure on private sector credit access. This coupled with ongoing decline in borrowing rates is expected to encourage more lending to the private sector, and,

- The total borrowing is expected to increase by 4.1% to Kshs 923.2 bn, from Kshs 887.2 bn in FY’2024/25, reflecting the dependence on debt to finance the fiscal deficit. This underscores the need for sustained fiscal consolidation efforts, including enhanced revenue mobilization and prudent expenditure management, to reduce long-term debt dependence and ensure fiscal sustainability.

We therefore note the persistent fiscal deficit is mainly on the back of low revenue collection and high expenditure. As such, the government needs to minimize spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. This would allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue.

Section IV: Finance Bill 2025

On 19th June 2025, the Kenyan Parliament approved the Finance Bill 2025. Rather than introducing aggressive tax hikes, the Bill focused on plugging revenue leakages, a more reserved approach following the widespread anti-finance bill protests that occurred in June and July 2024, following the Finance Bill 2024.The raft of tax changes in the Finance Bill 2025 are geared towards expanding the tax base and increasing revenues through sealing revenue leakages to meet the government’s budget for the fiscal year 2025/2026 of Kshs 4.3 tn, as well as reduce the budget deficit and borrowing.

Against this backdrop of fiscal consolidation and cautious borrowing, the Finance Bill 2025 introduces a series of targeted measures that aim to broaden the tax base, seal revenue leakages, and support the government’s drive toward a more sustainable fiscal framework. Below we highlight some of the key tax changes, effective from 1st July 2025 contained in the Finance Bill 2025 and the implications:

- Under the Income Tax Act, the Bill provides to:

- Restrict carryover of tax losses to a maximum of 5 years, which could hurt long-term, capital-intensive projects that take over 5 years to become profitable hence possibility of discouraging both foreign and local investment.

- Eliminate the ability to deduct past capital losses from future capital gains meaning taxpayers may be taxed on gains even when they’ve recently suffered related losses, increasing tax burden unfairly.

- Scrap the exemption that prevents income already taxed under another law from being taxed again as a capital gain, increasing the effective tax rate for investors.

- Exempt gains from transferring securities traded on any Capital Markets Authority-licensed exchange from tax, encouraging foreign investment in securities by removing tax on transfers, boosting market activity.

- Exempt dividends from tax for companies certified by the Nairobi International Financial Centre Authority (NIFCA) with a minimum reinvestment of Kshs 250.0 mn annually. This will therefore incentivize companies to reinvest significant amounts, balancing tax incentives with economic growth.

- Lower corporate income tax to 15.0% for the first 10 years for NIFCA-certified companies, then 20.0% thereafter, if they invest Kshs 3.0 bn in the first three years, are holding companies, employ 70.0% Kenyan senior management, and have 60.0% Kenyan employees in senior roles with headquarters in Kenya. For start-ups, 15.0% for the first three years, then 20.0% for the next four years. This promotes investment and job creation in Kenya by offering tax relief, encouraging foreign direct investment and supporting start-ups while ensuring local employment.

- Decrease the digital asset tax rate to 1.5% from 3.0% on transfer or exchange value, lowering the tax burden on digital asset transactions, therefore fostering higher trading volumes and stimulating Kenya’s digital market.

- Require only one designated entity in Kenya to file Country-by-Country Reporting (CbCR) when multiple entities of a multinational group are resident in Kenya, bringing clarity to the filing obligations of multinational entities, reducing uncertainty.

- Remove exemption from Country-by-Country Reporting (CbCR) filing for resident surrogate parent entities, aligning Kenya’s tax laws with international standards, BEPS Action 13, promoting global tax transparency.

- Allow taxpayers to agree in advance, Advance Pricing Agreements (APA) with the KRA on transfer pricing for up to 5 years, easing tax compliance for related-party transactions by reducing disputes and audit risks through pre-agreed pricing, effective from 1st January 2026.

- Introduce a withholding tax on profits or gains from non-resident ship owners or charterers, excluding transhipment activities, expanding the tax base to include income from non-residents, potentially increasing government revenue but raising shipping business costs and possibly redirecting shipping routes.

- Extend the definition of royalty to include recurring software-related payments made through distributors. This change could expand tax liability for software distributors, increasing compliance obligations and possibly reducing economic returns.

- Set the payment deadline for minimum top-up tax to the end of the fourth month after the financial year, to enhance clarity and consistency in payment timelines, aligning with amendments from the Tax Laws Amendment Act 2024.

- Raise the per diem cash benefit ceiling to Kshs 10,000.0 from Kshs 2,000.0 for employees as reimbursement for work-related duties. This increase offers financial relief to employees, to reflect the current economic conditions and the prevailing cost of living

- Grant tax exemptions, reliefs, and deductions under the Income Tax Act on employee income before applying PAYE, increasing the disposable income

- Apply the corporate income tax rate to fringe benefits, simplifying the tax calculation process for fringe benefits, reducing the administrative burden on businesses.

- Mandate that companies report dividends distributed from untaxed gains in their annual tax returns.

- Include payments for the sale of scrap and supply of goods to a public entity under the ambit of withholding tax.

- Broaden the Significant Economic Presence Tax to cover businesses operating over the internet or through digital marketplaces.

- Remove the Kshs 5.0 mn annual turnover threshold for non-residents to be liable for the Significant Economic Presence Tax.

- Under the Excise Duty Act, the Bill provides to:

- Remove excise duty on imported eggs, onions, potatoes, potato crisps, and chips self-adhesive plates, sheets, films, foils, tapes, and flat shapes and printed paper or paperboard, except for items from East African Community (EAC) Partner States meeting EAC Rules of Origin, potentially lowering consumer pricesfor goods from the EAC region through increased competition and boosting regional economic activity.

- Introduce a 14-day deadline within which the Kenya Revenue Authority (KRA) must either approve or reject applications for licenses concerning the manufacture or importation of excisable goods and services. This time-bound framework aims to increase certainty and speed in the licensing process.

- Redefine a digital lender as someone who provides credit via electronic means, excluding banks under the Banking Act, Sacco societies under the Co-operative Societies Act, or microfinance institutions under the Microfinance Act offering relief to financial institutions already subject to excise duties, reducing double taxation and enhancing clarity in the regulatory framework.

- Describe a digital marketplace as any electronic or online platform that enables users to buy or access goods, services, or property. This updated definition ensures harmonization with existing tax laws, including the Income Tax Act, VAT Act, and Excise Duty Act, thereby promoting consistent tax treatment.

- Broaden the reach of excise duty to include digital services provided by non-residents over the internet, electronic networks, or digital marketplaces, defining a non-resident as a person outside Kenya.

- Under the Value Added Tax (VAT) Act, the Bill provides to:

- Add Section 66A, which imposes VAT liability if exempt or zero-rated goods/services are used or disposed of in a way that contradicts their original exempted purpose implying that taxpayers must now ensure strict adherence to the intended use of exempt or zero-rated items.

- Reduce the allowed period for businesses to apply for VAT refunds to 12 months from 24 months after the tax becomes due, meaning businesses will face tighter deadlines to claim VAT refunds, potentially increasing compliance pressure.

- Cut the refund claim period for VAT on unpaid debts to 2 years from 3 years after supply and permits KRA, upon approval, to apply any refunded VAT to offset other VAT debts.

- Introduces a formal definition of Tax Invoice including mandatory electronic issuance under Section 23A of the Tax Procedure Act and expand VAT-registered businesses' obligation to issue tax invoices to cover exempt supplies, removing the term "taxable" from existing provisions.

- Subject fuels, lubricants, and tires used in vehicles for official aid projects to a 16.0% VAT. Even though other goods for aid-funded projects will remain VAT-exempt, these specific vehicle-related items will now attract VAT.

- Apply 16.0% VAT to goods used exclusively in building tourism infrastructure like hotels, parks (minimum 50 acres), and conference venues, if approved by the Cabinet Secretary, locally assembled vehicles purchased before customs clearance by tour operators for tourist transportation, subject to certain conditions. Key to note, previous VAT exemptions for such developments remain until 30th June 2026. This proposal had been included in the 2024 Finance Bill but was not enacted at that time.

- Apply 16.0% VAT to construction goods under the Affordable Housing Programme, if approved by the Cabinet Secretary. Key to note, previous VAT exemptions for such developments remain until 30th June 2026.

- Change the VAT status of locally assembled mobile phones from zero-rated to exempt.

The Finance Bill 2025 reflects a cautious approach, with the government opting for tax administration reforms over new tax burdens. This move is clearly informed by the lessons of 2024, where unpopular tax hikes triggered widespread protests and public discontent. By focusing on broadening the tax base, improving compliance, and sealing revenue leakages, the government seeks to achieve its fiscal objectives while maintaining economic and social stability. The updated budget estimates for FY’2025/26 underscore this approach, with a reduced projected fiscal deficit target of 4.8% of GDP, down from the 5.1% in FY’2024/25. Notably, inflation has remained relatively stable, remaining within the CBK’s target range of 2.5%-7.5%, although the risk of inflationary pressures still remains majorly as a result of the easing monetary policy. Additionally, and the Kenyan shilling has stabilized against major currencies, supporting the overall economic performance. Lending rates have started to ease following the continued easing of the monetary policy stance, with the weighted average lending rate for commercial banks standing at 15.7% as of April 2025, 0.1% points down from 15.8% in March 2025, as such this will create a more favorable environment for credit growth to the private sector, which had previously been constrained by high borrowing costs. With GDP growth expected to rebound from 4.7% in 2024 to an estimated 5.3% in 2025, the stage is set for renewed economic momentum, provided the right mix of fiscal discipline and policy support is maintained and stimulation of the business environment to encourage investment. As Kenya navigates the challenges of high public debt, constrained fiscal space, and growing public expectations, the success of this budget cycle will depend on transparency, accountability, and effective implementation. The Finance Bill 2025 marks a step in the right direction, but sustained commitment will be essential to realize its promise.

Section V: Conclusion and Our View

The Kenyan economy has continued to remain resilient despite recording a slowdown in growth to 4.7% in FY’2024 compared to a growth of 5.7% recorded in FY’2023. We expect the economy to gain momentum and grow at a faster pace given the improved business environment as result of the declining cost of credit providing some relief to businesses and households. Additionally, the Central Bank of Kenya’s Monetary Policy Committee’s (MPC) decision on 10th June 2025 to lower the Central Bank Rate (CBR) to 9.75% from 10.00% in April 2025 in a bid to lower the cost of credit and promote economic growth. The lower CBR is set to reduce the cost of credit issued by lenders, hence encouraging borrowing, which will in turn lead to increased investment spending in the economy by both individuals and businesses. Moreover, the economy is expected to record a growth rate of 5.3% in 2025, mainly supported by private sector growth, continued strong growth of the financial services sector, and recoveries in the agricultural sector. Furthermore, in the FY’2025/2026 budget, the government has allocated Kshs 8.0 bn for the fertilizer subsidy program aimed at lowering the cost of farm input and enhancing food supply in the country.

The government has increased its appetite for debt, projecting to borrow Kshs 923.2 bn in total debt in the FY’2025/26, a 4.1% increase from 887.2 billion in the FY’2024/25. The move is expected to increase the cost of debt servicing, given that both foreign and domestic debt has been ballooning as a result of wide budget deficits. Additionally, with the government's continued inclination towards domestic borrowing, by projecting to increase its domestic borrowing by 4.9% to Kshs 635.5 bn in FY’2025/26, from Kshs 605.7 bn in FY’2024/25, remains a risk to lending to the private sector, with increased credit demand by the government in the absence of alternative borrowing. Notably, the government has also turned to private placements as seen in the recent issue of USD 500.0 mn amortizing note maturing in 2032 on April 2025, which is part of the USD 1.5 billion private bond placements signed in February 2025, showing its efforts to raise funds amid constrained access to external financing.

Overall, we are of the view that the main driver of the growing public debt is the fiscal deficit occasioned by lower revenues as compared to expenditures. As a result, implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by minimizing spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. Fiscal consolidation would also allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue. However, the overall risk to the economy remains high, owing to the high debt servicing costs in the next fiscal year.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.