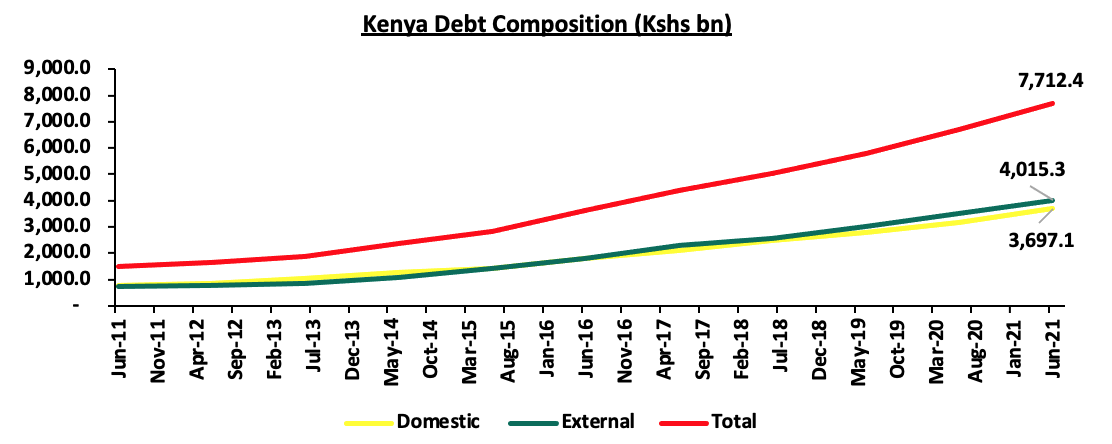

Kenya’s Public Debt has been on the rise, increasing at a 10-year CAGR of 18.5% to Kshs 7.7 tn in June 2021, from Kshs 1.5 tn in June 2011. The rising debt has been brought about by the government’s significant borrowing to fund infrastructural projects and bridge the fiscal deficit that has averaged 7.4% of GDP over the 10 years. The borrowing is both direct by government and also by guaranteeing state corporations. The debt mix, as at June 2021 stood at 52:48 external to domestic debt, respectively, compared to 49:51 external to domestic debt in June 2011. Kenya’s debt stock has increased significantly due to advances from Multilateral lenders such as the International Monetary Fund (IMF) of USD 2.3 bn ( Kshs 256.0 bn) and from the World Bank of USD 750.0 mn (Kshs 82.0 bn), which were used to boost the country’s COVID-19 recovery efforts. The rise in public debt to new highs has been driven by several factors which include but not limited to;

- The fiscal deficit which has averaged 7.4% in the last 10 years and is projected to be at 7.5% of GDP in FY’2021/22 leading to a continuous growth in borrowing and the average borrowing over the 10 years has been Kshs 622.5 bn per annum,

- The lower tax collections than projected in the budget. The overall tax collection rate has averaged 96.7% over the last 10 years leading to the government borrowing more to bridge the gap,

- The guaranteeing of state corporations which have been underperforming leading to the burdening of the government to support them, and,

- Increased debt servicing costs especially the commercial loans and Eurobonds, since they are denominated in US dollars and with the weakening currency the cost rises.

We have been tracking the evolution of the public debt and below are the previous topicals we have done on Kenya’s debt:

- Kenya’s Debt Levels: Are we on a Sustainable Path?– In May 2016, we wrote about the rising debt levels in the country and concluded that they were within the safer bounds in terms of debt levels but needed to look into risks associated with the changing funding patterns that could see the debt levels rise,

- Kenyan Debt Sustainability– In December 2016, we wrote about Kenya’s debt level, questioning its sustainability, and concluded that the government needed to reduce the amount of public debt, giving suggestions as to how this could be achieved,

- Kenya’s Public Debt, Should We be concerned? – In February 2018, we wrote about the concerns surrounding the debt level of the country and concluded that we should be concerned about the country’s debt levels unless decisive policies were implemented,

- Kenya’s Public Debt – In July 2020, we wrote about the high debt levels in the country, which have exceeded the recommended threshold, and the downgrading of Kenya’s creditworthiness on the back of an economic downturn following the global pandemic and we gave suggestions on measures that could be taken towards debt sustainability, and,

- Kenya Public Debt 2020 – In December 2020, we took a look at Kenya’s Public debt as at December 2020, with a keen focus on how the country’s debt increased during the COVID-19 pandemic and the debt management strategies at play,

In this week’s topical, we focus on the current state of affairs regarding the country’s public debt profile and levels and discuss whether it is sustainable. Under this, we shall cover:

- Kenya’s Current Debt Levels and Evolution of Debt ,

- Analysis of debt metrics,

- Kenya’s risk of debt distress, and,

- Conclusion

Section I: Current Debt Levels and Evolution of Debt

The country’s total public debt as at 30th June 2021 stood at Kshs 7.7 tn (equivalent to 67.7% of GDP), which is a 14.9% increase from the Kshs 6.7 tn debt recorded in June 2020 (equivalent to 62.2% of GDP). Parliament approved to increase the debt ceiling to the absolute figure of Kshs 9.0 tn from the initial 50.0% of GDP in October 2019, meaning that the government has headroom to borrow an additional Kshs 1.3 tn before the current debt ceiling is exceeded. Since the first reported case of COVID-19 on 13th March 2020 in Kenya, the total public debt has grown by 22.8% to Kshs 7.7 tn from Kshs 6.3 tn. The debt mix as at June 2021 stood at 52:48 external to domestic debt, respectively, with foreign borrowing at Kshs 4.0 tn while domestic borrowing stands at Kshs 3.7 tn.

Banking institutions account for the highest percentage of domestic debt in terms of government securities holdings at 50.8%, but this has been reducing as the exposure by pensions schemes have been on the rise.

Below is a table of the composition of government domestic debt by holder:

|

Composition of Government Domestic Debt by Holder |

|||||||||||

|

|

Sep-11 |

Sep-12 |

Sep-13 |

Sep-14 |

Sep-15 |

Sep-16 |

Sep-17 |

Sep-18 |

Sep-19 |

Sep-20 |

Sep-21 |

|

Banking Institutions |

48.7% |

50.8% |

49.7% |

51.9% |

56.5% |

54.9% |

55.9% |

55.0% |

53.3% |

55.2% |

50.8% |

|

Insurance Companies |

11.6% |

10.7% |

10.5% |

10.3% |

8.7% |

7.4% |

6.2% |

6.1% |

6.4% |

6.1% |

6.6% |

|

Parastatals |

6.9% |

5.0% |

3.8% |

2.9% |

4.7% |

5.6% |

6.3% |

7.3% |

7.3% |

5.4% |

5.4% |

|

Pension Funds |

29.3% |

22.5% |

25.8% |

25.9% |

25.3% |

26.5% |

27.3% |

27.1% |

28.7% |

28.8% |

31.2% |

|

Other Investors |

3.4% |

11.0% |

10.2% |

9.0% |

4.8% |

5.6% |

4.3% |

4.5% |

4.3% |

4.7% |

6.0% |

|

Total |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

Source: Central Bank of Kenya

Below is a table highlighting the trend in the external and domestic debt composition over the last 10 years;

Source: Central Bank of Kenya

Debt composition and Evolution:

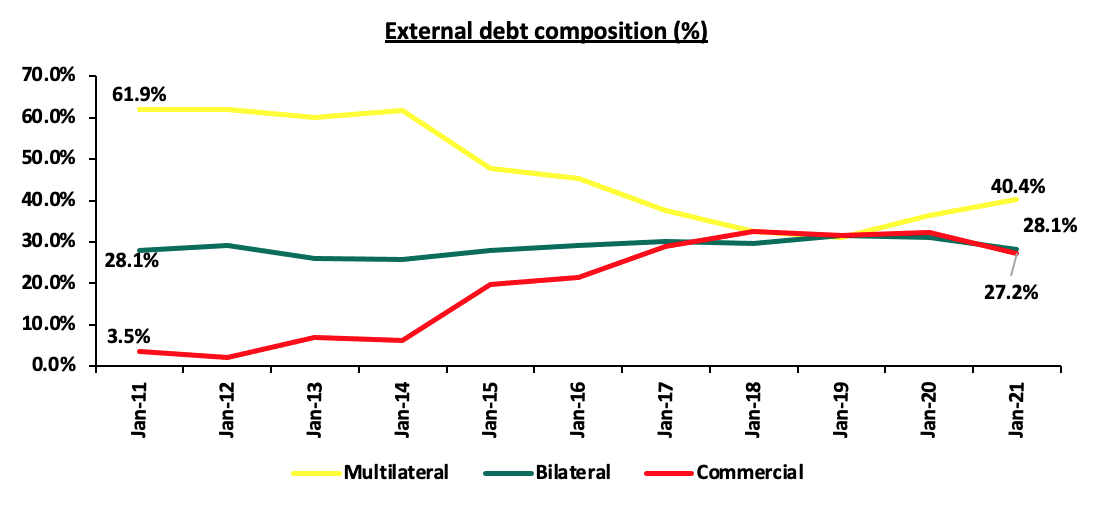

The country’s debt composition has evolved, with foreign debt increasing at a 10-year CAGR of 18.7% to Kshs 4.0 tn as at June 2021, compared to Kshs 0.7 tn in June 2011. Domestic debt has increased to Kshs 3.7 tn as at June 2021 compared to 0.7 tn in June 2011, a 10-year CAGR of 17.1%. Foreign debt has therefore increased at a faster rate than domestic debt, indicating that the government is turning more to external lenders. Foreign debt comprises of multilateral loans, bilateral loans and commercial loans. Multilateral loans are debts issued by international institutions such as the World Bank and the IMF to member nations to promote social and economic development while bilateral loans are loan agreements between individual nations. Multilateral and bilateral loans are categorized as concessional loans due to the favorable terms offered in terms of either below-market interest rates, long grace periods or a combination of both. Commercial loans, on the other hand, are loans agreed between a country and an external commercial bank or an external financial debt instrument. Commercial loans typically have higher rates and shorter grace periods.

Kenya’s exposure to bilateral and multilateral loans has been declining in favor of a much more commercial funding structure comprising of Eurobonds and syndicated loans (loans provided by a group of lenders who work together to provide funds for a single borrower). This has seen the proportion of concessional loans (Bilateral and Multilateral debt) which stood at 90.0% of total external debt as at May 2011, decline by 21.5% points to approximately 68.5% of total external debt as at May 2021. Commercial loans, deemed more expensive because of their high-interest costs, have grown at a 10-year CAGR of 45.3% from a low of Kshs 23.8 bn (equivalent to 3.5% of total external debt) as at May 2011, to Kshs 1.0 tn (equivalent to 27.2% of total external debt) as at May 2021; on the other hand multilateral loans have grown at a 10-year CAGR of 13.9% in the same period.

It is key to note that:

- Multilateral debt increased to 40.2%, from 33.0% of total external debt in March 2020 due to loans received from the IMF and the World Bank during the period. In the same period, Bilateral debt decreased to 28.2% from 31.0% in March 2020, and,

- Since Kenya’s first Eurobond issue in June 2014, commercial debt has cumulatively increased by 19.4% points to 27.3% of total external debt in May 2021, from 7.9% in May 2014, mainly attributable to the issue of Eurobonds within the period.

The increasing commercial debt stock is attributable to Kenya’s change of status in 2014, from a low income country to a lower middle income country after Revising and rebasing National accounts. This resulted in the country being locked out of concessional borrowing for low income countries, and pushed it to commercial borrowing. The government has also preferred commercial borrowing as it gets complete control of funds as compared to multi/bilateral borrowing which is sometimes released in tranches over a period of time. Commercial debt, though expensive, come with fewer restrictions and conditions especially on the loan usage and allocation.

The chart below highlights the trend in External debt composition over the last 10 years;

Source: Central Bank of Kenya & National Treasury

Section II: Debt Metrics

- Debt to GDP Ratio

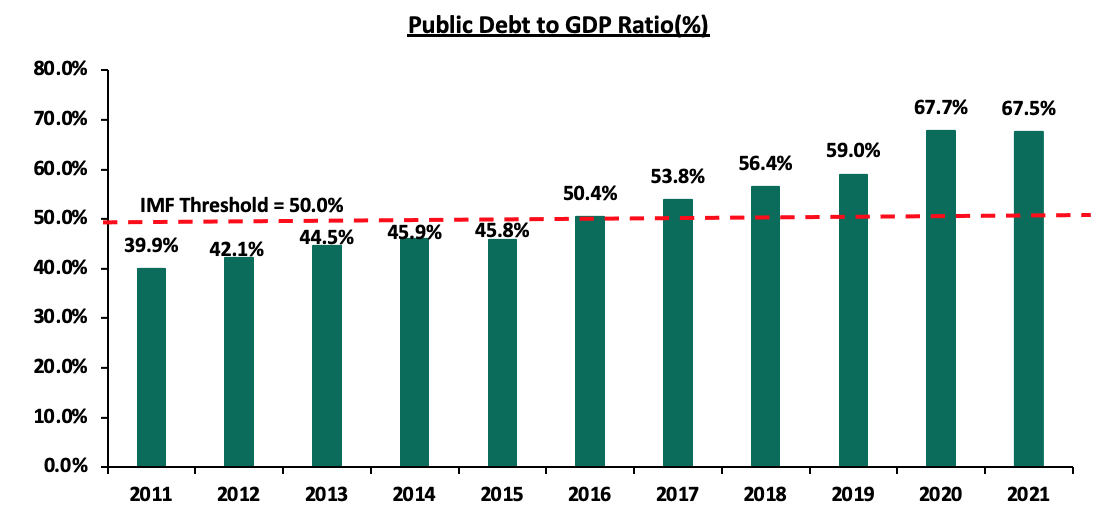

Kenya’s debt to GDP ratio came in at 67.5% in June 2021, 17.5% points above the IMF’s recommended threshold of 50.0% for developing countries. In October 2019, the treasury amended the Public Finance Management (PFM) regulations to substitute the debt ceiling which was previously set at 50.0% of GDP with an absolute figure of Kshs 9.0 tn to plug the budget shortfalls. Government debt is forecasted to reach 70.0% of GDP by end 2021 on the back of rising debt levels outpacing economic growth. Below is a graph highlighting the trend in the country’s debt to GDP ratio;

Source: Central Bank of Kenya, Kenya National Bureau of Statistics

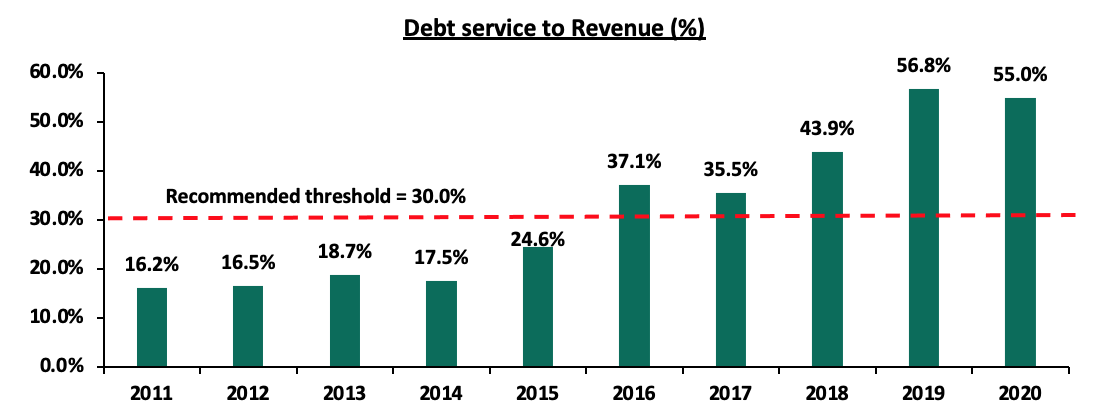

- Debt Service to revenue

This is a measure of how much of the government’s revenue is used to service debt. According to the Controller of Budget, the debt service to revenue ratio was estimated at 55.0% at the end of 2020, 25.0% points higher than the recommended threshold of 30.0%, but 1.8% points lower than FY’2019’s debt service ratio of 56.8%. This is attributable to reduced debt service obligations during the year. The reduction in service obligations in 2020 compared to 2019 is attributed to the country retiring the Kshs 75.0 bn Eurobond floated in 2014 during the period. This payment was however serviced using funds from the Kshs 210.0 bn dual-tranche 7-year and 12-year Eurobond, both issued in 2019. The sustained level of debt service to revenue ratio above the recommended threshold is concerning given the elevated refinancing risk following shocks arising from the COVID-19 pandemic. For the FY’2021/22 fiscal year, a total of Kshs 1.2 tn has been set aside for debt servicing against a targeted Kshs 1.8 tn revenue collection, bringing the debt service to revenue ratio to 65.8%. In the August 2021 Budget Outturn, the National treasury spent Kshs 162.4 bn on debt servicing, against collected revenue of 247.2 bn, amounting to a 64.7% debt service to revenue. Below is a chart showing the debt service to revenue ratio;

Source: Public Debt Management Office Annual reports, Controller of Budgets FY2020/21 Budget Implementation report

Further to the above, we expect the country’s cost of debt servicing to rise driven by the depreciation of the shilling against the USD, which accounts for 65.2% of Kenya’s external debt. On a YTD basis, the shilling has depreciated by 1.4% to close the week at Kshs/USD 110.7. This means that as the shilling depreciates, the government will have to pay more to service its foreign-denominated external debt. The cost of debt servicing is also expected to increase in 2022 upon expiry of the G-20’s Debt Servicing Suspension Initiative (DSSI) in December 2021. The table below shows the currency composition of foreign debt in May-2021 compared to May-2011;

|

Currency composition of External Debt |

||

|

|

May-11 |

May-21 |

|

USD |

30.1% |

65.2% |

|

Euro |

33.3% |

19.0% |

|

Japanese Yen |

23.4% |

7.7% |

|

Chinese Yuan |

1.8% |

5.4% |

|

GBP |

5.4% |

2.4% |

|

Others |

6.0% |

0.2% |

|

Total |

100.0% |

100.0% |

Source: Public debt management office, National treasury

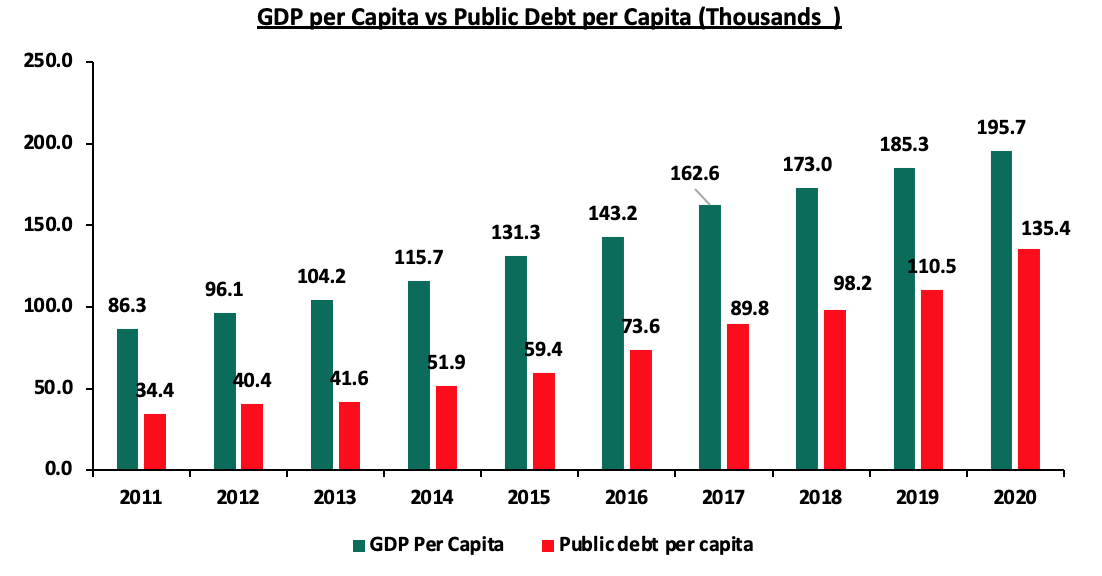

- GDP per Capita vs Debt per Capita

Kenya’s Public Debt per Capita has grown at a 10-year CAGR of 14.7% from 2011 to 2021, compared to GDP per Capita which has grown at a CAGR of 8.5% in the same period. This is an indication that public debt is rising at a faster rate than the GDP, further elevating the risk of debt distress and may also be an indication that the debt being incurred is not translating into economic growth. The Debt per Capita, which can be viewed as an indicator of the average debt burden on an individual citizen, currently stands at Kshs 135,422.2, with the GDP per Capita currently at Kshs 195,678.9, according to World Bank data. Below is a graph highlighting GDP per Capita against Debt per Capita.

Source: World Bank

Section III: Kenya’s risk of Debt Distress

As seen in the above section, the country’s risk of debt distress is extremely high as evidenced by the high debt service to revenue ratio of 55.0%, which is 25.0% points above IMF’s recommended threshold of 30.0%. Additionally, Kenya’s debt to GDP ratio stood at 67.7% in 2020, 17.7% points above IMF’s recommended threshold of 50.0% for developing countries. We note that the growth of Public Debt at a 10-year CAGR of 14.7% has outpaced economic growth at a 10-year CAGR of 8.5% pointing to a high risk of debt distress as revenue alone might not be sufficient to service debt. The fiscal deficits resulting from the revenue-expenditure mismatch have also presented an ever present challenge in fiscal consolidation as revenue continues to lag behind expenditure.

The ongoing COVID-19 pandemic which has constrained economic growth may see the government’s fiscal consolidation efforts delay. The Debt Servicing Suspension Initiative whose aim was to reduce the debt servicing burden in the medium term is likely to lead to a pile up in debt servicing expenses in the long term as Kenya might be required to pay approximately Kshs 25.0 bn annually. Additionally, given that most of Kenya’s foreign debt is denominated in USD, we believe that the shillings depreciation against the dollar will mean that Kenya will continue to incur a relatively higher cost to purchase foreign currency used to settle the outstanding debt obligations. On a YTD basis, the shilling has continued to depreciate against the USD, depreciating by 1.4% to close at Kshs 110.7 in October 2021, from Kshs 109.2 at the start of the year.

In the current year, we have seen a couple of Global rating agencies relook the country’s Sovereign Credit Outlook and affirm the negative outlook on the Country’s debt sustainability. Below is a summary of the key rating agencies and their outlook;

|

Rating Agency |

Rating as at June 2020 |

Outlook as at June 2021 |

Current Rating |

Current Outlook |

|

Moody’s |

B2 |

Negative |

B2 |

Negative |

|

S&P Global |

B+ ‘short term’, B ‘Long term’ |

Negative |

B ‘short term’, B ‘Long term’ |

Negative |

|

Fitch Ratings |

B+ |

Negative |

B+ |

Negative |

The three credit rating agencies have maintained the same ratings and outlook as at the same period last year, with Moody’s citing that their decision to maintain a negative outlook being informed by the Government’s inability to deliver on planned fiscal consolidation which would leave Kenya vulnerable to tightening financing conditions and increase liquidity risk, sentiments shared by the other credit rating agencies. The IMF also conducted a debt sustainability analysis on the country, highlighting that both the risk of external debt distress and overall risk of debt distress are high but Kenya’s debt is sustainable, provided the country sticks to the IMF framework envisaged under the Extended Credit Facility/Extended Fund Facility.

Concerns raised by the Debt rating agencies and the IMF are valid as the high debt levels are detrimental to the country in the medium and long term. Below are some of the risks associated with precariously high debt levels;

- The higher cost of debt servicing due to debt obligations in foreign currencies despite a weakening shilling, which may lead to higher taxation as the government tries to keep up with its debt obligations,

- The increased cost of further borrowing since lenders will price the new debt at higher rates considering the heightened risk which stifles the private sector and economic growth,

- Narrowing of the fiscal space and as a result, limited resources for infrastructure and capital expenditure,

- Crowding out of the private sector by the government which largely leads to lower projected economic growth, subsequently impacting collections further, and,

- Fiscal consolidation and austerity measures which undermine economic activity, development objectives and decrease the government’s ability to effectively respond to emergencies since governments often borrow to address unexpected events.

Recommendations

Given the high debt levels and the fiscal challenges the country continues to face from the COVID-19 pandemic, we believe that the National Treasury should work on reducing the risk of debt distress and extreme unsustainability of the country’s Public Debt. We commend the government on the measures put in place to boost revenue collection, however, we believe that a lot needs to be done to take Kenya towards debt Sustainability. Below are some actionable steps the government can take;

- Revenue Collection – The Kenyan Government should aim to enhance revenue collection as it forms a huge part in reducing the debt burden. This can be done by streamlining the revenue collection process and conducting frequent tax audits to help seal loopholes that lead to loss of revenue,

- Robust fiscal consolidation – The main driver of the growing public debt is the fiscal deficit occasioned by the lower revenues as compared to expenditure. Implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by reducing expenditure by introducing austerity measures and reducing amounts extended to recurrent expenditure. Fiscal consolidation would also enable the Government to refinance other crucial sectors such as agriculture which would contribute to higher revenue. Capital expenditure should also be limited to projects with either high social impact or have a high Economic Rate of Return (ERR), whose economic benefits outweigh costs,

- Reducing the share of commercial borrowing – The Kenyan government should move towards reducing the share of commercial borrowing as compared to concessional borrowing so as to reduce amounts paid in debt service. Concessional loans also have longer repayment periods and lower interest rates,

- Build an export driven economy – This can be achieved by promoting export oriented policies and manufacturing to increase exports, thus improve the current account while at the same time reduce imports to preserve our foreign exchange reserves. This would stabilize the exchange rate and stop our foreign denominated debt from increasing as the shilling depreciates,

- Fully operationalize and streamline alternative means of funding development projects – The ballooning of public debt has partially been driven by the government’s over-reliance on borrowing to fund its ambitious development agenda. As a substitute to this, the government should fully operationalize and remove bottlenecks to Private Public Partnerships (PPPs) and joint ventures to attract more private sector involvement.

- Promote Capital Markets: Our capital markets remain dormant with banking markets having mobilized Kshs 4.0 tn in deposits compared to Collective Investment Schemes at only Kshs 0.1 tn. Efforts should be made to strengthen the Capital Markets structure to ease the pooling of funds by investors to undertake development projects,

- Aggressive Privatization: The government should aggressively privatize parastatals to release capital, reduce debt and also to prevent the widening of debt from parastatal losses and inefficiencies, and,

- Strengthening Parliament’s oversight role – This would ensure that Parliament plays a sufficient and independent oversight role over the National treasury to ensure that future debt uptake is well interrogated, is feasible and will bring economic benefit to the country. Parliament should also play a bigger vigilance role to ensure that fiscal deficits are sustainable at the budget approval stage to lessen the need for borrowing to bridge them.

Section IV: Conclusion

As a result of the COVID-19 pandemic that led to the global economy contracting by 3.6% in 2020, Governments globally have turned to debt to bridge fiscal deficits resulting from reduced revenues and economic shocks from the pandemic. In the Fiscal monitor 2021 by the IMF, public debt as a percentage of GDP reached 97.0% in 2020 and is expected to reach 99.0% in 2021, underlining the difficult situation that governments not only in Kenya, but around the world are in.

According to the IMF and the World Bank, Kenya’s debt remains sustainable driven by the fact that most of Kenya’s public debt remains concessional and the fact that historically, the country has had a smooth debt service profile. However, the risk of debt distress remains high given the ongoing COVID-19 pandemic. We believe that Kenya is on a path towards debt distress if fundamental concerns like fiscal consolidation are not well addressed. With the local economy expected to gradually bounce back upon gradual resumption of key economic activities, we expect a tough balancing act for the government as an increase in revenue collections is expected to be followed by higher debt servicing requirements upon expiry of the Debt Servicing Suspension Initiative. In our view, we expect that the government will fully explore alternative means of funding the ambitious development agenda such as Private Public Partnerships (PPPs) which do not occasion uptake of more debt.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.