According to the Kenya National Bureau of Statistics (KNBS), wholesale and retail trade is the 5th largest contributor to Kenya’s GDP and the 3rd largest contributor to private sector employment. In 2016, wholesale and retail trade employed 238,500 Kenyans and accounted for 8.4% of Kenya’s GDP. Moreover, according to Nielsen, a leading global information and measurement company, shifting consumer trends has driven growth in formal retail, with 30.0% of the Kenyan population now shopping in formal retail establishments compared to 4.0% in Ghana and 2.0% in Cameroon and Nigeria. This is the second highest in Sub-Saharan Africa after South Africa, which has a formal retail penetration of 60.0%.

Given the recent challenges faced by two local players, this week’s Focus Note examines what led to their current distress and then draws lessons learnt, by looking at the following areas:

- Overview of Kenya’s Retail Industry,

- Analyzing the Drivers of Kenya’s Retail Industry,

- The Current State of Kenyan Retail,

- The Trouble with Rapid Growth / Growth by Default, and

- Providing a Path to Success for Kenyan Retailers.

- Overview of Kenya’s Retail Industry

Years of robust GDP growth, increased purchasing power, and shifting consumer habits have accelerated transformation of the Kenyan retail market. Kenya’s largest chains, Nakumatt and Uchumi, were positioned to be the main beneficiaries of the economic trends that drove more Kenyans into formal retail. Both chains owned flagship stores in Nairobi, Mombasa and Kisumu’s major catchment areas and served as the largest distributors for local consumer goods manufacturers. However, the opportunity in Kenya’s retail market attracted continental and international brands, spurring competition in the sector. As competition intensified, both chains drove aggressive expansion plans; often at the expense of their suppliers and shareholders. Beyond the main larger chains, outfits like Tusky’s, Naivas and Ukwala appealed to the average customer with outlets close to matatu and bus terminals. While these chains were financially successful, they all aspired to the traffic, footprint and prime locations to match Uchumi and Nakumatt.

The industry is currently well represented by both local and international franchises, some of which are highlighted in the table below. Key industry players include Carrefour Kenya (a franchise owned by Majid al Futtaim Group of the UAE), Tuskys, Nakumatt, Uchumi, Massmart (trading in Kenya as Game), Choppies (which acquired Ukwala Supermarkets), Naivas, and many local brands such as Mulley’s, Eastmart, Quickmart and Cleanshelf. The entry of Carrefour, Game, and Choppies has in part been aided by the recent woes facing Nakumatt and Uchumi.

|

Retailers Operating In Kenya |

||

|

Name of Retailer |

Store Count (Jan 2017) |

Percentage of Total |

|

Tusky's |

58 |

29.1% |

|

Nakumatt* |

45 |

22.6% |

|

Naivas |

39 |

19.6% |

|

Uchumi |

25 |

12.6% |

|

Choppies / Ukwala |

10 |

5.0% |

|

Eastmart |

9 |

4.5% |

|

Chandarana Stores |

8 |

4.0% |

|

Carrefour |

4 |

2.0% |

|

Game Stores (Massmart) |

1 |

0.5% |

|

Total |

199 |

100.0% |

|

Source: Cytonn Investments Research *Nakumatt has been updated for branches closed |

||

B. Analyzing the Drivers of Kenya’s Retail Industry

Having got an overview of Kenya’s retail sector, we now analyze the key drivers of the retail sector in Kenya. The growth of the retail industry in the decade to 2017 has been driven by;

- GDP Growth boosting disposable income & consumer spending - Kenya’s economy grew by 5.8% on average between 2012 and 2016, lifting household incomes and increasing consumption expenditures. The average value of a shopper’s basket increased by 67.0% to USD 20 (Kshs 2,016) between 2011 and 2017, making Kenya the fastest growing retail market in Sub-Saharan Africa. Additionally, according to KNBS, private consumption expenditure accounted for 79.0% of Kenya’s GDP in 2016. It increased from Kshs 3.3 tn (USD 38.5 bn) to Kshs 5.7 tn (USD 55.4 bn) during the same period, an average annual growth rate of 11.3%.

- Real Estate Investment - Real estate investments, notably residential malls and mixed-use developments, have driven the expansion of the Kenyan retail sector. In 2017 alone, Nairobi’s available retail space grew by 41.6%, from 3.9 mn square feet in of space in 2016 to 5.6 mn square feet. Moreover, mall operators preferred larger chains such as Nakumatt and Uchumi as anchor tenants, reasoning that they would attract more foot traffic.

- Changing consumer tastes & preferences, and globalization- The increase in disposable income that has come with GDP growth has also made Kenyan shoppers more aware of global retail trends and more demanding of the local shopping experience, goods and services.

Key Profitability Margins in the Industry:

In order to drive the retail business, supermarket chains rely on selling large volumes of goods at small margins. Consequently, gross and operating margins across the industry are low. Chains create value for owners primarily by adding new stores (growth) and improving their operations, distribution and supply networks to improve margins. Successful retailers are able to maintain reasonable operating and net margins while executing their growth strategy. Below are some of the operating margins of some industry players:

|

FY 2016 Operating Results |

||||||

|

|

Continental Retailers |

International Retailers |

||||

|

Margin |

Uchumi |

Choppies |

Shoprite Stores |

Massmart |

Costco Wholesale |

Target Corp |

|

Gross Margin |

15.2% |

21.2% |

24.0% |

19.0% |

13.3% |

29.7% |

|

Operating (EBIT) Margin |

(30.8%) |

1.6% |

5.5% |

2.9% |

3.2% |

7.2% |

|

Net Margin |

(44.1%) |

0.8% |

3.9% |

1.4% |

2.1% |

3.9% |

|

Choppies entered the Kenyan market with the acquisition of Ukwala Supermarkets Ltd Game Stores represent Massmart in Kenya with an outlet in Garden City |

||||||

From the above table, it is key to note that:

- Gross, Operating and Net Margins are low across the retail industry,

- Thin margins leave little room for any inefficiencies if a chain is to maintain profitability, and,

- Value is created by minimizing operating costs (increasing the EBIT margin) and growing volumes by adding stores.

C: The Current State of Kenyan Retail

For decades, it was business as usual for Kenya’s largest retailers - Uchumi and Nakumatt. There was little competition and plenty of room for expansion as long as competitors had little geographical overlap. Suppliers had little choice but to extend favorable terms as they had few alternatives in their distribution networks. Forgoing one large chain in favor of another meant ceding precious revenue to the competition. High end and middle-class consumers also had few options; either make several trips to the neighborhood kiosk or visit one of two large chains at which everything could be found. Beyond the large chains, then smaller outfits like Tusky’s, Naivas and Ukwala competed for the average customer with outlets close to matatu and bus terminals. While smaller chains were financially successful, they all aspired to achieve the traffic, footprint and prime locations to match Uchumi and Nakumatt.

Ambition, ample opportunity and tolerant investors provided the fuel for growth in the retailers’ expansion strategy. Between 1997 and 2004, Uchumi borrowed Kshs 3.6 bn to double its store footprint, growing from 10 outlets to 25 across Nairobi, Mombasa and Kampala. Nakumatt Supermarkets also grew from 10 outlets in 2002 to 42 in 2013 and 64 in 2016. In the same period, Tusky’s and Naivas also grew to 60 and 40 outlets, respectively. In 1997, Uchumi pioneered the hypermarket concept with Ngong Hyper, showing that larger footprint stores with embedded retailers could be successful. Uchumi subsequently replicated the concept in Lang’ata Hyper.

Rapid expansion without realizing their return on investment led to Uchumi’s insolvency in 2006 and the subsequent suspension from the Nairobi Stock Exchange. Uchumi’s 2006 insolvency should have warned the industry that such a growth model was unsustainable. However, banks continued to lend to Uchumi while investors offered more capital in subsequent rights issues. In 2005 and 2014, Uchumi shareholders oversubscribed to rights issues that added a total of Kshs 2.0 bn (Kshs 1.2 bn in 2005 and Kshs 0.9 bn in 2014) to company accounts while cumulatively diluting their holdings by 33.0% in 2005 and 28.0% in 2014. The funds were subsequently used to plug losses in Uchumi’s Tanzania and Kampala operations as well as to repay suppliers in Kenya; this was despite investment memoranda that stated they would be used in expanding the store footprint.

Rapid growth has posed the following challenges for Kenyan retailers:

- Thin margins and poor capital management make it difficult to expand without borrowing,

- Saturation makes selecting catchment areas to launch new stores a challenge,

- Competition limits traffic growth for new stores as areas become more saturated,

- High borrowing costs make it difficult for new stores to achieve profitability,

- Thin working capital cushions often mean that retailers have to choose between paying off debt and making payments to suppliers,

- Investments in fixed real estate strain returns to shareholders (Returns on Equity), and,

- Poor governance and oversight ensures that the same mistakes are repeated.

D: The Trouble with Rapid Growth/ Growth by Default

Uchumi and Nakumatt were not prepared for the new phase of growth initiated by real estate expansion. Years of mismanagement had left them with no internally sourced funds (retained earnings). As such, the only alternatives for funding new stores were internal cash flows (generated by delaying supplier payments), and bank debt.

Delaying supplier payments was the preferable source of funding because late payments accrued no interest. However, because short-term funds were used to fund long-term capital expenditures (a duration mismatch), chains required adequate liquidity (either from new loans from banks or commercial paper) or from stores that quickly ramped up sales to remain liquid. The other solution to the liquidity problem was to reduce initial expenditure for new stores with operating leases.

In addition to the initial capital expenditure, new stores had the following operating costs, coming to approximately 32.0% of all revenue:

- VAT (13.0% - 14.0% of revenues)

- Electricity costs- lighting, refrigerators and chiller units (1.0% of revenues)

- Rent and service charges (1.0% of revenues)

- Depreciation (1.0% of revenues)

- Labour, finance, distribution and administrative costs (15.0% of revenues)

Both new and existing stores had the same average cost outlays. However, costs for existing stores would rise by 7.0% annually. To remain profitable, they had to grow revenues by at least 7.0% p.a. Revenue growth for these stores (Same Store Sales Growth) would come from:

- Traffic Growth - Increases in the number of regular visitors to each store, and

- Ticket Growth – Increases in the average basket size per regular visitor.

As a result, management had the following responsibilities:

- Stewarding existing stores to ensure they met growth targets,

- Containing cost escalation for existing stores, and,

- Grow traffic to new stores to ensure they grew revenues.

Uchumi and Nakumatt are emblematic of the challenges above. Even as new stores added to revenues, management struggled to contain costs and grow traffic. Furthermore, financing pressures from increased debt depressed profitability and returns on equity.

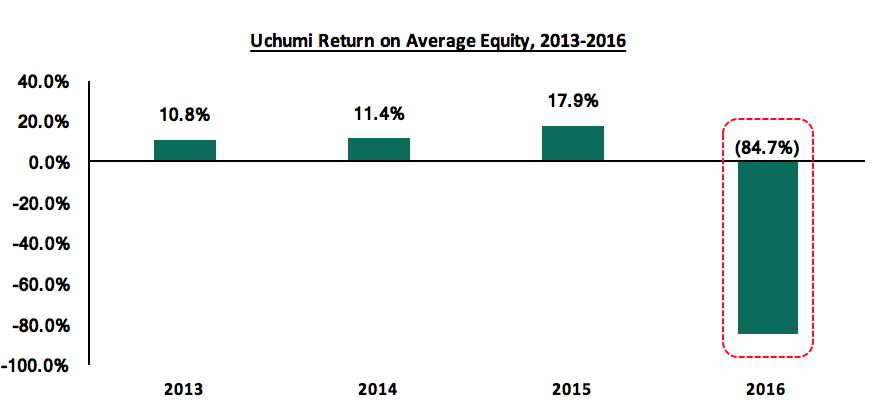

Mounting losses pushed Uchumi’s Return on Equity to a negative 84.7% in 2016

In comparison to continental and international retailer, Uchumi’s Cash Conversion Cycle (CCC) worsened from 1.2 days in 2012 to (282.2) days during the latest financial year:

|

Cash Conversion Cycle: Latest Financial Year |

||||||

|

|

Uchumi |

Choppies |

Shoprite Stores |

Massmart |

Costco Wholesale |

Target Corp |

|

DSI (Days to Sell Inventories) |

18.9 |

52.6 |

60.6 |

58.3 |

32.1 |

62.1 |

|

DSO (Days to Collect Receivables) |

12.7 |

9.8 |

13.2 |

18.7 |

4.1 |

5.8 |

|

DPO (Days to Pay Suppliers) |

(313.7) |

(52.0) |

(59.3) |

(96.9) |

(31.3) |

(54.2) |

|

CCC: (Total Days to convert sales to cash) |

(282.2) |

10.5 |

14.5 |

(19.9) |

4.9 |

13.7 |

During the same period (2012-2015), shareholder returns also suffered with Uchumi’s book value contracting by 259.5% to Kshs 0.7 bn in 2015 from Kshs 2.7 bn in 2012.

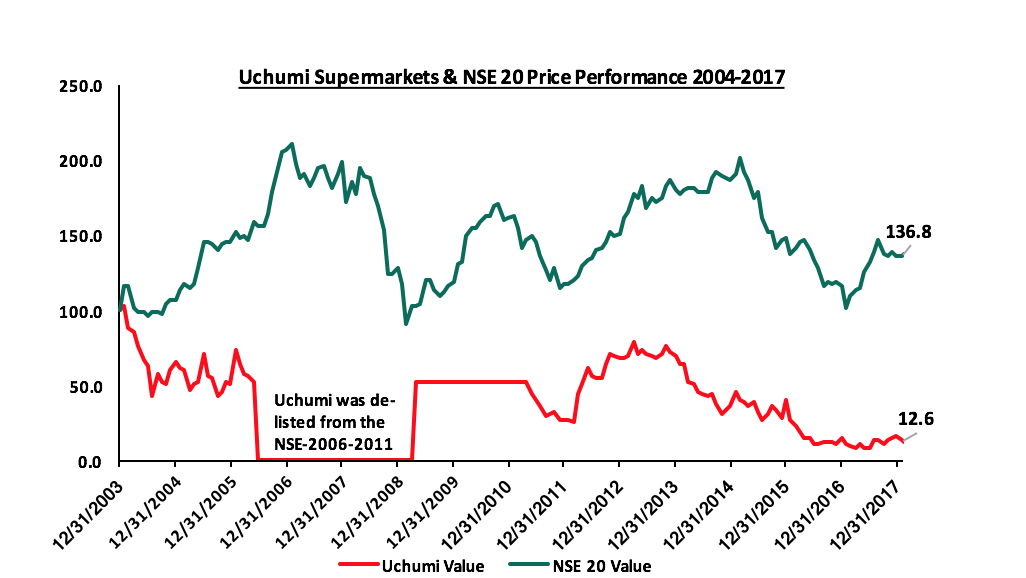

An Uchumi shareholder lost 88.0% of the amount they invested between 2004 and 2017 and was better off investing in the broader NSE 20 Index, which gained 37.0% during the period.

Table 3: Uchumi/NSE 20- Price Performance, 2004-2017. KSh 100 invested in Uchumi in 2004 would only be worth Kshs 0.12 in 2014; a 1- year compounded loss rate of 19.1% p.a.

Capital Structure

For any business, striking the right balance between the debt and equity into the business is key especially during the growth phase. The financing mix for continental retailers was on average 20.0% debt and 80.0% retained earnings. Successful retailers worldwide were also better able to pay off the interest on their debt, the average retailer generated 22.3x their annual interest payments in operating income. Below is a list of some of the ratios used to track the above:

|

Capital & Financing Mix |

|||||||

|

|

CONTINENTAL RETAILERS |

INTERNATIONAL RETAILERS |

|

||||

|

Ratio |

Uchumi, FY 2016 |

Choppies |

Shoprite Stores |

Massmart |

Costco Wholesale |

Target Corp |

Average |

|

Debt to Equity Ratio |

- 0.13x |

0.31x |

0.17x |

0.57x |

0.44x |

1.12x |

0.52x |

|

Interest coverage ratio |

1.21x |

51.78x |

16.13x |

8.14x |

29.00x |

6.50x |

22.31x |

|

Selected solvency ratios for Uchumi and international retailers

|

|||||||

By and large, successful chains deploy little to no leverage when expanding their operations. Expansion is financed by retained earnings. Choppies Supermarkets, for example, acquired Ukwala Supermarkets with internally generated funds from its listing on the Johannesburg Stock Exchange.

E: Providing a Path to Success for Kenyan Retailers

Our analysis finds that Kenyan retailers can succeed by:

- Implementing good corporate governance: The strategic missteps that led to Uchumi and Nakumatt’s current situation were exacerbated by poor governance. The Capital Markets Authority (CMA), twice investigated Uchumi management and auditors for errors contained in the offering memoranda for the two rights issues in 2005 and 2014. Furthermore, leadership teams ignored the lessons learned from previous business failures. Kenya’s public and privately-owned retail chains would benefit from having experienced finance and investment professionals in senior management roles and opening their boards to participation from independent investment management professionals.

- Forging partnerships with private equity firms: We find that family owned and managed firms would benefit from the capital and expertise offered by private equity firms seeking to invest in the country. The long-term capital gained by selling equity stakes to PE firms would alleviate the need to borrow for expansion. Furthermore, external owners would also enforce good corporate governance by insisting on proper processes and procedures.

- Properly planning for growth/ new stores - Nairobi is currently saturated with retail outlets. The Thika Road area featured two anchor Nakumatt outlets in TRM and Garden City Malls. These are now closed. Furthermore, Chandarana Supermarkets features two outlets, one at Rosslyn Riviera and a second at Two Rivers Mall, only 5 minutes away. Chandarana Supermarkets also has an outlet at Yaya Centre and another at Ad-Life Plaza, only 5 minutes away. Both outlets compete for the same pool of consumer in Ngong Road and Kilimani areas.

- Maintain the right capital structure: Nakumatt’s experience has shown that debt and forgoing supplier payments are poor sources of funding for long term growth. Kenya’s retailers should continuously ensure that they are not significantly past the right leverage ratios and this could even mean selling some stake in the company to get equity.

- Operational efficiency - Chains should not continue to support stores that don’t generate their own income. In the past, Uchumi used funds from rights issues to support the ailing operations of stores in Uganda and Tanzania. Had the company exited these markets earlier, shareholders would have avoided millions of shillings in losses. Additionally, introducing store level financial reporting to better quantify individual store performance for investors is another way to enhance operational efficiency. It is common practice for global retailers to report average metrics for individual stores i.e. average store opening costs, time to profitability, working capital needs per store, average store size, average store cash flows and expenses in their annual reports. This information empowers investors, lenders and suppliers in their assessment of the chain’s profitability, and we are of the view that this should be adapted locally.

There are still opportunities for success in Kenyan owned retail. However, the entry of international competition has made the industry less tolerant of poor governance and a poorly executed strategy. Kenyan retail is not dead; it is now maturing in the face of competition.

Disclaimer: The views expressed in this publication, are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.