In December 2017, as part of the Big Four agenda, President Uhuru Kenyatta announced provision of Housing as one of the key pillars of the big four agenda. The specific target was provision of 500,000 houses across all the 47 counties by 2022. However, three years later the goal is far from being achieved. It is our view that the main reason why housing will remain a challenge is lack of capital for real estate, hence the focus on Loan Funds in Kenya, which can help with improving the funding crunch in our markets.

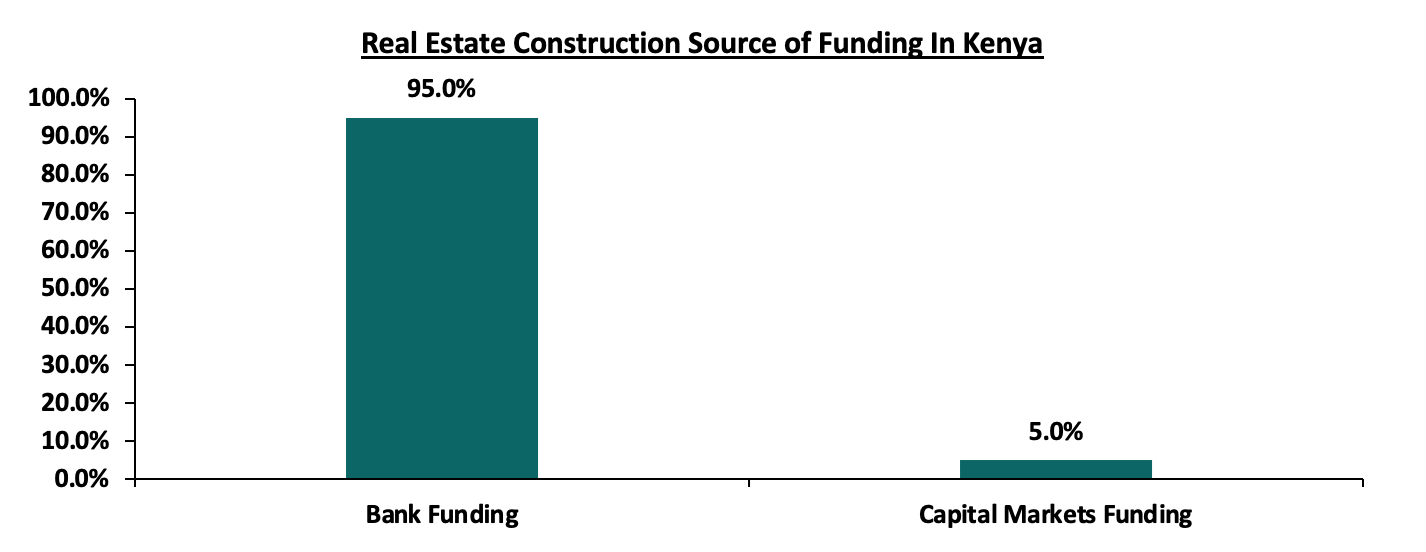

In the Capital Markets Authority Soundness Report Q4’2020, the regulator maintained that as part of the post-Covid recovery period the capital markets remained a suitable option for capital raising initiatives. The report also highlighted another publication by the African Housing Finance Year book 2020 which stated that the current construction finance by the capital markets stands at 5.0% with the banking sector taking up 95.0% of the rest. It is our view that to jump start development financing, we need to improve our loan markets, hence our focus on demystifying what Loan Funds are, the various types and how Loan Funds work so as investors can understand the need for having them in the market.

This week we focus on the Loan Funds investments in the Kenyan market, where we shall discuss the following:

- Introduction to Loan Funds,

- The role loan funds can play in the Kenyan economy,

- Background and overview of Loan Funds in Kenya,

- The Regulatory and Legal Framework,

- Challenges facing Loan Funds in Kenya,

- Recommendations on how to resolve them, and,

- Conclusion,

Section I: Introduction

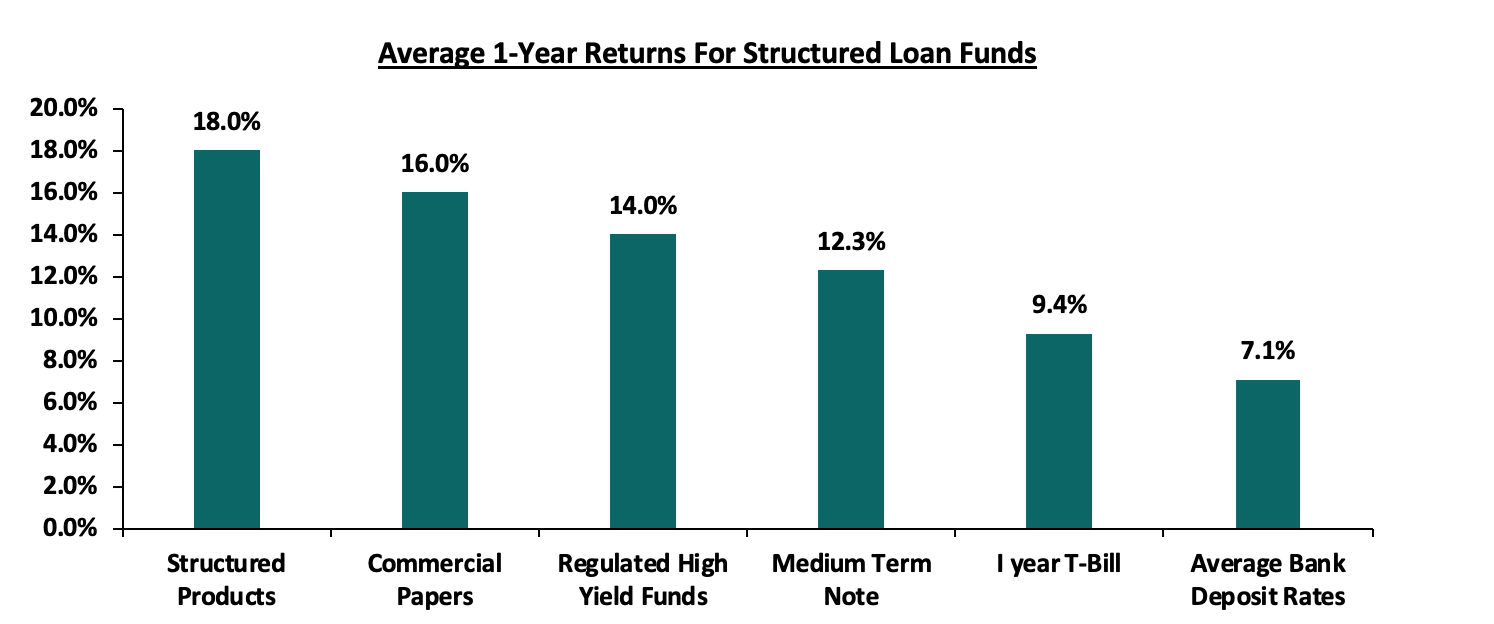

Loan funds can be defined as specialized investment vehicles that are formed by fund managers or investment firms with the intention to borrow from investors and allocate the funds into deserving asset classes that will in turn generate returns for the investors. Depending on their particular investment strategy, loan funds can be classified as loan originating funds which grant and restructure loans by prolonging duration and deferral of payments or participating funds which are allowed to partially or fully restructure existing loans from banks and other lending institutions. Loan funds generally provide higher returns than instruments in other asset classes as shown in the graph below which considers a 1-year return:

Some of the Loan Funds Instruments available in the local Kenyan market are stated below but shall be discussed in details later. They include:

- Structured Loan Funds: Structured Products are considered as a subset of Alternative Investments where they are highly customized investment product that is packaged by investment professionals to enable the investor access returns or meet investment objectives that are not accessible in the traditional markets such as stocks, bonds and bank deposits,

- Commercial Paper: These are promissory notes issued by companies as a form of raising short-term debt. These securities can be secured or unsecured and are priced at a premium to the Treasury Bills. They are short-term securities for tenors up to one year and mainly target institutional investors,

- Regulated High Yield Funds: These are Funds that mostly comprise of Special Collective Investments Schemes with a considerable allocation to a specific underlying asset class. They operate as licensed and regulated Unit Trust Funds with investors being known as unit holders, and,

- Medium Term Notes: These are secured debt instruments issued in the capital markets as medium-term, between 3-7 years, by companies with the approval from the Capital Markets Authority (CMA) and are priced at a premium to Treasury Bonds.

Section II: The role loan funds can play in the Kenyan economy

As mentioned above, in well-functioning markets, bank credit makes up 40.0% of total credit with the balance of 60.0% coming from Capital Markets according to the world bank, however, Kenya relies on banks for 95.0% of credit with only 5.0% coming from capital markets, making it difficult for business such as developers to access credit.

Loan funds are crucial for several reasons:

- Providing capital outside the traditional banking system – The funds have created avenues for businesses that have trouble accessing bank funding to raise capital. The capping of the interest rates in 2016 led to banks retreating from lending due to a fear of a mismatch in the risk assessment. Therefore, lack of lending created a funding gap and an opportunity for loan funds to thrive,

- Providing higher than market average returns - They also provide investment opportunities for yield-hungry investors, who have a high-risk appetite for higher returns than they would otherwise get in public markets. These investment returns go into securing the financial well-being of retirees, families and individuals trying to improve themselves. Local investors previously had to go offshore for attractive opportunities such as structured notes, but with the recent development of structured products in Kenya, local investors have been able to find attractive investments,

- Increase Foreign investments into the country: Structured products have also opened up the Kenyan market to global institutional investors seeking above average returns and directly contributing to the increase in foreign direct investments,

- Capital market and private markets deepening: Over half of the Kenyan economy is not in the listed markets, which account for only 49% of the economy. The balance of the markets is in the private markets. An active private market, fueled by structured financing, is crucial to the accessing of funding by the private economy,

- Product development and innovation: The complexity, speed and innovation that accompany loan funds helps with product development, enhancement and pricing in the public markets since both markets are complementary, and,

- Growth of the capital intensive sectors e.g. real estate: Most of the major real estate developments in the country currently are being funded, in some part, by structured loan fund products to sophisticated investors, as a form of fund raising for the various projects. This has in turn led to creation of jobs and improving the living standards of people as well as growing the economy in general. In fact, various banks have recently made a decision to reduce or simply stop funding real estate developments. Without the structured loan fund products, the already under-financed real estate sector would face further financing challenges,

Section III: Background and overview of Loan Funds in Kenya

The Loan Funds market is mostly comprised of unregulated investment vehicles set up as Limited Liability Partnerships (LLPs) and commercial paper vehicles, though there is emergence of some regulated loan funds. The attractiveness of Loan Fund products to investors is due to a number of reasons namely:

- Potential for Principal Protection: Loan Fund products are designed to secure the principal of the investor, unlike traditional investments like equities, which may reduce the investor’s principal. They are backed by an underlying asset, which does not negatively affect the principal, such as fixed deposits and real estate, and the structuring manager typically holds the risk in case the underlying asset underperforms,

- Enhanced Returns: The alternative products manager, given their skills and experience, is able to take an underlying riskier asset, such as real estate, structure it into a yield product, offer a higher return to the investor that is greater than other yield products such as fixed deposits or money market funds,

- Reduced Volatility: Structured products are usually backed by alternative assets, such as real estate and private equity, which are not subject to market volatility, which in turn reduces volatility over the period of investment, with most structured products offering fixed rates of return to their investors,

- Enhanced Self-Regulation and Protection: Given that the participants in private markets and structured products tend to be more sophisticated and discerning, the due diligence, evaluation and analysis of products tends to be more rigorous

- Diversification: Loan Funds also enable investors to diversify their portfolio away from traditional assets, which reduces investment risk, with returns higher than the prevailing inflation rates therefore increasing the investor’s purchasing power.

Some of the Loan Funds investment products in the Kenyan market include Privately Offered Structured Products, Regulated High Yield Funds, Medium Term Notes, and Commercial Paper.

a. Privately Offered structured products

Structured Products as previously covered in our Cytonn Weekly #43/2017 and Cytonn Weekly #19/2015 are defined as highly customized / tailor made investment product that is packaged by investment professionals to enable the investor access returns or meet investment objectives that are not accessible in the traditional / public / conventional markets such as stocks, bonds and bank deposits. Structured Products are considered as a subset of Alternative Investments. The process of structuring starts by traditional products such as equities, bonds and bank deposits, either alone or in combination with a non-traditional product, such as real estate, and creating cash flows and returns that are supported by the underlying products, but whose features are different from the underlying product because of the structuring that is done.

Here is a very simplified example of two scenarios of how a Traditional / Conventional Transaction can be structured to become a Structured Transaction:

Traditional / Conventional Transaction Scenario: A saver with money takes it to the bank and gets little to no return on their deposit. The bank in turn lends the money to, say, a developer and charges market rate cost of borrowing. The bank enjoys the difference between the cost of the deposit paid to saver and the yield on loan received from the developer. This is illustrated below:

- Saver has Kshs. 10 million; he can go deposit it in a bank and get at best 7% per annum return on the deposit,

- Developer can then go to the bank and borrow the Kshs. 10 million from the bank. Remember the bank will be lending to Mr. Developer the same Kshs. 10 million that the bank got from Mr. Saver, but the all-in cost after all bank charges and loan fees comes to about 18% per annum,

- Developer will then use the money to develop a house and sell it for Kshs. 12.5 million, essentially making a gross return of 25%, or Kshs. 2.5 on the Kshs. 10 million loan,

- Developer will then pay to the bank the Kshs. 10 million loan plus 18% total cost of loan, equal to Kshs. 1.8 million, so a total of Kshs. 11.8 million goes back to the bank, leaving Mr. Developer with Kshs. 0.7 million of profit.

A Structured Transaction Scenario: In the structured scenario, the facts remain essential the same, except that the intermediary is not a bank but an investment vehicle; the saver with money takes it to an investment professional, through an Investment Vehicle, who gives the money directly to the developer. The developer will still pay the usual cost of borrowing, but instead of paying it to the bank, it will be paid to the Investment Vehicle, which this will pass the returns to the saver. By structuring out the bank, the saver has been able to increase the returns from the typical rate of return given on deposits, to the typical rate of borrowing paid by developers. This is illustrated below:

- Saver has changed to Mr. Investor and channels his Kshs. 10 million to an Investment Vehicle managed by an investment professional,

- Developer can then go borrow the Kshs. 10 million from the Investment Vehicle and pay the same 18% per annum they would have paid to the bank in the conventional scenario,

- Developer will then use the money to develop a house and sell it for Kshs. 12.5 million, essentially making a gross return of 25% or Kshs. 2.5 million on the Kshs. 10 million loan,

- Developer will then pay to the Investment Vehicle the Kshs. 10 million loan plus 18% total cost of loan, or Kshs 1.8 million, which will be paid to Mr. Investor,

- As a result, a total of Kshs 11.8 million goes to Mr. Saver turned Mr. Investor, leaving Mr. Developer with Kshs 0.7 million of profit.

The difference between Traditional Transaction and the Structured Transaction is that the borrower has to come up with a private Investment Vehicle to be able to transact directly, by structuring out the bank. For the party with money, they get a much higher return, and for the party needing the money, the developer, they are able transact very quickly and move faster than other developers relying only on conventional bank funding; that is the key essence of a Structured Product Transaction: using highly customized features, it brings two parties through innovative features and delivers to them superior results than they would otherwise not get in conventional channels.

The best example of structured products in Kenya is the Cytonn High Yield Solution (CHYS) and the Cytonn Project Notes (CPN) which are privately offered investment solutions offered to pre-qualified high net worth investors. The two solutions involve structuring out the bank and borrowing directly from investors for purposes of pursuing investment grade Real Estate developments with returns of 18.0%-20.0% p.a. for a fixed period of 1- 3 years.

b. Regulated High Yield Funds

The Regulated High Yield Funds mostly comprise of Special Collective Investments Schemes with a considerable allocation to a specific underlying asset class. They operate like the conventional Unit Trusts where the funds are managed by a licensed Fund manager who has the expertise on where to invest as well as doing the administrative role of keeping records of unit holders. Other parties with a key role in ensuring the security of the investors’ funds are; The trustee who ensures that the investment policy statement is followed and the funds are invested as per the regulators guidelines and the Custodian Bank which holds the securities of the fund as well as executing transaction orders from the Fund Manager with the approval of the Trustee.

The target market for these specialized funds is sophisticated High net worth individuals with the ability to meet a certain minimum investment in most cases it will be above Kshs 1,000,000.0, as well as investors who are comfortable with a medium to high risk investments, and in return get a high-income yield and capital preservation. The funds are meant to provide a mixture of liquidity and above market returns with a target return of 13.0 -15.0% p.a. which is around the loan market rates. Thus, the funds are more flexible to withdraw as compared to the structured products with only a lock in period of 3-6 months. The main advantage of registering a special fund as Collective Investment Scheme with CMA, is that investors will enjoy a 15.0% final tax on their returns.

The best example of a regulated High Yield Fund in the Kenyan market is the Cytonn High Yield Fund, CHYF, which is allowed to allocate up to 80.0% of the Portfolio in Real Estate Investment Instruments, which in turn invests in well researched, presold, investment-grade real estate assets in Kenya have consistently demonstrated the ability to deliver higher returns than those from traditionally available assets.

c. Corporate Medium term Notes (MTN) Issuances

Corporate Medium term Notes are medium-term, between 3-7 years, secured debt securities issued by companies with approval from the Capital Markets Authority (CMA) and are priced at a premium to Treasury Bonds. They are normally listed on an exchange. Investors stand to gain from periodic interest payment over the life of the bond or capital gains through trading at the securities exchange. Current corporate bonds in the market are yielding from 8.5% to 13.0% per annum. After the issuer has raised the amount the Notes can then be listed at the NSE and the investors can trade them for capital gains.

MTNs provide a cheaper source of funding to developments as compared to Bank Funding. Over the years there has been corporate bonds issued in the market for the purpose of funding Real estate developments they include:

- Housing Finance Bond - In 2012, HF Group issued a 7.0 year bond raising Kshs 5.0 bn which was a 78.0% oversubscription from the intended Kshs 3.0 bn initially intended to be raised, bearing a coupon rate of 13.0%. The company indicated that the issue would be used to fund mortgage lending as well as funding Real estate developments. The Bond has since been fully redeemed in October 2019 with the management indicating that the bond had brought the intended effect of funding property development, and,

- Centum Medium Term Note – In December, 2020, the Capital Markets Authority (CMA) granted approval to Centum Real Estate Limited (Centum Re) to issue a 3.0 year, secured zero-coupon plain vanilla at 12.5% and secured zero-coupon equity-linked Medium-Term Notes totaling to Kshs 4.0 bn, with a green shoe option of Kshs 2.0 bn. The senior secured zero-coupon equity-linked notes had an indicative rate of 12.0% which comprised an additional 200 basis points over and above the interest rate, subject to the Issuer meeting a minimum project internal rate of return of 20.0% on at least two of the projects financed by the notes. The offer was a restricted issue that targeted sophisticated investors who are sufficiently versed with the risks associated with the notes with the proceeds being used to fund real estate development by Centum Re, a subsidiary of Centum Investment Company Limited. However, The Bond was undersubscribed after raising Kshs 3.0 bn which was 75.0% of the intended Kshs 4.0 bn, but was still 50.0% above the minimum required amount of Kshs 2.0 bn.

d. Commercial Papers

These are promissory notes issued by companies as a form of raising short-term debt. These securities can be secured or unsecured and are priced at a premium to the Treasury Bills. They are short-term securities for tenors up to one year and mainly target institutional investors. Investors stand to gain from yields which are derived from the difference between the maturity value and price when issued. Unlike the Loan Funds discussed above which are mainly used to fund Real Estate developments, commercial papers are mostly used to fund the working capital requirements of companies which must not necessarily be in Real Estate. Commercial papers in the market currently yield from 12% to 18% p.a. The issuance of commercial papers involves four main players:

- The Issuer - This is the entity that needs the funds and has entered the market for borrowing purposes,

- The Arranger - This is an intermediary who brings the involved parties together in most cases it is usually an investment bank Licensed by the Capital Markets Authority to carry out such activities, and,

- The investor – This are the Individuals whose aim is to make a given return and hold the funds they want to commit to the commercial paper,

Below is a Summary Table of Loan Funds in Kenya

|

Loan Fund |

Type of Loan Fund |

Issuer rate |

|

Cytonn Projects Notes (CPN) |

Structured Products |

19.0% -21.0% |

|

Cytonn High Yield Solutions (CHYS) |

Structured Products |

15% to 18% |

|

Cytonn High Yield Fund (CHYF) |

Regulated High Yield Fund |

13.0%-15.0% |

|

Centum Real Estate bond |

Medium Term Bonds |

12.0% -12.5% |

|

ASL Credit Short Term Note Program |

Commercial Paper |

10.5% - 12.0% |

|

KK Security Short Term Note Program |

Commercial Paper |

13.25% |

|

Car & General Short Term Note Program |

Commercial Paper |

12.0% - 13.0% |

|

MyCredit Limited Short Term Note Program |

Commercial Paper |

15.0% |

Section IV: Regulatory and Legal Framework

Having now clarified how Loan Funds generate superior returns, the next question tends to be the regulatory framework governing the issuance of such Loan Funds. For a Loan Fund to be issued it must meet the test of being classified as a security as summarized in SEC vs W. J Howey Co where it was decided that securities; (i) are an investment of money, (ii) in a common enterprise, (iii) with profits, (iv) to come solely from the efforts of the manager. As such Loan funds, in Kenya are issued as securities by way of either private or public offerings.

- Public offers are defined in the Capital Markets Act, Sections 30A, 30B and 30C, as read together. So an issuer or investment manager of a Loan Fund can issue it under the public offers regulations. The challenge is that public offers tend to be highly standardized, and that is why public offers work well for standardized products such as equities, bonds, and unit trust funds. Loan funds by their nature, are highly customized and that is why they tend to be offered to high net worth investors through private offers. To provide for private offers, Section 30A (3) of the CMA Act then goes ahead to specify that “An offer shall not be considered a public offer if – (a) the offer is not calculated to result, directly or indirectly, in the securities of the company being available to persons other than those receiving the offer; or (b) otherwise being a private concern of the person receiving the offer and the person making the offer”. So it is clear that the CMA Act contemplates offers that are not public, hence private offers.

- The meaning of Private Offers is then provided for in The Capital Markets Regulations, 2002, Section 21, which provides conditions under which an offer will be deemed a private offer. Structured products and Commercial papers have typically been offered in the private markets through the enterprising efforts of persons looking for a cost efficient, effective and flexible mode of fundraising. It is important to clarify that courts have settled that the manner of offering is what determines whether an offer is private or public; an offer even to one million people is a private offer if offered privately, and an offer even to one person can be a public offer if offered publicly.

Section V: Challenges facing Loan Funds in Kenya

The existences of the Loan Funds in the Kenyan market is not without challenges, especially given that the most of the products are an innovation and are new to the market. Some of the most notable challenges include:

- Complex structure - They tend to be complex, opaque and hard to value or even understand for some of the target investors. This has really limited their adoption into the market, translating to a slower growth despite the attractive returns,

- Constant push for regulation – Most investors in the Kenyan market associate regulation with safety of their fund and hence do not understand how a debt instrument cannot be regulated and still deliver returns. The urge to bring the industry under the frameworks of public markets can be tempting, however, this would end up driving away private market capital that is not seeking to play in the widely accessible and generic returns of the public markets. The Capital Markets Regulations, 2002, Section 21, which provides conditions under which an offer will be deemed a private offer, and the regulator has clarified that meeting any of the conditions deems an offer to be a Private Offer

- Negative Investor sentiments – The Loan Funds instruments are often viewed with suspicion given that they mostly operate in an unregulated space. The negativity from investors has really slowed down their adoption and growth

Section VI: Recommendations on how to resolve them

We therefore recommend the following actions so as to speed up the adoption of Loan Fund instruments in the Kenyan market:

- Investor education - Continuous education of potential investors to understand the products and returns prospects of the product and how they fit into their portfolios,

- Creation of a regional body - To support the growth of structured products, we propose the creation of a Regional Association for Alternative Investments, that will spearhead education initiatives and the creation of a standardized framework for issuing and classifying loan funds,

- Encouraging industry wide adoption – The market participants and the regulatory framework, need to evolve from the mentality that all financial products must be regulated, and clearly allocate what is a private offer and what is a public offer, therefore, allowing both to co-exist for the benefit of advancing our capital markets

Section VII: Conclusion

In conclusion, a proper adoption and utilization of Loan Funds will help developed and deepen our capital market thus creating a sustainable, low-cost distribution mechanism for multiple financial products and services across the country. We cannot achieve our goal of being a regional financial services hub without an active and vibrant Loan Funds and private markets lending activity, which have shown that they can play a crucial role in financing a growing economy and complementing the mainstream bank debt financing, especially for real estate development. To develop Loan Funds, there is a need to align regulatory frameworks for capital markets with socio-economic policies, such as the President’s Housing Agenda, in order to enhance efficient financial intermediation. A well-developed capital market will encourage the flow of loan funded capital investment into infrastructure and real estate development that will go a long way to help achieve socio-economic development goals.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.