In 2023, we released the Nairobi Metropolitan Area (NMA) Infrastructure Report 2023, which highlighted the Nairobi Metropolitan Area (NMA) boasts of 1,131.6 Km of ongoing construction and rehabilitation projects valued at Kshs 86.3 bn. This represented a significant increase from the 940.5 Km projects worth 97.3 bn that was recorded in 2022. NMA’s average water coverage declined by 4.0% to 51.8% in 2021 from 55.8% in 2020. This week, we update our report using 2024 market research data and by focusing on;

- Introduction,

- Infrastructure Trends in Kenya,

- State of Infrastructure within the NMA,

- Importance of Roads, Water, and Sewer Network Availability to the Real Estate Sector, and

- Conclusion and Recommendations

Section I: Introduction

Infrastructure constitutes the fundamental systems required for the proper functioning of utility services such as water, transport, energy, internet, sewer and drainage networks, among others. These systems are essential for any region to realize economic growth and social development, specifically these networks support economic activities and improve the quality of life. In Kenya, the government continues to actively support infrastructure development through several financial strategies including Public Private Partnerships (PPPs), the issuance of infrastructure bonds, debt financing, and substantial budgetary allocations with its main focus on road networks.

According to the Kenya National Highways Authority (KeNHA) 2023-2027 Strategic Plan the Authority targets to construct 2,349 km of roads, comprising 1,183 km new road construction, capacity enhancement of 674 km and rehabilitation of 492 km. Additionally, the authority aims to cumulatively maintain 75,891 km of the national trunk road network and design 5,575 km of the road network during this period. The implementation of the Strategic Plan requires Kshs 708.7 Bn of which Ksh 99.3 Bn will be funded through PPPs, Kshs. 1.7 Bn through climate funding, and Kshs 8.2 Bn through own source revenue.

Section II: Infrastructure Trends in Kenya

- Government continued launch and completion of infrastructure projects

The Kenyan government’s commitment to infrastructure has led to the launch and progression of several key projects across the nation, with a special focus on road networks. These road projects continue to enhance connectivity that supports trading activities, draws investments in various sectors and promotes economic growth. Additionally, better infrastructure boosts productivity, spurs innovation and improves the quality of life of Kenyan citizens. Some of the notable projects this year include: 25-kilometre Rukuriri-Kathageri Kanyaumbora road in Embu County, Dongo Kundu Bypass was officially opened to the public, ground breaking for the tarmacking of 65.0km -long link roads in Sombogo, Kitutu Chache, and tarmacking of Metembe-Ngenyi/Bobaracho-Ititi/RiomaNyaore/Marani-Nyakoe Roads in Marani, Kisii County, the proposed dualling of Nairobi-Nakuru highway, rehabilitation of Savannah 17 Bridge Road, Jogoo road and Ladhies Road in Nairobi, aimed at improving traffic flow and safety.

- Inclusive infrastructure planning

There has been a shift towards inclusive infrastructure planning to ensure communities benefit from infrastructural developments while addressing environmental protection, social sustainability, stakeholder engagement, economic empowerment and road safety. KenNHA 2023-2027 strategy includes compliance with environmental and social safeguards, mainstreaming cross-cutting issues like gender and disability, improving customer and stakeholder relations, integrating road safety and local content in projects, linking road construction with socio-economic development, advocating for responsive legislation, building climate-resilient structures, and preserving the environment. This holistic strategy aims to enhance the sustainability of Kenya's national trunk road network.

- Enhanced infrastructure development in affordable housing and settlement areas

The government continues to direct considerable efforts towards enhancing road networks connecting previously remote areas, thereby facilitating the expansion of housing and settlement. KenNHA 2023-2027 strategy aims to enhance the Outer Ring Junction-Kamulu-Komarock, Isinya-Konza, and Bomas-Ongata Rongai-Kiserian-Kona Baridi roads to increase accessibility to new affordable housing zones. Additionally, the authority is committed to maintaining essential connections to County Headquarters to support the connectivity required for the affordable housing initiatives under the BETA program.

- Financing Strategies

- Public-Private Partnerships (PPPs)

The Kenyan government continues to actively pursue Public-Private Partnerships (PPPs) to improve infrastructure development in the country. Notable projects being the Mombasa-Nairobi Expressway, which entails a USD 3.6 bn investment agreement with Everstrong Capital and the upgrading to Bitumen standards and maintenance of the 90.0km Kiambu-Raini, Junction, Kaspat Road, Nduota-Gathanga-Kiguaro, and other roads funded by the Chinese African Development Bank. This significant partnership highlights the government's strategy to utilize substantial private capital for major infrastructure projects, aiming to enhance connectivity, stimulate economic growth, and ensure sustainable development. Partnerships between the public sector and private entities facilitates improved efficiency, drives innovation, and provides the necessary funding for project delivery.

- Budgetary Allocations

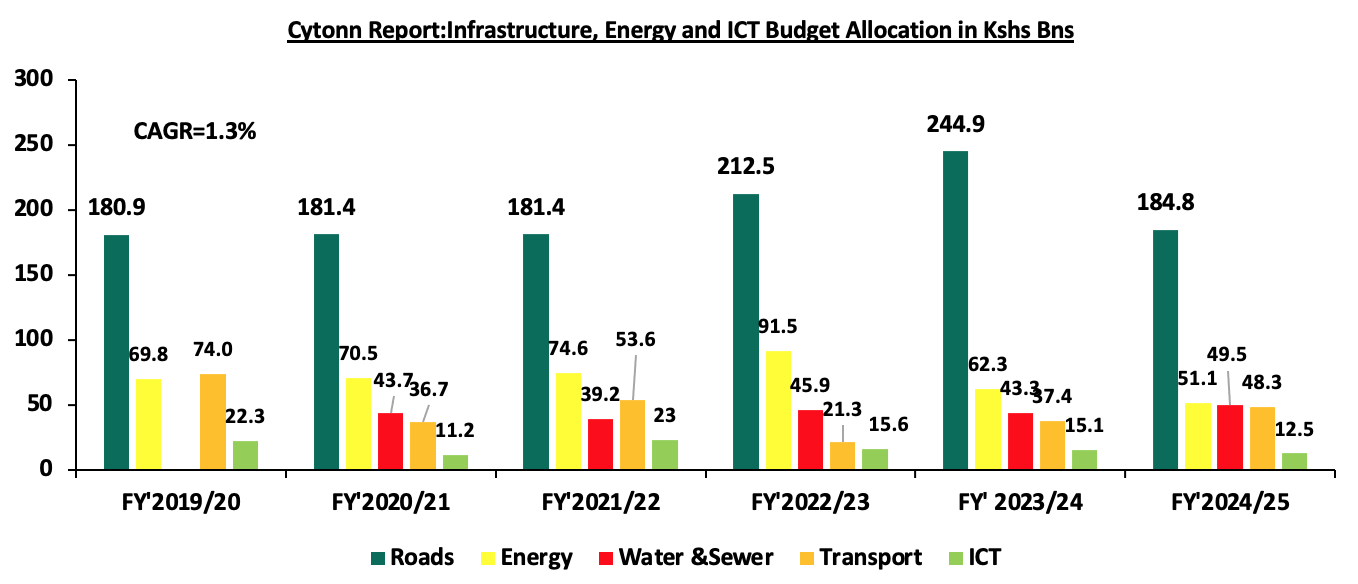

The government’s year-on-year budgetary allocations continue to play a pivotal role in steering Kenya's infrastructure development. In the FY’2024/25, the total budget allocation for infrastructure, energy and ICT stands at a substantial Kshs 477.2bn, recording a 1.9% increase from the Kshs 468.2 bn recorded in the preceding FY’2023/24. This highlights the recognition of the capital-intensive nature of infrastructure projects and their direct impact on job creation and regional economic growth. The chart below illustrates the growth in budgetary allocations for infrastructure, energy and ICT over the last five fiscal years:

Source: National Treasury of Kenya

- Issuance of infrastructure bonds

Issuing of infrastructure bonds has emerged as an important financial strategy for the government in a bid to raise additional resources for infrastructure projects beyond the limits of annual budgets. In September 2024, the Central Bank of Kenya released the auction results for the IFB1/2023/017 tap sale with a tenor to maturity of 15.7 years. The bond was oversubscribed with the overall subscription rate coming in at 234.6%, receiving bids worth Kshs 35.2 bn against the offered Kshs 15.0 bn. The government accepted bids worth Kshs 32.0 bn, translating to an acceptance rate of 91.0%. The weighted average rate of accepted Bids was 17.7%. The growing interest from investors in these bonds is largely driven by their tax-exempt coupon feature, which enhances their appeal and offers an effective option for portfolio diversification. These infrastructure bonds serve as both a dependable financing mechanism and a testament to investors' trust in the government's dedication to infrastructure advancement. The capital raised through these bonds plays a crucial role in supporting ongoing and future infrastructure projects, thereby promoting economic growth and development.

- Credits and Grants from development partners

The government of Kenya continues to rely on credits and grants from international development partners as a crucial funding source for its infrastructure initiatives. These collaborations provide not only financial support but also technical expertise and knowledge sharing. Key contributors include the World Bank, which, through programs like the Kenya Urban Support Program (KUSP), has played a significant role in advancing urban infrastructure development. Other notable financiers include the African Development Bank (AfDB), the European Union (EU) with special focus on energy, roads and water, and bilateral partners such as China, Japan, and the United States. The government’s ability to negotiate favorable financing terms with these partners facilitates the implementation of projects that might otherwise be cost-prohibitive.

Section III: State of Infrastructure in the Nairobi Metropolitan Area (NMA)

For our analysis, we covered the current supply of infrastructure in the Nairobi Metropolitan Area and projects that are currently underway with a focus on roads, water supply, and sewerage systems. The counties of focus within the NMA include Nairobi, Kiambu, Machakos, and Kajiado Counties. Below is the analysis of the infrastructure provision in the Nairobi Metropolitan Area;

- Roads

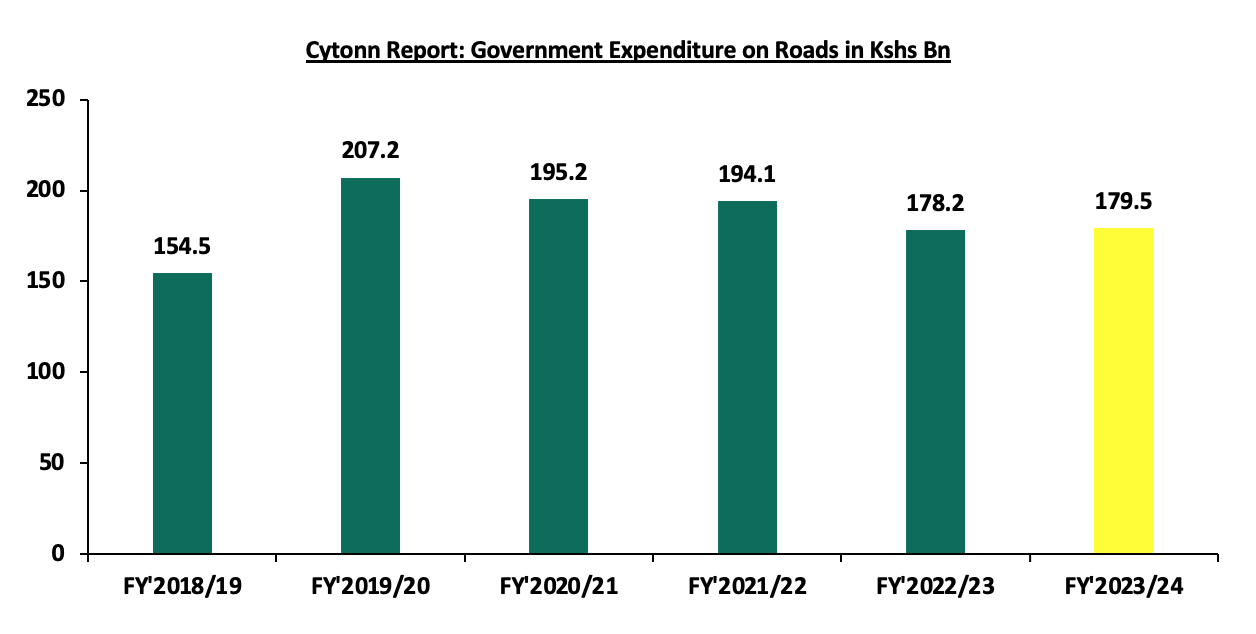

According to the KNBS Economic Survey 2024, road transport was the leading contributor to the value output of the transport and storage sector, accounting for 75.8% of the sector’s value output at Kshs 2.6 tn which stood in contrast to the overall value output of the entire transport and storage sector amounting to ksh 3.3 tn. This highlights that road transport is the primary mode of transport in the country. In line with the its Bottom-Up Economic Transformation Agenda (BETA), the government remains keen on improving the livelihoods and welfare of Kenyans through rehabilitation and upgrading of major trunk roads and regional transport corridors. According to the survey report the governments expenditure on roads is expected to increase by 0.7% to ksh 179.5bn in FY’ 2023/24 from ksh 178.2bn in FY’2022/23 which is within the current budgetary allocation to construction and rehabilitation of roads at ksh 193.2bn. Due to the governments continued efforts to improve infrastructure it is estimated that currently the road network in the country stands at 246,757 Kms out of which 162,055 Kms are classified as one of the country’s largest investment. The graph below shows the Kenyan government’s expenditure on roads during the last five years;

Source: Kenya National Bureau Statistics (KNBS)

However, recent developments relating to the expenditure as revealed by the National Treasury, highlight a shift in government spending priorities, indicating a reduced expenditure in FY’2024/25, as result of budgetary cuts. According to the supplementary budget FY’2024/25, allocation to the state department of roads was reduced by 4.4% to ksh 184.8 bn from the ksh 193.4 bn set in the FY’2024/25 budget. This was attributed to a strategy by the government to cut expenditure in response to pressure from anti-finance bill 2024 protests and to restore calm in the country. We anticipate the government continued efforts to improve infrastructure in the country more so in road and transport sector in line with its BETA agenda and economic stimulation. However, this may be weighed down by the recent budgetary cuts therefore reducing the number of successfully completed projects.

The State Department of Roads is responsible for the development, maintenance, and management of road infrastructure in the country, a mandate carried out through several state agencies. The Kenya Roads Board (KRB) oversees the national road network and coordinates maintenance, rehabilitation, and development using the Roads Maintenance Levy Fund (RMLF). The Kenya National Highways Authority (KeNHA) manages, develops, and maintains National Trunk Roads in Classes S, A, and B, while the Kenya Rural Roads Authority (KeRRA) is tasked with Class C roads. The Kenya Urban Roads Authority (KURA) focuses on urban roads within cities and municipalities, and the Kenya Wildlife Service (KWS) manages roads within National Parks and Game Reserves.

|

Cytonn Report: Road Classification in Kenya |

|||

|

# |

Road Class |

Definition |

Overseeing Body |

|

1 |

Superhighway (S) |

Highway connecting two or more cities/towns meant to carry safely a large volume of traffic at the highest legal speed of operation. |

KeNHA |

|

2 |

International Trunk Road (A) |

Roads forming strategic routes and corridors, connecting international boundaries at identified immigration entry and exit points and international terminals such as international air or sea ports |

KeNHA |

|

3 |

National Trunk Road (B) |

Roads forming important national routes linking national trading or economic hubs, county headquarters and other nationally important centres to each other and to the national capital or to Class A roads |

KeNHA |

|

4 |

Primary Road (C) |

Roads forming important regional routes, linking County headquarters or other regionally important centres, to each other and to class A or B roads |

KeRRA |

|

5 |

Secondary Road (D) |

Roads linking constituency headquarters, municipal or town council centres and other towns to each other and to higher class roads |

KURA |

Source: Kenya Roads Board

In terms of performance, in the Nairobi Metropolitan Area (NMA), a total of 97.4 Km road networks constructions valued at Kshs 23.6 bn have been completed between 2023/2024 an increase of 6.0 km from 2022/ 2023. Some of the notable projects completed during the period include Nairobi construction of missing Link roads in Nairobi, improvement of Nairobi outering road and Rehabilitation and upgrading of Eastland’s Roads (Phase 11). Below is a summary of completed road network coverage in the Nairobi Metropolitan Area (NMA) between 2023 and November 2024;

|

Cytonn Report: Summary of completed road network coverage in the NMA 2023/2024 |

||

|

County |

Completed Roads (Km) |

Cost |

|

(All Values in Kshs Bns Unless Stated otherwise) |

||

|

Kajiado |

7.4 |

0.5 |

|

Nairobi |

65.8 |

20.8 |

|

Kiambu |

23.0 |

2.3 |

|

Machakos |

8.6 |

0.5 |

|

Average |

104.8 |

24.1 |

Source KeRRA and KURA

In addition to the aforementioned completed road networks projects, the Nairobi Metropolitan Area (NMA) boasts of 926.7kms of ongoing construction and rehabilitation projects valued at Kshs 68.2 bn. This represents a significant decrease from the 1131.6 kms projects worth 86.3 bn in 2023. Some of the notable ongoing projects include;

- Kenol - Ngoleni - Kaani / Mutituni - Kaseve,

- U-G29664 Kamunyu A/ U-G29671 Kamunyu B/UG29572 Gathiaka - Gathuya/ Marigi Gategi/ Cununuki - Gacharage/ Gitwe Kiganjo/ Kahata - Munyuini/ Karinga - Kimaruri/Kuri - Cununuki - Gacharage/Ruburi - Wanugu - Flyover,

- Rehabilitation of Innercore Estate Roads,

- Rehabilitation of Kasarani - Mwiki Road,

- Improvement of access to Kibera housing project,

- Construction of Ngong-Suswa road.

Below is a summary of the ongoing road network coverage in the NMA;

|

Cytonn Report: Summary of Nairobi Metropolitan Area Ongoing Road Projects |

|||

|

County |

Total Coverage (KM) |

Status |

Cost (Kshs) |

|

Kajiado |

142.4 |

73.3% |

7.3 |

|

Nairobi |

60.3 |

65.3% |

7.7 |

|

Kiambu |

516.0 |

59.1% |

37.2 |

|

Machakos |

208.0 |

62.3% |

16.0 |

|

Total |

926.7 |

65.0% |

68.2 |

Source: KeRRA and KURA

- Water Supply

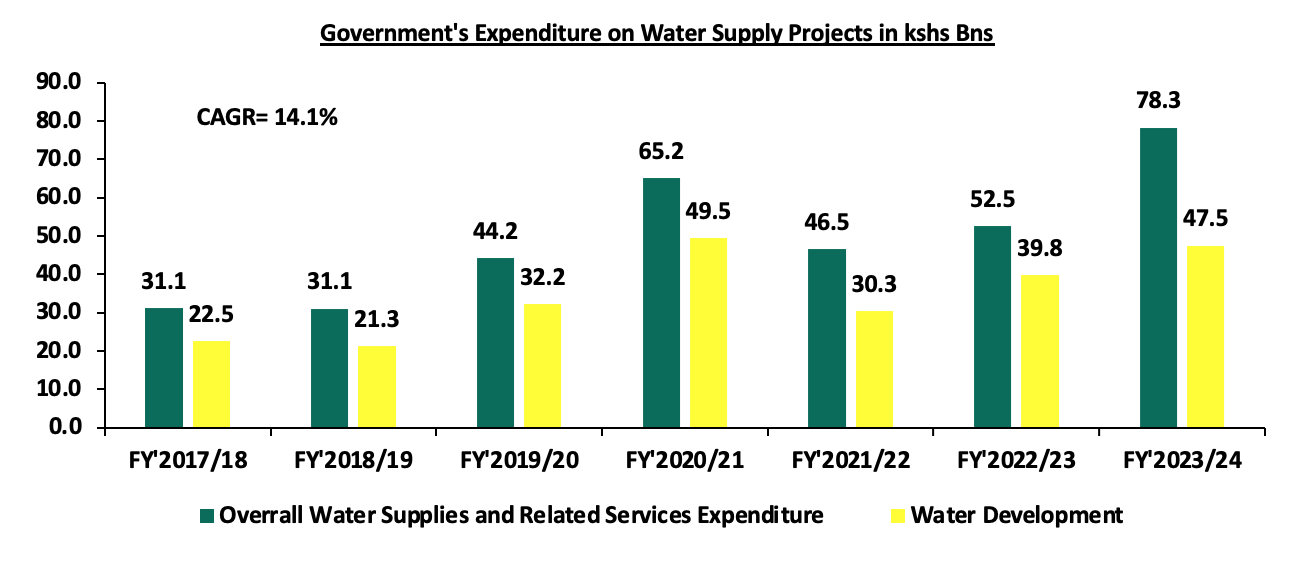

According to the Economic Survey 2024 report, water supply accounted for 12.1% of the environment and natural resources sector value output at Kshs 65.0 bn. This was in comparison to the overall environment and natural resources sector which recorded a value output of Kshs 534.5 bn, a 3.5% share contribution to the country’s Gross Domestic Product (GDP) as at 2023. In terms of expenditure, the report highlights that the government’s expenditure on water supplies and related services is projected to rise by 49.3% to KSh 78.4 bn in 2023/24 from Ksh 52.5 bn in 2022/2023. Notable projects ongoing during the period under review include rehabilitation of 400 water supply projects in Mandera, Garissa, Wajir, Turkana and Marsabit counties, Karimenu II, Siyoi-Muruny dam in West, Bura Irrigation Rehabilitation Phase II and

Lower Nzoia irrigation infrastructure Project Phase I. However, Expenditure on water Development is expected to rise by 19.3% to KSh 47.5 bn in FY’2023/24 from ksh 39.8bn in FY’2022/23, highlights the government’s ongoing commitment to enhancing the availability and accessibility of safe and sufficient water in various regions by drilling boreholes and maintaining water purification facilities. The graph below shows government’s expenditure on water supply projects and related services in the last five years;

Source: Kenya National Bureau of Statistics

In the Nairobi Metropolitan Area (NMA) government piped water systems and boreholes are the primary sources of water. In terms of water coverage performance, the Water Services Regulatory Board (WASREB’s) Impact Issue Report No.16 highlights NMA’s average water coverage in NMA stands at 53.5% between 2022/23, a 1.7% increase from 51.8% recorded in FY’2021/22. This slow improvement in coverage can be attributed to relatively high urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023 sustaining demand for water supply and related services. Some of the completed water projects include: i) Laying 25km water pipelines in Embakasi Central, ii) Westlands bulk water transfer system project, iii) Embakasi West water project, iv) Nairobi Northern collector tunnel water project iv) 19.5km Kiamumbi water line extensions in Kiambu among others.

In terms of coverage per county, Nairobi registered the highest water coverage at 83.0% compared to NMA’s average of 53.5%, as at 2022/23, due to presence of adequate water supply systems and networks. On the other hand, Machakos recorded the least water coverage at 28.0%, attributable to inadequate water supply. WASREB defines water coverage as the number of people served with drinking water expressed as a percentage of the total population within the service area of a utility. The table below show the Nairobi Metropolitan Area water coverage as at 2022/23:

|

Cytonn Report: Nairobi Metropolitan Area Water Coverage |

||

|

County |

2022/23 |

2021/22 |

|

Nairobi |

83.0% |

86.0% |

|

Kiambu |

71.0% |

70.0% |

|

Machakos |

28.0% |

28.0% |

|

Kajiado |

32.0% |

23.0% |

|

Average |

53.5% |

51.8% |

Source: Water Services Regulatory Board (WASREB)

Below is a list of some of the water and sewer system companies within the Nairobi Metropolitan Area;

|

Cytonn Report: Nairobi Metropolitan Area Water and Sewer Service Providers |

|||

|

Company |

County |

Company |

County |

|

Kiambu Water and Sewerage Company |

Kiambu |

Nairobi City Water & Sewerage Company |

Nairobi |

|

Thika Water and Sewerage Company |

Kiambu |

Runda Water Services Provider |

Nairobi |

|

Ruiru-Juja Water and Sanitation |

Kiambu |

Machakos Water and Sewerage Company |

Machakos |

|

Limuru Water and Sewerage Company |

Kiambu |

Mavoko Water and Sewerage Company |

Machakos |

|

Kikuyu Water and Sewerage company |

Kiambu |

Kangundo–Matungulu Water and Sewerage Company |

Machakos |

|

Gatundu Water and Sanitation Company |

Kiambu |

Mwala Water and Sanitation Company |

Machakos |

|

Karimenu Water and Sanitation Company |

Kiambu |

Oloolaiser Water and Sewerage Company |

Kajiado |

|

Kikuyu Water and Sewerage company |

Kiambu |

Nol-Turesh Loitokitok Water & Sanitation Company |

Kajiado |

|

Karuri Water and Sewerage Company |

Kiambu |

Olkejuado Water and Sewerage Company |

Kajiado |

|

Athi Water Works Development Agency |

Nairobi |

Tanathi Water Works Development Agency |

Machakos |

Source: Water Services Regulatory Board

In efforts to bridge the gap of inadequate water and sewer systems within the Nairobi Metropolitan Area, the government has initiated several projects to achieve its goals including;

- Utawala, Mihango Area water supply project in Nairobi county,

- Ruiru water treatment plant project in Kiambu county,

- Limuru, Loroho and Gitiha Areas water supply project in Kiambu county,

- Kiambaa Water Supply Project in Kiambu county,

- Gatundu Water Supply project in Kiambu County,

- Oloitoktok water supply and sanitation project in Kajiado county,

- Namanga mega water project in Kajiado county,

- Mwala Cluster and Matungulu Water Supply and Sanitation project in Machakos County, and,

- Machakos water supply project, among others.

- Sewer Systems

Sewer systems in the Nairobi Metropolitan Area recorded an average network coverage of 24.8% in 2022/23, a slight increase of 2.3% from 22.5% recorded in 2021/22, according to the Impact Report Issue No. 16 published by the Water Services Regulator Board (WASREB). This can be attributed to the completion of numerous projects during the period such as i) Njiru sewer line extension, ii) Gatundu, Karimenu and Karure sewer systems, iii) Donholm - Savannah Sewer Rehabilitation and Upgrade, iv) Kiamaiko sewer rehabilitation, v) Riruta sewer extension works, and vi) Athi River sewer lines construction and upgrade projects among others.

Notably, Nairobi County led with the highest coverage at 49.0%, while counties like Kajiado had minimal connectivity with majority of the population still relying on alternative systems such pit latrines, septic tanks, and bio digesters. The table below shows the water and sewer coverage of various counties within the NMA as at 2022/23;

|

Cytonn Report: Nairobi Metropolitan Area Sewer Systems Coverage |

||

|

County |

Sewer Coverage 2021/22 |

Sewer Coverage 2022/23 |

|

Nairobi |

50.0% |

49.0% |

|

Kiambu |

24.0% |

30.0% |

|

Machakos |

16.0% |

20.0% |

|

Kajiado |

0.0% |

0.0% |

|

Average |

22.5% |

24.8% |

Source: Water Services Regulatory Board (WASREB)

Despite slight improvements in coverage, there remains a significant need for adequate sewer systems in the Nairobi Metropolitan Area. The government is addressing this through ongoing sewer line improvement and rehabilitation projects including;

- Riruta Sewer Extension Works in Nairobi city,

- Donholm and Savannah Sewer Rehabilitation and Upgrade Project in Nairobi County,

- Njiru Sewer Line Extension Project in Nairobi County,

- Construction of Machakos Sewerage Project in Machakos County,

- Kiambu Ruaka Sewerage Project in Kiambu County,

- Mavoko National Housing Corporation Sewerage Project in Machakos County,

- Machakos Sewerage Project, among many others.

The table below presents a summary of infrastructure coverage in the Nairobi Metropolitan Area;

|

Cytonn Report: Summary of Infrastructure Coverage in the Nairobi Metropolitan Area |

|||||

|

# |

County |

Ongoing Road Projects Coverage in Km (2022/23) |

Completed Road Projects in Km (2022 /23) |

Water Coverage (2022/23) |

Sewer Coverage (2022/23) |

|

1 |

Nairobi |

60.3 |

65.8 |

83.0% |

49.0% |

|

2 |

Kiambu |

516.0 |

23.0 |

71.0% |

30.0% |

|

3 |

Machakos |

208.0 |

8.6 |

28.0% |

20.0% |

|

4 |

Kajiado |

142.4 |

7.4 |

32.0% |

0.0% |

|

|

Total |

926.7 |

104.8 |

|

|

|

|

Average |

|

|

53.5% |

24.8% |

Source: KeRRA, KURA, KeNHA, WASREB

Section IV: Importance of Roads, Water, and, Sewer Network Availability to the Real Estate Sector

The connection between infrastructure and Real Estate is a critical one, the development of infrastructural systems is essential for economic progress and has a direct impact on the real estate sector. Strong infrastructure not only supports the growth of residential, commercial, and industrial properties but also drives investment and may lead to improvement in demand for properties in areas that are well covered.

- Improved Price of properties: Good infrastructure directly boosts property prices by improving accessibility, convenience, and overall liveability. Well-developed roads, public transportation, and essential utilities make areas more desirable, attracting buyers and renters. For real estate developers, areas with existing infrastructure more often reduces construction costs making it more attractive for the developers to build in such areas,

- Opening Up Areas for Investments: Improvement of existing infrastructure such as roads networks opens up areas for investment by improving accessibility and connectivity, making these areas more attractive to developers and businesses. Some of notable developments launched around major roads include the Global Trade Centre (GTC), Crystal Rivers Mall, and Imaara Mall, all located along the Nairobi Expressway project, Mi Vida Homes and Garden City Business park along the Thika Superhighway, and Two rivers mall along Limuru road,

- Reduction of Development Costs: Infrastructure reduces development costs by providing essential services like roads, water, electricity, and sewerage systems which developers would have incurred a cost to install. The Center for Affordable Housing Finance Africa (CAHF), estimates that infrastructure costs accounts for averagely 11.1% of total developmental costs,

- Enhancing Trade and commercial activities: The development of infrastructure, particularly transport networks and utilities, enhances trade operations by improving the efficiency and speed of moving goods and services thus attracting both local and international trade.

- Enhance the Quality of Housing Stock: Presence of adequate infrastructural amenities such as roads, water supply and sanitation services including sewerage systems significantly enhances the quality of delivered housing stock. Subsequently, adequate infrastructure improves the living standards of citizens through access to clean water, sanitation and good roads

- Promoting Tourism and Attracting Foreign Investments: A well-developed infrastructure framework not only encourages domestic investment but also attracts international capital. Kenya’s ongoing infrastructure improvements have positioned the country as an important regional hub. As result, the country has experienced an influx of foreign investments with notable ones in 2024 including JPMorgan Chase & Co, Bill and Melinda Gates Foundation and Genesis.

Section V: Conclusion and Recommendation

To gauge Real Estate investment opportunities based on infrastructure, we looked at the key infrastructural sectors and ranked them in terms of performance and availability as follows;

The points are 1-4, with 4 awarded to the Best Performing Area Based on Infrastructure Availability

|

Cytonn Report: County Ranking based on the State of Infrastructure Development 2023/24 |

||||||

|

County |

Completed Roads |

Roads in Pipeline |

Water Connectivity |

Sewer Connectivity |

Average Points |

Rank |

|

Nairobi |

4 |

2 |

4 |

4 |

3.5 |

1 |

|

Kiambu |

3 |

4 |

3 |

3 |

3.3 |

2 |

|

Machakos |

1 |

3 |

2 |

2 |

2.0 |

3 |

|

Kajiado |

1 |

2 |

1 |

1 |

1.3 |

4 |

Source: Cytonn Research

Based on the above infrastructure services, Nairobi and Kiambu emerge as the best Counties for Real Estate developments such as residential and commercial units, due to the presence of adequate completed road networks, and, adequate water and sewer connectivity. Some of the areas to invest in Nairobi County that are at least endowed with some infrastructure infrastructure include; Westlands, Gigiri, Ridgeways, Karen, Runda, Kilimani, Upperhill, Parklands, Upperhill, Spring Valley, Kileleshwa, Syokimau among many others. Some of the best areas to implement Real Estate investments in Kiambu county include; Thika, Kiambu town, Ruiru, and Juja among others. Kajiado ranks at the bottom of all four counties, due to absence of adequate infrastructural amenities such as sewered sanitation services, water connectivity and low volume of road networks.

We anticipate the government continued efforts to improve infrastructure in the country more so in road and transport sector in line with its BETA agenda and economic stimulation goal. However, this may be slowed down by the reduction in allocation to state department of roads by 4.4% in the supplementary budget FY’2024/25,to ksh 184.8 bn from the ksh193.4 bn set in the FY’2024/25 budget. Consequently, we anticipate that going forward, there will be a decline in the number of infrastructure projects completed, while the number of stalled infrastructure projects across the country is expected to continue rising due financial constraints. Although the government acknowledges the importance of Public-Private Partnerships (PPPs) in tackling financing challenges, we believe that prioritizing PPPs is fundamental in addressing funding shortfalls. By leveraging the resources and expertise of the private sector, PPPs can support sustainable infrastructure development and stimulate economic growth.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.