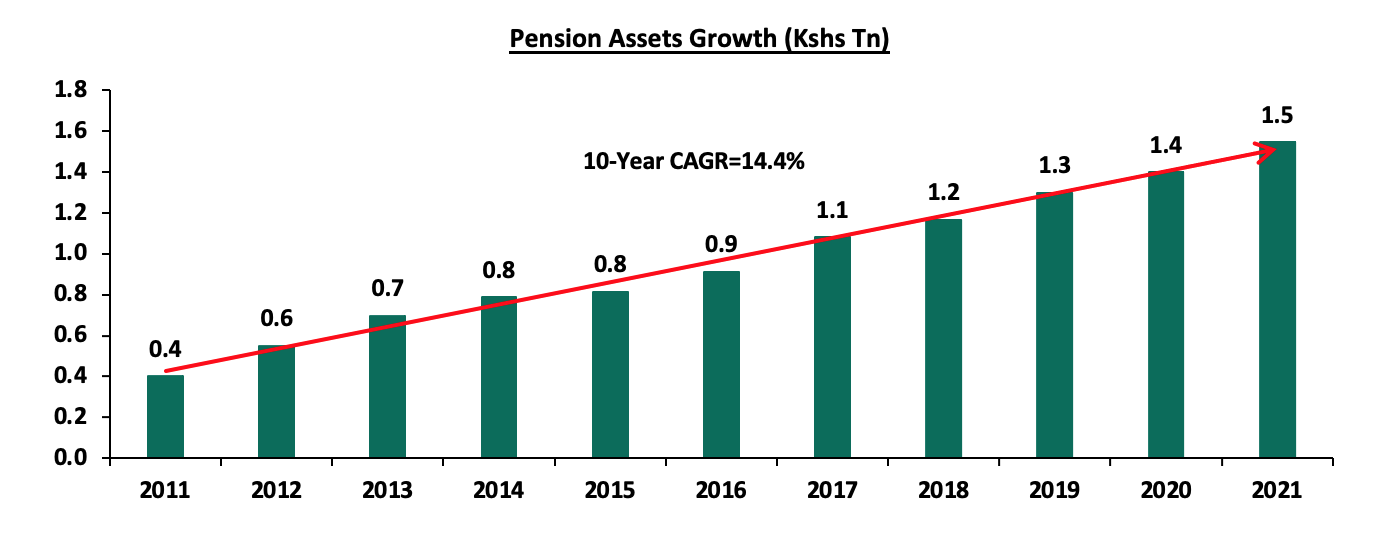

In the face of unprecedented economic occurrences such as the resurgence of COVID-19 infections and the persistent geopolitical pressures, the pensions industry continues to feel the impact in terms of both sustainability and adequacy, with the pension schemes registering lower returns hence a decline in their asset value. The economic uncertainties influence retirement benefit schemes through various ways including: i) Increased individuals exiting the schemes ii) A decline in the disposable income hence lower contributions, and, iii) Regulatory compliance challenges due to fair value losses in some of the asset classes invested in. Closer home, the pensions industry in Kenya has experienced steady growth over time, with the assets under management having grown at a 10-year CAGR of 14.4% to Kshs 1,547.4 bn in 2021 from Kshs 403.2 bn in 2011. However, pensions uptake is still low with only 12.0% of the adult population in the labor force saving for their retirement in retirement benefits schemes as of 2021. Overall, the key challenge remains the extent to which pension schemes can accommodate the existing economic uncertainties.

We have been tracking the performance of retirement benefit schemes with the most recent topic being Kenya Retirement Benefit Schemes FY’2021 Performance. This week, we turn our focus to the progress of Kenyan pensions schemes in 2022, by providing a deep analysis of the current status and what can be done going forward. Therefore, we shall look at the topic in five different sections:

- Introduction

- The Current State of Retirement Benefits Schemes in Kenya

- Factors Hindering the Growth of Retirement Benefits Schemes in Kenya

- Key Considerations to Improving Retirement Prospects in Kenya

- Conclusion

Section 1: Introduction

Retirement Benefits Schemes allow members to make regular contributions during their working years and once a member retires either after attaining the retirement age or earlier due to other factors, mainly ill-health, these contributions plus accrued interest are utilized to provide retirement income to the member. Having a retirement plan cushions retirees from reduced income and ensures decent living after retirement. The retirement schemes in Kenya are categorized based on contributions, mode of payment at retirement, membership and mode of investment, as follows:

- Based on Contributions:

- Defined Benefits Schemes – Defined benefit plans are funded either exclusively by employer contributions or sometimes require employee contributions. The cost of the promises being earned each year are calculated in advance, to advice on the required amount that needs to be contributed each year to keep the scheme healthy, and,

- Defined Contribution Scheme - Member’ and employer’ contributions are fixed either as a percentage of pensionable earnings or as a shilling amount. However, members have the freedom to contribute more than the defined rate (Additional Voluntary Contribution).

- Based on Mode of Payment at Retirement:

- Pension Scheme – At retirement, a member of a pension scheme may access up to a third of their contributions and contributions made on their behalf plus accrued interest as a lump sum and then the remainder is used to purchase an annuity (pension) that pays a periodic income to the pensioner in their retirement years, usually, monthly, and,

- Provident Fund - At retirement, a member of a provident fund receives their contribution and contributions made on their behalf plus accrued interest as a Lump Sum.

- Type of Membership:

- Occupational Retirement Benefits Scheme - These are schemes that are set up by an employer where only members of their staff are eligible to join,

- Umbrella Retirement Benefits Scheme - These are schemes that pool the retirement contributions of multiple employers on behalf of their employees thereby reducing the average cost per member and enhancing the overall returns of both the employer and the employees’ contributions, and,

- Individual Retirement Benefits Scheme – These are schemes where individuals contribute directly into the scheme towards saving for their retirement. The contributions are usually flexible in order to accommodate an individual’s financial circumstances.

- Mode of Investment:

- Segregated Funds – These are Funds where members’ contributions are invested directly by the Trustees via an appointed Fund Manager. The Trustees establish an appropriate Investment Policy which is then implemented by the Fund Manager. The scheme directly holds the investments and the returns are fully accrued to the scheme for the benefit of its members, and,

- Guaranteed Funds - Guaranteed funds are those offered by insurance companies where the members’ contributions are pooled together. The insurance company guarantees a minimum rate of return and should the actual return surpass the minimum guaranteed rate, the insurance company may either top up the minimum rate with a bonus rate of return or reserve the extra return.

As people progressively live longer and retire from employment, it requires more money at retirement. The requirement for a longer period of income also impacts the ability to retire early, being able to stop working due to a health condition or keep the same standard of living. Key to note, saving enough money for retirement reduces the over-reliance on one’s relatives during retirement. As such, it is important for any person with the ability to generate income to join at least one retirement saving plan for a better retirement life.

Section 2: The Current State of Retirement Benefits Schemes in Kenya

- Growth of Retirement Benefits Schemes

According to the Retirement Benefits Authority (RBA), the retirement benefits schemes industry has registered significant growth with the Assets under Management growing steadily at a 10-year CAGR of 14.4% to Kshs 1,547.4 bn in 2021 from Kshs 403.2 bn in 2011. In 2021, assets grew at a faster rate of 10.6% to Kshs 1,547.4 bn from Kshs 1,399.0 bn compared to 7.8% growth in 2020 as a result of the economic recovery that saw people resume contribution to the retirement benefits schemes. The graph below shows the growth of Assets under Management of the retirement benefits schemes over the last 10 years:

Source: Retirement Benefits Authority (RBA)

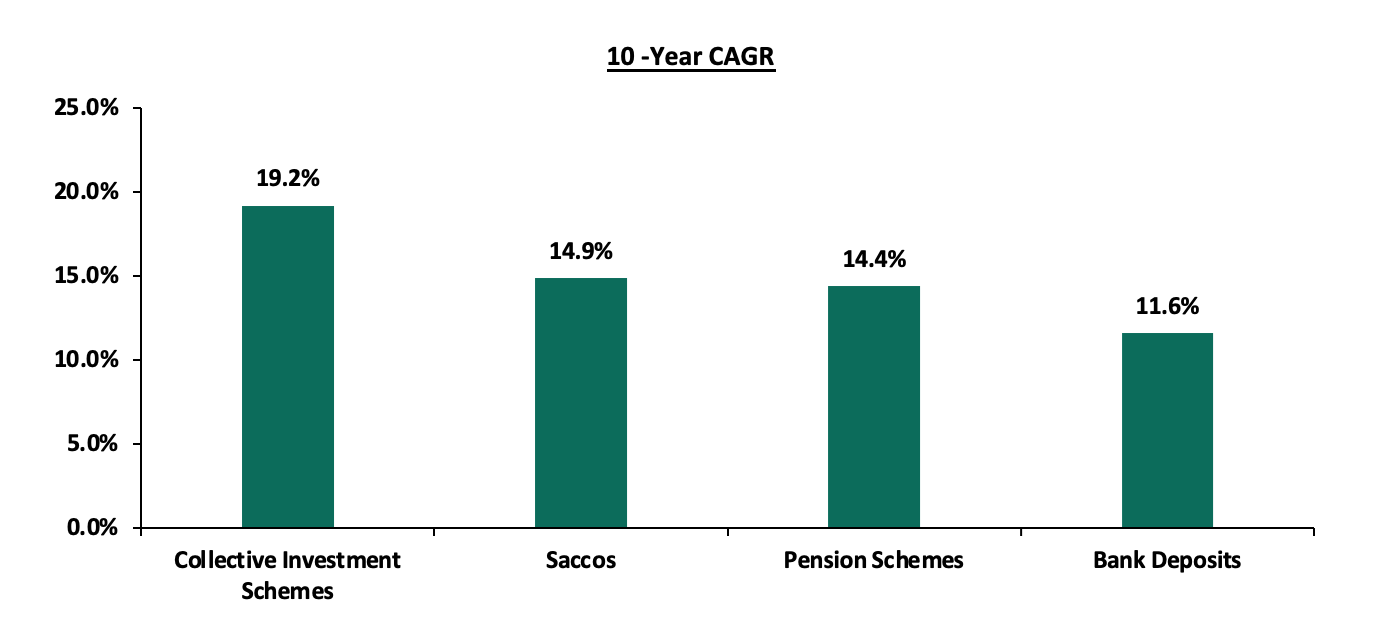

The graph below shows the 10-year CAGR of pension schemes’ Assets under Management against other capital markets products and Banking deposits:

Source: Sasra Annual Reports, Central Bank, Retirement Benefits Authority (RBA), Capital Markets Authority Quarterly Statistical Bulletin

- Performance of Retirement Benefits Schemes

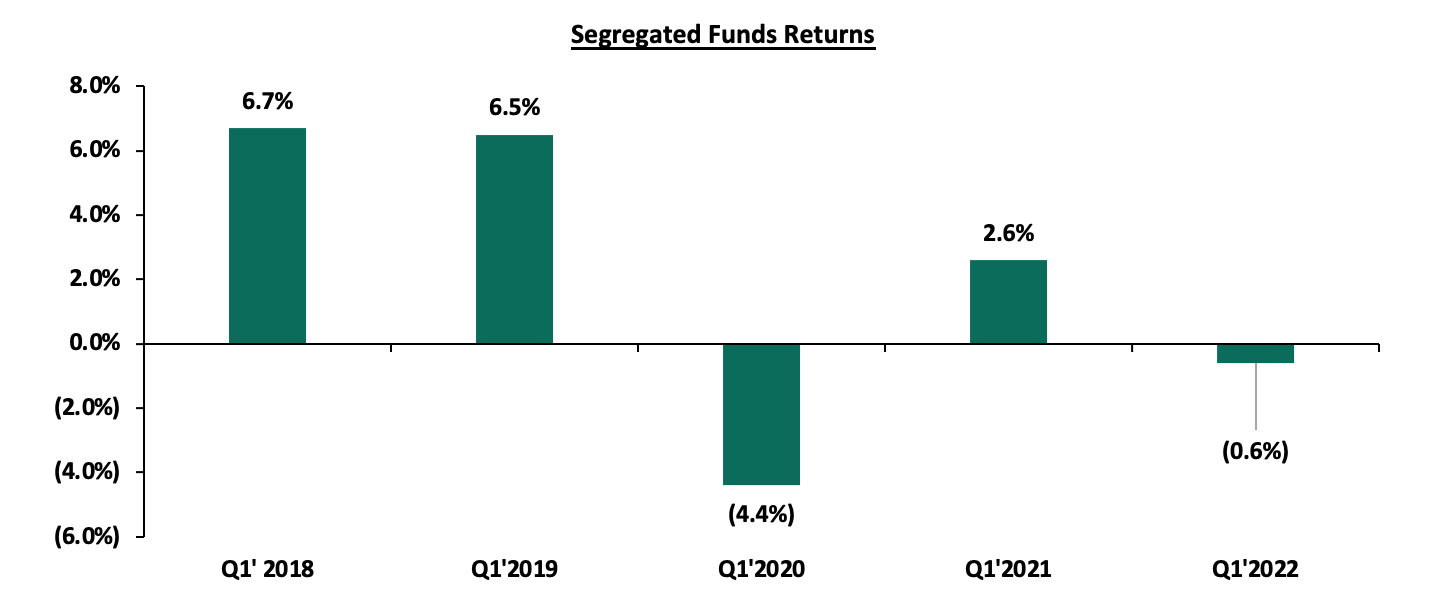

According to the ACTSERV Q1’2022 Pension Schemes Investments Performance Survey, segregated retirement benefits schemes recorded a 0.6% decline in Q1’2022, down from the 2.6% increase recorded in Q1’2021. The decline was largely driven by a 4.8% decline recorded in the equities portfolio in Q1’2022 from the 5.6% gain recorded in Q1’2021 as a result of increased investor selloffs emanating from the uncertainties regarding global political events and the forthcoming general elections. The graph below highlights the performance of the segregated pension schemes over the last five years:

Source: ACTSERV Surveys

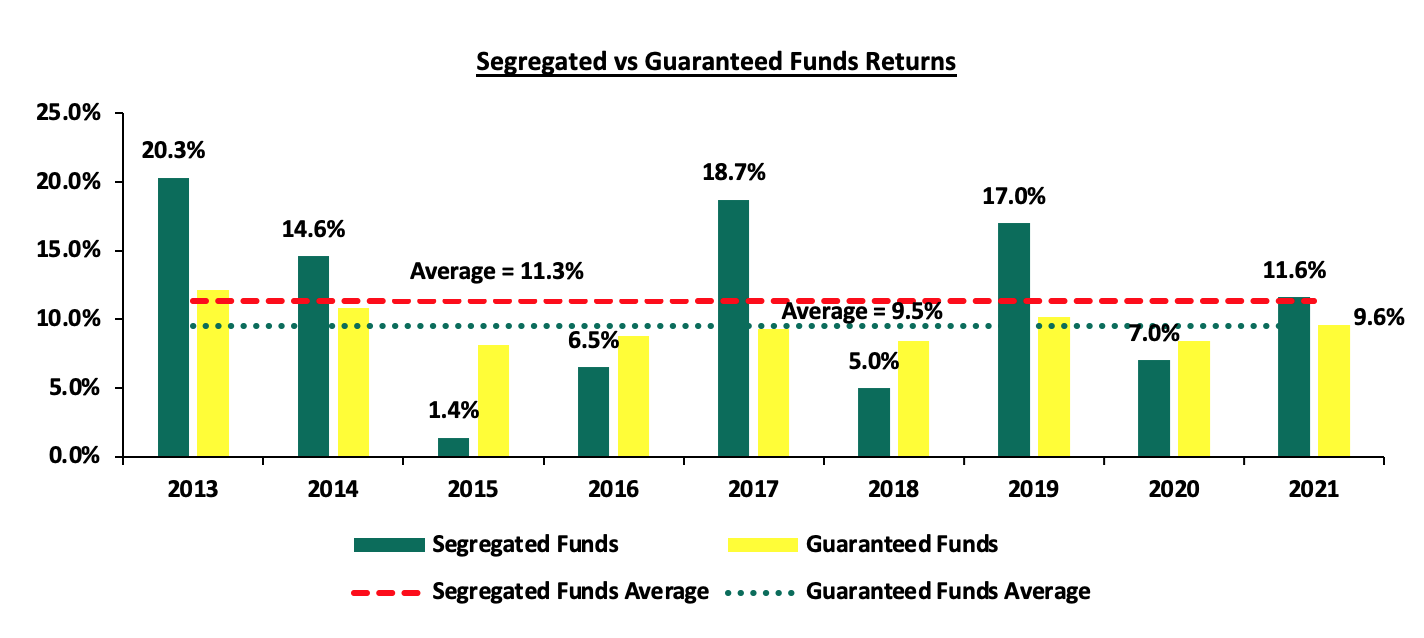

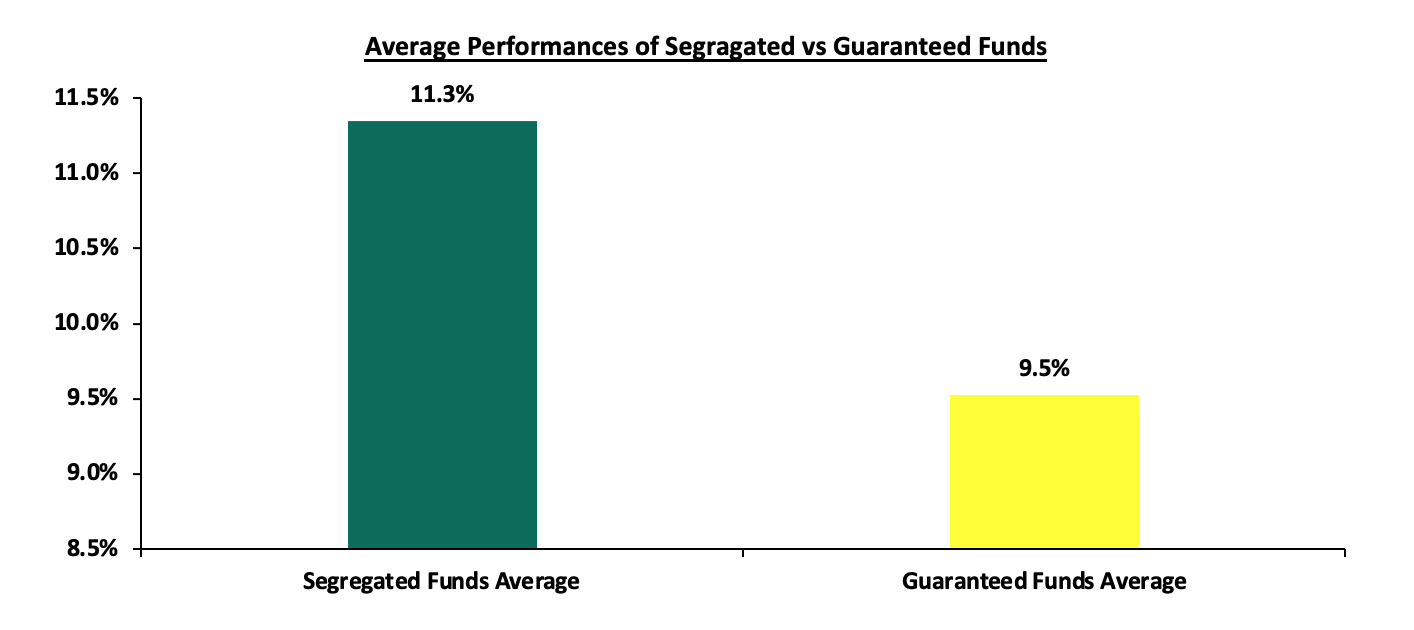

Overtime, segregated funds have continued to outperform the guaranteed funds save for 2020, when the equities market significantly weighed down the overall performance of segregated funds having declined by 23.9% due to the effects of the pandemic. The graph below highlights the performance of the Segregated Vs Guaranteed Schemes between 2013 and 2021:

Source: ACTSERV Surveys, Cytonn Research

The average performance for the segregated funds during the period under review is 11.3%, 1.8% points higher than the 9.5% average return for the Guaranteed Funds. However, the performance of Segregated schemes has fluctuated over the years and was highest in 2013 at 20.3%.

The graph below shows the average performance of segregated funds vs guaranteed funds between 2013 to 2021:

Source: ACTSERV Surveys, Cytonn Research

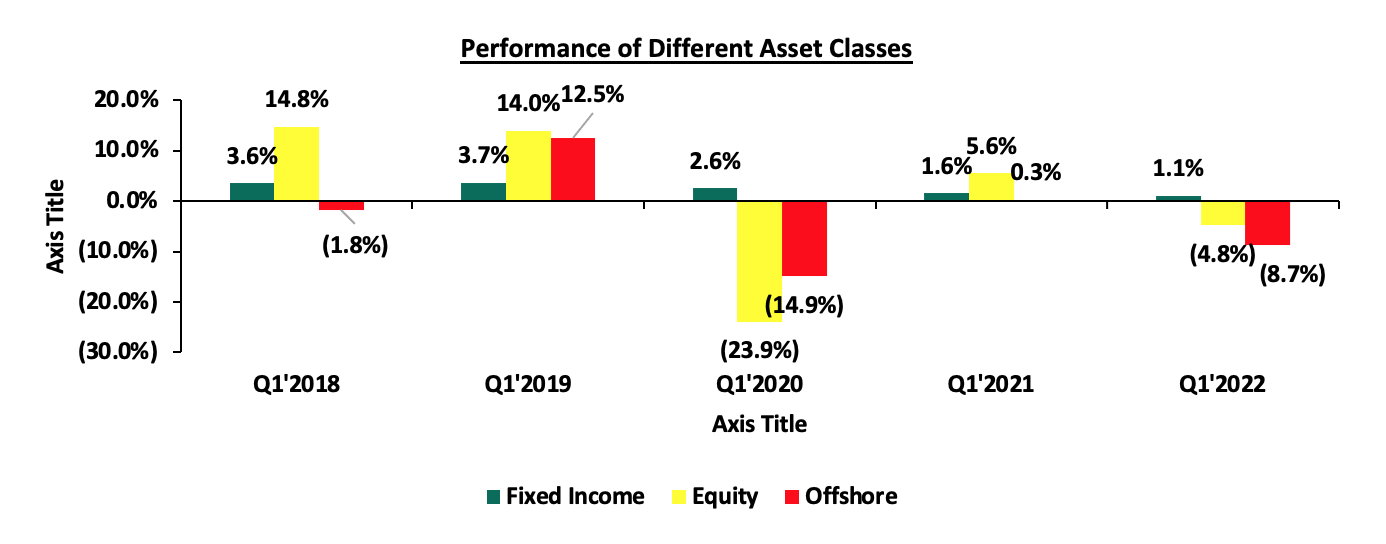

Further, we look into the various asset classes quarter one performance classified into broad categories of fixed income, Equity and Offshore. Below is a graph showing their performances over the last five years:

Source: ACTSERV Surveys

Key take-outs from the graph above include;

- Equity investments recorded a 4.8% decline in Q1’2022, from a 5.6% increase recorded in Q1’2021 attributable to increased investor selloffs stemming from the heightened uncertainties regarding global political events and the upcoming general elections,

- Fixed income performance recorded a 1.1% gain in Q1’2022, 0.5% points decline from the 1.6% recorded in Q1’2021 attributable to the increasing yields in government securities as a result of the tighter liquidity in the interbank market, weakening of the Kenyan Shilling and rising inflation,

- In Q1’2022, offshore investments recorded an 8.7% compared to the 0.3% increase recorded in Q1’2021 as a result of high risks emanating from the rising global inflation and global tensions. Offshore investments performed poorly against the other asset classes between Q1’2018-Q1’2022 at an average decline of 2.5% compared to average gains of 2.5% and 1.1% for fixed income and equities, respectively.

Retirement Benefits Schemes Investments Allocations

The performance of the various pension schemes in Kenya has been pegged on a number of factors such as; Asset allocation, selecting the best performing security within a particular asset class, size of the scheme, risk appetite and the investment horizon. The Retirement Benefits (Forms and Fees) Regulations, 2000 offers investment guidelines for retirement benefit schemes in Kenya in terms of the asset classes to invest in and the limits of exposure to ensure good returns and that members’ funds are hedged against losses. Some of the asset classes where the schemes can invest in are; government securities, fixed deposits, quoted equities, and immovable properties. Key to note, pension schemes can formulate their own Investment Policy Statements (IPS) to guide on how much to invest in the asset option and assist the trustees in monitoring and evaluating the performance of the Fund. Additionally, Investments Policy Statements often vary depending on risk return profile and expectations mainly determined by factors such as scheme’s demography and the economic outlook. The table below represents how the retirement benefits schemes have invested their funds in the past:

|

Kenyan Pension Funds Assets Allocation |

|||||||||||

|

Asset Class |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

Average |

Limit |

|

Government Securities |

33.8% |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.7% |

45.7% |

37.9% |

90.0% |

|

Quoted Equities |

25.5% |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

15.6% |

16.5% |

19.8% |

70.0% |

|

Immovable Property |

17.2% |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.0% |

16.5% |

18.4% |

30.0% |

|

Guaranteed Funds |

10.3% |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.5% |

16.8% |

13.8% |

100.0% |

|

Listed Corporate Bonds |

4.4% |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.4% |

0.4% |

3.4% |

20.0% |

|

Fixed Deposits |

4.9% |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

2.8% |

1.8% |

3.7% |

30.0% |

|

Offshore |

2.2% |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.8% |

1.3% |

1.2% |

15.0% |

|

Cash |

1.3% |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

0.9% |

0.6% |

1.1% |

5.0% |

|

Unquoted Equities |

0.6% |

0.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.2% |

0.3% |

5.0% |

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.1% |

10.0% |

|

REITs |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

30.0% |

|

Commercial Paper, non-listed bonds by private companies |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

|

Others e.g. unlisted commercial papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.0% |

10.0% |

|

|

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

|

Source: Retirement Benefits Authority

Key Take-outs from the table above are;

- Schemes in Kenya allocated an average of 57.7% of their members’ funds towards government securities and Quoted Equities between the period of 2013 and 2021. The 37.9% average allocation to government securities is the highest among the asset classes attributable to safety assurances of members’ funds because of low risk investments,

- The allocation towards quoted equities increased to 16.5% in 2021 from 15.6% in 2020 because of the recovery of the equities market after easing of the pandemic effects, and,

- Retirement Benefits Schemes investments in offshore markets increased by 0.5% points to 1.3% in 2021 from 0.8% in 2020 as a result of its impressive performance.

Key to note, retirement benefits schemes have skewed their investments towards traditional assets such as government securities and quoted equities for a long time. However, other asset classes such as alternative investments (Private Equity and Immovable Properties) are viable and attractive opportunities that have experienced low allocation averaging 18.6% between 2013-2021 against the limit of 70.0% attributable to lack of expertise and experience in the field. This is despite the fact that the asset class offers greater value in terms of returns and can hedge against volatility in the market. Investing in this asset class such as real estate would offer superior long term returns and hence growth in the funds.

Section 3: Factors Hindering the Growth of Retirement Benefits Schemes in Kenya

As aforementioned, the retirement benefits scheme industry in Kenya has significantly grown over the past 10 years with a CAGR of 14.4% to Kshs 1,547.4 bn in 2021 as a result of factors such as government’s legislations to support savings, creating retirement benefits schemes among the citizens by RBA and industry players, as well as improved management of schemes in Kenya among many other factors. However, a huge population of Kenyans are still not in any retirement saving plan mainly due to factors such as;

-

- Market volatility – For segregated schemes, the investment returns are usually uncertain attributable to market volatility that has worsened with the COVID-19 pandemic and the global tensions such as the Russian-Ukrainian war. As a result, many Kenyans are usually reluctant to contribute to retirement schemes for fear of losing their money. The high market volatility also presents a chance of beneficiaries funds depreciating in value,

- Possibility of accessing contributions before retirement – In many retirement benefit schemes, employees can access their savings before actually retiring because of losing a job or leaving a particular employer. However, such actions can always prove to be shortsighted since it significantly depletes the value of savings upon retirement and will reduce the growth of the sector,

- Reluctant attitude towards savings – Substantial number of Kenyans usually worry less concerning their retirements because of the belief on assistance by their children as they have invested in them,

- Belief that pensions is for the older generation – Majority of young people believe that they are too young to start saving for pensions and it is only the older people who should have retirement benefit schemes. Such attitude hinders young people from joining schemes at the onset of their employment and start saving while it is too late, and,

- Low income level from the slow economic growth – Many Kenyans are in informal employment or unemployed which is characterized by seasonal or fluctuating and low income. Such status makes it extremely difficult for them to commit to pension contributions towards their retirement.

Section 4: Key Consideration to Improving Retirement Prospects for Employers and Employees

Employers have a significant impact on employees' capacity to achieve a secure retirement. Their role encompasses the offering of retirement benefits, creating a welcoming environment for workers of all ages, fostering work-life balance, and adapting business practices to support transitions to retirement. Employers also provide valuable non-retirement benefits that can help their employees protect their health, income, and savings. As such, we shall discuss and give recommendations to both employers and employees on how to improve their retirement prospects and increase the likelihood of sufficient income during retirement years by investing in the appropriate scheme;

Recommendations for Employer:

- Offer a Retirement Plan or join an Umbrella Retirement Plan – Firms can offer retirement plans to their employees to encourage them to save for their retirement. However, if the employer has no occupational retirement scheme for the employees or does not have the capacity to start one, they can join an Umbrella Pension Schemes which reduces the average cost per member and provides an avenue to save for retirement,

- Increase efforts to reduce the number of withdrawals in the retirement plan- Employers should create awareness among employees about the ramifications of undertaking premature withdrawals from retirement accounts. Employees should understand and come up with ways of dealing with non-routine and emergency expenses, which will offer employees alternative ways as opposed to withdrawing the retirement benefits,

- Help pre-retirees plan their transition into retirement – Employers can help pre-retirees by educating them about retirement income strategies to efficiently manage savings and retirement plan distribution options,

- Allow part-time employees to join retirement schemes – Firms should encourage part-time employees to join retirement schemes by extending retirement plan eligibility to such groups, and the necessity of back-up plan if forced into early retirement,

- Expected returns – Employers should select providers whose return rate is high enough to ensure a sizeable growth for the retirement savings. The appropriate rate of return should always be higher than the inflation rate to ensure a positive real return by not losing value over time,

- Extra benefits – Employers should recommend to workers schemes that will offer extra benefits in terms of insurance covers and health care benefits. Such complimentary benefits would improve the quality of a retirement plan.

Recommendations for Employees:

- Creating a budget – Employees should have a budget to guide on how to spend on expenses and remain with income to save for retirement in a suitable scheme,

- Have a back-up plan – Employees should have backup plans in case of job loss or early retirement arising from accidents or ill-health,

- Affordability and flexibility – As an employee, it is essential to select a retirement plan that will not strain you in terms of contributions. Additionally, you should look into the flexibility of the plan in terms of changing the contribution amount and measures, if any, should you miss a contribution,

- Understand the various options available – It is prudent to understand how your money will be treated, its accessibility, and the mode of payment at the time of retirement to ensure that its features align with your objectives. Schemes have different provisions on whether you can use your savings to secure mortgage facilities or even buy a residential house, and,

- Select a manager you trust – Retirement benefits plan is a long term affair and the only way to feel secure about your contributions is by selecting a manager you trust. Key to note, a trustworthy manager should have good governance structures and management experience.

Even as we commend the Kenyan government for demystifying retirement benefits by making the services readily accessible, we believe that the current pensions system still leaves many pockets of the society uncovered or with insufficient funds for retirement. We note that more people continue to use banks as a savings channel, as evidenced by the increasing bank deposits at Kshs 4.4 tn compared to the Kshs 1.5 tn pensions assets under management as of Q1’2022. As such, the pensions uptake remains low in the country putting more people at risk of old age poverty. However, we expect the growth trend to continue in the coming years as the economy recovers and more people understand the importance of saving for retirement. The key challenge remains how fast the government comes up with ways to expand the pensions coverage in Kenya and how best to persuade the working population to save enough money for retirement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.