According to the Retirement Benefits Authority (RBA) Industry report for December 2023, assets under management for retirement benefits schemes increased by 9.4% to Kshs 1.7 tn in December 2023 from the Kshs 1.6 tn recorded in 2022. The growth of the assets can be attributed to the enhanced contributions to the mandatory scheme, NSSF, which began in earnest in February 2023 following the court of appeal ruling that set aside the initial ruling of the Employment and Labour Relations Court suspending implementation of the NSSF Act. The Act, which increased the contribution rates from Kshs 400 to 12.0% of an employee’s monthly earnings, with a 6% deduction from the employee and an equivalent 6% deduction from the employer, had been rendered unconstitutional by the lower court. Despite the continued growth, Kenya remains characterized by a low saving culture with research by the Federal Reserve Bank showing that only 14.2% of the adult population in the labor force save, including for their retirement in Retirement Benefits Schemes (RBSs), lower than Nigeria’s 26.3%, but higher than South Africa’s 13.6%. According to the World Bank, our gross savings to GDP stands at just 16.0%, indicating that more still needs to be done to boost the savings numbers. On a semi-annual basis, however, the assets grew by a paltry 1.3% to Kshs 1.73 tn in December from the Kshs 1.70 tn recorded in June 2023. This subdued growth of assets under management during the period is majorly attributed to negative movement in some asset classes such as quoted equities, listed corporate bonds, unquoted equities, and commercial papers. Quoted equities, for instance, recorded a 3.0% decline in Q4’2023.

Additionally, funds held by the National Social Security Fund increased by 4.3% to Kshs 308.3 bn in 2023 from the Kshs 295.7 bn held in 2022. Of these assets, NSSF managed Kshs 46.6 bn internally while Kshs 250.0 bn were managed externally by six fund managers.

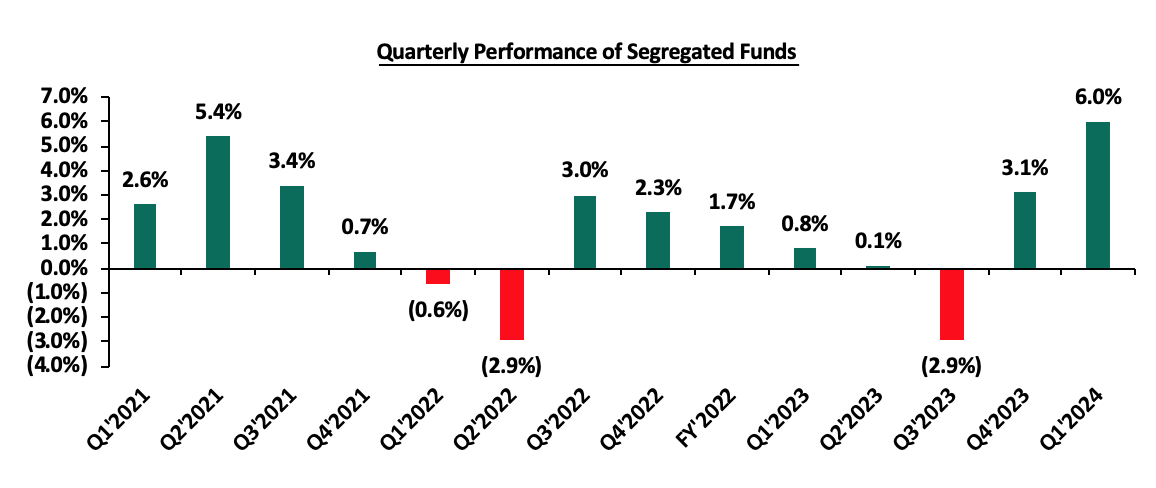

On a separate note, according to the ACTSERV Q1’2024 Retirement Benefits Schemes Investments Performance Survey, segregated retirement benefits schemes recorded a 6.0% return in Q1’2024, up from the 0.8% recorded in Q1’2023. The increase was largely supported by the performance of equities investments made by the schemes which recorded a significant 25.6% gain, a reversal from the 7.2% decline recorded in 2022, on the back of positive investor sentiment following the successful Eurobond buyback, easing inflation and the shilling appreciation which gradually slowed down investor flight from the market.

Notably, The recently introduced Finance Bill of 2024 introduced a raft of changes to the retirement landscape in Kenya. With the bill currently in the public participation stage, here are some of the proposed changes in the pensions sector:

- Registration of Retirement Funds – Currently, individual retirement Funds and Pension Funds need to be registered with the Commissioner for the enjoyment of tax deductions of up to Kshs 20,000 monthly per individual. The bill proposes that this requirement of registration with the Commissioner be eliminated, and bring this under the purview of the Retirement Benefits Authority (RBA),

- Tax exemptions on withdrawals – The current law grants tax exemptions for withdrawal of pensions for individuals who are sixty-five years old or more. With the proposed change, Pension benefits from registered pension funds, provident funds, individual retirement funds, or National Social Security Fund are now exempted from income tax upon reaching retirement age. This exemption also applies if a person retires early due to ill health or withdraws from the fund after twenty years of membership. This expansion of the exemption to include early retirement seeks to cover for unfortunate occurrences that were earlier not provided for in law,

- Pension withdrawal period – Currently, the law provides for reduced tax rates if payments are made 15 years from the start of contributions into a registered retirement benefits scheme or upon retirement. The bill proposes an extension of this period from the current 15 years to 20 years. This is aimed at encouraging individuals to keep money saved for retirement invested longer, and reduce dependency on government upon retirement, and,

- Gratuity Paid to Pension funds – as it stands, the law currently exempts tax on amounts paid to pension funds for up to Kshs 20,000 monthly per individual. This finance bill proposes that the amount be increased to Kshs 30,000. This will offer further relief for individuals contributing to the pension schemes, although it is worth noting that this will majorly benefit high-income earners able to contribute up to Kshs 30,000 monthly to their retirement.

We have been tracking the performance of Kenya’s Pension schemes with the most recent topicals being, Kenya Retirement Benefits Schemes Q4’2023 Performance, Progress of Kenya’s Pension Schemes-2022 done on August 2022 and Kenya Retirement Benefits Schemes FY’2021 Performance done on March 2022. This week, we shall focus on understanding Retirement Benefits Schemes and look into the historical and current state of retirement benefits schemes in Kenya with a key focus on 2023 and what can be done going forward. We shall also analyze other asset classes such as REITs that the schemes can tap into to achieve higher returns. Additionally, we shall look into factors and challenges influencing the growth of the RBSs in Kenya as well as the actionable steps that can be taken to improve the pension industry. We shall do this by looking into the following:

- Introduction to Retirement Benefits Schemes in Kenya,

- Historical and Current State of Retirement Benefits Schemes in Kenya,

- Factors Influencing the Growth of Retirement Benefits Scheme in Kenya

- Challenges that Have Hindered the Growth of Retirement Benefit Schemes, and,

- Recommendations on Enhancing the Performance of Retirement Benefits Schemes in Kenya;

Section I: Introduction to Retirement Benefits Schemes in Kenya

A retirement benefits scheme refers to a savings platform allowing individuals to make regular contributions during their working years where the contributed funds are invested in order to generate returns. The various schemes allow members to make regular contributions during their working years and once a member retires either after attaining the retirement age or earlier due to other factors, mainly ill-health, these contributions plus accrued interest are utilized to provide retirement income to the member. Further, a retirement plan is essential in cushioning retirees from reduced income and ensures decent living after retirement thus reducing old-age dependency. According to the Retirement Benefits Authority (RBA), retirement schemes in Kenya are categorized based on contributions, mode of payment at retirement, membership, and mode of investment. The categories are explained as follows:

- Based on Contributions:

- Defined Benefits Schemes – Defined benefit plans are funded either exclusively by employer contributions or sometimes require employee contributions. The cost of the promises being earned each year is calculated in advance, to advise on the required amount that needs to be contributed each year to keep the scheme healthy, and,

- Defined Contribution Scheme – Here, member’s and employer’s contributions are fixed either as a percentage of pensionable earnings or as a shilling amount. However, members have the freedom to contribute more than the defined rate (Additional Voluntary Contribution). The scheme’s benefits are usually not known and the level of retirement income will depend on the level of contributions made over the period, fees by the service provider, investment returns, and the cost of buying benefits.

- Based on Mode of Payment at Retirement:

- Pension Scheme – At retirement, a member of a pension scheme may access up to a third of their contributions and contributions made on their behalf plus accrued interest as a lump sum, and then the remainder is used to purchase an annuity (pension) that pays a periodic income to the pensioner in their retirement years, usually monthly, and,

- Provident Fund – The scheme offers members payments of lump sums and other accrued benefits to employees upon retirement or to their dependents upon death.

- Type of Membership:

- Occupational Retirement Benefits Scheme - These are schemes that are set up by an employer where only members of their staff are eligible to join. The employees contribute to the scheme and automatically leave once their contract with the employer is over,

- Umbrella Retirement Benefits Scheme – Here, the retirement scheme pools the retirement contributions of multiple employers on behalf of their employees. It is a cost-effective scheme reducing the average cost per member and enhancing the overall returns of both the employer and the employees’ contributions, and,

- Individual Retirement Benefits Scheme – These are schemes run by independent financial institutions and individuals contribute directly towards saving for their retirement. The contributions are flexible to accommodate individuals with varying financial capabilities.

- Mode of Investment:

- Segregated Funds – Refers to schemes where contributions by members are invested directly by the Trustees through an appointed Fund Manager. Notably, the Trustees establish an appropriate Investment Policy which is then implemented by the Fund Manager. The scheme directly holds the investments and the returns are fully accrued to the scheme to earn interest for the members, and,

- Guaranteed Funds - These are funds offered by insurance companies where the members’ contributions are pooled together and the insurance company guarantees a minimum rate of return. However, should the actual return surpass the minimum guaranteed rate, the insurance company may either top up the minimum rate with a bonus rate of return or reserve the extra return.

One of the biggest reasons people should save for retirement is so that they can be able to afford the lifestyle they lead in their working days. Below are some of the reasons why an individual should join an appropriate Retirement Benefits Scheme:

- Compounded and Tax-free Interest – Savings in retirement benefits schemes earn compounded interest. This means that your money grows faster as even the interest earned is reinvested and grows. Additionally, the investment income of retirement schemes is tax-exempt meaning that the schemes have more to reinvest,

- Tax-exemptions on Contributions – Members of retirement benefits schemes enjoy monthly tax relief on their contributions of up to Kshs 20,000.0 per month, Kshs 240,000 per annum or 30.0% of their monthly salary, whichever is less. The proposed amendments,

- to the Finance Bill 2024 will revise the amount upwards to Kshs 30,000 per month. As such, this lessens the total income tax deducted from one’s earnings and ensures more capital preservation,

- Use of Pensions Benefit as Mortgage Security – When applying for a mortgage, one can use his savings in the various schemes as security. This is essential as it will enable individuals to own homes without the need to look for security,

- Financial Independence upon Retirement – Old age poverty and dependency is currently a scourge where most parents depend on their children and relatives for survival. According to the World Bank, Kenya’s age dependency ratio stands at 69.0%, indicating that the working population has to support most of the non-working population who are individuals below the age of 15 and people above 64 years. However, having a concrete retirement plan ensures that an individual remains financially independent upon retirement and avoids being a burden to relatives and other family members ensuring a dignified life,

- Ascertaining Income Security – Saving in a Retirement benefits schemes allow individuals to be financially secure by accessing funds in case of job loss, retirement, or contract termination as a result of ill-health. Savings will ascertain a continued income stream even if you stop working hence protecting you from being dependent and enabling you to live comfortably, and,

- Earn Returns – Saving for retirement through the Schemes give you an opportunity to be part of an investment portfolio that is structured to optimize investment returns and offer the members above-market average returns. A fund manager and a team of qualified personnel conduct the market research and make investment decisions so you don’t have to worry about it.

Section II: Historical and the Current State of Retirement Benefits Schemes in Kenya

- Growth of Retirement Benefits Schemes

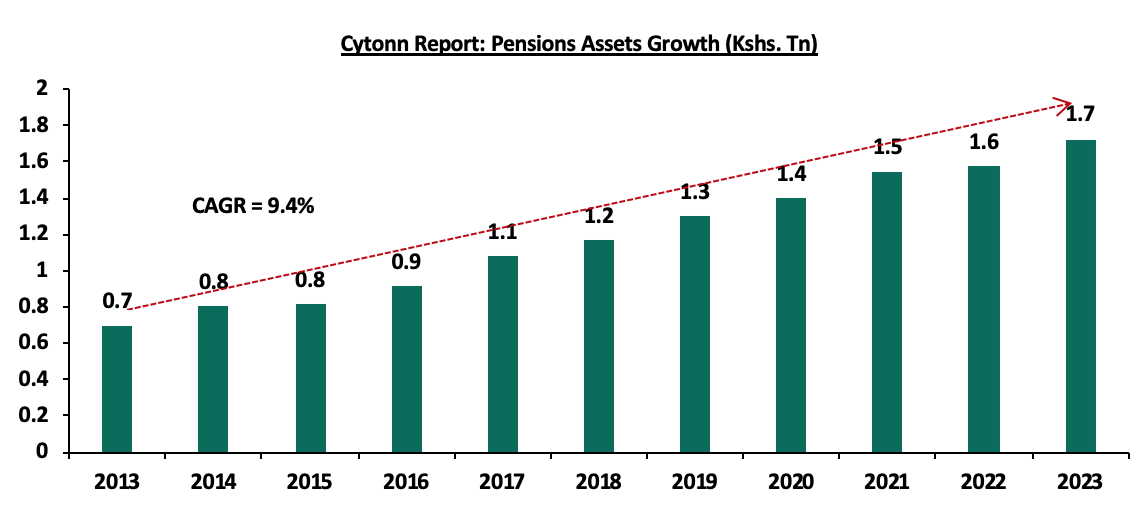

According to the Retirement Benefits Authority (RBA) Industry report for December 2023, assets under management for retirement benefits schemes increased by 9.4% to Kshs 1.7 tn in December 2023 from the Kshs 1.6 tn recorded in 2022. The growth of the assets can be attributed to the enhanced contributions to the mandatory scheme, NSSF, which began in earnest in February 2023 following the court of appeal ruling. The growth of the assets can be attributed to the enhanced contributions to the mandatory scheme, NSSF, which began in earnest in February 2023 following the court of appeal ruling which has now since gone to the supreme court and been reverted back to the lower courts, awaiting determination.

The graph below shows the growth of Assets under Management of the retirement benefits schemes over the last 10 years:

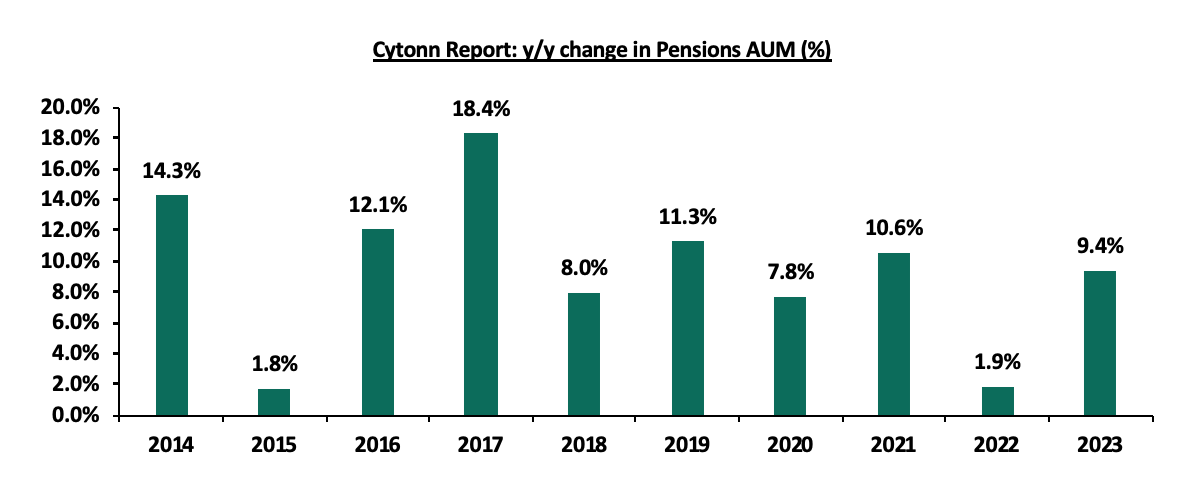

The 9.4% increase in Assets Under Management is a 7.5% increase in growth from the 1.9% growth that was recorded in 2022, demonstrating the significant role that the enhanced NSSF contributions made to the recovery of the industry’s performance following a difficult period in 2022.

The chart below shows the y/y changes in the assets under management for the schemes over the years.

On a bi-annual basis, however, the assets grew by a paltry 1.3% to Kshs 1.73 tn in December from the Kshs 1.70 tn recorded in June 2023. This subdued growth of assets under management during the period is majorly attributed to negative movement in some asset classes such as quoted equities, listed corporate bonds, unquoted equities, and commercial papers. Quoted equities, for instance, recorded a 3.0% decline in Q4’2023. Despite the continued growth, Kenya is characterized by a low saving culture with research by the Federal Reserve Bank only 14.2% of the adult population in the labor force save for their retirement in Retirement Benefits Schemes (RBSs).

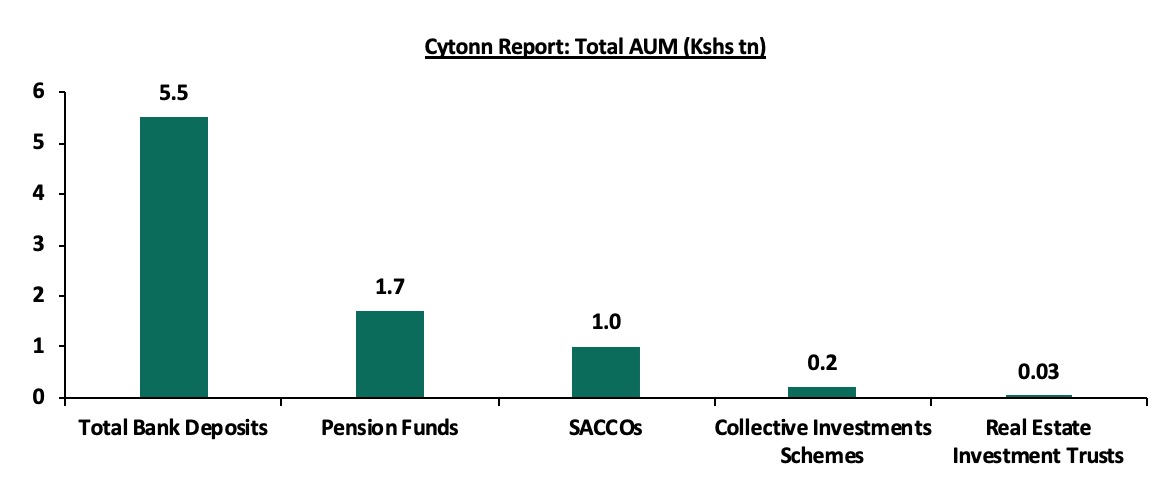

The graph below shows the Assets under Management of Pensions against other Capital Markets products and bank deposits:

Sources: CMA, RBA, SASRA and REIT Financial Statements

- Retirement Benefits Schemes Allocations and Various Investment Opportunities

Retirement Benefits Schemes allocate funds to various available assets in the markets aimed at the preservation of the members’ contributions as well as earning attractive returns. There are various investment opportunities that Retirement Benefits Schemes can invest in such as the traditional asset classes including equities and fixed income as well as alternative investment options such as Real Estate. As such, the performance of Retirement Benefits Schemes in Kenya depends on a number of factors such as;

- Asset allocation,

- Selection of the best-performing security within a particular asset class,

- Size of the scheme,

- Risk appetite of members and investors, and,

- Investment horizon.

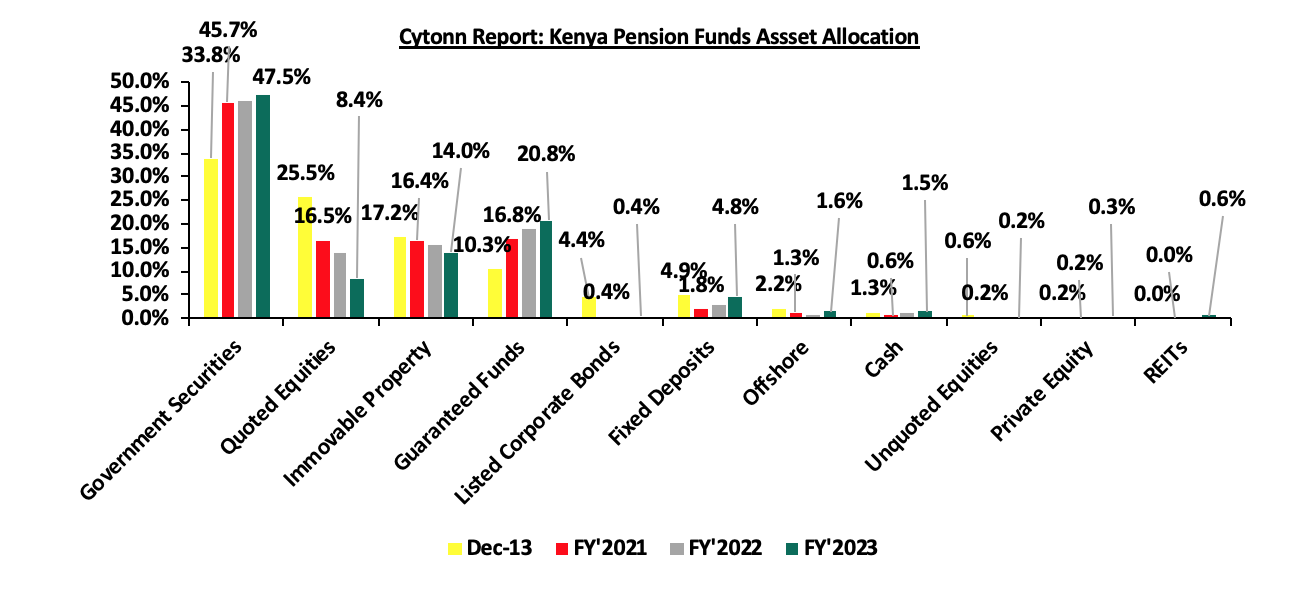

The Retirement Benefits (Forms and Fees) Regulations, 2000 offers investment guidelines for retirement benefit schemes in Kenya in terms of the asset classes to invest in and the limits of exposure to ensure good returns and that members’ funds are hedged against losses. According to RBA’s Regulations, the various schemes through their Trustees can formulate their own Investment Policy Statements (IPS) to Act as a guideline on how much to invest in the asset option and assist the trustees in monitoring and evaluating the performance of the Fund. However, IPSs often vary depending on risk-return profile and expectations mainly determined by factors such as the scheme’s demography and the economic outlook. The table below represents how the retirement benefits schemes have invested their funds in the past:

|

Cytonn Report: Kenyan Pension Funds’ Assets Allocation |

||||||||||||||

|

Asset Class |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Average |

Limit |

||

|

Government Securities |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.7% |

45.7% |

45.8% |

47.5% |

40.5% |

90.0% |

||

|

Quoted Equities |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

15.6% |

16.5% |

13.7% |

8.4% |

17.5% |

70.0% |

||

|

Immovable Property |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.0% |

16.5% |

15.8% |

14.0% |

17.4% |

30.0% |

||

|

Guaranteed Funds |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.5% |

16.8% |

18.9% |

20.8% |

15.4% |

100.0% |

||

|

Listed Corporate Bonds |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.4% |

0.4% |

0.5% |

0.4% |

2.7% |

20.0% |

||

|

Fixed Deposits |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

2.8% |

1.8% |

2.7% |

4.8% |

3.4% |

30.0% |

||

|

Offshore |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.8% |

1.3% |

0.9% |

1.6% |

1.2% |

15.0% |

||

|

Cash |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

0.9% |

0.6% |

1.1% |

1.5% |

1.2% |

5.0% |

||

|

Unquoted Equities |

0.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.2% |

0.3% |

0.2% |

0.4% |

5.0% |

||

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.2% |

0.3% |

0.1% |

10.0% |

||

|

REITs |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

0.6% |

0.1% |

30.0% |

||

|

Commercial Paper, non-listed bonds by private companies |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0% |

||

|

Others e.g. unlisted commercial papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.2% |

- |

0.0% |

10.0% |

||

|

Total |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

||

Source: Retirement Benefits Authority

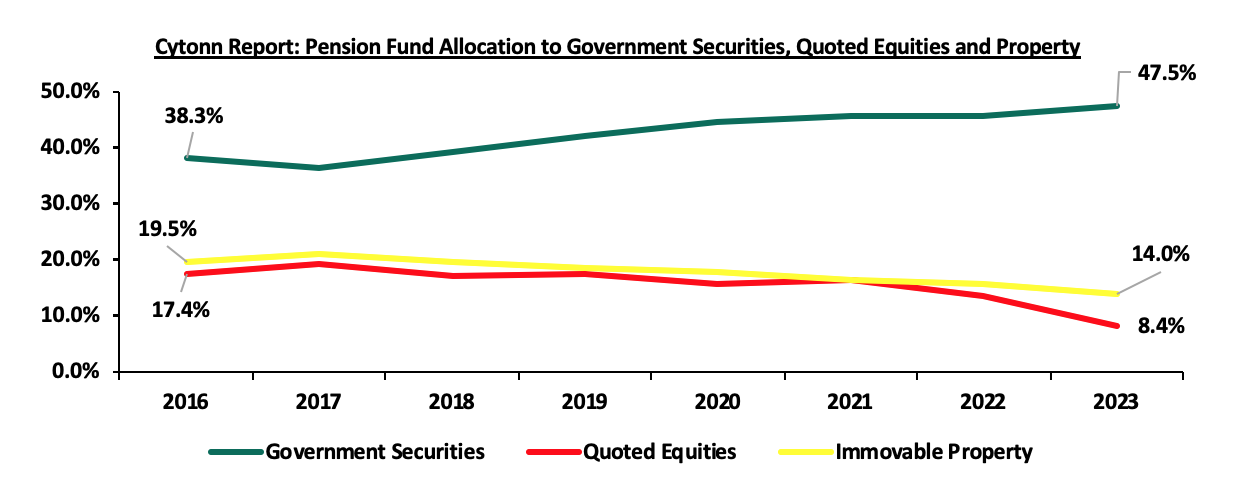

Key Take-outs from the table above are;

- Schemes in Kenya allocated an average of 58.0% of their members’ funds towards government securities and Quoted Equities between the period of 2013 and 2023. The 40.5% average allocation to government securities is the highest among the asset classes attributable to safety assurances of members’ funds because of low-risk investments and the elevated yields in the country in 2023,

- The allocation towards quoted equities declined to 8.4% as of December 2023, from 13.7% in 2022 on the back of increased capital flight as foreign investors sold off their investments in the Kenyan equities market due to macroeconomic uncertainties in the country as well a series of interest rate hikes in the developed economies, and,

- Retirement Benefits Schemes investments in offshore markets increased by 0.7% points to 1.6% as of December 2023, from 0.9% in 2022 as a result of the weakening Kenyan currency which made offshore investments attractive to preserve the value of investments and take advantage of exchange rate gains.

The chart below shows the allocation by pension schemes on the three major asset classes over the years:

Source: RBA Industry report

Performance of the Retirement Benefit Schemes

According to the ACTSERV Q4’2023 Pension Schemes Investments Performance Survey, the ten-year average return for segregated schemes over the period 2015 to 2024 was 10.0% with the performance fluctuating over the years to a high of 18.7% in 2017 and a low of 1.4% in 2015 reflective of the markets performance. Notably, segregated retirement benefits scheme returns increased by 6.0% return in Q1’2024, up from the 0.8% recorded in Q1’2023.

The chart below shows the quarterly performance of segregated pension schemes since 2021:

Source: ACTSERV Survey Reports (Segregated Schemes)

The key take-outs from the graph include:

- Schemes recorded a 6.0% gain in Q1’2024, representing a 2.9% increase from the 3.1% gain recorded in Q4’2023. The performance was largely driven by a 25.6% gain in Equities investments in comparison to the 3.0% decline recorded in Q4’2023, largely attributable to positive investor sentiment following the successful Eurobond buyback, easing inflation and the shilling appreciation which gradually slowed down investor flight from the market. This was despite the 1.1% decrease in fixed income returns to 2.9% from 2.9 recorded in Q4’2023. The performance was, however, weighed down by the 9.2% decline in offshore investments, and,

- Overall returns for Q4’2023 increased by 5.2% points to 6.0%, from 0.8% in Q1’2023 largely due to a 25.6% gain in Equities investments in comparison to the 7.2% decline recorded in Q1’2023.

The survey covered the performance of asset classes in three broad categories: Fixed Income, Equity, Offshore, and Overall Return.

Below is a graph showing the first quarter performances over the period 2020-2024:

|

Cytonn Report: Quarterly Performance of Asset Classes (2020 – 2024) |

||||||

|

|

Q1'2020 |

Q1'2021 |

Q1'2022 |

Q1'2023 |

Q1'2024 |

Average |

|

Fixed Income |

2.6% |

1.6% |

1.1% |

2.6% |

2.9% |

2.2% |

|

Equity |

(23.9%) |

5.6% |

(4.8%) |

(7.2%) |

25.6% |

(0.9%) |

|

Offshore |

(14.9%) |

0.3% |

(8.7%) |

16.0% |

(9.2%) |

(3.3%) |

|

Overall Return |

(4.4%) |

2.6% |

(0.6%) |

0.8% |

6.0% |

0.9% |

Source: ACTSERV Surveys

Key take-outs from the table above include;

- Returns from Equity investments recorded a significant increase by 32.8% points to a 25.6% gain in Q1’2024, from the 7.2% decline recorded in Q1’2023. The performance was partly attributable to positive investor sentiment following the successful Eurobond buyback, easing inflation and the shilling appreciation which gradually slowed down investor flight from the market. The performance of the equities markets was further evidenced in the Kenyan equities market which was on an upward trajectory, with NSE 10 gaining the most by 27.3%, while NSE 25, NASI, and NSE 20 gained by 25.0%, 22.8%, and 16.7% respectively. Notably, the allocation towards the asset class had declined to 8.4% in 2023, from 17.3% in 2019 as a result of the sustained poor performance and uncertainty in the bourse, which is now on a recovery path,

- Returns from Fixed Income recorded an increase of 0.3% points to 2.9% in Q1’2024 from the 2.6% recorded in Q1’2023. This performance in Q4’2023 is partially attributable to increased yields as a result of elevated inflationary pressures and aggressive government borrowing. The Central Bank, during the quarter, increased the base lending rate by 0.5% points to 13.0%, which caused a ripple effect on the interest rates. The yields on all the treasury bills, for instance, were on an upward trajectory with the average yields on the 364-day, 182-day, and 91-day papers increasing by 119.4 bps, 118.3 bps, and 114.0 bps to 16.7%, 16.6%, and 16.4%, from 15.5%, 15.4% and 15.3%, respectively, recorded in Q4’2023. Fixed income has continued to offer stable returns with little volatility over the years, recording the highest return in Q4’2023, and,

- Returns from the Offshore investments recorded a sharp decline of 25.2% in Q1’2024, to a 9.2% decline from the 16.0% return recorded in Q1’2023. The performance was partly attributable to sustained high interest rates as policymakers prioritize inflation control, pushing back anticipated rate cuts to the second half of the year, appreciation of the currency, and rising geopolitical tensions, with the instability in Ukraine and Israel. In Q1’2024, the Kenya Shilling gained against the US Dollar by 16.0%, to close at Kshs 131.8, from Kshs 157.0 recorded at the start of the quarter. This appreciation led to a decrease in returns on offshore investments denominated in foreign currencies.

Other Asset Classes that Retirement Benefit Schemes Can Leverage on

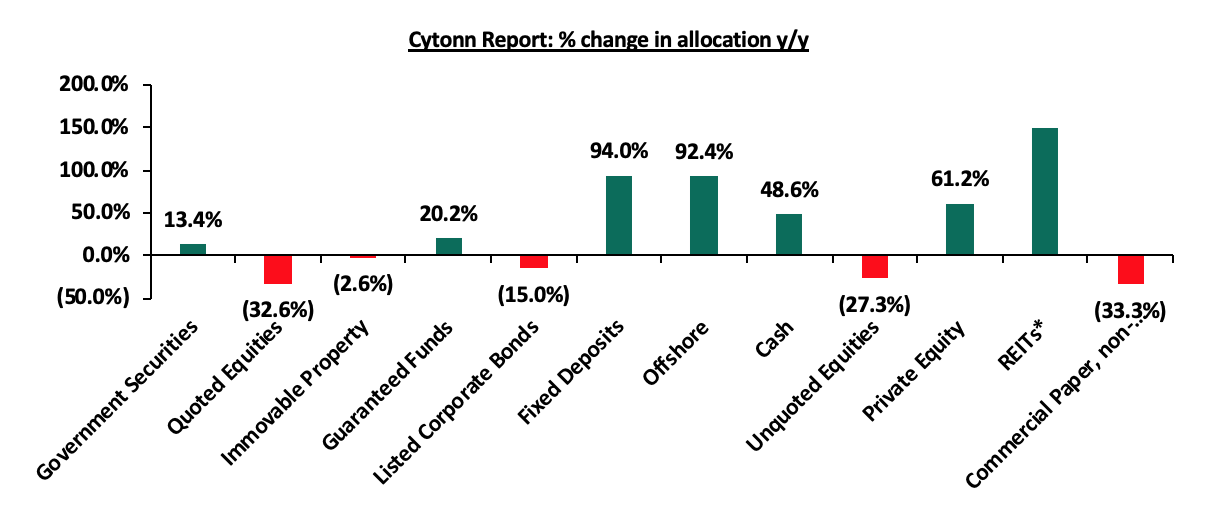

Retirement benefits schemes have for a long time skewed their investments towards traditional assets, mostly, government securities and the equities market, averaging 58.0% as of 2023, leaving only 42.0% for the other asset classes. In the asset allocation, alternative investments that include immovable property, private equity as well as Real Estate Investments Trusts (REITs) account for an average of only 15.4% against the total allowable limit of 70.0%. This is despite the fact that these asset classes such as REITs offer benefits such as low-cost exposure to Real Estate and tax incentives hence the potential for better returns. It is vital to note, however, that FY’2023 recorded one of the most significant increase in investments in Real Estate Investment Trusts by 3,871.4% to 11.1 bn from 0.3 bn recorded in FY’2022. This is partly attributable to the unveiling of the Local Authorities Pension Trust (LAPTRUST) during the year, as the first pension-driven REIT listed in the Nairobi Securities Exchange (NSE). Additionally, allocation to Private Equity increased by 61.2% to Kshs 5.7 bn from Kshs 3.6 bn in FY’2023.

The graph below shows the y/y change in allocation to the various asset classes;

Source: RBA Industry Report

However, in terms of overall asset allocation, alternative investments still lagged way behind the other asset classes, as has been the norm over the years as demonstrated in the graph below;

Source: RBA Industry report

We believe Alternative Investments including REITs would play a big role in improving the performance of retirement benefits schemes;

- Alternative Investments (Immovable Property, Private Equity and REITs)

Refers to investments that are supplemental strategies to traditional long-only positions in equities, bonds, and cash. They differ from traditional investments on the basis of complexity, liquidity, and regulations and can invest in immovable property, private equity, and Real Estate Investment Trusts (REITs) to a limit of 70.0% exposure. The schemes’ allocation to alternative investments has averaged only 6.1% in the period 2014 to 2023, with the allocation to immovable property at an average of 17.8% during the period. The low allocation is partly attributable to bureaucracies and insufficient expertise and experience with these asset classes as investing in them requires adequate research and expertise.

According to RBA regulations, schemes can invest up to 70.0% of their assets in private equity, immovable property, and REITs. However, the allocation between 2013 and 2021 has averaged 13.9%, with Q1’2024 allocation coming in at 15.4%.

Additionally, asset classes such as listed REITs have experienced numerous challenges and performed poorly over time. It is vital to note, however, that FY’2023 recorded one of the most significant increase in investments in Real Estate Investment Trusts by 3,871.4% to 11.1 bn from 0.3 bn recorded in FY’2022. This follows the unveiling of the Local Authorities Pension Trust (LAPTRUST) during the year, as the first pension-driven REIT listed in the Nairobi Securities Exchange (NSE). Despite the growth in allocation, Kshs 11.0 bn is still a drop in the ocean compared to the assets under management. We believe that there is value in the alternative markets that schemes can take advantage of. Some of the key advantages of alternatives investments include:

- Diversification: Investing in a variety of asset classes such as REITs, fixed income securities and equities helps to reduce risk when incorporated into a single investment, as it spreads the investments across diverse locations, sectors, platforms, and classes. REIT institutions typically own physical assets such as land and buildings, and frequently enter into lengthy leases with their tenants. This makes REITs some of the most dependable investments on the market. This diversification creates the opportunity for a blended portfolio to earn higher returns while reducing the potential for negative or low returns, and,

- Competitive Long-Term Returns: REITs provide robust and long-term yields. This makes them an ideal component of a successful and efficient portfolio.

Section III: Factors Influencing the Growth of Retirement Benefit Schemes

The retirement benefit scheme industry in Kenya has registered significant growth in the past 10 years with assets under management growing at a CAGR of 9.4% to Kshs 1.7 tn in FY’2023, from Kshs 0.7 tn in 2013. The growth is attributable to:

- Increased Pension Awareness – More people are becoming increasingly aware of the importance of pension schemes and as such, they are joining schemes to grow their retirement pot which they will use during their golden years. Over the last 20 years, pension coverage has grown from 12.0% to about 25.0% of the labour force. This growth reflects industry-wide initiatives to increase awareness among Kenyan citizens on the need for retirement planning and innovations,

- Legislation – As earlier discussed, the Finance Bill 2024, is the latest proposed piece of legislation that will affect the pension industry. It adds to the Retirement Benefits (Good Governance Practices) Guidelines, 2018 and Retirement Benefits (Treating Customers Fairly) Guidelines, 2019 which aim to ensure that pension schemes are well anchored on practices that ensure effective and efficient service delivery of the pension schemes. This has raised standards in the way retirement schemes conduct their day-to-day businesses and increased confidence in the pension industry. Additionally, the implementation of the National Social Security Fund Act, 2013 is entering its second year and is expected to foster the growth of the pension industry by allowing both the employees in the formal and informal sector to save towards their retirement, as opposed to the previous NSSF Act cap 258 of 1965, which was only targeting the employees in the formal sector,

- Public-Private partnerships - Public-private partnerships can be instrumental in expanding financial inclusion in the Kenyan pension sector. Collaborations between the government and private financial institutions can lead to the development and promotion of inclusive pension products. In Kenya, the National Social Security Fund (NSSF) is currently licensing and partnering with the private sector (Pension Fund Managers) to invest and manage NSSF Tier II contributions. This is a good example that the government is giving employees, employers, and persons in the informal sector to invest and save for their retirement in the private sector,

- Tax Incentives - Members of Retirement Benefit Schemes are entitled to a maximum tax-free contribution of Kshs 20,000 monthly or 30.0% of their monthly salary, whichever is less. Consequently, pension scheme members enjoy a reduction in their taxable income and pay less taxes. This incentive has motivated more people to not only register but also increase their regular contributions to pension schemes,

- Micro-pension schemes - Micro-pension schemes are tailored to address the needs of Kenyans in the informal sector with irregular earnings. These schemes allow people to make small, flexible contributions towards their retirement. By accommodating their financial realities, micro-pensions can attract a broader segment of the population into the pension sector. Examples of these pension schemes are Mbao Pension Plan and Individual Pension Schemese. Britam Individual Pension Plan where one can start saving voluntarily and any amount towards their retirement.

- Relevant Product Development – Pension schemes are not only targeting people in formal employment but also those in informal employment through individual pension schemes, with the main aim of improving pension coverage in Kenya. To achieve this, most Individual schemes have come up with flexible plans that fit various individuals in terms of affordability and convenience. Additionally, the National Social Security Fund Act, 2013 contains a provision for self-employed members to register as members of the fund, with the minimum aggregate contribution in a year being Kshs 4,800 with the flexibility of making the contribution by paying directly to their designated offices or through mobile money or any other electronics transfers specified by the board,

- Demographics - Kenya’s rising population has played a big role in supporting the pensions industry in Kenya. The young population aged 15-24, currently at a population of 10.4 mn approximately 19.6% of the total population, has grown rapidly with the United Nations projecting that the corresponding population of youth in Kenya aged 15-24 years and ready to join the workforce will increase to 18.0 mn, from 9.5 mn over the period 2015 to 2065. This will support the continuous increase in people joining the workforce and saving for retirement. Which will consequently increase scheme membership significantly,

- Technological Advancement – The adoption of technology into pension schemes has improved the efficiency and management of pension schemes. Additionally, the improvement of mobile penetration rate and internet connectivity has enabled members to make contributions and track their benefits from the convenience of their mobile phones, and,

- Financial literacy programs - Financial literacy programs play a vital role in promoting the growth of retirement benefit schemes by enhancing financial inclusion among the public. Educating the public about the benefits of retirement savings and how to navigate pension schemes can empower individuals to take control of their financial future. The Retirement Benefits Authority (RBA) is at the forefront of ensuring the public is educated on financial literacy by organizing free training.

Section IV: Challenges that Have Hindered the Growth of Retirement Benefit Schemes

Despite the growth of the Retirement Benefit industry, the industry still faces a number of challenges that impede its growth. Some of the factors that hinder growth include:

- Market Volatility – For segregated schemes, the investment returns are not guaranteed and vary depending on the market volatility. In 2023, market volatility was witnessed in the in the equities investments which recorded a decline of 3.0% in Q4’2023, and a subsequent 25.6% return in Q1’2024,

- High Unemployment Rate – According to the Kenya National Bureau of Statistics Q4’2022 labour report, 6% of Kenya’s 29.1 mn working-age population aged between 15-64 years was unemployed. Such a status makes it extremely difficult for them to commit to pension contributions towards their retirement,

- Access of Savings before Retirement - In retirement benefit schemes, members of Individual pension schemes can be able to access 100.0% of their contributions, provided that those contributions do not consist of the contributions made by a former employer when transferring into the scheme. As for umbrella and occupation schemes, employees can only access 50.0% of their total benefits. This gives employees access to their savings before actually retiring because of losing a job or leaving a particular employer. However, such actions can always prove to be short-sighted since they significantly deplete the value of savings upon retirement and will reduce the growth of the sector,

- Low Pension Coverage in the Informal Sector – The informal sector constitutes an important part of the Kenyan economy. It is often characterized by irregular income and lack of job security. According to the Retirement Benefit Statistical Digest 2021, there are 266,764 members registered in the individual pension schemes. This is significantly low considering that according to the Kenya National Bureau of Statistics Economic Survey Report 2022, there are 15.2 mn people engaged in the informal sector translating to 83.2% of the total working population. These individuals may prioritize immediate financial needs over long-term retirement planning. Traditional pension schemes may not cater to their unique financial circumstances.

- Unremitted Contributions – Umbrella schemes and occupational schemes have over the years grappled with the issue of unremitted contributions from employers due to financial challenges and this has led to some pension schemes being underfunded. Consequently, according to the Retirement Benefit Statistical Digest 2021, this has resulted in the total unremitted contributions increasing to Kshs 42.8 bn in 2021, from Kshs 34.7 bn in 2020, and,

- Delayed Processing and Payment of Benefits - Payments of members’ benefits undergo a number of processes. From the determination of total accrued benefits by the pension scheme administrator to approval of payment by the Trustees of pensions schemes and in the case of Occupational or umbrella schemes, the employer has to give approval, before the benefits finally reach the members. Delays may occur as the benefits files move from one service provider to there. This is quite disadvantageous, especially for those members who have reached the age of retirement. These delays, consequently, discourage those not in pension schemes from joining.

Section V: Recommendations on Enhancing the growth and penetration of Retirement Benefit Schemes in Kenya

Employment serves as the bedrock of the retirement savings landscape, providing the primary means through which individuals accumulate the necessary funds for their post-working years. Employers have a significant impact on employees' capacity to achieve a secure retirement. Their role encompasses the offering of retirement benefits, creating a welcoming environment for workers of all ages, fostering work-life balance, and adapting business practices to support transitions to retirement. Employers also provide valuable non-retirement benefits that can help their employees protect their health, income, and savings. As such, we shall discuss and give recommendations to both employers and employees on how to improve their retirement prospects and increase the likelihood of sufficient income during retirement years by investing in the appropriate scheme;

Recommendations for Employer:

- Offer a Retirement Plan or join an Umbrella Retirement Plan – Firms can offer retirement plans to their employees to encourage them to save for their retirement. However, if the employer has no occupational retirement scheme for the employees or does not have the capacity to start one, they can join an Umbrella Pension Schemes which reduces the average cost per member and provides an avenue to save for retirement,

- Increase efforts to reduce the number of withdrawals in the retirement plan- Employers should create awareness among employees about the ramifications of undertaking premature withdrawals from retirement accounts. Employees should understand and come up with ways of dealing with non-routine and emergency expenses, which will offer employees alternative ways as opposed to withdrawing the retirement benefits,

- Help pre-retirees plan their transition into retirement – Employers can help pre-retirees by educating them about retirement income strategies to efficiently manage savings and retirement plan distribution options,

- Allow part-time employees to join retirement schemes – Firms should encourage part-time employees to join retirement schemes by extending retirement plan eligibility to such groups, and the necessity of backup plan if forced into early retirement,

- Expected returns – Employers should select providers whose return rate is high enough to ensure a sizeable growth for retirement savings. The appropriate rate of return should always be higher than the inflation rate to ensure a positive real return by not losing value over time, and,

- Extra benefits – Employers should recommend to workers schemes that will offer extra benefits in terms of insurance covers and health care benefits. Such complimentary benefits would improve the quality of a retirement plan.

Recommendations for Employees:

- Creating a budget – Employees should have a budget to guide them on how to spend on expenses and maintain income to save for retirement in a suitable scheme,

- Have a backup plan – Employees should have backup plans in case of job loss or early retirement arising from accidents or ill health,

- Affordability and flexibility – As an employee, it is essential to select a retirement plan that will not strain you in terms of contributions. Additionally, you should look into the flexibility of the plan in terms of changing the contribution amount and measures, if any, should you miss a contribution,

- Understand the various options available – It is prudent to understand how your money will be treated, its accessibility, and the mode of payment at the time of retirement to ensure that its features align with your objectives. Schemes have different provisions on whether you can use your savings to secure mortgage facilities or even buy a residential house, and,

- Select a manager you trust – Retirement benefits plan is a long-term affair and the only way to feel secure about your contributions is by selecting a manager you trust. Key to note, a trustworthy manager should have good governance structures and management experience.

Even as we commend the government for its role in legislation and regulation that has led to growth in the industry, we believe that the current pension system still leaves many pockets of society uncovered or with insufficient funds for retirement. We note that more people continue to use banks as a savings channel, as evidenced by the increasing bank deposits at Kshs 5.5 tn compared to the Kshs 1.7 tn pension assets under management as of December 2023. As such, the pensions uptake remains low in the country putting more people at risk of old age poverty. Going forward, we expect the growth trend to continue in the coming years as the economy continues to recover and more people understand the importance of saving for retirement. We hope the recommendations for the industry in the Finance Bill will be adopted, and they will signal a continued government interest in driving pension savings penetration in the country forward.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.