Following ongoing discussions in the financial markets around regulated and unregulated offers, a member of parliament recently requested the Chairperson of the Department Committee on Finance and Planning to issue a statement on unregulated / private offers. Therefore, in this week’s topical, our Research Team seeks to build on a previous focus on the same topic covered in 2020 and educate the general public about these two types of markets/investment categories, which are complementary and important to well-functioning financial markets. As such, we shall discuss the following:

- Introduction to Regulated and Unregulated markets,

- Regulated and Unregulated Investment Categories,

- Pros and Cons of Each Investment Category,

- Issues to Consider for Each Category,

- Myths About Each Category, and,

- Conclusion.

Section I: Introduction to Regulated and Unregulated Investment markets

Investment markets from a regulatory point of view can be divided into two large categories, regulated and unregulated markets.

Regulated markets, often referred to as public markets are controlled by a regulatory body whose key mandate is to protect the public interest. The products in the public markets tend to be standardized and easily accessible to the public. Common examples of regulated products include shares purchased at the securities exchange, Fixed Deposits offered by Banks, Collective Investment Schemes such as Money Market Funds, among other. The offering of the product needs to have been reviewed and approved by the respective regulator before the investment products can be sold to the public. If a product is a banking product, it is regulated by CBK, an insurance product by Insurance Regulatory Authority (IRA), shares/equities and Collective Investment Schemes/ Unit Trust Funds by Capital Markets Authority (CMA), and pension products by Retirement Benefits Authority (RBA).

Unregulated markets are governed by the prevailing contracts between the participating parties and therefore they are not regulated by a specific regulator; however, the process of offering is usually regulated so that it follows a set of defined rules and guidelines. The manner of offering is usually private; hence they are also loosely referred to as private products or private offers. Since they are an alternative to public markets products, they are also referred to as alternative market products. For one to issue a private offer in Kenya, they must adhere to Section 21 of the Capital Markets (Securities) (Public Offers, Listings and Disclosures) Regulation, 2002 which gives a set of 9 conditions that should be met prior to a private offer issuance. We have clarified with CMA that meeting any one of those conditions is sufficient to meet the private offers threshold. The 9 conditions are:

- The securities are offered to not more than one hundred persons,

- The securities are offered to the members of a club or association and the members can reasonably be regarded as having a common interest with each other,

- The securities are offered to a restricted circle of persons whom the offer or reasonably believes to be sufficiently knowledgeable to understand the risks involved in accepting the offer,

- The securities are offered in connection with a bona fide invitation to enter into an underwriting agreement with respect to them,

- The minimum subscription for securities per applicant is not less than Kenya Shillings one hundred thousand (Kshs. 100,000),

- The securities result from the conversion of convertible securities and a prospectus relating to the convertible securities was approved by the Authority and published in accordance with these Regulations

- The securities of a listed company are offered in connection with a take-over scheme approved by the Authority

- The securities are not freely transferable, and,

- The securities are of a private company and are offered by that company to members or employees of the company or a restricted circle of persons whom the offer or reasonably believes to be sufficiently knowledgeable to understand the risks involved in accepting the offer,

Examples of unregulated products in the Kenyan Market include: Real Estate, Private Equity, Structured products and Commercial papers.

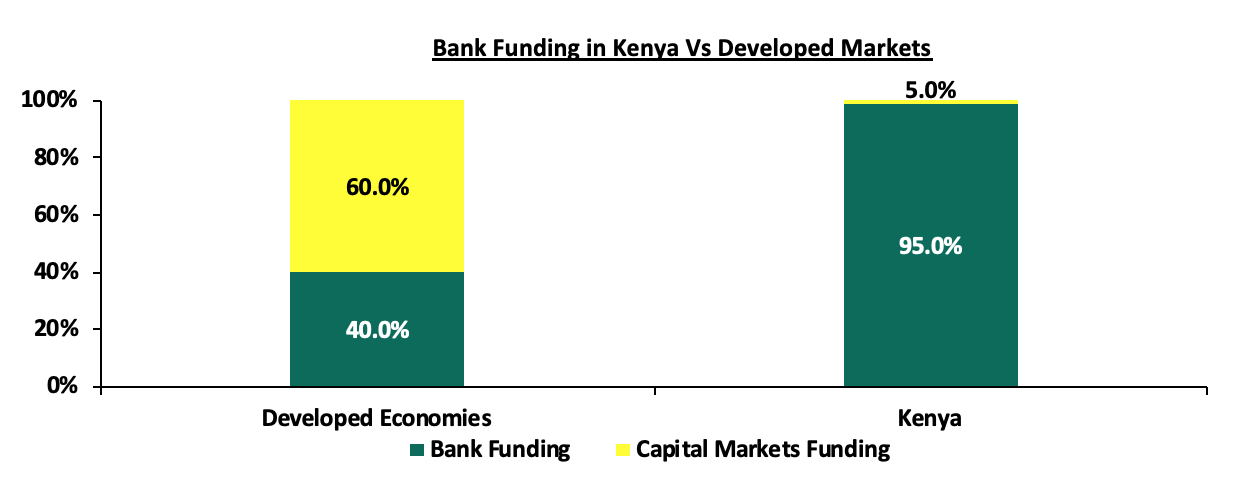

For economies to grow, there is need for companies to be in a position to access capital to finance their businesses, hence necessitating the presence of capital markets. According to World Bank data, in more developed markets, both regulated and unregulated capital markets contribute about 60% of all business funding and the remaining 40% of capital coming from banks. However, in Kenya businesses funding largely rely on bank funding and according to the Capital Markets Authority Soundness Report Q4’2020, the regulator, CMA, highlighted that funding from the capital markets in Kenya stood at 5.0%, with the banking sector taking up 95.0% of the funding for businesses. This shows that our capital markets remain subdued compared to other economies, and access to funding remains a concern. The upshot is that there is banking dominance in Kenya, which then makes capital hard to access, and when accessed it is expensively priced.

Section II: Regulated and Unregulated Investment Categories

As earlier mentioned, regulated products are standardized and are easily available to the market. The products are issued publicly and as per the Capital Markets Authority guidelines pertaining to each type of security. Their issuance and trading are overseen by independent regulatory bodies through a set of governing rules. Examples of regulated products include:

- Equities – Equities represent ownership interest in a company and is considered to be relatively liquid and highly volatile. The returns from equities are in two forms i) Capital appreciation -this is when you sale the security at a higher price than the original purchase price and ii) Dividends which is when listed companies offer cash compensation to equities investors. Investments in equities are largely for medium to long term investments as they come with some level of volatility,

- Fixed Income Securities – These are debt instruments that offer a return in the form of fixed periodic interest payments and principal redemption upon maturity or expiration of the securities’ tenor. Investors usually earn a fixed amount of income in the form of coupon payments on their bond portfolios at regular intervals. Usually the yields on the securities increase with the increase in the tenor of investments. Examples of fixed income securities available to investors include: Treasury Bills, Treasury Bonds and Bank Fixed deposits,

- Mutual Funds/Unit Trust Funds – These are a collective investment scheme that pools money together from many investors and are managed by professional fund managers who invests the pooled funds with a view of paying a return in accordance with specific shared investment objectives that have been established for the scheme. The funds in the mutual fund give returns in the form of dividends, interest income and/or capital gains depending on the asset class the funds are invested in. Examples of Unit Trust Funds in the market include: Money Market Fund, Equity Fund, Balanced Fund and Fixed Income Fund. For more information, please read our previous topical on Investing in Unit Trust Funds, and,

- Pension Funds – These refers to investment funds into which individuals contribute their investments with the aim of saving for retirement. The investments are guided by the provisions of the Retirement Benefits Act and the specific characterizes of the fund as set out in the Investment Policy statement. Pension funds can be categorized into two in terms of returns; guaranteed funds, which provide a guaranteed minimum rate of return, and segregated funds, which offer market-based returns. For more information, see our topical on Retirement Benefit Schemes in Kenya.

- Real Estate Investment Trusts (REITS) – These are pooled investments typically designed to enable the investors to profit from investing in large-scale real estate enterprises and offer investors a liquid interest in real estate. Types of REITS include: Income REITS whose example is the Fahari I-REIT which trades at the Nairobi Securities Exchange, Development (D-REIT) and Islamic REIT,

- Derivatives - A derivative is a financial instrument that derives its value from one or more underlying assets which can be based on different types of assets such as commodities, equities, bonds, interest rates, exchange rates, or real estates. They are legal contracts in which two parties agree to pay off each other depending on the value of an underlying asset at a certain point in time. Additionally, derivatives can either be traded over-the-counter (OTC) or on an exchange. The main types of derivatives contracts include: forward contracts, options contracts, futures, swaps and warrants which involve buying and selling of assets under a specified set of rules, and,

- Exchange Traded Funds (ETFs) – These are publicly traded investment products that monitor the performance of a diversified portfolio of stocks, bonds, and commodities. An ETF can also track a single commodity such as oil or a precious metal like gold. This funds give investors the chance to buy units that track whole indices as easily as buying shares listed on the Exchange. An example of an ETF is the Barclays New Gold ETF which was launched on 30th June 2017 and listed on the Johannesburg Stocks Exchange the fund enables investors to invest in an instrument that monitors the price of Gold Bullion. Price movement of the ETF are determined by the price movement of gold and each gold security corresponds to approximately 0.01 troy ounces of gold bullion.

The issuance of unregulated products involves private arrangements between the various participants which mostly does not happen in the public domain as these products are not to be advertised publicly. Therefore the main players involved in the issuance of private offers include:

- The Issuer - This is the entity that needs the funds and has entered the market for borrowing purposes,

- The Arranger - This is an intermediary who brings the involved parties. They act as the match maker between the issuer looking for capital and the investor with capital to commit, and,

- The investor – These are the Individuals whose aim is to make a given return and commit funds in to the investment instrument.

Some of the unregulated products available in the market include:

- Structured products - Structured Products as previously covered in our Cytonn Weekly #43/2017 and Cytonn Weekly #19/2015 are defined as highly customized / tailor made investment products that are packaged by investment professionals to enable the investor access returns or meet investment objectives that are not accessible in the traditional / public / conventional markets. Structured Products are considered as a subset of Alternative Investments. The process of structuring starts by traditional products such as equities, bonds and bank deposits, either alone or in combination with a non-traditional product, such as real estate, and creating cash flows and returns that are supported by the underlying products, but whose features are different from the underlying product because of the structuring that is done. Examples of structured products in the market include: Cytonn Real Estate Note at 18.0%, Two Rivers Development Fund at 17.0% and Maiyan Holdings Fund at 17.0%,

- Commercial Papers- These are promissory notes issued by companies as a form of raising short-term debt. These securities can be secured or unsecured and are priced at a premium to the Treasury Bills. Commercial Papers often have tenors of up to one year and mainly target institutional investors. Commercial papers are mostly used to fund the working capital requirements of companies which must not necessarily be in Real Estate. So as to improve the attractiveness to investors, some commercial papers are rated by Credit ratings agencies who evaluate the credit worthiness of the issuer company. Examples of commercial papers issued in 2021 include: Watu Credit at 15.0%, Premier Credit at 15.0%, Car & General at 12.0% - 13.0% and KK Security Note at 13.3%.

- Real Estate Notes– This involves the structuring of investments whose returns are backed by the returns from the underlying assets which is real estate. The capital raised is used for the purchase of land, construction costs and even maybe the purchase of buildings for the purposes of income generation. An example includes: Cytonn Real Estate Note at 18.0%, and,

- Private Equity - This involves buying shares that are not listed on a public exchange or buying shares of a public company with the intent to privatizing them. Private Equity investments may take the form of Venture Capital investing – which is the investment of capital into a small business or start-up which has the potential of growth in the long run, Growth capital investing in already established companies that are looking to scale their operations and private equity which involves financing established companies that require money to restructure and facilitate a change of ownership. An example includes: Fusion capital which raised Kshs 800.0 mn from international investors for the Meru Greenwood City project.

Summary Table of Privately Offered Products in the Kenyan Market

|

|

Name of Private Offer |

Type of Private Offer |

|

1. |

Car & General Short Term Note Program |

Commercial Paper |

|

2. |

ASL Credit Short Term Note Program |

Commercial Paper |

|

3. |

KK Security Short Term Note Program |

Commercial Paper |

|

4. |

Premier Credit Note Program |

Commercial Paper |

|

5. |

Watu Credit Note Program |

Commercial Paper |

|

6. |

My Credit Note Program |

Commercial Paper |

|

7. |

Maiyan Holdings |

Real Estate Note |

|

8. |

Heri Homes Capital LLP |

Real Estate Note |

|

9. |

Cytonn Projects Notes (CPN) |

Real Estate Note |

|

10. |

Two Rivers Development Fund |

Real Estate Note |

|

11. |

Meru Greenwood City*** |

Real Estate Equity |

|

12. |

Cytonn High Yield Solutions (CHYS) |

Structured Product |

|

13. |

Britam Wealth Management Fund LLP |

Structured Product |

|

*** Raised funds from international investors from UK and Finland |

||

Source: Cytonn Research

Section III: Pros and Cons of Each Investment Category

Any investment, regulated and unregulated products have their advantages and disadvantages. No product is better or worse than the other as they both serve unique purposes depending on an investor’s specific investment objective. The table below shows the pros and cons of investing in any of the two categories:

|

Regulated vs Unregulated Products – Pros & Cons |

||

|

Pros |

Cons |

|

|

Regulated Products |

|

|

|

Unregulated Products |

|

|

Source: Cytonn Research

Section IV: Factors to consider while investing

There are a number of areas for an investor to consider before making an investment decision, and this usually boils down to financial planning and unique preferences for an investor, after they have considered the pros and cons of each category:

- Risk Appetite: An investor has to evaluate the two types of categories and then make a call on the uncertainty that an investment may not earn its expected rate of return, and as well risks such as interest rate risk, currency risk, re-investment risk, and credit risk,

- Return: These are the earnings from investments, and they vary depending on the type of investment e.g. dividends, rent, interest and capital appreciation. Investors should ask themselves whether the return profile meets the risk-reward proposition,

- Liquidity: This is a definition of how quickly an asset can be converted into cash. Investors will usually find that unregulated products have a higher chance of being illiquid compared to regulated products,

- Taxation: It is critical for investors to understand their tax status for tax planning purposes. Regulated products such as bank deposits and Unit Trust Funds in Kenya attract a 15% withholding tax, which is final, whereas unregulated Structured Products attract a total 30% tax rate on any returns made,

- Governance: Governance around regulated products usually involves a Regulator, Trustee, and Custodian, who provide oversight over funds being invested. In unregulated products, governance is usually done by select investors who are investors in the funds themselves, alongside the Investment Manager and their Investment Committee, and,

- Sophistication: Regulation exists to provide oversight for less sophisticated investors. These include retail investors who may not fully understand the characteristics of products they are investing in. Unregulated products are for sophisticated investors who understand the characteristics of their investments and have taken time to understand the underlying asset class / economic activity that is delivering the return.

Section V: Myths about Each Category

Given our interaction with investors, we felt it best to bring out and debunk many myths that we have heard surrounding both categories of investments especially given that we are still an emerging market were private products are less prevalent:

Myths about Regulated Products:

- Always Safer: The myth has always been that regulated products are safer and investors will not lose money in regulated products. However, experience in Kenya has shown that investors in regulated products such as banking and capital markets have lost funds due to isolated cases of lapses in corporate governance. As such, investing in a regulated institution is no guarantee over the safety of your investment. The Kenya Deposit Insurance Fund, for example, only guarantees Kshs 500,000 worth of deposit for each account in a banking institution. Some of the regulated products that have recently run into trouble leading to billions of losses include:

|

Shareholders’ Loss for Regulated Entities Largely Due to Poor Corporate Governance |

||||

|

Firm |

Peak Share Price |

Current Share Price |

No. of Shares (bn) |

Loss in Value (Kshs bn) |

|

Kenya Airways** |

58.0 |

3.8 |

1.5 |

81.5 |

|

Mumias Sugar |

20.7 |

0.3 |

1.5 |

31.2 |

|

Athi River Mining (ARM) |

33.0*** |

5.6* |

1.0 |

27.4 |

|

Transcentury |

57.0 |

1.4 |

0.4 |

22.2 |

|

Uchumi* |

10.9 |

0.3 |

0.4 |

3.9 |

|

Imperial Bank |

|

|

|

36.0 |

|

Chase Bank |

|

|

|

4.8 |

|

Real People |

1.6 |

|||

|

CMC Motors |

1.2 |

|||

|

Amana Capital |

|

|

|

0.3 |

|

Total |

210.1 |

|||

|

*Last trading price before suspension **Peak share price since the 2012 rights issue *** Represents the median share price for the 10 years to the suspension |

||||

Source: Cytonn Research, NSE, Reuters

- Very Liquid: While regulated funds are likely to be a lot more liquid than unregulated, there are times when a regulated business or fund undergoes a strain, and as such, there shall be periods where funds are not easily accessible. This could be in the case of a Unit Trust Fund being closed for withdrawals, or a bank under receivership; a good example is what Amana Money Market Fund has recently experience,

- Don’t Invest in Alternatives: Regulated funds and products usually all have an allocation to alternative investments. The simplest example is that any deposit in a bank is then pushed forward by a bank and lent to an individual for a mortgage, or a developer to undertake a development project. Unit Trust Funds in Kenya as well, as per the regulations, are allowed to invest in alternative investments such as real estate and private equity, and,

- That the Regulator Fully Understands the Investments: Whether regulated or unregulated, investments always entail risks that even the best analysts, let alone a regulator, may not uncover. Investors should not think that just because it was signed off by a regulator, that they totally understood the investment; investors should still do their own due diligence.

Myths about Unregulated Products:

- Risky Investments: Unregulated products are not necessarily more risky, especially when they are sourced through a competent research and investment team, and one that has experience in managing illiquid and alternative assets. Take real estate for example, where the project has been sourced through detailed research and is delivered by a well-run and professional project manager, and there is visibility over pre-sales, such an investment would be attractive for those seeking diversification in their portfolios,

- They Are Too Complex: Unregulated investments are really not more complex than regulated products, in spite of the jargon that usually accompanies them. Accessing private or unregulated markets is down to experience and skill of the management and investment team, and their ability to package the unregulated asset class into investible security,

- They cannot be offered by Regulated Entities: Regulated entities can offer both regulated and unregulated products. For any regulated product, it is approved by the respective regulator, similarly, any unregulated product also needs to pass through the respective regulator.

- They are unlawful: Unregulated products are often viewed as unlawful and with a lot of suspicion, mainly because they do not require regulatory approval. However, it is important for investors to note that even without regulatory approval, the unregulated products are still issued within the confines of set guidelines by the regulators. We have recently filed a petition in the High Court for an interpretation on what constitutes a private offer,

- Have to only be distributed to a Few Individuals: There is a myth that unregulated private products must only be distributed to a few individuals. There is ample case laws to demonstrate that what matters is the manner of offering, and not the number of investors. Courts have concluded that an offer even to one person is deemed a public offer if it was offered in a public manner, and an offer even to a million people is a private offer if it was offered in a private manner. Case laws in developed markets shows us that unregulated products can be widely distributed:

- United States: The leading case in the United States with regard to ‘transactions by an issuer not involving any public offering’ is Securities Exchange Commission vs Ralston Purina Company 346 US 119 Supreme Court, where an offering was made to at least 7,000 members of staff. The eligibility criteria were simply an employee eligible for a promotion, an individual sympathetic to management, the courts concluded that it was not a public offer because there was an eligibility criteria, even though the regulator wanted it deemed a public offer.

- United Kingdom: In Nash vs Lynde, a case where a question was raised over the distribution of shares, the questions framed by the Court were, amongst others, whether a private company could be held to have offered and issued its shares to the public as 20-30 prospectus was issued. The Court in this matter held as follows ‘The public is a general word and no particular numbers are described. Anything from two to infinity may serve perhaps even one ….’. The Offer, in this case, was therefore not deemed a Public Offer, as those the offer was being made to were specific and shared a common goal. A key takeout is that numbers are not a determining factor as to whether an offer is made to the Public or a Section of the Public.

- Australia: The leading case for Australia is Corporate Affairs Commission (SA) VS Australian Central Credit Union (1985), where it was held that an Offer to 23,000 persons would not amount to a Public Offer. This was on the basis that the law expressly allowed for this exemption on the basis of persons with a common interest.

Based on the above, it is clear that our own securities regulations need to undergo judicial interpretation as to what is a private offer and a public offer. Where there is eligibility criteria, where there offer is being made to specific individuals, and where the law expressly allows for an exemption, the offer is deemed private. We have recently filed a petition in the High Court seeking judicial interpretation.

Section VI: Conclusion

While Regulated products are standardized and easy to comprehend, the unregulated products tend to be complex, opaque, and hard to value and understand, which has largely contributed to limiting their growth. Additionally, the growth of unregulated products in the Kenyan market continues to be curtailed by the lack of regulatory support as despite the product being unregulated, the process of offering is usually regulated so that it follows a set of rules and guidelines. We believe that in order to catalyze the growth of our capital markets, there needs to be a synergy between the regulated and the unregulated markets as this will lead to a more inclusive capital market. Consequently, we believe this will lead to the growth of the economy as businesses will have access to cheaper forms of funding in the capital markets. The recent parliamentary inquiry on private offers together with the recent petition should help shape the future of private offers in Kenya.

It is important to have continuous education for current and potential investors to understand the products and the return prospects, as well as, how they fit in to the investors’ portfolio. It is also important for investors to understand that not every financial instrument needs to be regulated as this will kill innovation. For investors, they need to first understand their investment objective, risk appetite, then understand the investment products available to them before they make an investment decision towards or away from unregulated products. We highly recommend that you speak to a Financial Advisor before you invest in any of the two categories of investments.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.