In August 2021, the National Treasury published two legal notices affecting the Individual Retirement Benefits Scheme and Umbrella Retirement Benefits Scheme. The legal notices have amended the access rule to allow members, before retirement age, to access a maximum of 50.0% of the total accrued pension benefits, down from the previous regulation where members could access 100.0% of their own contributions plus 50.0% of the employer's portion. The additional clause stipulates that a trust corporation shall not appoint an administrator, fund manager, custodian or approved issuer who is related to the trust corporation by way of ownership, directorship or employment. This and many other regulatory amendments and guidelines point towards the Retirement Benefits Authority (RBA) proactive change of regulations aimed at boosting the pensions industry's development.

This week, we will demystify these guidelines and assess the impacts the changes will have in the industry. As such, we will cover the topic in four different sections:

- State of the Pensions Industry in Kenya,

- Factors Affecting the Growth of the Pensions Industry,

- Regulatory Changes in the Industry,

- Recommendations, and,

- Conclusion;

Section 1: State of the Pensions Industry in Kenya

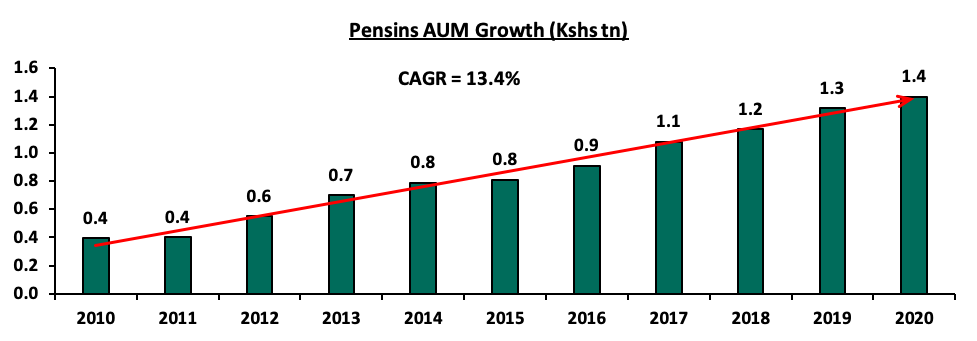

The Pensions industry refers to the economic sector comprising of Retirement Benefits Schemes as well as the assets these schemes control. According to the 2019 FinAccess Household Survey Report, the Pensions Industry has seen significant growth with the number of registered members growing by a 10-year CAGR of 15.7% to 3.0 mn members in 2019, from 0.7 mn registered members in 2009. During the same period, the Assets under Management (AUM) grew by a 10-year CAGR of 13.4% to Kshs 1.4 tn as of December 2020, from Kshs 0.4 tn in December 2010 attributable to the initiatives done by the regulator and other stakeholders to educate the public on the need to join retirement benefits schemes coupled with an enabling regulatory environment. Financial technology has also played a significant role in making it easier for Kenyans to join and contribute to pension schemes, as well as enhancing communication between the schemes and their members. However, growth in the pensions industry was disrupted by the adverse effects of the COVID-19 pandemic which negatively impacted the financial markets and the economy at large, as disposable income was reduced due to loss of jobs and salary cuts as firms sought to reduce their expenses.

The graph below shows the growth in Kenyan pension schemes’ AUM over the last 10 years:

Source: RBA Industry Reports

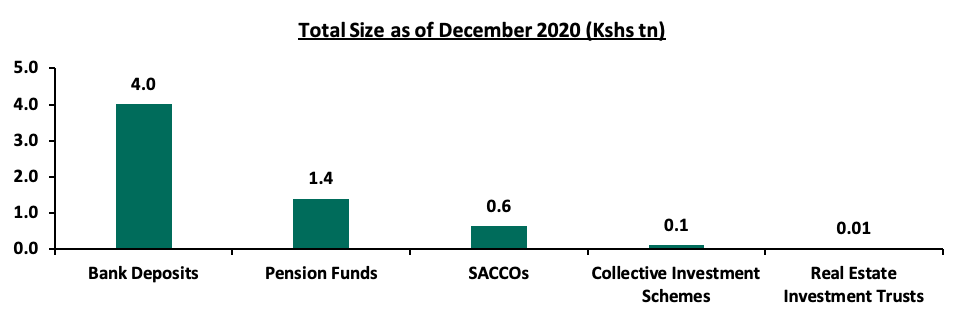

As at the end of 2020, the pension industry ranked second as the most preferred mode of saving with assets worth Kshs 1.4 tn after bank deposits at Kshs 4.0 tn. Below is a graph showing the sizes of different saving channels and capital market products in Kenya as at December 2020:

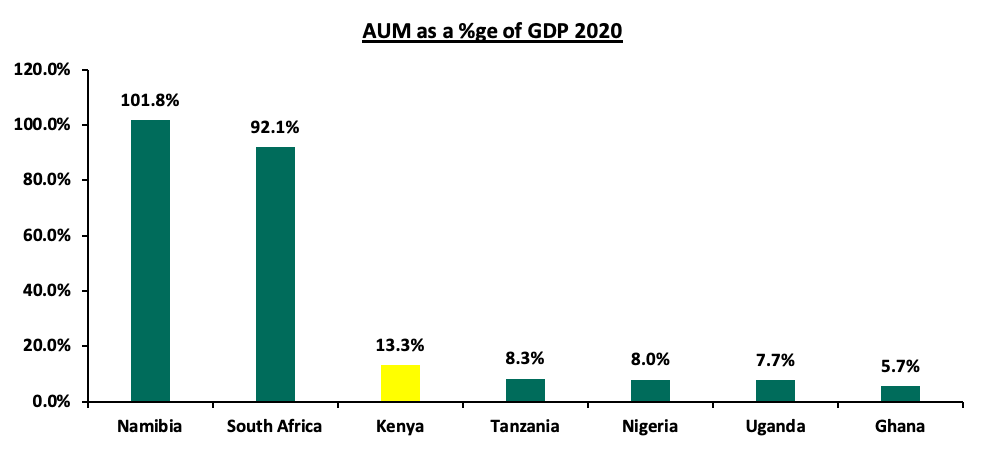

Despite the historical growth, there is still room for improvement given that the Kenyan Pension Schemes’ AUM was equivalent to 13.3% of the country’s GDP in 2020. Compared to other countries, the difference remains significant with the AUM for some of the developed countries exceeding the size of their domestic economy. According to the OECD Pension Funds in Figures June 2021 Report, pension assets in five developed countries exceeded the size of their domestic economy in 2020, Netherlands being top of the list with the AUM equivalent to 210.3% of the country’s GDP. For the African countries, Namibia tops the list with the pensions AUM as a percentage of GDP standing at 101.8% followed by South Africa at 92.1% as of December 2020. The graph below shows the AUM as a percentage of GDP for select Africa countries:

Source: OECD Pensions in Focus Report

The retirement schemes can invest their funds in various asset classes but historically, they have allocated an average of 57.8% of their members’ funds towards Government securities and Quoted Equities over the period 2012 to H1’2021. The high allocation to government securities, an average of 37.5% over the last decade and highest among the asset classes invested in, can be attributed to the fact that pension schemes prioritize on safety of their members’ funds and prefer a high allocation to relatively lower risk investments. It is due to this continued preference that some of the regulatory changes introduced recently are set to encourage investments in alternative assets such as introduction of commercial papers and public private partnership debt instruments as new asset classes. The table below shows the overall historical investment portfolio of pension schemes:

|

Kenyan Pension Funds Asset Allocation |

||||||||||||

|

Asset Class |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

H1'2021 |

Average |

Allowable Limit |

|

Government Securities |

35.0% |

33.8% |

31.0% |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.7% |

44.1% |

37.5% |

90.0% |

|

Quoted Equities |

24.0% |

25.5% |

26.0% |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

15.6% |

16.9% |

20.3% |

70.0% |

|

Immovable Property |

19.0% |

17.2% |

17.0% |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.0% |

16.7% |

18.5% |

30.0% |

|

Guaranteed Funds |

9.0% |

10.3% |

11.0% |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.5% |

16.7% |

13.3% |

100.0% |

|

Listed Corporate Bonds |

5.0% |

4.4% |

6.0% |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.4% |

0.2% |

3.6% |

20.0% |

|

Fixed Deposits |

5.0% |

4.9% |

5.0% |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

2.8% |

2.5% |

3.9% |

30.0% |

|

Offshore |

2.0% |

2.2% |

2.0% |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.8% |

1.1% |

1.3% |

15.0% |

|

Cash |

2.0% |

1.3% |

1.0% |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

0.9% |

1.2% |

1.3% |

5.0% |

|

Unquoted Equities |

1.0% |

0.6% |

1.0% |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.2% |

0.5% |

5.0% |

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.0% |

10.0% |

|

REITs |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

30.0% |

|

Commercial Paper, non-listed bonds by private companies* |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

10.0%s |

|

Others e.g. Unlisted Commercial Papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.0% |

10.0% |

|

|

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

|

|

Commercial paper, non-listed bonds and other debt instruments issued by private companies was introduced as a new separate asset class category in 2016 through the legal notice No. 107. |

||||||||||||

Source: RBA Industry Reports

Section 2: Factors Affecting Growth of the Pensions Industry

As previously stated, the Kenyan pensions industry has grown significantly in the last ten years with the main factors that have contributed to the growth being:

- Demographic factors – Demographic factors include the statistical factors that influence population growth in one way or another. Over time, the Kenyan young population has witnessed rapid growth, leading to an almost continuous growth of people joining the workforce and saving for retirement. Further, the United Nations’ projects that the corresponding population of youth in Kenya aged 15-24 years and ready to join the workforce will increase to 18.0 mn from 9.5 mn over the period 2015 to 2065. This will likely increase pension scheme membership significantly,

- Technology Advancements and Increased Financial inclusion – Increase in technology advancements, mobile penetration rate and internet connectivity in Kenya have provided an important platform for the delivery of a wide range of financial services. Currently, almost all Individual Pension Plans (IPPs) allow contributions through M-PESA pay bill numbers, a simple and convenient way to make payments. As more people become financially educated particularly in the informal sector, the technological advancements make it easy for people to join schemes and contribute funds as well as track the status of their portfolios,

- Legislation – The numerous reforms in the pensions industry over the past two decades have proved beneficial to the pensions industry. These reforms includes i) tax reliefs on contributions to a maximum of Kshs 20,000 per month or 30.0% of one’s salary, whichever is less, and ii) house ownership structures whereby the members can assign up to 60.0% of the accumulated retirement savings towards securing a mortgage facility or use up to 40.0% of their pension savings directly to purchase a residential house. The enactment of these reforms has served as a great incentive as Kenyans continue to take advantage of the current regulatory environment,

- Social Change - As globalization takes the centre stage, the goal remains boosting economies around the world by creating efficient markets and more job opportunities. Consequently, individuals are becoming less dependent as they have more disposable income and as people understand better the importance of saving for retirement. Additionally, globalization has resulted to an interconnected financial world, which has reduced geographical inequality and ensured that wealth is distributed more evenly. As such, there is increased disposable income and authorities are able to benchmark with each other hence creating efficient systems, and,

- Trustees Certification programs which help improve the management of the Pension Schemes and better equips the Trustees in carrying out their roles.

Challenges in the industry:

Despite the significant developments, the pension coverage in Kenya is still low at 20.0%, with only 3.0 mn people in Pension Schemes out of the 27.1 mn people in the labor force. Some of the challenges that have slowed down the growth in the pensions industry, include:

- Market Volatility – Due to the uncertainty surrounding investment returns, several Kenyans are hesitant to contribute to pension schemes for their retirement for fear of losing their hard-earned money. Pension schemes with high allocation to the Equity markets stand to lose as well due to the market volatility and risk of their members’ funds declining in value,

- Slowdown in economic growth and unemployment - According to data by the Kenya National Bureau of Statistics (KNBS) Quarterly Labor Force Survey Q1 2021, 16.9% (3.0 mn) of the 17.7 million Kenyan youth not in school lacked some form of employment as of March 2021. This was aggravated by the pandemic in 2020, which resulted in millions of job losses as many businesses were forced to downsize leading to reduced disposable income. Additionally, pension reforms are primarily focused on the formal sector in recent decades hence leaving out the informal sector which forms the larger portion of the economy,

- Access of Pension savings before retirement – Employees have previously chosen to withdraw their pension savings immediately after leaving their job. While withdrawing one's pension savings may appear to be a rational option, especially after losing a job or experiencing financial difficulty, it is more self-defeating and short-sighted because we borrow money from our own future. This has a negative impact on the adequacy of pensions upon retirement and result in a lower quality of life after retirement. Withdrawing from pension schemes also slows the growth of the Pension Industry because it takes money out of the schemes, and,

- Low Prioritization of Retirement Planning - Most Kenyans focus more on other immediate financial challenges and end up postponing retirement planning. This leads to low-income replacement ratio as people start saving later in their working years when they have more responsibilities than they had while younger. As a result of saving a small amount of money for a shorter period of time, the retiree ends up with insufficient retirement benefits and is forced to continue working or depending on relatives.

Section 3: Regulatory Changes in the Industry

Over the past few years, the government together with the Retirement Benefits Authority has developed and amended pension schemes’ regulations aimed at strengthening the legal and regulatory framework in the pensions industry. The goal has been to achieve comprehensive pension coverage across the formal and informal sectors and better protect the interests of beneficiaries and rights of pension contributors. These changes are often introduced through;

- Changes to the Finance Act usually as part of the annual budget process,

- Direct Changes to the Retirement Benefits Act or Regulations, often initiated by the Ministry of National Treasury, and,

- Changes to the Income Tax Act.

In Kenya, the Retirement Benefits Authority (“RBA”) is the governing body established under the terms of the Retirement Benefits Act 1997 tasked with regulating and supervising the establishment, management and promotion of Retirement Benefits Schemes. The Authority’s mandate also includes (i) protecting the interest of members and sponsors of Retirement Benefits Schemes, (ii) promoting the development of the retirement benefits sector, (iii) implementing all government policies relating to the sector, and, (iv) Advising the Cabinet Secretary in charge of the National Treasury on the national policy to be followed with regard to the retirement benefits industry. The RBA’s mandate covers all private and government parastatal pension schemes. The civil service pension scheme and the Teachers Services Commission pension scheme is governed by the pensions department under the Ministry of National Treasury.

RBA’s mandate is included in the Retirement Benefits Act and Regulations, a set of legal documents that provide for the existence of the various types of pension schemes in the country and guidelines on how they should be run. However, there are other Acts that affect the pensions industry including the Income Tax Act which contains how different taxes such as Withholding tax are to be charged on pension benefits.

Some of the major changes that have taken place over the last five years include:

- Qualification criteria for Corporate Trustees – In June 2021, the President of Kenya assented to the Finance Act, 2021 which amongst other changes, introduced provisions for the registration and regulation of corporate trustees in the retirement benefits industry through amendments to the Retirement Benefits Act, 1997. Some of the eligibility requirements for a pension corporate trusteeship applicant include having a minimum capital requirement of Kshs 10.0 mn and the applicant should have the professional and technical capacity and adequate operational systems to perform its functions. Detailed requirements are expected to be provided by RBA in its regulations. It is important to note that in Kenya, umbrella pension funds and occupational pension schemes may make use of individual trustees to govern umbrella schemes while Individual Pension Schemes (IPPs) cannot. The move to clearly outline qualification criteria for corporate trustees is highly welcome as it eliminates the element of subjectivity in the trustees’ application process,

- Corporate Trustee Compliance: In 2020, the Retirement Benefits Authority Act, 1997 was amended introducing penalties where a trustee fails to submit a copy of the actuarial report to the Chief Executive Officer of the Retirement Benefits Authority. A penalty of Kshs 100,000 will immediately be imposed in case of delay and a further penalty of Kshs 1,000 shall be charged for each day or part thereof during which the report remains un-submitted. The amendment came in after the authority added two regulatory clauses regarding trustees in 2018 necessitating the approval of trustees remuneration approved by members during the annual general meeting as an object and function of the authority. Further, the guidelines issued a restriction to prevent persons who do not comply with the guidelines or practice notes issued by the Authority from serving as a trustee of any scheme. In our view, the amendment aims to increase trustee compliance by establishing a penalty if statutory requirements are not met. Consequently, this will play a significant role in improving the management of the valuation process, set assumptions, and strategic recovery plans for each period, as trustees will be informed of the current and projected status of their schemes, reducing unforeseen situations such as untimely benefit payment. Overall, these policies prove beneficial since they protect the interests of members of retirement benefit systems. Trustees, on the other hand, may face extra penalties, such as being prohibited from serving, if the RBA finds them to be non-compliant,

- Housing Ownership Structure: In September 2020, the retirement benefits schemes regulations were amended to allow members utilize up to 40.0% or a maximum of Kshs 7.0 mn of their accrued benefits to purchase a residential house. However, scheme members already receiving pension earnings, members already on early retirement, and those that have attained the retirement age will not benefit from this new provision. Previously the proportion was not pre-determined and was bound by terms as may be prescribed in regulations made by the Minister in charge of finances.We are of the view that this amendment will play a big role in supporting members of retirement benefit schemes to own homes after retirement through their pension savings, therefore incentivizing workers to save in retirements benefits schemes. Additionally, the law furthers the Government’s strategic goals in the Big Four Agenda. On the down side, allowing people to purchase houses using the retirement savings will beat the logic of a retirement scheme which is to save for retirement years and in turn reduce the income replacement ratio. It is important to note that previously, pension scheme members were allowed to assign up to 60.0% of their retirement benefits to secure a mortgage facility – a law that was introduced in 2009 and still remains in place,

- Introduction of New Asset Classes – Also in 2020, the RBA introduced two asset classes as investment options for pension schemes; Exchange Traded Funds (ETFs) and Public Private Partnership Debt instruments (PPPs) after introducing Commercial Papers and non-listed bonds in 2016.Previously, pension schemes exposure to infrastructure was through listed companies, Real Estate Portfolios or Private Equity Funds. The introduction allowed a 10.0% allocation of assets under management in PPPs to invest in Debt instruments for the financing of infrastructure or affordable housing projects. In our view, the move by RBA to introduce new asset classes is commendable as pension schemes can take advantage of the long-term stable returns while also aiding in the improvement of Kenyan living standards. Furthermore, the reduction of the maximum percentage that can be invested in unlisted debt instruments to 10.0% from 30.0% will ensure that pension schemes are protected from extensive market risks,

- Transfer of Funds from Guaranteed Schemes: In 2019, the transfer period of schemes that invest in Guaranteed Schemes and wish to withdraw their funds and transfer them to another Scheme (Guaranteed or Segregated), was reduced from three-years to one-year or less as may be specified in the prior agreement. We believe that this change benefits Trustees of schemes who are dissatisfied with their present Approved Issuer/Insurance Company because the assets will begin earning the more favorable returns of the new Approved Issuer/Insurance Company or Fund Manager sooner rather than waiting three years. This would require Approved Issuers/Insurance Companies that offer Guaranteed Schemes to be more cautious in their investment selections and make arrangements for the shorter period allowed for liquidation of a portion of their Guaranteed Fund,

- Post-Retirement Medical Fund: In November 2019, regulations regarding post-retirement medical fund was amended to allow Umbrella Scheme members to make additional voluntary contributions to a post-retirement medical fund. This provision was initially available to members of Occupational Schemes and Individual Schemes. The amendments also include a provision that allows members to transfer up to 10.0% of their retirement savings into the medical fund in order to achieve the desired level of medical funds. This amendment will play a major role towards the achievement of universal health coverage and allow members to fund their medical needs after retirement seeing that most insurance companies do not cover old age diseases. However, the uptake of the fund by people saving for retirement is still very low given that it is voluntary with most people viewing it as an extra expense,

- Income Drawdown as an Alternative Option to annuity at Retirement: Also in 2019, the Retirement Benefits Regulations saw the introduction of the provision requiring schemes to include income drawdown as an option for members to access their retirement benefits at retirement, in addition to an annuity or a lump sum. The income drawdown fund allows a member the chance to leave inheritance to his/her beneficiaries in the event of death. Currently, there are 13 income drawdown funds registered under the RBA compared to only 5 in 2019 hence a positive outlook,

- Treatment of Unclaimed Benefits – In 2019, and with regards to the winding up procedures of a pension scheme, the Retirement Benefits Act clause 45A was amended to provide that if the scheme liquidator shall be unable to trace he member to whom savings in the scheme belong within 2 years, then the savings would become unclaimed assets and become payable to the Unclaimed Assets Authority (UFAA) whose primary mandate is to receive unclaimed financial assets and re-unite the assets with their rightful owners,

- Recovery of Unremitted Contributions - In 2018, the Retirement Benefits Act was amended with additional provisions for the recovery of unremitted contributions by employers. The provisions include paying the contributions and interest accrued to the scheme in full within the period specified in the notice and a penalty of 5.0% of unremitted contributions or Kshs 20,000 whichever is higher, payable to the Authority within seven days of receipt of the notice. The RBA was also given powers to wind up the scheme and facilitate members to join individual schemes where their contributions shall be remitted. We expect the amendment to enhance timely remittance of employer contributions for their employees to avoid penalties and hence avoid extra costs, and,

- Amendments on Scheme’s Transparency: In 2016, the RBA introduced guidelines that necessitated pension schemes to submit to the Authority audited financial statements, a list of the directors and top management, any changes in clientele and any further information as required by RBA by 30th September of every year. Further, the guidelines required pension schemes to communicate any changes in shareholding, directorship or top management to RBA within thirty days of the change. We believe that the move by RBA will ensure checks and balances on the management of pension schemes by the fund managers, custodians and administrators are achieved. Pension schemes will also enhance transparency and efficiency as they will need to have in place audited finances by 30 September of every year.

Legal Notices Published in August 2021

In August 2021, two Legal Notices, No. 163 and No. 165, were issued affecting the Individual Retirement Benefits Scheme and Umbrella Retirement Benefits Scheme regulations. The two key changes were as discussed below:

- Access to Retirement Benefits before Retirement: The RBA recently published a legal notice which has amended the access rule to allow members of Umbrella and Occupational schemes, before retirement age who wish to transfer their accrued retirement benefits to an individual retirement benefits scheme, to access a maximum of 50.0% of the total accrued pension benefits and the investment income that has accrued in respect of those contributions. This is down from the previous regulation where members could access 100.0% of their own contributions plus 50.0% of the employer's portion. We believe that this amendment will go a long way to increase pension adequacy and improve the income replacement ratio for retirees, thereby reducing old age poverty and over-dependence. For the pensions industry, the amendment will lead to a faster growth of assets, and better returns as trustees, through their Fund Managers, will have more room to make long-term investments, and,

- Independence of Trustees/ Service Providers: In the recently published legal notices, the Retirement Benefits Authority has included an additional clause indicating that a trust corporation shall not appoint an administrator, fund manager, custodian or approved issuer who is related to the trust corporation by way of ownership, directorship or employment. Prior to this, the trustees of the scheme was only required to notify the Authority of the details and qualifications of the person administering the scheme. In our view, the amendment will ensure that no conflict of interest will prevail and that trustees work for the benefit of the schemes’ beneficiaries including members without being swayed by the interests of the business.

Section 4: Recommendations

Despite the significant developments in the pensions industry, pension coverage in Kenya is still low with most uncovered population being in the informal and agricultural sector. The low coverage can be attributed to a faster growing informal sector compared to the formal sector, individual schemes still in infancy stage and the fact that it is optional for employers to sponsor a scheme. The industry thus has a greater potential for growth in that the main purpose of pension schemes is extending coverage to majority of the population, protecting members against old age poverty and provision of partial income replacement. Given the continued growth and development in the pensions sector, we expect the trend to continue as the Retirement Benefits Authority continue enacting and amending the necessary laws. Below, we recommend some of the regulatory changes that can further support the growth of the pensions industry:

- Extending the limit on withdrawals to voluntary benefits in the individual schemes: The amendment made by the Retirement Benefits Authority on access to benefits before retirement age only applies to umbrella and occupational pension schemes. As such, members of individual pension schemes are able to withdraw their benefits in the event where the member becomes a member of another scheme or has a need related to personal aptitude for which the trustees have given approval and obtained prior written consent of the Authority. We believe that extending the amendment to the individual schemes will go a long way in ensuring that individuals have enough money at retirement and the pensions industry continues growing as scheme managers have more funds and enough time to make long term investments,

- Issue guidelines on procurement of pension services where new players will be considered: By allowing more players into the industry, the Authority will increase competition among fund managers as this will lead to better returns for pension scheme members and consequently growth of the pensions industry. However, new fund managers find it difficult to get business through private and public tenders due to their lack of experience as a company despite having team members with sufficient experience. As such, the proposed guidelines would require or weight the experience of the key personnel running the fund management business to be viewed the same as the overall company business, thereby increasing the chances of the new fund managers to get business. This would also help with fund managers specializing in specific asset classes that they are good at, and,

- Increased member education: The Retirement Benefits Authority can adopt Initiatives such as media campaigns and strategic collaborations with county governments, professional associations, religious institutions, saccos, as well as welfare associations that are closer to the mass to educate citizens on the importance of saving for retirement. It is also recommended that bureaucracy and other barriers be removed to encourage participation by informal sector workers

- Extend the requirement to include independent trusteeship in the board of schemes similar to the provisions of the companies act: The additional clause on trustee independence applies only to trust corporations. We believe that extending the regulation to individual trustees/ board of trustees will aid in better protection of the scheme members’ funds as the trustees’ actions will entirely be for the benefit of the scheme's beneficiaries, including members, without being influenced by the business's interests.

Section 5: Conclusion

The reforms implemented over the last few years have had a significant impact on governance, benefit security, and investment management concerns particularly in the occupational and umbrella retirement benefit schemes. As such, the amendments provide a firm basis on which to consider a deeper and broader Pension Industry. We therefore believe that through increased member education, schemes can leverage on these new regulations and amendments to the benefit of their members and draw more people into their schemes. Similar actions by the regulator and the continued interaction with the different service providers in the pensions industry will be key to increase the pension coverage in Kenya. Additionally, we expect the RBA to continue enacting and amending the present regulations to accommodate the changes that may come by.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.