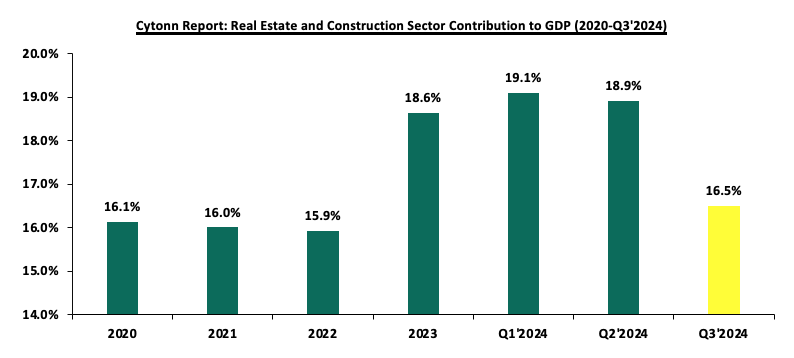

In 2024, the general Real Estate sector continued to witness considerable growth in activity in terms of property transactions and development activities. Consequently, the sector’s activity contribution to Gross Domestic Product (GDP) grew by 5.5 % to Kshs 283.8 bn in Q3’2024, from Kshs 268.9 bn recorded during the same period in 2023. In addition, the sector contributed 10.8% to the country’s GDP, 0.3% points increase from 10.5% recorded in Q3’2023. Cumulatively, the Real Estate and construction sectors contributed 16.5% to GDP, 0.2% points lower than 16.7% in Q3’2023, contributable to decline in construction contribution to GDP by 0.4% points, to 5.7% in Q3’2024, from 6.1% recorded in Q3’2023. The decline in Construction sector was attributable to the high cost of building materials that led to a 2.0% contraction in the construction sector in Q3’2024, compared to a 4.0% growth in Q3’2023. The graph below highlights the Real Estate and Construction sectors’ contribution to GDP from 2020 to Q3’2024;

Source: Kenya National Bureau of Statistics (KNBS)

Some of the key factors that continued to positively shape the performance of the Real Estate sector include; i) The government's ongoing focus on the Affordable Housing Program has been a major driver of growth,ii) Continuous improvements in infrastructure, such as new roads, bridges, and utilities, have opened up previously inaccessible areas for real estate development, iii) Kenya Mortgage Refinance Company (KMRC) has continued to drive the availability and affordability of home loans to Kenyans by providing single-digit fixed rate, and long-term finance to Primary Mortgage Lenders (PMLs) such as banks and SACCOs, iv) the retail landscape has seen a surge in growth, with both domestic and international retailers like Naivas, QuickMart, China Square, and Carrefour aggressively expanding their market presence, v) Kenya continues to enjoy recognition as a regional business hub, vi) high urbanization and population growth rates of 3.8% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, there is a sustained demand for more housing units in the country, vii) increase in investor confidence has greatly influenced hospitality sector and this is evident through mergers, acquisitions and expansions of hotels, viii) increased popularity of purpose-built properties to host Student housing, medical centers, Diplomatic residentials, data centers which offer potential for growth to the Real Estate sector through alternative markets.

Despite the above cushioning factors, there were various challenges that impeded the optimum performance of the Real Estate sector such as; i) rising Construction costs increased by 17.6% in 2024 to an average of Kshs 83,731 per SQM from an average of Kshs 71,200 per SQM recorded in 2023, ii) existing oversupply of physical space in select sectors, iii)The REITs market in Kenya continues to be subdued owing to various challenges such as the large capital requirements of Kshs 100.0 mn for trustees compared to Kshs. 10 mn for pension funds Trustees which limits the role to banks, prolonged approval process for REITs, only a few legal entities capable of incorporating REITs, high minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and 5.0 mn for restricted I-REITs and lack of adequate knowledge of the financial asset class by investors, iv) constrained financing to developers as lenders continues to tighten their lending requirements and demand more collateral from developers as a result of the high credit risk in the real estate sector.

As the REITs continue to gain popularity in Kenya, we set to explore and review the REITs environment in 2024 building to the previous reports we did on the same field. These reports include: Real Estate Investment Trusts (REITs) progress in Kenya and Kenya’s REITs H1’2024.

This week’s report will focus on the below named sections as we dig deeper to understand REITs in Kenya

- Overview of the REITs Sector in Kenya

- Key Drivers and Market Trends in 2024

- Challenges and Opportunities in the REITs Sector

- Conclusion and Outlook for the REITs Sector in 2025

Section I: Overview of the REITs Sector in Kenya

Real Estate Investment Trusts are crucial to the development given the limited funding available to the developers. Real Estate Investment Trusts (REITs) represent an innovative financing avenue for real estate development in Kenya. REITs provide a structured mechanism for pooling resources from multiple investors to finance or acquire income-generating real estate assets. The Capital Markets Authority (CMA) regulates REITs in Kenya, ensuring transparency and investor protection. Despite being relatively new in the Kenyan financial market, REITs have shown potential as a transformative tool for real estate financing.

In Kenya, REITs are classified into two main types:

- Development REITs (D-REITs): These focus on financing the construction of new real estate projects. Developers utilize D-REITs to raise capital for large-scale projects, such as residential complexes, commercial buildings, or mixed-use developments. Investors in D-REITs anticipate returns from the eventual sale or lease of the completed properties. Example of this REIT include Acorn D-REIT.

- Income REITs (I-REITs): These are designed for properties that generate consistent rental income. I-REITs appeal to investors seeking steady cash flow from established properties such as office buildings, shopping malls, or industrial parks. In Kenya examples of I-REITs include Acorn I-REIT and Stanbic Fahari I-REITs.

REITs in Kenya are governed by strict regulations aimed at safeguarding investors. They operate as collective investment schemes where a REIT manager oversees the fund's operations. Investors purchase units of the REIT, similar to shares in a company, granting them proportional ownership of the underlying real estate assets. These units are typically traded on the Nairobi Securities Exchange (NSE), providing liquidity and enabling investors to buy or sell their stakes easily.

REITs must allocate a significant portion of their income, often up to 90.0%to investors as dividends, making them attractive to those seeking regular income. Additionally, REITs benefit from tax incentives, such as exemptions on corporate tax, which enhance their appeal to both developers and investors.

In 2013, the Capital Markets Authority (CMA) introduced a detailed framework and regulations for REITs, enabling developers to secure capital through this investment avenue.

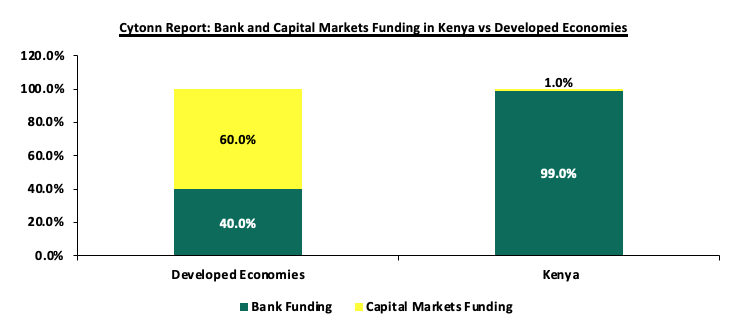

Kenya's Real Estate sector has been expanding due to ongoing construction activities driven by strong demand for real estate developments. The residential market is significantly under-supplied, with an 80.0% housing deficit; only 50,000 units are delivered annually against an estimated need for 200,000 units per year. Additionally, the formal retail market in Kenya is still in its nascent stages, with a penetration rate of approximately 30.0%, as reported by the world bank. Despite the high demand, developers in Kenya encounter limited financing options, with local banks providing nearly 99.0% of construction financing, in stark contrast to the 40.0% typically seen in developed countries. The graph below illustrates the comparison of construction financing in Kenya versus developed economies;

Source: World Bank

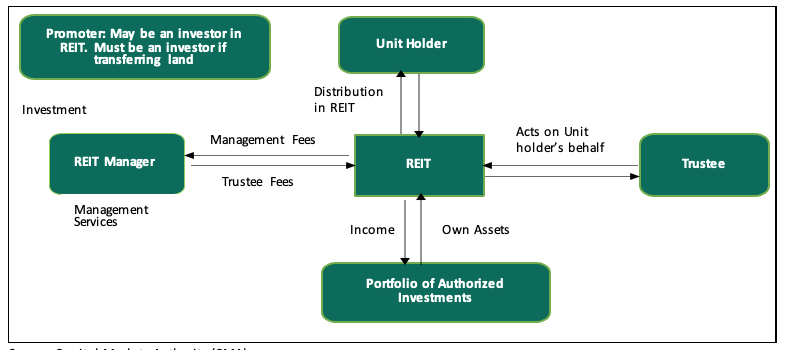

To bridge the funding gap, developers are increasingly turning to alternative financing methods. In 2013, the Capital Markets Authority (CMA) introduced a regulatory framework for Real Estate Investment Trusts (REITs) in Kenya. REITs are collective investment vehicles that pool funds from investors, who then acquire rights or interests in a trust divided into units. Investors benefit from profits or income generated by the real estate assets held within the trust. To ensure transparency, accountability, and the protection of investors' interests, four essential entities play key roles in the REIT structure in Kenya:

- The Promoter: This entity is responsible for establishing the REIT scheme. The promoter acts as the initial issuer of REIT securities and handles submissions to regulatory authorities for approvals of trust deeds, prospectuses, or offering memorandums. Examples of REIT promoters in Kenya include Acorn Holdings Limited and LAP Trust.

- The REIT Manager: This is a licensed company in Kenya that provides real estate and fund management services for a REIT scheme on behalf of investors. There are currently 10 REIT Managers in Kenya, including Cytonn Asset Managers Limited, Acorn Investment Management, and Stanlib Kenya Limited.

- The Trustee: A corporation or company appointed under a trust deed and licensed by the CMA to hold real estate assets on behalf of investors. The trustee's primary role is to act in the best interests of investors by evaluating investment proposals from the REIT Manager and ensuring compliance with the Trust Deed. REIT trustees in Kenya include Kenya Commercial Bank (KCB) and Co-operative Bank.

- Project/Property Manager: The project manager oversees the planning and execution of construction projects within the REITs. Meanwhile, the property manager handles the management of completed real estate developments acquired by a REIT, with a focus on generating profit.

The relationship between key parties in a typical REIT structure is depicted in the figure below;

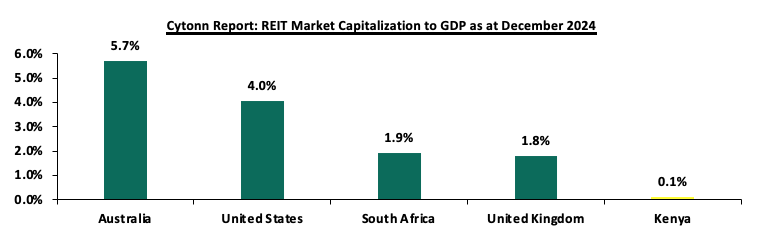

Since its introduction in 2013, the REIT market in Kenya has faced several hurdles that have hindered its growth. Key challenges include the hefty capital requirement of Kshs 100.0 mn for trustees, limiting this role largely to banks, and a protracted approval process for setting up REITs. Additionally, the high minimum investment threshold of Kshs 5.0 mn discourages potential investors, while a lack of sufficient investor education and awareness further impedes market expansion. As a result, the REIT market capitalization in Kenya remains significantly lower compared to other regions

The underdeveloped capital markets in Kenya has continually failed to provide alternative means of financing Real Estate developments. Due to this, most property developers rely on conventional sources of funding such as banks, compared to other developed countries. As a result, Kenya’s REIT Market Capitalization to GDP has remained significantly low at 0.1%, compared to other countries such as South Africa with 1.9%, as shown below;

Source: European Public Real Estate Association (EPRA), World Bank, Cytonn Research

Most property developers in Kenya continue to rely on traditional funding sources, such as banks, unlike in more developed markets. Since the establishment of REIT regulations, four REITs have been approved in Kenya, all structured as closed-ended funds with a fixed number of shares. However, none of these REITs are actively trading on the Main Investment Market Segment of the Nairobi Securities Exchange (NSE). Following the recent delisting of ILAM Fahari I-REIT, LAPTrust Imara I-REIT is the only listed REIT in the country, quoted on the restricted market sub-segment of the NSE's Main Investment Market. It is important to note that Imara did not raise funds upon listing. The ILAM Fahari I-REIT, Acorn I-REIT and D-REIT are not listed but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. The table below outlines all REITs authorized by the Capital Markets Authority (CMA) in Kenya

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

# |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

July 2024 |

Unquoted Securities Platform (USP) |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

March 2023 |

Restricted Market Sub-Segment of the Main Invesment Market |

Restricted |

Source: Nairobi Securities Exchange, CMA

Section II: Themes that Shaped the REIT Sector in 2024

In this section, we examine the key themes that have significantly shaped the REIT sector in 2024. We explore how evolving regulations, strategic acquisitions, and capital-raising initiatives have influenced the REIT industry's trajectory. Additionally, we provide insights into the broader factors that have impacted the sector's performance and overall direction during this period.

- Regulations

REITs are formally established in accordance with regulations set forth for Real Estate Investment Trusts (REITs) and granted approval by the Capital Markets Authority (CMA) under the Capital Markets Real Estate Investment Trusts Collective Investment Schemes Regulations of 2013. Instead of taking the form of conventional companies, they are structured as trusts. The management of investment properties falls under the purview of a corporate REIT manager, licensed by the CMA. Units of listed REITs are traded on the Nairobi Securities Exchange (NSE), akin to shares of any other company listed on both the Main Market Segment and the Unquoted Security Platform (USP), providing investors with a liquid stake in Real Estate. Both individual and corporate investors have the opportunity to partake in a public offering on the NSE, as outlined in the Regulations of 2013.

Furthermore, the regulations stipulate that Kenyan REITs are mandated to distribute a minimum of 80.0% of distributable earnings to their unitholders. REITs automatically qualify for several tax exemptions such as the Income Tax Act (ITA), Value Added Tax (VAT), and Capital Gains Tax (CGT) under the authorization of the Kenya Revenue Authority (KRA). Some of the recent regulatory transformations in the REITs industry include;

- Exemption from Income Tax Act

Section 20 (1) (c) and (d) of the Income Tax Act (ITA) mandates that, upon registration with the Commissioner of the Kenya Revenue Authority (KRA), both REITs and the companies they invest in are exempt from the standard 30.0% Income Tax Rate (ITR). Furthermore, income distributed by REITs to their investors (unitholders) is not taxed. However, this exemption does not apply to the withholding tax on interest income and dividends received by non-exempt unitholders, as outlined in the first schedule of the ITA. The applicable withholding tax rates can be found in paragraph 5 of the third schedule of the Income Tax Act.

- Capital Gains Tax (CGT) exemptions

A capital gain arises when the value of a unit upon transfer exceeds its adjusted cost. The disparity between these values is liable to a tax rate of 15.0%. Consequently, any profits made by a promoter or investors of a REIT from transferring property into the REIT are now subject to Capital Gains Tax (CGT) at the revised rate of 15.0%, supplanting the previous rate of 5.0% effective from 1 January 2023. Additionally, individuals holding units in a REIT who opt to sell their ownership stake are also required to remit CGT. This stipulation emerged following an amendment to Section 34 (1) (j) of the Income Tax Act through the Finance Act 2022.

However, within the REIT industry, there are certain scenarios that qualify for exemptions from CGT:

- Transfers of property from life insurance companies to a REIT are exempt from CGT, as outlined in Section 19 (6B) of the Income Tax Act (ITA),

- Indirect transfer of property into a REIT when the promoter first transfers properties to a Special Purpose Vehicle (SPV). Subsequently, the shares of the investee company held by the SPV are transferred to the REIT. This is considered a restructuring, as the property transfer does not involve a third party. This exemption is based on Paragraph 13 of the Eighth Schedule to the ITA. However, CGT is applicable on gains made during the transfer of shares from the investee company to the REIT Trustee,

- Payments received by unit holders or shareholders in a REIT for unit redemption or share sale are exempt from CGT in accordance with section 20 (2) of the ITA, and,

- Gains realized by the REIT from the sale of properties, whether directly or through an SPV, are also exempt from CGT.

- Exemption from Value Added Tax (VAT)

The Finance Act 2021 reinstated a significant alteration concerning the exemption from Value Added Tax (VAT) for transactions involving the transfer of assets to REITs and asset-backed securities. This exemption had previously been rescinded by the Tax Laws Amendment Act No. 2 of 2020. In line with Paragraph 33 of Part II of the First Schedule to the VAT Act 2021, a direct transfer of property from the REIT promoter or investors is not subject to VAT. However, if the transfer of assets to the REIT occurs indirectly, through the initial transfer of assets to the investee company, VAT will apply. It is noteworthy that the transfer of shares from a REITs SPV to the REIT trustee will be exempt from VAT, regardless of whether the initial asset transfer involved VAT.

- Reintroduction of Stamp Duty from January 2023

In accordance with the Stamp Duty Act's Section 96A, transfers of stabilized properties from Development REITs (D-REITs) to Income REITs (I-REITs) were previously exempt from stamp duty. However, this exemption expired on December 31, 2022. Effective January 1, 2023, such transfers are now subject to stamp duty as per Section 96A subsection 4.

The intricate nature of REIT regulations, combined with the complexity of the REIT structure, can make it challenging for individuals to understand the tax implications of their investments. This lack of clarity can deter potential investors, fostering skepticism about the fairness and reliability of the REIT market.

Moreover, the limited public information available on REIT regulations exacerbates this issue. Investors who are unaware of the tax consequences of their decisions may avoid investing altogether or make uninformed choices, potentially impacting their financial returns.

To address these concerns, it is crucial for both the government and REIT stakeholders to prioritize the following: i) Enhanced Transparency: Increase public access to clear and concise information about REIT regulations and tax implications, ii) educational Initiatives: Launch educational campaigns and provide resources to inform investors about REITs and their associated tax considerations, iii) collaboration: Foster collaboration between regulatory authorities and industry stakeholders to raise awareness about the benefits and drawbacks of REIT investments, iv) Clear Documentation: Provide easily understandable documentation outlining the tax implications of various investment scenarios, and, v) Consultation Services: Establish accessible consultation services to allow investors to seek expert advice on tax-related aspects of REIT investments.

By implementing these measures, we can help create a more informed and confident investment environment for REITs in Kenya.

- Portfolio Holdings & Acquisitions

Acquisitions play a pivotal role in the dynamic landscape of the Kenyan REITs industry. These strategic moves signify the industry's evolution, adaptability, sustainability, and growth potential. As of January 2024, the industry has witnessed noteworthy acquisitions that are reshaping the sector. These acquisitions hold a promising outlook for the industry, contributing to its progress and value proposition. They exemplify how REITs are actively enhancing their portfolios, expanding their market presence, and optimizing their performance. Some of the notable acquisitions in 2024 include;

- LAPTrust Imara I-REIT possesses a diversified portfolio of properties which include; i) Pension Towers, Metro Park, and CPF House which are commercial office buildings located in Nairobi CBD, ii) Retail centre Freedom Heights mall located in Lang’ata, iii) Nova Pioneer which is a purpose-built educational facility located in Eldoret, iv) Freedoms Height residential apartments and serviced plot located in Lang’ata, and, v) Man apartments located in Kilimani,

- ILAM Fahari I-REIT manages and operates several properties under their portfolio which include: i) a mixed used development (MUD) Greenspan Mall located in Donholm, Nairobi, ii) 67 Gitanga Place which is a prime office property located in Lavington, and, iii) Bay Holdings and Highway House which are industrial properties located in Industrial Area and Mombasa Road area respectively,

- Acorn Student Accommodation (ASA) I-REIT has five completed student housing properties with 3,003 beds under their management serving up to 128 universities and colleges. These properties include; Qwetu Jogoo Road, Qwetu Ruaraka, Qwetu WilsonView in Lang’ata, Qwetu Parklands, and Qwetu Aberdare Heights I along Thika Road next to United States International University Africa (USIU-A). On the other hand, Acorn D-REIT boasts of four properties which are currently operational and six other properties under development bringing to a total of ten properties with 10,060 beds under its portfolio. Operational properties include; Qwetu Hurlingham, Qwetu Abedare Heights II, Qwetu Karen, Qejani Karen whereas properties under development include; Qwetu Chiromo, Qejani Chiromo, Qejani JKUAT next to Jomo Kenyatta University of Agriculture and Technology, Qejani Hurlingham, Qwetu KU, and Qejani KU next to Kenyatta University,

- In 2024, Acorn Student Accommodation Development REIT (ASA D-REIT) announcedit had sold its stabilized asset, Qwetu Aberdare Heights II, to the Acorn Student Accommodation Income REIT (ASA I-REIT) in a Kshs 1.5 bn deal. The acquisition of the 630-bed capacity hostel located adjacent to Qwetu Aberdare Heights I and United States International University (USIU) brings the total number of assets acquired by the I-REIT to four over the last three years, after successful acquisitions of Qwetu Hurlingham in June 2023, Qwetu WilsonView in February 2021, and Qwetu Aberdare Heights I in October 2022. Through the sale, ASA D-REIT will repay Kshs 600.0 mn of the Acorn Green Bond, pushing the repayment of the Kshs 5.7 bn bond to Kshs 3.0 bn ahead of its maturity in November 2024. The bond which was first floated in 2019, was issued in partnership with Private Equity Fund Helios and had attracted an 85.0% subscription rate, raising Kshs 4.3 bn of the targeted amount of Kshs 5.0 bn. The bond was priced at a rate of 12.3%, and was intended to be used to finance sustainable and climate-resilient student accommodation with a combined capacity of 40,000 beds. Later in the year, the student accommodation developer Acorn Holdings announced that it has fully redeemed its Kshs 5.7 bn green bond before its scheduled maturity on November 8, 2024. The firm announced that it had paid the balance of Kshs 2.7 bn from the paper, alongside the accrued interest, on its five-year medium-term note issued in November 2019, and

- During the year, the Capital Markets Authority (CMA) granted a license to Mi Vida Homes Limited to operate as a REIT Manager in efforts to strengthen and develop the country’s capital markets. This brings the total number of REIT managers in Kenya to 11. As a REIT Manager, the company will offer Real Estate and fund management services for Real Estate investment trusts (REITs) on behalf of investors within a REIT scheme. We expect this milestone will open exciting new opportunities for investors and further develop our country’s Real Estate market, as the country’s REIT market remains underdeveloped and relies primarily on conventional funding alternatives.

- Future Construkt Investment Managers Ltd, a subsidiary of Construkt Africa LLC was granted a REIT Manager license by the Capital Markets Authority-Kenya. It is expected that this significant milestone will position the company to attract institutional capital, aligning with its strategic goal of developing large-scale, green affordable housing projects and subsequently managing its institutional-grade commercial property portfolios. In line with its vision, Construkt Africa had recently launched Teja Spaces, a premier co-working office at Delta Riverside Office Park, offering flexible workspaces and premium amenities marking the first of many planned projects as the company continues its regional expansion,

- Centum Investment Company announced a plan to introduce Kenya's first dollar-denominated Income Real Estate Investment Trust (I-REIT) at its Two Rivers development in Nairobi. This strategic move aims to attract international investors seeking exposure to Kenya's real estate market while mitigating currency risk. The proposed I-REIT will focus on income-generating properties within the Two Rivers precinct, including office spaces, retail outlets, and residential units. By denominating the fund in U.S. dollars, Centum seeks to provide a hedge against the volatility of the Kenyan shilling, offering more stable returns for foreign investors.

In the future, we expect REITs to maintain a strategic acquisition strategy. This will involve actively seeking opportunities to expand their portfolios, diversify their holdings, and respond to evolving market demands. Additionally, REITs are likely to prioritize environmental sustainability, as exemplified by Acorn Holding's issuance of green bonds. Such acquisitions can also stimulate innovation within the industry, encouraging the development of new ideas, designs, and services that cater to the needs of both investors and tenants.

- Capital Raising

Raising capital is essential in the REITs industry, fueling growth, development, and innovation. Securing funds from diverse sources, whether through debt or equity, enables REITs to expand their portfolios, improve existing properties, and explore new investment opportunities. This practice benefits the REITs and significantly shapes the Real Estate landscape, providing attractive investment options to stakeholders. Some of the notable capital infusion in the REITs industry as of 2024 include;

- Acorn Holdings, a student hostel developer in Nairobi announced a bid to raise Kshs 2.8 bn in new capital for its development and income Real Estate Investment Trusts (REITS) by February 2025 to fund the development and acquisition of new properties. The firm targets Kshs 1.9 bn for the Acorn student accommodation I-REIT and Kshs 810.0 mn for the D-REIT, which is set to be raised through a combination of a rights issue that closed on 31st July and open market offer which continues until February 2025. Acorn offered an open market price of Kshs 24.54 for the D-REIT and Kshs 22.03 for the I-REIT with existing unit holders enjoying a discount of 0.6% during the rights issue offer period which has since expired. The recent offer by Acorn Holdings forms the third supplemental cash call made by the firm since inception of the REITs, following similar issuances in 2022 and 2023 making this strategy the primary capital raising instrument for the company. As at the end of June 2024, the ASA D-REIT holds 11 properties under different development stages, with a total valuation of Kshs 10.9 bn. These properties include two hostels in Karen under the company’s Qwetu and Qejani brands, which the firm expects to offload to the I-Reit by the end of Q1’2025. Similarly, the ASA I-REIT holds a portfolio of 7 hostels with a combined valuation of Kshs 10.3 bn as at June 2024 with the most recent acquisitions being the Qwetu Hurlingham in September 2023 and Qwetu Aberdare Heights II in January 2024.

- The Acorn D-REIT currently has an outstanding Kshs 1.86 bn green bond issued in October 2019, which financed eight hostel projects. The company had acquired Kshs 5.7 bn and has been making early repayments before the debt matures in November 2024. In February 2022, the D-REIT contracted a Kshs 6.7 bn loan from Absa Bank to fund 10 hostel projects, out of which Kshs 1.0 bn had been drawn down by June 2024 for ongoing projects at Juja, Kenyatta University and Hurlingham.

- The Linzi Sukuk bond was launched on July 31, 2024, marking Kenya's first Sharia-compliant bond aimed at funding affordable housing projects. President William Ruto announced that the KShs 3 bn (approximately USD 20 mn) bond would finance the construction of 3,069 affordable housing units, significantly reducing the cost of home ownership for many Kenyans. The initiative allows potential homeowners to pay as little as KShs 7,000 per month over a 15-year period for homes valued at an average of KShs 1.4 mn. The Sukuk bond was structured to align with Islamic finance principles, which prohibit interest payments and instead provide investors with a share of profits from the underlying assets. The bond is expected to create thousands of jobs and stimulate economic growth by leveraging private funds for public housing. President Ruto emphasized the importance of using public land for these developments, arguing that it helps combat land speculation and ensures that housing benefits a broader segment of the population

- Delisting & Listing on the USP

ILAM Fahari I-REIT's delisting from the Main Investment Market Segment (MIMS) of the Nairobi Securities Exchange (NSE) was a strategic response to operational difficulties and the need for structural optimization. After receiving approval from the Capital Markets Authority (CMA), ILAM Fahari transitioned to a Restricted I-REIT, focusing on professional investors. This shift from the unrestricted segment to a restricted one highlights the REIT's challenges and its proactive restructuring approach. Operational issues prompted a reassessment, leading to resolutions at an Extraordinary General Meeting (EGM) in December 2023, where the decision to convert to a restricted REIT and delist received strong support from unitholders.

Implications of Delisting:

- Non-Professional Unitholders: Retail investors had to choose between accepting the redemption offer, which ended their unitholder status, or retaining units with post-conversion trading restrictions.

- Professional Unitholders: They remained largely unaffected, with the ability to trade units on the Unquoted Securities Platform (USP), though liquidity concerns persist.

- Tenants and Regulators: Minimal impact was observed, with the CMA continuing regulatory oversight as the REIT shifted to a Restricted I-REIT.

ILAM Fahari’s delisting and conversion were aligned with its goal to focus on professional investors, offering them specialized investment opportunities, enhancing flexibility, and unlocking growth potential. While this restructuring aids operational efficiency and capital raising, it limits retail investor participation, signaling a shift towards catering to high-net-worth individuals. Going forward, capital raising through equity, debt, and strategic partnerships, particularly in affordable housing and infrastructure, will be crucial in driving the expansion and sustainability of Kenya's REIT industry. Collaborative efforts, regulatory support, and investor education will be key to ensuring successful capital raising and a vibrant future for the sector.

During 2024, ICEA Lion Asset Managers (ILAM) Fahari I-REIT was admitted to the Unquoted Securities Platform (USP) of the Nairobi Securities Exchange (NSE), following their delisting from the main investment market in February 2024. ILAM Fahari joined Acorn I-REIT, Acorn D-REIT, and Linzi Sukuk in the USP, marking the first trading day in the segment. The delisting from the Main Investment Market Segment (MIMS) of the NSE will provide greater flexibility in managing the REIT's portfolio without affecting the unitholders’ ability to trade their units. The REIT’s shares (units) were available for trading on the platform at a fixed price of Kshs 11.0, representing the price at which a section of minority investors was bought out last year by ILAM, which is also the manager of the REIT.

Section III: Challenges and Opportunities in the REITs Sector

Kenya’s REIT market is evolving, and while it offers promising investment prospects, several challenges continue to shape its growth trajectory. At the same time, these challenges create opportunities for strategic improvements and market expansion of the sector;

- Regulatory and compliance hurdles

One of the major challenges confronting the REIT market in Kenya is the evolving regulatory framework. Although the Capital Markets Authority (CMA) has introduced guidelines to enhance transparency and protect investors, frequent changes and complex compliance requirements often create uncertainty for REIT managers and potential issuers. The intricate registration process and continuous updates in regulatory policies can discourage market participants, limiting the number of listings. However, this challenge also provides an opportunity for the industry to collaborate more closely with regulators, streamlining processes and establishing more predictable compliance standards that could, in turn, bolster investor confidence and market stability. The REITS association of Kenya can help to advocate for clear, stable and supportive frameworks and streamlining of compliance processes to reduce uncertainties for REIT managers and issuers. Some of the regulatory and compliance challenges include:

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

- Lengthy approval processes for REIT creation, and,

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only.

- Market liquidity constraints

Liquidity remains a significant challenge for Kenyan REITs. The relatively small number of REIT listings on the Nairobi Securities Exchange (NSE) has resulted in lower trading volumes, which makes it difficult for investors to enter or exit positions quickly. Limited secondary market activity has often led to wider bid-ask spreads, reducing overall market efficiency. On the upside, this situation encourages market stakeholders to work on initiatives aimed at increasing awareness and participation. Efforts to attract more diverse investors and promote secondary market trading can improve liquidity, making the REIT market more vibrant and accessible.

- Investor awareness and confidence

A critical challenge in the Kenyan REIT landscape is the insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products. The low level of investor awareness about these investment vehicles. Many local investors are still more comfortable with traditional bank deposits and direct property investments. Historical performance issues in some segments of the real estate market, coupled with a lack of comprehensive educational initiatives, have contributed to cautious investor sentiment. This challenge, however, presents a considerable opportunity. By launching targeted investor education programs, hosting seminars, and enhancing market transparency through better reporting and digital platforms, REIT managers can gradually shift public perception. Building a robust narrative around stable, income-generating real estate investments can lead to increased participation and sustained growth in the market.

- Economic volatility and market uncertainties

Macroeconomic factors such as currency fluctuations, inflationary pressures, and interest rate adjustments pose risks for the REIT market. Economic volatility directly impacts property valuations and rental incomes, making it more challenging to forecast returns accurately. These uncertainties may lead to conservative lending practices and cautious investment behaviors. Nonetheless, the inherent volatility also creates opportunities for REITs to diversify their portfolios. By investing in a mix of asset classes—such as commercial, industrial, and residential properties—REITs can mitigate risks and build more resilient revenue streams. Additionally, partnerships with government agencies and financial institutions to secure favorable financing terms can further stabilize the market during turbulent economic periods.

- Operational and management challenges

Managing a diverse portfolio of real estate assets across different regions requires advanced operational systems and strategic expertise. Inefficient property management, underutilization of assets, and the lack of technological integration can hinder the overall performance of REITs. This challenge, however, also opens the door for innovation. The adoption of modern property management software, digital leasing platforms, and data-driven decision-making tools can significantly enhance operational efficiency. By embracing technology, REITs can reduce costs, improve tenant satisfaction, and increase overall yields, thereby creating a more attractive proposition for investors.

- Opportunities for growth and expansion

Despite the challenges, the opportunities in the Kenyan REIT market are significant. Rapid urbanization in major cities such as Nairobi, Mombasa, and Kisumu are driving demand for quality commercial and residential spaces. Government initiatives to improve infrastructure and attract foreign investment further enhance the market potential. With supportive policy reforms and a growing emphasis on financial inclusion, REITs are well positioned to tap into new asset classes and diversify their investment portfolios. By capitalizing on these trends, REITs can not only improve their performance but also play a crucial role in shaping Kenya’s broader real estate landscape. The two upcoming Cities: Eldoret and Nakuru will see an increase in demand for Real Estate infrastructures in retail, hospitality, office, residential, and industrial spaces.

Addressing these challenges will go a long way ensuring the sector thrives and the funding constraint improves. The REITS association of Kenya can intervene and advocate for the rights and welfare of the REITs managers and issuers

Section IV: Conclusion, Recommendations, and Outlook for the REITs Sector

Kenya's REITs market has seen moderate performance, shaped by various factors. Despite challenges, there are encouraging trends, such as growth in net operating incomes, indicating improved financial performance. Additionally, leverage ratios for most REITs have remained low, with many REITs being ungeared and relying on short-term debt for their operations to avoid overexposure to rising interest rates. This trend is expected to continue as REITs seek to maintain financial sustainability, as evidenced by Acorn Holdings' issuance of a green bond. Moreover, the recent regulatory proposal by the Capital Markets Authority (CMA) to reduce the minimum investment amounts for professional investors to Kshs 10,000 is anticipated to increase interest in the sector and attract a broader investor base.

Recommendations to Enhance the REITs Sector:

- Stakeholder education: There is a pressing need to educate all key stakeholders on the REIT structure. Implementing comprehensive investor education and awareness campaigns is essential to inform potential investors about both the benefits and inherent risks of REIT investments. By enhancing investor knowledge and understanding, a larger pool of individuals can be encouraged to participate in the REIT market, ultimately driving its growth and fostering sustainable development.

- Expanding legal entities: In South Africa, the REIT framework allows for a variety of legal entities to form REITs, unlike in Kenya where the structure is predominantly limited to trusts. In countries like Belgium and the United States, REITs can be established using diverse legal structures such as public limited companies, limited liability companies, cooperatives, or trusts. This flexibility accommodates different investor preferences and business models. To strengthen the Kenyan REIT market, it is advisable to broaden the range of permissible structures beyond traditional trust models to include corporations, partnerships, and limited liability companies. Such diversification would better cater to various investor needs and lower the barriers to market entry, ultimately promoting a more robust and dynamic REIT sector.

- Streamlined approval process: To enhance the efficiency of REIT approvals, consolidating the current dual-agency process—managed by the Capital Markets Authority (CMA) and the Kenya Revenue Authority (KRA)—into a single regulatory body is recommended. By centralizing the approval process, REIT managers and potential issuers would no longer need to navigate two separate regulatory frameworks. This consolidation is expected to streamline the process, reduce associated costs, and improve overall transparency and accountability.

- Introduce hybrid REIT vehicles: At present, investors are often required to subscribe to separate REIT classes, which leads to duplicate costs and complicates the investment process. Introducing a hybrid REIT structure would integrate the high returns associated with development-focused assets with the stable income streams characteristic of income-oriented REITs. Such a unified vehicle would simplify the investment process by eliminating redundant costs and offering investors a balanced risk-reward profile, thereby enhancing overall market appeal.

- Flexibility in listing: Given the apprehensions of many companies regarding an immediate shift to public listing, a phased approach is recommended. Providing REITs with an initial period of private operation before mandating public listing could ensure a smoother transition and align with corporate comfort levels. For example, Belgium’s model—requiring 30% public shareholding—strikes a balance between public participation and promoter flexibility. Kenya could adopt a similar strategy, or even consider offering REITs the choice between public and private listings, which would foster inclusivity and better accommodate diverse investor preferences while bolstering market liquidity.

- Lower capital requirement for trustees: Currently, the minimum capital requirement for REIT trustees is set at Kshs 100.0 mn, a threshold that effectively restricts trusteeship primarily to major banking institutions. With only a handful of banks registered as REIT trustees—such as Kenya Commercial Bank (KCB), Co-operative Bank, Housing Finance Bank, and NCBA Bank Kenya—it is recommended that this minimum be reduced to Kshs 10.0 mn. This adjustment, aligning with the minimum standards set for Pension Fund Trustees, would expand the pool of potential trustees and encourage more competitive, innovative service provision for REIT managers.

- Introduce tokenization of REITs: Embracing the concept of tokenization presents an innovative avenue to broaden market participation. By digitizing REIT units into smaller denominations—potentially allowing investments as low as Kshs 100.0—it becomes possible to lower entry barriers, enhance liquidity, and attract a broader range of investors, including those with limited capital.

- Diminishing Entry Barriers: Revisiting the current minimum investment requirement of Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for the restricted I-REIT, is essential to eliminate barriers that restrict individual participation. Notably, given that D-REITs are riskier compared to I-REITS, it makes no sense having I-REITs with higher minimum investment requirements compared to D-REITs. Lowering this threshold to Kshs 50,000 for I-REITs would foster a more inclusive investment environment, allowing a wider array of investors to access and benefit from the REIT market, ultimately bolstering overall market vibrancy and liquidity.

The outlook for Kenya's REITs sector remains cautiously optimistic. While challenges such as high construction costs and market saturation in certain areas persist, the continued government support through infrastructure development and affordable housing initiatives provides a positive backdrop. Investors are expected to remain focused on income-generating REITs, particularly those tied to resilient sectors like retail and commercial properties. The sector's growth will likely hinge on increased investor awareness and the broadening of investment options within the REITs market.

In 2025, we expect REITS to gain popularity as developers such as Future construkt being licenced as REIT managers by the Capital Market Authority. Centum Real Estate are looking forward to launch a dollar based Income REIT and we expect that the dollar based I-REIT will: i) increase foreign investments by boosting investors’ confidence against local currency uncertainties, ,ii) dollar-denominated REITs provide an alternative for investors seeking more liquid and globally recognized investment options, iii) the dollar based move is likely to set a precedent for other players in the market, encouraging the development of more innovative and investor-centric financial products, and, iv) the fund could force policy regulatory framework improvement to ensure transparency and investments protection.

In addition, we expect the sector will continue to lag behind in comparison to other African countries such as South Africa, attributable to several challenges facing the sector such as; i) lack of sufficient investor awareness regarding the potential of REITs as an investment tool, ii) lengthy approval procedures for establishing REITs have hindered their formation and deployment in the market, iii) high minimum capital requirement of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only,, and, iv) steep minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs.

However, we also expect the trend of strategic acquisitions to persist, with REITs actively seeking opportunities to broaden and diversify their portfolios, cater to evolving market demands and also set standards in promoting environmental sustainability such as execution of green bonds by Acorn holding. While there are supportive factors for the growth of REITs in Kenya, such as urbanization and government infrastructure projects, challenges like high interest rates and regulatory constraints may tamper performance. Stakeholders in the REIT sector are advised to monitor these dynamics closely and engage in strategic planning to navigate the evolving market landscape effectively.

Moving forward, we also expect the trend of strategic acquisitions to persist, with REITs actively seeking opportunities to broaden and diversify their portfolios, cater to evolving market demands and also set standards in promoting environmental sustainability such as execution of green bonds by Acorn holding.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.