Over the years the Kenyan government has put its best foot forward towards delivering affordable housing to its citizens. The current regime, since assuming office, has shown consistent commitment to addressing the existing housing deficit in the country, integrating housing and settlement as one of the five pillars of its Bottom Up Economic Transformation Agenda(BETA). The plan envisages delivering 250,000 new homes annually and growing the number of mortgages from 30,000 to 1,000,000, thereby increasing the percentage of affordable housing supply from 2.0% to 50.0% by 2027.

The Affordable Housing Bill 2023 represents a strategic attempt by the government to develop a pool of resources geared towards the provision of affordable housing. The bill was first tabled in Parliament on 7th December, 2023 by the National Assembly Majority Leader Kimani Ichung’wa, to cure for the issues raised by the High Court. The fundamental concept of the bill is the contentious housing levy; first introduced in the Finance Bill 2023 under Section 84. In November 2023, the High Court rendered it a blow, terming it as unconstitutional, primarily for its opaqueness and discriminatory nature. The court’s decision was anchored on the grounds that the levy lacked a comprehensive legal framework, in violation of articles 10 and 201 of the Kenyan Constitution regarding principles of public finance. In addition, the Court noted that the levy was discriminatory in nature, since it would only be subjected to Kenyans in the formal sectors hence leaving out those in the informal sector.

In a race against time, the government, through the Majority Leader has sought to regularize the levy through the Affordable Housing Bill 2023. Simultaneously, the bill also seeks to iron out the fiscal grey areas that were pointed out by the court. Having already gone through the first reading, the bill is currently in the public participation stage. It seeks to mandatorily deduct 1.5% of an employee’s gross monthly salary and have a matching 1.5% contribution remitted by employers on behalf of each employee from their payroll on a monthly basis.

The bill has outlined its fundamental objectives as; i) to give the right to accessible and adequate housing, ii) to impose a levy to finance the provision of affordable housing and associated infrastructure, and, iii) provide a legal framework for the implementation of the affordable housing levy, programs and projects. Putting the above-mentioned into consideration, the government continues to demonstrate efforts in addressing the critical housing issue in the country. However, the bill comes against the backdrop of the High Court ruling and remains contentious especially because of the legality issues surrounding it. The anticipation of interesting developments implies potential legal complexities and uncertainties in the near future, with regard to the implementation and subsequent success of the levy in bridging the country’s housing gap. In our topical this week, we review the Affordable Housing Bill 2023 by covering the following;

- Overview of the Kenya’s Real Estate Sector,

- Current State of Housing in Kenya,

- Analysis of Affordable Housing Bill 2023, and,

- Conclusion and Recommendations.

Section I: Overview of Kenya’s Real Estate Sector

The Real Estate sector in Kenya has grown over the years to become one of the largest contributors to the country’s Gross Domestic Product (GDP), supported by factors such as; i) positive demographics including higher urbanization and population growth rates of 3.7% and 1.9% respectively, against global averages of 1.5% and 0.8%, ii) government’s sustained efforts to promote infrastructural development, opening up new areas for investments, iii) emphasis to provide affordable housing by the government through programs such as the Affordable Housing Program (AHP), iv) increased investment by both local and foreign investors, and, v) increased accessibility to low-interest loans provided by entities such as Kenya Mortgage Refinance Company (KMRC) among others.

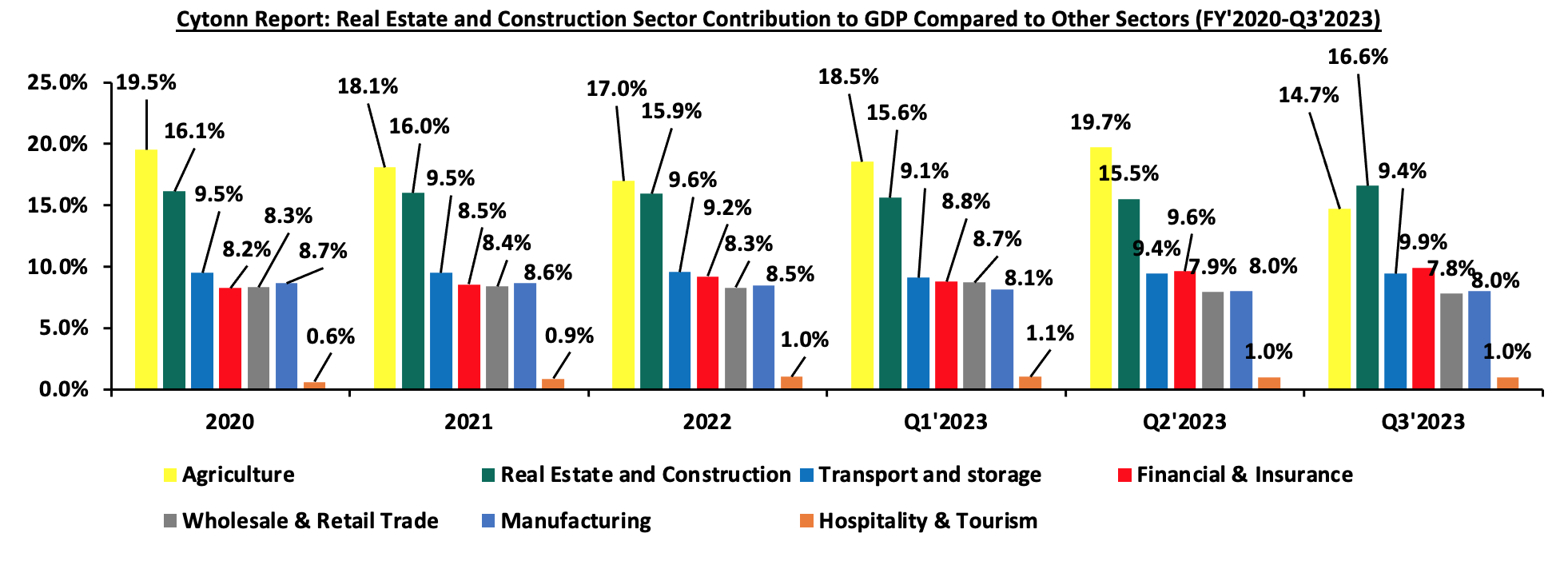

As we assess the growth in the Kenyan property market, it is imperative to recognize the growth achieved by the Real Estate sector, collaboratively with the construction sector, given their interdependence and inherent correlation. Construction and Real Estate sectors jointly contributed to 16.6% to the country’s GDP in Q3’2023, subsequently being the largest contributors. The performance surpassed major and perennial sector contributors including agriculture at 14.7%, transport at 9.4%, financial services and insurance at 9.9%, and

manufacturing which contributed 8.0%. The performance of the two sectors confirms their importance to the Kenyan economy, and additionally draws a positive outlook. The graph below shows the trend of the Real Estate and Construction sectors contribution to GDP between FY’2020 and Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

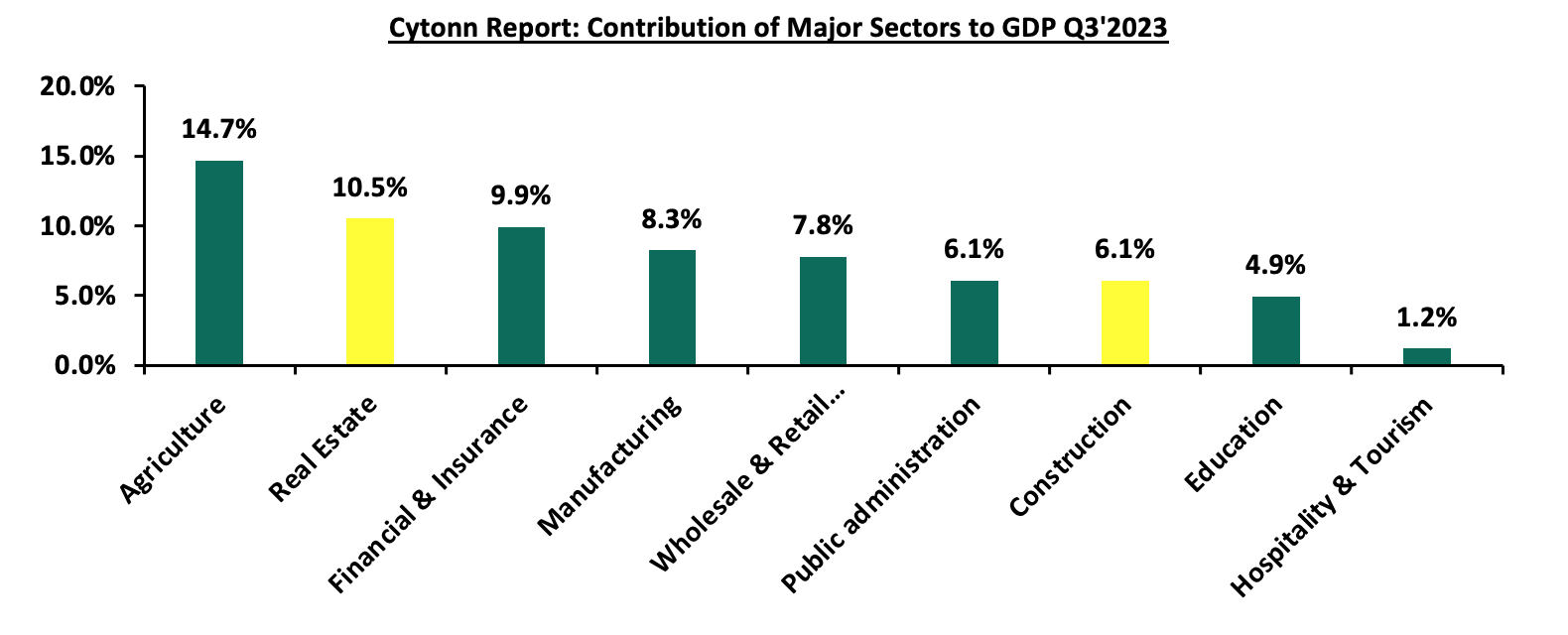

Below is a graph highlighting the top sectoral contributors to GDP in Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

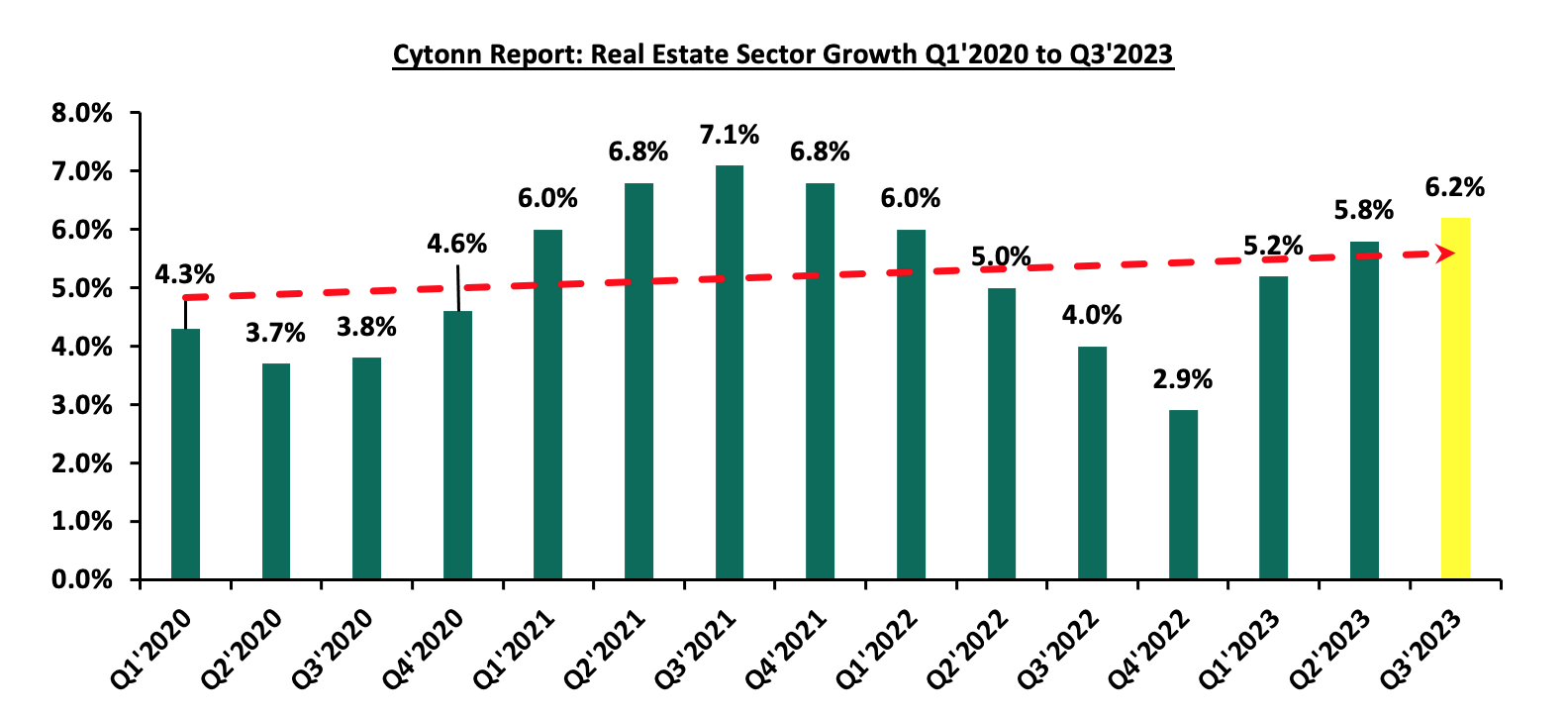

Despite the growth in the sector, the sector has also experienced some setbacks ranging from macro-economic factors to sector specific factors over the years. In FY’2020, the sector experienced the hardest shock from the unprecedented COVID-19 pandemic. However, the sector has since made a turnaround in FY’2021 as the business world embarked on reopening driven by mass administration of COVID-19 vaccine and ease of travel restrictions and lockdowns.

In 2022, however, the sector’s witnessed a turnaround in performance, reverting to a downward trajectory. Notably, the sector’s growth declined to 2.9% in Q4’2022 from 6.0% in Q4’2021, attributable to the August general elections. In the period leading to the elections, investors faced uncertainty as they assessed the country’s political environment. However, the electioneering period concluded peacefully which boosted investors’ confidence, and paved way for the resumption of business activities in 2023 as evidenced by the 5.2% growth rate recorded in Q1’2023.

We however note that the sector’s growth has been weighed down by other factors including an oversupply of 5.8 mn SQFT of commercial office space in the Nairobi Metropolitan Area (NMA), 3.3 mn SQFT in the NMA retail market, and 2.1 mn SQFT oversupply in the overall Kenyan retail market as at 2023, and harsh macro-economic environment. The graph below shows the Real Estate Sector Growth Rate between Q1’2020 and Q3’2023;

Source: Kenya National Bureau of Statistics (KNBS)

Section III: Current State of Housing in Kenya

According to the Center for Affordable Housing Finance Africa (CAHF), the demand for buying property in Kenya is at 45.1%, compared to a 35.1% demand for renting, as of August 2023 indicating a strong inclination among Kenyans towards possessing their residences. Standalone properties and apartments exhibit higher preference, with their demand estimated at 27.6% and 26.7%, respectively. However, urban homeownership rates in Kenya have remained low at 21.3%. This translates to a renter population of 78.7%, out of which, 89.0% of the existing and incoming supply is estimated to be delivered entirely by the private sector.

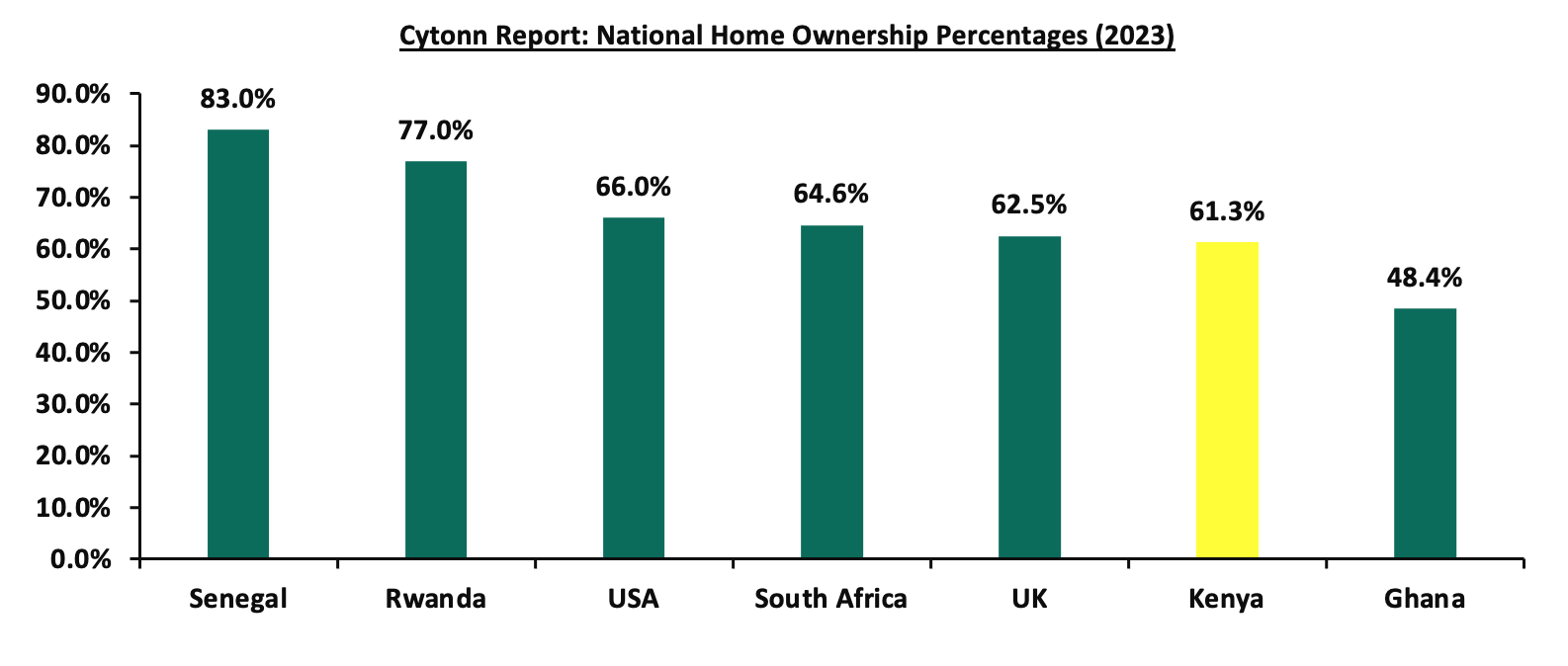

On a national scale, Kenya’s home ownership rate stands at 61.3%, albeit significantly higher than urban homeownership rates. Nevertheless, it remains lower than other African countries such as Senegal, Rwanda and South Africa with 83.0%, 77.0% and 64.6% respectively. The graph below shows national home ownership percentages of other countries as compared to Kenya;

Source: Centre for Affordable Housing Africa, US Census Bureau, United Kingdom Office for National Statistics

Additionally, the Centre for Affordable Housing Africa reports that Kenya faces an annual housing deficit of 200,000 units, exacerbating the existing shortage estimated a 2.0 mn units. While the demand stands at 250,000 units, both private developers and government cumulatively supply merely 50,000 units annually, with the low-income group severely underserved, allocated only 2.0% of the constructed units. The Government of Kenya, in December 2017, launched the Affordable Housing Program (AHP), as part of the Big Four Agenda, aimed towards tackling the housing deficit issue. It planned to deliver 500,000 low-cost housing units in 5 years. Since then, the government has further initiated the 200 Units per Constituency Program in an effort to localize the Affordable Housing Program and stimulate local economic growth while contributing to the Bottom Up Economic Transformation Agenda (BETA). The initiative has resulted in the following achievements in the Kenyan housing market over the years as follows;

- Incentives to developers,

- Operationalization of the Kenya Mortgage Refinancing Company (KMRC) which aims to provide affordable mortgages,

- Launch of the Boma Yangu Platform where Kenyans can access the housing units,

- Legislation of the Affordable Housing Levy, and,

- Construction of Affordable and Social projects.

For more information on the above achievements, please see our topical on the Progress of Affordable Housing in Kenya 2023 Report. Despite the progress made by the Affordable Housing Program (AHP), the objectives have not been fully met as the project faces various limitations such as;

- High construction costs: In 2023, construction costs increased by 27.0% to an average of Kshs 71,200 per SQM from an average of Kshs 56,075 per SQM recorded in 2022, attributable to the price increase of key construction materials such as cement, steel, paint and aluminum. The increase in price is as a result of relatively high inflation which was at 6.6% in December 2023,

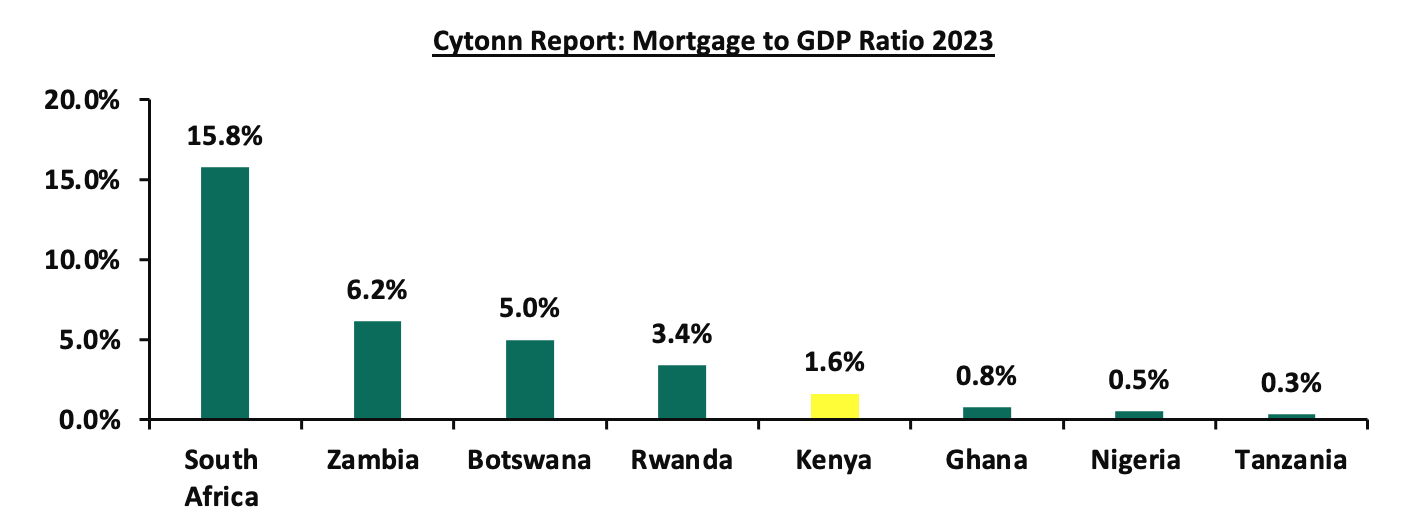

- Lack of access to affordable mortgages: Kenyans endure challenges while looking for financing to purchase homes due to high financing costs, which reduces the uptake of affordable homes and mortgages. As such, Kenya’s mortgage to GDP ratio continues to underperform at 1.6%, in comparison to other African countries such as South Africa, Zambia, Botswana and Rwanda at approximately 15.8%, 6.2%, 5.0%, and 3.4%. The graph below shows the mortgage to GDP ratio in Kenya in comparison with other African countries;

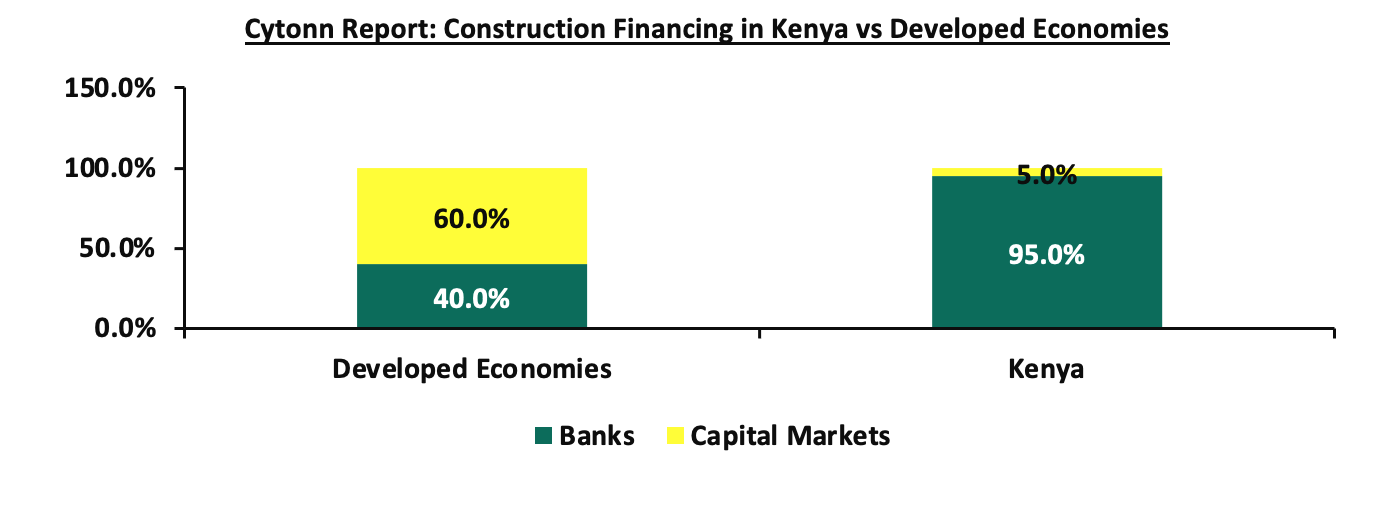

- Inadequate development financing: Lenders continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector. This is evidenced by the 20.9% increase in gross Non-Performing Loans (NPLs) to Kshs 96.0 bn in H1’2023 from Kshs 79.4 bn recorded H1’2022. In addition, there is overreliance on banks for the expensive funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding. The graph below shows the comparison of construction financing in Kenya against developed economies;

- Inadequate supply of serviced land: There is scarcity of affordable land serviced with support infrastructure such as water, sewerage and electricity necessary for development of affordable units. This is due to high land prices in urban areas with the average land prices in the NMA coming in at an average of Kshs 128.6 mn in FY’2023, and,

- Extended Timelines: Bureaucratic transaction timelines characterize property registration in Kenya, surpassing those of other African countries. The process takes an average of 159 days at an average cost of 2.8% of construction costs to obtain building permits. This is notably higher than countries such as Ghana, where the registration period is 10 days, ranging between a cost of 0.1% to 0.5%. These figures highlight the overall sluggish nature of processes in Kenya, indicating a need for improvement.

The Affordable Housing Levy

The Housing Levy was first introduced through the Finance Act of 2018, by way of amendments to the Employment Act, 2007. Under the levy, employers and employees were required to each make a contribution of 1.5% of the employee’s monthly basic salary to the Housing Fund, provided that the combined contribution did not exceed Kshs 5,000 per month. Persons who were not in formal employment or who were non-citizens were to contribute a minimum of Kshs 200 per month. The Fund was proposed to be under the control of the National Housing Corporation (NHC).

In September 2018, the Central Organization of Trade Unions (COTU) filed a suit, alongside lobby groups Consumer Federation of Kenya (Cofek) and the Federation of Kenya Employers (FKE) challenging the implementation of the housing levy which was set to take effect on 1st January 2019. COTU contested the implementation of the levy arguing it was unconstitutional and amounted to double taxation. The lobby groups also cited improper consultation of the policy by the government. This led to a court order suspending the implementation of the levy.

In March 2020, the Ministry of Housing set up several regulations regarding the structure and operations of the National Housing and Development Fund (NHDF) and presented the notice to the National Assembly in May for discussions and approval. Several key take outs from the notice were proposals to have; i) minimum monthly contribution of Kshs 200 to NHDF by all employees and employers who will be registered under the Fund, where the Kshs 100 was to be directed towards facilitating maintenance and operations of the Fund and the rest of Kshs 100 was to be directed to member’s housing fund accounts, ii) make the deductions voluntary and not mandatory as had previously been stated in the Finance Bill 2018, and, iii) providing full authority to the National Housing Corporation (NHC) in disbursement of loans to local authorities, organizations, companies and individuals for purchase and construction of affordable units, at an interest rate that will be adjustable from time to time. However, since the Ministry of Housing tabled the Housing Fund regulations in 2020, there were no amendments made to the deduction rates on wages until the Finance Act 2023.

In May 2023, under President Ruto’s government, the Cabinet Secretary for the National Treasury submitted the Finance Bill 2023 to the National Assembly for consideration for enactment into the Finance Act 2023. Among the various proposals in the bill was the re-introduction of the mandatory housing levy set at 3.0% of the employee’s gross monthly income, to be matched with the employer’s contribution that would be remitted to the National Housing Development Fund (NHDF). The deducted amount was required to be remitted to the collection agent by no later than the 9th day of the subsequent month following the deduction, and the cumulative deduction should not surpass Kshs 5,000. The main objective of the levy was to raise funds from various sources aimed at providing affordable housing to Kenyans. On 26th June 2023, the President assented the bill to the Finance Act 2023 which allowed the Treasury to begin collection of the levy.

It is essential to highlight that, prior to its enactment in June 2023, the finance bill precipitated the submission of constitutional petitions from various parties which challenged the constitutionality of the legislative process that resulted in the enactment of the Finance Act 2023.

In November 2023, a three-judge bench of the High Court ruled on the petitions, declaring the levy unconstitutional, on the basis that it was discriminatory in nature as it was to only be imposed on workers in the formal sector, disregarding those in the informal sector. The Court noted the policy was discriminatory, irrational, arbitrary and in violation of articles 27 and 201 (b) (i) of the constitution regarding principles of public finance. Additionally, the court ruled that the introduction of the Employment Act by section 84 of the Finance Act 2023 lacked a comprehensive legal framework in violation of articles 10, 201, 206 and 210 of the constitution respectively. Following the ruling, the High Court granted the government stay orders, allowing the National Treasury to continue with the collection of the levy for 45 days.

Subsequently, in December 2023, the Affordable Housing Bill was tabled in the National Assembly with the intention of addressing the issues raised by the High Court. The bill which was first tabled on 7th December 2023 is currently in the public participation stage. Alike previous legislations, it has not been without its challenges. Public participation was set to commence on 9th December 2023 to 28th December 2023 by the National Assembly through a published notice. In response to the short notice period, a Kisumu based lobby group moved to court under a certificate of urgency to halt the intended public participation on the Affordable Housing Bill 2023. On 20th December 2023, Kisumu High Court ordered the halting of the public participation on the bill pending the hearing of an inter-party application. However, despite the court order barring the exercise, the National Assembly has scheduled public forums and hearings across 19 counties commencing on 17th January 2024.

The Court of Appeal will on 26th January 2024 rule on the government’s application, seeking orders that suspend the High Court decision which declared the housing levy unconstitutional.

Section IV: Analysis of the Affordable Housing Bill 2023

- Imposition of Affordable Housing Levy

Section 4 of the bill mandates that both employed and non-employed individuals must remit the levy to designated collectors by the 9th of the subsequent month. Notably, the Kenya Revenue Authority (KRA) is earmarked as the primary collector. All funds collected, as stipulated by the Bill, are to be channeled into the Affordable Housing Fund, established to facilitate housing initiatives.

Employers bear the responsibility of deducting and remitting the levy from their employees' gross salaries, according to section 5 of the bill. Granting discretionary authority to the Cabinet Secretary for the National Treasury in consultation with the CS for Housing, the Bill allows for the exemption of specific income classes or groups from the levy. This provision aims to tailor the implementation to address potential disparities and challenges faced by particular segments of the population. We however note that a complete list of any income or class of income, persons or category of persons eligible for exemption is yet to be provided.

In the event of non-compliance by employers in remitting the levy, the bill prescribes a penalty of 3.0% of the total unpaid amount to be remitted to the Fund. However, concerns have been raised regarding the severity of this penalty, with suggestions for its reduction due to potential financial strain on businesses in the prevailing economic recession. The penalty's harshness could impose additional burdens on businesses already grappling with economic challenges. Advocates for a milder penalty argue that it would strike a balance between enforcing compliance and acknowledging the economic hardships faced by employers. This debate highlights the need for a nuanced approach to penalties, considering the broader economic context and the shared goal of fostering sustainable financial practices for both businesses and the Affordable Housing Fund.

- Establishment and Management of the Affordable Housing Fund

The legislative inception of the Affordable Housing Fund represents a strategic move aimed at financially supporting affordable housing initiatives in harmony with the goals set forth in the Affordable Housing Bill. This institutional framework stands as a pivotal stride towards realizing the broader objectives of the legislation. The Bill outlines diverse funding sources for the Fund, encompassing revenue from the affordable housing levy, income from investments, funds generated through statutory functions, and appropriations by the National Assembly.

The overarching mission of the Affordable Housing Fund is clarified, underscoring its role in funding affordable housing projects and the related social and physical infrastructure. The Fund is geared towards

- Facilitating the provision of funds for affordable housing and affordable housing schemes in the promotion of homeownership,

- Extending low-interest loans for the acquisition of affordable housing units within approved affordable housing schemes,

- Aiding scheme development in all counties,

- Developing long-term financial solutions for the development and off-take of affordable housing, Provide funds for the maintenance of any land or building, estate or interest therein for purposes of the Fund, and,

- Funding of any other activities’ incidental to the furtherance of objectives of the Fund.

Section 11 of the bill highlights the allocation plan, specifying designated percentages for various purposes to specified agencies, including; i) 30.0% to the National Housing Corporation, ii) 25.0% to slum upgrading, iii) 36.0% to institutional housing programs, iv) up to 2.0% to the levy collector, and, v) up to 2.0% to the Board for administrative tasks.

Crucial to effective governance, the Affordable Housing Bill establishes the Affordable Housing Board, tasked with overseeing Fund operations and ensuring resource allocation aligns with the Bill's objectives. The Board's composition includes;

- a non-executive chairperson appointed by the president,

- representatives from the National Treasury and State Department for Affordable Housing,

- appointees by the Cabinet Secretary,

- individuals with qualifications in the built environment, finance, or law appointed by the Cabinet Secretary, and,

- The Chief Executive Officer without voting rights.

The Board's duties involve i) coordinating optimal fund utilization for affordable housing programs, ii) ensuring efficiency and cost-effectiveness, iii) determining financial allocations based on a 5-year investment program, iv) managing and allocating funds per Section 11, v) ensuring annual allocations align with the approved work program, vi) limiting the use of funds for maintenance and rehabilitation to 5.0%, vii) monitoring and evaluating projects through audits, viii) complying with procurement regulations, ix) identifying potential revenue sources, x) approving fund accounts, xi) endorsing yearly budgets, and xii) performing other duties assigned by the Cabinet Secretary.

Qualifications for Board appointments emphasize expertise in housing and financial matters, with clearly defined tenures, vacancy filling procedures, and governance conduct regulations. Mandating transparency, the Bill requires Board members to disclose conflicts of interest, while addressing remuneration structures for Board members and the CEO to ensure equitable compensation.

Introducing the role of the Fund's administrator, responsible for day-to-day operations, fiscal safeguards are in place to prevent overdrawn scenarios, promoting financial prudence. The Bill addresses administrative costs, capped at 2.0% of the latest audited financial statement, empowering the administrator with access to pertinent information for effective decision-making. Administrative roles, including the Corporation Secretary, staff composition, and delegation of powers, are also outlined. The introduction of a common seal formalizes the authenticity of official documents and decisions, enhancing transparency and credibility. In summary, the section on the establishment and management of the affordable housing fund framework encapsulates a legislative framework crafted to oversee the affordable housing Fund and ensure responsible Fund utilization for the betterment of Kenya.

- Eligibility Criteria and Application Procedure for an Affordable Housing Unit

The eligibility criteria for affordable housing outlined in the bill require applicants to be Kenyan citizens, at least 18 years old, and possess a valid Kenyan ID. Applicants must submit formal applications to approved agencies. We however note that the list of specified agencies is yet to be provided thus creating uncertainty. The bill mandates agencies to prioritize marginalized individuals, vulnerable groups, youth, women, and persons with disabilities. The agency has the authority to off-take units under approved affordable housing schemes, subject to compliance with policy, statutory requirements, and additional criteria.

Beneficiaries seeking a change in allocated housing units must formally apply to the specific agency through which they made an application for a housing unit with, detailing the request for unit alteration and loan repayment transfer. The legislation introduces a loan application process for eligible beneficiaries, featuring interest rates based on a reducing balance. For social housing and affordable units, rates are at3.0% for both, and for affordable and market units 9.0%, respectively. The legislation categorizes affordable housing units into three distinct groups;

- Social Housing - Units intended for individuals earning less than Kshs 20,000 per month, with a plinth area of between 18-30 SQM,

- Affordable Housing - Units designed for those with monthly incomes ranging from Kshs 20,000 to Kshs 149,000, with a plinth area of 18-50 SQM and,

- Affordable Market Housing - Units aimed at individuals earning over Kshs 149,000 monthly, with a plinth area of 36-50 SQM.

Regarding voluntary savings, all the agencies must establish a dedicated bank account for participants, allowing withdrawals with a 90-day notice for a refund with accrued interest, if any.

- Financial and miscellaneous provisions of the Act including, penalties for offenders under the Act, repeal of Employment Act, 2007 among others

The bill requires the Fund's administrator to maintain accurate financial records, including income, expenditure, and assets, and submit the fund's accounts to the Auditor General within three months of each financial year's end.

Under the section, the Board is mandated to disseminate information about its activities through regular publications to keep the public informed. Violations of specified regulations may result in penalties upon conviction, with individuals facing fines of up to Kshs 10.0 mn or imprisonment for a period not exceeding 5 years.

Section 43 of the Affordable Housing Bill amends the Employment Act, 2007, by repealing sections 31B and 31C. The repeal implies that any payments made or actions taken under the repealed sections are considered to have been made or taken under the provisions of this Act. Furthermore, any commitments or obligations made by the national government regarding affordable housing, in accordance with the previous Act of Parliament, are now deemed to be commitments or obligations made under this Act.

In simpler terms, the changes in Section 43 mean that certain sections related to housing in the Employment Act, 2007, are removed and replaced by the Affordable Housing Bill. The repealed sections contained specific details about how employers should provide housing accommodation or additional sums for rent. The repeal means that the Affordable Housing Act, once enacted will now dictate the rules and regulations regarding employer responsibilities for affordable housing. Payments and actions taken under the old sections are still valid and considered under the new Act. Additionally, any commitments or obligations by the government for affordable housing, previously based on the Employment Act, are now considered commitments or obligations under the Affordable Housing Bill.

Section V: Recommendations and Conclusion

We recognize the efforts made by the bill to establish a legal structure for the affordable housing levy and address concerns raised by the High Court. Nevertheless, certain aspects of the bill necessitate additional consideration and resolution for enhanced practicality. In this regard, we present the following recommendations to the Kenyan government and all stakeholders involved in the implementation of the Housing Fund;

- Informal Sector Compliance: We note that the strategy for ensuring monthly deductions for the housing levy in the informal sector remains unclear. While it's straightforward to deduct from salaried Kenyans with pay slips, the same cannot be assumed for those without such documentation. It is therefore crucial for the government to provide a clear explanation of how it intends to ensure optimal compliance in the informal sector, as the current lack of articulation has resulted in speculation and uncertainty,

- Explicit Exemption Criteria: The bill needs to explicitly outline all circumstances warranting exemptions from mandatory contributions to the Levy. As it is, the bill does not expressly specify a list or provide clearly defined criteria for exemptions from the Levy, as is the case with other legislated Acts in the property sector. These include but are not limited to Stamp Duty and Capital Gains Tax Acts. The absence of a clearly defined list or criteria for Levy exemptions in the bill requires to be addressed in order to ensure transparency and promote public trust and compliance,

- Construction Approach and Risk Mitigation: The government should refrain from directly engaging in unit construction to mitigate potential citizen losses and avoid potential financial risks through government led projects, as well as to ensure timely project delivery,

- Alternative Development Approaches: Instead, the focus should be on emulating successful models employed in countries such as the United Kingdom and Zimbabwe, where the government promotes self-builds through providing serviced plots affixed with essential infrastructure either at a subsidized cost or free of charge to its citizens. It is worth noting that most governments are increasingly encouraging self-builds by offering citizens plots serviced with infrastructure (roads, footpaths, drainage) and utilities (water, electricity). Alternatively, the government ought to pursue more Public-Private Partnerships (PPPs) where under such arrangements, the government offers land and leaves construction and financing to developers. These approaches relieve the government of the responsibility of overseeing construction and subsequently the burden of funding developments,

- Optimized Fund Allocation: We propose the funds collected be used only towards the acquisition and provision of land, development of supporting infrastructure, strengthening the mortgage plan, and off-taking units from developers. This entails dividing the funds among three key areas: firstly, investing in the creation of essential infrastructure on land provided by the government; secondly, acquiring completed units from developers and thirdly, facilitating the provision of affordable home loans through the Tenant Purchase Scheme (TPS). In essence, the aim is to ensure a well-balanced distribution of resources to address infrastructure needs, expand housing finance availability, and make homeownership more accessible through affordable financing,

- Eligibility and Allocation Criteria: The bill provides that to qualify for affordable housing units, individuals must be Kenyan citizens aged 18 or above and possess an identity card. This implies that anyone able to meet deposit requirements, set as a percentage of the affordable housing unit's value (e.g., 10.0%), and having all necessary documentation, can apply for a unit, irrespective of whether or not they already have a house. However, there is a need for a more structured eligibility and allocation criteria prioritizing individuals with greater housing needs. This includes those currently without homes or living in informal settlements. This approach will foster and ensure a more equitable distribution of resources,

- Eliminate Ambiguity: The bill defines affordable housing as housing that is both adequate and costs no more than thirty percent of an individual's monthly income to rent or acquire. In principle, any residence, regardless of its cost, qualifies as affordable housing if the associated rent or mortgage payment constitutes less than 30.0% of a person's monthly income. This definition is therefore vague and needs refinement to eliminate any ambiguity as to what will constitute affordable housing under the legislation,

- Impose Milder Penalties: The proposed penalty in the Bill, set at 3.0% of the total unpaid amount to be remitted to the Fund, has sparked concerns over its severity. In the current harsh micro-economic environment, this harsh penalty could exacerbate the financial strain on businesses. As such, reducing it would strike a balance between enforcing compliance and recognizing the economic hardships faced by employers, thus fostering a more equitable approach in challenging times, and,

- Provide a Complete List of Agencies: While the bill establishes an eligibility criterion for affordable housing applicants, an ambiguity arises from the lack of specificity regarding the approved agencies to which formal applications must be submitted. This uncertainty could pose challenges for prospective applicants, as they may be unable to identify the specific entities responsible for processing their applications. Clarity on the list of specified agencies is crucial for ensuring a transparent and accessible application process, thereby promoting fairness and inclusivity in the distribution of affordable housing.

In conclusion, the recommendations outlined above are essential for refining and enhancing the effectiveness of the proposed affordable housing legislation. These refinements aim to create a robust framework that aligns with successful international models and optimizes the allocation of resources for a sustainable and equitable affordable housing solution in Kenya. In addition, the success of the Housing Fund levy in contributing to the Affordable Housing Program (AHP) will depend on the government's ability to effectively engage with stakeholders, address concerns raised, and ensure compliance with the set regulations.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor