According to the World Bank, the Sub-Saharan economy is projected to grow at 3.7% in 2022, which is significantly lower than the 4.2% growth estimates recorded in 2021. The expected slowdown in the region’s growth will be driven by continued supply constraints, outbreak of new COVID-19 variants and increased inflationary pressures. Concerns also remain high on the inflated import bill and widening trade deficit as oil prices continue to rise due to supply bottlenecks worsened by the geopolitical tensions arising from the Russia-Ukraine invasion given that most countries in the Sub-Saharan African are net importers.

Debt sustainability in Sub-Saharan Africa continues to be a major concern and as per World Bank’s Africa’s Pulse April 2022 , the region’s public debt to GDP ratio increased to 61.0% in 2021, from 60.0% in 2020. The public debt is expected to remain elevated following tightened global financial condition due to policy rates increase in the developed economies. Additionally, many countries are providing subsidies in order to mitigate inflationary pressures which could worsen public finance, increase public debt and weigh down on debt sustainability.

Currency Performance

All the select currencies depreciated against the US Dollar in H1’2022 as compared to H1’2021 where most currencies recovered following a sharp depreciation in 2020. The continued depreciation of the currencies in Sub-Saharan Africa is attributable to the increased inflationary pressures in many countries in the region given the effects of Russia’s invasion of Ukraine on commodity prices and supply chains. The Ghanaian Cedi was the worst performer in H1’2022 having depreciated by 29.1% on YTD. The performance is attributable to a deteriorating macroeconomic environment, amid increasing concerns over public debt sustainability with the public debt to GDP ratio reaching 81.8% in 2021 and is projected to rise further to 84.6% in 2022, coupled with affirmation of a negative outlook by Fitch ratings in May 2022. The Kenya Shilling depreciated by 4.1% in H1’2022 to close at Kshs 117.8 against the US Dollar, compared to Kshs 113.2 recorded at the beginning of the year. Below is a table showing the performance of select Sub-Saharan African currencies:

|

Select Sub Saharan Africa Currency Performance vs USD |

|||||

|

Currency |

Jun-21 |

Jan-22 |

Jun-22 |

Last 12 Months change (%) |

YTD change (%) |

|

Nigerian Naira |

410.5 |

412.4 |

415.1 |

(1.1%) |

(0.6%) |

|

South African Rand |

14.3 |

15.9 |

16.0 |

(12.1%) |

(0.9%) |

|

Tanzanian Shilling |

2319 |

2,304.5 |

2,330.5 |

(0.5%) |

(1.1%) |

|

Zambian Kwacha |

22.6 |

16.7 |

17.2 |

24.0% |

(2.6%) |

|

Mauritius Rupee |

42.7 |

43.6 |

45.0 |

(5.3%) |

(3.1%) |

|

Botswana Pula |

10.8 |

11.7 |

12.2 |

(12.8%) |

(3.8%) |

|

Kenyan Shilling |

107.9 |

113.2 |

117.8 |

(9.2%) |

(4.1%) |

|

Ugandan Shilling |

3556.8 |

3,544.6 |

3,749.5 |

(5.4%) |

(5.8%) |

|

Malawian Kwacha |

805.8 |

816.8 |

1,019.5 |

(26.5%) |

(24.8%) |

|

Ghanaian Cedi |

5.8 |

6.1 |

7.9 |

(35.9%) |

(29.1%) |

Source: S&P Capital

African Eurobonds:

During H1’2022, Africa Eurobonds recorded reduced activity with the latest issuers being Nigeria and Angola who raised USD 1. 3 bn and USD 1.8 bn in March and April 2022, respectively. The Africa’s appetite for foreign-denominated debt has been slowed down by pressures arising from the Russia-Ukraine tension and concerns around global interest rate hikes as a result of increasing inflationary pressures across most developed and developing countries.

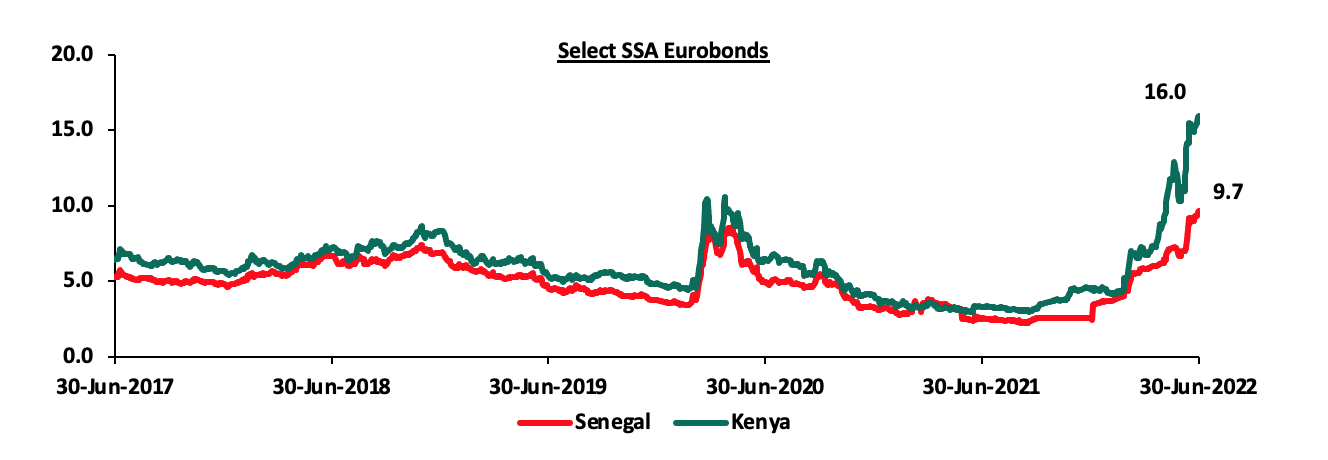

Yields on African Eurobonds increased significantly in H1’2022 partly attributable to investors attaching higher risk premium on the Sub-Saharan region and other emerging markets due to perceived higher risks arising from increasing inflationary pressures and local currency depreciation. The increase in Eurobond yields come on the back of inflationary pressures and local currency depreciation that has worsened the existing supply chain constraints. Yields on the Kenyan and Senegal Eurobonds increased in H1’2022 by 11.6% points and 7.3% points to 16.0% and 9.7%, from 4.4% and 2.4%, respectively, recorded at the end of December 2021. Key to note, Kenya cancelled the issuance of Kshs 115.0 bn Eurobond in June 2022 due to the elevated yields.

Below is a 5-year graph showing the Eurobond secondary market performance of select 10-year Eurobonds issued by the respective countries:

Equities Market Performance

Sub-Saharan Africa (SSA) stock markets recorded mixed performance in H1’2022, with Nigeria’s NGSEASI being the best performing market gaining by 19.6% attributable to the increased foreign investor sentiments amid rising of commodity prices. Kenya’s NASI was the worst-performing market with a loss of 32.5%, partly attributable to a deterioration in the business environment following uncertainties around the upcoming general election. Below is a summary of the performance of key indices:

|

Equities Market Performance (Dollarized*) |

||||||

|

Country |

Index |

Jun-21 |

Jan-22 |

Jun-22 |

Last 12 Months change (%) |

YTD change (%) |

|

Nigeria |

NGSEASI |

91.6 |

104.1 |

124.5 |

35.9% |

19.6% |

|

Zambia |

LASILZ |

205.5 |

362.2 |

398.6 |

94.0% |

10.1% |

|

Rwanda |

RSEASI |

0.1 |

0.1 |

0.1 |

(2.2%) |

0.02% |

|

Tanzania |

DARSDSEI |

0.6 |

0.6 |

0.6 |

(5.0%) |

(6.4%) |

|

South Africa |

JALSH |

4,682.5 |

4,639.6 |

4,197.9 |

(10.3%) |

(9.5%) |

|

Uganda |

USEASI |

0.4 |

0.4 |

0.3 |

(27.7%) |

(23.5%) |

|

Ghana |

GGSECI |

455.8 |

454.6 |

318.1 |

(30.2%) |

(30.0%) |

|

Kenya |

NASI |

1.6 |

1.5 |

1.0 |

(37.3%) |

(32.5%) |

|

*The index values are dollarized for ease of comparison |

||||||

Source: S&P Capital

GDP growth in Sub-Saharan Africa region is expected to record slow growth, in line with the rest of the global economy. Additionally, some of the countries are suffering from high debt levels that increased to 61.0% of GDP in 2021, from 60.0% of GDP in 2020 making them less attractive to foreign capital. The significant weakening of the currencies has made debt service also become more costly.