Eurobonds are fixed income debt instruments issued in a currency other than the currency of the country or market in which they are issued, mostly denominated in a currency that is widely traded and accepted globally, like the US Dollar or the Euro. Generally, Eurobonds allow issuers to tap into a broader investor base allowing for diversification in capital sourcing. Hence, Sub-Saharan Eurobonds, of which most are listed on the London and Irish stock exchanges, allow governments and corporations to raise funds by issuing bonds in a foreign currency. Majority of countries in the region issue Eurobonds to finance maturing debt obligations, finance their budget deficits and undertake heavy infrastructural projects.

In 2024, sub-Saharan Africa (SSA) began re-emerging in the international Eurobond market after nearly two years of limited access. This marked a shift from 2023, when high global interest rates and widening spreads effectively shut most SSA countries out of the primary market. While 2023 saw only one exception, Gabon’s USD 500 mn blue bond issued as part of a debt-for-nature swap at a discounted rate tied to conservation outcomes, 2024 brought renewed, though cautious, investor interest. In the first quarter alone, Côte d’Ivoire raised USD 2.6 bn, Benin raised USD 750.0 mn, and Kenya raised USD 1.5 bn through Eurobond issuances, collectively amounting to USD 4.9 bn, all significantly oversubscribed despite high average coupon rates of around 8.5%. As a result, many SSA governments have turned to concessional sources of finance. Countries such as Côte d’Ivoire, Kenya, and Senegal secured high-value arrangements with the IMF, while others leaned on multilateral institutions like the World Bank to plug financing gaps. The region’s broader economic recovery has been hampered by elevated import bills, which continue to strain the external and fiscal positions of commodity-importing nations. Nonetheless, with large Eurobond maturities looming and domestic financing often insufficient, many SSA countries are expected to continue returning to the international market despite the steep borrowing costs.

We have previously covered topicals including the “Sub-Saharan Africa (SSA) Eurobonds: 2019 Performance” in January 2020, where we expected the Eurobond yields to stabilize mainly on the back of loosened monetary policy regimes in advanced countries. Additionally, we did a topical on “Sub-Saharan Africa Eurobond Performance 2022” in July 2022, where we expected yields to continue rising on the back of economic performance uncertainties, with investors attaching a higher risk premium on the region and increased interest in the developed economies. In our 2023 review, “Sub-Saharan Africa Eurobond Performance 2023” in January 2024, we noted that most SSA countries remained locked out of the Eurobond market due to elevated interest rates and rising risk premiums, with investor sentiment weakened by concerns around debt sustainability and credit downgrades. This week we analyze the Sub-Saharan Africa (SSA) Eurobond performance in 2024 and 2025 year to date, given the gradually easing rates in the developed countries. The analysis will be broken down as follows:

- Background of Eurobonds in Sub-Saharan Africa,

- Analysis of Existing Eurobond Issues in Sub-Saharan Africa,

- Debt Sustainability in the Sub-Saharan African region, and,

- Outlook on SSA Eurobonds Performance.

Section I: Background of Eurobonds Issued in Sub-Saharan Africa

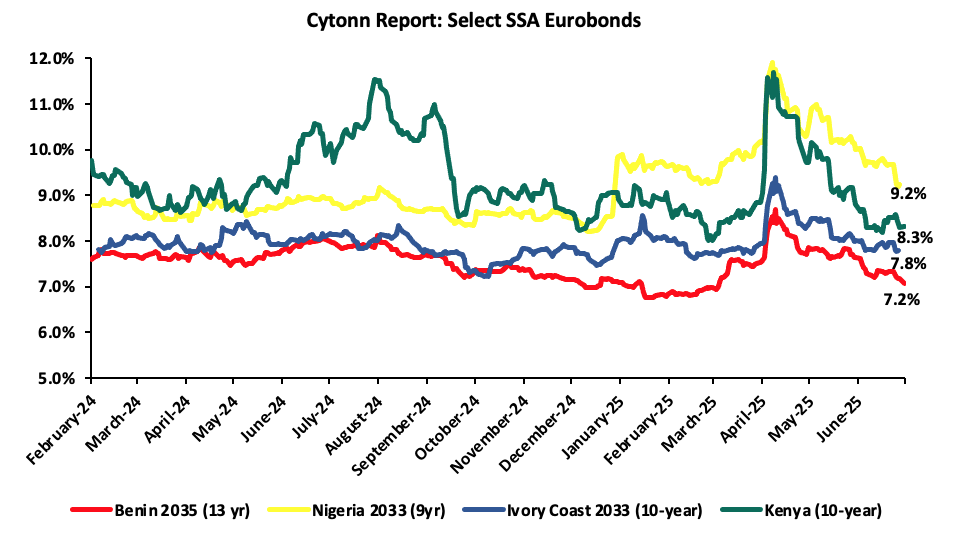

Africa’s appetite for foreign-denominated debt has increased in recent times with the latest issuers during the six months to end of HY’2025 being Ivory Coast and Benin raising a total of USD 1.8 bn and USD 0.5 bn respectively. Additionally, 2024 issuers were Ivory Coast, Benin, Kenya, Senegal and Cameroon raising a total of USD 2.6 bn, USD 0.8 bn, USD 1.5 bn, USD 0.8 bn and USD 0.6 bn respectively. Notably, all the bonds were oversubscribed with the high support being driven by the yield hungry investors and also the outlook of positive recovery in the regional economies. It is good to note that there was a general decline in the yields of the various bonds from most countries due to general improvement in investor sentiment as the economy recovers and the easing inflationary pressures in the region. The yields on Kenya’s 10-year Eurobond maturing in 2028 declined by 2.0% points to 8.3% as of end-June 2025, from 10.4% in June 2024. This was partly attributable to improved investor confidence following the successful buy-back of the 2027 Eurobond in February 2025, increased IMF credit inflows, and the stabilization of the Kenyan shilling against the US dollar. Although Kenya did not receive the final disbursement under its current IMF programme, this was due to a mutual agreement with the Fund to cancel the ninth and final review, citing time constraints, with the government subsequently applying for a new programme to access remaining funds. Similarly, the yields for Benin’s 13-year and Ivory Coast’s 10-year Eurobonds maturing in 2035 and 2033 respectively decreased by 1.0% and 0.5% to 7.1% and 7.7% respectively at the end of June 2025. However, the yields of Nigerian 9-year Eurobond maturing in 2033 increased marginally by 0.2% to 9.1% from 8.9% in June 2024.

|

Fitch Rating's Long-Term Foreign-Currency Issuer Default Rating (IDR) |

2024 Eurobond Issues |

2025 Eurobond Issues |

||||||||||

|

Country |

IDR Credit Rating |

Issue Date |

Value USD Mn |

Tenor (Years) |

Coupon Rate |

Issue Date |

Value USD Mn |

Tenor (Years) |

Coupon Rate |

|||

|

Ivory Coast

|

BB-

|

Stable

|

Aug-24

|

Jan-24

|

1100.0 |

9 |

7.650% |

Mar-25 |

1750.0 |

11 |

8.45% |

|

|

1500.0 |

13 |

8.250% |

||||||||||

|

Benin |

B+ |

Stable |

Feb-25 |

Feb-24 |

750.0 |

14 |

8.375% |

Jan-25

|

500.0 |

16 |

8.625% |

|

|

Kenya |

B- |

Stable |

Jul-25 |

Feb-24 |

1500.0 |

7 |

9.750% |

Feb-25 |

1500.0 |

11 |

9.500% |

|

|

Senegal |

B- |

Stable |

Nov-24 |

Jun-24 |

750.0 |

7 |

7.750% |

|

|

|

|

|

|

Cameroon |

B |

Negative |

May-24 |

Jul-24 |

550.0 |

7 |

10.750% |

|

|

|

|

|

|

South Africa |

BB- |

Stable |

Sep-24 |

Nov-24 |

2000.0 |

12 |

7.100% |

|

|

|

|

|

|

1500.0 |

30 |

7.950% |

||||||||||

|

Nigeria |

B- |

Positive |

Nov-24 |

Dec-24 |

700.0 |

6.5 |

9.625% |

|

|

|

|

|

|

1500.0 |

10 |

10.375% |

||||||||||

Section II: Analysis of Existing Eurobond Issues in Sub-Saharan Africa

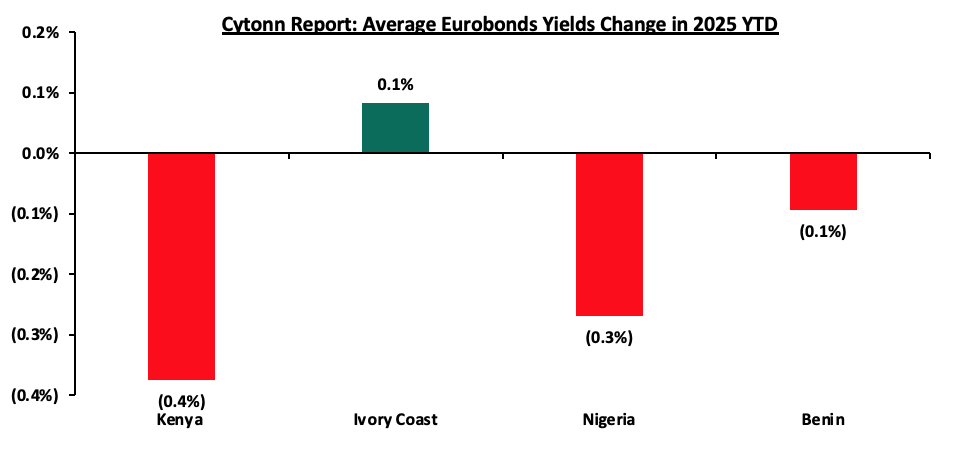

Yields on the select SSA Eurobonds recorded a mixed performance with 3 out of the 4 selected countries registering a decline in Eurobond yields in 2025 YTD. Despite the slight decline in the Eurobond yields, the rates remained relatively elevated attributable to investors attaching higher risk premium on the Sub-Saharan region and other emerging markets due to heightened debt sustainability concerns coupled with sustained inflationary pressures and local currency depreciation. Notably, while the U.S. Federal Reserve held interest rates steady throughout 2025 maintaining the federal funds rate in the range of 4.25% to 4.50%, where it has been since December 2024 the sustained high rates continued to support a strong U.S. dollar. This environment kept global capital flows tilted toward the U.S. market, often at the expense of emerging and developing economies such as those in the Sub-Saharan Africa (SSA) region. According to the International Monetary Fund (IMF), growth in the region is now expected to ease to 3.8% in 2025 and 4.2% in 2026, a downward revision of 0.4% points and 0.2% points, respectively. The slowdown has been driven in large part by turbulent global conditions, as reflected in lower external demand, subdued commodity prices, and tighter financial conditions, with more significant downgrades for commodity exporters and countries with larger trade exposures to the United States. In addition to the subdued global outlook, uncertainty surrounding the world economy is exceptionally high, and a further increase in trade tensions or tightening of global financial conditions in advanced economies could weigh on regional confidence and activity, while raising borrowing costs. Moreover, official development assistance inflows into sub-Saharan Africa will likely decline going forward, placing an added burden on the region. The table below highlights the recent performance of select African Eurobonds:

|

Cytonn Report: Yield Changes in Select SSA Eurobonds Issued Before 2025 |

|||||||||

|

Country |

Issue Tenor (years) |

Issue Date |

Maturity Date |

Coupon |

Yield as at 30th June 2024 |

Yield as at 31st Dec 2024 |

Yield as at 30th June 2025 |

2025 y/y change (%Points) |

2025 YTD change (%Points) |

|

Kenya |

10 |

Jul-18 |

Jun-28 |

7.3% |

10.4% |

9.1% |

8.3% |

(1.3%) |

(0.8%) |

|

Ivory Coast |

9 |

Aug-19 |

Jul-28 |

9.0% |

7.4% |

6.7% |

6.3% |

(0.7%) |

(0.5%) |

|

Nigeria |

6 |

Nov-24 |

Nov-30 |

4.9% |

8.9% |

8.6% |

8.5% |

(0.4%) |

(0.0%) |

|

Kenya |

7 |

Feb-24 |

Jan-31 |

8.0% |

10.8% |

10.1% |

9.6% |

(0.7%) |

(0.5%) |

|

Kenya |

12 |

Feb-20 |

Jan-32 |

8.0% |

10.8% |

10.1% |

9.6% |

(0.7%) |

(0.5%) |

|

Nigeria |

9 |

Feb-24 |

Jan-33 |

5.9% |

8.9% |

8.5% |

7.4% |

(0.4%) |

(1.0%) |

|

Nigeria |

9 |

May-24 |

May-33 |

7.8% |

10.9% |

8.6% |

9.1% |

(2.4%) |

0.6% |

|

Ivory Coast |

10 |

Jun-23 |

May-33 |

7.0% |

8.0% |

9.9% |

7.9% |

1.8% |

(2.0%) |

|

Kenya |

13 |

Mar-21 |

Feb-34 |

6.3% |

10.8% |

10.1% |

9.8% |

(0.7%) |

(0.3%) |

|

Benin |

13 |

Dec-22 |

Dec-35 |

6.6% |

8.0% |

7.2% |

7.1% |

(0.8%) |

(0.1%) |

|

Ivory Coast |

13 |

Feb-24 |

Jan-37 |

5.8% |

8.6% |

6.3% |

8.8% |

(2.4%) |

2.5% |

|

Benin |

14 |

Feb-24 |

Jan-38 |

6.3% |

8.9% |

8.7% |

8.6% |

(0.2%) |

(0.1%) |

|

Kenya |

30 |

Feb-18 |

Jan-48 |

7.3% |

11.0% |

10.3% |

10.5% |

(0.7%) |

0.2% |

|

Ivory Coast |

30 |

Dec-18 |

Nov-48 |

6.4% |

8.9% |

8.6% |

8.9% |

(0.4%) |

0.3% |

|

Benin |

30 |

Feb-22 |

Jan-52 |

8.1% |

9.0% |

8.4% |

8.4% |

(0.6%) |

0.0% |

Source: Reuters

From the table above,

- The most notable yield decline in 2025 was observed in Nigeria’s 9-year Eurobond issued in May 2024 and maturing in May 2033, which dropped by 2.4% points year-on-year. This movement was largely driven by improving macroeconomic fundamentals in Nigeria. The government advanced fiscal reforms, particularly the removal of costly fuel subsidies and the continuation of exchange rate unification, which helped reduce distortions in the FX market. Additionally, higher-than-expected oil production levels supported external balances, while successful engagement with the IMF bolstered investor confidence. The combination of these factors, alongside declining global interest rates in early 2025, contributed to the strong rally in Nigerian sovereign debt.

- The most significant yield increase occurred in Côte d’Ivoire’s 13-year Eurobond issued in 2024 and maturing in 2037, which rose by 2.5% points year-to-date. This sharp upward movement was driven by mounting political uncertainty ahead of the 2025 presidential election, which raised concerns about potential fiscal slippage or policy disruptions. In parallel, the country faced deteriorating external conditions, with declining cocoa prices and lower export earnings contributing to current account pressures. These concerns, combined with a broader market reassessment of risk in long-dated West African debt, led to a pronounced sell-off in the bond.

- Benin’s 30-year Eurobond issued in February 2022 and maturing in January 2052 also recorded a notable yield decline of 0.6% points year-on-year. The drop reflected sustained macroeconomic stability and prudent fiscal management underpinned by strong reform implementation and an ongoing IMF-supported program. Benin’s commitment to maintaining a primary fiscal surplus and relatively low debt levels helped reassure investors.

- Kenya also saw a meaningful yield decline of 1.3% points on its 10-year Eurobond maturing in 2028. This was mainly attributed to successful liability management operations early in the year, including a Eurobond buyback and a new issuance that improved maturity profiles and alleviated immediate refinancing concerns. Progress in fiscal consolidation efforts and improved communication with markets further supported positive investor sentiment toward Kenyan debt.

The graph below summarizes the average YTD change in the Eurobond yields of select countries;

Source: Reuters

*Average yields increase calculated as an average of the Country’s Eurobonds yields increase

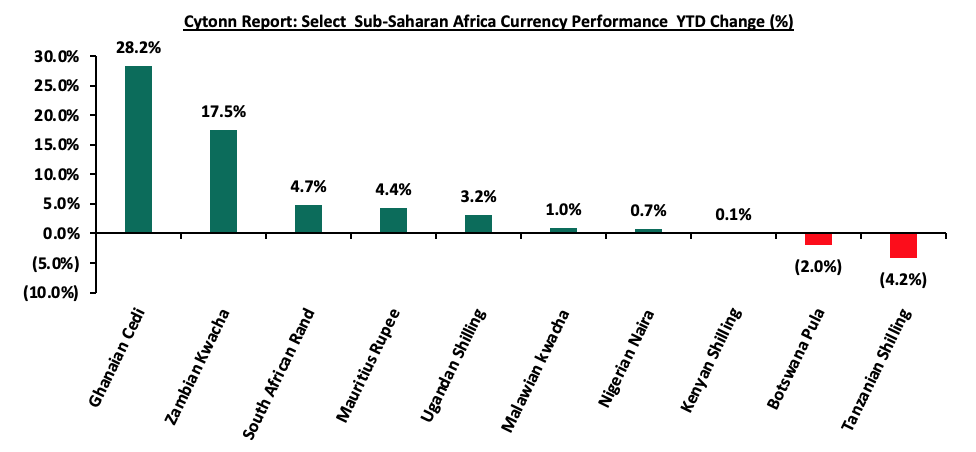

Eurobonds, being denominated in foreign currency, imply that a depreciation in a country’s local currency leads to increased costs. These costs are incurred when purchasing foreign currency to service existing debt obligations. Below is a summary of the performance of the different resident currencies as at the end of July 2025:

|

Currency |

Jul-24 |

Jan-25 |

Jul-25 |

Last 12 months |

YTD change (%) |

|

Ghanaian Cedi |

15.6 |

14.7 |

10.6 |

32.4% |

28.2% |

|

Zambian Kwacha |

26.1 |

27.9 |

23.0 |

11.6% |

17.5% |

|

South African Rand |

18.9 |

18.8 |

17.9 |

5.3% |

4.7% |

|

Mauritius Rupee |

46.3 |

47.7 |

45.6 |

1.4% |

4.4% |

|

Ugandan Shilling |

3713.0 |

3,697.6 |

3580.5 |

3.6% |

3.2% |

|

Malawian kwacha |

1,734.0 |

1,750.3 |

1,733.7 |

0.0% |

1.0% |

|

Nigerian Naira |

1,590.0 |

1,540.7 |

1,529.5 |

3.8% |

0.7% |

|

Kenyan Shilling |

129.2 |

129.3 |

129.2 |

(0.1%) |

0.1% |

|

Botswana Pula |

13.3 |

14.0 |

14.3 |

(7.5%) |

(2.0%) |

|

Tanzanian Shilling |

2,715.0 |

2,374.7 |

2,475.0 |

8.8% |

(4.2%) |

Source: S&P Capital

Most Sub-Saharan African currencies have appreciated on a year-to-date basis in 2025, driven primarily by improved macroeconomic fundamentals, tight monetary policy stances by central banks, and renewed investor confidence. Countries such as Nigeria, Kenya, and Ghana have witnessed a resurgence in foreign inflows, supported by narrower current account deficits, improved trade balances, and enhanced forex liquidity from multilateral disbursements and diaspora remittances. Additionally, monetary authorities across the region have maintained relatively high interest rates to tame inflation and stabilize currencies, thereby attracting yield-seeking investors. The US Federal Reserve’s shift toward a more dovish monetary stance has also lessened pressure on emerging market currencies, providing further relief. Overall, the convergence of internal stabilization measures and a more favorable external environment has buoyed regional currencies, underscoring growing resilience in Sub-Saharan Africa’s macroeconomic outlook.

The Ghanaian Cedi has recorded the best performance appreciating by 28.2% year-to-date in 2025, marking one of the strongest currency performances in Sub-Saharan Africa and reversing the sharp depreciation experienced in previous years. This robust performance has been anchored by Ghana’s successful engagement with the International Monetary Fund (IMF) under the USD 3.0 billion Extended Credit Facility, which has improved market sentiment and unlocked additional multilateral and bilateral support. Disbursements from the IMF, World Bank, and African Development Bank have significantly bolstered foreign exchange reserves, improving liquidity in the foreign exchange market and enhancing the Bank of Ghana’s ability to intervene when necessary. The government has also made meaningful progress on fiscal consolidation, with a marked improvement in revenue collection and expenditure control, resulting in a reduced fiscal deficit of 1.1% of GDP. On the external side, strong commodity exports, particularly from gold, which has benefited from elevated global prices, have supported the trade balance, while remittance inflows have remained resilient. Meanwhile, the Bank of Ghana’s tight monetary stance, with a policy rate maintained above 25.0%, has helped rein in inflation and attracted foreign portfolio flows into government securities. Combined, these factors have contributed to a more stable macroeconomic environment, renewed investor confidence, and a significant rebound in the Cedi’s value;

Source: IMF, CBK

From the graph above the key take outs include;

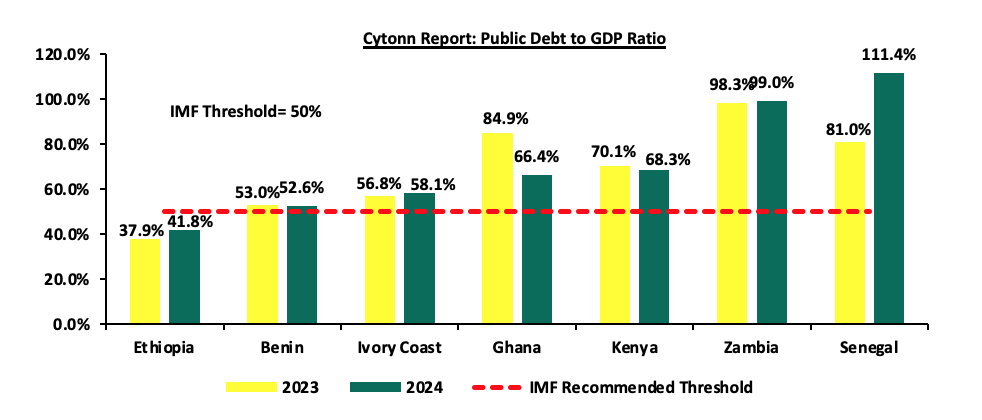

- Senegal’s public debt-to-GDP ratio surged by 30.4% points to 111.4% in 2024 from 81.0% in 2023, marking one of the steepest deteriorations in debt sustainability across Sub-Saharan Africa. This sharp increase was primarily driven by elevated fiscal deficits, heavy pre-production borrowing linked to oil and gas projects, and a significant depreciation of the CFA Franc against the US Dollar. The situation was further exacerbated by delays in hydrocarbon revenue inflows, which were expected to alleviate fiscal pressure. However, the most notable blow to Senegal’s fiscal credibility came in late 2024, following the release of an audit by the Court of Auditors, which uncovered substantial discrepancies in the country's reported debt figures. The audit revealed that central government debt had reached 99.7% of GDP in 2023 roughly 25.0% points higher than previously published, exposing material governance lapses and significantly limiting fiscal space. In response, Moody’s downgraded Senegal’s sovereign credit rating from Ba3 to B1 in 2024, citing weakened fiscal metrics, elevated funding needs, and heightened vulnerability to external shocks. The outlook was also revised to negative, reflecting risks around the government's ability to implement fiscal consolidation and manage gross financing requirements in a constrained funding environment. Although the government has announced ambitious plans to narrow the fiscal deficit, the newly uncovered fiscal realities are expected to complicate consolidation efforts. Moody’s assumes eventual IMF support in its baseline, but warned that tighter market access could challenge liquidity management. Additionally, Senegal’s local and foreign currency ceilings were lowered to Ba2 and Ba3, respectively, from Baa3 and Ba1, to reflect the diminished fiscal credibility. Nonetheless, the country’s membership in the West African Economic and Monetary Union (WAEMU) and the French Treasury’s backing of the CFA Franc-Euro peg continue to provide a degree of external stability, cushioning transfer and convertibility risks.

- Kenya’s public debt-to-GDP ratio declined by 1.8% points to 68.3% in 2024 from 70.1% in 2023, reflecting early signs of fiscal consolidation and improved nominal GDP growth. This was further supported by the Central Bank’s Monetary Policy Committee (MPC), which maintained a tight monetary policy stance through most of 2024 to anchor inflation and support exchange rate stability. However, the Central Bank Rate (CBR) began to ease in August 2024, as inflationary pressures moderated and the Kenyan shilling showed signs of stability. The decline can be further attributed to the government’s deliberate fiscal tightening measures, including expenditure rationalization and improved revenue mobilization efforts under the guidance of its IMF-supported Extended Fund Facility (EFF) and Extended Credit Facility (ECF) programmes. Robust nominal GDP growth, supported by easing inflation and a recovery in key sectors such as agriculture and services, also played a significant role in lowering the debt ratio. On the financing side, Kenya undertook a successful Eurobond issuance in early 2024 to manage its maturing 2024 Eurobond, easing rollover risk and improving investor confidence. The external liability management operations, combined with a stable exchange rate and improved current account position, helped anchor debt metrics. However, despite the marginal improvement, Kenya’s debt burden remains elevated by historical standards, and fiscal pressures persist amid rising interest payments and constrained revenue performance. However, it’s worth noting that there has been a gradual improvement, supported by early fiscal consolidation efforts, improved nominal GDP growth, and more stable macroeconomic conditions. Credit rating agencies have maintained a cautious stance, with Kenya’s outlook remaining under watch given the government’s high gross financing needs and reliance on external market access, even as reforms continue to gain traction. Below is a graph showing the Eurobond secondary market performance of select SSA countries;

- Ethiopia’s public debt-to-GDP ratio rose by 3.9% points to 41.8% in 2024 from 37.9% in 2023, reflecting mounting fiscal pressures amid a fragile post-conflict recovery and limited revenue mobilization. The increase was largely driven by higher external borrowing to support budgetary needs and stabilize the economy, coupled with local currency depreciation, which inflated the value of external debt obligations. Notably, Ethiopia remains in external debt distress, having defaulted on its USD 1.0 bn Eurobond in December 2023 becoming the third Sub-Saharan African country to default since the onset of the COVID-19 pandemic, after Zambia and Ghana. The default highlighted the country’s acute liquidity challenges and underscored its vulnerability to external financing shocks. In response, Ethiopia entered into an IMF-supported programme and, by mid-2025, had secured an MoU with official creditors to restructure approximately USD 8.4 billion in debt and provide USD 2.5 billion in debt service relief through 2028. The IMF completed the third programme review in July 2025, unlocking USD 262.3 mn in additional financing. However, talks with private creditors remain incomplete, and concerns over debt transparency and weak institutional capacity continue to weigh on investor sentiment. While Ethiopia’s debt ratio remains relatively low by regional standards, the country’s default and ongoing restructuring efforts signal elevated sovereign risk and underscore the urgency of comprehensive fiscal and structural reforms.

- Zambia’s public debt-to-GDP ratio edged up slightly by 0.6% points to 99.0% in 2024 from 98.3% in 2023, reflecting continued debt distress and limited fiscal consolidation, despite the country being over three years into its restructuring process. The marginal increase was largely driven by exchange rate depreciation and sluggish economic growth, which have hampered efforts to reduce the debt burden. Although Zambia reached an agreement with official creditors in 2023 and restructured a portion of its Eurobond and commercial debt, progress has been slow in finalizing deals with remaining private and non-Paris Club lenders. The prolonged nature of debt restructuring continues to weigh on investor confidence and limits access to affordable external financing. However, credit rating agency Moody’s upgraded Zambia’s economic outlook from stable to positive in April 2025, affirming its long-term foreign currency sovereign rating at Caa2, signalling cautious optimism despite remaining in speculative-grade territory. Additionally, S&P Global downgraded Zambia to ‘SD’ (selective default) following missed payments during the negotiation process, though the rating is expected to be revisited once a comprehensive agreement with all creditors is reached. Despite securing additional support from the IMF, most recently a USD 145 million disbursement request tied to a 12-month extension of its Extended Credit Facility, Zambia’s debt trajectory remains highly vulnerable to external shocks and implementation delays, underscoring the need for stronger fiscal discipline and governance reforms to restore long-term debt sustainability and,

- Ghana’s public debt-to-GDP ratio declined significantly by 18.5% points to 66.4% in 2024 from 84.9% in 2023, marking a major turnaround in its debt sustainability trajectory following years of distress and default. The sharp decline was driven by a successful restructuring of both domestic and external debt, coupled with a strong recovery in nominal GDP growth and improved macroeconomic management. The completion of the USD 13.1 bn Eurobond restructuring in October 2024 and the ratification of a USD 5.1 bn bilateral debt agreement in January 2025 under the G20 Common Framework played a central role in reducing the debt burden and smoothing the country’s repayment profile. Additionally, strong Cedi appreciation, easing inflation, and an improving current account balance supported macroeconomic stability and strengthened debt affordability metrics. Reflecting these improvements, Fitch Ratings upgraded Ghana’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B-’ with a Stable Outlook in June 2025, from ‘Restricted Default’ (RD). The upgrade was underpinned by the normalization of relations with the majority of external commercial creditors and Fitch’s expectation that the remaining USD 2.6 bn in unresolved debt, of which only USD 700.0 mn is commercial, will be restructured with minimal holdout risk. Ghana's stronger external buffers, including a rebound in international reserves to USD 6.8 bn and projected surpluses in the current account, further support the country's external liquidity position. However, Fitch flagged high interest-to-revenue ratios, projected at 26.0% in 2025, as a key constraint on the rating, despite falling debt ratios and improved fiscal buffers. Ghana’s outlook remains cautiously optimistic, with projected debt expected to decline to 60.0% of GDP by 2026, supported by strong nominal growth, declining inflation, and a gradual return to market financing. While challenges remain, particularly around sustaining fiscal discipline and reopening the local bond market, the recent upgrade signals a critical turning point in Ghana’s sovereign credit profile following its default in 2022.

Section IV: Outlook on SSA Eurobonds Performance

- Elevated Eurobond Yields – Sub-Saharan Africa (SSA) Eurobond yields have remained elevated in 2025, reflecting sustained investor caution amid global monetary tightening, weak commodity prices, and ongoing fiscal vulnerabilities across the region. While some stability has emerged in the first half of 2025 on the back of easing inflationary pressures and growing expectations of a U.S. Fed pivot, yields for most SSA sovereigns remain high, particularly for issuers grappling with debt restructuring or governance concerns. Countries like Nigeria saw yields spike above 11.0% during Q2’2025 due to external financing pressures and weak investor sentiment, while credit downgrades, such as in Senegal following the disclosure of significantly higher debt levels, have further exacerbated market volatility. Although improving reform momentum and potential multilateral support could pave the way for yield compression in selected names, broader market recovery remains contingent on global risk appetite and credible fiscal consolidation efforts by sovereigns,

- Public debt to GDP ratios will continue to rise – According to the World Bank’s Africa’s Pulse October 2024, Public debt in Sub-Saharan Africa was four times higher in 2023 compared to 2006, reflecting external and domestic debt stabilizing at elevated levels and high Gross Financing Needs (GFN). The average nominal level of debt in 2006–19 was around USD 565.0 bn, and the nominal public debt at end-2023 stood at USD 1.3 tn. As of 2025, public debt-to-GDP ratios across Sub-Saharan Africa (SSA) present a mixed picture, reflecting divergent fiscal paths post-COVID-19 and varying access to concessional financing and debt restructuring. Countries that have undergone or are undergoing debt restructuring, such as Ghana, Zambia, and Ethiopia, have seen notable improvements or moderate increases depending on the stage of restructuring and IMF programme support. For instance, Ghana's debt-to-GDP ratio dropped significantly to 66.4% in 2024 from 84.9% in 2023, following a successful restructuring and stronger nominal GDP growth. Conversely, countries like Senegal recorded a sharp upward revision in debt levels, with public debt-to-GDP rising by 30.4% points to 111.4% in 2024, after a national audit revealed significantly underreported obligations, triggering a sovereign downgrade. Kenya managed to reduce its ratio from 70.1% to 68.3% over the same period, aided by fiscal consolidation and improved revenue mobilisation. Meanwhile, Zambia’s ratio inched up to 99.0% despite ongoing restructuring, while Ethiopia’s rose to 41.8% amid external financing pressures and currency depreciation. These developments underscore the region’s fragile fiscal space, with elevated debt burdens remaining a key vulnerability despite reform momentum and IMF engagement. Going forward, the pace of debt reduction will hinge on sustained fiscal discipline, favourable growth dynamics, and the successful conclusion of external debt treatments., and,

- Debt distress and sustainability concerns - From the regional economic outlook by IMF ,as a result of narrowing primary deficits, average public debt in SSA has stabilized and is now starting to decline as a proportion of GDP. Primary balances are now below pre-pandemic levels in many countries, with the median balance having improved by 0.5% of GDP in 2024, bringing the 2022-24 cumulative consolidation to about 2.0% points. In-addition the World Bank’s report points out that, Sub-Saharan Africa’s total debt service levels have increased steadily since 2006, adversely affecting fiscal space and increasing vulnerability to shocks, especially for countries that have gained access to the international bond market and other non-concessional financing sources. Despite ongoing efforts to stabilise public finances, the region continues to grapple with high external debt levels, limited revenue mobilisation, and rising interest costs, all of which constrain fiscal space and crowd out development spending. Countries like Zambia, Ghana, and Ethiopia have already defaulted on their external obligations and remain engaged in complex restructuring processes under the G20 Common Framework, while others such as Kenya and Nigeria face rising refinancing risks and widening fiscal deficits. In Senegal, the revelation of underreported debt pushed the country into a higher-risk category, leading to a ratings downgrade and a sharp deterioration in investor sentiment. The elevated debt burdens and liquidity challenges have made access to international capital markets prohibitively expensive for most frontier issuers, reinforcing reliance on multilateral support. While recent IMF programmes and fiscal reforms offer a path toward debt sustainability, progress is uneven, and the region remains highly vulnerable to external shocks. Addressing these vulnerabilities will require stronger governance, enhanced debt transparency, and credible medium-term consolidation strategies anchored in domestic resource mobilisation and expenditure efficiency.

Measures that the SSA Region Can Take to Improve Its Credit Ratings

- Engagement with International Institutions – The region should actively seek engagement with prominent international financial institutions as a strategic measure to enhance its creditworthiness. Collaborating with institutions such as the International Monetary Fund (IMF) and the World Bank provides Sub-Saharan African countries with access to financial resources, technical expertise, and policy advice. By doing so, countries in the Sub-Saharan African region can benefit from tailored programs that address country-specific economic challenges,

- Diversification of Revenue Sources – The region should put more efforts on diversifying their economies by encouraging the growth of non-traditional sectors such as technology, agribusiness, manufacturing, and renewable energy as well as Implement structural reforms to improve the ease of doing business and attract foreign direct investment (FDI) which would in turn increase the region’s revenue collection and mitigate the impacts of external shocks,

- Debt Management – Implement comprehensive debt management strategies that encompass short, medium, and long-term objectives which regularly assess the cost and risk profile of the debt portfolio as well as Prioritizing refinancing high-cost debt with lower-cost alternatives to reduce debt service obligations in the region. One way to achieve this is through debt-for-nature swaps as in the case of Gambia,

- Efficient Tax Collection – The region should strengthen tax collection and administration to improve revenue collection without increasing tax rates significantly. This can be done through broadening the tax base while ensuring tax policies are equitable and do not disproportionately burden the lower-income segments of the population,

- Social and Economic Development Initiatives – The region should focus on prioritizing investments in social and economic development projects such as Infrastructure development, education, and healthcare in order to boost the overall economic growth and in turn provide a long-term stability,

- Diaspora remittances & Tourism Promotion – The region should prioritize developing its low hanging sources of dollars, such as diaspora and tourism to bring in foreign currency. This can be achieved by putting in place policies to support the tourism industry, marketing tourist attractions and strengthening security within the region,

- Fiscal Responsibility and Transparency – The region should eliminate the rampant corruption associated with SAA countries and ensure that borrowed funds are allocated to projects with measurable economic and social impact. This can be achieved through the establishment of independent oversight bodies tasked with monitoring the implementation of projects funded through external borrowing. Budgetary discipline coupled with transparent reporting mechanisms must be upheld to prevent unnecessary expenditures, with a clear emphasis on directing funds towards initiatives that promote development, and,

- Development of Robust Capital Markets: – SSA countries should prioritize enhancing capital markets to elevate their credit ratings. Developing transparent, efficient, and well-regulated capital markets attracts diverse investors, both locally and internationally. This will help in broadening investment opportunities, increasing liquidity and participation from institutional investors. Strengthening capital markets is crucial to instil investor confidence, drive economic growth, and improve credit ratings in Sub-Saharan Africa.

Conclusion: From our analysis, the unfavourable credit ratings, elevated debt levels, and fragile investor confidence continue to weigh heavily on the Sub-Saharan Africa (SSA) Eurobond market. Despite signs of stabilisation in global financial markets, access to international capital remains constrained for most frontier issuers, with only a few creditworthy sovereigns managing to return to the market under tighter pricing conditions. Going forward, the region will need to accelerate structural reforms aimed at restoring macroeconomic stability, strengthening debt transparency, and enhancing fiscal credibility. A comprehensive economic restructuring, anchored in robust public financial management, domestic revenue mobilisation, and targeted spending, will be critical not only to support debt sustainability but also to rebuild investor trust and reduce overreliance on costly external borrowing.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor