National Social Security schemes are created by governments to form the first pillar of social security. In Africa, Kenya was the second country after Ghana to form a national security scheme, The National Social Security Fund (NSSF), done in 1965 through an Act of Parliament (Cap 258). It is a provident fund, which provides benefits to retiring members as a lump sum rather than through periodic payments. In recent years, discussions around the growth and reform of the NSSF have gained momentum, with key considerations on how to increase coverage, especially for the informal sector, and improve service delivery. As such, we saw it fit to cover a topical on the Kenyan National Social Security Fund to shed light on the Kenyan National Social Security Fund to shed light on the fourth phase of the NSSF Act, 2013 deductions, effective 1st February 2026, the financial performance for the year ended 30th June 2025, recent developments and provide recommendations to improve efficiency. We shall do this by taking a look into the following:

- Introduction to the National Social Security Fund,

- Financial Performance for the year ended 30th June 2025,

- Recent Developments at the National Social Security Fund,

- Factors hindering growth of the NSSF,

- Key considerations to improving NSSF in Kenya, and,

- Conclusion.

Section I: Introduction to the National Social Security Fund

Social security is defined as any programme of social protection established by legislation, or any other mandatory arrangement, that provides individuals with a degree of income security when faced with the contingencies of old age, survivorship, incapacity, disability, or unemployment. In Kenya, the National Social Security Fund (NSSF) offers social protection to all Kenyan workers in the formal and informal sectors by providing a platform to make contributions during their productive years to cater for their livelihoods in old age and the other consequences resulting from unprecedented occurrences such as death or invalidity among others.

The National Social Security Fund (NSSF) has evolved over time having been established in 1965 through an Act of Parliament Cap 258 of the Laws of Kenya. The Fund initially operated as a Department of the Ministry of Labor until 1987 when the NSSF Act was amended transforming the Fund into a State Corporation under the Management of a Board of Trustees. The Act was established as a mandatory national scheme whose main objective was to provide basic financial security benefits to Kenyans upon retirement. The Fund was set up as a Provident Fund providing benefits in the form of a lump sum. Thereafter, the National Social Security Fund (NSSF) Act, No.45 of 2013 was assented to on 24th December 2013 and commenced on 10th January 2014 thereby transforming NSSF from a Provident Fund to a Pension Scheme. Every Kenyan with an income was required to contribute a percentage of his/her gross earnings so as to be guaranteed basic compensation in case of permanent disability, basic assistance to needy dependents in case of death, and a monthly life pension upon retirement. The Act establishes two funds namely;

- Pension Fund, and,

- Provident Fund

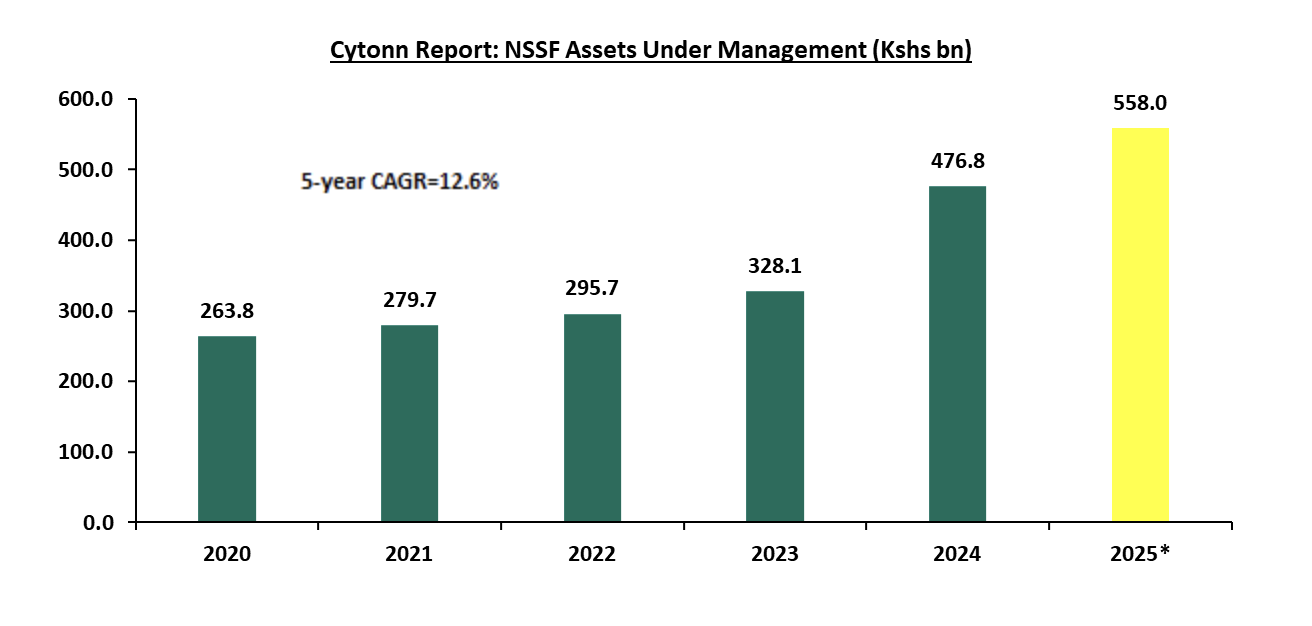

NSSF has gained traction over the years, but particularly in the last three years, owing to implementation of the NSSF Act of 2013, which came into effect in February 2023 and is currently in its third year of implementation. The fourth phase of the Act will begin in February 2026. The Act increased contributions to the fund from the initial Kshs 400.0 to 12.0% of individuals' income, with the employee and employers both contributing 6.0% each. As of June 2025, total assets held by NSSF stood at Kshs 558.0 bn, a 17.0% increase from Kshs 476.8 bn in December 2024. On y/y basis the assets under management increased by 43.2% from Kshs 389.7 bn in June 2024, attributable to the higher member contributions as a result of the second phase of the implementation of the NSSF Act of 2013, which increased monthly contributions leading to higher fund inflows. The graph below shows the movement of the Fund’s Assets Under Management from 2020 to 2025:

Source: RBA Annual Reports & NSSF Audited Financials FY’2024/25 2025* data as of June 2025

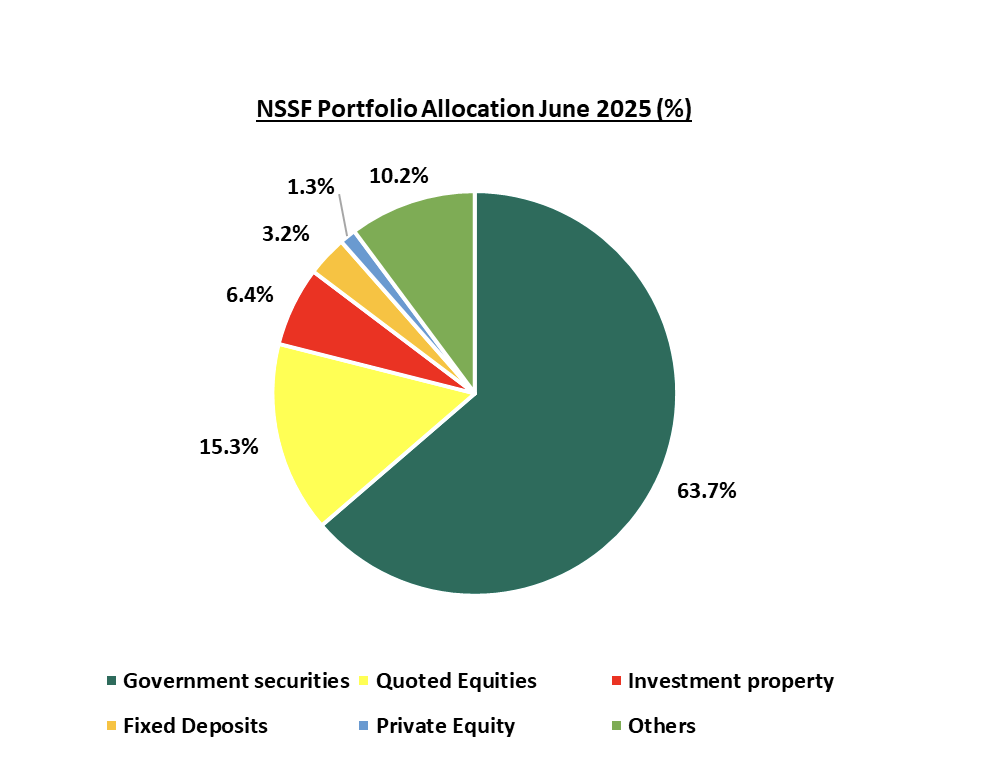

According to the latest Retirement Benefits Authority (RBA) Annual Report, 7.2% of the NSSF’s total assets, amounting to Kshs 40.1 bn was managed internally by NSSF, while the remaining Kshs 518.0 bn was held by seven external fund managers. A breakdown of NSSF’s investment portfolio as of June 2025 reveals a strong preference for government securities, which accounted for 63.7% of total assets. This significant allocation is both strategic and common among pension schemes due to the safety, stability, and credibility associated with government bonds. These instruments offer guaranteed returns, minimal default risk, and predictable income streams, aligning well with the long-term investment horizon of pension funds. Beyond government securities, quoted equities made up 15.3% of the portfolio, reflecting NSSF’s exposure to publicly traded companies, while immovable property comprised 6.4% of the portfolio and 3.2% in fixed deposits. The chart below shows NSSF total assets spread as of June 2025:

Source: Kenya Gazette, NSSF Audited Financials FY’2024/25

Section II: Financial Year 2024/2025 Financial Performance

From the latest financial reports, the National Social Security Fund (NSSF) recorded a significant 96.1% net increase in funds to Kshs 172.6 bn for the period ending 30th June 2025, from Kshs 88.0 bn in a similar period in 2024. This was mainly driven by the 152.5% increase in the net investment income to Kshs 105.3 bn in FY’2024/25 from Kshs 41.7 bn in FY’2022/23, coupled with a 43.1% growth in the net contributions to Kshs 75.2 bn in FY’2024/25 from Kshs 52.6 bn in FY’2023/24. The performance was however weighed down by the 23.2% increase in total operating costs to Kshs 8.5 bn, from Kshs 6.9 bn in FY’2023’24. The table below shows a breakdown of NSSF statement of changes in net assets for the year ended 30th June 2025:

|

Cytonn Report: NSSF Statement of Change in Net Assets |

|||

|

|

FY'2023/24 |

FY'2024/25 |

y/y change |

|

Kshs (bn) |

Kshs (bn) |

||

|

Dealings with Member Funds |

|

|

|

|

Remitted Member Contributions |

59.1 |

81.9 |

38.5% |

|

Unremitted Member Contributions |

3.1 |

2.0 |

(35.4%) |

|

Total Contributions Receivable |

62.3 |

84.0 |

34.8% |

|

Benefits Paid |

(9.7) |

(8.7) |

(10.1%) |

|

Net Contributions |

52.6 |

75.2 |

43.1% |

|

Investment Income |

|

|

|

|

FV Gain (Loss) on Revaluation of Investments |

3.0 |

46.1 |

1441.2% |

|

FV Gain (Loss) on Realization of Investments |

(0.2) |

4.6 |

2,214.0% |

|

Investment Income |

39.6 |

55.8 |

40.8% |

|

Investment Management Expenses |

(0.7) |

(1.1) |

59.8% |

|

Net Investment Income |

41.7 |

105.3 |

152.5% |

|

Other Income |

0.6 |

0.6 |

(9.7%) |

|

Net Revenue |

42.3 |

105.9 |

150.1% |

|

Total Operating Costs |

(6.9) |

(8.5) |

23.2% |

|

Net Increase in Fund |

88.0 |

172.6 |

96.1% |

|

Net Assets as Previously Stated |

312.1 |

400.1 |

28.2% |

|

Net Assets |

400.1 |

572.8 |

43.1% |

Source: Kenya Gazette Vol. CXXVIII—No. 14, NSSF Audited Financials FY’2024/25

Key take outs from the table include:

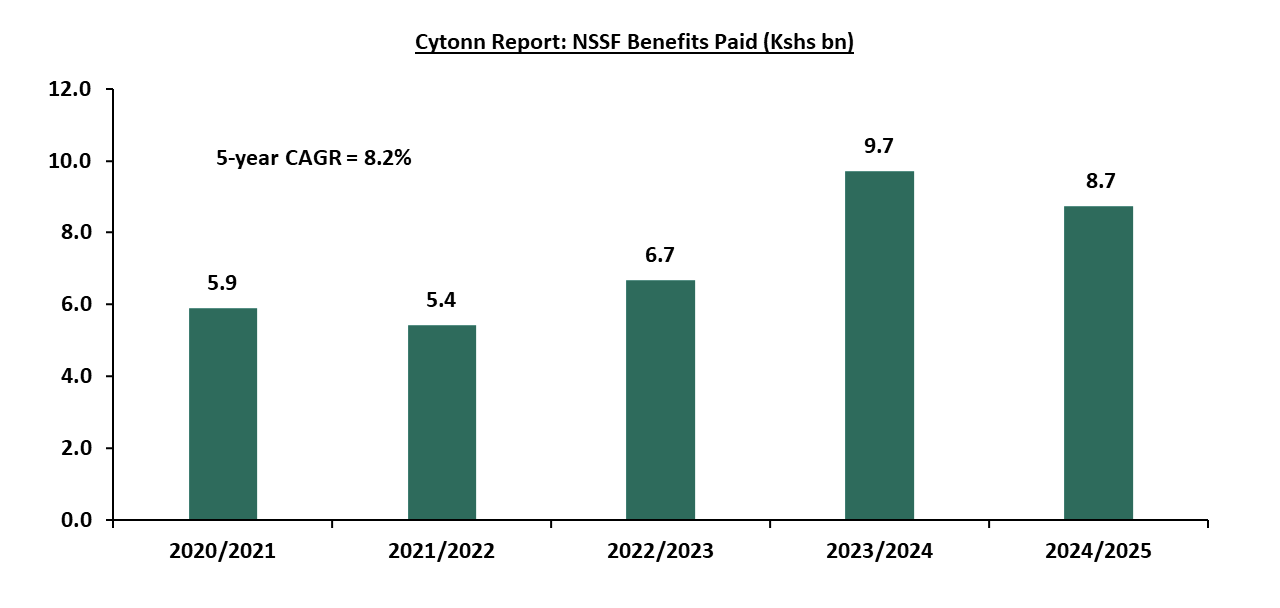

- Net contributions increased by 43.1% to Kshs 75.2 bn in FY’2024/25 from Kshs 52.6 bn in FY’2023/24 attributable to the 34.8% increase in the total contributions receivable to Kshs 84.0 bn, from Kshs 62.3 bn in FY’2023/25, coupled with the 10.1% decrease in the benefits paid to Kshs 8.7 bn in FY’2024/25 from Kshs 9.7 bn in FY’2023/24,

- Net Investment Income grew by 152.5% to Kshs 105.3 bn in FY’2024/25 from Kshs 41.7 bn in FY’2023/24 attributable to a 40.8% increase in the investment income to Kshs 55.8 bn from Kshs 39.6 bn in FY’2023/2024, but was weighed down by the 59.8% increase in management expenses to Kshs 1.1 bn from Kshs 0.7 bn in FY’2023/24,

- Net revenue increased by 150.1% to Kshs 105.9 bn in FY’2024/25 from Kshs 42.3 bn in FY’2023/24,

- Total operating costs increased by 23.2% to Kshs 8.5 bn in FY’2024/25 from Kshs 6.9 bn in FY’2023/24 attributable to the 17.3 % increase in administrative costs to Kshs 8.2 bn from Kshs 7.0 bn in FY’2023/24. Investment management expenses increased by 59.8% to Kshs 1.1 bn from Kshs 0.7 bn in FY’2023/24 resulting in a 26.6% increase in the total expenses to Kshs 9.6 bn in FY’2024/25 from Kshs 7.6 bn in a similar period in 2024. Despite this increase in the Fund’s total expenses, total expenses to total assets ratio decreased by 0.2% points to 1.7% for the year ending June 2025 from 1.9% in a similar period in 2024 remaining above the maximum threshold which is in violation of Section 50 of the National Social Security Fund Act, 2013, that stipulates that the Fund shall not pay out more than 2.0% of its total assets in the first six years of its operation, and not more than 1.5% thereafter, and,

- Benefits paid decreased by 10.1% to Kshs 8.7 bn in FY’2024/25 from Kshs 9.7 bn in FY’2023/24. Notably, payment of claims after retirement has also evolved over time growing at a 5-year CAGR of 8.2% to Kshs 8.7 bn in FY’2024/25 from Kshs 5.9 bn recorded in FY’2020/21. The graph below shows the benefits payout over the last five years;

Source: Kenya Gazette Vol. CXXVIII—No. 14, NSSF Audited Financials FY’2024/25

The table below shows the NSSF statement of net assets available for benefits as of 30th June 2025:

|

Cytonn Report: NSSF Statement of Net Assets Available for Benefits |

|||||||

|

Investment Assets |

FY'2023/24 (a) |

FY'2024/25 (b) |

% Allocation FY'2023/24 (c) |

%Allocation FY'2024/25 (d) |

y/y %change (a-b) |

% points change (c-d) |

|

|

Government Securities |

253.8 |

355.4 |

65.1% |

63.7% |

40.0% |

(1.4%) |

|

|

Quoted Stocks |

61.2 |

85.1 |

15.7% |

15.3% |

39.1% |

(0.4%) |

|

|

Eurobonds |

7.2 |

34.3 |

1.8% |

6.1% |

378.3% |

4.3% |

|

|

Term and Demand Deposits |

11.4 |

18.0 |

2.9% |

3.2% |

57.3% |

0.3% |

|

|

Accrued Income |

10.9 |

14.2 |

2.8% |

2.6% |

30.1% |

(0.3%) |

|

|

Private Equity |

3.3 |

7.3 |

0.8% |

1.3% |

120.7% |

0.5% |

|

|

TPS Loans |

2.5 |

2.1 |

0.7% |

0.4% |

(18.1%) |

(0.3%) |

|

|

Corporate Bonds |

1.7 |

1.6 |

0.4% |

0.3% |

(8.7%) |

(0.2%) |

|

|

Money Market Funds |

0.0 |

0.2 |

0.0% |

0.04% |

- |

0.04% |

|

|

Others |

37.6 |

39.8 |

9.6% |

7.1% |

6.0% |

(2.5%) |

|

|

Total |

389.7 |

558.0 |

100.0% |

100.0% |

43.2% |

|

|

Source: Kenya Gazette Vol. CXXVIII—No. 14, NSSF Audited Financials FY’2024/25

Key take outs from the table include:

- Government securities remained with the largest investment allocation, coming in at 63.7% in June 2025, a decline from 65.1% recorded in June 2024. Similarly, the amounts invested in government securities as of 30th June 2025 recorded a 40.0% increase to Kshs 355.4 bn, from Kshs 253.8 bn recorded at the end of FY’2023/24. Notably, on a y/y basis the allocation government securities decreased marginally by 1.4% points from 65.1% allocation recorded in FY’2023/24 mainly attributable to the low yields on government papers over the period,

- Quoted stocks recorded a decline in their investment allocation, decreasing by 0.4% points to 15.3% at the end of June 2025, from 15.7% at the end of June 2024. However, equity funds recorded a 39.1% growth in AUM to Kshs 85.1 bn in FY’2024/25, up from Kshs 61.2 bn in FY’2024/25. The increase in AUM is largely attributable to increased market activity, with the Nairobi All Share Index (NASI) registering a 22.4% gain in the six months to June 2025, as well as an improved business environment as evidenced by Purchasing Manager’s Index (PMI) registering an average of 50.5, in the six months to June 2025, from an average of 50.0 in a similar period in 2024.

- Private Equity recorded a significant 120.7% growth to Kshs 7.3 bn in June 2025, up from Kshs 3.3 bn in June 2024. Similarly, the allocation increased by 0.5% points to 1.3%, from the 0.8% recorded in a similar period in 2024, highlighting the Fund’s diversification efforts,

- The fund diversified into investment in Money Market Funds in FY’2024/25, allocating Kshs 204.0 mn, which represented 0.04% of the total investment assets. This indicates that NSSF has begun exploring low-risk, liquid investment options to enhance diversification and stability, and,

- The Fund took exposure on Eurobonds investing Kshs 34.3 bn, equivalent to 6.1% of the total investment assets and this is a result of Kenya’s February and October 2025 Eurobonds issuance attracting institutional investors like NSSF seeking competitive yields.

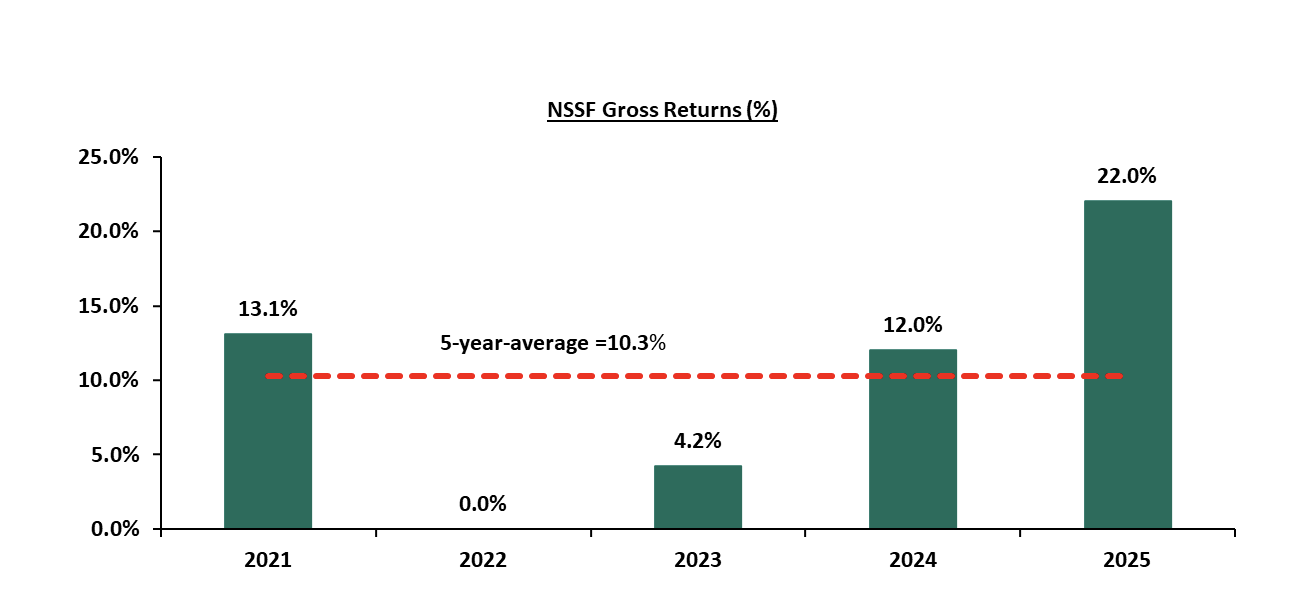

The Fund’s returns increased by 10.0% points to 22.0% in FY’2024/25 from 12.0% recorded in a similar period in 2024. NSSF has recorded an average return of 10.3% over the last five years with the highest return recorded in 2025. The graph below shows the performance of the Fund’s returns over the last 5 years:

Source: Kenya Gazette Vol. CXXVIII—No. 14, NSSF Audited Financials FY’2024/25

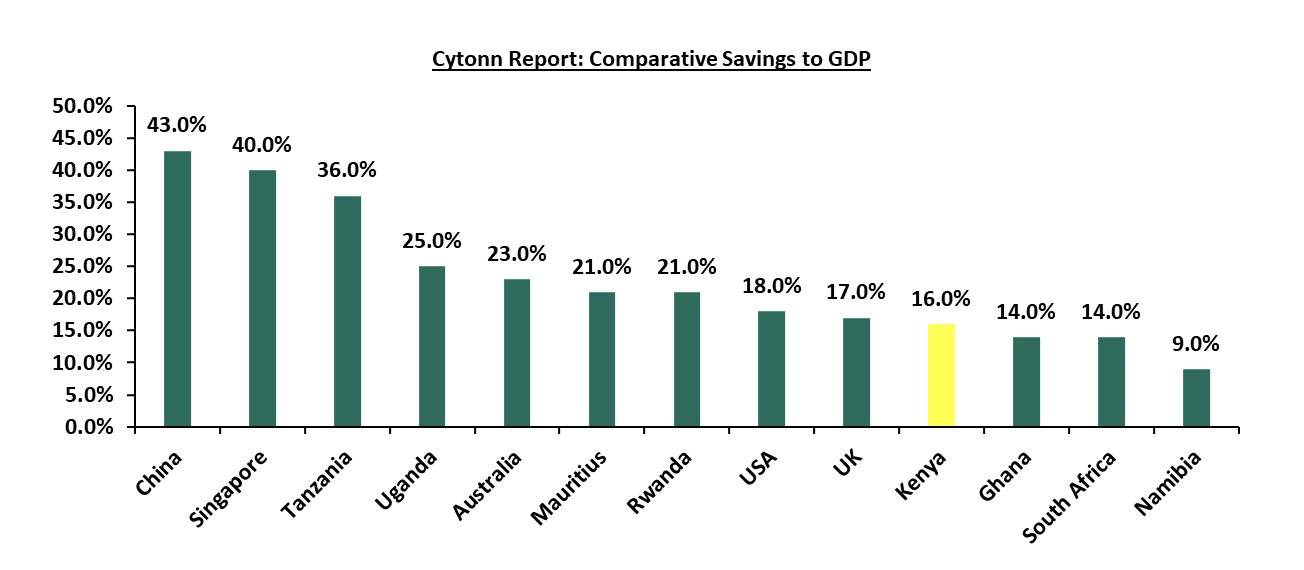

Despite the government making NSSF mandatory, Kenya’s saving culture still lags behind in comparison to other more developed countries partly attributable to low disposable income with 16.0% of the Kenyan population as of 2024 living below the poverty line coupled with lack of sufficient knowledge on the importance of saving for retirement. The graph below shows the gross savings to GDP of select countries in the Sub-Saharan Africa Region and the developed economies;

Source: World Bank

Section III: Recent Developments at the National Social Security Fund

In early 2025, Kenya’s National Social Security Fund (NSSF) ushered in a pivotal chapter of its evolution, marking the third year of implementing the transformative NSSF Act of 2013, with the fourth phase of implementation scheduled to commence in February 2026. With the stroke of new contribution limits effective 1st February 2026, the fund has broadened its reach, pulling more of workers’ earnings into the fold of pension savings. The lower earnings threshold will edge up from Kshs 8,000 to Kshs 9,000, while the upper limit will soar from Kshs 72,000 to Kshs 108,000, doubling the ceiling for contributions.

- Adjustments to NSSF Contribution Limits - Effective February 1, 2026, the contribution limits governing pensionable income will be adjusted, reflecting an ambitious push to secure stronger retirement benefits for workers. The lower earnings limit, previously set at Kshs 8,000, will rise to Kshs 9,000, lifting the minimum monthly contribution from Kshs 480 to Kshs 540 per employee, with employers matching this amount to total Kshs 1,080 for Tier I. Meanwhile, the upper earnings limit will increase by 50%, leaping from Kshs 72,000 to Kshs 108,000. This shift pushes the maximum contribution to Kshs 6,480 per employee, matched equally by employers, resulting in a combined total of Kshs 12,960 for those earning Kshs 108,000 or more. For an employee earning Kshs 50,000, the deduction will remain unchanged at Kshs 3,000, while for an employee earning Kshs 80,000, the deduction will increase to Kshs 4,800 from Kshs 4,320, illustrating how these changes reach across income brackets, capturing a larger slice of salaries for pension savings. The table below illustrates the changes in NSSF contribution rates between 2025 and 2026 across various gross salary levels:

|

Cytonn Report: Comparison of NSSF Contribution Rates by Gross Salary (2025 vs 2026) |

|||||

|

Gross Salary |

2025 Rates |

2026 Rates |

|

||

|

Employee contribution |

Total employee + employer contributions |

Employee contribution |

Total employee + employer contributions |

% Difference |

|

|

9,000 |

540 |

1,080 |

540 |

1,080 |

0.0% |

|

72,000 |

4,320 |

8,640 |

4,320 |

8,640 |

0.0% |

|

80,000 |

4,320 |

8,640 |

4,800 |

9,600 |

11.1% |

|

100,000 |

4,320 |

8,640 |

6,000 |

12,000 |

38.9% |

|

108,000 |

4,320 |

8,640 |

6,480 |

12,960 |

50.0% |

This expansion, however, is a double-edged sword. For employees, particularly those at the lower end of the income spectrum, the increase from Kshs 480 to Kshs 540 trims take-home pay by an additional Kshs 60 monthly, a modest figure that nonetheless bites into budgets already stretched by rising costs. Total contributions for mid-tier earners earning between Kshs 9,000 and Kshs 72,000 will remain unchanged, while high earners earning Kshs 108,000 and above will see their contributions increase by 50.0% to Kshs 6,480 from Kshs 4,320, promising greater retirement security at the expense of current liquidity. Employers, too, feel the weight of these adjustments. A business with a handful of employees earning above Kshs 108,000 now shoulders an additional Kshs 2,160 per worker each month, a burden that could strain small enterprises or prompt larger firms to rethink staffing strategies. Yet, there’s a potential relief valve: employers with private pension schemes can opt out of Tier II contributions, redirecting funds to approved alternatives, though this requires navigating regulatory hoops. The adjustments, effective from February this year, are summarized as follows:

|

Cytonn Report: NSSF Contribution Limits Adjustments |

||

|

|

Year 3 (Previous Rates) |

Year 4 (New Rates Commenced February 2026) |

|

Lower Limit (Tier 1) |

8,000 |

9,000 |

|

Total Contribution by Employee |

480 |

540 |

|

Total Contribution by Employer |

480 |

540 |

|

Total Tier 1 NSSF Contributions |

960 |

1,080 |

|

Upper Limit (Tier 2) |

72,000 |

108,000 |

|

Contribution on Upper Limit (6% of Upper Limit Less Lower Limit) |

64,000 |

99,000 |

|

Total Contribution by Employee |

3,840 |

5,940 |

|

Total Contribution by Employer |

3,840 |

5,940 |

|

Total Tier 2 NSSF Contributions |

7,680 |

11,880 |

|

Total NSSF Contributions |

8,640 |

12,960 |

Source: www.nssf.or.ke

- Public Private Partnership in the Mau-Summit Road - NSSF is investing Kshs 25.0 bn in a 30-year investment in a Public- Private Partnership (PPP), partnering with China Road and Bridge Corporation (CRBC). The project involves upgrading the Nairobi-Nakuru-Mau Summit Highway section of the A8 highway into a tolled dual carriageway. The PPP is based on a Design, Build, Finance, Operate, Maintain and Transfer (DBFOMT) model, under which the two entities will design, build, finance, operate, and maintain the road, recover their investment through user tolls, and transfer the asset to the public sector at the end of the 30-year concession period. The Kshs 25.0 bn represents 4.5% of the NSSF’s current Assets Under Management, and remains within the RBA maximum limit of 10% for investments in debt instruments used to finance infrastructure projects approved under the Public Private Partnerships Act, 2013. NSSF is investing in the Nairobi–Nakuru–Mau Summit Highway to diversify members’ savings into higher-return, long-term infrastructure assets that are more resilient than traditional investments. The project aligns with the government’s push for Public-Private Partnerships to fund critical infrastructure amid constrained public debt and reduced access to multilateral financing. Backed by toll revenues, the highway offers a secure, predictable income stream that supports pensioners’ returns while contributing to national socio-economic development.

- Stagnation in NSSF Bond Trading Investigation - The investigation into alleged irregular bond trading at NSSF, launched by the Capital Markets Authority (CMA) in September 2024, has shown no significant progress by January 23, 2026. The probe targeted transactions between May and July 2024, during which bonds were reportedly purchased at above-market prices and, in other instances, sold at a loss before being repurchased days later at higher prices, potentially benefiting select individuals. Initial momentum including summons of Central Bank of Kenya (CBK) and CMA officials by the National Assembly’s Finance and National Planning Committee has dissipated. Challenges include delays in accessing digital communication evidence and a leaked internal letter that may have compromised the inquiry by alerting suspects to delete data. The Committee also cited disruption from other urgent government matters, including the budgeting process. However, it aims to resume the probe after returning from recess in February 2026. The lack of updates suggests operational or political hurdles in enforcing financial oversight, undermining confidence in CMA’s regulatory capacity. With NSSF’s total assets at Kshs 558.1 bn as of June 2025, any unresolved mismanagement could erode member returns, highlighting systemic risks in transparency and governance within Kenya’s pension sector.

- NSSF’s Divestment from EAPCC - The National Social Security Fund (NSSF) recently divested its 27.0% stake in East African Portland Cement Company (EAPCC) for Kshs 1.6 billion to Kalahari, a strategic move aimed at strengthening the Fund’s long-term financial position and refocusing its investment portfolio. By offloading the stake to Kalahari Cement Ltd, the NSSF unlocked value from a long-held investment that had faced operational and performance challenges, allowing the Fund to reallocate capital into assets with potentially stronger and more stable returns for members. The transaction, which received full regulatory approval from the CMA, CAK and relevant government ministries, reduced NSSF’s exposure to sector-specific risk while supporting the recapitalization and revival of EAPCC under a new majority shareholder. For the Fund, the sale underscores a broader shift toward active portfolio management, liquidity enhancement, and protection of contributors’ savings, reinforcing NSSF’s mandate to safeguard and grow retirement funds in a sustainable and prudent manner.

Section IV: Factors Hindering the Growth of NSSF

The growth of Kenya’s National Social Security Fund (NSSF) has been constrained by a combination of interconnected factors affecting its efficiency, financial stability, and capacity to deliver sufficient retirement benefits. In this regard, we examine the key challenges that have hindered the fund’s growth as follows:

- Unremitted Contributions - The fund has struggled with unremitted contributions from state corporations, government-owned enterprises, and semi-autonomous agencies. By the end of FY’2024/25, unremitted member contributions to the NSSF had declined to Kshs 2.0 bn, reflecting an improvement compared to the previous year at Kshs 3.1 bn but still representing a substantial gap. This gap underscores a widening funding gap that jeopardizes the fund’s capacity to fulfill its retirement obligations,

- Leadership and Governance Issues - The NSSF has struggled with ongoing governance challenges, including accusations of mismanagement and corruption. Probes into corruption allegations involving senior officials have eroded trust in the fund's leadership. The NSSF has faced persistent governance issues, including allegations of mismanagement and corruption. Investigations into corruption allegations involving senior officials at the NSSF have undermined confidence in the fund’s management. Senior officials have been accused of suspicious irregular bond dealings between May and July 2024 in order to generate illegal profits for the participants. This has sparked demands for reforms; however, progress has been hindered by bureaucratic obstacles and resistance from vested interests. The absence of strong governance has led to inefficiencies and continued mismanagement,

- High Unemployment Rate in Kenya - The unemployment rate in Kenya stood at 5.4% at the end of 2024; Largely due to the country's economic development challenges, coupled with a growing youth population. This has raised the dependency ratio among the working population, making it harder for them to allocate funds toward social security contributions for their retirement. As a result, the National Social Security Fund (NSSF) faces slower growth, with fewer contributors limiting its ability to expand its asset base,

- Slow Economic Growth and Low Savings - Kenya’s economy has continued to experience modest growth, averaging 4.5% over the past five years and recording a GDP growth rate of 4.7% in 2024. Despite this, the country’s gross savings to GDP ratio stood at only 16.0% in 2024, underscoring the relatively low savings culture. This weak savings performance directly affects the ability of citizens to make regular contributions to the National Social Security Fund (NSSF). Inflationary pressures and rising costs of living further erode disposable income, making it difficult for both individuals and employers to meet their obligations. Consequently, contribution inflows remain subdued, limiting NSSF’s capacity to grow its asset base and provide adequate retirement benefits. Compared to economies with higher savings rates, Kenya’s low savings levels highlight the urgent need for reforms that encourage consistent contributions and strengthen long-term financial security.

- Government Interference – As a government-owned institution, the NSSF is directly affected by legislative changes, particularly increased taxation, which negatively impacts its growth and operations. Additionally, while the rise in NSSF contribution rates aims to enhance fund collections, it has also increased employment costs. Employers, required to match employee contributions, face higher expenses, discouraging formal employment and ultimately limiting overall contributions. This challenge is further exacerbated by Kenya’s already high unemployment rate. Critics have also argued that the NSSF reforms lacked sufficient public consultation, raising concerns about whether the NSSF Act met constitutional requirements for public participation. As a result, legal disputes and resistance have increased challenging the implemented reforms, further obstructing the growth and stability of NSSF,

- Accessing Funds After Retirement - A significant challenge facing NSSF is the difficulty retirees encounter when trying to access their rightful benefits. Many members report delays or outright non-payment of benefits, leaving them financially stranded at a time when they most depend on the Fund. These unremitted benefits mean that retirees, despite years of contributing, are unable to receive the pensions or lump-sum payments they are entitled to. The situation is worsened by administrative inefficiencies and bureaucratic hurdles, which slow down claim verification and disbursement. As a result, retirees often face prolonged uncertainty, forcing them to rely on family support or informal savings mechanisms while waiting for their entitlements. This undermines the very purpose of NSSF as a reliable retirement safety net and highlights the urgent need for reforms to ensure timely and guaranteed access to benefits, and,

- Limited Coverage in the Informal Sector- The informal sector constitutes the majority of Kenya’s workforce, including small-scale traders, artisans, casual laborers, and self-employed individuals. Despite its critical role in the economy, the National Social Security Fund (NSSF) has faced persistent challenges in extending coverage to this segment. Key barriers include limited awareness and financial literacy among informal workers, mistrust arising from past mismanagement and corruption scandals, and administrative systems that are primarily tailored to formal employment structures where payroll deductions are automated. Moreover, the irregular and unpredictable income patterns typical of informal work make it difficult for individuals to commit to consistent contributions, resulting in low participation rates or complete exclusion from the scheme. This gap not only undermines the NSSF’s ability to pool resources effectively but also leaves a significant portion of the population vulnerable to financial insecurity in retirement.

Section V: Key Considerations for Improving NSSF in Kenya

We note that the government has consistently tried to promote a savings culture in the country through various reforms, including raising contribution rates and making contributions mandatory. For instance, in the NSSF Act 2013, the government recommended a mandatory registration contribution to NSSF by employees and employers. The Act aimed to enhance the sustainability of retirement benefits for Kenyan workers. Key provisions of the Act include an increase in contribution rates, from a flat rate of Kshs 400.0 to 12.0% of an employee's monthly earnings, with 6.0% contributed by the employee and an equal amount by the employer.

However, the enactment of the Act has faced legal challenges. Multiple petitions were filed questioning its constitutionality, leading to a decision by the Employment and Labor Relations Court (ELRC). On September 19, 2022, in Kenya Tea Growers Association & 8 Others v. NSSF Board & Others, the ELRC ruled that the Act was unconstitutional on the basis of;

- The provisions of the NSSF Act, 2013 were not subjected to public participation and were not tabled before the Senate prior to its enactment as per constitutional requirements,

- Imposing mandatory registration and contribution to NSSF would have overburdened employees and consequently reduce disposable income since a vast majority of employees have their pay slips already strained due to their various financial commitments with other institutions and their subscription to other pensions schemes, and,

- The provisions of the Act would have given NSSF a competitive advantage thus making the Fund a monopoly in the provision of pension and social security services in the country.

After this ruling, the NSSF Board of Trustees filed an appeal, and the case eventually reached the Supreme Court of Kenya. The Supreme Court assessed whether the ELRC had the authority to determine the Act's constitutionality. In the end, the court upheld the ELRC’s jurisdiction but referred the case to the Court of Appeal for further review. In our opinion, the following are key actionable steps that can be considered to drive NSSF’s growth while striving to balance the interests of the government, employers, and employees.

- Mass education on developing a savings culture – It is essential to raise awareness among Kenyans about the importance of cultivating a savings culture. Many young people in the informal sector view retirement planning as something reserved for older generations rather than a necessary long-term financial strategy. In addition, a significant number of Kenyans rely on the expectation that their children will provide support in the future, which discourages them from voluntarily joining schemes such as the NSSF, even when they have a stable income. Public education is also needed on the provisions of the NSSF Act of 2013, highlighting its implications for employees, employers, and government, as well as the benefits it offers to all stakeholders,

- Ensure involvement of all stakeholders in NSSF reforms – For NSSF reforms to be effective and legally sound, it is essential that all stakeholders, including the general public, employees, employers, and government institutions are actively involved in the decision-making process. The failure to engage the public and secure Senate approval led to the suspension of the NSSF Act of 2013, which had proposed raising monthly contributions to Kshs 2,068 from Kshs 200. Because the law directly impacted county employees and devolved government finances, excluding these voices violated constitutional requirements for public participation. Had the reforms been properly consulted and implemented, the higher contributions would have significantly strengthened NSSF by creating a larger retirement fund and improving workers’ pension benefits compared to the current system,

- Enforcement of compliance from employers – Employer compliance with NSSF contributions remains a critical challenge, with unremitted amounts remaining high despite declining to Kshs 2.0 billion in FY 2024/25. To safeguard the fund’s sustainability, NSSF must strengthen enforcement mechanisms and close existing loopholes to ensure that all employers remit contributions in full and on time. A key solution lies in adopting integrated digital platforms that consolidate payroll-related contributions under one system. Such technology would enhance efficiency, enable real-time reconciliation of records, and make it easier to detect employers who partially remit payments or fail to comply altogether. Stronger monitoring, coupled with penalties for non-compliance, would not only protect employees’ retirement savings but also reinforce trust in the fund, and,

- Streamline operational efficiency – In the financial year ended 30th June 2025, NSSF’s total net assets rose by 43.1% to Kshs 572.8 bn from Kshs 400.1 bn in the same period the previous year. The total expenses increased by 26.6% to Kshs 9.6 bn in FY’2024/25 from Kshs 7.6 bn in FY’2023/24. This indicates that while some progress has been made in controlling costs relative to assets under management, further improvements are necessary to align with best practice benchmarks. To better serve the interests of contributors, beneficiaries, and other stakeholders, NSSF should adopt proactive measures aimed at enhancing operational efficiency, streamlining administrative processes, and reducing unnecessary expenditures. Such measures may include leveraging technology to automate routine functions, strengthening internal controls to curb wastage, renegotiating supplier contracts to achieve cost savings, and adopting performance-based budgeting. By implementing these reforms, NSSF can improve its financial sustainability, maximize returns for members, and reinforce public confidence in its ability to manage retirement savings responsibly.

- Openness and Transparency - Transparency is a cornerstone of effective pension fund management, as it builds trust among contributors, beneficiaries, and the wider public. According to the NSSF Act, the NSSF’s Board of Trustees should submit the Fund’s financial statements to the Auditor General within three months after the end of each financial year. However, the National Social Security Fund (NSSF) released its financial statements for the year ended 30th June 2025, on 23rd January 2026, more than six months past the statutory requirement, raising concerns about accountability and timely disclosure. In contrast, private pension schemes regulated by the Retirement Benefits Authority (RBA) are required to file audited accounts within three months of year‑end, ensuring that stakeholders have access to up‑to‑date information on fund performance, governance, and compliance. The same standard should be enforced for NSSF, given its critical role in safeguarding the retirement savings of millions of Kenyans.

Section VI: Conclusion

The National Social Security Fund (NSSF) has seen quite a turnaround in its performance due to its implemented strategies such as diversification of its investments in high yielding investments as well as increased contribution due to implementation of the revived NSSF Act of 2013. Some of the notable strides are reflected by the 43.2% y/y growth in the Assets Under Management to Kshs 558.0 bn as of June 2025. Additionally, the strong financial performance recorded in FY’2024/25 highlighted by an increase of 43.1% in net contributions to Kshs 75.2 bn and a significant 152.5% increase in net investment income to Kshs 105.3 bn. However, there are still some challenges that threatens its credibility and the financial security of its members that needs to be addressed. For countless retirees, the NSSF represents a lifetime of dedication and sacrifice, making the protection of their benefits essential. Restoring trust requires the establishment of robust oversight mechanisms, including independent audits and strict adherence to remittance timelines. Now is the time for all stakeholders including government, regulators, and fund management, to come together in a unified effort to strengthen the NSSF, ensuring it continues to secure the retirement futures of millions of Kenyans. Swift action is imperative, as it will help alleviate old-age poverty and provide a stable income to replace earnings in retirement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.