Unit Trust Funds (UTFs) are Collective Investment Schemes that pool funds from multiple investors and are managed by professional fund managers. The fund managers invest the pooled funds in a diversified portfolio of securities such as equities, bonds or any authorized financial securities, with the aim of generating returns to meet the specific objectives of the fund. Following the release of the Capital Markets Authority (CMA) Quarterly Statistical Bulletin-Q2’2023, we analyze the performance of Unit Trust Funds for the period ending 31st March 2023, whose total Assets Under Management (AUM) have been steadily increasing, and are among the most popular investment options in the Kenyan market. We will further analyze the performance of Money Market Funds, a product under Unit Trust Funds.

In our previous focus on Unit Trust Funds, we looked at the Unit Trust Funds Performance – FY’2022 by Fund Managers, where we highlighted that their AUM stood at Kshs 161.0 bn, a 3.3% increase from Kshs 155.9 bn recorded in Q3’2022. In this topical, we focus on the Q1’2023 performance of Unit Trust Funds where we shall analyze the following:

- Performance of the Unit Trust Funds Industry,

- Performance of Money Market Funds,

- Comparing Unit Trust Funds AUM Growth with other Markets, and,

- Recommendations.

Section I: Performance of the Unit Trust Funds Industry

Unit Trust Funds are Investment schemes that pool funds from investors and are managed by professional Fund Managers. The fund manager invests the pooled funds with the aim of generating returns in line with the specific objectives of the fund. The Unit Trust Funds earn returns in the form of dividends, interest income, rent and/or capital gains depending on the underlying security. The main types of Unit Trust Funds include:

- Money Market Funds – These are funds that invest in fixed income securities such as fixed deposits, treasury bills and bonds, commercial papers, etc. They are very liquid, have stable returns, and, they are suitable for risk averse investors,

- Equity Funds – These are funds which largely invest in listed securities and seek to offer superior returns over the medium to long-term by maximizing capital gains and dividend income. The funds invest in various sectors to reduce concentration risk and maintain some portion of the fund’s cash in liquid fixed income investments to maintain liquidity and pay investors if need be without losing value,

- Balanced Funds – These are funds whose investments are diversified across the Equities and the Fixed Income market. Balanced Funds offer investors long-term growth as well as reasonable levels of stability of income,

- Fixed Income Funds – These are funds which invest in interest-bearing securities, which include treasury bills, treasury bonds, preference shares, corporate bonds, loan stock, approved securities, notes and liquid assets consistent with the portfolio’s investment objective, and,

- Sector Specific Funds – These are funds that invest primarily in a particular sector or industry. The funds provide a greater measure of diversification within a given sector than may be otherwise possible for the other funds. They are specifically approved by the Capital Markets Authority as they are not invested as per the set rules and regulations.

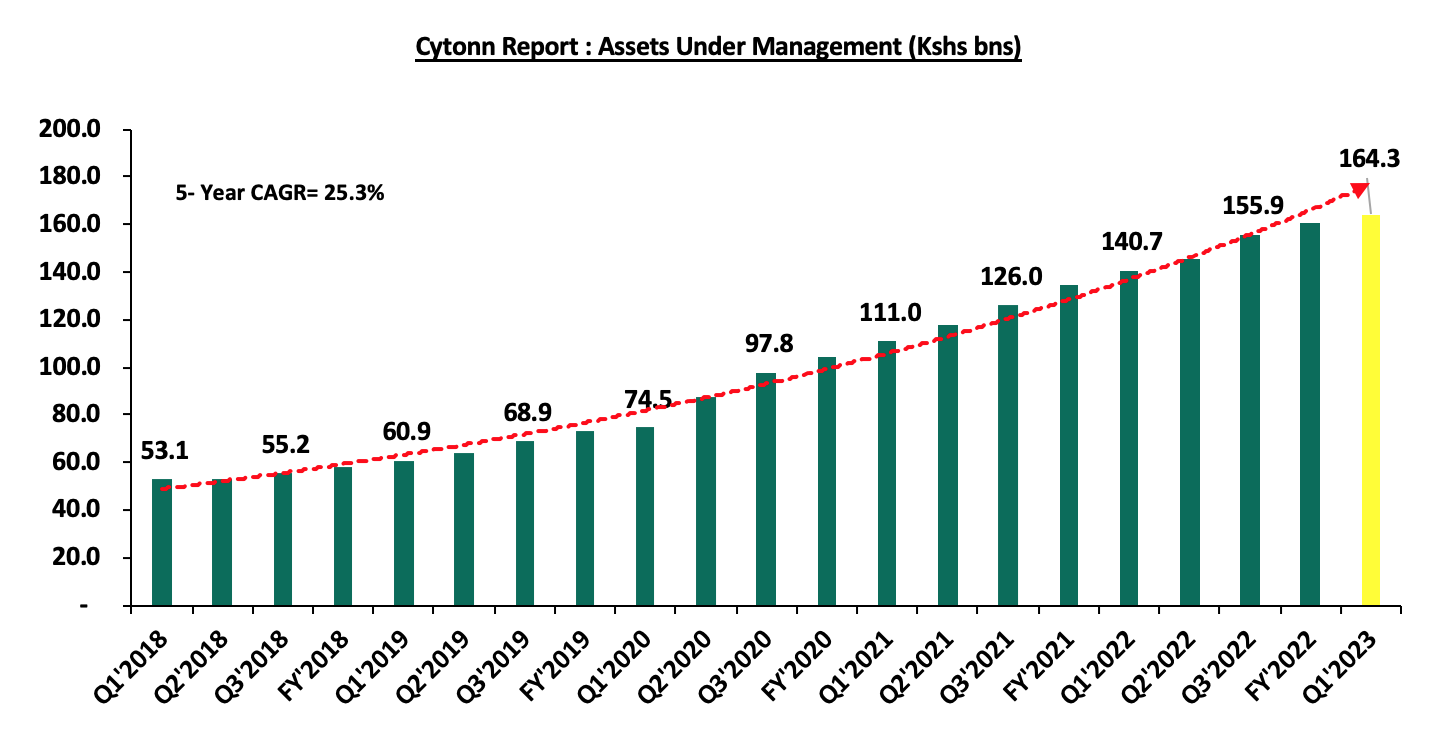

As per the Capital Markets Authority (CMA) Quarterly Statistical Bulletin-Q2’2023, the industry’s overall Assets under Management (AUM) grew by 2.0% on a quarter on quarter basis to Kshs 164.3 bn as at the end of Q1’2023, from Kshs 161.0 bn recorded in FY’2022. On a y/y basis, the total AUM increased by 16.8% to Kshs 164.3 bn, from Kshs 140.7 bn as at the end of Q1’2022. Key to note, Assets under Management of the Unit Trust Funds have registered an upward trajectory over the last five years, growing at a 5-year CAGR of 25.3% from Kshs 53.1 bn recorded in Q1’2018. The chart below shows the growth in Unit Trust Funds’ AUM:

Source: Capital Markets Authority Quarterly Statistical bulletins

The growth can be largely attributed to:

- Low Investments minimums: Majority of the Unit Trust Funds Collective Investment Schemes’ (CIS) in the market require a relatively low initial investment ranging between Kshs 100.0 - Kshs 10,000.0. This has in turn has promoted financial inclusion by allowing even small scale investors to access professionally managed investments opportunities

- Increased Investor Knowledge: There has been a drive towards investor education mainly by the Capital Markets Authority (CMA) and the fund managers on the various products offered by trust funds, which has meant that more people are aware and have a deeper understanding of the investment subject. As a result, their confidence has been boosted leading to increased uptake,

- Diversified product offering: Unit Trust Funds are also advantageous in terms of providing investors with access to a wider range of investment securities through pooling of funds. This allows investors the opportunity of diversifying their portfolios which would have not been accessible if they invested on their own. Additionally, they also ensure investors are able to shield themselves against the risks associated with market volatility associated with some asset classes

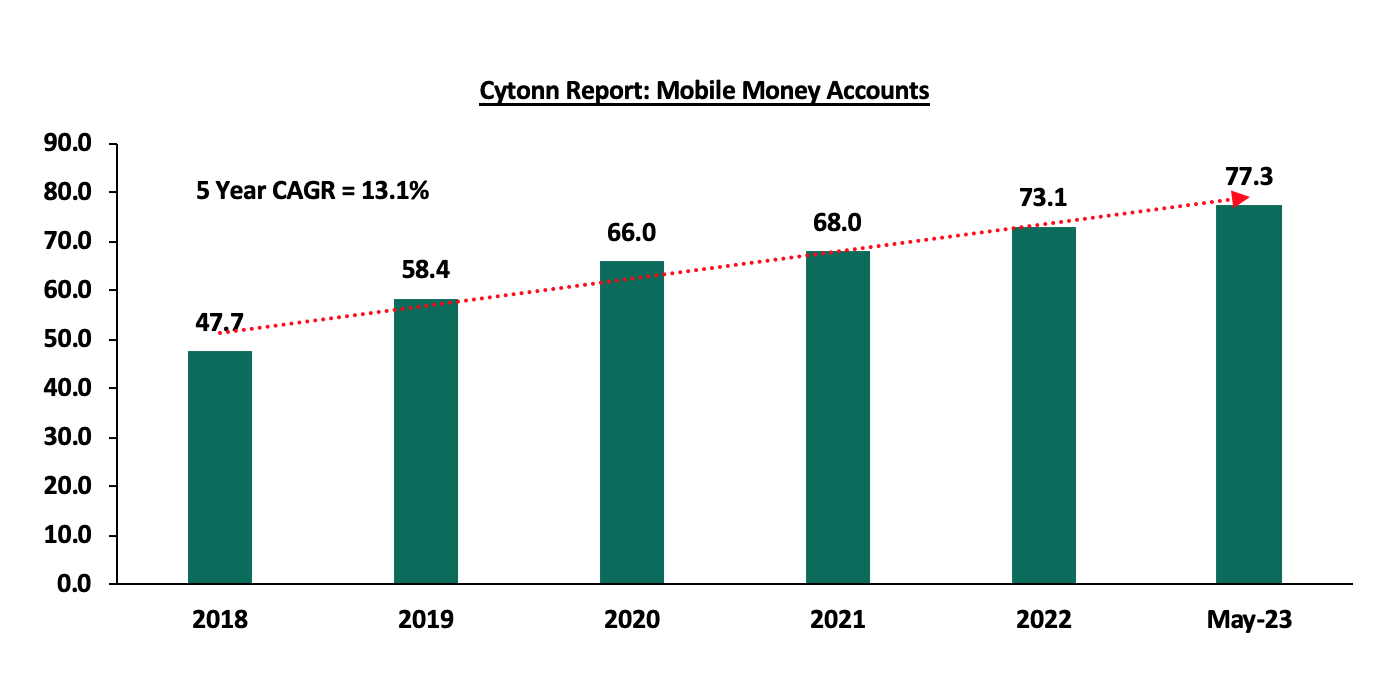

- Adoption of Fintech: Digitization and automation within the industry has enhanced ease in cash accessibility, enabling investors to immediately access their investments via mobile payment platforms. According to the Central Bank of Kenya, more individuals are transacting through mobile money services as evidenced by the increase in the total number of registered mobile money accounts to 77.3 mn in May 2023, up from 41.7 mn recorded in May 2018, translating to a 5-year CAGR of 13.1%. The graph below shows the growth in the number of mobile money accounts in the period 2018 to May 2023;

Source: CBK

Additionally, investors can easily track their investments based on principal invested as well as interest earned during various periods and the charges incurred via mobile apps,

- Competitive returns - Positive performance and competitive returns have been instrumental in attracting investors to unit trust funds. As these funds consistently outperform certain traditional investment options, more investors are drawn to their potential for generating wealth over the long term

According to the Capital Markets Authority, as at the end of Q1’2023, there were 36 Collective Investment Schemes (CISs) in Kenya, up from 34 recorded at the end of FY’2022 and 30 recorded at the end of Q1’2022. Out of the 36, 25 schemes equivalent to 69.4% were active while 11 (30.6%) were inactive. The table below outlines the performance of the Collective Investment Schemes comparing FY’2022 and Q1’2023:

|

|

Cytonn Report: Assets Under Management (AUM) for the Approved Collective Investment Schemes |

|||||

|

No. |

Collective Investment Schemes |

FY'2022 AUM |

FY’2022 |

Q1'2023 AUM |

Q1’2023 |

AUM Growth |

|

(Kshs mn) |

Market Share |

(Kshs mn) |

Market Share |

FY'2022 –Q1'2023 |

||

|

1 |

CIC Unit Trust Scheme |

61,263.9 |

38.1% |

56,970.2 |

34.7% |

(7.0%) |

|

2 |

NCBA Unit Trust Scheme |

25,342.0 |

15.7% |

27,739.7 |

16.9% |

9.5% |

|

3 |

Sanlam Unit Trust Scheme |

15,841.6 |

9.8% |

16,915.2 |

10.3% |

6.8% |

|

4 |

ICEA Unit Trust Scheme |

14,758.9 |

9.2% |

14,558.6 |

8.9% |

(1.4%) |

|

5 |

British American Unit Trust Scheme |

13,318.0 |

8.3% |

13,201.8 |

8.0% |

(0.9%) |

|

6 |

Old Mutual Unit Trust Scheme |

7,570.5 |

4.7% |

8,035.6 |

4.9% |

6.1% |

|

7 |

Dry Associates Unit Trust |

3,881.8 |

2.4% |

4,497.9 |

2.7% |

15.9% |

|

8 |

Coop Unit Trust Scheme |

3,567.4 |

2.2% |

4,011.4 |

2.4% |

12.4% |

|

9 |

Nabo Capital Ltd |

3,291.4 |

2.0% |

3,943.2 |

2.4% |

19.8% |

|

10 |

Madison Asset Unit Trust Funds |

2,923.2 |

1.8% |

3,565.4 |

2.2% |

22.0% |

|

11 |

ABSA Unit Trust Scheme |

2,342.1 |

1.5% |

2,869.6 |

1.7% |

22.5% |

|

12 |

Zimele Unit Trust Scheme |

2,605.5 |

1.6% |

2,692.9 |

1.6% |

3.4% |

|

13 |

African Alliance Kenya Unit Trust Scheme |

1,579.3 |

1.0% |

1,595.8 |

1.0% |

1.0% |

|

14 |

Mali Money Market Fund |

- |

0.0% |

877.4 |

0.5% |

0.0% |

|

15 |

Apollo Unit Trust Scheme |

871.1 |

0.5% |

862.0 |

0.5% |

(1.0%) |

|

16 |

Cytonn Unit Trust Fund |

774.5 |

0.5% |

701.4 |

0.4% |

(9.4%) |

|

17 |

Genghis Unit Trust Funds |

608.9 |

0.4% |

620.0 |

0.4% |

1.8% |

|

18 |

Orient Collective Investment Scheme |

248.0 |

0.2% |

252.2 |

0.2% |

1.7% |

|

19 |

Equity Investment Bank |

185.5 |

0.1% |

185.7 |

0.1% |

0.1% |

|

20 |

Kuza Asset Managers |

- |

0.0% |

72.1 |

0.0% |

0.0% |

|

21 |

KCB Asset Managers |

- |

0.0% |

56.3 |

0.0% |

0.0% |

|

22 |

Amana Unit Trust Funds |

27.8 |

0.0% |

26.5 |

0.0% |

(5.0%) |

|

23 |

GenAfrica Unit Trust Scheme |

2.9 |

0.0% |

19.1 |

0.0% |

549.6% |

|

24 |

Etica Capital Limited |

- |

0.0% |

5.3 |

0.0% |

0.0% |

|

25 |

Wanafunzi Investments |

0.7 |

0.0% |

0.7 |

0.0% |

2.2% |

|

26 |

Genghis Specialized Funds |

- |

- |

- |

- |

- |

|

27 |

Standard Investment Trust Funds |

- |

- |

- |

- |

- |

|

28 |

Diaspora Unit Trust Scheme |

- |

- |

- |

- |

- |

|

29 |

Dyer and Blair Unit Trust Scheme |

- |

- |

- |

- |

- |

|

30 |

Jaza Unit Trust Fund |

- |

- |

- |

- |

- |

|

31 |

Masaru Unit Trust Fund |

- |

- |

- |

- |

- |

|

32 |

Adam Unit Trust Fund |

- |

- |

- |

- |

- |

|

33 |

First Ethical Opportunities Fund |

- |

- |

- |

- |

- |

|

34 |

Amaka Unit Trust (Umbrella) Scheme |

- |

- |

- |

- |

- |

|

35 |

Jubilee Unit Trust Scheme |

|

|

|

|

|

|

36 |

Enwealth Capital Unit Trust |

|

|

|

|

|

|

|

Total |

161,004.8 |

100.0% |

164,276.0 |

100.0% |

2.03% |

Source: Capital Markets Authority: Quarterly Statistical Bulletin, Q2’2023

Key take outs from the above table include:

- Assets Under Management: CIC Unit Trust Scheme remained the largest overall Unit Trust Fund, with an AUM of Kshs 57.0 bn in Q1’2023, albeit lower than the AUM of Kshs 61.3 bn in FY’2022, translating to a 7.0% decline in AUM growth,

- Growth: In terms of AUM growth, GenAfrica Unit Trust Scheme recorded the highest growth of 549.6% with its AUM increasing to Kshs 19.1 mn, from Kshs 2.9 mn in FY’2022, equivalent to a 549.6% AUM growth, due to the low base effect. On the other hand, Cytonn Unit Trust Fund recorded the largest decline with its AUM declining by 9.4% to Kshs 701.4 mn in Q1’2023, from Kshs 774.5 mn in FY’2022,

- Market Share: CIC Unit Trust Scheme remained the largest overall Unit Trust with a market share of 34.7%, 3.4% points decline from 38.1% recorded in FY’2022. The decline in market share is an indication of increasing competition as new collective schemes enter the market,

- New Collective Investment Schemes: Mali Money Market Fund scheme, Kuza Unit trust scheme, KCB unit trust schemes, and Etica Unit trusts schemes, with AUMs of Kshs 877.4 mn, Kshs 72.1 mn, Kshs 56.3 and Kshs 5.3 mn respectively, became active collective investment schemes in the capital market during Q1’2023, increasing the number of active collective schemes to 25.

- 11 UTFs remained inactive during at the end of Q1’2023: First Ethical Opportunities Fund, Adam Unit Trust Fund, Masaru Unit Trust Fund, Jaza Unit Trust Fund, Dyer and Blair Unit Trust Scheme, Diaspora Unit Trust Scheme, Standard Investments Bank, Genghis Specialized Fund, Jubilee Unit Trust, Enwealth Capital Trust and Amaka Unit Trust remained inactive as at the end of Q1’2023,

Section II: Performance of Money Market Funds

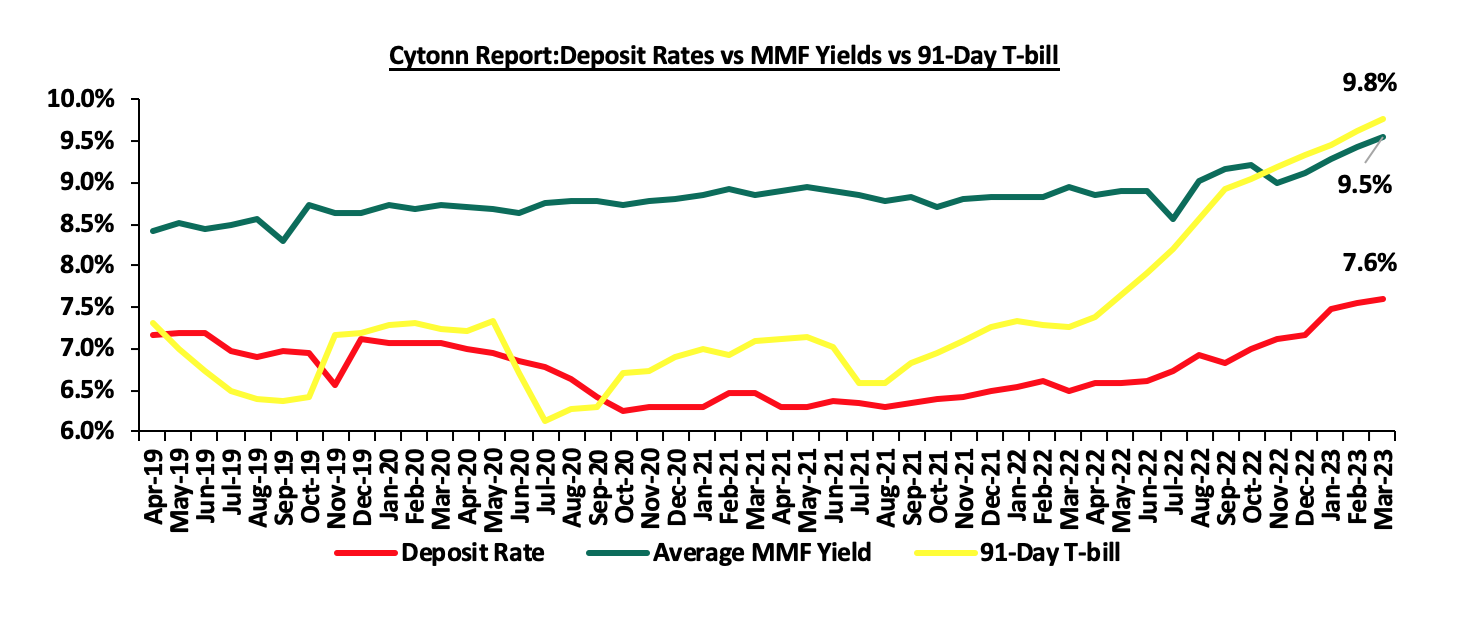

Money Market Funds (MMFs) have continued to gain popularity in Kenya, with one of the main reasons is being the higher returns from money market funds compared to the returns on bank deposits. According to the Central Bank of Kenya data, the average deposit rate in March 2023 increased to 7.6% from 7.5% recorded in January 2023. Despite the increase, the average deposit rate continues to offer the lowest returns in compared to 91-day T-bill and money market funds average yields of 9.8% and 9.5% respectively. The graph below shows the performance of the Money Market Fund to other short-term financial instruments:

Source: Central Bank of Kenya, Cytonn Research

As per the regulations, funds in MMFs should be invested in short-term liquid interest-bearing securities with a weighted tenor to maturity of 13 months or less. The short-term securities include treasury bills, call deposits, commercial papers and fixed deposits in commercial banks and deposit taking institutions, among others as specified by CBK. As a result, the Money Market funds are best suited for investors who require a low-risk investment that offers capital stability, liquidity, but with a high-income yield. The fund is also a good safe haven for investors who wish to switch from a higher risk portfolio to a low risk portfolio, especially during times of uncertainty.

Top Five Money Market Funds by Yields

During the period under review, the following Money Market Funds had the highest average effective annual yield declared, with the Cytonn Money Market Fund having the highest effective annual yield at 10.9% against the industry Q1’2023 average of 9.4%.

|

Cytonn Report: Top 5 Money Market Fund Yield in Q1’2023 |

||

|

Rank |

Money Market Fund |

Effective Annual Rate (Average Q1'2023) |

|

1 |

Cytonn Money Market Fund |

10.9% |

|

2 |

Apollo Money Market Fund |

10.2% |

|

3 |

GenCap Hela Imara Money Market Fund |

9.9% |

|

4 |

NCBA Money Market Fund |

9.9% |

|

5 |

Zimele Money Market Fund |

9.9% |

|

|

Average of Top 5 Money Market Funds |

10.2% |

|

Industry average |

9.4% |

|

Source: Cytonn Research

Section IV: Comparison between Unit Trust Funds AUM Growth and other Markets

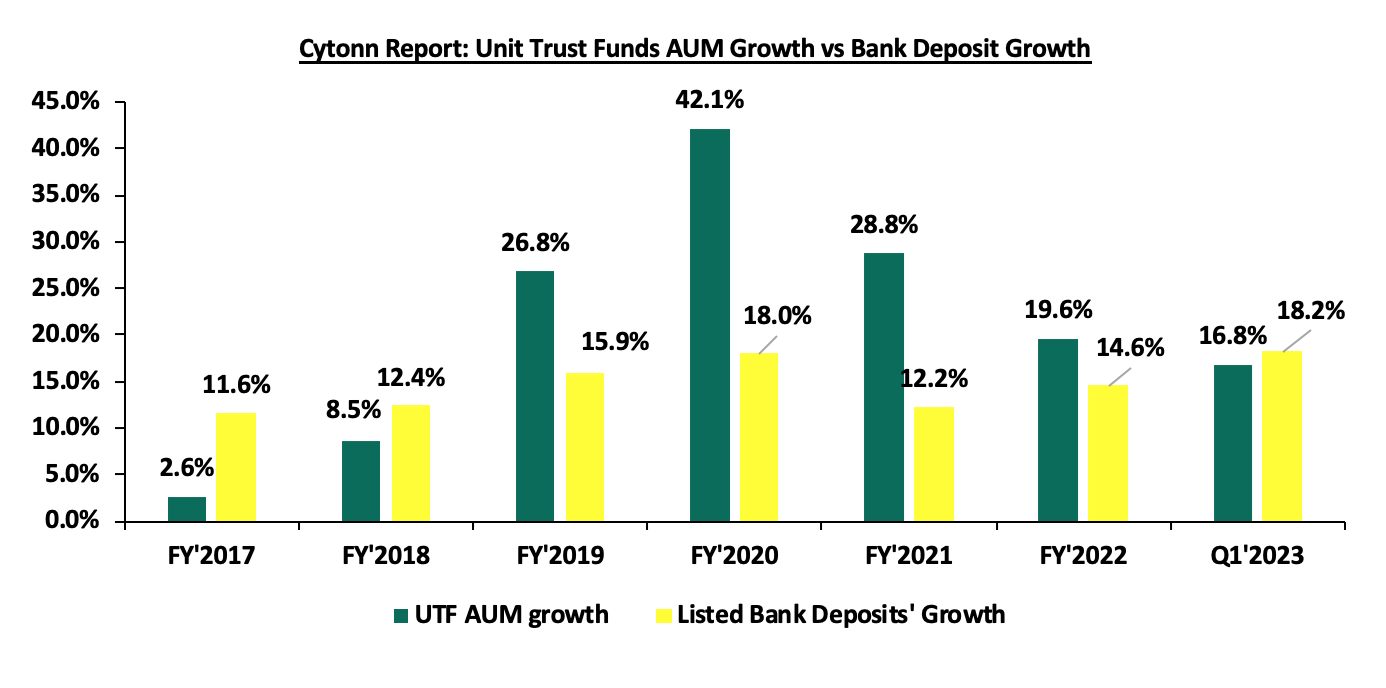

Unit Trust Funds’ assets recorded a y/y growth of 16.8% in Q1’2023, while the listed banks cumulative deposits recorded a slightly higher growth of 18.2% over the same period. For the Unit Trust Funds, the growth of 16.8% was a decline, compared to 19.6% growth recorded in FY’2022. On the other hand, listed banks deposits, recorded an increase of 3.6% points to 18.2%, from the 14.6% growth recorded in FY’2022. The chart below highlights the year on year AUM growths for Unit Trust Funds AUM vs Listed banks deposits growth since 2017;

Source: Cytonn Research

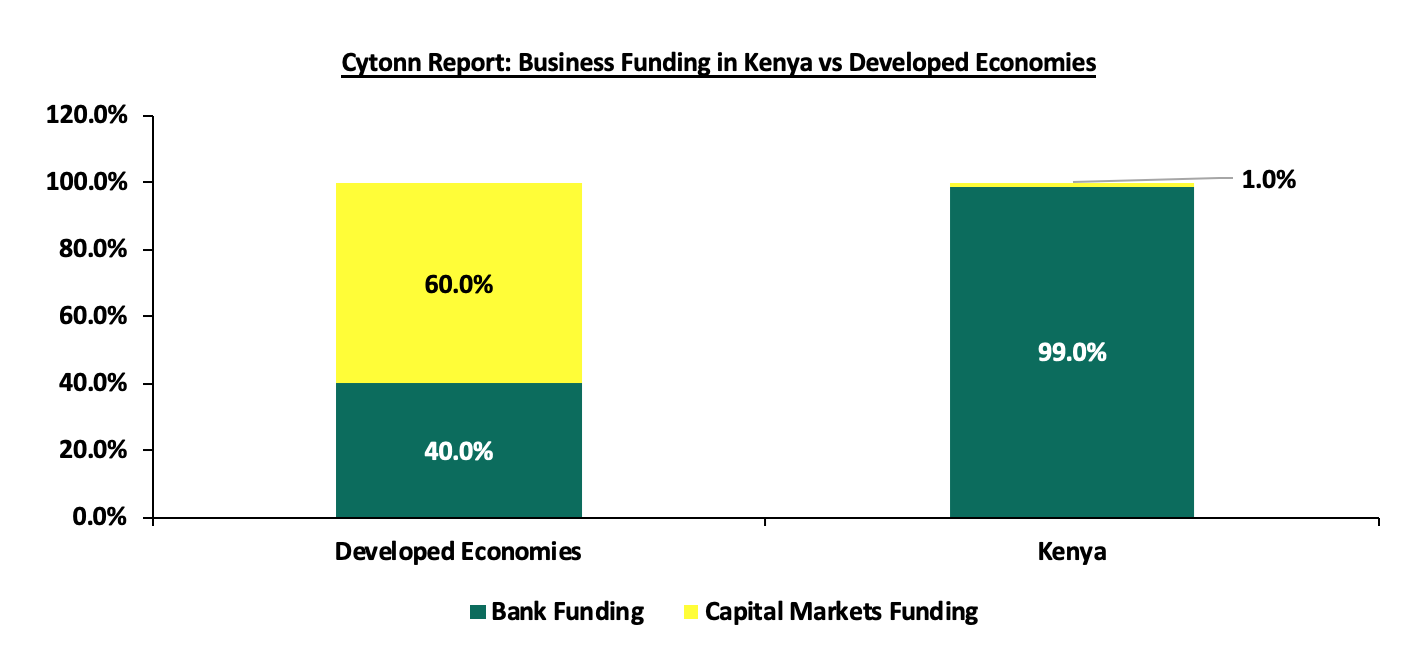

We note that the 2.8% points q/q decline in UTF growth compared to listed bank deposits growth of 3.6% points during the same period is an indication of a relative slowdown in our capital markets with the faster growth of bank deposits pointing towards a constrained capital market. According to the World Bank data, in well-functioning economies, businesses rely on bank funding for a mere 40.0%, with the larger percentage of 60.0% coming from the Capital markets. Closer home, the World Bank noted that businesses in Kenya relied on banks for 99.0% of their funding while less than 1.0% come from the capital markets. Kenya’s capital market remains stunted, driven by overreliance on the banking sector for funding.

Source: World Bank

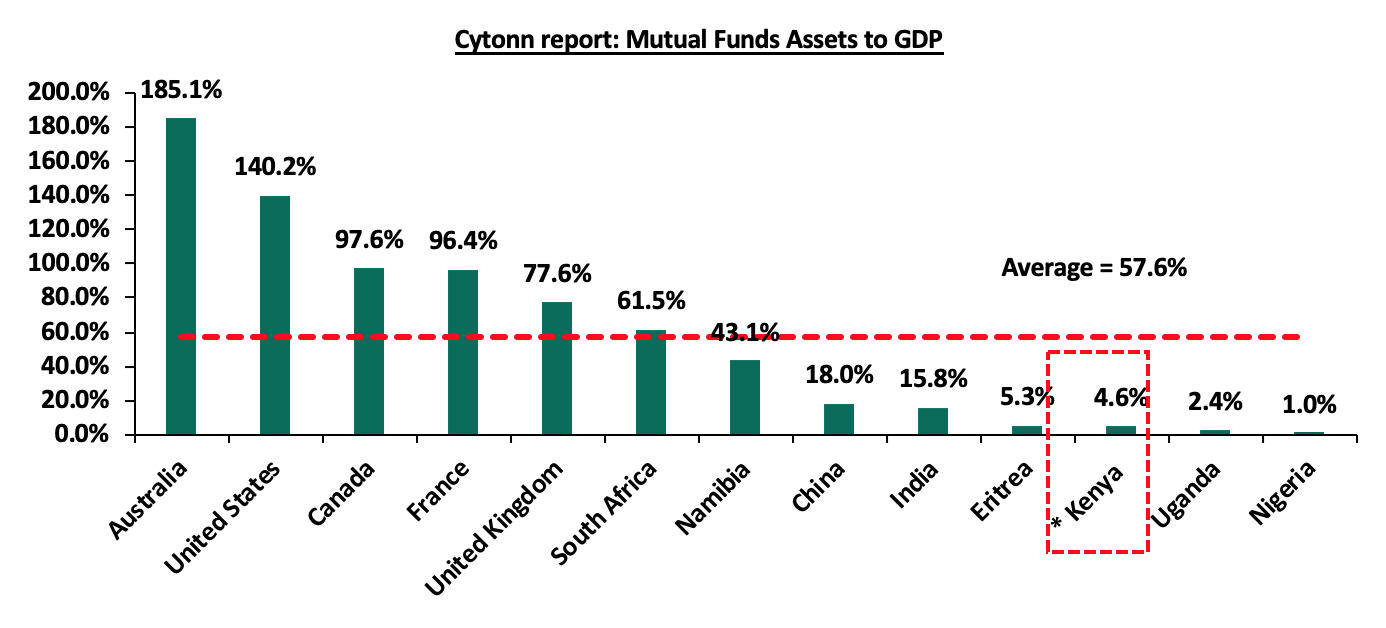

Notably, Kenya’s Mutual Funds/UTFs to GDP ratio at the end of Q1’2023 came in at 4.6% significantly lower compared to an average of 57.6% amongst select global markets an indication of a need to enhance our capital markets Additionally, Sub-Saharan African countries such as South Africa and Namibia have higher mutual funds to GDP ratios of 61.5% and 43.1%, respectively as at end of 2020, compared to Kenya. The chart below shows select countries’ mutual funds as a percentage of GDP:

*

*Data as of March 2023

Source: World Bank Data

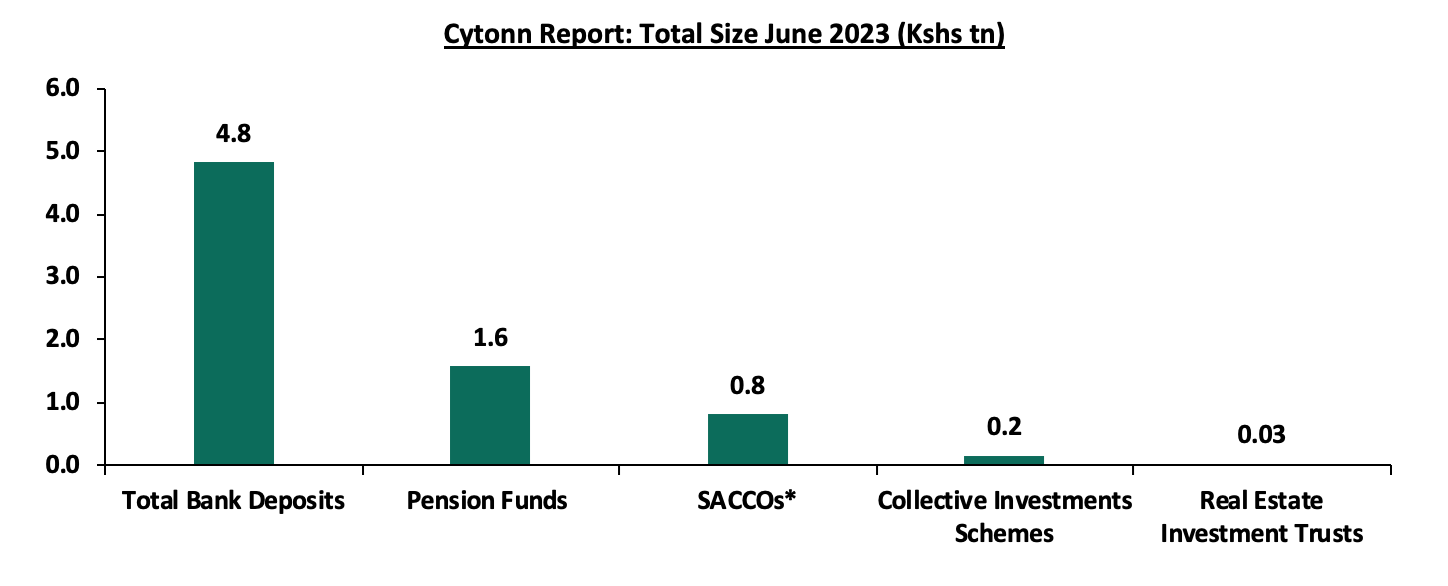

Over the past 5 years, Unit Trust Funds (UTFs) AUM has exhibited positive performance, with the Unit Trust Funds AUM having grown at a 5-year CAGR of 25.3% to Kshs 164.3 bn in Q1’2023, from Kshs 53.1 bn recorded in Q1’2018. However, the industry is still dwarfed when compared to other deposit taking institutions such as bank deposits, with the entire banking sector deposit coming in at Kshs 4.8 tn as at March 2023 and the pension industry at Kshs 1.6 tn as of December 2022. Below is a graph showing the sizes of different saving channels and capital market products in Kenya;

* Data as of December 2021

Total Bank Deposit as of 31st March 2023

Pension Funds as of 31st December 2023

Source: CMA, RBA, CBK, SASRA Annual Reports and REITs Financial Statements

Comparing other Capital Markets products like REITS, Kenya has made strides in the sector, however, there is still a lot of room for improvement. The REITs’ numbers remain low, with the only 4 registered REITS, out of which, only the ILAM Fahari I-REIT currently openly trading on the NSE main investment market. The table below show the authorized REITs in the country:

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

No |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

October 2015 |

Main Investment Segment |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform |

Trading |

|

4 |

Local Authorities Pension Trust (LAP Trust) |

Imara |

I-REIT |

November 2022 |

Main Investment Segment – Restricted Sub segment |

Restricted |

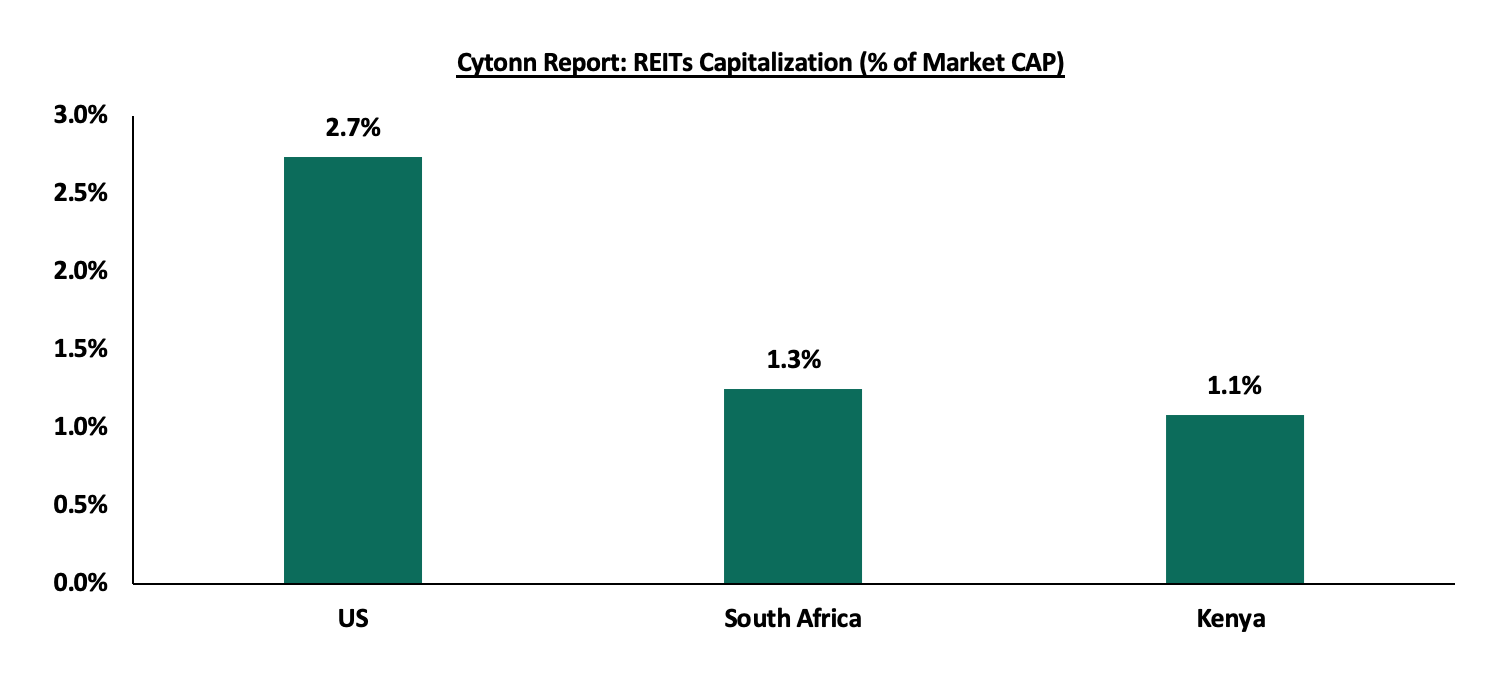

The listed REITs capitalization as a percentage of total market cap in Kenya stands at 1.1%, as compared to 2.7% in the United States (US) and 1.3% in South Africa, as of 4 August 2023. The perfomance of the Kenya’s listed REIT is due to the decline in the total market capitalization that has adversely affected Nairobi Stock Exchange, with NASI registering 16.6% YTD decline, attributable foreign investors leaving the NSE Market, with NSE registering a net outflow position of USD 277.2 bn as at 4th August 2023. Below is a graph showing comparison of Kenya’s REITs to Market Cap Ratio to that of US and South Africa:

Source: European Public Real Estate Association (EPRA), Nairobi Securities Exchange (NSE)

Section V: Recommendations

In conclusion, as witnessed by the growing numbers of total registered Mobile Money Accounts there is need to leverage more on innovation and digitization in order to further propel the growth of unit trust products in Kenya. The use of technology as a distribution channel for unit trusts products opens up the funds to the retail segment, which is characterized by strong demand among retail clients for convenient and innovative products. In addition, we recommend the following actions to stimulate growth of UTFs in the Kenyan capital market;

- Lower the minimum investment amounts: Currently, the minimum investment for sector specific funds is Kshs 1.0 mn, while that for Development REITS is currently at Kshs 5.0 mn. According to the Kenya National Bureau of Statistics, 87.7% of employees are earning below Kshs 100,000.0 monthly. As such, the high minimum initial and top up investments amounts for investing in sector specific funds deter potential investors. Furthermore, these high amounts disadvantage the majority of retail investors by restricting their options for investments,

- Encourage innovation and diversification of UTFs’ investments: Majority of UTFs’ investments are either in fixed income or fixed deposits, highlighting high concentration risks. There is need to encourage fund managers to invest in different sectors of the economy as this will spur diversification of investments such as real estate and private offers. As at 31st March 2023, the total allocation to Government securities and Fixed deposit stood at 46.2% and 39.5% respectively, accounting for 85.7% of the total AUM for unit trust, thus bringing about concentration risk

- Update regulations: The current Collective Investments Schemes Regulations in Kenya were formulated in 2001 and have not been updated since, despite the dynamic nature of the capital markets worldwide. This has led to the regulations lagging behind. For instance, the regulations do not include provisions for private offers that have grown in importance over the years. The regulations also lack stipulated guidelines on special funds to cater for the sophisticated investors’ interest in regulated alternative investments products. While there are efforts to update the regulations, we note that they remain in progress and are yet to be completed,

- Allow for sector funds: Under the current capital markets regulations, UTFs are required to diversify. However, one has to seek special dispensation in the form of sector funds such as a financial services fund, a technology fund or a Real Estate Unit Trust Fund. Regulations allowing unit holders to invest in sector funds would go a long way in expanding the scope of unit holders interested in investing. For example, in Kenya, Real Estate continues to play an important role in the economy contributing 10.0% to the GDP as of March 2023 and remains a popular investment option due to the stable returns it delivers and low correlation with traditional investments. However, looking at the various types of Unit trust we have, investments in real estate are conspicuously missing.

- Incentives: Introduce incentives such as tax benefits or government subsidies for unit trust fund investments, to encourage more people to consider them as part of their investment portfolio, similar to pensions and Education plans. This will be of great importance in encouraging investors to invest in a long time horizon

- Better disclosure by UTFs: For an investor to make an informed decision they need to be provided with a detailed portfolio holding of the UTFs. Investors need to understand where they moneys are invested so as to be aware of the risk their investments are exposed to. The information should be available to the investors and also to prospective clients

- Eliminate conflicts of interest in the capital markets governance and allow non-financial institutions to also serve as Trustees: The capital markets regulations should foster a governance structure that is more responsive to both market participants and market growth. In particular, restricting Trustees of Unit Trust Schemes to Banks only limits options, especially given the direct competition between the banking industry and capital markets. Notably, the pension industry has 6 non-bank Trustees yet the capital market only has one non-bank Trustee. Opening up the corporate trustee will bring about a more competitive and predictable trustee environment and consequently bring about more innovation and better services by trustees and growth in capital markets

- Provide Support to Fund Managers: In our opinion, the regulator, CMA needs to include market stabilization tools as part of the regulations/Act that will help Fund Managers meet fund obligations especially during times of distress like when there are a lot of withdrawals from the funds. We commend and appreciate the regulator’s role in safeguarding investor interests. However, since Fund Managers also play a significant role in the capital markets, the regulator should also protect the reputation of different fund managers in the industry.

We believe that the UTF market is still underdeveloped, however, it has great opportunity and potential to gain in terms of number of investors and AUM. The Authority and the services providers should proactively and decisively address any challenges that may occur so as to improve on the investor confidence. This will come a long way in encouraging more people to invest through our UTFs and enable the UTFs to have a significant contribution to the economic growth of Kenya

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.