Unit Trust Funds (UTFs) are collective investment schemes that pool funds from many different investors and are managed by professional Fund Managers. The fund managers invest the pooled funds in a portfolio of securities with the aim of generating returns in line with the specific objectives of the fund. Following the release of the Capital Markets Authority (CMA) Quarterly Statistical Bulletin – Q4’2020, we examine the performance of Unit Trust Funds, as the total Assets Under Management (AUM) have been steadily increasing and they are among the most popular investment options in the Kenyan market. We will further analyze the performance of Money Market Funds, a product under Unit Trust Funds. In our previous focus on Unit Trust Funds, we looked at the Q2’2020 Performance by Unit Trust Fund Managers. In this topical, we focus on the Q3’2020 performance of Unit Trust by Fund Managers, where we shall analyze the following:

- Performance of the Unit Trust Funds Industry,

- Performance of Money Market Funds,

- Comparing Unit Trust Funds AUM Growth with Bank Deposits Growth, and,

- Conclusion

Section I: Performance of the Unit Trust Funds Industry

Unit Trust Funds are investment schemes that pool funds from investors and are managed by professional Fund Managers. The fund manager invests the pooled funds with the aim of generating returns in line with the specific objectives of the fund. The Unit Trust funds earn returns in the form of dividends, interest income and/or capital gains depending on the asset class the funds are invested in. The main types of Unit Trust Funds include:

- Money Market Fund – This fund invests in short-term debt securities with high credit quality such as fixed deposits, treasury bills and commercial papers. Money Market Funds are suitable for risk averse investors as they provide stable fixed income returns with minimal risk while providing easy access to the cash,

- Equity Fund – This fund aims to offer superior returns over the medium to longer-term by maximizing capital gains and dividend income through investing in listed equity securities. The funds invest in various sectors to reduce concentration of risk and maintain some portion of the fund’s cash in liquid fixed income investments to be able to pay investors if need be without losing value,

- Balanced Fund – These are funds in whose investments are diversified across the Equities and the fixed income market. The Balanced Fund offers investors long-term growth as well as reasonable levels of stability of income,

- Fixed Income Fund – This fund invests in interest-bearing securities, which include treasury bills, treasury bonds, preference shares, corporate bonds, loan stock, approved securities, notes and liquid assets consistent with the portfolio’s investment objective, and,

- Sector Funds – These are funds that invest primarily in a particular sector or industry. The funds provide a greater measure of diversification within a given sector than may be otherwise possible for individual investors.

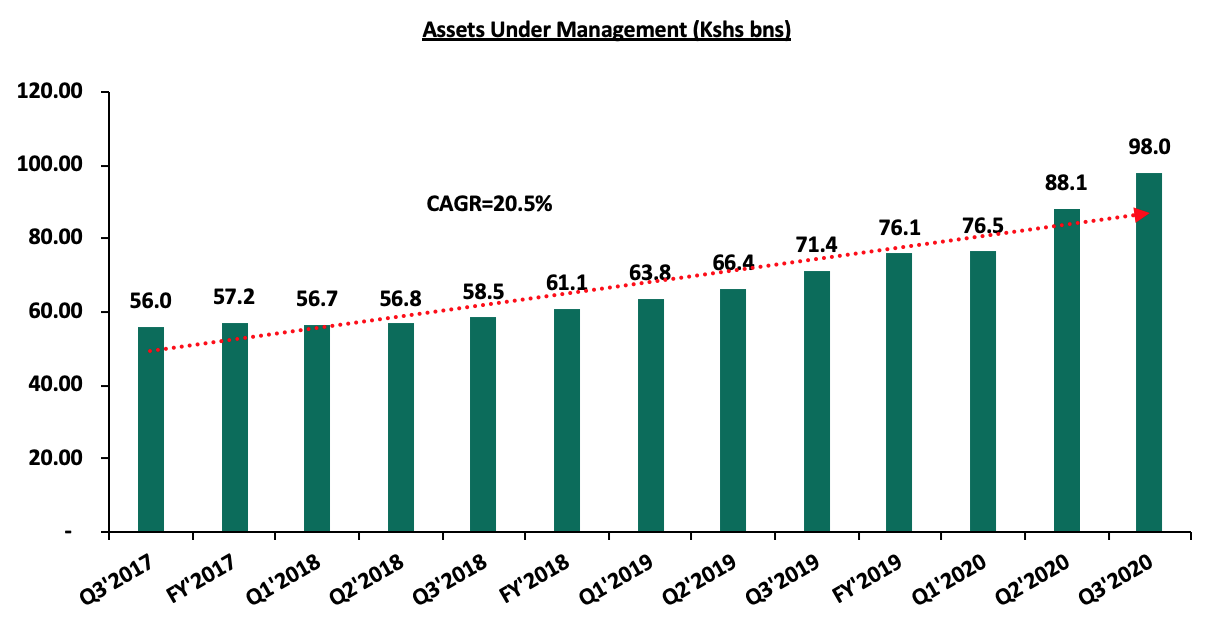

In line with Capital Market Regulations (2002) Part IV (32), Unit Trust Funds Managers released their Q3’2020 results. As per the Capital Markets Authority (CMA) Quarterly Statistical Bulletin – Q4’2020, the industry’s overall Assets Under Management (AUM) grew by 11.2% to Kshs 98.0 bn as at the end of Q3’2020, from Kshs 88.1 bn as at the end of Q2’2020. In the last three years, Assets Under Management of the Unit Trust Funds have grown at a CAGR of 20.5% to Kshs 98.0 bn in Q3’2020, from Kshs 56.0 bn recorded in Q3’2017.

This growth can be largely attributable to:

- Low Investments minimums: Unit Trust Funds have become more accessible to retail investors, with a majority of the Collective Investment Schemes’ (CIS) in the market requiring an initial investment ranging between Kshs 100.0 - Kshs 10,000.0,

- Investor Knowledge: There has been a drive towards investor education that has meant that more people are more aware and are taking advantage of this and investing,

- Diversified product offering: Unit Trust Funds are also advantageous in terms of offering investors the opportunity of diversifying their portfolios by providing them with access to a wider range of investment securities through pooling of funds, which would have not been accessible if they invested on their own,

- Efficiency and ease of access to cash/High Liquidity: Compared to other investment options such as equities, unit trusts are liquid, as it is easy to sell and buy units without depending on demand and supply at the time of investment or exit. Furthermore, the advent of digitization and automation within the industry has enhanced liquidity, enabling investors to receive their funds within 3 to 5 working days if they are withdrawing to their bank accounts, and immediate access to funds when withdrawing via M-Pesa, and,

- Emergence of Fintech: The financial services industry in the country is seeing its traditional model disrupted by technology and regulations; from March 2020 when the pandemic hit, many individuals and businesses have been forced to resort to technological avenues to curb the spread of the virus as they enforce social distancing. With the value of mobile money transactions growing at a 5-year CAGR of 10.4% to Kshs 4.6 bn from Kshs 2.8 in 2015, the reception of mobile money technology has increased financial inclusion, providing financial services to the ‘unbanked’, and as such, investing and divesting has been made easy for investors. Additionally, Fintech Inclusion has increased the efficiency of processing both payments and investments for fund managers.

According to the Capital Markets Authority, as at the end of Q3’2020 there were 19 active collective investment schemes. During the period under review, total Assets Under Management grew by 11.2% to Kshs 98.0 bn in Q3’2020, from Kshs 88.1 bn as at Q2’2020. The table below outlines the performance of Fund Managers of Unit Trust Funds in terms of Assets under Management:

|

Assets Under Management (AUM) for the Approved and Active Collective Investment Schemes |

||||||

|

No. |

Fund Managers |

Q2’2020 AUM |

Q2’2020 |

Q3’2020 AUM |

Q3’2020 |

AUM Growth |

|

(Kshs mns) |

Market Share |

(Kshs mns) |

Market Share |

Q2’2020 – Q3’2020 |

||

|

1 |

CIC Asset Managers |

36,313.7 |

41.2% |

40,524.2 |

41.4% |

11.6% |

|

2 |

BRITAM |

10,444.7 |

11.9% |

11,335.1 |

11.6% |

8.5% |

|

3 |

Commercial Bank of Africa |

9,263.0 |

10.5% |

11,040.0 |

11.3% |

19.2% |

|

4 |

ICEA Lion |

9,801.9 |

11.1% |

10,637.0 |

10.9% |

8.5% |

|

5 |

Old Mutual |

6,129.0 |

7.0% |

6,131.0 |

6.3% |

0.0% |

|

6 |

Sanlam Investments |

4,328.5 |

4.9% |

5,735.4 |

5.9% |

32.5% |

|

7 |

Dry Associates |

1,947.9 |

2.2% |

2,133.4 |

2.2% |

9.5% |

|

8 |

African Alliance Kenya |

1,907.4 |

2.2% |

1,785.6 |

1.8% |

(6.4%) |

|

9 |

Madison Asset Managers |

1,481.0 |

1.7% |

1,611.5 |

1.6% |

8.8% |

|

10 |

Co-op Trust Investment Services Limited |

1,156.4 |

1.3% |

1,474.8 |

1.5% |

27.5% |

|

11 |

Nabo Capital (Centum) |

1,284.4 |

1.5% |

1,456.4 |

1.5% |

13.4% |

|

12 |

Zimele Asset Managers |

1,206.2 |

1.4% |

1,275.8 |

1.3% |

5.8% |

|

13 |

Cytonn Asset Managers |

951.6 |

1.1% |

1,009.2 |

1.0% |

6.1% |

|

14 |

Genghis Capital |

655.4 |

0.7% |

556.0 |

0.6% |

(15.2%) |

|

15 |

Apollo Asset Managers |

498.4 |

0.6% |

549.5 |

0.6% |

10.3% |

|

16 |

Equity Investment Bank |

329.7 |

0.4% |

318.0 |

0.3% |

(3.5%) |

|

17 |

Amana Capital |

203.5 |

0.2% |

221.8 |

0.2% |

9.0% |

|

18 |

Alpha Africa Asset Managers |

192.4 |

0.2% |

203.4 |

0.2% |

5.7% |

|

19 |

Wanafunzi Investments |

0.2 |

0.0% |

0.7 |

0.0% |

316.9% |

|

|

Total |

88,095.1 |

100.0% |

97,998.6 |

100.0% |

11.2% |

Key to note from the above table:

- Assets Under Management: CIC Asset Managers remained the largest overall Unit Trust Fund Manager with an AUM of Kshs 40.5 bn in Q3’2020, from an AUM of Kshs 36.3 bn as at Q2’2020 translating to an 11.6% AUM growth,

- Market Share: CIC Asset Managers remained the largest overall Unit Trust with a market share of 41.4%, an increase from 41.2% in Q2’2020. Key to note, Sanlam Investments recorded the highest increase in its market share with the market share increasing by 1.0% points to 5.9% from 4.9% in Q2’2020, and,

- Growth: In terms of AUM growth, Wanafunzi Investments recorded the strongest growth of 316.9%, with its AUM increasing to Kshs 0.7 mn, from Kshs 0.2 mn in Q2’2020 due to the low base effect. Genghis Capital recorded the largest decline of 15.2%, with its market share declining to 0.6% from 0.7% in Q2’2020.

Section II: Performance of Money Market Funds

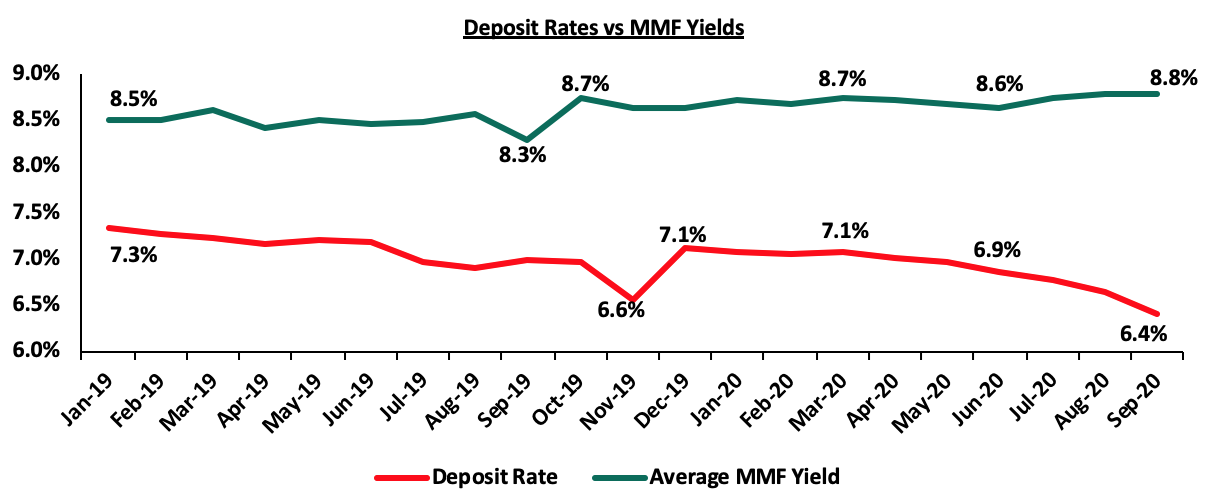

Money Market Funds (MMFs) in the recent past have gained popularity in Kenya, with one of the main reasons is the higher returns from money market funds compared to the returns on bank deposits. According to the Central Bank of Kenya data, the average deposit rate during the quarter declined to 6.4%, post the removal of the deposit rate cap floor in August 2018, from an average of 7.8% when the legislation was in place.

Source: CBK

As per regulations, funds in MMFs should be invested in liquid interest-bearing securities that have a weighted average maturity of less than 13 months. These securities include bank deposits, securities listed on NSE, and securities issued by the Government of Kenya. The Fund is best suited for investors who require a low-risk investment that offers capital stability, liquidity, and require a high-income yield. The Fund is also a good safe haven for investors who wish to switch from a higher risk portfolio to a low risk portfolio, especially during times of uncertainty.

Top Five (5) Money Market Funds by Yields:

During the period under review, the following Money Market Funds had the highest average effective annual yield declared, with the Cytonn Money Market Fund having the highest effective annual yield at 10.6% against the industrial average of 8.8%.

|

Top 5 Money Market Funds by Yield in Q3’2020 |

||

|

Rank |

Money Market Funds |

Effective Annual Rate (Average Q3’2020) |

|

1 |

Cytonn Money Market Fund |

10.6% |

|

2 |

GenCapHela Imara Money Market Fund |

10.2% |

|

3 |

Zimele Money Market Fund |

9.9% |

|

4 |

Alphafrica Kaisha Money Market Fund |

9.7% |

|

5 |

Nabo Africa Money Market Fund |

9.5% |

|

6 |

Madison Money Market Fund |

9.5% |

|

|

Industrial Average |

8.8% |

Section III: Comparing Unit Trust Funds AUM Growth with Bank Deposits Growth

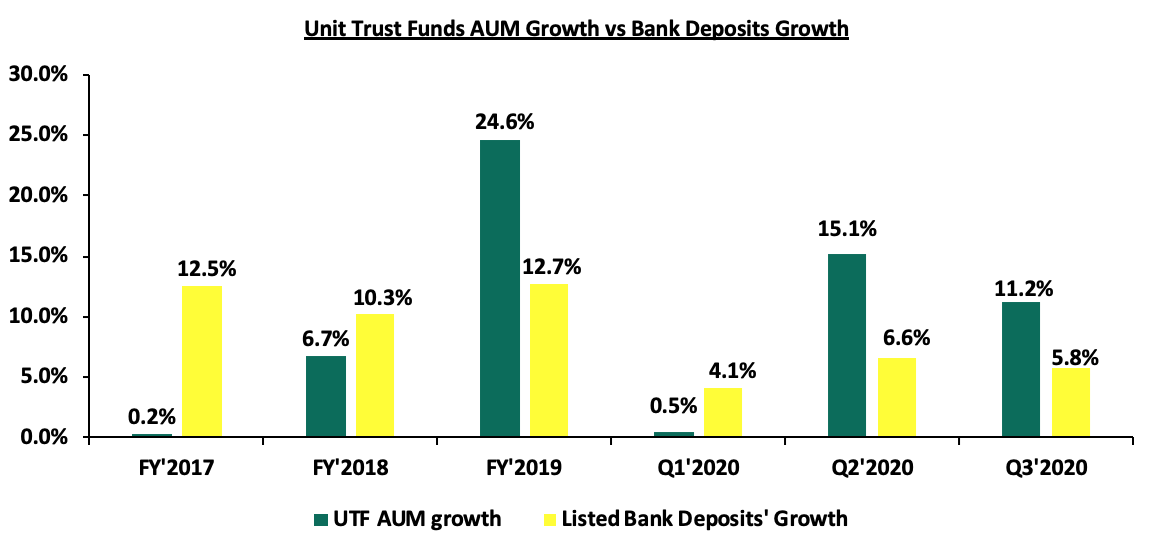

Unit Trust Funds assets recorded a q/q growth of 11.2% in Q3’2020, compared to a q/q growth of 15.1% in Q2’2020, while the listed bank deposits recorded a q/q growth of 5.8% in Q3’2020, compared to a q/q growth of 6.6% recorded in Q2’2020. The chart below highlights the Unit Trust Funds AUM growth vs bank deposits growth over the last 3 years;

As shown in the above chart, the Unit Trust Funds’ growth of 11.2% outpaced the listed banking sector’s deposit growth of 5.8% in Q3’2020, an indication that there is increasing investor confidence in our capital markets. Since Q2’2020, UTF AUM growth outpaced bank deposits’ growth, attributable to improved investor knowledge coupled with the liquidity and higher yields offered by Unit Trust Funds over bank deposits. The 0.5% growth recorded in Q1’2020, which was 3.6% points lower than the listed banking sector’s growth is attributable to investor flight caused by the onset of the pandemic in the country which impacted the disposable income of individuals due to the subdued economic environment.

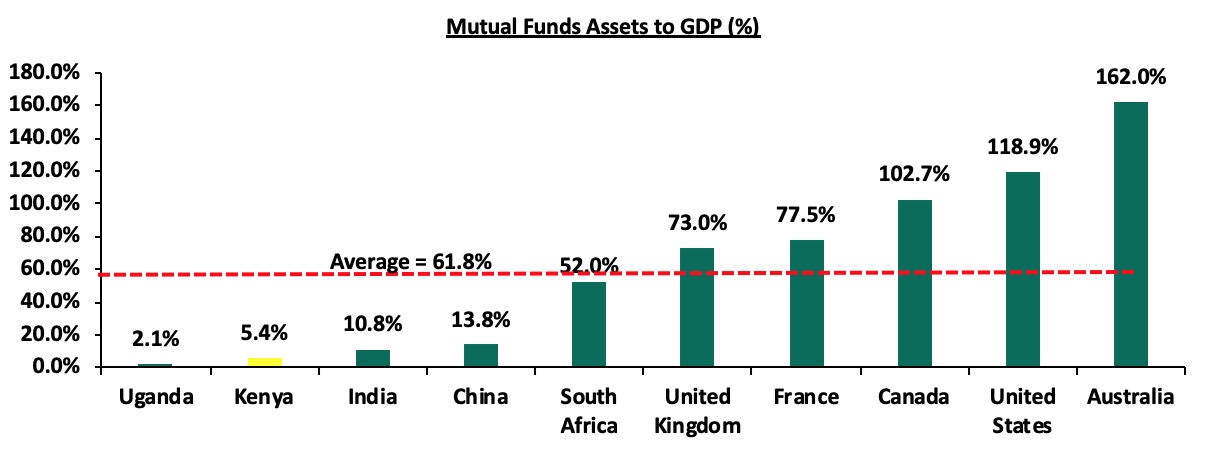

Despite Unit Trust Funds’ AUM growth outpacing that of listed banks, their AUM as at Q3’2020 stood at 2.8% of the listed banking sector’s deposits, which translates to the fact that businesses locally are still largely funded by banks which is not in line with the World Bank data, that shows that in well-functioning economies, businesses should rely get only 40.0% of their funding from banks and the larger percentage of 60.0% from Capital Markets. In Kenya, businesses rely on banks for a staggering 99.0% of their funding; with less than 1.0% coming from Capital Markets. Additionally, Kenya’s Mutual Funds / UTFs to GDP ratio at 5.4% is still very low compared to global average of 61.8%, showing that we still have room to improve and enhance our capital markets.

Source: World Bank Data

In order to improve our Capital Markets and stimulate its growth, we recommend the following actions:

- Improve fund transparency to provide investors with more information: Each Unit Trust Fund should be required to publish their portfolio holdings on a quarterly basis to enhance transparency for investors,

- Allow for sector funds: The current capital markets regulations require that funds must diversify. Consequently, one has to seek special dispensation in form of sector funds such as a financial services fund, a technology fund or a real estate UTF fund. Regulations allowing unit holders to invest in sector funds would expand the scope of unit holders interested in investing,

- Reduce the minimum investments to reasonable amounts: Currently, the minimum investment for sector specific funds is Kshs 1.0 mn, while that for Development REITS is currently at Kshs 5.0 mn. With the national median income for employed people estimated at around Kshs 50,000, the high minimum initial and top up investments amounts are unreasonably high and therefore lock out a lot of potential investors. Additionally, as compared to the Yu’eBao investment fund in China where the minimum investment is Kshs 17.5 (USD 0.16), these high amounts discriminate against most retail investors giving them fewer investment choices,

- Invest in more public training on matters capital markets so that we have more players coming into the market: The Capital Markets Authority and Unit Trust funds should increase their efforts in training investors on the various products offered in the market so as to increase investor knowledge and consequently increase investments in Unit Trust Funds,

- Eliminate conflicts of interest in the governance of capital markets: The capital markets regulations should enable a governance structure that is more responsive to market participants and market growth, and,

- Create increased competition in the market by encouraging different players to set shop and offer different services such as the opening up of Trustees to non-financial institutions: Competition in capital markets will not only push Unit Trust Fund managers to provide higher returns for investors but will also eliminate conflicts of interest in markets and enhance the provision of innovative products and services.

The Capital Markets Authority’s move to be more accommodative and expand the eligibility of trustees to include non-bank trustees such as corporate trustees is a step in the right direction for the growth of capital markets, since it eliminates the conflict of interest that existed where banks were mandatory trustees in a market where they are also competing for funds. The move also facilitates the development of complex financial products compared to plain vanilla investments such as bank deposits and government debt that banks invest in. The current review of the capital markets masterplan with the CMA bringing on board a consultant is also commendable since it will ensure the further development of the country’s capital markets.

Section IV: Conclusion

For continued growth of the capital markets, there is a need to leverage more on innovation and digitization in order to further propel the growth of UTFs in Kenya. For instance, China’s first online money market fund known as Yu’eBao has explosively grown into one of the world’s largest MMF with an AUM of USD 174.4 bn as at 30th September 2020, despite being launched in 2013. Yu’eBao of Tianhong Asset Management was launched as a spare cash management platform, allowing users to transfer idle cash as low as Kshs 17.5 (USD 0.16) into the money market fund, with the use of the Alipay e-wallet. The use of technology as a distribution channel for mutual fund products opened up the fund manager to the retail segment, which is characterized by strong demand among retail clients for convenient and innovative products.

Cytonn Asset Managers, which also leverages on technology such as USSD and digital platforms, experienced a growth of 42.9% to Kshs 1.0 bn in Q3’2020 from Kshs 0.7 bn in FY’2019. The advent of digitization and automation within the industry has also enhanced liquidity. Cytonn Money Market Fund clients can issue withdrawal instructions and have funds remitted to their bank accounts within 2–4 working days while funds withdrawn through the USSD or digital platforms are remitted to their M-Pesa and Bank accounts within 5 minutes and 2 working days respectively; the Cytonn Money Market Fund is accessible through dialing *809#. As highlighted in our topical Potential Effects of COVID-19 on Money Market Funds, we believe that amidst the Coronavirus pandemic, returns for Money Market Funds will remain stable with a bias to a slight increase upwards should rates on government securities increase. They will also remain the most liquid of all mutual funds providing a short-term parking bay that earns higher income yields compared to deposits and savings accounts. UTFs provide a more convenient platform in terms of accessibility and liquidity with the additional benefit of higher returns for investors.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.