Real Estate development relies on several elements, primarily financing and marketing. Real Estate finance involves providing the necessary financial resources for investment projects aimed at expanding building infrastructure and services. On the other hand, Real Estate marketing serves as a connection between those responsible for the production of various Real Estate properties such as residential houses and offices and those who purchase and benefit from them. Its objective is to fulfill the needs and desires of individuals by offering properties, whether it be land or housing, at the right value and with exceptional customer service.

Off-plan investment in the Real Estate sector has emerged as an enticing opportunity, offering a mutually beneficial platform for both developers and buyers. This concept involves the sale and purchase of properties that are yet to be constructed or are still under development, with the completion and ownership transfer being governed by agreed contractual obligations. Over the years, off-plan investment has gained significant traction offering an advantageous platform for both developers and homebuyers. From the perspective of developers, off-plan investment refers to selling a property that has an approved design but has not been constructed or is still under development. In such cases, the developer is responsible for completing the property's construction, delivering it on time, and transferring ownership to the buyer according to the agreed contract. From the perspective of homebuyers, off-plan acquisition involves purchasing a property before its construction has commenced or been finalized. Buyers can make their decision based on blueprints, plans, and computer-generated representations of the proposed housing project. Prior to construction, buyers can secure the home by making a down payment or providing the developer with a letter of credit. Through a contractual agreement, the buyer becomes the owner of a Real Estate unit with predetermined characteristics and specifications, whether it is an existing property or one under construction. The developer, in turn, is obligated to complete the construction within the agreed-upon timeframe, while the buyer is obliged to pay the price either in an expedited or deferred manner. The growing popularity of off-plan investment signifies its potential to reshape the Real Estate market by providing a promising avenue for profitable ventures and fulfilling the housing needs of prospective homeowners.

We have previously covered the same topic on the concept of off-plan in Kenya’s Real Estate namely; Off Plan Real Estate Investing in January 2022 and Off Plan Investment in Real Estate - What a Buyer Needs to Know in 2017, where we provided an in-depth assessment of the concept of off plan investments in the Real Estate sector to provide a basis for the justification of the concept and advising buyers on what they should look out for when purchasing property off plan. This week, we turn our focus on reviewing Off Plan program in Real Estate Development and Investing in order to identify the financial and marketing challenges being faced by such program in Kenya. Additionally, we shall undertake a case study of countries where off plan projects have been successfully implemented and the off plan program is firmly and strictly regulated in the Real Estate sector. From the case studies, we shall give our recommendations of what can be done to improve the regulatory framework for off plan investments in Kenya. We shall undertake this by looking into the following;

- Background and Overview of the focus,

- Off-Plan Buying Process and Off-Plan Investing Tips,

- Benefits and Limitations of Off Plan Investments,

- Case Study of Off-Plan Development Frameworks in other countries, and,

- Recommendations and Conclusion.

Section One: Background and Overview of the topic

The Real Estate industry holds immense significance in the economy of any nation. It serves as a catalyst for growth, generating numerous employment prospects and stimulating economic activities across various sectors. It encompasses a wide range of activities, including pre-construction tasks such as engineering consultation, economic analysis, and marketing studies, as well as construction-related activities which include contracting, sourcing building materials, and actual construction work. Furthermore, the sector continues to contribute into growth of a country’s economy even after the completion of construction, with operations, property management, and maintenance of supporting infrastructures and facilities playing vital roles.

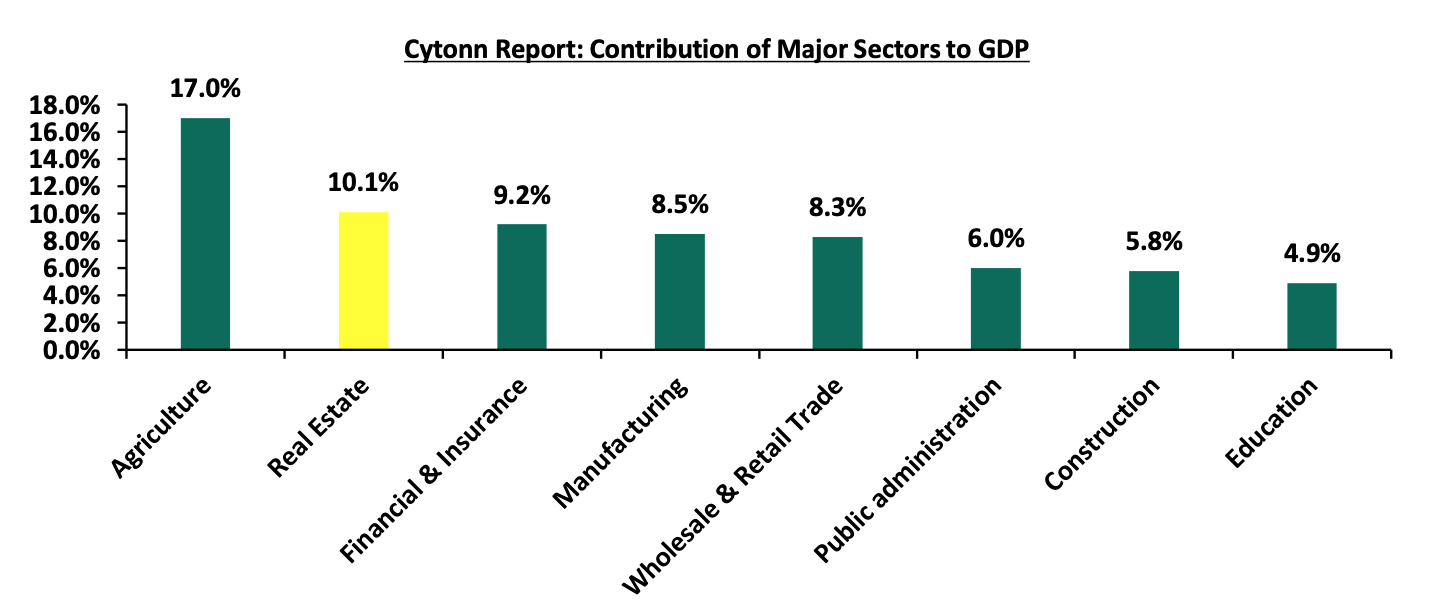

According to the Economic Survey 2023 by Kenya National Bureau of Statistics (KNBS), the Real Estate sector is the second largest contributor in Kenya’s economy as it contributed 10.1% to the country's Gross Domestic Product (GDP) in FY'2022, with a growth rate of 4.5%. With a rapid urbanization and population rates which stood at averages of 3.7% and 1.9% respectively as of 2021, against the global averages of 1.6% and 0.9, the demand for housing in Kenya is very high. This is far exceeding the available supply, as the country faces a significant housing deficit of about 2.0 mn units according to the National Housing Corporation (NHC). This is also at the back of increased infrastructural projects that have opened up new regions for development across the country. The graph below contribution of major sectors of Kenya’s economy to GDP in the year ending 2022;

Source: Kenya National Bureau of Statistics (KNBS)

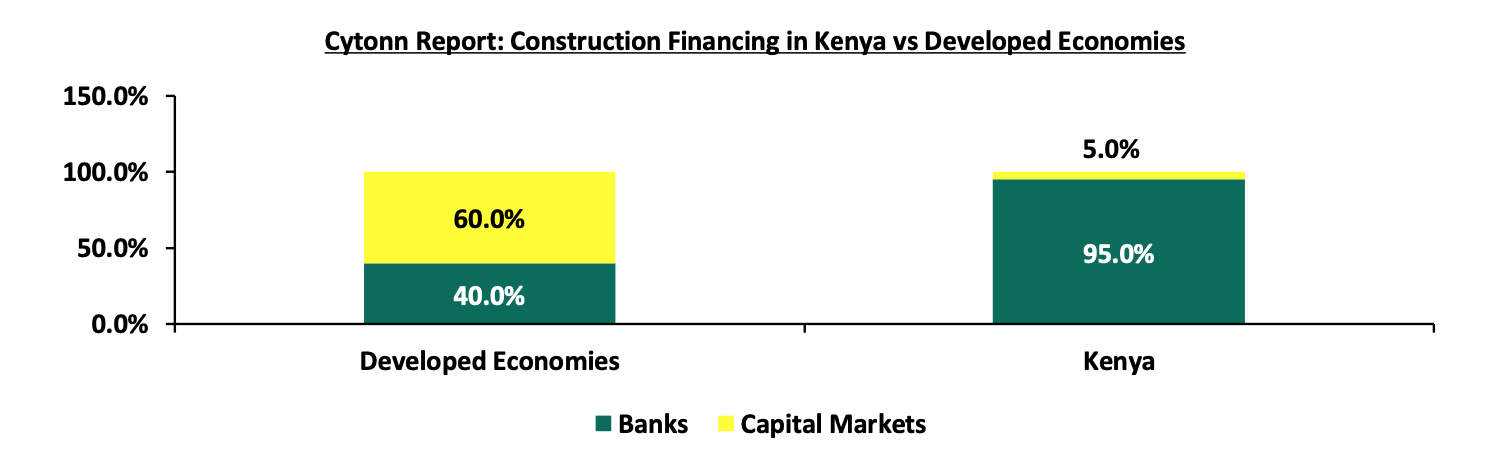

As such, there is a favorable opportunity for private developers in the residential Real Estate sector to construct additional housing units, alleviate the housing crisis, and generate significant profits from the sector. However, these developers are encountering significant financial limitations that hinder project execution. The primary issue lies in the heavy reliance on financial institutions, specifically banks, for costly financial capital required by private developers in execution of large-scale housing projects. This over-reliance and limited financial options make it challenging to secure the necessary affordable finances for construction and completion of housing projects in Kenya. In contrast, developed countries rely more on capital markets, which provide the majority of funding for such ventures. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: World Bank, Capital Markets Authority

Financial institutions, who have monopolized the access of capital for projects in the sector, continue to tighten their lending requirements and demand more collateral from developers as a result of elevated credit risk in the Real Estate sector. This is evidenced by;

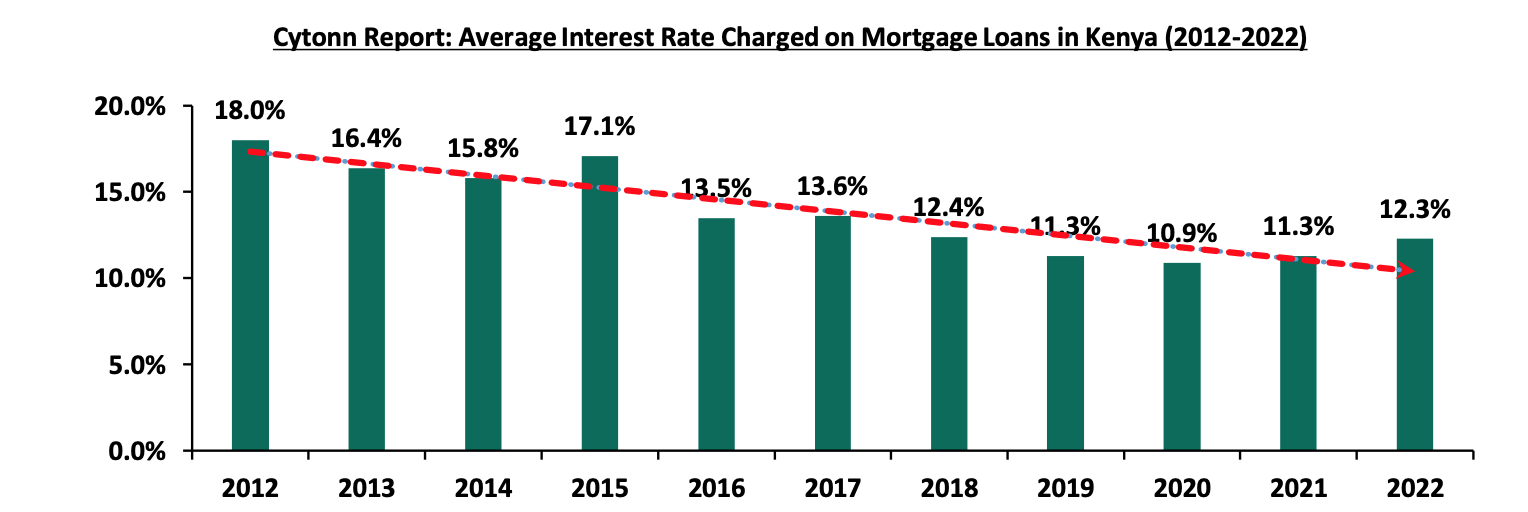

- Rising interest rates on loans: the Bank Supervision Annual Report 2022 by Central Bank of Kenya (CBK) which highlighted 1.0% points increase in interest rates charged on loans towards Real Estate developments to 12.3% in 2022, from 11.3% in 2021. The interest rates majorly ranged from 8.2% to 17.0% in 2022, compared to a range of from 7.1% to 15.0% recorded in 2021. The rise in the interest rates were in line with gradual increases in the MPC rate by CBK to 8.8% at the end of 2022, from 7.0% in 2021 aimed at curbing the elevated inflation rate. The rates are projected to even rise further illustrating return to pre-COVID-19 levels as majority of financial institutions begin to eradicate pandemic related reliefs in their new risk-based interest rate pricing formulas, making the loans more expensive. The graph below shows the trend in the average interest rate charged on mortgage loans in Kenya from 2012 to 2022:

Source: Central Bank of Kenya (CBK)

- Increasing Non-Performing Loans: the higher credit risks coincide with a 33.6% increase in the value of Non-Performing Mortgage Loans (NPMLs) to Kshs 37.8 bn in 2022, from Kshs 28.3 bn in 2021. This increase can be attributed to various factors that have made it challenging for a considerable number of housing investors and buyers to repay their loans which include; i) escalating construction costs over the years, ii) disruptions in the housing market activities caused by the COVID-19 pandemic and general elections, iii) the upward trend in prices of existing housing units, which has resulted in a slowdown in Real Estate sales, iv) rise in unemployment and income instability at the back of job losses, salary reductions and reduced business activities among borrowers, and, v) insufficient risk assessment can lead to a higher number of loans being extended to borrowers who are more likely to default,

- Decreasing the period of mortgage facilities to developers: the average maturity of the loans was 10.9 years ranging between 5 years and 18 years in 2022 as compared to loan maturity of 12 years recorded in 2021, ranging between 5 years and 20 years. As such, the financial institutions will continue to cushion themselves more against the heightened risk of default by investors in the Real Estate sector.

In light of the prevailing challenges in the industry, stakeholders are increasingly adjusting to off-plan investment which emerges as a unique alternative in progressing developments and stimulate activities in the sector majorly target to; i) lower the cost of purchasing housing units in comparison to buying ready-made units from the market, ii) protect the rights of buyers by establishing procedures and systems that ensure developers adhere to the agreed-upon project completion timelines and contractual obligations, and, iii) promoting competition among Real Estate development companies by implementing a system for qualifying and classifying developers.

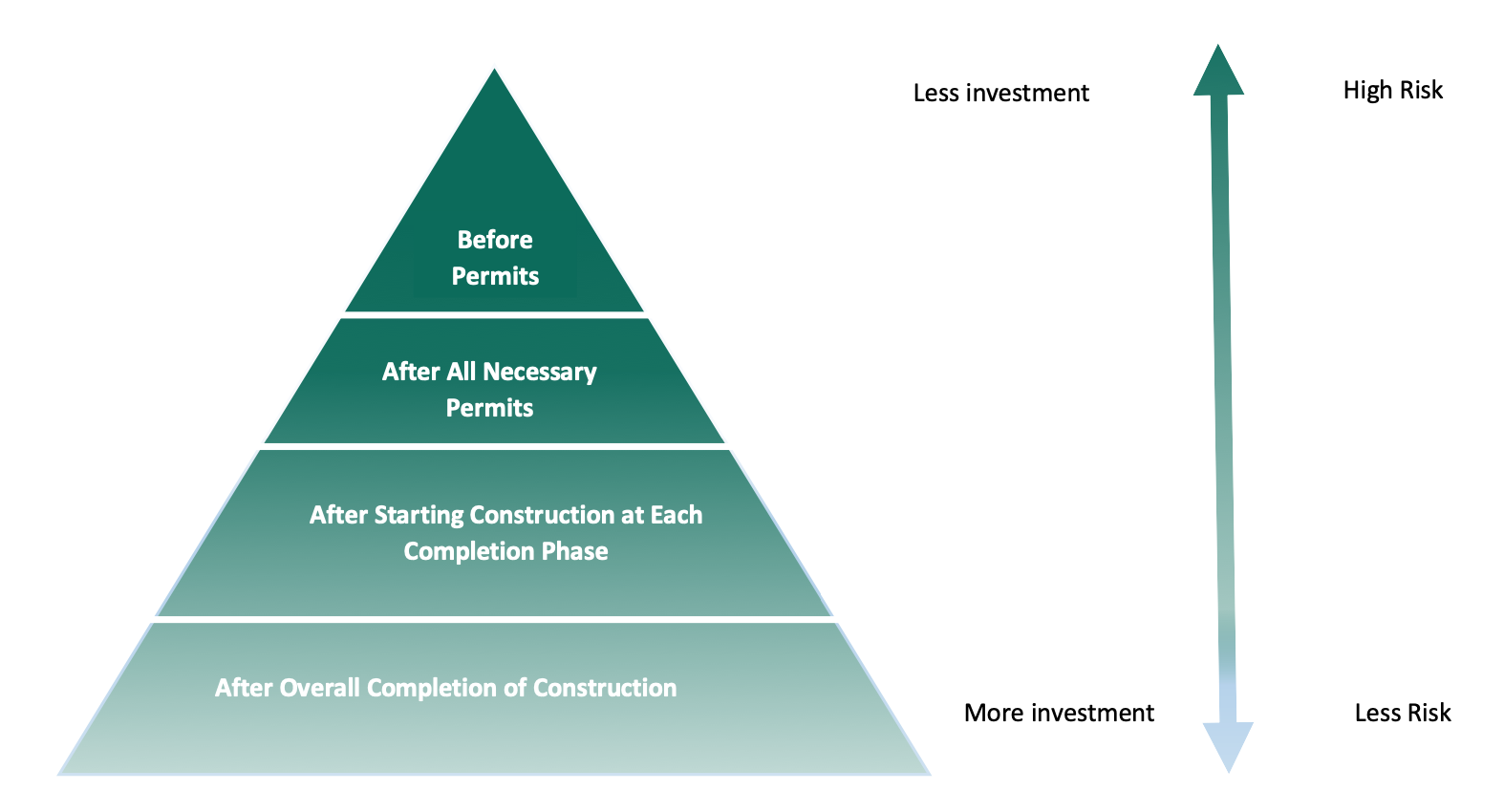

The concept of off-plan investment stands out from other sales programs due to its unique combination of financing and marketing strategies. This approach allows developers to secure funding by selling Real Estate units before construction begins, eliminating the need for costly bank fees and interest that could potentially inflate housing unit prices. Furthermore, it provides developers with valuable insights into market demand and allows them to assess buyer satisfaction and acceptance of their products. The process of off-plan sales typically involves multiple stages with varying levels of risk, which developers must carefully analyze. Initially, buyers are offered the opportunity to invest in the project at significant discount rates, even before construction starts and permits are obtained. This early stage carries a higher level of risk as the execution of the project and completion of construction is uncertain, despite thorough due diligence. However, as the project progresses and completion rates increase, the level of risk decreases, and developers adjust the discount rates offered to subsequent investors. When the project is near completion, the risk becomes very low or even non-existent as the physical nature of the project becomes evident, including the presence of amenities. However, buyers who purchase units at this stage may need to pay higher prices as developers aim to maximize profits, complete the finishing touches, initiate the handover process, and secure additional funds for property management and the operationalization of other on-site facilities. The chart below demonstrates the level of risk and amount of investments incurred by buyers during the life of an off-plan development project;

Source: Cytonn Research

Factors that have Contributed to the Concept’s Growth in Popularity Over the Years

In recent years, the concept of off-plan growth has gained popularity in the global Real Estate sector, including Kenya. Several factors that have contributed to this trend include;

- Potential for Capital Appreciation: Off-plan properties often offer the potential for significant capital appreciation. For instance, in the Pre-Launch stage when the construction has not yet begun, the developer offers a substantial discount to attract buyers during this phase. The pricing is set at a significantly lower rate compared to the subsequent tranches. As the development takes shape, more resources are needed hence the developer will demand more from other homebuyers seeking to purchase housing units reflecting increased value as the project nears its final stages. Therefore, off-plan buyers can take advantage of attractive pricing during the early stages, potentially benefiting from price appreciation as the project advances towards completion,

- Lower entry costs: Off-plan properties generally require a lower initial investment compared to completed properties. Developers often offer attractive pre-construction prices and flexible payment plans, allowing buyers to secure a property with a smaller down payment. This affordability factor appeals to a broader range of potential investors and homebuyers,

- Customization and personalization: Buying off-plan allows buyers to customize and personalize their properties according to their preferences. They can often choose from a variety of finishes, materials, and layouts during the construction phase. This level of customization is particularly appealing to buyers who want to create a unique living space that aligns with their specific requirements and tastes as the construction progresses,

- Developer incentives: Developers often offer incentives to attract buyers to off-plan projects. These incentives may include discounted prices, waived fees, or additional features and amenities. Such incentives serve as enticing benefits for investors and buyers, creating a sense of exclusivity and added value,

- Long-term investment Potential: Off-plan properties are seen as long-term investments, especially in rapidly developing areas. Investors and buyers anticipate that the surrounding infrastructure, amenities, and property values will improve by the time the project is completed. This expectation of long-term growth prospects and potential returns on investment drives the demand for off-plan properties,

- Limited supply as a result of high demand: with the significant low housing supply in Kenya, the growing demand for housing is never sufficiently met. By purchasing off-plan, buyers have the opportunity to secure a property in a location or development that may have a limited supply of completed units. This exclusivity factor appeals to buyers who are willing to commit to a property before its construction is completed, and,

- Market Speculation among investors: The Real Estate market, including the off-plan segment, can attract speculators looking to make a profit from property price fluctuations. Speculators may buy off-plan properties with the intention of selling them before completion to take advantage of rising market values. This speculation can contribute to the popularity of off-plan growth, particularly in markets with high demand and limited supply.

Examples of Off-plan Developments in Kenya

In Kenya, the adoption of off-plan investments by developers as a means to enhance their funding capacity has been a prominent trend. This strategy has proven to be advantageous for developers who are committed to fulfilling their promises, as it creates a mutually beneficial scenario for both the developers and the eventual buyers. Several noteworthy case studies serve as examples of successful projects that have been accomplished with the support of off-plan investments. These projects exemplify the effectiveness of this approach in securing funding and ensuring the successful completion of Real Estate developments and they include;

|

Cytonn Report: Capital Appreciations of Successful Off Plan Investments |

||||||||

|

Development Name |

Location |

Developer |

Number of Bedrooms |

Unit Size |

Price Before Completion (Kshs mn) |

Price After completion (Kshs mn) |

Capital Appreciation |

Summary |

|

Amara Ridge |

Karen |

Cytonn Real Estate |

5 |

470 |

85.0 |

125.2 |

47.3% |

The project was launched in 2015 and completed in 2017, with a 100.0% off plan sales achieved. It is a private gated community located in Karen, comprising of 10 luxurious 5 Bed Room Villas of 470 SQM each, and with easy access to Ngong and Lang’ata roads |

|

Alma (Phase 1, 2 and 3) |

Ruaka |

Cytonn Real Estate |

1 |

51 |

5.5 |

8.5 |

54.5% |

The comprehensive mixed use development project consisting of 477 units broke ground in 2016. Out of which, 201 units were sold as off plan in phase 1, 2 and 3, representing a 42.1% sales realized |

|

2 |

84 |

7.5 |

12.0 |

60.0% |

||||

|

3 |

117 |

9.0 |

15.0 |

66.7% |

||||

|

Muthaiga Valley Apartments |

Parklands |

Sameer Business Group |

3 |

174 |

14.0 |

18.1 |

29.3% |

The development project consisting of 50-3 bedroom apartments broke ground in 2015 and completed in 2017 with an overall 42.0% off plan sales achieved |

|

3 with SQ |

15.0 |

19.6 |

30.7% |

|||||

|

Ramata Greens Phase I |

Baba Dogo |

2 |

7.5 |

11.5 |

53.3% |

Construction of the 70-unit project began in 2013 and completed in 2016, with a 32.9% off plan sales made |

||

|

3 |

8.8 |

13.3 |

51.1% |

|||||

|

Pearl Heights |

Kileleshwa |

Custom Homes Limited |

3 |

223 |

19.0 |

25.9 |

36.3% |

This is an 8-storey apartment complex consisting of 32 units. It was launched in 2013 and completed in 2016, with a 31.3% off plan sales achieved during the period |

|

3 |

174 |

14.0 |

20.3 |

45.0% |

||||

|

Kings Millenium |

Imaara Daima |

Kings Developers Limited |

3 |

124 |

6.5 |

9.5 |

46.2% |

Construction began in 2013 and completed in 2016. During the period, 25.0% off plan sales were realized out of the 220 unit development project |

|

Mi Vida Homes Garden City |

Kasarani |

Shapoorji Pallonji Real Estate and Actis |

1 |

56 |

6.9 |

8.9 |

29.0% |

Construction of 221 apartments began in July 2019 and completed in August 2022 with 35.0% off-plan sales achieved during the period |

|

2 |

86 |

10.1 |

12.5 |

23.8% |

||||

|

3 |

123 |

12.9 |

16.7 |

29.5% |

||||

|

Average |

153 |

15.8 |

22.6 |

43.1% |

||||

Source: Cytonn Research

Existing Regulatory Gaps in Off-plan Investments in Kenya

In Kenya, there is a lack of clear legal provisions specifically addressing the sale of off-plan developments. While the Land laws in the country include provisions for property registration, there is no specific clause or article that covers the registration of properties purchased off-plan. The residential properties commonly sold through the off-plan strategy in Kenya include apartments, townhouses terraced and stand-alone maisonettes, and villas. Regulation for such developments are addressed through the Sectional Properties Act, 1987, No. 21 of 1987 which highlights the subdivision of buildings into units that can be registered separately by the Lands Registrar. This allows for the registration of sections of buildings and office suites as individual units with their own titles. Additionally, Section 5 of the same Act provides for the registration of sectional plans. Developers can generate a sectional plan from an existing plan of the site, enabling them to sell the concept of the off-plan development to potential investors. The registration of such sectional plans gives investors’ confidence that the developer has a genuine intention to undertake the proposed development.

However, due to its relative newness and the lack of a competent regulatory framework in the off-plan investment sector, these existing provisions do not fully encompass the specific regulatory needs and protections required for off-plan investments. These gaps in regulation have allowed some developers to exploit the system, leading to various challenges and risks for buyers. Here are some of the existing regulatory gaps in the sector:

- Inadequate consumer protection: There is a lack of comprehensive legislation specifically addressing off-plan investments, which leaves buyers vulnerable to potential fraudulent activities or unethical practices by developers as they take advantage of the information asymmetry that exist among most buyers in the housing market. The absence of clear guidelines on issues such as contract terms, dispute resolution mechanisms, and buyer rights has created an imbalance in the relationship between developers and buyers.

- Lack of oversight and monitoring: There is limited resources and insufficient mechanisms in place to effectively oversee the off-plan investment sector and developers' activities. This lack of oversight allows some developers to operate without proper scrutiny, potentially leading to partnering with quack contractors and specialists in construction to deliver sub-standard buildings, project delays, or even abandonment of projects with their traces never to be followed by law enforcers.

- Absence of escrow accounts: There is absence of mandatory requirements for developers to establish escrow accounts or mechanisms to safeguard buyers' funds or compensate them upon not delivering the projects as stipulated in contracts, posing a significant risk. Without such accounts, developers easily misuse buyers' deposits and fail to deliver the promised properties, leaving buyers with financial losses and unfinished projects.

- Insufficient disclosure requirements: There is a lack of clear guidelines on the information that developers should disclose to buyers during the off-plan investment process. This includes details about the developer's track record, financial standing, project timelines, construction plans, and potential risks associated with the development. Through the protection of contracts signed with clients, developers are at free will to adjust some clause which favor them in restricting crucial information regarding the progress of the project. Such insufficient disclosure hampers buyers' ability to make informed decisions and assess the credibility of developers.

- Limited remedies for breach of contract: The existing legal framework has not adequately address remedies for breaches of contract or non-compliance by developers. Apart from alternative resolution mechanisms that might have been agreed stakeholders in the off-plan development, parties in the transactions are left with very limited options to seek redress in case of project delays, poor construction quality, or other contractual violations.

Therefore, addressing these gaps in the regulatory framework is necessary to provide adequate safeguards and promote a transparent and secure off-plan investment environment in Kenya.

Section Two: Off-Plan Buying Process and Off-Plan Investing Tips

- Off-plan buying Process

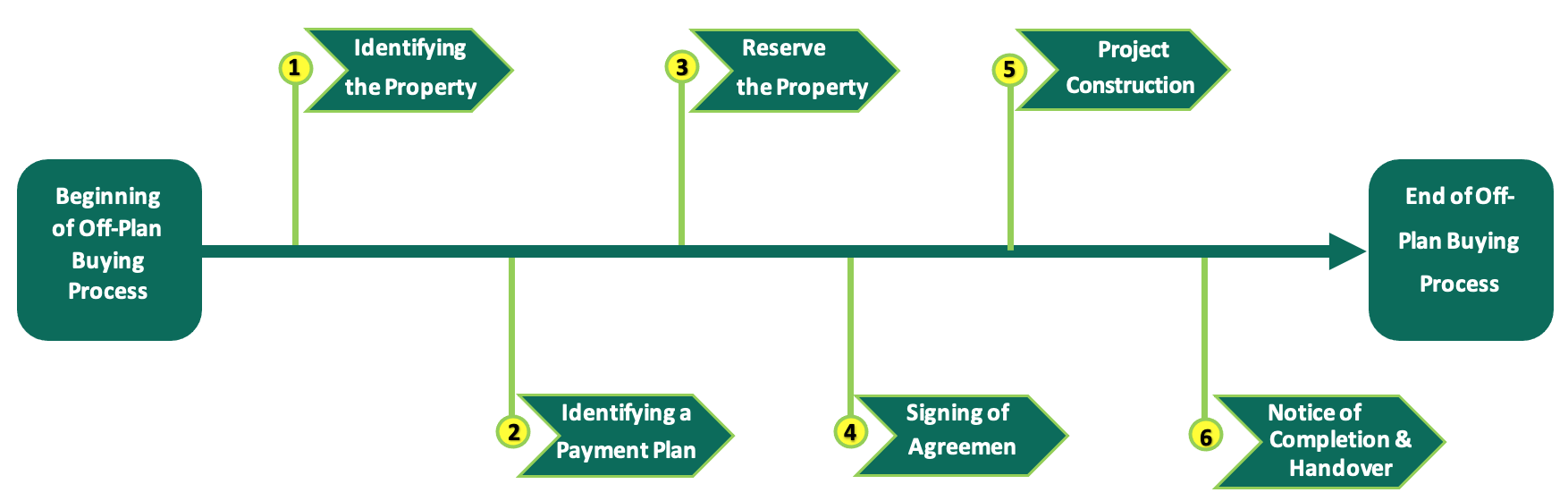

It is evident that Off-plan buying provides several advantages, including the potential for capital appreciation, customization options, and the ability to secure desirable units in high-demand areas. However, it also comes with its own set of considerations and risks. Therefore, understanding the off-plan buying process in Kenya is crucial for investors looking to participate in this dynamic market and maximize their investment opportunities. The process is outlined below;

Source: Cytonn Research

- Identifying the Property: The first step in off-plan investment is for the buyer to identify a development project that is either ongoing or yet to be executed. This requires conducting thorough due diligence on the developer responsible for the project such as; i) assessing their track records, ii) identifying the feasibility of the site where the development will be done, iii) having a review on the necessary permits available and ensure the developer followers up on statutory requirements that are yet to be undertaken, and, iv) reviewing blueprints and designs submitted for views, adjustments and preferences. Market research is also essential during this stage as it provides the buyer with valuable information on the performance of the development in comparison to similar properties in the market. Additionally, in the initial step, buyers become aware of off-plan projects through the marketing efforts conducted by developers. A vigorous marketing strategy is crucial to attract potential buyers to properties that are currently existing on paper or pre-construction phase and do not physically exist yet. Such strategies include; i) comprehensive promotional materials that showcase the proposed development, including detailed descriptions, high-quality renderings, architectural plans, and artist impressions, ii) setting up sales offices or showrooms where buyers can visit and explore a mock-up or model unit of the planned development, iii) establishing a strong online presence by creating dedicated project websites or microsites that provide comprehensive information about the off-plan project, including virtual tours, 3D walkthroughs, floor plans, and pricing details, iv) leverage social media platforms, online advertisements, and digital marketing campaigns to raise awareness and engage with potential buyers, v) organizing sales events, property exhibitions, and roadshows to showcase their off-plan projects to a targeted audience, vi) collaborating with Real Estate agents or agencies specializing in off-plan properties with networks of potential buyers, viii) producing various marketing collateral, such as brochures, flyers, advertisements in newspapers, magazines, and digital platforms, highlight the unique selling points, benefits, and investment potential of the development, aiming to capture the attention of potential buyers, and, ix) 0ffering referral programs or incentives for existing buyers to recommend the off-plan project to their friends, family, or colleagues.

- Choosing a Payment Plan: Once the right property has been identified, the buyer and seller must agree on the payment plan and schedule for the development. There are various payment options available, including cash payments, installment plans, and mortgages where the developer has partnered with various financial institutions. However, buyers have an option of engaging their preferred mortgagee if the developer has no partnership with such. It is important for the buyer to carefully evaluate and select the payment plan that best suits their financial situation and preferences,

- Reserve the Property: After deciding on a suitable payment plan and the appropriate property, the buyer can proceed to reserve the desired property. This is typically done by making an initial deposit or down payment, which secures the property and serves as a reservation or hold on the unit. The deposit amount is usually a percentage of the total purchase price. Activities under this step should be legally bound in a Reservation Form signed by both developer and homebuyers. Additionally, both parties should sign the Letter of Offer which indicates the amount of money that the developer is willing to accept in exchange of granting ownership of the off-plan property to the buyer,

- Signing of Agreement: At this stage, the buyer and seller enter into a legally binding agreement, such as a sale agreement contract. It is crucial for the buyer to thoroughly review the contract and ensure that all terms and conditions are clear, fair and in line with their expectations. Seeking legal advice from a qualified lawyer is highly recommended to ensure a smooth and effective conveyance process and to address any potential concerns,

- Project Construction: After the agreement has been signed, the developer proceeds with the construction of the project. The duration of the construction phase varies depending on factors such as the design, type, and complexity of the development. During this period, the buyer should stay informed about the progress of the project. This can be done through periodic site visits and inspections, as well as by maintaining open communication with the developer either physically or through online means. The developer should also provide regular updates to the buyer regarding the status of the project and any anticipated delays or changes,

- Notice of Completion and Handover: Once the project is fully implemented, the buyer receives a notice of completion from the developer. This notification indicates that the construction is finished, and the property is ready for handover. At this stage, the buyer officially takes possession of the property, and the developer transfers ownership to the buyer as outlined in the agreement. The buyer should conduct a thorough inspection of the property to ensure that it meets the agreed-upon specifications and quality standards.

- Tips for Developers and Buyers in Off-Plan Investments:

Investing in properties that are still in the planning or development stage carries significant risks, including the possibility of project delays. To mitigate these risks, it is important for an investor to undertake various strategies to minimize future risks and losses resulting from uncertainties such as projects stalling, and information asymmetry that cuts across all stakeholders in the transactions in different contexts such as moral hazards, adverse selection and hold up menace. Before engaging in off-plan investments, it is crucial to consider the following essential tips

- Conducting Due Diligence on Developers

Verify the developer's registration: Before investing, buyers should ensure that the developer is a registered company in the country of operation. They should also research the directors of the company and evaluate their track records in delivering previous projects and reputation in the market. This helps assess the developer's management, leadership, workmanship, adherence to timelines, and credibility, preventing investment with fraudulent or inexperienced entities,

- Conducting Due Diligence on the Projects

-

- Visit the site: It is essential for buyers to personally visit the site before making any investment. This ensures that the site exists not only on paper and provides an opportunity to monitor the progress of the development at any moment. Regular site visits allow buyers to stay updated and address any potential issues promptly, reducing the risk of being defrauded,

- Confirm land ownership: Homebuyers should request copies of the land title from the developer as proof of ownership. They can also conduct a search on the title in the Ministry of Lands to verify its authenticity and ensure there are no undisclosed encumbrances on the property,

- Obtain project plan approvals: Buyers should ascertain whether the developer has obtained all necessary approvals for the property and permits for construction of buildings. This ensures that there will be no delays in project delivery or cancellation of projects due to legal or regulatory issues,

- Evaluate the project team: It is important to assess the competence and experience of the project team and companies contracted in the project, including architects, engineers, and contractors. This helps gauge their ability to deliver the project successfully,

- Seek regular updates: Homebuyers should insist on receiving regular updates from the developer regarding the progress of the development. A lack of communication or transparency may indicate potential issues or fraudulent activities,

- Conduct research on comparable properties in the surrounding area: this is to mainly assess the potential returns promised by the developer from the project being executed. This includes studying rental prices, property prices, yields, occupancy rates, and market uptake and keep updated on the market trends. Such information helps buyers evaluate the feasibility of the investment and identify potential investment risks or overvaluation,

- Understand project timelines: Homebuyers should have a clear understanding of the project timelines and milestones. Holding the developer accountable to these timelines helps ensure timely completion of the project,

- Check for Insurance and Guarantees: Inquire about the developer's insurance coverage and warranties. An established developer should provide appropriate insurance policies that cover risks such as construction defects and project delays. These safeguards provide additional assurance and protection for the buyer,

- Conduct Due Diligence on Contracts

-

- Engage a conveyancing lawyer: It is crucial for buyers to hire a qualified conveyancing lawyer to review and assess all contracts involved in the transaction especially the Reserve Forms, Letter of Offers, Sale Agreements, and Handover Forms. This ensures that the contracts are legally sound, mitigating the risk of fraud or unnecessary exposure to risks,

- Additional Considerations

-

- Be cautious of unrealistically low prices and Occupancy Rates: Buyers should exercise caution if a developer offers properties at significantly lower prices than the market average. Unrealistically low prices and unreasonable occupancy rates at a very short timeline may indicate a scam aimed at deceiving desperate buyers. In most instances, such tactics are used by marketers in the industry to draw more leads. Conducting thorough due diligence and consulting professionals can help identify such scams,

- Paying attention on communication and transparency: Buyers should prioritize ensuring that the developer maintains regular and up-to-date open communication regarding the progress of the project. It is crucial for the developer to provide consistent updates and establish clear channels of communication, fostering trust, addressing any concerns in a timely manner, and facilitating a seamless and successful transaction.

On the other hand, developers are also at the hook of being swindled of their investments and hence at full responsibility of compensating homebuyers who had invested in their projects. Therefore, developers and other stakeholders are also advised to engage may involve financial experts or legal experts in ascertaining such hidden risks involved in off-plan investments in the following instances:

- Feasibility analysis: Prior to commencing an off-plan development project, developers may engage financial experts to conduct a comprehensive feasibility analysis. This analysis involves assessing the financial viability of the project, considering factors such as construction costs, projected sales prices, market demand, and keeping updated on the market trends and potential risks. Financial experts can provide valuable insights into the potential risks and returns associated with the project,

- Risk assessment: Developers may seek the expertise of financial or legal professionals to assess and mitigate the risks involved in off-plan investments. These experts can help identify potential legal, financial, and market risks that could impact the success of the project. They can also offer strategies to mitigate these risks, such as structuring contracts and agreements to protect the developer's interests,

- Contract review and negotiation: When entering into contracts with buyers or other stakeholders such as contractors, developers often involve legal experts to review and negotiate the terms and conditions. Legal experts ensure that the contracts are legally sound, protect the developer's rights, and minimize potential risks and liabilities,

- Compliance with regulatory requirements: Off-plan investments are subject to various common regulatory frameworks and compliance obligations in the construction industry. Developers may engage legal experts to ensure compliance with zoning regulations, building codes, environmental laws, and other legal requirements. Financial experts may also assist in navigating financial regulations and tax obligations associated with the investment,

- Investor relations: In cases where developers seek external funding or partnerships for their off-plan projects, financial experts can provide guidance on structuring investment deals, conducting due diligence on potential foreign and local investors, and evaluating the financial implications of different funding options. Legal experts can assist in drafting investor agreements and ensuring compliance with securities laws and regulations,

- Dispute resolution: In the event of disputes or legal challenges arising during the off-plan investment process, developers may engage legal experts to represent their interests and navigate the dispute resolution process. This includes negotiating settlements, resolving contractual disputes, or representing the developer in litigation if necessary,

- Diversify on various financial options and investment portfolios: Developers should carefully consider diversifying their investment portfolio as a risk mitigation strategy. Instead of solely focusing on a single development, they should explore opportunities to invest in multiple projects or properties across different locations. By diversifying their portfolio, developers can reduce their exposure to the risks associated with a single project and spread their investments across various avenues. This approach helps safeguard against potential losses and uncertainties that may arise in any particular development. Additionally, developers should also employ a mix of financing options to mitigate financial risks. By utilizing a blend of debt and equity financing, developers can distribute the financial risk associated with a project. Relying solely on one source of financing can be risky, as it exposes developers to the specific terms and conditions of that financing arrangement. By diversifying their sources of funding, developers can have more flexibility and resilience in managing financial risks.

- Maintain contingency fund: through the help of financial experts, developers are advised to establish and maintain a contingency fund specifically allocated for unexpected costs and potential delays during the construction phase. This fund serves as a financial buffer to address unforeseen circumstances that may arise throughout the project. Having a contingency fund in place ensures that developers can handle unexpected challenges without significant disruptions to the construction timeline or compromising the project's quality. It is essential to proactively plan for contingencies and allocate sufficient resources to the fund to mitigate potential risks and maintain project progress.

Section Three: Benefits and Limitations of Off Plan Investments

Off plan investments avail significant benefits to both buyers and developers when the projects are well executed. Some of the advantages of off plan investments include;

- Demand Validation from Market Insights: Off plan sales provide developers with valuable market insights for assessing the demand for their projects. By analyzing buyer preferences, sales patterns, and market trends during the off plan phase, developers can make informed decisions regarding design, amenities, and pricing for future projects. This market intelligence helps developers align their offerings with the needs and preferences of their target audience,

- Financial Stability through Pre-Sales: Off plan investments provide developers with a substantial source of capital early in the project's lifecycle. By securing pre-sales of units, developers can finance construction costs, acquire necessary permits, and initiate the development process with reduced financial risks. This financial stability enhances the developer's ability to complete the project successfully,

- Higher Profit Margins with Capital Appreciation: Off-plan developers often have the advantage of pricing their units at a premium compared to the final market value. As the development progresses, market conditions and the capital appreciation of the property allow developers to command higher prices for the remaining units. This pricing strategy can result in higher profit margins and overall project profitability,

- Enhanced Reputation and Brand Building: Successful execution of off plan projects contributes to the developer's reputation and brand image. Delivering high-quality developments on time and meeting buyers' expectations establishes trust and credibility in the market. This in turn attracts more buyers and investors for future projects, fostering long-term growth and success,

- Customization and Personalization: Off plan investments allow buyers to customize their properties according to their preferences. Buyers may have the flexibility to select specific finishes, fixtures, and layouts, creating a personalized living space tailored to their needs. Developers can benefit from this customization feature by offering various upgrade options to buyers, thereby increasing the value of the units and attracting more potential buyers,

- Favorable Payment Terms: Off plan investments typically involve installment-based payment structures. Buyers usually pay a small deposit upfront, followed by staggered payments over the construction period. This payment flexibility allows buyers to manage their finances more effectively and potentially invest in properties that might have been otherwise unaffordable, and,

- Early Entry at Lower Prices: Buyers who invest off plan often have the advantage of securing properties at lower prices compared to the market value upon completion. As the property market tends to appreciate over time, early entry can provide buyers with significant cost savings and potential capital gains. Developers benefit from this by attracting buyers during the early stages of a project, ensuring a steady stream of sales, and minimizing the risk of unsold units upon completion.

While off plan investments offer various advantages, there are potential pitfalls associated with this type of investment to both developers and buyers. Some of these limitations to off plan investing include;

- Potential Delays in Construction Timelines: Unforeseen circumstances such as company governance issues, supply chain disruptions, or regulatory issues can cause construction timelines to be extended. This can impact both buyers and developers, as buyers will have to wait longer to take possession of their properties, and developers may face increased costs in order to complete the off plan project,

- Poor Product Quality during Delivery: Despite careful planning, there is a risk of changes in the final product when investing in off plan properties. Cost overruns due to unforeseen circumstances may force developers to downgrade the final quality of finishes, fixtures, or materials compared to what was initially marketed. This can result in discrepancies between the buyer's vision and the final product, leading to dissatisfaction or the need for costly modifications,

- Capital Risk due to Market Fluctuations: Off plan investments are subject to market fluctuations, which can impact the property's value upon completion. The anticipated capital appreciation may not materialize as expected, leading to lower returns on investment. Factors such as changes in economic conditions, oversupply in the market, or shifts in buyer preferences can influence property values and affect the buyer's financial gains,

- Financing Challenges on Loan Approval: Securing financing for off plan properties can be more challenging compared to purchasing a completed property. This is as lenders may have stricter criteria and requirements for financing off plan investments, including higher down payments or additional documentation. In addition, buyers may face difficulties in obtaining loan approval or may need to pay higher interest rates, potentially affecting their financial plans and affordability,

- Absence of Rental Income: Until the property is completed, buyers cannot generate rental income from their investment. This lack of immediate cash flow can be a disadvantage for buyers who rely on rental income to offset their expenses or finance their investment. In addition, unforeseen delays in delivery of the project may lead to buyers defaulting on repayment of the initial financing taken to buy into the off plan project, causing penalties to the investors, and,

- Brand Trust and Reputation Risk: Developers undertaking off plan projects are entrusted with buyers' investments and expectations. Any failure to deliver on promises, such as construction delays, quality issues, or inadequate communication, can harm the developer's brand reputation and lead to decreased trust among buyers and potential investors. As such, the negative experiences shared by buyers can significantly impact the developer's future sales and success.

Section Four: Case Study of Off-Plan Development Frameworks in other countries

The popularity of off-plan financing in Real Estate development by developers has consistently grown in recent years, yet the sector remains largely unregulated. The absence of a well-established regulatory framework that is anchored in law has created an environment where rogue developers engage in fraudulent practices, with investors incurring major financial losses as projects they invested in ultimately fail to materialize. Consequently, many investors or buyers have become hesitant to purchase off-plan property due to uncertainties and concerns about the reliability of developers. Thus, it is imperative to establish a comprehensive framework that encompasses all aspects of the sector, in order to regulate the activities of key players and ensure improve investors’ confidence in the sector.

For our study, we look at case studies of off-plan development frameworks in other countries, with a focus on the Saudi Arabia and Dubai off-plan sales programs. We discuss key lessons and key take outs that we can derive from them as follows;

- Saudi Arabia – Off Plan Regulations Resolution No. 536 of 6th September 2016

Sale and lease operations of off-plan property units in Saudi Arabia are regulated by the Off-Plan Regulations Resolution No. 536, which were implemented by the Council of Ministers in September 2016, along with a number of implementing regulations (‘Implementing Regulations’). These newly implemented Off-Plan Regulations superseded the Council of Ministers Resolution No. 73, as amended by the Council of Ministers Resolution No. 47, which previously covered off-plan sales only. The Implementing Regulations include;

- Licensing regulations for developers,

- Escrow accounts regulations,

- Beneficiaries Rights and Developers Obligations Regulations, and,

- Principles of property project registration and marketing or advertising.

The objective of the regulations included; i) to establish a well-regulated and structured off-plan Real Estate market in Saudi Arabia by imposing specific requirements on stakeholders such as developers of Real Estate development projects, mandating them to obtain the necessary consents and approvals, ii) enhance confidence among end users, developers, and investors, iii) raise the level of transparency of quantities of supply and demand, and, iv) discourage property speculation. The regulations form the basis of the ‘Wafi Program’, or the Off-Plan Sales and Rent Program (OPSRP) which was launched by the Saudi government, with the purpose of authorizing and regulating off-plan development, as well as sales and rentals of off-plan property. The following are some the key take-outs from the Saudi OPSRP;

- Establishment of the Wafi Committee: The off-plan regulations provide for the establishment of a committee in the Ministry of Municipal, Rural Affairs and Housing, which has the power to approve or reject an application to obtain a license in order to undertake in the following activities; i) off plan sale or lease of property units, ii) off-plan property development including residential, commercial, investment, offices service, industrial or tourism property, and, iii) the carrying out of the marketing of off-plan property, whether locally or internationally including participation in property exhibitions,

- Operational Licensing Requirements for Developers: All developers are required to obtain a qualification certificate from the Wafi Committee, prior to being registered on the Real Estate Developer Registry known as Etnam, which records the names of all registered developers in. In the event the Committee revokes a developer’s license, the Real Estate Developer Register shall be amended accordingly with the removal of the details of the developer,

- Non-compliance and Penalties: The Committee has the power to revoke a license granted to a developer, should the developer fail to; i) commence construction of the project without an acceptable reason, ii) if the development has stalled or the developer does not have any intention of continuing with the project, iii) any provision of the Off-Plan Regulations is violated, or iv) if the developer has acted in a fraudulent manner,

- Operation of Escrow Accounts: The regulations generally expect buyers will make payments by means of instalments during construction. As such, law requires all payments by buyers along with any financing obtained, to be deposited into the project's designated escrow account. In addition, the funds can only be released from the escrow account to make progress payments to the principal contractor and other consultants involved in the project, such as those handling marketing and sales, subject to specific conditions being met and requires approval from the developer, consulting engineer, and a chartered accountant,

- Safe guarding Investors and Buyers Interest: The regulations mandate the Committee to take all required steps to safeguard the rights of end users and ensure the completion of the project or the return of funds paid by end users to the developer or any financing obtained by the developer, if a developer is unable to complete a project or should a project be stalled or suspended for a period of more than 6 months,

- Project Registration: Law mandates all developers to register any of their off-plan property projects with the Ministry of Municipal, Rural Affairs and Housing, upon which, caveats and restrictions will be placed on the title deed of the land preventing any disposition or conveyance. In the event that the developer is not the owner of the land upon which the project will be constructed on, the regulations further require the Committee to be provided with the agreement concluded between the developer and the owner of the land, in accordance with provisions of Article 5 of the Licensing Regulations. Moreover, a developer is required to submit but not limited to the following; i) a copy of the developer’s commercial registration, ii) a certificate demonstrating the developer has sufficient financial capability and strength, iii) a copy of the title deed or its equivalent, iv) a copy of the contract with a sub developer if any, iv) confirmation of the opening of an escrow account, v) the approved architectural designs for the project, and, vi) a project feasibility report,

- Regular Expert Project Supervision: The off-plan regulations require that all off-plan projects are supervised by a consultation office, which has been accredited with the Organization of Saudi Engineers and has no less than 3 years’ experience in construction and project management. The role of the consultation office includes submitting quarterly technical reports to the Committee on the progress of the project, and to provide a certificate which has been notarized by the Chamber of Commerce confirming the project has been completed, and,

- Standards for Advertising and Marketing: Regulations prohibit marketing, advertising and exhibitions of Real Estate projects, within or outside Saudi Arabia, without the approval of the Committee. Thus, a marketer is mandated to provide the Committee with several documents such as a copy of the title deed, and a copy of the contract between the marketer and the developer. In addition, a marketer is required to provide an additional financial guarantee of 1.0% of the value of the project up to a value of SAR 1.0 mn (USD 0.3 mn) for up to 3 months after the expiry of its license, where the project is located outside the country.

- Dubai – Laws No. 8 of 2007 & No. 13 of 2008

Dubai’s off plan Real Estate market is regulated by the Dubai Land Department (DLD), and the Real Estate Regulatory Agency (RERA). The main legislations governing off-plan Real Estate development frameworks include Law No.13 of 2008 ‘the Interim Real Property Register in the Emirate of Dubai’ and its amendments, and Law No.8 of 2007 concerning Escrow Accounts for Real Property Development in the Emirate of Dubai.

The main objectives of the legislations included; i) to set the rules regulating off-plan sale agreements in a way that ensures that the rights of developers and purchasers are protected, and ii) to create a safe and transparent environment where real property projects are implemented in a timely fashion. The following are some of the key aspects of the off-plan regulatory framework in Dubai:

- Dubai Land Department (DLD): The DLD is the primary regulatory authority responsible for overseeing and regulating the Real Estate sector in Dubai. DLD plays a crucial role in implementing and enforcing regulations related to off-plan projects. Furthermore, the DLD is also responsible for; i) documenting of property sales and purchases, ii) issuing Real Estate ownership, iii) organizing and promoting investments, and, iv) promoting education and cultural awareness regarding a skilled and competent domestic workforce in the Real Estate industry,

- Real Estate Regulatory Agency (RERA): RERA is a United Arab Emirates (UAE) government agency and regulatory body established in July 2007 under the DLD that focuses specifically on regulating the Real Estate market in Dubai. RERA is responsible for issuing permits and licenses to developers and Real Estate professionals, as well as monitoring compliance with regulations,

- Management of Real Estate Developers Trust Accounts: Off-plan regulations in Dubai require developers of off-plan projects to open escrow accounts with approved banks in Dubai. These accounts are managed by RERA and serve as a safeguard for investors' funds. The funds paid by buyers for off-plan properties are deposited into escrow accounts and are exclusively allocated for the purposes of construction of the particular Real Estate project and any other directly related activities. As such, funds from these accounts can only be withdrawn by the developer based on construction milestones or as specified in the sales and purchase agreement. Failure to comply leads to penalties including revoking of a developer’s license to operate,

- Project Registration and Licensing: A developer or sub-developer may not commence the implementation of a project or sell its units off-plan unless he obtains the necessary approvals from the DLD. Consequently, a developer may not enter into any sale contract with a purchaser until it obtains relevant approvals from the DLD. Therefore, as a fundamental step, buyers are required to ensure that the developer is registered with the DLD and RERA, and has obtained all the required permits and approvals from both government agencies. In addition, a developer may only commence project implementation or sell of its units off plan if in possession of the land on which the project is to be constructed on,

- Refund of all payments in case of project cancellation: RERA reserves the power to terminate or suspend a project on the basis of technical grounds, or in the event a developer does not fulfil required conditions such as; i) failing to commence construction work without a valid reason, ii) if the authority is satisfied that the developer has no genuine intention or ‘good faith’ to continue with the project, and, iii) failure by the developer to implement the project due to gross negligence.

In such instances, the law mandates that developers reimburse purchasers for all payments made, in accordance to Article 11(b) of the Dubai Amended Interim Real Property Registration Regulations of 2017. Failure to comply with this resolution empowers RERA to take any appropriate measures to safeguard the rights of purchasers, including but not limited to referring the matter to competent judicial authorities.

Section Five: Recommendations and Conclusion

As established in the preceding sections, there is a need for enacting legislation that specifically addresses off-plan Real Estate development and investing in Kenya, and encompasses comprehensive regulation of all aspects related to off-plan Real Estate. This can either be done through the enactment of an Act of Parliament that will establish a dedicated and independent Housing Committee responsible for overseeing the implementation of these off-plan regulations, similar to the system adopted in Saudi Arabia. Alternatively, the Real Estate Developers Regulatory Board (REDRB), the agency proposed to oversee the regulation of Real Estate developers in Kenya can oversee the implementation and enforcement of the off-plan regulations mirroring the existing approach in Dubai. Based on our analysis of the case studies, we propose the following recommendations for provisions that the government should incorporate during the formulation off-plan regulations in Kenya;

- Enactment of an Act of Parliament Specific to Off-Plan Real Estate: The government should formulate an Act of law that specifically addresses all aspect of off-plan Real Estate development and investing in Kenya. The regulatory framework should be comprehensive enough to oversee development activities as well as the sale and lease of off-plan rental units. This regulatory framework will; i) serve to protect the rights of all parties particularly buyers against fraudulent practices by developers, ii) promote transparency and fairness in the sector, and, iii) enhance confidence among end users, developers, and investors,

- Licensing Requirements for Developers: Developers who wish to undertake in off-plan Real Estate activities in Saudi Arabia are required by law to obtain a separate licensing certificate from the Wafi Committee that is renewable on an annual basis. Correspondingly, off-plan regulations in Kenya should require all developers who wish to undertake in off-plan Real Estate development and sales activities to obtain an additional licensing permit along with the development permit obtained from the REDRB. The license should be renewable on annual basis, subject to fulfilment of preset conditions. This will assist promote consumer protection by ensuring that developers meet certain standards and qualifications before engaging in off-plan activities, and quality assurance. In addition, the registry should be made available to the public at no extra-cost. This would be fundamental in assisting buyers assess the credibility of an off-plan property developer and avert possible cases of financial losses and fraud,

- Formulation of Penalties for Non-Compliance: Both agencies responsible for overseeing the implementation and enforcement of off-plan regulations in Saudi Arabia and Dubai reserve the right to terminate or suspend an off-plan project on the basis of technical grounds, and failure by a developer to meet required conditions. As such, off-plan regulations in Kenya should convey power to the agreed upon oversight regulatory body to terminate or suspend an off-plan project on the basis of either technical grounds, or any other conditions set out in the Act. These could include; i) failure by a developer to commence construction of the project without an acceptable reason at the agreed upon time, ii) if a development has stalled for a period exceeding twelve months, iii) if the developer has acted in a fraudulent manner, iv) if the authority is satisfied that the developer has no genuine intention or ‘good faith’ to continue with the project, v) failure by the developer to implement the project due to gross negligence, vi) if any provision of the off-plan Regulations are violated, and vii) any time the authority having investigated deems fit to do so.

Furthermore, additional measures such as fines and revoking of a developer’s licensing certificate to engage in off-plan Real Estate activities in case of law breaches should be put in place. Subsequently, the revoking of a developer’s licensing should be followed by an amendment in the Real Estate developer’s registry with the removal of the details of the developer. These measures would ensure developers comply with the law, maintain high ethical standards in the industry, and fulfill their obligations in a timely and responsible manner, failure to which would result in legal action,

- Establishment and Operation of Escrow Accounts: Off-plan regulations in Kenya should compel developers to open escrow accounts with approved banks as is the case in both Saudi Arabia and Dubai. Escrow accounts safeguard buyers' funds in off-plan Real Estate projects by establishing a trust account where the funds are held. The funds are to be released to the developer in a controlled manner, typically linked to specific project milestones or completion stages, ensuring that buyers' money is protected and used exclusively for the intended project. This reduces the risk of misappropriation or misuse of funds by developers, providing buyers with financial security and minimizing the potential for fraud or project abandonment,

- Refund of Payments Made by Buyers: Off-plan regulations in Saudi Arabia and Dubai ensure the reimbursement of payments made by purchasers to the developer or any financing obtained by the developer should a project be terminated or suspended. Similarly, off-plan regulations in Kenya should provide for the same in the event of either project suspension or termination. This would help minimize financial losses in cases where projects fail to materialize,

- Expert Supervision of Off-Plan Real Estate Projects: The off-plan regulations in Saudi Arabia require that all off-plan projects are supervised by a consultation office accredited with the Organization of Saudi Engineers. Correspondingly, off-plan regulation in Kenya should contain a provision for expert project supervision by a consultant engineer approved by the Engineers Board of Kenya. This would ensure quality and timely project delivery through regular technical and progress updates reports made by the consulting engineer to the oversight authority,

- Safeguarding Investors and Buyers Rights: Dubai off-plan Real Estate regulations allow for provisions which safeguard investors and buyers’ rights such as restrictions and cautions placed on land upon which the project is to be constructed on. These measures limit the sale or any conveyancing of land before or during construction. Likewise, it is prudent that off-plan regulations in Kenya incorporate such measures to ensure buyers and investor’s rights are protected in law,

- Standards for Advertising and Marketing: Off-plan regulations in both Dubai and Saudi Arabia contains strict regulations on the advertising and marketing standards of Real Estate properties. Real Estate marketing and salespeople and developers are required by law to include certain information in their advertisements, such as the license number of the dealer or developer, and any relevant disclosures. This provision helps to prevent deceptive advertising practices, and to enhance transparency and protect consumers by providing them with essential information about the developer's legitimacy and qualifications. More so, these requirements ensure that buyers have access to crucial details, enabling them to make informed decisions, and,

- Stimulation of Capital Markets to Improve Access to Financing: Insufficient funding poses a significant challenge for off-plan projects, frequently resulting in project delays or, in some cases, project suspension. Without adequate funds, developers may struggle to commence or complete construction on time, resulting in extended project timelines which can frustrate buyers, erode investor confidence, and lead to reputational damage for the developer. As such, the government should work towards the stimulation of capital markets in order to improve access to financing for developers. This can be achieved through the establishment and utilization of specialized Collective Investment Schemes (CIS) and Real Estate Investment Trusts (REITs) known as Development REITs (DREITs). Through CIS and DREITs, developers can tap into a broader range of potential investors as well as expand their investor base thus increasing the availability of capital for development projects, while reducing reliance on traditional financing channels such as bank loans.

Conclusion

Off-plan Real Estate development and investing in Kenya offers a promising opportunity for both investors and developers aiming to capitalize on the country's rapidly growing property market. Investors can leverage the potential for significant returns and the advantage of purchasing properties at lower prices during the construction phase. Simultaneously, developers stand to benefit from pre-sales, which provide upfront funding and in ensuring a ready market for their properties ahead of project completion. However, the sector stands to benefit from the establishment of a robust regulatory framework firmly enshrined in law. Such a framework would fuel the sector's growth, ensure regulation of the sector, foster transparency, bolster investor confidence, and pave the way for a thriving business landscape in off-plan Real Estate development and investing in Kenya.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.